In order to reduce the tax burden on Russian citizens, the state uses a number of mechanisms that make it possible to legally reduce the tax base and, accordingly, the amount of tax.

One such mechanism is the provision of tax deductions. These are statutory amounts that are deducted from taxable income. These benefits may concern not only earnings, but also other payments received in cash or property (in kind) form - for example, material assistance.

In the 2-NDFL certificate, as well as in the tax and accounting registers reflecting the income and expenses of individuals, these deductions are indicated using the corresponding numeric codes.

What types of income can be deducted?

Certificate 2-NDFL indicates all types of income that the taxpayer received in a specific reporting period, including:

- salary at the main and additional places of work;

- interest on deposits, income from transactions with securities;

- material assistance in cash or property (in kind);

- income from foreign currency transactions;

- winnings from bookmakers, casinos, from participation in lotteries and drawings, received in cash or property (for example, prizes);

- income from rental of vehicles and real estate;

- royalties, dividends, etc.

Tax deductions can be provided for different types of income. To avoid confusion when preparing a 2-NDFL certificate, as well as tax and accounting registers reflecting the income and expenses of individuals, an individual code is assigned to each type of income and tax deduction.

What is personal income tax

To understand why the 2-NDFL certificate is used, you must first understand the meaning of the required abbreviation that appears in its name after the number 2.

What is the certificate in question?

So, personal income tax is a tax levy withdrawn from income received by individuals. The list of these incomes is determined by law. Not all money a citizen can receive is subject to this tax. For example, funds donated by a close relative are not subject to partial deduction to the state treasury.

Most often, the state expects to receive funds for personal income tax from citizens when they:

- receive wages at the place of employment;

- receive bonuses from their superiors;

- accept the provision of financial assistance;

- sell an apartment, house or other housing, or maybe just a share in it;

- rent out their own living space;

- sell a car and other property belonging to them;

- receive royalties for the literary work they publish;

- in many other situations.

This fee is otherwise called income tax. The rates on it are fixed. There are two of them in total. One is relevant for so-called tax residents of the Russian Federation, the other for non-residents.

Possession of this status implies staying on the territory of Russia for a certain period of time - at least 183 days a year. If a citizen has been within the Russian borders for at least a day less, he is not assigned resident status.

At the same time, depending on the number of days “on the account” of each citizen, the tax rate will also change. Thus, residents have the opportunity to transfer funds to the treasury at the standard rate for the country: they give only 13% of the funds received. The named value is considered, however, to be quite acceptable. Non-residents are forced to share a huge part of their own income with the state - as much as 30%!

As a rule, Russians pay the most income tax in their own lives from the wages they receive at their place of employment. It is issued every month in a certain amount. On the day the salary is issued, a specific part (usually 13%) is deducted from it and transferred to the state treasury on behalf of the taxpayer from whom the money was calculated. The tax agent is involved in this procedure. This, as we have already found out, is the employer organization. In addition to the transfer of wages and tax deductions, the company also provides so-called deductions to citizens by decision of the tax service.

A tax deduction is a certain amount of money by which it is possible to reduce the monetary base taxed in favor of the treasury. In other words, the tax is always calculated from a certain value. Funds deducted from wages are calculated based on its original amount. So, if an employee is promised to be paid a salary of 20 thousand rubles, it means receiving 2 thousand 600 rubles less, that is, only 17 thousand 400 rubles. The difference not received is the part that is due to the state. Its value can be reduced by reducing the wage itself, however, not by demoting the employee or applying any sanctions to him.

It is possible to carry out the procedure using a tax deduction. It is provided to citizens as a result of relevant situations arising in their lives. Most often, deductions are provided through the employer:

- social, for treatment or training of an employee or his family members;

- property, issued when purchasing housing;

- standard, for child support and other types of compensation.

By the amount of the deductions provided, it is possible to reduce the monthly deduction of personal income tax in favor of the state budget, taken directly from the employee’s salary. This reduction will be made until all funds due have been provided in full to the employee.

What does tax deduction code 503 mean?

Financial assistance paid by an employer to its employees (including former employees retired due to age or disability) is one of the types of income for which a tax deduction is provided. Its amount is 4,000 rubles per year per employee, which is provided for in clause 18 of Art. 217 of the Russian Tax Code.

The deduction is indicated in the 2-NDFL certificate, as well as in the relevant tax and accounting documents, using code 503.

