The state is taking measures to reduce the tax burden on its citizens, including with the aim of providing additional support for the construction or purchase of housing in Russia.

To reduce the tax base, the mechanism of tax deductions is used. These are the names of the amounts that are established at the federal level and are deducted from income subject to taxation. This automatically leads to a reduction in the amount of calculated income tax; accordingly, after settling the budget, the payer has more money in his hands compared to the situation when no deduction is provided.

To indicate tax deductions in the 2-NDFL declaration, as well as in accounting registers containing information on income and taxation of individuals, special identifiers are used in the form of a set of numbers (codes).

The essence of deductions

A tax deduction is a legally established amount by which the tax paid to the state by individuals can be reduced. That is, of the 13% that goes from your income to the budget, part of the funds will not be withheld or it will be returned if the tax has already been paid.

In the Tax legislation of the Russian Federation there are different types of deductions - standard, property, investment and social. Deduction codes 311 and 312 refer to property deductions.

To let your employer know that you are claiming a tax deduction, contact the Internal Revenue Service to confirm your eligibility. In response to the request, the tax office will issue a notice that must be provided to the employer. Further control over the correct filling of the fields of income declarations is carried out by the company's accounting department.

If your tax return is prepared by your employer, but you have doubts about anything, you can ask the accounting department for a copy of the 2-NDFL certificate. And see if all deductions are reflected correctly. If you're filing your own income tax return, it's even more important to know how to fill out the different fields on the form so you don't overpay the government.

The amount of the deduction and the amount of money returned by the state are not the same thing. The deduction amount is the amount of money by which income is allowed to be reduced when purchasing property. And the returned tax is only 13% of the deduction. In this case, one employee will be able to receive 13% of the maximum amount of 2 million rubles . But you won’t get all the 2 million rubles you spent. from the budget, but only 260 thousand rubles. And even if 3 or 5 million rubles are spent, more than 260 thousand rubles, you still will not be compensated.

How to return up to 1,300,000 rubles. →

However, if the purchased housing cost 1.5 million rubles, then you can purchase a second one or a plot of land for an amount exceeding 0.5 million rubles. and collect the remainder of the deduction. But this applies only to those who did not exercise the right to deduct earlier, before 2014.

It is important to know that the deduction is given only once; it is impossible to use the benefit again. The declaration cannot be submitted in the year in which the property was purchased, but only the next year or even later.

What amounts to indicate in the section “Income received in the Russian Federation”

In the top panel of the “Income received in the Russian Federation” section there are three buttons - these are the personal income tax rates for resident income from sources in Russia. 13 percent is the most common rate, 9 percent for dividends, 35 percent for rare income (for example, for financial benefits from interest on loans). The 2-NDFL certificate will also help you navigate the rates.

If you didn’t have any income other than your regular salary, click where 13 percent is. And put the 2-NDFL certificate in front of you - you will now enter the amount of income received.

Example: Filling out the section “Income received in the Russian Federation”

A. S. Kondratyev in 2012 had only income taxed with personal income tax at a rate of 13 percent. He clicked on “13” and the green “+” in the “Payout Sources” menu. And he entered information about the company where he works - ZAO Alfa. I simply copied them from section 1 of the income certificate (in Form 2-NDFL), which I took from the accounting department. He also had income from the sale of a car (which he had owned for less than three years). Click on “+” again and enter your full name. buyer - Ivanov Petr Sergeevich. TIN, KPP and OKATO are required only for organizations. Income must be entered by each source and month.

Kondratiev highlighted “CJSC Alpha” at the top and clicked “+” in the bottom menu. And I entered the data from section 3 of the income certificate: income code, amount of income, month of income. For some income, you must also indicate the amount and deduction code here. For January, Kondratyev received a salary (code 2000) - 20,000 rubles. and remuneration under the contract (code 2010) - 4000 rubles; for February salary - 10,000 rubles. and vacation pay (code 2012) - 10,000 rubles; for March-December salary - 20,000 rubles. monthly. The program calculates the total amount of income automatically. We take the data for the remaining fields from section 5 of the income certificate (see figure below). All this will be displayed later on sheet A of the declaration.

