What reports and within what time frame are submitted to the Pension Fund upon termination of activity?

List of reporting to the Pension Fund upon liquidation of an LLC in 2022:

- SZV-STAGE;

- SZV-M;

- SZV-TD.

The forms are submitted within a month from the date of approval of the interim liquidation balance sheet (clause 3 of Article 11 of the Federal Law “On individual (personalized) accounting in the compulsory pension insurance system”). The instructions do not contain information on whether it is necessary to submit SZV-M upon liquidation of an LLC if there are no employees, but if the organization previously reported, it is necessary to send information to the Pension Fund.

How to submit a report to the Pension Fund of Russia

There are no special instructions or other specifics on how to reflect liquidation in the Pension Fund. Prepare reports either on paper or in electronic form and send them to the territorial department. After submitting the report, Pension Fund employees prepare a certificate from the Pension Fund upon liquidation of the LLC as confirmation of the fact of the company’s reporting upon closure.

Companies with fewer than 25 employees have the right to report in any way convenient for them - both on paper and in digital format.

IMPORTANT!

The electronic report requires certification by the digital signature of the head of the company.

Firms with 25 or more employees do not have the right to choose. Such policyholders are required to provide information to the Pension Fund exclusively in electronic form.

If there are employees

If there are employees, SZV-STAZH is given to those with whom employment contracts and civil law agreements have been concluded. When submitting reports to SZV-STAZH under GPC agreements, in column 11 of the form indicate the code value:

- “AGREEMENT” - if the employee received payments for the order;

- “NEOPLDOG” or “NEOPLAVT” - if you received an advance or did not receive any monetary compensation at all.

Made a mistake? Use free instructions from ConsultantPlus experts to correctly fill out and submit the correction form. If this is not done on time, you will pay a fine.

to read.

Features of filling out SZV-STAZH for 2022

When forming SZV-STAZH, it is necessary to take into account that the rules for determining the periods of work on the basis of which the right to retire earlier than the established period are granted have been changed. Amendments were made to the Pension Fund Resolution No. 507p dated December 6, 2018 based on the Pension Fund Resolution No. 304p dated September 6, 2021.

In this case, two important adjustments have been made:

- The period of advanced training is no longer required to be excluded from the preferential length of service. During this period, employees do not perform official duties, but they retain their workplace, position and average salary. In addition, the employer pays insurance premiums for them. Previously, these periods were excluded from the preferential length of service, but now it is necessary to include periods of basic and additional professional education for employees, which they need to perform their job duties (clause 3.1 of Government Resolution No. 665 dated July 16, 2014, as amended by Government Resolution dated March 4, 2014. 2021 No. 322). It turns out that when forming SZA-STAGE, the “QUALIFICATION” code can be entered in column 11 simultaneously with the entry of codes for special working conditions or length of service.

- You can simultaneously enter additional information with the code “CHILDREN” and territorial working conditions with the code “VILLAGE”. Periods of leave to care for children up to 1.5 years must be included in the work experience in agriculture, and therefore, when specifying the code “CHILDREN”, you can also enter the code “VILLAGE”. If you specify any other code for territorial working conditions, the program will generate an error when checking.

You can purchase services that help you work as an accountant here.

Do you want to install, configure, modify or update 1C? Leave a request!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

If there are no workers

There is no exemption from the obligation to submit personalized reports in the absence of full-time employees. As well as individual recommendations on how to fill out SZV-M and SZV-STAZH during liquidation, if there are no employees, the directors (sole founder) are usually indicated in the form.

List of reports to submit to the Pension Fund when liquidating an LLC if there are no employees:

- SZV-STAGE;

- SZV-M.

Every organization has a director. Send the forms to him, even if an employment or civil contract has not actually been concluded with the director (PFR letter No. 08-22/6356 dated 05/06/2016, Ministry of Labor letter No. 17-4/10/B-1846 dated 03/16/2018). It is required to submit an SZV-STAGE for him regardless of whether his salary is paid or not (letter of the Pension Fund of the Russian Federation dated March 29, 2018 No. LCH-08-24/5721).

Another question is whether it is necessary to take the SZV-M if the company is being liquidated, the director is fired and there are no employees - yes, this is mandatory. In such a situation, in the report form SZV-M and SZV-STAZH indicate not the former director, but the founder or liquidator, with whom they usually enter into a civil law agreement (GPC). If he receives remuneration under a GPC agreement, his data must be reflected in the reports. If you do not receive it, then you do not need to submit a zero report.

But SZV-STAZH will not be handed over to the liquidator without payment in 2022, since such relationships are not recognized as labor relations. If the work is paid, then reports on the liquidator are submitted to the territorial body of the Pension Fund of the Russian Federation at the place of registration of the organization in accordance with generally established deadlines - no later than the 15th day of the month following the reporting period (calendar month), throughout the entire period of liquidation.

SZV-STAZH when assigning a pension to an employee

When an employee is going to retire, he must write a statement in which, along with a request to be dismissed in connection with retirement, he asks to submit personalized accounting information to the Pension Fund of the Russian Federation. The SZV-STAZH form and the procedure for filling it out were approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p.

For employees who are retiring, SZV-STAZH must be submitted to the Pension Fund within three calendar days from the date of submission of the application.

How to fill out SZV-STAZH when assigning a pension

When you submit SZV-STAZH for an employee retiring, in the upper right corner of the form, opposite the “Pension Assignment” field in the information type, you need to put o.

What to consider when preparing SZV-STAZH for a person retiring

Section 3

Section 3 of the SZV-STAGE reflects the employee’s periods of work, including periods of vacation, sick leave and other reasons for absence from work. Specific dates are indicated in columns 6 and 7.

SZV-STAGE is compiled for a calendar year. If an employee has been working in the company for a long time, the employment contract with him was concluded much earlier than the beginning of the year, the first date in column 6 will still be the first day of the reporting year “01/01/2019”. There is no need to indicate previous years in the report.

The last date in column 7 will be the day of retirement.

Please note: when submitting a retirement application, the employee must indicate the start date of the pension.

For employees who work in special conditions, in hazardous work part-time, the periods of work must be indicated in column 11. This applies to those who are eligible for early retirement.

Columns 8–10, 12 and 13 need to be completed only if the employee has the right to early retirement. In this case, it is necessary to indicate the codes of the relevant working conditions in column 12.

In column 10, write the code of the basis for calculating the insurance period of an employee who is entering early retirement.

What information is included in the SZV-STAZH

Please note how to submit SZV-M upon liquidation of an enterprise:

- include in SZV-STAZH all employees under labor and civil contracts;

- use the standard form SZV-STAZH, approved by Resolution of the Board of the Pension Fund of the Russian Federation No. 507p;

- indicate the periods of work in the organization up to the day of drawing up the SZV-STAZH;

- reporting period - the year of completion of the organization's activities.

ConsultantPlus experts examined the deadlines for submitting calculations of insurance premiums to the tax authorities and reporting to the Pension Fund of the Russian Federation upon liquidation of an organization. Use these instructions for free.

to read.

What should be taken into account when forming SZV-STAZH?

Through Resolution of the Pension Fund of the Russian Federation dated September 2, 2020 No. 612p, the rules for the formation of SZV-STAZH were adjusted, but the report form was not changed.

The changes concern the following points:

- added a new code "VIRUS". It is placed in gr. 10 of the report to indicate the insurance experience of medical personnel providing medical care to patients with coronavirus;

- added additional codes for the category of insured persons for employees of SMEs and non-profit institutions (NPOs).

The added codes for the second point must be used when forming the SZV-KORR. These codes include:

| Code | Decoding |

| MS | Employee of an organization related to SME companies |

| IPMS | Temporary employee of an organization related to SME companies |

| VJMS | Temporary resident employee of an organization related to SME companies |

| HF | Employee of a company included in the register of socially oriented NPOs |

| VPKV | Temporary employee of an organization included in the register of socially oriented NPOs |

| VZhKV | Temporary resident employee of an organization included in the register of socially oriented NPOs |

How to report using the SZV-M form

The answer to the question of whether it is necessary to submit a personalized monthly report to SZV-M upon termination of activities and closure of an organization is clear: the report must be submitted. It includes information about all employees of the organization working under an employment and civil law contract. Reporting period - month and year of document preparation.

Use a standard form; there is no special form established by law when terminating activities. Please note the deadline for submitting the last SZV-M report upon liquidation of an LLC: within a month from the date of approval of the interim balance sheet, as well as the rest of the reporting.

IMPORTANT!

In April 2022, Resolution of the Board of the Pension Fund of the Russian Federation dated April 15, 2021 No. 103p approved a new form “Information about insured persons (SZV-M)” and the procedure for filling it out (now set out separately). It will be applied starting with reporting for May 2021.

The indicators of the new form SZV-M are similar to the previous form (with the exception of the line “Name of the policyholder”). Now this line indicates the full or abbreviated name. In the previous form there is a note that the name is indicated briefly. The filling procedure has been removed from the form and included in separate instructions.

Special mark on the title page of 4-FSS

Registration of 4-FSS upon closure, reorganization or continuation of activity is carried out according to the rules from the FSS order dated September 26.

2016 No. 381. For the reporting periods 2021-2022, you need to submit the same form, but taking into account the nuances associated with the transition to direct payments of FSS benefits. We talked about them here. You can see a sample of filling out Form 4-FSS for 2022 in ConsultantPlus. If you do not have access to this legal system, trial access can be obtained online for free.

The report submitted in connection with liquidation is drawn up taking into account certain nuances. One of them is the need to put o on the title page. Under normal circumstances, when the employer continues to operate, no special checks are made in this field.

We’ll tell you how to fill out 4-FSS when liquidating an LLC using an example.

In March 2022, the founders of TransPodryadchik LLC decided to liquidate. The company's activities actually ceased six months ago, and at the time of the actual liquidation there were no employees on staff. The previous 4-FSS report was zero and was submitted to social insurance within the usual time frame.

When filling out the latest reporting on Form 4-FSS, Fr. was entered in the “Cessation of activity” field on the title page.

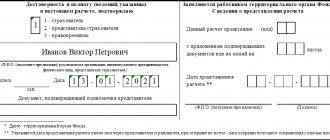

See below for a fragment of the title page of 4-FSS during the liquidation of the 2022 sample:

What else to pay attention to in sample 4-FSS during liquidation will be discussed in the next section.

Find out what other reporting is prepared during the liquidation of an organization using SOS in ConsultantPlus. Trial access to the legal system is provided free of charge.

Sample

Let's look at how to submit SZV-M upon liquidation of an organization by filling out the tabular part of the report. First, indicate the details of the policyholder:

- registration number in the Pension Fund of Russia;

- name of the enterprise (full or abbreviated);

- TIN;

- Checkpoint.

Then in the line “reporting period” indicate the code of the liquidation SZV-M - the serial number of the calendar month for which the report is submitted (01 - January, 02 - February, etc.) and the calendar year - 2022. This is what filling out the tabular part looks like and sample:

| No. | Last name, first name, patronymic (if any) of the insured person (indicated in the nominative case) | Insurance number of an individual personal account (must be indicated) | TIN (indicated if the policyholder has data on the individual’s TIN) |

| 1 | Ivanov Ivan Ivanovich | 012-345-678-90 | 1234567890 |

How to fill out SZV-TD

The form is filled out in the same way as when dismissing an employee. In the column about the reasons for termination of the contract, indicate the wording from the work book.

The date of dismissal is counted from the date of delivery of notice of dismissal to employees. It is handed over no later than two months before dismissal and indicates the date of the last working day.

When answering the question whether the SZV-TD is surrendered to the liquidator in 2022, if an agreement has not been concluded with him, it is necessary to find out who the liquidator is. If this is the director himself or another staff member, send the forms to the director or employee at the main place of work. If the liquidator is not a full-time specialist and the relationship with him is not formalized by an employment contract, SZV-TD does not give up.

Results

Before submitting an application for state registration in connection with liquidation to the tax office, you must submit 4-FSS to social insurance. Fr. is indicated on the title page of the report. The remaining fields of the form are filled in as usual.

If the liquidation occurred before the end of the calendar year, data in 4-FSS is presented from the beginning of the year to the day the report is submitted in connection with the liquidation. You can send the report in paper form or via TKS, depending on the number of individuals - the rules are the same as for the usual 4-FSS submission.

Sources:

- Federal Law of July 24, 1998 No. 125-FZ (as amended on December 2, 2019) “On compulsory social insurance against industrial accidents and occupational diseases”

- Order of the Federal Social Insurance Fund of the Russian Federation dated September 26, 2016 No. 381 “On approval of the calculation form...”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.