On January 20, companies must provide the tax office with information on the average number of employees. What will happen if you do not have time to submit information on time, you will of course be punished and fined, one thing is good, this form is not a declaration and your accounts will not be blocked for late submission.

Now let's figure out how to make the correct calculations and generate a report on the average headcount in 1C and send it to the Federal Tax Service using electronic reporting.

What depends on the number of your employees? Everything is very simple: first, how will you submit reports (if there are 100 people, then only in electronic form), second, and probably most importantly, if the average number of people exceeds 100 people, and you use the simplified tax system, then additional taxes may be charged to you.

To whom should the report be submitted?

Not everyone submits a report on the average number of employees. For example, if an entrepreneur does not have staff, then there is no need to report. But if you are an organization, then information must be provided in any case, even if there were no hired employees, in accordance with the letter of the Ministry of Finance dated February 4, 2014 No. 03-02-07/1/4390.

The report must be submitted to the following organizations:

- Company or individual entrepreneur with employees;

- New individual entrepreneurs with hired employees;

- Individual entrepreneur with hired personnel who ceased operations in the middle of the year;

- A new or reorganized company submits a report twice:

- no later than the 20th day of the month following the month of creation or reorganization;

- no later than January 20 of the year following the year of creation or reorganization.

It must be borne in mind that if an individual entrepreneur closes, but hired employees in 2022, then you will have to provide information on average activities.

So, information on the average number of employees must be provided before January 20 to the Federal Tax Service

If the average number of individual entrepreneurs without employees turns out to be “zero”

If there were no employees, the number is zero - is the entrepreneur himself included in the number? An individual entrepreneur is not a hired employee, he does not enter into an employment contract with himself, therefore, when calculating the number of “workers”, he is not included in their number. In paragraph 3 of Art. 80 of the Tax Code directly states that the form must be submitted by “an entrepreneur who hired employees during the specified period.”

Thus, the average number of employees of individual entrepreneurs without employees does not give up.

Checking the 1C database for errors with a 50% discount

We will provide a written report on errors. We analyze more than 30 parameters

- Incorrect indication of VAT in documents;

- Errors in mutual settlements (“red” and expanded balances according to settlement documents or agreements on accounts 60, 62, 76.);

- Lack of invoices, checking duplicates;

- Incorrect accounting of inventory items (re-grading, incorrect sequence of receipts and expenses);

- Duplication of elements (items, currencies, counterparties, contracts and accounts, etc.);

- Control of filling out details in documents (counterparties, contracts);

- Control (presence, absence) of movements in documents and others;

- Checking the correctness of contracts in transactions.

More details Order

When applying the patent taxation system (hereinafter referred to as the PSN), an individual entrepreneur has the right to attract employees, including under civil contracts. At the same time, the average number of people hired during the tax period should not exceed 15 people for all types of business activities in which the taxpayer is engaged. This is stated in paragraph 5 of Article 346.43 of the Tax Code of the Russian Federation.

Is an individual entrepreneur using PSN included in the calculation of the average number of employees? The answer to this question is given in a published letter from the Russian Ministry of Finance.

Regulatory act for calculating the average number

Specialists from the Finance Ministry indicated that the average number of employees is determined in accordance with the procedure established by Rosstat

.

In particular, you should be guided by the Instructions for filling out federal statistical observation forms

(hereinafter referred to as the Instructions):

- No. P-1 “Information on the production and shipment of goods and services”;

- No. P-2 “Information on investments in non-financial assets”;

- No. P-3 “Information on the financial condition of the organization”;

- No. P-4 “Information on the number, wages and movement of workers”;

- No. P-5(M) “Basic information about the organization’s activities.”

They were approved by Rosstat order No. 435 dated October 24, 2011

.

Determination of average number

According to paragraph 77 of the Guidelines, the average number of employees includes:

- average number

of employees; - average number of external part-time workers

; - the average number of employees

performing work

under civil contracts

.

Hence, the Ministry of Finance of Russia concluded that PSN has the right to apply an individual entrepreneur whose average number of employees, together with external part-time workers and those working under civil law contracts, is up to 15 people (inclusive)

.

As for the individual entrepreneur

is not taken into account

when calculating hired workers .

Example 1

Individual entrepreneur O.P. Lapshin provides excursion services. In 2013, he switched to PSN. The patent validity period is from January 1 to December 31, 2013.

To check the availability of the right to use PSN O.P. in April. Lapshin decided to calculate the average number of his employees from January 1 to March 31. During this period, he was assisted in providing excursion services by employees who:

- worked for him under an employment contract;

- performed labor duties under civil contracts;

- were invited from other organizations to work part-time.

At the same time, O.P. Lapshin, the average number of employees was 4 people, the average number of external part-time workers was 6 people, the average number of employees performing work under civil contracts was 5 people.

Thus, the average number of employees at O.P. Lapshin consisted of 15 people (4 + 6 + 5), which did not exceed the established limit.

This means that in April he has the right to apply the PSN, of course, if he has not violated the conditions regarding the amount of income from sales and timely payment of tax (payment of the patent).

In a published letter, the Russian Ministry of Finance also noted that an individual entrepreneur who does not attract

when conducting “patent” activities,

hired workers

also

have the right to apply PSN

.

Calculation of average headcount

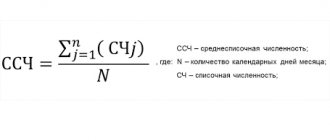

Let us remind you that according to paragraph 78 of the Instructions, the average number of employees per month is calculated using the formula:

| Average number of employees per month | = | The sum of the payroll number of employees for each calendar day of the month | : | Number of calendar days of the month |

When determining the amount of the payroll number of employees, the payroll number of employees is taken into account for each calendar day of the month, that is, from the 1st to the 30th or 31st (for February - on the 28th or 29th), including holidays (non-working days) and weekends.

The number of employees on the payroll for a weekend or holiday (non-working) day is taken to be equal to the number of employees on the payroll for the previous working day.

The average number of employees is calculated on the basis of daily records of the number of employees. The latter must be clarified by orders on hiring workers, transferring them to another job, or terminating an employment contract.

The number of employees on the payroll for each day must correspond to the data of the working time sheet, on the basis of which the number of employees who showed up and did not show up for work is determined.

The average number of employees is calculated based on data on the payroll number, which is given as of a certain date, for example, the last day of the reporting period (clause 79 of the Instructions).

The payroll includes mercenaries who worked under an employment contract and performed permanent, temporary or seasonal work for one day or more.

The list of employees for each calendar day takes into account both those actually working and those absent from work for any reason, for example:

- on business trips. The condition is that they retain their salary in this organization;

- those who did not show up for work due to illness;

- absent from work due to the performance of state or public duties.

Among the employees who are not included in the payroll, in particular, are (clause 80 of the Instructions):

- hired part-time from other organizations;

- performing work under civil contracts;

- those who submitted a letter of resignation and stopped performing their job duties before the expiration of the warning period (those who stopped working without warning the administration).

Some employees are not included in the average headcount. These include (clause 81.1 of the Guidelines):

- women on maternity leave;

- persons who were on leave in connection with the adoption of a newborn child directly from a maternity hospital, as well as on parental leave;

- employees who study in educational institutions and are on additional leave without pay, entering educational institutions who are on leave without pay to take entrance exams.

Example 2

Employees of individual entrepreneur O.P. Lapshins work on a five-day workweek schedule. For March, the following data is available on the number of employees working full time.

| Days of the month | Number of employees | In particular, they are not subject to inclusion in the SSChR (clause 81.1 of the Instructions) | To be included in the USSR (group 2 – group 3) |

| 1 | 2 | 3 | 4 |

| 1 | 5 | 1 | 4 |

| 2 (Saturday) | 5 | 1 | 4 |

| 3 (Sunday) | 5 | 1 | 4 |

| 4 | 6 | 2 | 4 |

| 5 | 6 | 2 | 4 |

| 6 | 6 | 2 | 4 |

| 7 | 6 | 2 | 4 |

| 8 (non-working holiday) | 6 | 2 | 4 |

| 9 (Saturday) | 6 | 2 | 4 |

| 10 (Sunday) | 6 | 2 | 4 |

| 11 | 8 | 2 | 6 |

| 12 | 8 | 2 | 6 |

| 13 | 8 | 2 | 6 |

| 14 | 8 | 2 | 6 |

| 15 | 7 | 2 | 5 |

| 16 (Saturday) | 7 | 2 | 5 |

| 17 (Sunday) | 7 | 2 | 5 |

| 18 | 6 | 2 | 4 |

| 19 | 6 | 2 | 4 |

| 20 | 6 | 2 | 4 |

| 21 | 6 | 2 | 4 |

| 22 | 6 | 2 | 4 |

| 23 (Saturday) | 6 | 2 | 4 |

| 24 (Sunday) | 6 | 2 | 4 |

| 25 | 6 | 2 | 4 |

| 26 | 6 | 2 | 4 |

| 27 | 6 | 2 | 4 |

| 28 | 6 | 2 | 4 |

| 29 | 6 | 2 | 4 |

| 30 (Saturday) | 6 | 2 | 4 |

| 31 (Sunday) | 6 | 2 | 4 |

| Sum | 194 | 59 | 135 |

The table shows that the sum of the number of payroll employees for all days of March to be included in the average payroll number is 135.

The calendar number of days in a month is 31.

Based on this, the national average for March will be 4.35 people (135: 31).

The NARR for the quarter is determined as follows. It is necessary to add up the SSChR for all months of the organization’s operation in the quarter and divide the resulting amount by three (clause 81.5 of the Instructions).

Example 3

Individual entrepreneur O.P. Lapshin has the following data on the USSR:

- for January - 3 people;

- for February – 4.65 people;

- for March – 4.35 people.

Thus, the NHR for the first quarter will be 4 people [(3 + 4.65 + 4.35) : 3].

To determine the SSChR for the period from the beginning of the year to the reporting month inclusive, it is necessary to add up the SSChR for all months that have elapsed for the period from the beginning of the year to the reporting month inclusive. Then divide the resulting amount by the number of months for the period from the beginning of the year, that is, respectively, by 2, 3, 4, etc. (clause 81.6 of the Instructions).

Example 4

Individual entrepreneur O.P. Lapshin has the following data on the USSR:

- for January - 3 people;

- for February – 4.65 people;

- for March – 4.35 people;

- for April – 6 people

Thus, the SSChR for the period from January 1 to April 30 will be 4 people [(3 + 4.65 + 4.35 + 4) : 4].

Reflection in the application for a patent

An individual entrepreneur who decides to use PSN must indicate the average number of employees in the application for a patent.

In the published letter, the Russian Ministry of Finance reminds that the recommended form of this document was approved by order of the Federal Tax Service of Russia dated December 14, 2012 No. ММВ-7-3/957.

In it, the taxpayer should indicate:

- information

that he carries out business activities

either with the involvement of hired workers

(including under civil contracts)

or without their involvement

; - the average number

of hired

workers

or

zero

if they are not involved.

It must be borne in mind that the constituent entities of the Russian Federation have the right to establish the amount of annual income that an individual entrepreneur can potentially receive, including depending on the average number of employees.

In the commented document, specialists from the Ministry of Finance believe that an individual entrepreneur who does not attract

when carrying out business activities on the territory of a constituent entity of the Russian Federation, in respect of which the PSN is applied, hired

workers

are included in the group “

average number of hired workers up to 5 people inclusive

.”

Reporting form.

Please note that information on the average number of employees is submitted in the recommended form, which was approved by Order of the Federal Tax Service of Russia dated March 29, 2007 No. MM-3-25/174.

Download for free

You can submit a report to the tax office either electronically or in paper form.

Important!

The calculation rules apply the same as for statistical reporting and for form 4-FSS: they were approved by Rosstat order No. 772 dated November 22, 2017. The document differs from the previous current order of Rosstat.

How to send information about the average headcount

IMPORTANT!

Remember: the average number of individual entrepreneurs without employees for 2021 is not required. Moreover, neither legal entities nor individual entrepreneurs with employees submit an annual report on the SSC. This report has been cancelled.

Organizations and individual entrepreneurs that have employees on staff send information as part of the calculation of insurance premiums. Its form was approved by order of the Federal Tax Service No. ММВ-7-11/ dated September 18, 2019, but this standard becomes invalid in 2022. From December 29, 2021, a new order of the Federal Tax Service No. ED-7-11/ dated October 6, 2021 comes into effect. Use the new 2022 filing form.

To find out what the average headcount of an individual entrepreneur without employees is for other purposes (for example, at the request of counterparties), use the methodology from Rosstat Order No. 711 dated November 27, 2019. Both organizations and individual entrepreneurs calculate information about the SSC as follows: the number of employees present for each day during the month is summed up and divided by the number of calendar days in the month. The data for each month is summed up and divided by 12; no exceptions or deductions are provided.

The calculation takes into account only personnel with whom the employer is obliged to enter into employment contracts. According to the norms, individual entrepreneurs without employees reflect the average number of employees in the DAM, if there were employees on staff in at least one month of the reporting period.

The certificate does not take into account personnel who:

- carries out labor activities outside the Russian Federation;

- transferred to another organization;

- placed under a student agreement;

- is on maternity leave, etc.

More details: average number of employees: report to the tax office

Rosstat Order No. 711 explains how many to indicate the number of employees if an individual entrepreneur has no employees - 0, that is, no one is required to be indicated. The individual entrepreneur himself, without hired employees, is not included in the SSC and is not taken into account either in statistical reports or in the calculation of insurance premiums.

Step by step calculation

To correctly calculate the indicator, we recommend using a step-by-step average headcount calculator.

Step No. 1. Calculate for each day of the month.

Only those employees with whom employment contracts have been concluded should be added to the report. Even if the employee is on vacation, sick leave or on a business trip.

There are employees who do not need to be shown in the average number. They are specified in paragraph 78 of Order No. 772:

- employees on civil servants' contracts;

- external part-time workers;

- founders of the organization who do not receive salaries;

- lawyers, etc.

Let's give an example. Peresvet LLC has 12 employees as of November 30, 2022. Two of them are external part-time workers, and one employee works under a contract agreement.

To determine the payroll number as of November 30, let’s make a simple calculation of the number of employees:

12 people – 2 people – 1 person = 9 people

Step No. 2. Find out the monthly number of full-time employees.

To calculate the average number of full-time employees, we recommend using the following formula:

Average number of full-time employees = Sum of the number of full-time employees for each day of the month / Number of calendar days of the month.

Please keep in mind that the total headcount of full-time employees for each day of the month includes weekends and holidays.

But do not include in the calculation of the average number of employees who are on maternity leave, “children’s” leave, or part-time workers. Also do not take into account employees who took time off at their own expense to study or enroll in a university. This point is stated in paragraph 79 of Order No. 772.

There is an exception.

If your employee works part-time while on maternity leave, do not exclude her from the average headcount. This rule will apply from 2022.

Let's look at this step with an example. We have already found out that the number of employees at Peresvet LLC as of November 30 is 9 people. Seven of them work full time. Two employees went on maternity leave on November 5 and 19.

We calculate the number of employees on the payroll for all days of November:

(9 people x 4 days) + (8 people x 14 days) + (7 people x 12 days) = 232 people.

Let's calculate the average number of full-time employees:

232 people/30 days = 7.73 people

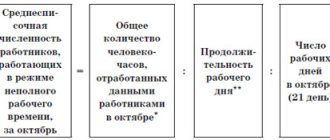

Step No. 3. Find out the monthly number of part-time employees

Count part-time workers in the monthly headcount in proportion to the hours worked. The number must be determined in two stages:

- Determine the number of man-days worked by part-time workers. You need to divide the monthly amount of man-hours by the length of the working day.

- Calculate the monthly number. Divide the number of man-days per month by the number of working calendar days in the month.

Let's return to our example with Peresvet LLC. The number of employees of the company as of November 30 is 9 people. Two employees work part-time: 2 and 6 hours a day.

First, we find out the number of person-days for November:

2 person-hour x 21 days / 8 hours + 6 person-hour x 21 days / 8 hours = 21 person-day

Now let’s calculate the average number of employees per month:

21 person-day / 21 days = 1 person.

