Home /Articles on bankruptcy of individuals

Author of the article: Konstantin Milantiev

Last revised January 30, 2022

Reading time 12 minutes

211

As a rule, entrepreneurial activity drowning in debt is a dead end for a businessman. The goal of entrepreneurship is to make a profit, and when all the profit goes to cover payments, or there is no revenue at all, only the entrepreneur’s debts increase. There is only one way out - bankruptcy.

Bankruptcy of an individual entrepreneur with debts is not only the right of a person to initiate a process to get rid of debts. Sometimes this is a direct responsibility.

In this article, we will consider when an individual entrepreneur is obliged to file for bankruptcy, how to file bankruptcy for an individual entrepreneur with loan debts, and what awaits him after receiving bankruptcy status.

Bankruptcy of an entrepreneur

An entrepreneur can begin bankruptcy without first liquidating the individual entrepreneur, but then the Unified State Register of Entrepreneurs will have information about the closure of activities by court decision. Therefore, lawyers usually close the status of an entrepreneur before filing an application.

Bankruptcy of an individual entrepreneur can be initiated either independently by the individual entrepreneur-debtor or by his creditors.

Self-bankruptcy

An individual entrepreneur with debts has the right to file an application for bankruptcy. However, in a number of cases this right becomes a duty.

When bankruptcy is the right of an individual entrepreneur

Who can file for bankruptcy as an individual entrepreneur?

Like an individual, having accumulated debts and realizing that he will not be able to repay them, an entrepreneur can file an application for recognition as insolvent (bankrupt).

The application is submitted to the Arbitration Court or to the MFC at the location or registration of the person. These are separate bankruptcy procedures that have the same outcome, but a different procedure for achieving it. We will discuss and compare the judicial and extrajudicial bankruptcy procedures for individual entrepreneurs later.

An entrepreneur with any amount of debt to creditors, which he objectively does not have the opportunity to repay, can independently apply for bankruptcy. Taking into account the costs of the procedure, people go to court with debts of 300 thousand rubles.

When bankruptcy is the responsibility of an individual entrepreneur

In accordance with the law, an entrepreneur is obliged to apply for bankruptcy in the following cases:

- The amount of debt to creditors is more than 500,000 rubles;

- The debt is overdue for more than 90 days;

- He cannot pay everyone completely.

Under such conditions, it is the debtor’s responsibility to initiate bankruptcy proceedings. According to Art. 14.13 of the Administrative Code, if the above obligation is not fulfilled, a fine of up to 3,000 rubles is imposed on the person.

Bankruptcy by creditors

An individual entrepreneur can be bankrupted by his creditor by collecting the necessary package of documents. If there is a debt of more than half a million rubles, creditors have the right to file an application against the debtor not only individually, but also by combining their claims in one application.

The moratorium on bankruptcy of individual entrepreneurs ended on January 7, 2021

of the year. Due to the coronavirus situation, a moratorium on bankruptcy of entrepreneurs by creditors was temporarily introduced. In 2022, banks, the Federal Tax Service and the entrepreneur’s counterparties have the right to file for bankruptcy.

Bankruptcy by authorized bodies - Federal Tax Service

One of the bodies that has the right to initiate bankruptcy of an entrepreneur is the Federal Tax Service.

When a citizen does not fulfill his obligations to the Federal Tax Service to pay taxes and fees for a long time, and the arrears exceed half a million rubles, the tax office can also file for bankruptcy.

Bankruptcy by employees and former employees of an entrepreneur

The entrepreneur's employees or former employees also have the right to file for bankruptcy of the entrepreneur if there are debts to pay wages, severance pay and other payments.

How will forced closure work and can it be challenged?

If an entrepreneur has committed violations, the tax authorities have the right to forcefully close it. Within three days after the decision is made, officials must publish an announcement about it in the State Registration Bulletin.

The tax authorities are not required to inform the entrepreneur himself about the upcoming closure.

Within a month after the announcement is published, all interested parties can challenge the upcoming closure by sending a free-form application to the address specified in the announcement. The document can be brought in person, sent by mail or electronically.

Such persons can be both counterparties (primarily creditors) and the entrepreneur himself. Creditors may not agree with the closure of an individual entrepreneur if the businessman has not repaid the debt to them. It will be more difficult to collect if an individual entrepreneur becomes just an individual. For example, he may close a store or workshop and not live at his place of registration.