Let’s assume that an employee of an enterprise received financial assistance from him in the amount of 15,000 rubles. In this case, this amount will be reflected in the 2-NDFL certificate using code 2760, and the amount of the due deduction (4,000 rubles) will be reflected under code 503. The calculation of the taxable amount in this case will look like this:

15,000-4,000 = 11,000 rubles

The amount under code 503 is a fixed amount that does not depend on the amount of financial assistance. It can be used several times a year, but only within the established limit.

For example, if a person received financial assistance in April in the amount of 1,500 rubles, in August - 2,000 rubles, and in November - 6,000 rubles, then in the first and second cases the amounts will be fully discounted, and in the third, the remaining 500 rubles will be deducted from the financial assistance:

4000 - 1500 - 2000 = 500 rubles

Consequently, income tax will be withheld only from November financial assistance, and the taxable amount will be 5,500 rubles.

What does the barcode on 2-NDFL mean?

Of course, in some companies the accounting program puts the required barcode on 2-NDFL. But, of course, not everyone keeps up with the times. If a company uses the program, then it makes sense to update it to the latest version. Perhaps the latest changes have already been taken into account.

For example, when receiving a loan from a bank, you will definitely need proof of your income. In this case, 2-NDFL will need to be provided. If it is filled out incorrectly, it may cause problems.

Therefore, it is important how to correctly draw up this document so that it complies with legal requirements.

What is the difference between deduction codes 503 and 508

It is worth noting that deduction code 503 has nothing to do with financial assistance paid on the occasion of the birth of a child. This is another type of income, which is reflected in the 2-NDFL certificate, as well as in the relevant tax and accounting documents, using code 2762.

In this case, the tax is calculated differently, and the corresponding tax deduction is indicated by code 508.

Thus, when filling out the 2-NDFL certificate, as well as the corresponding accounting and tax documentation, you need to remember the following:

- income code 2760 denotes financial assistance paid by an employer to its employees (including former employees retired due to age or disability), and is used only in conjunction with deduction code 503;

- income code 2762 denotes financial assistance paid by the employer on the occasion of the birth of a child, and is used only in conjunction with deduction code 508.

Deduction codes in the 2-NDFL certificate in 2022

- statement from an employee;

- child's birth certificate;

- child’s passport, if available;

- documents confirming adoption, if necessary;

- a certificate from an educational institution for a child over 18 years of age;

- divorce certificate or other document confirming single parent status, if necessary.

To determine which deduction is provided, the total number of children is considered, regardless of whether they are alive, whether they live with their parents, or whether there are other nuances. If the first child died, then the second one is still given a deduction of 127, not 126. The same applies to subsequent children.

Documents to confirm the right to deduct

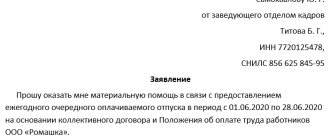

The decision to provide an employee with financial assistance is formalized by order of the head of the enterprise. The grounds for issuing an order may be:

- employee's personal statement;

- relevant provisions of the employment or collective agreement;

- internal regulatory document regulating the procedure for providing financial assistance to employees of the enterprise.

No additional documentary evidence is required to receive a deduction under code 503. This benefit is provided for at the legislative level and is set out in paragraph 28 of Art. 217 of the Russian Tax Code.

-Accordingly, if an employee received financial assistance, then a deduction in the amount of 4,000 rubles per year is provided automatically.

Deduction codes 501 and 503 in the 2-NDFL certificate: how to fill out

- receive wages at the place of employment;

- receive bonuses from their superiors;

- accept the provision of financial assistance;

- sell an apartment, house or other housing, or maybe just a share in it;

- rent out their own living space;

- sell a car and other property belonging to them;

- receive royalties for the literary work they publish;

- in many other situations.

If a company is not an employer, it is not required to make payroll payments and transfer income tax contributions to the state budget. This means that the organization is also not obliged to prepare, fill out and submit a tax return for verification.

Income and deduction codes in the 2-NDFL certificate

The requirements for filling out the certificate are the same regardless of who the recipient of the document is: the Federal Tax Service or the bank. However, in the first case, an accountant’s mistake is fraught with penalties for the compiling agent or a refusal to provide a deduction to a citizen.

