Since 2022, the Federal Accounting Standard FSBU 5/2019 “Inventories”, approved. by order of the Ministry of Finance of Russia dated November 15, 2019 No. 180n. Working clothes, special equipment and other low-value items with a service life of more than 12 months are no longer included in reserves. 1C experts tell how in “1C: Accounting 8” edition 3.0 you can take into account low-value equipment and inventories in accordance with changes in accounting and recommendations of the Accounting Methodological Center *.

* Accounting methodological) is a subject of non-state regulation of accounting within the competencies established by Article 24 of the Federal Law of December 6, 2011 No. 402-FZ.

By Order of the Ministry of Finance of Russia dated November 15, 2019 No. 180n, the Federal Accounting Standard FSBU 5/2019 “Inventories” was approved. FSB 5/2019 applies starting from reporting for 2022. In order No. 180n we are faced with two interesting points.

Course in the Educational “Accounting according to FAS 5/2019 “Inventories” in 1C: Accounting 8”

Firstly

, with the cancellation of the Guidelines for accounting of special tools, special devices, special equipment and special clothing (approved by order of the Ministry of Finance of Russia dated December 26, 2002 No. 135n).

Secondly

, with new wording in the definition of inventories: “For accounting purposes, inventories are assets consumed or sold within the normal operating cycle of the organization, or used for a period of no more than 12 months” (clause 3 of FSBU 5/2019).

Thus, in 2022, the concept of workwear and special equipment no longer exists in accounting. Now these are either materials or fixed assets (fixed assets). In this article we will look at the features of accounting for fixed assets in 2022.

About support for FSB 5/2019 in “1C: Accounting 8 CORP” edition 3.0, read:

FSBU 5/2019: methods for assessing finished products in “1C: Accounting 8 KORP”

FSBU 5/2019: impairment of inventories in 1C: Accounting 8 KORP

On the accounting of materials in accordance with FSBU 5/2019, see the video recording of the lecture “FSBU 5/2019 “Inventories” - fundamental differences compared to the current standard, reflected in the program “1C: Accounting 8″” with the participation of O.A. Sukhareva (Director of the National Budgetary Institution "BMC" Foundation) and 1C experts. The video is available for viewing on the 1C:ITS website on the 1C:Lecture page.

How to account for fixed assets in 2022

In 2022, two regulations on accounting for fixed assets will be in effect:

- You can still apply the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01 for the last year (approved by Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n);

- It is already possible to switch to the new Federal Accounting Standard FSBU 6/2020 “Fixed Assets” (approved by order of the Ministry of Finance of Russia dated September 17, 2020 No. 204n).

Both documents provide for simplified accounting of low-value fixed assets. But the general approach to simplifying accounting has changed significantly over the years.

Thus, paragraph 5 of PBU 6/01 states that assets that meet all the characteristics of fixed assets are valued within the limit established in the organization’s accounting policies, but not more than 40 thousand rubles. per unit, can be reflected in accounting and financial statements as part of inventories (MPI).

And according to paragraph 5 of FAS 6/2020, an organization may decide not to apply this standard in relation to assets that meet all the characteristics of fixed assets, but have a value below the limit established by the organization, taking into account the materiality of information about such assets. In this case, the costs of acquiring and creating such assets are recognized as expenses of the period in which they are incurred.

The first thing we pay attention to is the different accounting procedures for low-value fixed assets. The previous standard (PBU 6/01) suggests that we take such objects into account as part of the inventory. New FSBU 6/2020 - immediately reflected in expenses.

The next important point is how to determine which fixed assets are worthy of an inventory number and which are not.

Using PBU 6/01, the accountant sets a limit for the cost of fixed assets, and everything that turns out to be less than this limit is taken into account as inventory. PBU 6/01 also defines the maximum size of this limit - 40 thousand rubles. It turns out that, for example, a laptop for 39 thousand rubles. - this is not the main tool, but almost exactly the same laptop for 41 thousand rubles. - is already the main means.

In the new FSBU 6/2020, there is no maximum value limit in the form of a specific amount. In addition, there is no indication that the limit is set per unit of asset and that the limit is measured in monetary units. At the same time, a requirement was introduced that the limit is set taking into account materiality.

