Where did the conditional property number come from?

Before the entry into force of Federal Law No. 221-FZ of July 24, 2007 “On the State Real Estate Cadastre,” real estate registration was carried out by the BTI and land chambers, which assigned conditional registration numbers. From March 1, 2008, records were also kept using conditional numbers assigned by the body carrying out state registration of rights to real estate and transactions with it until 2012. Thus, until 2012, the prerequisites for creating a full-fledged real estate register were formed.

During 2012, the BTI electronically transferred to Rosreestr all the documents that were in their archives. By the end of 2012, all real estate objects that had a conditional number were automatically assigned a cadastral number.

Since the digitization and transfer to Rosreestr of a huge number of documents was carried out in a short time, we recommend that you check for free whether your property has been assigned a cadastral number if your title documents only have a conditional one.

Name code: table

You need to record the object name code. That is, indicate what kind of property was acquired. The meaning of the code depends on what kind of real estate was purchased by the individual:

| Type of property | Object name code in 3-NDFL |

| House | 1 |

| Apartment | 2 |

| Room | 3 |

| Share in a residential building/apartment/room/land plot | 4 |

| Land plot provided for individual housing construction | 5 |

| The land plot on which the purchased residential building is located | 6 |

| Residential building with land | 7 |

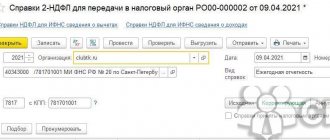

Declaration on the Federal Tax Service website

1. The general procedure for filling out a declaration on the website of the Federal Tax Service of Russia is described here.

2. By analogy with filling out the Declaration 2022 in the PPO, at the “Deductions” step on the “Property” tab, you must put the “Provide property tax deduction” marker.

3. Click “Add object” and fill in the fields, if necessary, selecting data from the drop-down lists:

- method of acquisition - purchase and sale agreement;

- object name - apartment;

- type of property - property;

- the taxpayer's attribute is the owner;

- object number code - conditional;

- object number;

- location;

- date of registration of ownership;

- cost of the object;

- interest on loans.

4. Go to the “Totals” tab and check the amount to be refunded. It, as in the PPO Declaration 2022, amounted to 68,952 rubles.

5. Check the declaration form by clicking “Download” and opening the *.pdf file. The calculation of the deduction on sheet D1 is similar to the calculation in the PPO Declaration 2022.

6. Further filing of the declaration through the Federal Tax Service website is described here.

As we can see, there are no discrepancies between the programs regarding the property deduction. Use the option that is most convenient for you.

How to find out the conditional number of an apartment or land plot

The conditional number of a property is easy to find, since in the 2000s this number was assigned to all objects and placed in the documents “Certificate of Ownership” or as they are usually called “Zelyonki”. Below is an example of a Conditional Number on a document:

What is the purpose?

Why do you need a conditional apartment code? It is not given to land plots, only to houses, apartments, rooms . Such a digital code is an identification indicator of this particular object, and not another.

By the signs contained, you can find out where the property is located. This code is needed to link all objects to the area and put them on maps.

But they do not include this code in the State Property Committee register; only when registering with the State Property Committee will all available information about the property be entered, including the old code.

Decoding

Groups of characters are separated by a hyphen and a vertical slash. The “old” numbering is a long combination of digital characters.

What do the numbers mean? The first two characters are the number of the subject of the Russian Federation , the second are the registration district . Here is an example of the “old” designation: 32-32-03/004/2004-216. After the second hyphen, the combination 01/002/2005 hides the number of the book of registration and accounting of incoming securities , where:

- 03 – code of the Federal Reserve Service department performing the registration of rights;

- 004 – number of the accounting book in order;

- 2004 – the year in which the real estate was registered;

- 216 – the serial order of entries in the registration ledger.

This numbering is quite understandable and logical, but is not subject to electronic recording, which is available throughout the country.

What is the difference between cadastral and conditional numbers?

Data on numbers assigned to real estate is stored by the state body Rosreestr. The main differences between the numbering are:

- Conditional numbers are no longer assigned and are for informational purposes only. Using UNON you can find out the cadastre code, as well as identify information about the history and location of the object on the cadastral map.