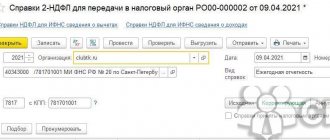

To fill out the document, the accountant must select the appropriate values from the reference book given in the Order of the Federal Tax Service MMV-7-11 / [email protected] , dated 2015. The list is frequently updated, so to correctly fill out the certificates, the accountant needs to monitor changes in legislation and make the appropriate settings in the accounting program (for example, 1C).

What other encoding is used?

Order No. ММВ-7-11/ [email protected] contains all current profitability codes and deductions that underestimate the tax base. Here are some of them.

2012

Line 2012 is the vacation code in 2-NDFL; it is filled out if the employee receives payments for annual paid vacation. Vacation pay compensation upon dismissal is reflected in line 2013.

2300

For sick leave, the income code in 2-NDFL is used: 2300: temporary disability benefits are recorded here.

2610

The material benefit received from the purchase of goods, works, services under a civil contract (GPC) is income code 2610 in 2-NDFL (income certificate) in 2022. Such an agreement is concluded with individuals, legal entities and individual entrepreneurs who are interdependent with the taxpayer.

2720

Using code 2720 in 2-NDFL, the cost of gifts for employees is indicated. When reflecting income in the form of gifts, the rule applies: only gifts exceeding the value of 4,000 rubles are subject to income tax. That is, tax is charged only on the excess amount. In the line next to code 2720 indicate deduction 501. Its amount is 4000 rubles.

The Federal Tax Service of Russia told how to reflect the tax deduction for material assistance in the 3-NDFL declaration

| deagreez1 / Depositphotos.com |

The organization accrued financial assistance to the employee and reflected it in the certificate of income and tax amounts of an individual (form 2-NDFL) under code 2760 “Material assistance provided by employers to their employees, as well as to their former employees who resigned due to disability retirement or by age."

To this income, the tax agent applied a tax deduction under code 503 “Deduction from the amount of financial assistance provided by employers to their employees, as well as to their former employees who quit due to retirement due to disability or age.” As the tax service explains in its letter, when filling out a tax return in form 3-NDFL, you must indicate in the “Information on income received” section income under code 2760 and the corresponding deduction amount under code 503. In this case, it is possible to manually adjust both the amount of income and the deduction amount (letter of the Federal Tax Service of Russia dated February 21, 2022 No. BS-3-11/ [email protected] ).

The Tax Service reminds that for filling out declarations, several services are available on the official website of the service, for example, “Declaration 2019” or in the taxpayer’s personal account for individuals. When filling out a tax return using the latest service, the software automatically transfers to the tax return personal information about the taxpayer and information about the income received by him (including a breakdown by income codes and corresponding deduction codes) and the amount of personal income tax paid; the program has a convenient and understandable interface, tips, which allows you to avoid mistakes when filling out a tax return.

Source

The essence of code 501

A 501 deduction is an amount that is deductible from the value of a prize, incentive received from an employer or a private organization gift.

Deduction code 501 has the following properties:

If the amount of the gift does not exceed 4,000 rubles, then no deductions will be made from such a gift to the state treasury. This condition also applies to winnings - if this condition is met, they will not be subject to tax. If the winnings exceed the specified limit of 4,000 rubles, then the tax amount is calculated. In the 2-NDFL certificate, the cost of a gift that is not subject to taxation will be encrypted under code 501 as a deduction.

Now the majority of residents of the Russian Federation use the standard tax deduction. Such a deduction is a means by which it is possible to reduce the tax base formed from the financial income of a citizen.

It can only be applied to certain types of income, which, in accordance with Decree of the Government of the Russian Federation of March 30, 2022 N 357, are forcibly subject to personal income tax (exclusively at a rate of 13%).

The tax agent has the privilege of calculating tax deductions for basic income and wages and providing this information to the taxpayer.

The right to receive a tax deduction is confirmed after submitting the appropriate package of documents and a tax return.

The documents must include a specialized written application from the taxpayer requesting a deduction. It is also recommended to demonstrate documents that confirm the possibility of receiving them. After this, recalculation occurs without fail. In this way, you can return the amounts paid in the form of personal income tax or reduce its amount.

Examples of calculating deductions using code 501

Thus, deduction under code 501 makes it possible to reduce the tax burden falling on individuals, in particular, in paying personal income tax.

What does deduction code 501 mean?

The 501 deduction is applied when an employee receives a gift or prize. For such income, a certain tax calculation scheme is used. When the gift amount is less than 4,000 rubles, it is not included in the tax base. But if the value of the prize exceeds this limit, it is subject to tax. It will be calculated on income minus benefits.