The second source is P.V. Ivanov. Income code - 1520 (sale of other property...). The amount of income according to the documents (under the purchase and sale agreement) is 300,000 rubles. But there is a right to a property deduction: either a fixed one (250,000 rubles) or in the amount of expenses for the purchase of a car (subclause 1, clause 1, article 220 of the Tax Code of the Russian Federation). The latter amounted to 350,000 rubles, so Kondratiev chose the second option. Income code - 903, deduction amount - 300,000 rubles. (the deduction cannot be more than income!). Taxable income is zero (300,000 rubles – 300,000 rubles), calculated tax is also (0 rubles × 13%). The result will be on sheet E of the declaration.

Where and what tax deductions to report

You transferred the amounts of income received. Now you need to show the deductions to which you are entitled. And there are three types: standard, social and property.

Standard deductions

From this year, the standard personal income tax deductions for the employee himself remain only preferential ones - 500 or 3,000 rubles. They are for a special category of citizens, for example for people with disabilities.

There are also deductions for children - 1400 or 3000 rubles. for each child (Article 218 of the Tax Code of the Russian Federation). These are given until income from the beginning of the year exceeds 280,000 rubles.

Example. How to reflect standard deductions in the 3-NDFL declaration

Let's continue with example 1. Kondratiev has a six-year-old son. Therefore, personal income tax was deducted from his salary, which was reduced by 1,400 rubles. (deduction code 114 in section 4 of the income certificate). At the top of the Deductions section, he selected the pencil check mark. And I checked the first line and the “Deductions for child(ren)” field. And in the field “The number of children did not change and amounted to” - one.

If there are three or more children, put a two in the “The number of children has not changed and is” field. And below is the number of children, starting from the third. For disabled children - a separate line.

Was your baby born in the middle of the year? Uncheck one of these lines. And enter the number of children in each month in the bottom table. If you are eligible for double the deduction (as a single parent), check this box. Was this right not available in all months? Place a dot next to the question mark and indicate the months in which it occurred.

The total amount of standard deductions should be reflected in paragraph 2.8 of sheet G1 of the declaration.

Social deductions

There are four types of social deductions. For training, treatment, contributions towards a future pension and charity (Article 219 of the Tax Code of the Russian Federation).

Let's say you paid for your training in advanced training courses. Click on the red tick icon and enter the amount of expenses in the required line. The program itself will determine whether the expenses fit into the limit. There are such limits. 120,000 rub. - for deductions for your own education, the education of brothers and sisters, treatment (except for some types) and two “pension”. And 50,000 rubles. — for education of one child (for both parents, guardians or guardians). You will see the result later in paragraph 3 of sheet G2 of the declaration.

Where to get data to calculate property deductions

| Index | Expenses for the purchase (construction) of housing | Loan repayment expenses |

| Deduction for previous years according to the declaration | Line 140 + line 240 of sheet I of the last submitted 3-NDFL (or sheet L, if this is a declaration for the period before 2010) | Line 170 + line 250 of sheet I of the last submitted 3-NDFL (or sheet L, if this is a declaration for the period before 2010) |

| Amount carried over from the previous year | Line 260 of sheet I from 3-NDFL for 2011. Or the amount from the notification of the Federal Tax Service for 2012 | Line 270 of sheet I from 3-NDFL for 2011. Or the amount from the notification of the Federal Tax Service for 2012 |

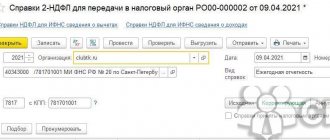

| Deduction for previous years from the tax agent | Clause 4.1 of certificates in form 2-NDFL for periods before 2012 (deduction code - 311) | Clause 4.1 of certificates in form 2-NDFL for periods before 2012 (deduction codes - 312 and 318) |

| Deduction from the tax agent in the reporting year | Clause 4.1 of the certificate in form 2-NDFL for 2012 (deduction code - 311) | Clause 4.1 of the certificate in form 2-NDFL for 2012 (deduction codes - 312 and 318) |

You will then see the amounts of the property deduction due to you for 2012 in paragraphs 2.8 and 2.9 of sheet I of the declaration.

