What about materials?

In the process of working towards making a profit, business entities are often faced with the need to purchase related materials.

This type of property is of low value and is rarely purchased for the purpose of further resale. Inventory inventories (MPI) are used for production or management needs. The procedure for accounting and movement of materials must be reflected in the accounting policy of the enterprise, which each business entity has the right to form independently, without violating the requirements of current legislation. The rules for using information on materials from 01/01/2021 are regulated by the new FSBU 5/2019 “Reserves”, PBU 5/01 has become invalid.

Some accounting rules for materials have changed significantly since 01/01/2021. The Guide from ConsultantPlus will help you adjust to the new order. If you do not already have access to this legal system, trial access is available for free.

Also, until the end of 2022, on the basis of PBU 6/01 “Accounting for fixed assets”, approved by order of the Ministry of Finance of the Russian Federation dated March 30, 2001 No. 26n, equipment whose cost does not exceed 40,000 rubles is included in the inventory.

Important! From 2022, PBU 6/01 “Accounting for fixed assets” will be replaced by two new standards: FSBU 6/2020 “Fixed assets” and FSBU 26/2020 “Capital investments”. One of the changes: organizations will be allowed to independently set a limit on the value of fixed assets, taking into account the materiality of information about such assets (instead of a fixed figure of 40,000 rubles). Objects with a cost below the limit accepted by the company can be recognized as expenses of the period in which they are incurred.

How to independently determine and set a limit on the cost of fixed assets in accounting in accordance with the new Federal Accounting Standards 6/2020 “Fixed Assets”? The answer to this question is in the Ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial demo access. It's free.

Read about the nuances of accounting for assets whose value is below 100,000 rubles here.

Description of the “Gratuitous receipts” account

Subaccount 98.02 “Gratuitous receipts” is used to reflect generalized information about other assets that the organization received as gratuitous receipts.

As a rule, subaccount 98.02 takes into account the cost of fixed assets and inventories that are transferred by the participants (founders) of the organization as a contribution to the authorized capital.

Amounts of income received in connection with the gratuitous receipt of assets are reflected according to Dt 98.02. Upon the arrival of the period to which the received income relates, the amount is written off according to Kt 98.02.

What types of materials are there?

In accounting, materials, according to the Chart of Accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n), are accounted for on account 10 “Materials”.

Materials have a diverse grouping according to purpose and nature of use. Depending on these conditions, the organization’s materials are grouped into the following subaccounts.

| Subaccount designation | Subaccount name | What is taken into account |

| 10.1 | "Raw materials" | Inventories included in manufactured products that are involved in the manufacturing and processing process |

| 10.2 | "Components, purchased semi-finished products" | Materials purchased for further packaging of manufactured products |

| 10.3 | "Fuel" | Movement of fuel, including gasoline and diesel, as well as lubricants necessary during the operation of vehicles |

| 10.4 | "Container and packaging materials" | Availability and movement of all types of containers (except for those used as household equipment), as well as materials and parts intended for the manufacture of containers and their repair |

| 10.5 | "Spare parts" | Movement of materials used as spare parts for vehicles and other equipment |

| 10.6 | "Other materials" | Production waste, irreparable defects, material assets received from the disposal of fixed assets that cannot be used as materials, fuel or spare parts in a given organization (scrap metal, waste materials), worn tires, etc. |

| 10.7 | “Materials transferred for processing to third parties” | Materials transferred for processing to other companies |

| 10.8 | "Construction Materials" | Used by real estate developers. The invoice takes into account the materials needed for construction and installation work |

| 10.9 | "Inventory" | Inventory and other household supplies |

| 10.10 | "Special equipment and clothing in the warehouse" | Special equipment, uniforms, special uniforms in warehouse |

| 10.11 | “Special equipment and clothing in use” | Special equipment, uniforms, special uniforms handed over to employees for use |

Subaccounts 10 accounts

PBUs establish a list of certain accounting accounts in the Chart of Accounts that should be used to account for materials in accordance with their classification and item groups.

Depending on the specifics of the activity (budgetary organization, manufacturing enterprise, trade, etc.) and accounting policies, accounts may be different.