The features of this benefit are as follows:

Suppose a person received a gift worth 8,000 rubles. This amount will be indicated on the certificate; below, the deduction will be indicated with code 501 in the amount of 4,000 rubles. Thus, the tax will be calculated on the amount of 8000 – 4000 = 4000 rubles. And it will be 4000 * 13% = 520 rubles.

Only residents with official income are entitled to claim this benefit.

Help 2-NDFL

When issuing a certificate, fill in the following fields:

- Sign. If the certificate is in the usual form, then it is given 1. If it is not possible to withhold personal income tax, then it is given 2.

- Correction number. If you submit the first version of the certificate, then 00 is entered. For subsequent adjustments, 01, 02, and so on are entered. If this is a cancellation certificate, then 99 is entered.

- OKTMO code. Depends on citizenship. It can also be found on the Federal Tax Service website.

- KPP, TIN and tax agent. In the “Tax Agent” column, enter the name of the organization - for example, Kristall LLC. If we are talking about an organization, then the checkpoint and TIN are entered, but if the certificate is filled out by an individual entrepreneur, then only the TIN is entered.

- Full name of the employee. If the employee’s last name has changed, then its new version should be indicated on the certificate. It should be remembered that the tax office may not have the employee’s new name - to do this, prepare a photocopy of his passport. In the case of foreign employees, FIs are entered in Latin letters.

- Taxpayer status. If the employee stayed in Russia for 12 months, then the number is 1; if less than 183 days, then the number is 2. In the case of a highly qualified employee, the number is 3.

- Citizenship. If the employee is a citizen of the Russian Federation, they enter code 643. The series in the passport means citizenship.

- Code of the document that proves identity. As mentioned earlier, each document in the certificate has its own number, the passport code is the number 21.

- Residence address. The employee's registered address is written here. As for the place of residence, this address is not recorded.

- Taxable income. Codes are set corresponding to the employee’s income.

- Tax deductions. Codes are set corresponding to the employee’s deductions.

- Total tax and income amounts. The results of tax deductions and income are summed up.

What do deduction codes 126-133 mean?

This value is found mainly in certificates on form 2-NDFL. Previously, instead of this and other numbers, the values 114, 115, 116 and so on up to 125 were used. However, they were canceled by the above-mentioned Order of the Federal Tax Service.

Only those persons who have a child in their care can receive a tax deduction on this basis. Moreover, the law separates biological parents and guardians:

- The values 126, 127, 128 and 129 are created for parents in their standard sense and adoptive parents;

- Codes 130 to 133 inclusive are designed for guardians, trustees and foster parents.

Help: legally, adoptive parents and guardians/adoptive parents are, although close, still different legal forms of guardianship. Adoptive parents assume parental rights for life, i.e. the child literally becomes a member of the family. Adoptive parents or guardians are those persons who have entered into a contract with the guardianship authorities; they have parental rights only until the child reaches adulthood.

The deduction is made only from the salary of an individual, and only upon reaching 280 thousand rubles of income per year. The deduction amount varies between 1,400 and 12,000 rubles depending on the number of children, their status (disabled or healthy), legal form of guardianship, etc.

The question of where to put the code can be answered like this: in the line with the value 2000, because deduction is made from salary. You can receive payments annually until the child reaches adulthood.

Deduction code 501 where to put in 3 personal income taxes for 2022

For information on how to fill out the 3-NDFL return, read the article “Sample for filling out the 3-NDFL tax return.” Is it always necessary to fill out 3-NDFL for property deduction? You can do without filling out 3-NDFL for property deductions when using deductions for the costs of purchasing (or building) housing and mortgage interest. This is acceptable in situations where, in the year of collecting the full package of documents required for such a deduction, a person applies to the Federal Tax Service for a notification of the right to deduction and, on the basis of this notification and a similar document received annually in subsequent years, returns the tax at work. If he uses only this algorithm of actions to return personal income tax on this basis, then he may not need a 3-NDFL declaration to receive a property deduction in connection with the purchase of a home.

Home / Taxes / Personal Income Tax / How to fill out codes in the 3-NDFL declaration 01/08/2020, Sashka Bukashka When filling out the 3-NDFL declaration, code designations are used. This help article contains all the necessary codes that you may need when filing your tax return yourself. Adjustment number The adjustment code for the 3-NDFL declaration means which declaration is submitted to the tax office for the reporting period.