Let us remember that the concept of materiality in accounting is not new. It is given in the Accounting Regulations “Accounting Policy of the Organization” PBU 1/2008 (approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n). Moreover, the concept of materiality is inextricably linked with the requirement of rationality:

- “The accounting policy of the organization must ensure ... rational accounting, based on business conditions and the size of the organization, as well as based on the ratio of costs for generating information about a specific accounting object and the usefulness (value) of this information” (clause 6 of PBU 1/2008 );

- “To the extent that the application of accounting policies... leads to the formation of information, the presence, absence or method of reflection of which in the accounting (financial) statements of an organization does not affect the economic decisions of users of these statements, the organization has the right to choose an accounting method, guided solely by the requirement of rationality … The organization carries out classification of information as non-essential independently…” (clause 7.4 of PBU 1/2008).

Receipt and commissioning

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

In the “Fixed assets and intangible assets” menu, select “Receipt of fixed assets” and create a new document.

In the header you must indicate the organization, counterparty and agreement. Set up the way to reflect depreciation and VAT expenses. If you are going to rent out the property in the future, check the appropriate box.

In the tabular part of the document, list the required fixed assets. Remember that if you buy several identical objects (for example, 3 machines), then in the “Fixed” assets directory and in this tabular section you should have 3 different positions with different inventory numbers.

The tabular part also indicates VAT, accounts (accounting, depreciation, VAT) and service life in months.

Post the document and register the invoice at the bottom of the form.

How to apply PBU 6/01 for low-value OS in 2022

But what should organizations do that have not yet switched to using FSBU 6/2020 in 2022? How to apply PBU 6/01 and at the same time take into account low-value fixed assets?

We believe that to answer the question about accounting for low-value fixed assets in 2022, you can use the recommendation of the Accounting Methodological Center (BMC) No. R-100/2019-KpR “Implementation of the requirement of rationality” (approved by the NRBU BMC Foundation on May 29, 2019).

Illustrative Example 1 of Recommendation No. R-100/2019-KpR proposes the following procedure for accounting for fixed assets:

- instead of applying the cost limit provided for in paragraph 5 of PBU 6/01 for individual fixed assets, it is possible to identify groups of fixed assets, information about which is obviously insignificant, based on the characteristics of the organization’s activities and the structure of its assets;

- this decision must be reviewed regularly (at least once a year);

- if this decision is made, costs for the acquisition, creation, improvement of fixed assets related to selected non-essential groups, regardless of the cost of individual objects, are written off as expenses for ordinary activities at the time they are incurred;

- objects belonging to significant groups, regardless of the cost of individual objects, are taken into account in the general procedure for accounting for fixed assets.

So, for example, the management of a plant may decide that all costs for the purchase of office equipment and computers for accounting, within a certain amount per year, are not significant for financial statements and can be written off as expenses (even if a separate copying machine costs 150 thousand rubles. ).

And according to the recommendation of the BMC No. R-122/2020-KpR “Special means of production” (approved by the NRBU “BMC” Foundation on December 11, 2020), the concept of materiality given in paragraph 7.4 of PBU 1/2008 can be applied to all low-value objects , regardless of the period of their use. Based on the requirement of rationality, an organization can decide from 01/01/2021 to include expenses for ordinary activities at the time when expenses were incurred for the acquisition, creation, improvement of special means of production, the cost of which individually and in the aggregate of a homogeneous group is insignificant, regardless of their period of use.

At the same time, assets that meet the criteria of fixed assets, with a useful life of more than 12 months and a value within the limit established by the organization (but not more than 40,000 rubles), can be reflected in accounting as part of the inventory, as before, i.e. before FSBU 5/2019 comes into force. This conclusion was made by the Russian Ministry of Finance in letter dated 03/02/2021 No. 07-01-09/14384.

1C:ITS

For more information on how to keep records of special clothing (special equipment) with a service life of more than 12 months in accounting and tax accounting in 2022, see the “Legislative Consultations” section.

The directory “Fixed Assets” has been optimized

The previous form of the directory element Fixed Assets contained four tabs: Main, Accounting Information, Accounting Information, and Additional. When entering a new item, the user typically filled out only the information on the Main tab. The information on the BU Information and NU Information tabs was filled in automatically after acceptance for accounting, commissioning, and registration of other events occurring with the fixed asset.

The Additional tab contains information intended for filling out the inventory card, while the Date of issue (construction) attribute in some cases can affect the transport tax rate. Meanwhile, the user often forgot about the Additional tab.

Now the form of the element of the fixed asset directory contains the tabs: Main, Accounting information, Accounting information, as well as Accounting depreciation and Accounting depreciation, if the object is depreciated in accounting and tax accounting (Fig. 1). All necessary details are filled in by the user only on the Main tab (the group of details Information for the inventory card is now included here), and all other bookmarks are filled in automatically in the program.

Rice. 1. Fixed asset card

How to classify objects taking into account the concept of materiality

It turns out that, taking into account the concept of materiality and the requirement of rationality, the classification of material objects in accounting may look like this (clause 7.4 PBU 1/08, clause 3 FSBU 5/2019, clause 5 FSBU 6/2020):

- Irrelevant items, regardless of their useful life, are materials and low-value fixed assets that are written off as expenses at the time of acquisition.

- Inventories are significant items used for less than 12 months. Materials with a service life of up to a year are accounted for in account 10 “Materials” and are written off as expenses when transferred to production in the same manner as before.

- Fixed assets are real, having a unique inventory number. These are significant objects with a service life of more than 12 months, which are first credited to account 08 “Investments in non-current assets” and then put into operation. The cost of fixed assets is repaid through depreciation.

And then the time has come to introduce the concept of “Low-valued equipment and inventories” - this is how we will call objects recognized as non-essential in accounting.

What might fall into this category? Most of what was previously special clothing and equipment, as well as furniture, office equipment, computers, power tools, fire extinguishers, etc.

As a rule, such objects require additional control, that is, operational accounting - to whom, when and how much was issued (clause 8 of FSBU 5/2019, clause 5 of PBU 6/01, clause 5 of FSBU 6/2020).

How to reflect the purchase of fixed assets in 1C? Step-by-step instruction

Dear friends, hello!

We continue to publish short notes from a series of articles devoted to solving everyday problems in 1C. Just the other day, one of our clients asked a question about how it should be reflected in the fixed asset purchase program. Moreover, he asked if there was a difference in how this was done in the “boxed” version of the program and using our service. For our part, we said that due to the speed and the fact that the service is “not stupid”, this problem can be solved many times faster if you use the “cloud”.

Let's see what the user needs to do to capitalize the OS:

The first thing, of course, is to open the start page. In the left column, select the section “OS and intangible assets”, in the list that opens - “Receipt of equipment”.

In the window that opens, fill in the appropriate lines. In particular, it is necessary to indicate the warehouse to which the goods were received, the purchasing organization, the counterparty, as well as direct information about the operating system.

Filling out the “Equipment” tab generates transactions in the journal of transactions for the account 08.04. At this point, the acquisition operation can be considered completed.

Next, we proceed directly to registering the operating system. To do this, we return to the start page and in the section familiar to us, select the line “Acceptance for accounting of fixed assets.”

After the window opens, you must again fill in the required fields. In particular, we write down the account number, name of the equipment, method of receipt and information about the OS event:

We leave the “Non-current asset” tab and go to “Fixed Assets”. Here we will need to fill in the name of the OS and enter the inventory number:

Next, we start working with our main tool and enter clarifying information on it. In particular, we indicate the depreciation group, OKOF code and fixed asset accounting group:

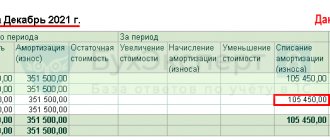

The next step is to fill out the “Accounting” tab. We indicate the parameters for calculating depreciation:

When filling out all the previous columns, it is important not to forget about the “Tax Accounting” section, where the useful life is specified. It is indicated in months:

The next step is to enter data in the “Depreciation bonus” tab. Depending on the class, it will be determined individually:

To top it all off, you can (and should) check how the newly capitalized OS is displayed in the Inventory Book. If everything is correct, then congratulations, mission accomplished!

As you can see, dear friends, there is nothing difficult in working with the 1C Online service! Don't forget to take advantage of free access for 14 days and enjoy all the benefits of cloud 1C!

We wish you good luck and see you soon!