Tax deduction code 311 in personal income tax certificate 2

It is quite obvious that a person can purchase or build a house, a country house, or purchase a plot of land for construction. If the acquisition was made on the territory of the Russian Federation, then in this case, the buyer has the right to certain deductions. These deductions are processed exclusively by contacting the tax office and completing a package of documents. To receive a deduction, it is necessary that the total amount of income for the reporting period does not exceed 280,000 rubles. That is, you will receive deductions until the amount of income exceeds the limit. Moreover, income is calculated not only by summing up wages, but also all other income. Only citizens of the Russian Federation can receive a deduction.

Who will need code 311

Income for individuals comes in different forms—monetary and non-monetary. In addition, these may be payments from an employer, entrepreneurs, self-employed people, other companies or individuals engaged in private practice:

- receipt of money or property as payment for labor;

- receipt of funds as payment under civil contracts for the performance of work or services;

- crediting or settlement from the provision of licensed services to intellectual property owners;

- crediting funds for the sale of intellectual property or settlement with the copyright holder;

- other income.

If, when filing 2-NDFL, the employer makes an error or inaccuracy in the coding, the tax authority will fine it. To avoid a fine, you can submit corrected returns yourself, before the tax authority identifies the error, or avoid inaccuracies when filing your return.

What type of deduction is coded under number 311

Property tax deductions are included in reports 2 and 3-NDFL. They come in two encodings:

- 311 - money that the taxpayer spent on construction on his own, or on the purchase of a new house, apartment, share in property, land plot for individual development;

- 312 - expenses that were spent on repaying targeted loans, interest or refinancing loans spent on the development or purchase of the same property as in code 311.

The following can exercise the right to tax deductions using codings 311 and 312:

- tax residents of the Russian Federation, that is, citizens who were in the territory of the Russian Federation for 183 days or longer during the last 12 months before filing the declaration;

- buyers who can document the transaction and ownership;

- individuals who have never previously exercised the right to this tax deduction, if their right has been wasted, then the deduction can be issued to their legal spouse;

- individuals who received official income in the specified period and had a tax of 13% withheld from them;

- those citizens whose loan and purchase transaction was concluded with a non-dependent person;

- buyers, if the transaction was concluded for the purchase of real estate in the Russian Federation;

- individuals who paid the costs of the transaction from their own savings or through borrowed funds.

A more detailed description of codes 311 and 312 can be found in the Tax Code of the Russian Federation in Article 220, paragraph 1, subparagraphs 3 and 4.

Tax refund through accounting

An officially employed taxpayer has the right to return personal income tax monthly through a tax agent. To do this, you need to write an application to the Federal Tax Service confirming the property deduction. This document is issued for a period of one year.

It’s not cheap to build or buy your own home now. Therefore, it is difficult to select the entire amount to be returned for the reporting year. After the expiration of the one-year period, a new confirmation must be obtained. This means that individuals must annually submit a 3-NDFL declaration, where they enter the code - 311 and record the amounts from which an income tax refund has already been received.

Attention! It doesn’t matter how the individual reimburses his expenses - through the Federal Tax Service or the employer, you need to write an application for deduction and declare income in both cases.

Applied tax refunds are reflected in the organization’s reporting documentation - certificate 2-NDFL. Here they are coded 311. The code is intended to reflect the amounts spent on the construction or purchase of their own housing. In accordance with them, personal income tax is redistributed.

The code is entered in reference documents when receiving a monthly property deduction based on confirmation received from the Federal Tax Service. This means that cash in the amount of 13% of earnings will be returned to the taxpayer every month throughout the year. To receive confirmation for the next year, submit a tax return completed in accordance with the issued 2-NDFL certificate.

As mentioned above, code 311 is used by enterprise accounting departments to encrypt tax deductions received by an employee in the reporting year. It is placed in the fourth section of the document. And next to it is indicated the remaining amount from which a tax refund can be made.