The main account is account 10, to which the following sub-accounts can be opened:

| Subaccounts to the 10th account | Name of material assets | A comment |

| 10.01 | Raw materials | |

| 10.02 | Semi-finished products, components, parts and structures (purchased) | For the production of products, services and own needs |

| 10.03 | Fuel, fuel and lubricants | |

| 10.04 | Container materials, packaging | |

| 10.05 | Spare parts | |

| 10.06 | Other materials (for example: stationery) | For production purposes |

| 10.07, 10.08, 10.09, 10.10 | Materials for processing (outside), Construction materials, Household supplies, equipment, Working clothes, equipment (in warehouse) |

The chart of accounts classifies materials according to product groups and the method of inclusion in a certain cost group (construction, production of own products, maintenance of auxiliary production and others, the table shows the most used ones).

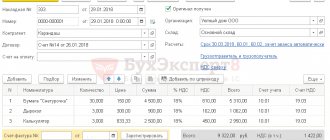

Materials accounting

In order to control the availability and movement of inventories, a business entity can use both unified forms approved by Decree of the State Statistics Committee of the Russian Federation dated July 30, 1997 No. 71a, and those developed independently, taking into account the requirements for the mandatory details of the primary document (Article 9 of the Law “On Accounting” dated 06.12. 2011 No. 402-FZ) and enshrined in the company’s accounting policies.

Among the unified forms, the most popular are the following:

- demand-invoice;

- invoice for the release of materials to the third party;

- receipt order;

- limit fence card.

Materials are capitalized at the actual cost recorded in the documentation upon receipt. Inventory in an organization is accounted for either at its actual cost of receipt or at accounting prices, which must be enshrined in the accounting policy. When using the 2nd option, you should use account 16 “Deviation in the cost of material assets” and account 15 “Procurement and acquisition of material assets” to reflect the difference between the accounting and actual costs.

Example 1

Retro LLC has enshrined in its accounting policy the need to accept materials at discount prices. A batch of raw materials (granulated sugar) was received for further use in production in the amount of 100 kg for the amount of 4,000 rubles. Accepted accounting (planned) prices for this item are 45 rubles. for 1 kg. The following postings have been made:

| Debit | Credit | Amount, rub. | Contents of operation |

| 15 | 60 | 4 000 | The receipt of raw materials (granulated sugar) from the supplier was capitalized |

| 19 | 60 | 800 | Input VAT included |

| 10.1 | 15 | 4 500 | Accepted raw materials at discount prices |

| 15 | 16 | 500 | The excess of the book value over the actual value is written off |

If the accounting price were less than the actual cost, then the last entry would have the following form:

Dt 16 Kt 15. – the difference in the excess of the cost of goods over the accounting prices is written off.

Example 2

LLC "Raduga" upon receipt of materials capitalizes them at actual cost. When purchasing office supplies (20 pencils for a total of 1,000 rubles), the following entries were made for administrative needs:

| Debit | Credit | Amount, rub. | Contents of operation |

| 10.6 | 60 | 1 000 | Stationery purchased from supplier |

| 19 | 60 | 200 | Input VAT included |

| 26 | 10.6 | 1 000 | Stationery supplies were transferred upon request-invoice for the needs of the administrative apparatus |

After receipt, the materials are written off for production or other general business needs using one of the existing methods, which also must be reflected in the accounting policy:

- By average cost - when writing off, the average price of 1 unit of homogeneous material is formed.

- At the cost of each unit - suitable for a small group of inventories in cases where it is possible to form the cost of each unit.

- Using the FIFO method - this method allows you to take into account the cost of the first materials received (clause 36 of FSBU 5/2019 (until 01/01/2021 - clause 16 of PBU 5/01)).

Find out how to write off materials according to the new FSBU 5/2019 from the Guide from ConsultantPlus by getting free trial access to the system.

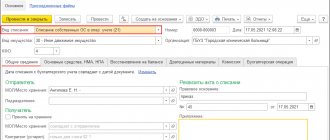

Postings for receipt and disposal of materials

There are several ways for materials to enter an organization: acquisition for a fee, acceptance as a contribution from the founders, production of materials, free receipt, etc.

Depending on the method of receipt, the following postings for materials appear in accounting.

| Debit | Credit | Contents of operation |

| 10 | 60, 76 | Receipt of the invoice from the supplier; Wholesale supply of goods is carried out under a sales contract |

| 10 | 71 | Acquisition of inventories by an accountable person |

| 10 | 75 | Founder's contribution; the estimated value of the property must be agreed upon with the person contributing the property |

| 10 | 91 | Reflected gratuitous receipt; In this case, the market value of the material is taken as the amount. A similar posting is made when taking into account materials received during the dismantling of fixed assets |

If upon receipt the cost of the material includes VAT, then its amount is reflected in a separate line.

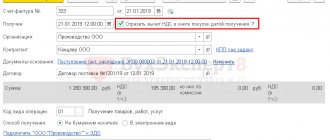

Example 3

Motiv LLC purchased a batch of paper (100 packs) for office needs using an invoice for a total amount of 18,000 rubles, including VAT 20% of 3,000 rubles. The organization made the following entries:

| Debit | Credit | Amount, rub. | Contents of operation |

| 10.6 | 60 | 15 000 | A batch of paper has arrived |

| 19.3 | 60 | 3 000 | The amount of input VAT is reflected |

| 68.2 | 19.3 | 3 000 | VAT amount accepted for refund |

| 60 | 51 | 18 800 | Payment was made to the supplier through a bank account |

For more information on the formation of VAT when purchasing inventories, see the material “How is VAT recorded on purchased assets?” .

If an organization applies a tax regime that excludes the use of VAT (for example, the simplified tax system), then the entire cost of materials should be credited to account 10. In this case, VAT does not apply to refundable taxes, but is taken into account when determining the cost price.

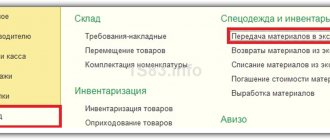

The release of inventories to third parties can be carried out for the following number of reasons:

| Debit | Credit | Contents of operation |

| 20, 23, 25, 26, 29, 44 | 10 | Issue from a warehouse for production or general business needs of the organization; transfer is carried out using limit-fence cards or requirements-invoices |

| 94 | 10 | The gratuitous write-off of materials as a result of damage or theft is reflected. As a rule, a lack of food supplies is identified as a result of an inventory; an act of write-off of materials is drawn up |

| 99 | 10 | The materials were lost due to a natural disaster; the transaction is reflected using a write-off statement |

| 91 | 10 | Reflection of the transfer (sale) of materials to the third party; actual cost is used |

List of accounts involved in accounting entries:

|

|

Below are accounting entries reflecting the consumption of materials for production and administrative needs.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 20 | 10 | Materials were released into main production. The consumption of materials in the main production is taken into account | Cost of materials | Limit-fence card (TMF No. M-8) Demand-invoice (TMF No. M-11) Invoice (TMF No. M-15) |

| 23 | 10 | Materials were released to auxiliary production. Material consumption taken into account | Cost of materials | Limit-fence card (TMF No. M-8) Demand-invoice (TMF No. M-11) Invoice (TMF No. M-15) |

| 25 | 10 | Materials were released for general production needs. Material consumption taken into account | Cost of materials | Limit-fence card (TMF No. M-8) Demand-invoice (TMF No. M-11) Invoice (TMF No. M-15) |

| 26 | 10 | Materials were released for general business needs. Material consumption taken into account | Cost of materials | Limit-fence card (TMF No. M-8) Demand-invoice (TMF No. M-11) Invoice (TMF No. M-15) |

| 10 | 10 | Materials were released to warehouses (storerooms) of departments (shops) | Cost of materials | Internal movement invoice |

Results

Any movement of inventories must be documented in primary documents and recorded in accounting entries. The primary report can be compiled using standardized forms or on forms developed by the business entity independently. Postings are compiled in accordance with the Chart of Accounts. The cost of materials and the rules for their acceptance for accounting, as well as movement or disposal from 01/01/2021 are determined by the new FSBU 5/2019 “Inventories”.

Sources: Order of the Ministry of Finance of Russia dated November 15, 2019 No. 180n “On approval of the Federal Accounting Standard FSBU 5/2019 “Inventories”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.