- KNON is assigned by the cadastre and is used in registration of real estate transactions. Objects without KNON are most likely not registered with Rosreestr. This complicates legal manipulations; it is necessary to assign a number in the cadastral chamber.

- The recording format and transcript are different. The principles of formation of the KNON and UNON ciphers also differ. Digital sets come in different lengths.

KNON helps to systematize real estate on the territory of the Russian Federation; they are assigned to any objects, including land plots. UNON is found only near buildings and apartments.

Structure of a conditional number

Ciphers consist of numbers and hyphens between them. Each group of numbers has a specific meaning:

- The first 2 digits before the hyphen indicate the code of the subject of the Russian Federation. Among the subjects are districts, regions, regions, territories, etc. The codes are generally accepted and were assigned according to the same principles in all documents. Region means the place of registration of the object, not the actual location.

- The following numbers after the hyphen are the registration authority code. Indicates the specific department of the authority that carried out the registration.

- No. of the archive book in which there is a record of registration of real estate, year and serial calculation of the record.

In essence, UNON is the serial number of registration of a specific object in the region.

Cadastral number structure

The cipher consists of four groups of numbers separated by colons. Sequentially the values of numeric groups:

- District;

- Area;

- Quarter;

- No. of land plot.

KNON contains basic information about the actual location of the property. There is no ordinal calculation.

All numbers are assigned by Rosreestr, the only authorized body in the Russian Federation. By law, all real estate in the country is subject to accounting and registration.

How to find out the conditional number of an object

All buildings, structures, apartments have documents, passports, certificates. If the object was built before 2002, UNON will be indicated in the documents. If the certificate is lost or the building is relatively new, there is no point in looking for a code.

UNON will help in finding the cadastral number, but in itself is no longer important. It is classified as reference information and has no legal significance when concluding transactions. It is more important for owners and interested parties to know KNON for real estate transactions.

In what cases is it not necessary to submit a 3-NDFL declaration?

Citizens who have sold a property (apartment, house, room, land) that has been owned for more than a minimum period are completely exempt from income tax and the obligation to file a tax return.

From January 1, 2022, the conditions for exemption from personal income tax when selling real estate have changed. The minimum period of ownership of property was reduced from 5 to 3 years if the property (room, apartment, residential building or share in the specified property) is the only residential premises owned by the taxpayer (including joint property of spouses). This does not take into account housing that was purchased within 90 calendar days before the date of state registration of the transfer of ownership of the sold residential premises from the taxpayer to the buyer (Federal Law dated July 26, 2019 No. 210-FZ).

Until 2016, the minimum period of ownership of real estate was 3 years, but Federal Law dated November 29, 2014 No. 382-FZ introduced Art. 217.1 of the Tax Code of the Russian Federation, which increased this period from 3 to 5 years for property that was acquired after January 1, 2016.

The three-year minimum time limit for ownership of a property has been retained only in cases where ownership of the property being sold has been obtained:

- by inheritance or under a gift agreement from an individual recognized as a family member or close relative;

- as a result of privatization;

- as a result of the transfer of property under a lifelong maintenance agreement with dependents.

From January 1, 2022, the sale of a single property (room, apartment, residential building) was added to these conditions. In all other cases, the minimum period of ownership of real estate will be 5 years.

After the sale of the property, next year the tax authorities will send you a notification about the need to submit a 3-NDFL declaration, regardless of the period of ownership of the apartment. The fact is that the tax authority sees only the date of alienation of the property without the detailed nuances of the transaction; it is obliged to warn you about the possible need to file a declaration.

If the period of ownership of the property exceeds the minimum period of ownership, there is no need to submit a declaration; in response to the notification to the tax authorities, it is necessary to send explanations and supporting documents (purchase agreement, gift agreement, certificate of registration of ownership, extract from the Unified State Register, certificate of payment share contribution, etc.).

This can be done through the taxpayer’s personal account on the tax website.

What can be the code for the name of the object in 3 personal income tax?