Below is the information about the paper issued by the tax office confirming the right to deduct property. The serial number, date of receipt of the document and individual Federal Tax Service code are indicated here.

Important! The tax refund will be provided only from the date indicated in the confirmation certificate.

It is worth noting that to receive funds using code 311, your annual earnings should not exceed 280 thousand rubles. Above this amount, no income tax refund is possible.

Deduction from the tax agent in the reporting year code 311 in 3 personal income tax what to write

Money spent on the purchase of a house is indicated in income certificates (2-NDFL) by the conditional code 311. It takes into account the finances that were spent on the construction of a new or the purchase of an already built house, as well as a plot or a share in them . This is what code 311 means in the 2-NDFL certificate.

Current legislation imposes quite serious obligations regarding the payment of personal income tax. persons (personal income tax). Such deductions to the budget are required to be made from almost any income. The employer must submit a certificate in Form 2-NDFL to the tax office. This certificate is necessary to control deductions.

Deduction from the tax agent in the reporting year code 311 in 3 personal income tax what to write

For the purposes of filling out 3-NDFL, a tax deduction is usually understood as a decrease in the income received by an individual or individual entrepreneur, on which income tax is paid. The same term denotes the return of previously paid personal income tax in situations provided for by the Tax Code of the Russian Federation (in connection with the purchase of property, expenses for training, treatment, etc.).

This article will provide step-by-step instructions for filling out the 3-NDFL declaration in 2022. Taxpayers will be able to find out what sheets the declaration submitted for verification should consist of, how the document is filled out, as well as some important details that must be taken into account in order to receive an income tax refund for an apartment.

Deduction from the tax agent in the reporting year code 311 in 3 personal income tax what to write

Below you must enter the details of the confirmation document issued by the Federal Tax Service to the employee and presented by him to his employer. The details include the document number, the date of its issue, as well as the code of the Federal Tax Service that issued it.

The legislation provides for the following code, which must be used when reflecting property deductions when issuing personal income tax certificate 2: 311 - when reflecting the amounts used for the acquisition or construction of real estate as a property deduction.

Deduction from the tax agent in the reporting year code 311 in 3 personal income tax what to write

Below you must enter the details of the confirmation document issued by the Federal Tax Service to the employee and presented by him to his employer. The details include the document number, the date of its issue, as well as the code of the Federal Tax Service that issued it.

The legislation provides for the following code, which must be used when reflecting property deductions when issuing personal income tax certificate 2: 311 - when reflecting the amounts used for the acquisition or construction of real estate as a property deduction.

How else can you use the deduction?

When calculating the deduction, state support funds are not taken into account. For example, maternity capital, military mortgage or housing certificates from the regional administration. Such government assistance is not reflected in the tax base. And funds spent on home decoration can be included in the limit amount up to 2 million rubles. But for this, certain nuances must be observed:

- if the housing was purchased from the developer, and the text of the purchase and sale agreement indicates that unfinished living space has been sold;

- The text of the purchase agreement states that the living space being sold is sold without finishing.

If the text of the contract specifies that the apartment has no repairs, not finishing, then the deduction may be denied. For the tax service, repair and decoration are not synonymous. Therefore, it is important to comply with this wording.

The buyer of an apartment can include the following finishing costs in the property deduction:

- materials for repairs;

- payment for the work of the construction team;

- payment for drawing up estimates and design of finishing works.

There is no clear list in the legislation, but the expenses incurred must be appropriate in meaning. Costs that are not directly related to finishing work may not be included in the property deduction amount. Expenses will be approved for:

- installation and dismantling of windows and doors;

- installation of flooring, tiles, kitchens, ceilings, bathrooms;

- painting or wallpapering walls and ceilings;

- laying communication systems - water supply, heating systems, electrical wiring.

To confirm expenses, checks, acts, receipts, payment orders are suitable, which clearly indicate what the payment was made for. You can include materials in expenses, even if you carried out all the repair and installation work yourself. You can specify any materials - doors, windows, primer, wallpaper. But a drill, an air conditioner or the price of a kitchen set cannot be included in the deduction.