Step 4. Calculate the average number of employees per month

To do this, you need to add up the number of full-time and part-time employees for this period. Fractional values must be rounded to the nearest whole value.

In the previous example it looks like this:

7.73 people + 1 person = 8.73 people (rounded up to 9 people).

Step 5. How to calculate the average headcount.

Here you need to use the formula:

Average number of employees for the year = Sum of average number of employees for all months of the year / 12 months.

To determine the number of employees for the first quarter, it is necessary to add up the number of employees for January, February and March and divide by 3. Similarly, the number is determined for six months and 9 months.

How to accurately calculate the average number of employees

To correctly calculate the average number of employees, specialists refer to the instructions for filling out statistical form No. P-4 “Information on the number and wages of employees.” For 2022, they were approved by Rosstat order No. 711 dated November 27, 2019. Starting with reporting for January 2022, Rosstat order No. 832 dated November 24, 2021 comes into force.

Important! Starting with reporting for January 2022, Rosstat order No. 832 dated November 24, 2021 comes into force. Read what’s new in this order in the Review from ConsultantPlus. Trial access to the system can be obtained for free.

When calculating, you need to understand which employees should be taken into account and which should not. Thus, those on sick leave, on regular leave, on study (but maintaining average earnings), on unpaid leave, on a business trip, missing work, etc. should be included in the TSS indicator.

The following categories of workers will not be included in the calculation:

- external part-time workers;

- employees who have signed civil contracts;

- transferred to other companies and sent abroad without pay;

- employees studying outside the production process, etc.

A complete list of persons included and not included in the calculation can be found in paragraphs 77-78 of the instructions.

The algorithm for calculating the MSS can be set as follows:

- We calculate the MSS for each day of the month.

- We calculate the SCN of full-time employees for each month.

- We find part-time employees for each month.

- We determine the MSS for each month of the period.

- We display the result - the average value for the past year.

The detailed algorithm can be viewed in ConsultantPlus by receiving free trial access to the system.

We generate a report on the payroll and average number of employees of the organization in “1C: ZUP 8”

In the 1C: Salary and Personnel Management 8 program it is convenient to analyze the average number of employees. To do this, you need to generate a report “Number of staff and turnover”

.

Please note that in the current version of the 1C:ZUP program and if there is a valid 1C:ITS agreement, the report generates information on the average number of employees in accordance with the instructions of Rosstat and the latest changes in legislation.

So, in the program, select the Personnel section - Personnel reports - link “Number of personnel and turnover”.

Next, in the “Period” field, specify the period for which you want to generate a report.

In the “Organization” field, indicate the organization for which you want to generate a report.

Select the “By departments” checkbox if you need to generate a report by departments.

If you need to decipher the report on employees, click on the desired line, after which a special “Field Selection” form will open, in which select the “Employee” field.

If you have any questions about generating a report on the average number of employees, you can ask them to the specialists of First Bit.

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

What is the average headcount?

SSCh is the average number of full-time employees who worked for you during a certain time (month, quarter, year). This information is used when:

- resolving the issue of classifying an organization or individual entrepreneur as a small or medium-sized enterprise (SME); this status provides a number of benefits: it exempts microenterprises from the obligation to adopt local regulations, provides benefits when participating in government procurement, etc.;

- formation of a register of small and medium enterprises by tax authorities;

- conducting an analysis of the level of salaries and the amount of salary taxes;

- submission of reports and application of certain benefits: enterprises with over 100 employees. Tax reporting is provided only in electronic form; in some regions, the size of this indicator is one of the conditions for applying a reduced rate under the simplified tax system.

In other words, information about the capital balance is one of the important indicators of the activity of an economic entity.

The form for providing the SSC for the report for 2022 was approved by Order of the Federal Tax Service of the Russian Federation dated March 29, 2007 No. MM-3-25/ [email protected] And instructions for filling it out are given in the Letter of the Federal Tax Service of the Russian Federation dated April 26, 2007 No. CHD-6-25/ [ email protected] .

Form of information about the SSC for 2022