HomeInformation Customs payment order

Material updated: 01/11/2022

A customs payment order is the most important document intended for payment of customs duties. Errors when filling out this document are not acceptable. The form of this document, as well as the procedure for filling it out, is regulated by law. The Federal Customs Service of the Russian Federation (FCS RF) is actively introducing modern digital technologies and, in accordance with this, changes are being made to the Payment Order “customs payments”. It is very important to monitor the changes that occur and fill out the payment order correctly in accordance with them. Unfortunately, even experienced participants in foreign trade activities make mistakes when filling out Customs payment orders. As a result of mistakes made, funds may not reach the correct account. It may take time to return the funds and transfer them to the correct account, which will cause a delay in customs clearance. This may lead to additional financial costs. Without correctly filling out the Customs payment order, customs clearance of goods is impossible. To avoid mistakes and losses during customs clearance, it is better to contact specialists. Our specialists will help you check the correctness of filling out the customs order and provide timely assistance in prompt customs clearance of goods. We work every day, seven days a week, and, if necessary, around the clock.

Types of customs payment orders

Types of customs payment orders to customs - paper and electronic. Previously, all payment orders to customs were in paper form, they had to be printed, certified with a seal, signed and sent; nowadays they are practically not used. Nowadays, electronic payments have come into use; accordingly, payment orders to customs are issued electronically. To do this, you need to fill out the necessary information on your computer or mobile device, generate a payment order and certify it with an electronic digital signature (EDS). All participants in foreign trade activities have appreciated the benefits of using electronic customs payment orders and the paper form of the document is already becoming a thing of the past.

How to fill out field 107 for customs

The payer must ask at the customs post at which customs office the payment will be made at this location. That is, what code does the higher customs office have for accepting transferred funds?

EXAMPLE

Bryansk customs has 10 posts for customs inspection. And each of them has its own individual code. But when a company fills out the customs authority code, in field 107 of the payment they indicate the numbers of the central office of the customs office of the Bryansk region. This code looks like this - 10102000.

This information is also provided on the website of the Customs Service of the Russian Federation https://ved.customs.ru/ in the “Databases” section. Everything that needs to be entered in field 107 is given at this link.

Changes to the procedure for paying duties in 2022

Changes in the procedure for paying duties in 2022 are associated with filling out field 104 of the customs order. Once upon a time, it was necessary to draw up a separate document for each type of customs payment, indicating the required budget classification code (BCC) in field 104 of the payment order. The procedure for paying duties in 2022 provides that in field 104 of the document for almost all types of customs payments: collection, import and export duties, VAT, excise tax, you must indicate KBK 15311009000011000110. Funds transferred under this KBK are transferred to an account controlled by the Federal Customs Service RF.

Previously, until 01/01/2021, it was necessary to indicate the customs code in the payment order. From January 1, 2022, in accordance with changes in the procedure for paying duties, a Unified Personal Account (USA) serviced by the Federal Customs Service of the Russian Federation is used to transfer customs payments. In field 107 of the customs payment order, you must indicate the ELS code: 10000010. Now the customs authority code in the 2022 payment order must be indicated only in exceptional cases.

Differences in customs payments

First of all, it is worth noting that tax receipts must reflect the specific tax period in field 107. A customs payment is a code assigned to the body of the Federal Customs Service of Russia (FCS).

Other fields of the payment order for customs are also filled out differently so that you can understand exactly what the payment was made for. Let's look at this in more detail.

The general and special rules by which payments are formed are written down in Order No. 107n of the Ministry of Finance of Russia dated November 12, 2013. Explanations regarding customs payments are given here in a separate Appendix No. 3. The procedure for filling out fields 104 – 109 in the payment order addressed to the Federal Customs Service authorities is described here.

However, first of all, to confidently pass control of this payment, it is necessary to correctly fill out column 101. It indicates the status of the payer himself as a participant in foreign economic transactions and transactions. It is prescribed with special digital codes such as 06 and 16 - 20. The purpose of these codes is to show that the person filling out the payment is a participant in foreign trade activities.

The budget classification code - abbreviated as KBK - is entered in field 104 to make a payment to the state customs office. A list of these codes and payment type codes specific to each BCC can be found on the official website of the Federal Customs Service in the “Information for Foreign Trade Participants” tab.

Here is the exact link.

In practice, most often you have to enter budget classification codes into payments:

- advances on payments to customs;

- duties for customs operations.

Line 104 may also contain a code indicating the payment of penalties on customs duties.

Based on the letter of the Federal Customs Service dated December 26, 2013 No. 01-11/59519, in field 105 it is necessary to indicate a single OKTMO code.

Information from the Federal Customs Service of Russia from 02/05/2018

Payment of customs and other duties is carried out to an account opened by the Interregional Operational Directorate of the Federal Treasury (hereinafter referred to as MOU FC) on balance sheet account N 40101 “Revenue distributed by the bodies of the Federal Treasury between the budgets of the budget system of the Russian Federation.”

The transfer of customs and other payments to the federal budget is carried out by issuing an order for the transfer of funds for payment of payments to the budget system.

The format, procedure for filling out and executing an order for the transfer of funds for payment of payments to the budget system (hereinafter referred to as the payment order) are determined by the Regulations on the rules for the transfer of funds, approved by the Bank of Russia on June 19, 2012 N 383-P, and by order of the Ministry of Finance of Russia dated November 12, 2013 N 107n “On approval of the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation.”

The execution of one payment order is allowed only for one customs and other payment (budget classification code) administered by the customs authorities, according to the budget classification of the Russian Federation.

Account details:

“Recipient's Bank” - Operations Department of the Bank of Russia, Moscow,

BIC 044501002,

account N 40101810800000002901,

recipient - MOU FC (FTS of Russia),

TIN 7730176610,

Gearbox 773001001,

OKTMO - 45328000.

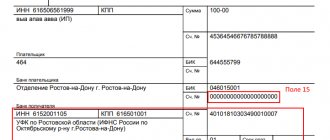

When filling out payment documents, the following fields must be completed:

(13) “Recipient Bank” - Operations Department of the Bank of Russia, Moscow;

(14) “BIK” - 044501002;

(17) “Account. N" - 40101810800000002901;

(21) “Essay. payment." - 5;

(22) “Code” - a unique accrual identifier is indicated, consisting of 20 or 25 characters, while all characters of the unique accrual identifier cannot simultaneously take the value zero (“0”). If there is no unique accrual identifier, the value zero (“0”);

(16) “Recipient” - MOU FC (FTS of Russia);

(61) "TIN" of the recipient" - 7730176610;

(103) “checkpoint” of the recipient - 773001001;

(101) - two-digit indicator of payer status:

“06” - participant in foreign economic activity - a legal entity, with the exception of the recipient of international mail;

“07” - customs authority;

“16” - participant in foreign economic activity - an individual;

“17” - participant in foreign economic activity - individual entrepreneur;

“18” - a payer of customs duties who is not a declarant, who is obligated by the legislation of the Russian Federation to pay customs duties;

“28” - participant in foreign economic activity - recipient of international mail.

(104) - budget classification code in accordance with the budget classification of the Russian Federation;

(105) — 45328000;

(107) - eight-digit code of the customs authority in accordance with the classification of customs authorities in the Russian Federation, administering the payment

In field (108), if the payment document details (101) indicate one of the statuses “03” and “16”, “19”, “20”, an identifier of information about an individual or zero may be indicated;

(24) “Purpose of payment” - additional information necessary to identify the purpose of payment.

These account details for transferring customs and other payments are relevant as of the date of publication of this document and require additional verification before use.

Registration of payment orders for customs

PAYMENT TO CUSTOMS

Payment of customs duties features

Import customs duties are always paid under a separate BCC, as they are distributed as a percentage among all participants of the Customs Union.

The standards for the distribution of import customs duties for each Member State are established in the following amounts:

Republic of Armenia - 1.220 percent; Republic of Belarus - 4.560 percent; Republic of Kazakhstan - 7.055 percent; Kyrgyz Republic - 1,900 percent; Russian Federation - 85.265 percent.

Advance payments for customs duties, VAT and a number of other payments can be combined on one BCC.

From January 1, 2022, the budget classification codes (hereinafter referred to as the BCC of customs payments) will change.

| Name of payment type | Recommended BCCs for customs |

| VAT on goods imported into the Russian Federation Excise taxes on goods imported into the Russian Federation Other export customs duties Customs duties Advance payments towards future customs and other payments Cash deposit to secure payment of customs and other payments | 153 1 1000 110 |

| Import customs duties (other duties, taxes and fees having an equivalent effect), paid in accordance with Appendix No. 5 to the Treaty on the Eurasian Economic Union of May 29, 2014 (payment amount (recalculations, arrears and debt on the relevant payment, including according to canceled) | 153 1 1000 110 |

Features of filling out customs duties:

(13) – In accordance with the letter of the Interregional Operations Directorate of the Federal Treasury dated September 29, 2015 No. 95-09-11/01-924, the Federal Customs Service reports. From October 1, 2015, in relation to bank accounts opened in the First Operations Department of the Bank of Russia, the name of the bank “OPERU-1 Bank of Russia” is replaced by the name “Operations Department of the Bank of Russia”. The numbers of open bank accounts do not change.

(21) – according to paragraph 2 of Article 855 of the Labor Code of the Russian Federation as amended by Federal Law No. 345-FZ dated 02.12.2013, the fifth order of payment is indicated.

(22) - according to Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n “On approval of the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation”, from March 31, 2014, it is provided for the indication of a unique accrual identifier (UIN ). When transferring amounts of taxes (fees) by legal entities, the UIN is not generated: from March 31, 2014, “0” is indicated in the “Code” detail.

(101) - two-digit indicator of payer status:

“06” - participant in foreign economic activity - legal entity,

"07" - customs authority,

“16” - participant in foreign economic activity - an individual,

“17” - participant in foreign economic activity - individual entrepreneur,

“18” - a payer of customs duties who is not a declarant, who is obligated by the legislation of the Russian Federation to pay customs duties,

“19” - organizations and their branches (hereinafter referred to as organizations) that have issued a settlement document for the transfer to the account of the Federal Treasury of funds withheld from the earnings (income) of the debtor - an individual to pay off debt on customs duties on the basis of an executive document sent to the organization in the prescribed manner,

“20” is a credit organization (its branch) that has issued a settlement document for each payment by an individual for the transfer of customs duties paid by individuals without opening a bank account.

(104) - indicator of the budget classification code in accordance with the budget classification of the Russian Federation, in accordance with the budget classification of the Russian Federation (Order of the Ministry of Finance of Russia dated June 8, 2022 N 132n “On the procedure for the formation and application of budget classification codes of the Russian Federation, their structure and principles of appointment"), for example:

KBK 153 1 1000 110 - import customs duty ; KBK 153 1 1000 110 - advance payments against future customs and other payments;

(105) - code assigned to the territory of the municipality in accordance with OKTMO - for transferring funds to the account of the Federal Treasury - 45328000

(107) - eight-digit code of the customs authority in accordance with the classification of customs authorities in the Russian Federation, administering the payment

Unified personal account (USA) – 10000010

LIST OF BUDGET CLASSIFICATION CODES RECOMMENDED FOR USE BY PARTICIPANTS IN FOREIGN ECONOMIC ACTIVITIES WHEN PAYING CUSTOMS AND OTHER PAYMENTS TO THE FEDERAL BUDGET INCOME

| Name of payment type | Federal budget income classification code recommended for payment |

| Value added tax on goods imported into the territory of the Russian Federation Excise taxes on goods imported into the Russian Federation Export customs duties on crude oil Export customs duties on natural gas Export customs duties on goods produced from oil Other export customs duties Customs duties Customs duties, taxes paid by individuals at uniform rates of customs duties, taxes or in the form of a total customs payment Advance payments towards future customs and other payments Cash deposit to secure payment of customs and other payments | 153 1 1000 110 |

| Import customs duties (other duties, taxes and fees having an equivalent effect), paid in accordance with Appendix No. 5 to the Treaty on the Eurasian Economic Union of May 29, 2014 (payment amount (recalculations, arrears and debt on the relevant payment, including according to canceled) | 153 1 1000 110 |

| Import customs duties (other duties, taxes and fees having an equivalent effect), paid in accordance with Appendix No. 5 to the Treaty on the Eurasian Economic Union of May 29, 2014 (penalties and interest on the relevant payment) | 153 1 1000 110 |

| Special, anti-dumping and countervailing duties paid in accordance with Appendix No. 8 to the Treaty on the Eurasian Economic Union of May 29, 2014 (payment amount (recalculations, arrears and debt on the relevant payment, including canceled ones) | 153 1 1000 110 |

| Special, anti-dumping and countervailing duties paid in accordance with Appendix No. 8 to the Treaty on the Eurasian Economic Union of May 29, 2014 (penalties and interest on the relevant payment) | 153 1 1000 110 |

| Preliminary special, preliminary anti-dumping and preliminary countervailing duties paid in accordance with Appendix No. 8 to the Treaty on the Eurasian Economic Union of May 29, 2014 (payment amount (recalculations, arrears and debt on the relevant payment, including the canceled one) | 153 1 1000 110 |

| Preliminary special, preliminary anti-dumping and preliminary countervailing duties paid in accordance with Appendix No. 8 to the Treaty on the Eurasian Economic Union of May 29, 2014 (penalties and interest on the relevant payment) | 153 1 1000 110 |

| Recycling fee (the amount of the fee paid for wheeled vehicles (chassis) and trailers for them imported into the Russian Federation, except for wheeled vehicles (chassis) and trailers for them imported from the territory of the Republic of Belarus) | 153 1 1200 120 |

| Recycling fee (penalties for late payment of the amount of the fee payable for wheeled vehicles (chassis) and trailers for them imported into the Russian Federation, except for wheeled vehicles (chassis) and trailers for them imported from the territory of the Republic of Belarus) | 153 1 1210 120 |

| Recycling fee (the amount of the fee paid for wheeled vehicles (chassis) and trailers for them imported into the Russian Federation from the territory of the Republic of Belarus) | 153 1 1200 120 |

| Recycling fee (penalties for late payment of the amount of the fee payable for wheeled vehicles (chassis) and trailers for them imported into the Russian Federation from the territory of the Republic of Belarus) | 153 1 1210 120 |

| Recycling fee (the amount of the fee paid for self-propelled vehicles and trailers for them imported into the Russian Federation, except for self-propelled vehicles and trailers for them imported from the territory of the Republic of Belarus) | 153 1 1200 120 |

| Recycling fee (the amount of the fee paid for self-propelled vehicles and trailers for them, imported into the Russian Federation from the territory of the Republic of Belarus) | 153 1 1200 120 |

| State duty for making preliminary decisions on the classification of goods according to the unified Commodity Nomenclature for Foreign Economic Activity of the Customs Union | 153 1 0800 110 |

| State duty for the issuance of excise stamps with a two-dimensional bar code containing the identifier of the unified state automated information system for recording the volume of production and turnover of ethyl alcohol, alcoholic and alcohol-containing products for labeling alcoholic products | 153 1 0800 110 |

| Other income from compensation of federal budget expenses (federal state bodies, Bank of Russia, management bodies of state extra-budgetary funds of the Russian Federation) | 153 1 1300 130 |

| Funds from the disposal and sale of confiscated and other property converted into the income of the Russian Federation (in terms of the sale of inventories of the said property) (other funds from the disposal and sale of confiscated and other property converted into the income of the Russian Federation) | 153 1 1400 440 |

| Funds paid by importers to customs authorities for the issuance of excise stamps | 153 1 1500 140 |

| Monetary penalties (fines) for violation of acts constituting the law of the Eurasian Economic Union, legislation of the Russian Federation on customs | 153 1 1600 140 |

| Monetary penalties (fines) for violation of the currency legislation of the Russian Federation and acts of currency regulatory authorities, as well as the legislation of the Russian Federation in the field of export control | 153 1 1600 140 |

| Monetary penalties (fines) for violation of the legislation of the Russian Federation on the fundamentals of the constitutional system of the Russian Federation, on the state power of the Russian Federation, on the civil service of the Russian Federation, on elections and referendums of the Russian Federation, on the Commissioner for Human Rights in the Russian Federation | 153 1 1600 140 |

| Monetary penalties (fines) and other amounts collected from persons guilty of committing crimes and for compensation for damage to property, credited to the federal budget | 153 1 1600 140 |

| Other receipts from monetary penalties (fines) and other amounts for damages credited to the federal budget | 153 1 1600 140 |