You can include the amount of finishing not in the deduction for the decoration of the apartment, but in another period. If this year the accrued tax amount is less than the deduction, then the balance can be carried over to the next year and so on until the entire allowable amount is returned.

Who will not receive the right to deduction using code 311

The IRS will not approve a property deduction under code 311 if you:

- are not considered a tax resident of Russia;

- you buy living space or land for development outside the territory of the Russian Federation;

- you cannot confirm the purchase and sale of the property;

- have already used their right to 2 million rubles and received a deduction earlier;

- purchased property from a relative;

- received housing as an inheritance or gift;

- did not receive income or wages from which 13% income tax would be withheld;

- did not carry out settlement of the transaction and are not the owner of the object or the legal spouse of the buyer.

Example of calculation using deduction code 311

The employee is a tax resident of the Russian Federation, lives in Kaluga and receives a salary of 60 thousand rubles. In 2022, he purchased housing for 1.3 million rubles. The housing has been renovated:

- cost of purchased materials - 100 thousand rubles;

- the work of a team of construction workers - 200 thousand rubles.

A loan was issued for the purchase of a home. For the use of borrowed funds in 2022, the bank paid 100,000 rubles in interest. An employee will be able to claim a property deduction in the amount of 1.7 million rubles:

- 1.6 million rubles. (1.3 million + 100 thousand + 200 thousand) - expenses for purchasing an apartment, materials and finishing.

- 100 thousand rubles. - interest paid.

An employee will have the right to reduce the tax base if he contacts his employer or directly to the tax authority. The total amount from which the calculation will take place is 1.7 million rubles. That is, the amount of the deduction reaches 221 thousand rubles, which is 1.7 million * 13%. Of which 208 thousand rubles. deduction for the purchase of living space and 13 thousand rubles. on interest paid.

It's important to note that mortgage interest does not carry over to other properties, unlike the rest of the unused deduction on the home itself. In this example, the citizen has 39 thousand rubles left, which he can claim when purchasing other suitable property.

The employee will not be able to select the entire deduction in one year with a salary of 60 thousand rubles, then the remaining portion will be transferred to the next year. The government will not withhold tax until the full amount of the deduction has been used. If income remains the same, then the 13% tax will not be levied for 2 years and 4 months:

- 60,000 * 13% = 7,800 - monthly income tax;

- 221,000/7,800 = 28.3 months - 2 years and 4.3 months.

Then the employee’s income tax withholding will resume. But only on the condition that he does not exercise his right to the remaining 39 thousand deductions.

What category of deductions does code 312 belong to?

In Russia, there are several types of tax deductions, which are provided depending on the taxpayer’s occupation, marital status and other factors.

For example.

The standard deduction is available to most people to provide tax relief for child support expenses. In addition, standard deductions are provided to citizens with a special status (Heroes of the USSR and the Russian Federation, holders of the Order of Glory, etc.). With the help of social deductions, amounts spent on full-time education in educational institutions of the taxpayer or his children under 24 years of age are subsidized. Investment deductions can be used by citizens who have received income from activities in the securities market.

As for the deduction under code 312, it belongs to the category of property deductions. They are used to reduce the tax base of persons who have purchased an apartment or other real estate.

What documents to provide

To qualify for a deduction, provide supporting documents or scanned copies of:

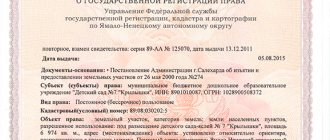

- passport if you personally contact the tax authority;

- a certificate confirming ownership, if the property was registered before July 1, 2015, if later, then an extract from the Unified State Register of Real Estate;

- contract for the purchase of an object;

- the act of transferring an object into ownership;

- payment documents - receipts, bank statements, checks;

- if a mortgage has been issued, then a loan agreement and a certificate from the bank about the interest paid;

- 2-NDFL, if you submit a return for deduction yourself;

- documents that confirm the payment for the object or construction costs.

In the example above, the employee receives the simultaneous right to two deductions under codes 311 and 312. This information will be reflected in 2-NDFL when filing a return through an employer or 3-NDFL when independently submitting a report to the tax authority.

