What general points are important to know about creating a reserve for repairs?

As indicated by the provisions of paragraph 2 of Art. 324 of the Tax Code of the Russian Federation, the reserve for the repair of fixed assets should be calculated in two ways:

- for the purpose of carrying out standard, inexpensive OS repair work;

- for the future implementation of complex and expensive repair work.

The creation and application of reserves for each of the above areas is carried out in its own way.

IMPORTANT! At the same time, when deciding on the formation of a reserve, in its accounting policy the company should determine the limit, if exceeded, repairs will be classified as expensive.

In order to correctly form a reserve for the repair of fixed assets, the company should have reliable and complete information:

- about the initial cost of fixed assets as of the beginning of the year;

- the amounts spent on repair work over the previous three years, as well as plans for carrying out such work in the future (at an estimated price);

- expensive repair work (separate information: what work was carried out previously, for what amount, what work is planned for the foreseeable future, etc.).

In addition, the company may be interested in aspects of creating other reserves. In particular, see the article “Provision for doubtful debts: procedure for creation and calculation of deductions.”

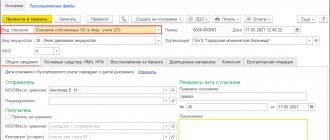

Documentation of the reserve

The correctness of determining monthly contributions in 2010 to the reserve for repairs of fixed assets can be confirmed by the following documents:

- defective statements (to justify the need for repair work);

- data on the initial cost or current (replacement) cost (in case of revaluation) of fixed assets;

- estimates for repairs;

- standards and data on the timing of its implementation;

- final calculations of deductions to the reserve for repairs of fixed assets.

Based on the defective list, an estimate is drawn up, work orders are issued on the basis of the estimate, as well as documents for obtaining from the warehouse the spare parts necessary for repairs.

What are the main stages of calculating the reserve for OS repairs?

As the norms of the Tax Code of the Russian Federation indicate, when creating the reserve in question, the company should focus on two main indicators: the standard of deductions and the total cost of fixed assets (clause 2 of Article 324 of the Tax Code of the Russian Federation).

In this context, the cost of fixed assets is understood as the total accounting value of all fixed assets that the company uses in production, as of the beginning of the year in which the reserve in question is created. At the same time, you should not include in the calculation the cost of leased operating systems and operating systems that the company uses free of charge.

IMPORTANT! Accounting specialists should not forget that in this situation, the initial cost is taken for calculation, and not the residual value.

In general, the algorithm for calculating contributions to the reserve under consideration can be presented in the form of successive steps:

- calculate the deduction limit;

- calculate the total cost of fixed assets that was relevant in the company at the beginning of the tax period;

- by calculation, determine the standard of deductions based on the results of the previous action;

- calculate the total amount of the reserve in question.

How to calculate the total cost of fixed assets

Contributions to such a reserve are calculated based on the total cost of fixed assets and deduction standards approved in the accounting policy for tax purposes.

The total cost of fixed assets is determined as the sum of the original cost of all depreciable fixed assets put into operation at the beginning of the year in which the reserve is formed.

Moreover, at the expense of the created reserve, expenses for repairs of only own fixed assets can be written off. Expenses associated with the repair of depreciable fixed assets leased by the taxpayer and fixed assets received for free use are taken into account as part of other expenses associated with production and sales (letter of the Ministry of Finance of Russia dated March 22, 2010 No. 03-03-06/1 /159).

Tax officials are not so categorical in their explanations: the tenant has the right to create a reserve for the repair of leased fixed assets, but only if he has his own depreciable fixed assets, based on the total cost of the latter (letter of the Ministry of Taxes of Russia dated February 26, 2004 No. 02-5-11 / [ email protected] ).

Thus, if the tenant has its own fixed assets, it can create a reserve for the repair of leased objects. However, the landlord does not have to reimburse the tenant for repair costs.

For the lessor, the value of the leased property is not excluded from the total value of fixed assets. Judges also think the same (resolution of the Federal Antimonopoly Service of the West Siberian District dated January 16, 2008 No. F04-233/2008(685-A45-26)).

How to calculate the maximum amount of contributions to the reserve and the standard?

In order for a company to find out the upper limit of possible contributions to the reserve, it is necessary to perform the following steps.

First, you need to prepare an estimate for “standard” (inexpensive) repairs, based on the order of repair work in the billing tax period (indicator A).

It is important for the company to remember that the costs of repair work may include the following (clause 1 of Article 324 of the Tax Code of the Russian Federation):

- amounts spent on the purchase of materials for repairs (spare parts for equipment);

- salaries of specialists who directly carry out such repairs;

- other expenses that the company incurs due to carrying out repairs on its own;

- other expenses of the company in the interests of third-party companies performing repairs for the company.

Secondly, the company must clearly understand the scale of funds spent on standard (inexpensive) repairs over the past period of 3 years. To do this, you need to divide the total costs for repairs by 3 (indicator B).

Next, you should compare indicators A and B. The indicator that is smaller is the maximum amount of contributions to the reserve in question.

The next step is to calculate the standard of deductions related to the specific total cost of the company's fixed assets.

To do this, accounting specialists at the enterprise should find the quotient of dividing the maximum amount of deductions by the total cost of the fixed assets. The result will be a certain percentage, which acts as the maximum allowable for the company.

IMPORTANT! The company should establish in its accounting policy the standard of deductions in such an amount that it does not exceed the maximum allowable, calculated according to the above algorithm.

Repair costs

There are two types of repairs:

- Current;

- Capital.

When reconstructing and modernizing, repair costs increase the cost of the facility. For repairs, both current and capital, they are written off as current expenses.

OS repairs are carried out economically, that is, on our own, or contractually, with the involvement of third-party performers. The costs of repairs are written off to production cost accounts, that is, included in the cost price.

General cost allocation scheme:

If the costs of repairing the OS amount to significant amounts, then the organization can restore these costs from the previously formed fund in account 96 “Reserve for future expenses.”

Determining the final amount of contributions to the reserve

At the final stage, the company needs, based on the data calculated by previous steps, to determine the final amount of contributions to the reserve.

As indicated by the provisions of tax legislation, the amounts allocated to the reserve for the repair of fixed assets are included in the company's tax expenses for income tax.

IMPORTANT! At the same time, deductions to the reserve are applied to expenses in equal parts on the end date of each reporting period (clause 2 of Article 324 of the Tax Code of the Russian Federation).

Consequently, if a company reports to controllers for a quarter, half a year, or 9 months, then each time (each reporting period) ¼ of the total annual reserve is included in the reserve.

If the company provides monthly calculations to the tax authorities, then each month it must take into account 1/12 of the total annual value of such a reserve as amounts increasing the reserve.

IMPORTANT! Despite the fact that the Tax Code of the Russian Federation does not directly explain which expenses a company can include amounts that increase the reserve, by virtue of clause 1 of Art. 260 of the Tax Code of the Russian Federation, the company has the right to attribute repair costs to other expenses. Therefore, the company has the right to include the reserve amounts in other expenses, which will reduce the total income tax.

What reserves are provided for by Chapter 25 of the Tax Code of the Russian Federation and why are they needed?

Chapter 25 of the Tax Code of the Russian Federation provides for the possibility of forming the following types of reserves for upcoming expenses:

– for doubtful debts (clause 3 of Article 266 of the Tax Code of the Russian Federation); – to pay for vacations (Article 324.1 of the Tax Code of the Russian Federation); – for the payment of annual remunerations for length of service and based on the results of work for the year (clause 6 of Article 324.1 of the Tax Code of the Russian Federation); – for warranty repairs and maintenance (Article 267 of the Tax Code of the Russian Federation); – for R&D (Article 267.2 of the Tax Code of the Russian Federation); – for the repair of fixed assets (clause 3 of Article 324 of the Tax Code of the Russian Federation).

Non-profit organizations also have the right to create reserves for future expenses in accordance with Art. 267.3 of the Tax Code of the Russian Federation (in relation to expenses that are not indicated in the above list - see Letter of the Ministry of Finance of the Russian Federation dated May 28, 2012 No. 03-03-06/4/53).

For your information:

the institution has the right (but is not obligated) to create any of the above reserves.

What are reserves needed for? First of all, for a more even distribution of expenses during the tax period (year). This is especially true for expenses such as vacation pay, remuneration based on the results of work for the year, annual remuneration for long service, that is, for such items of expenses where payments have to be made “en masse”, which is why the size of the taxable base fluctuates significantly, including or other reporting period. In particular, this is especially noticeable when most of the employees go on vacation in the summer.

Reserves can be considered as one of the tools for legal tax optimization, because the amounts that form them reduce the taxable base for income tax before expenses have been incurred. A striking example of this is the reserve for upcoming repair costs.

The procedure for creating a reserve for repairs

As follows from paragraph. 3 p. 2 art. 324 of the Tax Code of the Russian Federation, the “repair” reserve consists of two parts:

– for routine and inexpensive types of repairs; – for complex and expensive types of major repairs.

Each of these parts is formed and used differently, so they need to be clearly separated. Chapter 25 of the Tax Code of the Russian Federation does not explain the concept of “expensive / inexpensive”. This figure is individual for each institution. Therefore, when deciding to create a reserve for repairs, it is necessary to indicate in the accounting policy the threshold beyond which repairs will be considered complex and expensive.

To correctly form a reserve for the repair of fixed assets, it is necessary to ensure that the following data is taken into account:

– the initial cost of depreciable fixed assets at the beginning of the tax period; – the actual amount of repair costs for the previous three years; – schedule of repairs, including those occurring during the current tax period; – the estimated cost of the specified repairs; – a list of fixed assets for which particularly complex and expensive types of capital repairs will be carried out; – a schedule for the repair of these fixed assets, which indicates the period of repair work and its estimated cost.

What is important to remember when determining the amount of reserve for expensive repairs?

In practice, there are often situations when a company’s operating system requires not standard routine repairs, but complex and expensive ones.

The company can use the amounts intended for such repairs to increase the limit of contributions to the reserve in question. This is stated in paragraph 2 of Art. 324 Tax Code of the Russian Federation.

To do this, the company needs:

- have at your disposal a schedule of planned expensive repairs and estimates for them;

- make savings for such repairs over more than one tax period (in this case, the possibility of such savings must be specified in the accounting policy);

- not have any costly repairs of the operating system in the three previous tax years.

It is important for a company to understand that the repair reserve should be increased only before the tax period, in which the company plans to begin carrying out expensive repair work.

Moreover, due to the literal interpretation of paragraph 2 of Art. 324 of the Tax Code of the Russian Federation, expenses can include deductions (accumulations) for upcoming expensive repairs in the full amount of the period in which such accumulations were made.

“Expensive” option for calculating the reserve amount

How the reserve is formed without repairs

The main difference between expensive capital repairs and ordinary ones is that the organization has the right to accumulate the amounts necessary for this over more than one tax period. The repair schedule, as in the previous version of the calculation, is focused on technical documentation and the knowledge of qualified specialist engineers of the company.

Since fixed assets requiring expensive overhauls are accounted for separately from other fixed assets being repaired, then, according to paragraph 2 of Article 324 of the Tax Code of the Russian Federation, the accumulated amount for the “expensive” reserve increases the maximum amount of the cost of ordinary repairs. As mentioned above, the limit, exceeding which will lead to the classification of repairs as expensive, should be recorded in the accounting policy at the beginning of the tax period.

The amount of contributions to the reserve is calculated using the formula:

An example of calculating the reserve for OS repairs

Example 2. Initial data of example 1. An additional condition will be the fact of using a fixed asset, which must be repaired every six years, according to the technical documentation. According to the plan, the total cost of repairing this OS will be 2.4 million rubles. That is, the organization must accumulate this amount within six years, contributing 400 thousand rubles to the reserve. in year. (RUB 2,400,000 / 6 years).

That is, it can increase the amount of contributions to the reserve by 400 thousand rubles. Let's calculate the maximum possible standard of deductions typical for this example:

- N deduction = (RUB 666,667+RUB 400,000)/RUB 9,000,000 × 100% = 11.85%.

So, let’s imagine that the actual costs incurred for “standard” repairs in 2022 amounted to 600 thousand rubles. In this case, the total amount of contributions to the reserve, taking into account expensive repairs, is equal to:

- Rtot. = =1,066,500 rub.

The amount of deductions excluding expensive repairs is equal to (Rch):

- Rch. = = 666,900 rub.

That is, the amount of unused reserve is 66,900 rubles. (RUB 666,900 – RUB 600,000) will be taken into account in non-operating income on 12/31/2017. As for the accumulated deductions for “expensive repairs”, they will have to be taken into account as part of the general reserve accumulated for 2022. An important point: the accumulated reserve for expensive repairs, but not used in the current tax period, should not be included in non-operating income.

How is the reserve used and can the unused portion be carried forward to the future?

If the company has created a reserve for the repair of fixed assets , then subsequently the amount actually spent on the repair of the operating system is written off against such a reserve (clause 2 of Article 324 of the Tax Code of the Russian Federation).

At the same time, companies should clearly understand that repair costs must be written off against the reserve of the year in which such work was actually performed for the company. That is, when the documents closing the repair work were signed. This is especially true in situations where the start and end of OS repairs occur in different tax periods.

At the end of each period, the company should conduct an inventory, during which company specialists compare the actual amounts spent during the year on repairs with the amount of the previously created reserve.

For information on inventory, see the article “How to conduct an inventory before annual reporting.”

If the repairs for the company cost more than the previously created reserve, then the difference should be taken into account as other expenses due to the instructions in paragraph 2 of Art. 324 and paragraph 1 of Art. 260 Tax Code of the Russian Federation. If, on the contrary, upon completion of the repair there are excess (unused) funds remaining, then such excess must be included in non-operating income.

PAY ATTENTION! Carrying over the unclaimed portion of the reserve for standard (inexpensive) repairs to the next year is not allowed.

This provision also applies to situations where no repairs were carried out at all. In such a situation, the entire reserve is reflected in income on the last calendar day of the year in which the reserve was formed.

As for the reserve for complex and expensive repairs, the legislator does not require that the amounts allocated to increase such a reserve be restored. They accumulate from year to year until repairs are started/implemented. But only if the company states in its accounting policy that it has adopted the practice of making deductions towards the reserve for complex and expensive repairs over more than one tax period.

In the year when expensive repairs are carried out, the company will also have to identify the balance and attribute the excess to expenses and the excess to income.

Expenses for repairs of fixed assets and the creation of reserves for such repairs

Print (Ctrl+P)

General provisions

When calculating income tax, organizations have the right to take into account in other expenses the costs of repairing their own and leased fixed assets. With the accrual method, these costs reduce the tax base at a time in the reporting (tax) period in which they were incurred (regardless of payment), in the amount of actual costs (clauses 1, 2 of Article 260, clause 5 of Article 272 of the Tax Code of the Russian Federation ). Using the cash method, only actually paid repair costs can be taken into account in expenses (clause 3 of Article 273 of the Tax Code of the Russian Federation).

In analytical accounting, the taxpayer forms the amount of expenses for the repair of fixed assets, taking into account the grouping of all expenses incurred, including (clause 1 of Article 324 of the Tax Code of the Russian Federation):

- the cost of spare parts and consumables used for repairs;

- expenses for remuneration of workers carrying out repairs;

- other expenses associated with carrying out the specified repairs on your own;

- costs of paying for work performed by third parties.

In addition, in order to evenly include expenses for upcoming repairs of fixed assets over one or more tax periods, taxpayers can create appropriate reserves according to the rules of Art. 324 Tax Code of the Russian Federation.

If a reserve is created, the costs of repairing fixed assets are written off against it and are not taken into account in expenses. And only if the amount of repair expenses incurred exceeds the amount of the reserve, the difference between them can be included in other expenses (paragraph 5, 6, paragraph 2, article 324 of the Tax Code of the Russian Federation).

If a taxpayer carries out several types of activities for which the income tax base is calculated separately (Article 274 of the Tax Code of the Russian Federation), then analytical accounting of expenses for the repair of fixed assets for tax purposes is carried out for these types of activities (Clause 3 of Article 324 of the Tax Code RF). This rule also applies to expenses in the form of deductions to the reserve for the repair of fixed assets (see letter of the Ministry of Finance of Russia dated October 7, 2003 No. 04-02-05/3/75).

So, according to paragraph 2 of Art. 274 of the Tax Code of the Russian Federation, the tax base for profits that are not taxed at the general rate is determined by the taxpayer separately. In this case, the organization is obliged to keep separate records of income (expenses) for operations for which, in accordance with Chapter. 25 of the Tax Code of the Russian Federation provides for a different procedure for accounting for profits and losses.

In particular, separately from the general tax base, a tax base is formed from activities related to the use of service industries and farms (OPH), from transactions with securities not traded on the organized market (Part 1 of Article 275.1, Clause 22 of Article 280 of the Tax Code of the Russian Federation ). Consequently, the costs of repairing fixed assets (including contributions to the reserve), used, for example, in industrial enterprises, must be taken into account only when determining the financial result of this activity.

What works are repairs?

The Tax Code of the Russian Federation does not contain a definition of repair, therefore, if there are corresponding definitions in other regulatory legal acts, which are usually of an industry nature, it is necessary to be guided by them (clause 1 of Article 11 of the Tax Code of the Russian Federation). The main conclusion that follows from such definitions is that the purpose of any repair is to transfer an object from a faulty state to an operational one. At the same time, its original technical and economic characteristics do not change. This applies to both current and major repairs. Despite the fact that as a result of a major overhaul, the main components (units, assemblies) of the OS object are replaced, its technical indicators are restored to the original level.

At the same time, the main problem that a taxpayer may encounter is distinguishing between repairs (especially capital repairs) and reconstruction (modernization) of fixed assets. Both those and other works relate to types of restoration of fixed assets (see, for example, paragraph 26 of PBU 6/01).

However, the costs of modernization or reconstruction are aimed at improving the original characteristics of the property. Unlike repair costs, such capital investments are not immediately taken into account in expenses: they increase the initial cost of the object and are included in expenses through depreciation charges (clause 2 of Article 257, Article 259 - 259.3, clause 5 of Article 270 of the Tax Code of the Russian Federation) .

In particular, modernization includes work caused by a change in the technological or service purpose of equipment, a building, structure or other object, increased loads and (or) other new qualities. Reconstruction means the reconstruction of existing OS facilities, which:

- associated with improvement of production;

- increases the technical and economic indicators of the OS facility;

- carried out under a project for the reconstruction of fixed assets;

- produced in order to increase production capacity, improve quality and change the product range.

These definitions are given in paragraph 2 of Art. 257 Tax Code of the Russian Federation.

Thus, the main result of modernization or reconstruction is a change or improvement of the initial technical and economic characteristics of the OS object.

Therefore, it is first of all important to determine whether the work carried out is truly a repair and does not relate to modernization or reconstruction.

At the same time, the repair of a fixed asset can also be accompanied by an improvement in the characteristics of the object. For example, in a situation where a new spare part is installed instead of a failed part, which has a longer service life or helps to increase the useful life or productivity of the OS object as a whole.

For the correct qualification of work performed on buildings and structures, the following documents containing lists of relevant work may be useful:

- Resolution of the USSR State Construction Committee dated December 29, 1973 No. 279 “On approval of the Regulations on carrying out scheduled preventive maintenance of industrial buildings and structures” (MDS 13-14.2000);

- Order of the State Committee for Architecture under the USSR State Construction Committee dated November 23, 1988 No. 312 “On approval of departmental building standards of the State Committee for Architecture “Regulations on the organization and implementation of reconstruction, repair and maintenance of residential buildings, communal and socio-cultural facilities” (VSN 58-88 (r)) .

How to confirm the need for repairs

For this it is recommended:

- draw up a defect sheet with a description of the faults that have arisen at the OS object, a list of necessary repair (restoration) work and purchased spare parts;

- issue an order (instruction) from the head of the organization to carry out repairs of this facility.

These documents are not mandatory, but as practice shows, it is much more difficult to confirm the validity (economic justification) of repair costs without them (clause 1 of Article 252 of the Tax Code of the Russian Federation).

Therefore, in order to avoid disputes with regulatory authorities, you should fill out the defective statement using a self-developed form (Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”). As a sample, you can take a report on identified equipment defects in form No. OS-16, approved. Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

To draw up a defective statement, it is recommended to create a commission of representatives of the accounting department, the operating and repair department of the organization (a third-party contract repair organization), who will sign this statement.

Based on the defective statement, the head of the organization issues an order (instruction) to repair the faulty OS object.

Creating a reserve for repairs of OS objects

Organizations have the right to create according to the rules of paragraph 2 of Art. 324 of the Tax Code of the Russian Federation reserves for future expenses for the repair of fixed assets (clause 3 of Article 260 of the Tax Code of the Russian Federation).

There can be two such reserves:

- for current and major repairs of fixed assets (accumulated and spent within one tax period) - general reserve;

- for particularly complex and expensive types of capital repairs of fixed assets (can be accumulated over several tax periods and spent during the period of major repairs).

Criteria for the complexity and high cost of capital repairs must be established in the accounting policy for tax purposes.

If the accumulation of funds for carrying out particularly complex repairs is carried out over several tax periods, then during this repair, deductions for its financing can increase the maximum amount of the total reserve for repairs (paragraph 3, paragraph 2, article 324 of the Tax Code of the Russian Federation).

If a reserve is created, the costs of repairing fixed assets are written off against it and are not taken into account in expenses. And only if the amount of repair expenses incurred exceeds the amount of the reserve, the difference between them can be included in other expenses (paragraph 5, 6, paragraph 2, article 324 of the Tax Code of the Russian Federation).

Let us note that in paragraph 2 of Art. 324 of the Tax Code of the Russian Federation does not directly speak about the possibility of creating the two indicated reserves. For information on whether a taxpayer can include in expenses the costs of current and ordinary major repairs of fixed assets if a reserve has been formed for particularly complex and expensive types of major repairs (the general reserve was not created or was spent), see the recommendation article.

General reserve (determining the maximum annual amount)

In accordance with paragraph 2 of Art. 324 of the Tax Code of the Russian Federation, contributions to the reserve are calculated based on:

- total cost of fixed assets. This cost is defined as the sum of the initial (replacement) cost of all depreciable fixed assets in operation at the beginning of the tax period, in which a reserve for future expenses for the repair of fixed assets is formed. Thus, the reserve can only be created in relation to one’s own property, since it is precisely this that is subject to depreciation (clause 1 of article 256, clause 1 of article 257 of the Tax Code of the Russian Federation). No reserve is created for objects leased or used free of charge (see letter of the Ministry of Finance of the Russian Federation dated March 22, 2010 No. 03-03-06/1/159). Consequently, it is also impossible to create a reserve for the repair of fixed assets that are not subject to depreciation (clause 2 of Article 256 of the Tax Code of the Russian Federation) or are excluded from depreciable property due to transfer for free use, conservation, reconstruction or modernization (clause 3 of Art. 256 of the Tax Code of the Russian Federation).

- standards of deductions developed and approved in the accounting policy depending on the frequency of repairs of fixed assets, the frequency of replacement of elements of fixed assets (in particular, assemblies, parts, structures) and the estimated cost of repairs.

The maximum annual amount of the reserve for future expenses for the specified repairs cannot exceed the average annual value of actual expenses for repairs over the past three years. At the same time, the actual expenses include the cost of repairing the operating system, regardless of the order in which these amounts are written off in tax accounting (at the expense of the reserve or by inclusion in other expenses).

In order to determine the standard for contributions to the reserve, it is necessary:

- Assess the costs of upcoming repairs this year by drawing up an estimate of upcoming expenses. There are no requirements for its preparation, however, when determining the amount of costs, it is worth taking into account the frequency of repairs of each fixed asset item and the current cost of such repairs.

- Calculate the average cost of repairing your own fixed assets over the past three years, not including the cost of expensive repairs in this calculation.

- The smaller of these values is divided by the total initial cost of fixed assets and multiplied by 100%.

The above calculation procedure confirms that an organization that was created less than three years ago, or has not carried out repairs in the last three years, will have difficulties forming such a reserve.

In order to determine the annual amount of the reserve, the interest received must be multiplied by the original cost of fixed assets. This will be the maximum annual reserve amount, which should be evenly taken into account in expenses.

Example

In January 2016, the company forms a reserve for the annual maintenance of fixed assets in tax accounting. Over the past three years, the total cost of equipment maintenance amounted to 5,580,000 rubles. In 2013 - 1,760,000 rubles, in 2014 - 1,840,000 rubles, in 2015 - 1,980,000 rubles. In accordance with the consolidated estimate for maintenance work, the cost of work in 2016 will be 2,080,000 rubles. The initial cost of fixed assets as of January 1, 2016 is 246,879,000 rubles. The calculation of the standard for contributions to the reserve is: 2,580,000 / 3 = 1,860,000. Since 1,860,000 rubles is less than 2,080,000 rubles, we use it for the calculation. 1,860,000 / 246,879,000 x 100% = 0.75%. Thus, the annual amount of the reserve will be 1,851,590 rubles.

Reserve for expensive major repairs (determining the maximum annual amount)

Such a reserve can be formed only if major repairs were not carried out in previous tax periods (paragraph 3, paragraph 2, article 324 of the Tax Code of the Russian Federation).

Moreover, according to the Russian Ministry of Finance, such tax periods are understood to be three years immediately preceding the current tax period (see letters dated November 29, 2005 No. 03-03-04/1/386, dated April 8, 2005 No. 03-03-01 -04/1/180). This definition allows the formation of a reserve for expensive types of capital repairs (as opposed to a reserve for ordinary types of repairs) for those organizations that were created less than three years ago and which have not carried out repairs in the last three years.

The reserve for particularly expensive repairs is accumulated separately for the fixed assets for which it is planned. The size of such a reserve is not limited, however, it can only be formed between years in which repairs are carried out (letters of the Ministry of Finance of Russia dated June 22, 2011 No. 03-03-06/1/369, dated July 7, 2009 No. 03-03-06/4/ 56). Thus, to determine the amount of the annual reserve for particularly expensive major repairs, the following is necessary.

- Determine the cost of repairing the OS by drawing up an estimate.

- Determine the number of years between which repairs are carried out, i.e. if the last time a particularly expensive repair was carried out was in 2013, and the next one is planned for 2022, the number of years between repairs is 3.

- Divide the estimated cost of repairs by the number of years between repairs, i.e. If we continue our example, then the cost of repairs according to the estimate drawn up in 2014 must be divided by 3 - this will be the annual amount of the reserve for repairs taken into account.

Thus, if in a specific situation the taxpayer considers the formation of a reserve for expensive major repairs inappropriate (economically ineffective, difficult to implement, associated with the risks of claims from the tax inspectorate, etc.), then it is better to accumulate funds for such repairs within the framework of the general reserve for repair of OS objects.

Accounting for reserves in expenses

Deductions to the reserves for future expenses for repairing the OS during the tax period are written off as expenses in equal shares on the last day of the corresponding reporting (tax) period (paragraph 4, clause 2, article 324 of the Tax Code of the Russian Federation). This applies to both the general reserve and the reserve for expensive major repairs.

Accordingly, in order to determine the amount that can be taken into account quarterly (monthly) in expenses, the maximum annual reserve amount must be divided by 4 (if the tax reporting periods are the first quarter, half a year and nine months of the calendar year) or by 12 (if the taxpayer calculates monthly advance payments). payments based on actual profit received).

Using the reserve, taking into account its surplus and deficiency

If a reserve is created for the repair of fixed assets, the actual costs of such repairs are written off against it. These costs cannot be included in expenses until this reserve is completely exhausted. This is due to the fact that previously expenses included contributions to the reserve.

As of the last day of the current tax period, it is necessary to conduct an inventory of the reserve and the actual costs of repairing fixed assets. If the reserve is insufficient, the balance of repair costs is included in other expenses as of December 31 of the current tax period.

The excess reserve, on the contrary, must be taken into account in non-operating income. Exception: excess reserve for expensive major repairs. It needs to be restored in income only at the end of the year, which was planned for carrying out expensive major repairs. Otherwise, such a surplus is added to the reserve for expensive major repairs, which will be formed next year.

This follows from paragraph. 4 – 8 p. 2 tbsp. 324 of the Tax Code of the Russian Federation and letters of the Ministry of Finance of Russia dated July 19, 2006 No. 03-03-04/1/588.

If repair work was started in one tax period and completed in another, then the costs for them must be written off from the reserve in the tax period in which the documents confirming the completion of such work were signed (letter of the Ministry of Finance of Russia dated March 6, 2007 No. 03- 03-06/1/149).

0

Share link:

- Click to share on Twitter (Opens in new window)

- Click here to share content on Facebook. (Opens in a new window)

Liked this:

Like

Similar

Author of the publication

offline 1 day

master1c8

1

Comments: 41Publications: 513Registration: 12/25/2016

Results

Forming a reserve for the repair of fixed assets requires the company to correctly record information about the cost of all fixed assets, about completed and upcoming repair work (more specifically, about their estimated cost).

At the same time, the rules for creating and accounting for tax purposes of contributions to the reserve for standard repairs and for expensive repairs are slightly different. In particular, the unused reserve for ordinary repairs must be restored, and if the reserve for expensive repairs has not been fully used, then it can be transferred to future periods. However, in a year when the company carried out expensive repairs, the remainder of the reserve should be included in income, and excessively spent funds should be included in expenses. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

An example of accounting for major equipment repairs.

A small aviation company overhauls its aircraft every 3 or 4 years. Assume that the total cost of the aircraft is CU1,000 and its useful life is 20 years.

After 4 years you will need to carry out a major overhaul, which is expected to cost CU100.

So you simply recognize the asset in accordance with IAS 16 Property, Plant and Equipment as:

Debit. Fixed assets: CU 1,000

Credit. Settlements with suppliers: CU 1,000

Further, you do NOT recognize a provision for capital repairs of CU100.

Instead, you depreciate separately 2 components of the cost of the aircraft:

- Amount CU 100 refers to major repairs that will occur in 4 years, therefore, with the direct depreciation method, the annual deduction for depreciation is CU 25 ,

- The remaining amount is CU 900. (1,000 - 100) is depreciated over the useful life of the aircraft (20 years), which is CU 45 . per year (900 / 20).

Thus, the total annual depreciation charge for the next 4 years is:

25 + 45 = 70 cu.

After 4 years you need to carry out major repairs and you will spend CU 100.

This operation will be reflected in accounting as:

Debit. Fixed assets - aircraft: CU 100

Credit. Settlements with suppliers: CU 100

Again, you will discount the CU100 cost of repairs. over the next 4 years until the next major overhaul.

Accounting for reserve

At the time of writing, the future of the reserve for repairs of fixed assets in 2011 remains unclear. Currently, its creation is regulated by clause 72 of the Regulations on accounting and financial reporting, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n. Not long ago, a draft order of the financial department was posted on the official website of the Russian Ministry of Finance, which introduces serious changes to accounting legislation. Thus, according to the innovations, this paragraph loses force from January 1, 2011. In the Chart of Accounts, account 96 “Reserves for future expenses” is being prepared to be renamed “Estimated Liabilities”. In addition, it is planned to release the new PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets”. In the meantime, let’s check whether the reserve for the repair of fixed assets has been correctly formed in accounting and what needs to be done with its balance at the end of 2010.