If no statements regarding the forced closure of the individual entrepreneur are received within a month from the date of publication, the tax authorities will exclude the entrepreneur from the state register. After this, those who were late to express their disagreement can appeal the closure of the individual entrepreneur in court for another year. A former entrepreneur can also go to court.

Stages of judicial bankruptcy

If we talk about the procedure for bankruptcy of an entrepreneur on his own initiative, then from the moment he thinks about bankruptcy until bankruptcy itself, the step-by-step instructions will be as follows:

- Search for a financial manager and lawyer

The key persons in the bankruptcy process are the financial manager and the lawyer. Both persons are selected by the debtor before filing the application.This step should not be neglected, since the quality and duration of bankruptcy depends on their professionalism. By quality we mean how profitable the bankruptcy procedure will be for the individual entrepreneur, whether it will be possible to write off all debts, what property will be sold, and what the consequences will be for the bankrupt entrepreneur.

- The financial manager is the person who accompanies the procedure. He is entrusted with the following responsibilities: receiving the debtor’s income and managing his accounts, searching for hidden accounts, property and fictitious contracts, assessing and selling property, as well as supporting other issues arising in the bankruptcy process.

A lawyer is the right hand of a future bankrupt. A lawyer acts in the interests of the debtor, protects his interests in court, in disputes with creditors, collectors, bailiffs and banks. The right lawyer is no less interested than the debtor himself in a successful bankruptcy without adverse consequences for the debtor. A lawyer works with his client (entrepreneur-debtor) from the first consultation and filing of an application until a decision is made to declare the person insolvent.

- Collection of documents and preparation of application

When preparing an application, you must refer to evidence, copies of which are attached to the application.If the package of documents is incorrectly collected or the application is prepared incorrectly, the court will not accept such an application. It is important to prepare the application correctly and attach all the necessary documents.

List of documents for bankruptcy of an individual - 25.5 KB

The list of documents required to submit an application is established by law. This includes copies of the passport, SNILS, TIN of the debtor entrepreneur, financial documentation, certificates, loan agreements, and so on.

Documents for bankruptcy of an individual in 2022Related articleDocuments are attached to the application to show the court the impossibility of the person fulfilling his obligations to creditors and to prove the need for bankruptcy.

- Acceptance of the debtor's application for proceedings

After examining the application and documents, subject to all requirements of the law, the judge accepts the application and initiates legal proceedings. - Debt restructuring

After the initiation of proceedings, the stage of restructuring the debtor’s debts begins. This is an attempt to restore the solvency of the individual entrepreneur and financial recovery.If a citizen has a stable income, a restructuring plan is drawn up, which the debtor must adhere to. In case of deviation from the plan, the restructuring is terminated and the sale of property is introduced.

The restructuring stage exists in the interests of the entrepreneur himself. He can cope with debts without resorting to selling property. This means there is an opportunity to save the business.

- Sale of property

When the debtor violates the restructuring plan, or the payment plan cannot be approved, due to the fact that a non-working individual entrepreneur goes bankrupt without income, the stage of selling his property begins.

How is the sale of property carried outRelated articleAll property is described and assessed. What can be sold is included in the bankruptcy estate and is sold at auction.

The proceeds go to pay off debts. Bankruptcy of an individual entrepreneur without property passes faster due to the lack of bidding.

Based on the results of the sale of property or in the case where there is nothing to sell, the arbitration court issues a ruling that ends the procedure. The debtor is released from fulfilling obligations.

Judicial representation rests entirely with the lawyer, which frees the debtor from endless trips to court and other authorities, and protects him from unnecessary stress and contacts with former counterparties and other creditors.

Extrajudicial bankruptcy

The simplified out-of-court bankruptcy procedure differs from the court procedure, the deadlines, the necessary documents and the bankruptcy authority itself.

Conditions

- A simplified procedure is possible when the amount of individual entrepreneur’s debts does not exceed 500,000 rubles.

- The absence of property and income must be confirmed earlier - in relation to this debtor, the FSSP has completed enforcement proceedings under clause 4 of part 1 of art. 46 Federal Law No. 229.

An entrepreneur with debts can obtain bankruptcy status without a trial by submitting an application to the MFC. There is no need to pay state duty.

Six months from the date of filing the application with the MFC, information about the completion of the procedure is included in the Unified Federal Register of Bankruptcy Information. The debtor is released from fulfilling obligations to creditors.