In the second case, the tax office reviews the documents and conducts a desk audit up to 3 months from the date of filing the declaration. It then refunds the previously withheld tax to the taxpayer's bank account specified on the application. If the required deduction and accumulated interest are not exhausted in one year, then next year you will need to submit 3-NDFL again. The procedure is repeated until the state compensates the entire amount.

5 / 5 ( 1 voice )

about the author

Klavdiya Treskova is an expert in the field of financial literacy and investment. Higher education in economics. More than 15 years of experience in banking. He regularly improves his qualifications and takes courses in finance and investments, which is confirmed by certificates from the Bank of Russia, the Association for the Development of Financial Literacy, Netology and other educational platforms. Collaborates with Sravni.ru, Tinkoff Investments, GPB Investments and other financial publications. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Obtaining a property deduction from the Federal Tax Service in 2022

When returning income tax once a year through the Federal Tax Service, the declaration is filled out on the basis of the issued 2-NDFL certificates. To enter code 311, line 180 of clause 2.5 is intended. The mentioned columns are located on sheet D1.

Declaration of income in Form 3-NDFL provides not only for the provision of property returns, but also a general report on taxes paid in favor of the state. The following persons must submit this report:

- Individuals operating as individual entrepreneurs and independently calculating and paying income tax. These also include private notary and law firms.

- People who have Russian citizenship, but receive financial compensation from foreign companies.

- Individuals who have additional income from the sale of unused property or its transfer to other persons on a lease basis. This category includes receiving expensive gifts or lottery winnings.

When receiving a property deduction under code 311, a 3-NDFL declaration is submitted for the entire calendar year. This means that the tax will be returned as a total amount from the moment the right to property arises. The calculation is submitted after the end of the tax year. The deadlines established for filing a declaration under standard conditions may not be observed when receiving only a property deduction. This document can be submitted after April 30.

A personal income tax refund received by filing a tax return does not have a statute of limitations. That is, you can receive a deduction both after 12 months and after several years. This right is limited to the three preceding years. This means that if you bought an apartment in 2010, and submitted documents for deduction only in 2019, you can only return income taxes for 2016, 2017 and 2022.

To receive a property tax deduction after purchasing an apartment with a military mortgage, you must fill out 3 personal income taxes 2015. When purchasing the apartment, your own funds of 1,000,000 rubles were used. what figure to write in the column “deduction from the tax agent in the reporting year” (I believe that this is the amount of salary tax for the year). what figure to write in the section “object data” “information about the object” “cost of the object (share) - the entire cost of the apartment or the own funds used. In addition, you can become a tax agent when you sell confiscated property on the territory of the Russian Federation, property by court decision, ownerless valuables, treasures and purchased valuables, valuables transferred by right of inheritance to the state, as well as when there is a delay in registering a vessel in the Russian International Ship Register. We will start with the acquisition of goods (works, services) from a foreigner.

VAT tax agents are organizations and entrepreneurs who calculate VAT for another taxpayer, withhold the amount of tax from the income paid to him and transfer it to the budget. Note that foreign companies that operate in the Russian Federation through branches, representative offices, and other separate divisions (branches ), are also subject to registration with the tax authorities and are assigned a TIN and CONDITION 3. The agreement is concluded with a foreigner directly, and not through a Russian intermediary participating in the settlements. Purchased goods (works, services) are subject to VAT. If the purchased goods (work, services) are exempt from VAT (named in Article 149 of the Tax Code of the Russian Federation) or their sale is not an object of taxation (named in Clause 146 of the Tax Code of the Russian Federation), then you do not withhold tax from a foreigner and transfer it to the budget should And here it is important to pay attention to this.

You will need to withhold the calculated VAT from the money that you will transfer to the foreigner. This means that the foreigner will receive the amount of income minus tax. Therefore, this information must be conveyed to your foreign counterparty at the stage of concluding the contract.

That is, you need to set a price in the contract so that you can withhold tax from it without any problems, and the foreigner receives exactly the amount he wants.

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya