Legal entities are created in the form of commercial and non-profit organizations - for the former the characteristic purpose of activity is to make a profit, the latter are established to carry out other tasks not related to generating profit and distributing it among participants. One of the forms of non-profit enterprises are budgetary institutions. The Tax Code obliges all organizations, including budget ones, to pay income tax under certain conditions. In this article we will talk about the income tax of budgetary institutions, consider the terms and procedure for payment.

Which budgetary institutions are required to pay income tax?

An institution is a non-profit enterprise established by the owner to carry out functions of a non-commercial nature, such as socio-cultural and managerial. The founder may be:

- Individual and legal entity (then the enterprise is a private institution).

- Russian Federation (the enterprise will be a state institution).

- Subject or municipal entity (municipal institutions):

- autonomous,

- budget,

- official

Budgetary institution is a non-profit enterprise established by the Russian Federation, a constituent entity of the Russian Federation or a municipal entity for the purpose of providing services and performing work aimed at ensuring the possibility of exercising the powers of state and regional authorities (approved by law) in the field of education, culture, employment, science, healthcare, social protection, physical culture and sports, as well as in other spheres of the country’s life.

Budgetary institutions have the right to provide services and perform work:

- from the list of main activities under the state (municipal) assignment (financed through subsidies and allocation of funds from the relevant budget),

- in addition to the assignment for individuals and legal entities for money under the same conditions,

- not specified as core activities if they are designed to contribute to the achievement of the enterprise's objectives.

The budgetary institution itself does not accept budget funds; the money is sent to state authorities, local governments, etc. And since a budgetary institution is not recognized as a recipient of money, the norms of the Budget Code for recipients of budget funds are not applicable to it. Read also the article: → “Features of tax and accounting in cultural institutions in 2022.”

Until January 1, 2011, budgetary institutions did not have the right to dispose of earnings from entrepreneurial activities. However, those enterprises that were established in accordance with Law No. 83-FZ received permission to dispose of such funds. This means that they (like commercial companies) receive income for the results of their work and manage the funds themselves. This gives rise to tax obligations that must be fulfilled on a general basis. Among other things, there is a need to transfer income tax on activities aimed at generating income.

"Entrepreneurial" budgetary institutions. Taxes and reporting

Veterinary institutions are regional government institutions, financed from the regional budget and engaged in entrepreneurial activities.

Institutions have been transferred to the taxation system in the form of a single tax on imputed income.

What taxes are our institutions required to pay?

What tax returns are our institutions required to submit to the tax authorities?

Organizations financed from the budget are recognized as payers

corporate income tax, VAT, unified social tax, transport tax, corporate property tax, land tax, as well as payers of insurance premiums for compulsory pension insurance, insurance premiums for compulsory insurance against industrial accidents and occupational diseases.

Since your institutions in the field of veterinary services have been transferred to the payment of a single tax on imputed income, then in accordance with clause 4 of Art. 346.26 Tax Code of the Russian Federation

they are exempt from the obligation to pay

corporate income tax

(in relation to profits received from business activities, subject to a single tax),

corporate property tax

(in relation to property used for business activities, subject to a single tax) and

unified social tax

(in in relation to payments made to individuals in connection with the conduct of business activities subject to a single tax), and are also

not recognized as VAT taxpayers

(in relation to transactions recognized as objects of taxation in accordance with

Chapter 21 of the Tax Code of the Russian Federation

, carried out within the framework of business activities subject to a single tax) , with the exception of value added tax payable when importing goods into the customs territory of the Russian Federation.

Other taxes and fees of budgetary institutions transferred to the payment of UTII are calculated and paid in accordance with the general taxation regime.

Corporate income tax

In accordance with Art.

246 of the Tax Code of the Russian Federation, Russian organizations

(including institutions) are recognized as taxpayers of corporate income tax.

Object of taxation

for them, profit is recognized, that is, income received, reduced by the amount of expenses incurred (

Article 247 of the Tax Code of the Russian Federation

).

At the same time, according to Art. 321.1 Tax Code of the Russian Federation

taxpayers -

budgetary institutions

financed from budgets of all levels, state extra-budgetary funds allocated according to the budgetary institution's income and expenditure estimates, as well as receiving income from other sources, for tax purposes are required to keep

separate records

of income (expenses) received (produced) within the framework of targeted financing and from other sources.

And the tax base

budgetary institutions is defined as the difference between

the amount of income received from the sale of

goods, work performed, services rendered, the amount of non-sales income (excluding value added tax, excise taxes on excisable goods) and

the amount of expenses actually incurred

related to conducting commercial activities.

Since all commercial activities of institutions in your case have been transferred to the payment of UTII and the payment of corporate income tax has been replaced by the payment of a single tax, then the object of taxation by income tax does not arise

.

Let us remind you that the income and expenses of budgetary institutions included in the tax base do not include

income received in the form of targeted financing and targeted revenues for the maintenance of budgetary institutions and the conduct of statutory activities financed from these sources, and expenses incurred from these funds (clause 2 of Article

321.1 of the Tax Code of the Russian Federation

).

But despite the fact that the object of taxation does not arise

, the institution as a whole as an organization

does not cease

to be recognized as a payer of corporate income tax.

In accordance with clause 1.2 of the Procedure for filling out a tax return for corporate income tax, approved by order of the Ministry of Finance of the Russian Federation dated 02/07/2006 No. 24n, non-profit organizations (which include budgetary institutions) that do not have obligations to pay tax

, submit an Income Tax Declaration after the expiration of the tax period (calendar year) in the form as part of

the Title Page (Sheet 01), Sheet 02

and, upon receipt of targeted financing funds, targeted revenues and other funds specified in

paragraphs 1

and

2 of Art.

251 Tax Code of the Russian Federation , –

Sheet 07

.

Value added tax

As we noted above, in relation to transactions carried out within the framework of activities transferred to the payment of UTII, the institution is not recognized as a VAT taxpayer.

In this case, the institution does not have the obligation to provide a VAT return.

, since only

taxpayers

who are not recognized as institutions transferred to pay UTII are required to submit a declaration.

If an institution provides veterinary services financed from the budget, then the sale of such services is not subject to

VAT taxation in accordance with

paragraphs.

2 p. 2 art. 149 Tax Code of the Russian Federation .

However, in this case the institution does not cease to be recognized as a VAT taxpayer.

despite the absence of an object of taxation in accordance with the tax benefit and, therefore,

is not exempt

from the obligation to submit a tax return, including a “zero” one.

In accordance with clause 7 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 17, 2003 No. 71, the absence of a taxpayer at the end of a specific tax period in the amount of tax payable does not exempt

him from the obligation to submit a tax return for a given tax period, unless otherwise established by the legislation on taxes and fees.

In order not to submit “zero” returns each tax period, an institution can receive an exemption

from fulfilling the duties of a VAT taxpayer (

Article 145 of the Tax Code of the Russian Federation

).

Since the Tax Code of the Russian Federation does not provide for the obligation to submit “zero” tax returns to the tax authorities, from which taxpayers are exempt, then, having received the exemption, you will get rid of the hassle of regularly submitting “zero” returns.

Note!

In case of issuing invoices to buyers with a allocated VAT amount

, and also if the institution acts as

a tax agent

for VAT, the declaration will have to be submitted according to the rules of

Chapter 21 of the Tax Code of the Russian Federation

.

Organizational property tax

According to paragraphs. 2 p. 2 art. 3 of the Law of the Sverdlovsk Region dated November 27, 2003 No. 35-OZ “On the establishment of a property tax for organizations on the territory of the Sverdlovsk Region” (as amended on July 21, 2006) state institutions of the Sverdlovsk Region and municipal institutions are exempt

from paying corporate property tax.

The situation is similar to that with VAT.

The institution is recognized as a payer of corporate property tax, but does not pay

in accordance with the benefit provided (and the benefit is provided in respect of

all property

of the institution, regardless of sources of financing).

Therefore, in accordance with Art. 386 Tax Code of the Russian Federation

institutions are required, at the end of each reporting and tax period, to submit tax

calculations

at their location

, at the location of each of their

separate divisions

that have a separate balance sheet, as well as at the location of each

piece of real estate

(for which a separate procedure for calculating and paying tax is established). on advance tax payments and

tax return

.

In addition, a property tax benefit is provided to an institution upon submission of a written application

on the provision of tax benefits for property tax of organizations, copies of constituent documents.

, tax calculations

for advance payments and

a tax return

for this tax must be submitted

Transport tax

According to paragraphs. 3 p. 1 art. 4 of the Law of the Sverdlovsk Region dated November 29, 2002 No. 43-OZ “On the establishment and enforcement of transport tax on the territory of the Sverdlovsk Region” (as amended on July 21, 2006) are exempt

do not have income

are exempt from paying transport tax .

are not entitled to transport tax benefits

.

Consequently, the tax is paid and the declaration is submitted on a general basis according to the rules of Chapter 28 of the Tax Code of the Russian Federation

and Law No. 43-OZ.

UST and contributions to compulsory pension insurance

For activities financed from the budget, institutions are payers of unified social tax and insurance contributions

for compulsory pension insurance.

In relation to payments made to individuals in connection with the conduct of business activities subject to a single tax

For imputed income, the institution

is exempt

from paying UST.

At the same time, institutions that are taxpayers of the single tax pay insurance premiums

for compulsory pension insurance.

Consequently, payments to employees made from extra-budgetary funds are subject to only contributions to compulsory pension insurance.

In accordance with Art. 243 Tax Code of the Russian Federation

data on the amounts of calculated and paid

advance payments under the Unified Social Tax

, data on the amount

of tax deduction

used by the taxpayer, as well as on the amounts of actually paid insurance premiums for the same period, the taxpayer reflects

in the calculation

submitted

no later than the 20th day

of the month following for the reporting period, to the tax authority in the form approved by order of the Ministry of Finance of the Russian Federation dated 02/09/2007 No. 13n.

No later than March 30

of the year following the expired tax period (calendar year), a tax return under the Unified Social Tax is submitted in the form approved by Order of the Ministry of Finance of the Russian Federation dated January 31, 2006 No. 19n.

A copy

A tax return with a mark from the tax authority or another document confirming the submission of the declaration to the tax authority

no later than July 1 of the year

following the expired tax period.

According to Art. 24 of the Federal Law of the Russian Federation dated December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation” the policyholder reflects data on the calculated and paid amounts of advance payments for insurance premiums in the calculation

, submitted

no later than the 20th day

of the month following the reporting month to the tax authority in the form approved by order of the Ministry of Finance of the Russian Federation dated March 24, 2005 No. 48n.

Declaration

for insurance premiums must be submitted to the tax authority

no later than March 30

of the year following the expired billing period (calendar year) in the form approved by order of the Ministry of Finance of the Russian Federation dated February 27, 2006 No. 30n.

Compulsory social insurance against industrial accidents and occupational diseases

In accordance with the Federal Law of the Russian Federation dated July 24, 1998 No. 125-FZ, budgetary institutions are recognized as insurers

in relation to individuals performing work on the basis of an employment agreement (contract) for individuals performing work on the basis of a civil contract, if in accordance with the specified contract the policyholder is obliged to pay insurance premiums to the insurer.

Insurance premiums are calculated on the accrued wages (income)

employees (including freelance, seasonal, temporary, and part-time workers), and in appropriate cases - for the amount of remuneration under a civil contract.

Policyholders quarterly no later than the 15th

of the month following the expired quarter must submit, in the prescribed manner, to the insurer at the place of their registration

with Form 4-FSS of the Russian Federation

, approved by Resolution of the FSS of the Russian Federation dated December 22, 2004 No. 11.

UTII payers are not exempt

from the payment of these insurance premiums, therefore contributions are also accrued for payments made to employees within the framework of business activities transferred to the payment of UTII.

Which budgetary institutions do not pay income tax?

The object of income taxation appears in a budgetary enterprise only when it carries out commercial activities. Accordingly, if a budgetary organization is exclusively engaged in carrying out tasks of state and municipal departments at the expense of subsidies and relevant budgets, the results of its work are not subject to corporate income tax.

The following categories of cash receipts do not include income (accordingly, they are not subject to income tax):

- income in the form of property paid in advance (not taken into account for those who use the accrual method),

- income in the form of property provided as collateral for the fulfillment of any obligations,

- free assistance, recognized as gratuitous when provided by foreign states,

- income in the form of property from state or municipal enterprises,

- granted grants,

- targeted receipts (money from budgets of any level and from individuals to carry out the main activities of a budgetary institution),

- donations in any form,

- other income listed in Art. 251 Tax Code.

Expenses not taken into account for income tax purposes include:

- dividends accrued after taxes (including income tax),

- contributions to the authorized capital of other organizations,

- fines and penalties imposed on the institution for violation of tax obligations,

- voluntary membership contributions to public organizations,

- donation of property to individuals and legal entities,

- money donated to trade unions

- other costs listed in Art. 270 Tax Code.

Budgetary organizations: concept, types

The concept of a budgetary organization is enshrined in Belarusian legislation in the Budget Code, other definitions either refer to it or repeat it to one degree or another. Let's figure out which organizations are budgetary, what types they have, and how not to confuse them with other government organizations.

The concept of a budget organization

A budgetary organization is understood as an organization created (formed) by the President, government agencies, including local executive and administrative bodies, or another government organization authorized by the President to carry out managerial, socio-cultural, scientific, technical or other functions of a non-profit nature, the functioning of which is financed at the expense of the corresponding budget on the basis of the budget estimate and accounting of which is maintained in accordance with the chart of accounts approved in the prescribed manner for budgetary organizations, and (or) taking into account the peculiarities of accounting and reporting in accordance with the law (subclause 1.4 p. 1 Article 2 BDK).

Thus, budgetary organizations are characterized by the following main features, reflected in diagram 1 (subclause 1.4, article 2 of the Budget Code, subclause 2.3, clause 2, article 13 of the Tax Code, subclause 1.3, clause 1, part 7, clause 3, article 79 BDK, Instruction No. 22).

Scheme 1

Note! A budgetary organization has the right to engage in extra-budgetary activities (clause 2 of Article 79 of the Budget Code), i.e. earn money on your own. As a result of such activities, the budgetary organization receives extra-budgetary funds, which it spends according to the estimate of income and expenses. In general, this activity is regulated by Regulation N 641. For example, budgetary organizations can carry out the following types of income-generating activities: - paid services (educational, medical, veterinary, sports and recreation, motor transport, etc.); - leasing of state property, etc. d.

Basically, from the point of view of civil legislation, a budgetary organization is a state institution if it does not belong to a government agency (Article 120 of the Civil Code).

Thus, an institution is recognized as an organization created by the owner to carry out managerial, socio-cultural or other functions of a non-profit nature and financed by him in whole or in part (Part 1, Clause 1, Article 120 of the Civil Code).

In this case, it is necessary to distinguish a budgetary organization from another government organization.

Based on the definition of a budgetary organization and the current legislation, the following are not considered budgetary:

— organizations that receive subsidies or subsidies from the budget to cover losses from business activities and maintain fixed assets;

— receiving funds from the budget to carry out business activities;

— state organizations with a state share of ownership in the authorized capital.

That is, ChTUP, individual entrepreneur, RUP, LLC, OJSC, CJSC, LLC, ADO are not budgetary organizations, although they can use budgetary funds.

In this regard, it is necessary to distinguish a budget organization from a recipient of budget funds. The latter can be either the budget organization itself or another organization, individual entrepreneur, who have the right to accept and (or) fulfill budget obligations in the corresponding financial year and are responsible for the targeted and effective use of received budget funds (subclause 1.44, clause 1, article 2 BDK).

Note! The concept of “budgetary institution” is absent in Belarusian legislation, but in practice it is used on a par with the concept of “budgetary organization”. In Russian legislation, for example, on the contrary, the concept of “budgetary institution” is used, but there is no concept of a budgetary organization as such. And according to the legislation of the Union State A budgetary institution is an organization whose activities are financed from the budget of the Union State (Resolution of the Council of Ministers of the Union State of January 25, 2002 N 8).

Some government organizations can be equated in status to budgetary ones. For example, organizations that are equivalent to budget ones in terms of wages. In such organizations it is necessary to be guided by budget legislation in the field of remuneration of workers.

The peculiarities of the legal status of certain types of state institutions are determined by law (clause 3 of article 120 of the Civil Code).

Note For more information about the features of payroll and accounting in a budgetary organization, see the Guide to Budgetary Accounting.

Types of budget organizations

Budgetary organizations can be classified on various grounds. Let's consider only the most basic ones. They are presented in diagram 2.

Scheme 2

Types of budget organizations

Property of a budget organization

Any legal entity, among other things, can, on its own behalf, acquire and exercise property and personal non-property rights (clause 1 of Article 44 of the Civil Code).

The property of a state institution is state property (republican or communal) and is assigned to it with the right of operational management.

The disposal of state property is carried out in accordance with the procedure established by Decree No. 169 and the legal regulations adopted in its development.

If a state institution has the right and carries out income-generating activities, then the institution disposes of the income received from such activities and the property acquired at their expense independently, and they are taken into account on a separate balance sheet, unless otherwise provided by law (clause 2 of Article 279 of the Civil Code).

The general rules for assigning property to a budget organization are shown in Diagram 3.

Scheme 3

Read this material in ilex >> * following the link you will be taken to the paid content of the ilex service

The procedure for paying income tax by budget-funded enterprises

Budgetary institutions are required to pay income tax under general conditions. The object of taxation is the taxpayer’s profit. Profit, in turn, is the difference between all cash receipts and expenses, calculated on the basis of Chapter 25 of the Tax Code of the Russian Federation. That is, the profit of a budgetary institution is profit from activities carried out for the purpose of making a profit.

Income taken into account when paying income tax is proceeds from the sale of goods, works and services. Non-operating income is other cash receipts.

Institutions must develop and approve accounting policies in order to always calculate income tax according to the same scheme. Subsidies allocated to budgetary institutions are not taxed since they are funds of targeted financing, subject to maintaining separate books of income (expenses) received (produced) within the framework of targeted financing.

Income received by an institution from providing services to pensioners and disabled people at home, as well as in semi-stationary conditions, is not included in the list of income tax-exempt. That is, revenue from the provision of social services is also subject to income tax.

Income from the sale of paid work or services is also included in the tax base for the income tax of budgetary institutions. In order to reduce the tax base, an enterprise can take into account costs (justified and supported by documents), but only those that are allowed to be taken into account by tax legislation.

Features of taxation of state institutions

Tax legislation prohibits state institutions from using a simplified taxation system; no prohibition has been established in relation to the single tax on imputed income, but this system is irrational for state institutions, since it exempts them from paying income tax, which they practically do not pay in accordance with the law. fully. Income tax does not apply to income from all work and services provided by state institutions, and is valid only in relation to non-operating income received, including:

- firstly, from the sale of objects recognized as fixed assets;

- secondly, income received from the provision of property under operational management for temporary use to other persons (with the consent of the owner);

- thirdly, surplus inventory items that were identified during the inventory;

- fourthly, in the form of voluntary donations.

Also, government institutions are exempt from paying value added tax, with the exception of manufactured products.

Note 2

Income tax is paid by a government institution by the 28th day of the month following the reporting quarter, value added tax - by the 25th day of the month following the reporting quarter.

Legally significant actions of government institutions are also exempt from payment of state duty.

Interest rate of income tax for budgetary enterprises

The basic income tax rate is 20%. Educational and medical institutions have the right to apply a zero rate to the tax base, unless other rates are established for the tax base in accordance with paragraphs 3, 4 of Art. 284 of the Tax Code of the Russian Federation, and subject to the conditions of Art. 284.1 Tax Code.

The main requirement for applying the 0% rate is receiving income from the provision of educational/medical services, research in the field of science, and the creation of experimental developments. Moreover, the share of revenue from carrying out the listed types of activities should be no less than 90% of all earnings. Even if the share is 89.9%, income tax will have to be paid.

Responsibility for evasion of income tax

When budgetary organizations discover errors in the payment of income tax, they should correct them themselves, recalculate the tax, pay the difference and penalties to the budget for the period until the error was identified, and send an updated declaration to the tax service.

Otherwise, a fine will be imposed on the institution, calculated on the basis of the amount of arrears minus the amounts of overpayments available in the institution. A penalty will also be charged for each day of late payment. In case of malicious violation of tax laws, penalties will be toughened up to the point of bringing the management of the enterprise to criminal liability.

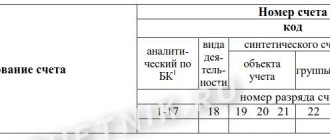

Accounting entries for accounting

The accrual of income tax and its payment to the budget by budgetary institutions is reflected by the entries indicated in the table.

| Operation | DEBIT | CREDIT |

| Corporate income tax accrued: | ||

| ● from income from the sale of non-financial assets | 2.401.10.172 | 2.303.03.730 |

| ● from rental income | 2.401.10.120 | |

| ● from income from paid work/services | 2.401.10.130 | |

| ● from other income (for example, from gratuitous receipts) | 2.401.10.180 | |

| Income tax paid to the budget | 2.303.03.830 | 2.201.11.610 |

| Decrease in off-balance sheet account 17 (according to KOSGU code 130 or 180 - depending on the accounting policy of the enterprise) | ||

Reporting of budgetary institutions on income tax

Budgetary institutions are required to report income taxes to the Federal Tax Service and submit reports on the same basis as commercial enterprises. In order to fully have information about the calculation of income tax, budgetary institutions must maintain tax accounting - a system for summarizing information for calculating the taxable base for taxes on the basis of primary documentation, sorted in an approved manner.

Tax accounting information must be confirmed by primary documentation (copies of primary documents used in accounting), a certificate from accounting, analytical registers, and calculations of the taxable base. Tax returns are sent to the local authorities of the Federal Tax Service (at the location of each budgetary enterprise) in the general manner defined in the Tax Code of the Russian Federation, regardless of:

- existence of a tax obligation (payment of tax or advance payment),

- features of calculating the amount payable,

- payment of tax.

Budgetary institutions that do not have to pay income tax send a tax return at the end of the tax period (calendar year) in the following composition:

- title page (sheet 01),

- sheet 02,

- applications in case there were income and expenses, the types of which are given in Appendix No. 4 to the Procedure for filling out a tax return,

- Sheet 07 (if targeted funding money, targeted revenues and other funds listed in paragraphs 1, 2 of Article 251 of the Tax Code of the Russian Federation were received).

An example of calculating income tax for a budget organization

During the reporting quarter, the cash receipts of the budgetary institution amounted to:

- 1,900,000 rubles from the budget,

- 175,000,000 rubles of target funds,

- 550,000,000 rubles from business activities.

In total: 2,625,000 rubles.

- Cash received from the provision of paid services amounted to:

550 million: (2625 million – 175 million) * 100% = 22.4%

- Total expenses for the quarter: 2,425,000 (and 175 million earmarked funds). Calculation of business costs:

(2425 million – 175 million): 100 * 22.4% = 504 million rubles.

- The amount subject to corporate income tax will be:

550 million – 504 million = 46 million rubles.

- Calculation of income tax using the general formula:

(550 million – 504 million) * 0.20 = 9,200,000 rubles.

Taxation of targeted revenues of budgetary institutions

The state institution of social services for the population is a budgetary institution and is fully financed from the regional budget. Does not engage in entrepreneurial activities.

With the permission of the Ministry of Finance, an off-budget account has been opened, which receives charitable donations from individuals and legal entities (for 2007, 25,000 rubles), payment for food for employees in the center canteen (36,000 rubles) and targeted funds for food during the summer health campaign from the Federal Social Insurance Fund of the Russian Federation ( 224,000 rubles).

Employees prepay for lunches, there is a provision for meals for employees at the center, meals are stipulated in the employment contract, since the institution is closed, and employees do not have the opportunity to leave children unattended during the lunch break. The cost of lunch does not include any extra charges - only the cost of purchased food products is compensated.

Does the institution have the right to provide tax benefits for VAT and income tax on the specified sources of income, and how to correctly fill out the declarations:

a) for income tax: is it necessary to fill out section 00212 of sheet 7 “Report on the intended use of property, funds received as part of charitable activities, targeted income ...” under code 140 for a total amount of 285,000 rubles?

b) for VAT: is it necessary to fill out section 9 “Operations not subject to taxation” under code 1010232 “Sales of food products...” in the amount of 36,000 rubles (meals for center employees);

under code 1010288 “Transfer of goods, works, services within the framework of charitable activities...” in the amount of 25,000 rubles (charitable assistance received by us); under code 1010295 “Services of sanatorium-resort, health-improving organizations...” in the amount of 224,000 rubles (funds received from the Federal Social Insurance Fund of the Russian Federation to pay the cost of food for children in a summer health camp)? Corporate income tax

According to Art. 321.1 Tax Code of the Russian Federation

taxpayers - budgetary institutions financed from the budgets of the budgetary system of the Russian Federation, as well as receiving income from other sources, for tax purposes are required to keep

separate records

of income (expenses) received (produced) within the framework of targeted financing and from other sources.

At the same time, other sources

— income from commercial activities is recognized as income of budgetary institutions received from legal entities and individuals for transactions involving the sale of goods, work, services, property rights, and non-operating income.

The tax base

budgetary institutions is defined as the difference between the amount of income received from the sale of goods, work performed, services rendered, the amount of non-sales income (excluding VAT, excise taxes on excisable goods) and the amount of expenses actually incurred related to the conduct of commercial activities.

The income and expenses of budgetary institutions included in the tax base do not include income

, received in the form of targeted financing and targeted revenues for the maintenance of budgetary institutions and the conduct of statutory activities financed from these sources, and expenses incurred from these funds.

In accordance with paragraph 2 of Art. 251 Tax Code of the Russian Federation

when determining the tax base,

targeted revenues are not taken into account

These include targeted revenues

from the budget and targeted revenues for the maintenance of non-profit organizations and the conduct of their

statutory activities,

received free of charge from other organizations and (or) individuals and used by the specified recipients for their intended purpose.

At the same time, taxpayers who are recipients of these targeted revenues are required to keep separate records

income (expenses) received (produced) within the framework of target revenues.

Targeted revenues for the maintenance of non-profit organizations (which include budgetary institutions) and the conduct of their statutory activities include, in particular:

– donations

, recognized as such in accordance with the civil legislation of the Russian Federation;

– amounts of funding from budgets

state extra-budgetary funds allocated for the implementation of the statutory activities of non-profit organizations;

– funds and other property received for charitable

activities.

Based on this norm, in your situation will not be taken into account

when determining the tax base:

– donations;

– targeted funds received from the Federal Social Insurance Fund of the Russian Federation.

Art. 251 Tax Code of the Russian Federation

it is specified that

donations

recognized as such in accordance with civil law are not taken into account

for profit tax purposes

Art. 582 of the Civil Code of the Russian Federation

recognizes as a donation the donation of a thing or right for generally beneficial purposes.

Donations can be made to citizens, medical, educational institutions, social protection institutions and other similar institutions, charitable, scientific and educational institutions, foundations, museums and other cultural institutions, public and religious organizations, other non-profit organizations in accordance with the law, as well as the state and other subjects of civil law specified in Art. 124 Civil Code of the Russian Federation

.

No one's permission or consent is required to accept a donation.

The donation of property to legal entities may be conditional on the donor using this property for a specific purpose.

A legal entity accepting a donation for which a specific purpose has been established must keep separate records of all transactions involving the use of the donated property.

Since in Art. 251 Tax Code of the Russian Federation

If the concept of “donation” is used, and nothing else, then in order to avoid misunderstandings with the tax authorities, legal entities and individuals transferring funds to the account of your institution must indicate exactly

“donation”

, and not “charitable contribution”, no different “help”, etc.

According to the Procedure for filling out Sheet 07 of the tax return for corporate income tax, approved by Order of the Ministry of Finance of the Russian Federation dated 02/07/2006 No. 24n, “Report on the intended use of property (including funds), works, services received as part of charitable activities, targeted revenues, targeted financing" are taxpayers who received targeted financing

, targeted revenues and other funds specified in

paragraphs 1 and 2 of Art.

251 Tax Code of the Russian Federation .

However, the Report does not include

funds allocated to budgetary institutions

according to the estimate of income and expenses

of the budgetary institution from budgets of all levels and state extra-budgetary funds.

Based on the types of designated funds received by the organization, the organization selects the corresponding names and codes from the table given in Appendix No. 2 to the Procedure and transfers them, respectively, to columns 2 and 3 of the report

.

The funds received by your institution are targeted and have codes: 140

– donations recognized as such in accordance with the Civil Code of the Russian Federation,

170

– amounts of funding from the federal budget, budgets of constituent entities of the Russian Federation, local budgets, budgets of state extra-budgetary funds allocated for the implementation of the statutory activities of non-profit organizations.

Thus, you must fill out Sheet 07 of the declaration indicating the type of receipt codes 140 (in the amount of 25,000 rubles) and 170 (in the amount of 224,000 rubles).

Amounts reimbursed by employees of the institution for the cost of food products are not

targeted revenues are not named in the closed list of income

not taken into account

when determining the tax base for income tax, therefore they are included in the tax base as part of

income from sales

.

Value added tax

In accordance with Art. 146 Tax Code of the Russian Federation

The object of taxation with value added tax is transactions involving

the sale

of goods (work, services) on the territory of the Russian Federation.

Implementation

of goods, work or services, an organization recognizes, accordingly, the transfer on a paid basis (including the exchange of goods, work or services) of ownership of goods, the results of work performed by one person for another person, the provision of services for a fee by one person to another person (

Article 39 of the Tax Code of the Russian Federation

).

Since your institution, in relations with legal entities and individuals - donors and the Federal Social Insurance Fund of the Russian Federation, is not a transmitter, but a recipient

party, the institution does not have an object of VAT taxation, therefore,

there is no need

to fill out section 9 of the VAT return.

Different nutrition

employees of the institution.

In this case, the institution implements

dishes for employees.

According to paragraphs 5 p. 2 art. 149 Tax Code of the Russian Federation

not subject to taxation (exempt from taxation) VAT sales of food products directly produced by student and school canteens, canteens of other

educational

institutions, canteens of

medical

organizations, preschool

institutions

and sold by them in these institutions, as well as food products directly produced by public catering organizations and sold by them to the specified canteens or specified institutions (tax-free transaction code 1010232).

The type of your institution is not mentioned in paragraphs 5 p. 2 art. 149 Tax Code of the Russian Federation

.

does not apply to your institution.

.

Consequently, the sale of food to employees of an institution is subject to VAT on a general basis.

Legislative acts on the topic

It is recommended to study the following legislative acts:

| Article | Description |

| Art. 50 Civil Code of the Russian Federation | On the possibility of non-profit organizations carrying out entrepreneurial activities in order to achieve the goals for which the organization was created |

| Art. 120 Civil Code of the Russian Federation | On the opening of an institution by individuals and legal entities, the Russian Federation or municipalities |

| Federal Law of January 12, 1996 No. 7-FZ “On Non-Profit Organizations” | On the definition of non-profit organizations |

| Decree of the Government of the Russian Federation dated 02.09.2010 No. 671 | About the formation of state assignments in relation to federal budgetary and government institutions and financial support for the implementation of state. tasks |

| Letter of the Ministry of Finance of the Russian Federation dated September 28, 2012 No. 02-13-11/3990 | The fact that the norms of the Budget Code for recipients of budget funds cannot be applied to budget organizations |

| Ch. 25 Tax Code of the Russian Federation | About income tax |

| Letter from the Federal Tax Service of Russia for Moscow dated October 17, 2011 No. 16-15/ [email protected] | On the obligation of budgetary organizations to pay income tax on activities aimed at generating income |

| Art. 247 Tax Code of the Russian Federation | Object of taxation for income tax |

| Art. 250 Tax Code of the Russian Federation | About non-operating income |

| Letter of the Ministry of Finance of the Russian Federation dated December 28, 2012 No. 03-03-06/4/124 | On the recognition of funds for targeted financing as subject to income tax if the enterprise does not keep a separate ledger for them recording income and expenses |

| Letter of the Ministry of Finance of the Russian Federation dated June 27, 2012 No. 03-03-06/4/68 | On the taxation of income tax on income of budgetary institutions received from the provision of services to pensioners and disabled people at home, as well as in semi-stationary conditions |

| Art. 270 Tax Code of the Russian Federation | Expenses not taken into account for tax purposes |

| Order of the Federal Tax Service of the Russian Federation dated March 22, 2012 No. ММВ-7-3/ [email protected] | Form and format of a tax return for corporate income tax |

| PBU 18/02 “Accounting for income tax calculations” | Guidelines for calculating income tax |

| Order of the Ministry of Finance of the Russian Federation dated November 19, 2002 No. 114n | Approval of PBU 18/02 |

Profit from budget revenues

According to the amendments introduced by Federal Law No. 325-FZ of September 29, 2019 to the Tax Code of the Russian Federation, on January 1, 2022, changes to the income tax for state-owned institutions came into force.

Now government institutions do not need to pay income tax on any funds received from income-generating activities, including income from the sale of goods, finished products and other property (Federal Law of September 29, 2019 No. 325-FZ in paragraph 33.1 p. 1 Article 251 of the Tax Code of the Russian Federation).

Previously, only funds received by state institutions from the provision of services (performance of work) were exempt from taxation. And, for example, income from the sale of non-financial assets was taxed in accordance with the generally established procedure (letters of the Ministry of Finance of the Russian Federation dated April 25, 2019 No. 03-03-05/30244, dated April 4, 2019 No. 03-03-07/23385, dated February 26, 2019 No. 03 -03-06/3/12369). If the sold property was purchased at the expense of budgetary funds, then the tax base included all proceeds from the sale without reducing it by the cost of acquiring the NFA.

The innovation is quite reasonable and expected. Since all funds received from income-generating activities were sent to the budget by state institutions. They do not have the right to independently dispose of these funds (clause 4 of article 298 of the Civil Code of the Russian Federation). Essentially, these funds are budget income, not income of government institutions. It turns out that previously income tax was paid from budget revenues.

Typical calculation errors

Mistake #1. A budgetary enterprise determines the amount of income taking into account VAT, sales tax and excise taxes.

Income from the sale of goods, work performed and services provided, income from the sale of property rights and non-operating income of budgetary institutions are determined in the manner established by Art. 249 of the Tax Code of the Russian Federation (excluding VAT, excise taxes, sales tax).

Mistake #2. Some expenses of a budgetary institution, which are not related to business activities and should have been financed from targeted financing, were covered by the business activities of the same enterprise.

It is allowed to direct funds to cover the costs of a budgetary institution, which should be covered from targeted financing, only from net profit from commercial activities (after identifying financial results and paying income tax).

General provisions on taxation of state and municipal organizations

State and municipal organizations, as well as commercial ones, need to make mandatory payments to the country's budget system.

The procedure for calculating and paying taxes by state and municipal organizations is regulated by the Tax Code of Russia.

Are you an expert in this subject area? We invite you to become the author of the Directory Working Conditions

This regulatory document establishes a number of features for the calculation of taxes and fees by state and municipal organizations in relation to the following taxes:

- income tax paid by organizations;

- value added tax;

- state duties.

Taxes are calculated and paid on a general basis by state and municipal organizations in relation to the following taxes:

- firstly, the personal income tax, in relation to which state and municipal organizations act as tax agents, withholding this tax when paying income to their employees;

- secondly, contributions to social, pension, health insurance and insurance against accidents and occupational diseases;

- thirdly, transport tax paid by state and municipal organizations if they have vehicles on their balance sheet;

- fourthly, land tax paid by state and municipal organizations if they have land plots for various purposes on their balance sheet.

Finished works on a similar topic

Course work Taxation of state and municipal organizations 450 ₽ Abstract Taxation of state and municipal organizations 220 ₽ Test work Taxation of state and municipal organizations 240 ₽

Receive completed work or specialist advice on your educational project Find out the cost

Note 1

A special procedure for calculating taxes by state and municipal organizations is established in relation to government institutions, budgetary institutions, and autonomous institutions.