Our services and prices

Free consultation

0 ₽

- You talk about your problem, ask questions;

- The lawyer clarifies the necessary information, analyzes the situation, tells options for the development of events;

- Together you choose a profitable option - bankruptcy, refinancing, just a complaint against debt collectors or a bank;

- The lawyer tells you how to prepare, where to get documents, and what to do in your case.

Read more

Out-of-court bankruptcy in MFC on a turnkey basis

25 160 ₽

- Verification and recording of debts and proceedings in the FSSP, assessment of property and contestability of transactions for 3 years

- Drawing up an application and list of creditors

- Filing a bankruptcy application to the MFC by proxy

- Working with banks and collectors - notification of refusal to cooperate, complaints to the prosecutor's office and the FSSP in case of violations

- Representation of interests by a lawyer in case of objections from creditors

- Six months later, you receive a decision from the MFC to declare you bankrupt and write off your debts.

Read more

Turnkey bankruptcy of an individual

from 8,460 ₽/month.

- Filing a bankruptcy petition

- Collection of necessary documents

- State duty and remuneration of the arbitration manager

- Representation of interests by a lawyer at a court hearing on the introduction of bankruptcy proceedings

- Full support of bankruptcy proceedings by financial managers

More details

How much does bankruptcy cost?

Bankruptcy through the court is not a free procedure, and it cannot be done without paying fees. Its cost consists of:

Debt write-off price in 2022: how much does bankruptcy cost on loans? Related article

- postage;

- state duty 300 rubles;

- payment of remuneration to the financial manager 25,000 rubles;

- expenses for publications and auctions.

Legal costs will start from 60 thousand rubles, and lawyer’s services - from 100 thousand rubles per procedure.

The advantage of extrajudicial bankruptcy is that it is free of charge. When submitting an application through the MFC, as well as in the extrajudicial bankruptcy process itself, the applicant does not have to pay anything. The procedure is completely free.

What debts are not written off in the event of bankruptcy of an individual entrepreneur?

Bankruptcy should be a conscious step. The state cannot afford to release everyone from any obligations, because there is also a second party to the contract - the bank, supplier, employee or recipient of alimony. Bankruptcy has its own characteristics for everyone.

Recognition of insolvency will allow the individual entrepreneur to part with loans, but some debts still remain with the debtor after bankruptcy. The types of such debts are fixed by law.

These include:

- Current payments;

- Compensation for harm to life and health, moral damage;

- Severance pay and wages;

- Alimony;

- Vicarious liability.

An entrepreneur will not get rid of all these debts, even if he goes bankrupt. And after the death of the person, these debts will pass to the heirs. Therefore, it makes no sense to go bankrupt only with huge debts to pay salaries to your employees. Here, in a sense, an individual entrepreneur without employees or without debts to them will be lucky.

Writing off tax debts for individual entrepreneurs

Is it possible to exit the procedure without paying taxes? The headache for entrepreneurs who have filed for bankruptcy is taxes. Is bankruptcy possible for an individual entrepreneur with tax debts, and will bankruptcy help pay off debts to the tax authorities? The answer to the first question is yes. On the second - no. Let's figure it out.

The law does not limit the types of debts that can be filed for bankruptcy. Whether it is credit, tax debts, debts to suppliers and customers of individual entrepreneurs - it does not matter. It is possible to go bankrupt with unpaid taxes. Next, the court will assess the situation:

- If a person had no income and did not pay taxes, then arrears can be written off.

- But if the activity was carried out, there was money, and the person did not pay taxes, hid the turnover from the Federal Tax Service, etc. the court may refuse to write off debts to the budget. But at the same time, if an individual entrepreneur is insolvent, he will still be released from debts to individuals and commercial organizations. It all depends on the situation and the competent work of your lawyer.

How to find out tax debt using Taxpayer Identification Number article on the topic

But the former individual entrepreneur will have to pay tax debts after bankruptcy for the period during which the case was going on. Taxes are included in the list of “current payments” that remain with the debtor even after the loans are written off. Current claims include those that arose after the initiation of bankruptcy proceedings. For example:

- rent;

- provision of services: utilities, communication services;

- mandatory payments: fees, taxes (including VAT), fees, etc.;

- severance pay and wages of employees if they work during the bankruptcy period;

- payment for the services of lawyers, notaries, advocates.

These obligations will remain after the insolvency procedure. After bankruptcy proceedings have been initiated, taxes continue to be assessed—for example, on property (a single apartment). And since taxes are assessed, they will need to be paid.

The individual entrepreneur has a debt

Immediately about individual entrepreneurs is possible if there are any debts!

Debt to contractors and employees

If an individual entrepreneur has a debt to contractors and employees, liquidation is possible without prior payment (the regulatory authority does not require payment). Unlike legal persons, individual entrepreneurs are not required to notify creditors before closing; but such debt will be transferred to individuals. face.

Debt to the budget of the Russian Federation: debt on taxes and fees

If an individual entrepreneur has a debt to the budget, it is also possible to close the individual entrepreneur without paying the debts in advance.

Let us recall that previously (until 2011) the main obstacle to closing an individual entrepreneur was the need for the entrepreneur to provide the regulatory authority with a Certificate from the Pension Fund of the Russian Federation confirming the absence of arrears. However, since 2011, the procedure has been changed and such a certificate is not required to be submitted (but many do not know about this and take unnecessary actions) - the regulatory agency requests it independently through an interdepartmental agreement.

After the individual entrepreneur is closed, the responsibility for repaying arrears passes to the individual. face.

The law establishes a 15-day period for the payment of insurance premiums, which is calculated from the moment information about the liquidation of an individual entrepreneur is entered into the Unified State Register of Individual Entrepreneurs (clause 8 of Article 16 of the Law of July 24, 2009 N 212-FZ). After the expiration of the specified period, interested authorities have the right to file a claim in court and, after receiving a court decision, contact the bailiff service for forced collection.

An important detail should be taken into account that the source of payment of the debts of the former individual entrepreneur is all his personal property

, with the exception of that which is not subject to penalty: the only suitable housing, personal belongings (except for luxury items), food.

Closing an individual entrepreneur

When it is difficult to cope with debts, they accumulate like a snowball, and there is no question of continuing the business. An individual entrepreneur has the right to close his business without bankruptcy by submitting an application to the tax office.

The fact that an individual entrepreneur is liquidated does not mean getting rid of debts incurred as a result of entrepreneurial activity. An individual entrepreneur's liability for debts extends beyond the business assets. An entrepreneur is liable for obligations with all of his property: personal, half of the common property with his wife and commercial assets.

The person terminates his registration as an entrepreneur, and after cessation of activity, all debts are transferred to him as an individual. Therefore, a situation where an individual entrepreneur is closed, but debts remain, is in the order of things. Taking out a loan for an individual entrepreneur and going bankrupt so as not to pay it off will not work.

It is also possible to close a current account with debts to counterparties and taxes, since from now on payments will be made by an individual from his personal account.

Close your bank account. A closed individual entrepreneur does not need it

The law does not oblige an entrepreneur to close a current account when closing an individual entrepreneur. But we advise you to do this, so as not to arouse increased interest from the tax authorities. After all, the account was opened in the name of the entrepreneur, and after the closure of the individual entrepreneur, the entrepreneurial status is lost.

So, after paying final settlements to employees, returning and collecting debts, paying fees and taxes, it is better to close the account. Before doing this, do not forget to withdraw the remaining money from him and return the debt to the bank, if any.

You can request an account closure application form from your bank. Confirmation of closing the current account will be a certificate issued by the bank.

In 2014, the obligation of an entrepreneur to report the closure of a current account to the tax office and funds was abolished. The bank will do this on its own.

How to close an individual entrepreneur through public services with debts without visiting the tax office

An individual entrepreneur can be closed by personally contacting the Federal Tax Service or the MFC. You can also close an individual entrepreneur online through the tax office website, which will be faster, without queues and hassle with making an appointment. You cannot close an individual entrepreneur through State Services - there is no such function. But there are detailed instructions on how to deregister with the Federal Tax Service.

The procedure for closing an individual entrepreneur with debts is no different from closing an individual entrepreneur without debts. It is necessary to pay the state fee, fill out an application and receive a document confirming the submission of reports to the Pension Fund.

It is also possible to close a peasant farm with tax debts. At the same time, the liquidation of a peasant farm registered as an individual entrepreneur is carried out in the same order and through the same authorities.

How to protect an individual entrepreneur from forced closure

The best way to solve this problem is prevention. To avoid forced closure, an individual entrepreneur must:

- Submit all tax reports on time.

- Pay taxes and insurance premiums not on the last day of the year, but monthly, in equal installments. This will help plan tax payments in the following reporting periods.

- Every year in January, reconcile calculations of taxes and fees with the tax office for the previous year or request a certificate of fulfillment of the obligation to pay taxes. This will help identify discrepancies and technical errors in the Federal Tax Service’s taxpayer accounting system.

But if violations have already been committed, and there is a risk of forced closure, then you need to act as follows:

First, check the information monthly on the State Registration Bulletin website. To do this, just enter your TIN in the search bar.

To get information about an individual entrepreneur, you need to enter the TIN in the search bar

Secondly, if an announcement appears about the upcoming exclusion of an individual entrepreneur from the state register, urgently prepare and send a reasoned objection in any form to the address specified in the announcement. The document can be brought in person, sent by mail or sent electronically.

The law does not say exactly how an entrepreneur can justify his position. But we can assume that the following arguments will be effective:

- the arrears have already been repaid and overdue reports have been submitted;

- the entrepreneur actually conducts business and pays taxes.

It is possible that there were no violations, and the entrepreneur was included in the list due to a technical error when accepting declarations or recording payments.

Then the objection should indicate this fact by including in the letter wording like: “I inform you that the decision to forcefully exclude me from the Unified State Register of Individual Entrepreneurs was made in error. All reports were submitted on time, there are no tax arrears, which is confirmed by receipts, payment orders and a reconciliation report with the Federal Tax Service.”

Thirdly, if a month has passed since the publication and the tax authorities have already closed the individual entrepreneur, then all that remains is to go to court. The claim can indicate the same grounds as indicated in the previous paragraph.

To substantiate his objections, the entrepreneur can attach supporting documents to the application:

- payment orders for the transfer of taxes with a bank mark;

- reconciliation report with the Federal Tax Service;

- tax returns with a mark from the Federal Tax Service on acceptance or receipts for sending reports in electronic form.

If an individual entrepreneur is liquidated, do I need to pay taxes?

It is possible to close an individual entrepreneur with tax debts, just like with debts on insurance premiums, debts to LLCs or bailiffs. But the closure is not an amnesty. The former entrepreneur continues to be liable for these debts to counterparties (including paying insurance premiums to the pension fund), but as an individual. Therefore, it will not be possible to close an individual entrepreneur and not pay taxes - everything that is accrued will be collected.

How to close an individual entrepreneur with debts in 2022 Related article

By taking on the debts of a failed business, a person is not deprived of the right to bankruptcy as an individual.

But what to do if you close your individual entrepreneur, but taxes are coming?

Making demands for payment of arrears on taxes is quite possible even after activities as an individual entrepreneur have been terminated.

Here you need to check the debt and understand what kind of accruals are occurring. To find out the debt for a closed individual entrepreneur, you need to contact the Federal Tax Service and, in case of an error, urgently appeal the actions of the authority.

Submit final reports for employees so as not to receive a fine

If an individual entrepreneur has employees, before closing the enterprise it is necessary to submit reports to the tax office, the Pension Fund and the Social Insurance Fund. Entrepreneurs without employees can skip this step.

Individual entrepreneurs with hired employees most likely have already had to submit reports at least once, since they are submitted monthly and quarterly. If not, we will tell you where you can and see the order of filling them out.

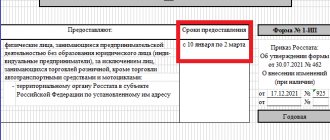

You need to submit a calculation of insurance premiums (DAM), certificates 2-NDFL and 6-NDFL to the tax office. The form and procedure for filling out the RSV can be downloaded in the appendix to the order of the Federal Tax Service dated September 18, 2019, the form and procedure for filling out certificate 2-NDFL - in the appendix to the order of the Federal Tax Service dated 02.10.2018, the form and procedure for filling out certificate 6-NDFL - in the appendix to the order of the Federal Tax Service dated 10/14/2015.

Reports SZV-M and SZV-STAZH should be submitted to the Pension Fund. The SZV-STAZH form can be downloaded from the Resolution of the PFR Board dated December 06, 2018, and the SZV-M form can be downloaded from the PFR website in the “for policyholders” section.

And finally, submit a report to the FSS in form 4-FSS. You can download the form on the FSS website in the “financial reporting” section.

Important. Submit all reports for employees, except for 2-personal income tax, to the tax office and funds before the day of filing the application to close the individual entrepreneur. 2-NDFL can be submitted before April 1 of the year following the year of termination of the individual entrepreneur’s activities.