Filling out the column with the object name code, as well as other fields that contain information about the taxpayer, is not particularly difficult. It is enough to refer to the reference information, which is presented in the form of a table, and find the object of interest. Each of them has its own digital designation. For example, when purchasing a residential building, you should enter the number “1” in the corresponding column, while purchasing a residential building along with a land plot requires the code “7”. Thus, when filling out the declaration column in which you need to indicate the code for the name of the object in 3 personal income tax, carefully read the summary table of codes and choose the one that is suitable for your specific case.

Please note that this information is subject to change due to changes in regulatory legislation.

In this regard, it is recommended to refer to the original source of data. All classifier codes, as well as other reference information that may be useful when filling out the 3-NDFL declaration, are given in the relevant Appendices to Order No. 153n of the Ministry of Finance of the Russian Federation “Procedure for filling out the tax return form for personal income tax.” Object name code in 3-NDFL

| Type of property | Object name code in 3-NDFL |

| House | 1 |

| Apartment | 2 |

| Room | 3 |

| Share in a residential building/apartment/room/land plot | 4 |

| Land plot provided for individual housing construction | 5 |

| The land plot on which the purchased residential building is located | 6 |

| Residential building with land | 7 |

Name of the real estate property

The subject of assessment is located in the Chelyabinsk region in 7. Troitsk is a city (since 1743) in Russia, the administrative center of the Troitsky district of the Chelyabinsk region. Located 119 km. South of the city of Chelyabinsk. The city's population is 82 thousand people. The economy is represented by the following enterprises:

is a branch of OGK-2 Troitskaya GRES. In 1991, the installed capacity of the station was 2500 MW. In 2008, construction began on two more power units of 660 MW each, commissioning is scheduled for 2012. Currently, the design capacity of TGRES is 2045 MW.

Appendix No. 5 to the Procedure for filling out the tax return form for personal income (form 3-NDFL), approved by order of the Federal Tax Service dated December 24, 2014 No. ММВ-7-11/ [email protected] (as amended by the Order of the Federal Tax Service Russia dated November 25, 2015 N ММВ-7-11/ [email protected] )

Directory “Object name codes”

| 1 | House |

| 2 | apartment |

| 3 | room |

| 4 | share(s) in a residential building, apartment, room, land plot |

| 5 | land plot provided for individual housing construction |

| 6 | land plot on which the purchased residential building is located |

| 7 | residential building with land |

The procedure for filling out the tax return form for personal income tax (form 3-NDFL)

I. General requirements for filling out the tax return form for personal income tax

II. Contents of the Declaration

III. The procedure for filling out the title page of the Declaration form

IV. The procedure for filling out Section 1 “Information on the amounts of tax subject to payment (addition) to the budget/refund from the budget” of the Declaration form

V. The procedure for filling out Section 2 “Calculation of the tax base and the amount of tax on income taxed at the rate of (001)%” of the Declaration form

VI. The procedure for filling out Sheet A “Income from sources in the Russian Federation” of the Declaration form

VII. The procedure for filling out Sheet B “Income from sources outside the Russian Federation, taxed at the rate of (001)%” of the Declaration form

VIII. The procedure for filling out Sheet B “Income received from business, advocacy and private practice” of the Declaration form

IX. The procedure for filling out Sheet D “Calculation of the amount of income not subject to taxation” of the Declaration form

X. The procedure for filling out Sheet D1 “Calculation of property tax deductions for expenses on new construction or acquisition of real estate” of the Declaration form

XI. The procedure for filling out Sheet D2 “Calculation of property tax deductions for income from the sale of property” of the Declaration form

XII. The procedure for filling out Sheet E1 “Calculation of standard and social tax deductions” of the Declaration form

XIII. The procedure for filling out Sheet E2 “Calculation of social tax deductions established by subparagraph 4 and subparagraph 5 of paragraph 1 of Article 219 of the Tax Code of the Russian Federation” of the Declaration form

XIV. The procedure for filling out Sheet G “Calculation of professional tax deductions established by paragraphs 2, 3 of Article 221 of the Tax Code of the Russian Federation, as well as tax deductions for the sale of shares in the authorized capital and for the assignment of the right of claim under an agreement for participation in shared construction”

XV. The procedure for filling out Sheet 3 “Calculation of taxable income from transactions with securities and transactions with financial instruments of futures transactions” of the Declaration form

XVI. The procedure for filling out Sheet I “Calculation of taxable income from participation in investment partnerships” of the Declaration form

Appendix No. 1 Directory “Taxpayer Category Codes”

Appendix No. 2 Directory “Codes of types of documents”

Appendix No. 3 Directory “Region Codes”

Appendix No. 4 Directory “Codes of types of income”

Appendix No. 5 Directory “Object name codes”

Appendix No. 6 Directory “Codes of persons claiming property tax deductions”

Assistance in filling out tax returns 3-NDFL

Detailed information can be obtained by calling 210-82-31

Code of the name of the object in 3 personal income tax, what code of the name of the object should be written in the certificate of 3 personal income tax

Almost all reporting to the tax office for each employee is provided by the employer. However, in some situations it is necessary to fill out the declaration yourself.

Most often we are talking about Form 3 of personal income tax, which is relevant not only for individual entrepreneurs and notaries, but also for ordinary citizens who are either required to pay tax on additional income or apply for a tax deduction.

Entering information into this document has a number of features, since they are presented in encoded form. Let us consider in more detail the question of what to indicate in the field in which the code for the name of the object is displayed in 3 personal income tax, and in what cases it is necessary to fill it out.

Where in the declaration

The correct property codes in 3-NDFL will tell the tax authorities what kind of real estate the applicant invested in in 2016. To be more precise, I incurred expenses on:

- New construction.

- Purchasing real estate.

Since many people are now investing in real estate, filling out Sheet D1 3-NDFL with the code for the name of the object allows you to return part of the expenses spent on a new building or the purchase of real estate.

Also see “How to fill out Sheet D1 in 3-NDFL for 2016.”

What does the object name code mean in 3 personal income tax and when is it required?

As can be seen from the name of the column in question, in this case an indication of the type of housing referred to in the tax return is required.

The need to enter it arises when information is submitted in order to obtain a property tax deduction based on the purchase or construction of housing. An individual may submit such a request if there is documentary evidence of expenses incurred for these purposes.

They are attached to the completed declaration form 3-NDFL. It consists of several sheets and contains extensive information about the taxpayer and the transaction he conducted.

In order to correctly fill out a tax return, you can contact organizations that specialize in providing such services and pay the required amount. This option is suitable for those who do not have the opportunity to spend time studying legal issues or who have a non-standard situation in which it is important to get specialist advice.

However, filling out a tax return yourself is also possible, since it is enough to follow the instructions. In addition, there are a number of sites that simplify this task by providing the ability to fill out a tax return online.

A number of information is indicated on the tax return, so when filling it out you must be able to refer to such documents as:

- passport (or other document that proves identity);

- TIN certificate;

- data on the transaction for the purchase or construction of housing (agreement, confirmation of transfer of ownership, registration, etc.).

Among other information, the columns on sheet D1 are also filled out. Here there is a calculation of the deduction, which is based on the fact of construction or purchase of housing (13% of the amount spent, then no more than 260 thousand rubles).

This is where the graph discussed in this article is located. It should indicate which property has become the property of the taxpayer.

Please note that income tax refunds can only be made for the last three years.

Object number code in 3 personal income tax 2022 where to get when buying an apartment

When purchasing real estate, citizens receive the right to a refund of a property tax deduction from the amount of the property acquisition. How to submit a tax deduction declaration, and what other documents will be needed for a refund? Composition of the certificate The declaration for property compensation consists of 23 sheets.

Filling out 3 personal income tax when returning apartment tax

- a deduction is an amount that reduces the tax base;

- base - the amount of income on which personal income tax is levied;

- the deduction in the form of a refund is provided according to a catch-up scheme - you pay personal income tax from your salary for the entire calendar year, and next year you return the amount for all 12 months;

- the maximum amount of deduction for a purchase is 2,000,000 rubles, for interest - 3,000,000 rubles; therefore, the maximum return for a purchase is 260,000 (multiply by 13%), and for interest - 390,000 rubles;

- You cannot return more in a year than you paid, so to fill out Appendix 7 you need a 2-NDFL certificate from your place of work.

- the deduction in the form of a refund is provided according to a catch-up scheme - you pay personal income tax from your salary for the entire calendar year, and next year you return the amount for all 12 months;

- the maximum amount of deduction for a purchase is 2,000,000 rubles, for interest - 3,000,000 rubles; therefore, the maximum return for a purchase is 260,000 (multiply by 13%), and for interest - 390,000 rubles;

- You cannot return more in a year than you paid, so to fill out Appendix 7 you need a 2-NDFL certificate from your place of work.

Thus, sheet D1, required by citizens receiving a property deduction, has been renamed “Appendix 7”. This sheet has previously caused difficulties in filling out, especially in the second and subsequent years, when balances are transferred, and now, after the changes, citizens need to learn how to fill it out again.

Code of the object number in the declaration 3 personal income tax for 2018

At the top of each page you fill out, indicate your Taxpayer Identification Number, as well as your last name and initials. The TIN must be filled out if the declaration is submitted by an entrepreneur. Individuals may not fill out this field, but then they will have to provide passport data (clause 1.10 and subclause 7 of clause 3.2 of the Procedure).

In the “Taxpayer Category Code” field, enter the code in accordance with Appendix 1 to the Procedure approved by Order of the Federal Tax Service dated October 3, 2018 No. ММВ-7-11/569. For an individual entrepreneur, put “720” in this field, for individuals – “760”. Separate codes are provided for notaries, lawyers, arbitration managers, and heads of peasant (farm) households.

Changes in the 3-NDFL declaration for 2022 compared to the 2016 declaration

In addition, you can use a service that will help you determine not only the BCC, but also the numbers of your inspection of the Federal Tax Service and the All-Russian Classifier of Municipal Territories (OKTMO).

Personal income tax paid late: how to avoid a fine? How to calculate vacation pay and compensation for unused vacation? Is it an accounting error to pay wages without taking into account personal income tax? Look at the topic: guest. Zarechny March 22 at Hello! Zarechny March 23 at Thank you.

What caused the appearance of a new form? What has fundamentally changed about it? What should you pay special attention to when preparing personal income tax reporting for taxpayers, including individual entrepreneurs? By order of the Federal Tax Service of Russia dated This order comes into force from the Title page, section. To be completed only by taxpayers who are tax residents of the Russian Federation;

Appendix 7 of the tax return 3-NDFL - sample filling

How to correctly fill out 3-NDFL for filing a tax deduction. The procedure for filling out Appendix 7 of the 3-NDFL tax return, if the deduction is issued for the first time: section 1. Filling out Appendix 7, if the deduction is issued for the first time: section 2. Appendix 7 of the 3-NDFL declaration - a sample of filling out, if the deduction is issued again. For all these reasons, the personal income tax payer can reduce the amount of tax withheld from him and request a refund from the budget of the personal income tax amounts previously transferred for him.

This is especially important if you write down all the data manually, because you cannot correct anything in the finished declaration. We fill out the calculation to Appendix 1 line by line: enter the TIN, last name and initials; Leave the page number for now; — a column for indicating the cadastral number of the property

Contained in property documents, you can find out for free in the Rosreestr database; — enter the cadastral value of the property as of January 1 of the year in which the property was purchased.

Field “Object name code” in the 3-NDFL declaration

The income declaration is prepared by tax deduction applicants according to the template approved by Order No. ММВ-7-11 dated October 3, 2018/ [email protected]

To receive a deduction, you must reflect the total income for the year received from various sources, the amount of personal income tax withheld and paid. Property deductions associated with the acquisition of a new property are recorded in Appendix 7.

If other types of deductions are applied for the reporting year, they must be indicated in the declaration in Appendix 5 (standard, social, investment).

“Object name code” in 3-NDFL is line 010 of Appendix 7, it reflects the digital code. Possible code options are presented in Order No. ММВ-7-11/ [email protected] in Appendix 6 to the Procedure for filling out the declaration. The list contains 7 categories of real estate by which the fiscal authority can identify the subject of the transaction under a purchase and sale agreement:

- Code “1” denotes a residential property purchased by an individual.

- Object name code “2” in 3-NDFL is used for apartments purchased by citizens.

- If the applicant applies to the tax office with a request to reimburse him for part of the costs in the amount of personal income tax withheld from income in connection with the purchase of a room, the code “3” must appear in field 010 of Appendix 7 in the declaration.

- Object name code “4” in 3-NDFL is used when purchasing real estate in joint ownership, that is, the applicant receives the right of ownership and disposal only for a share in a residential building, apartment, room or land plot (the size of the share does not matter).

- A property deduction is also due to individuals who purchased a plot of land intended for individual housing construction (individual housing construction) - in this case, the acquired property is indicated in the declaration with the code “5”.

- If the plot on which the purchased residential building is located is purchased, this asset is reflected in the declaration using code “6”.

- The object name code “7” in 3-NDFL is used in situations with the acquisition of two assets at once under one sale and purchase agreement - a residential building along with a land plot.

When filling out Appendix 7 of the declaration form, you must enter data in the fields indicating the type of property purchased, its number code (inventory, cadastral, conditional).

If there is no information about the inventory or other asset code, it is necessary to identify the property by indicating its location.

It is necessary to enter information about when the applicant bought a house, apartment or other asset, and on what date the ownership title was registered.

If a deduction is claimed for several acquisitions at once, the object name code in 3-NDFL (line 010) is indicated separately for each asset. That is, for each property a separate sheet of Appendix 7 is drawn up with the designation of the corresponding type of property.

Code of type of income in 3-NDFL for 2022

Additionally, in this part of the declaration the amount of deduction for reimbursement is calculated:

- the amount of costs for the purchase or construction of real estate is indicated;

- shows the amount of credit interest on a mortgage issued in connection with the acquisition of a specific property;

- if part of the deduction has already been spent, this is reflected in the declaration, so that when calculating the final amount for reimbursement, the maximum tax benefit limit is observed;

- If it was not possible to apply the deduction in full in one year, the balance can be transferred to the next period.

The object name code in 3-NDFL is a mandatory element of the declaration submitted for the return of tax payments as part of the property deduction. Regardless of what code is indicated in column 010, the total maximum benefit amount will remain unchanged - 2 million rubles.

Code for the name of the object in the tax return 3-NDFL

Last update 2019-01-05 at 12:22

Since 2022, Federal Tax Service Order No. ММВ-7-11/ [email protected] . It introduces a new form of declaration 3-NDFL, which is applied starting from the reporting period of 2022. In the article we will look at how in the new 3-NDFL, write down the code for the name of the object and in what cases it must be indicated.

What object name code to put in 3-NDFL

The meanings of the codes are contained in Appendix No. 6 to the Procedure for filling out the declaration. There, all the names of objects are collected in a separate table:

Each type of object corresponds to one number from 1 to 7. The code is entered depending on what kind of property the taxpayer purchased or built.

Important!

The maximum deduction amount is specified in clause 1, clause 3, Article 220 of the Tax Code and is not tied to the type of object.

Example

Valery purchased a new two-room apartment in 2022. In 2019, he fills out a tax return. He puts in Appendix 7 in 3-NDFL the code for the name of the object 2 (apartment).

Reference! In the previous form 3-NDFL, which is valid for the periods 2014-2017, types of real estate objects have the same code designation. The indicator is written on sheet D1 of the declaration.

What is the 3-NDFL declaration

All taxes calculated on the income of individuals are carefully controlled by the state with the help of a specialized inspection of the Federal Tax Service. This happens to ensure that individuals and legal entities fulfill their obligations in full and on time. For the total accounting of each taxpayer, the concept of a unique number, or TIN, was introduced, which participates as the main person code in the tax authorities’ database.

To generate reporting for determining tax withholding for a given TIN of a citizen, there is a special form 3-NDFL.

Information! 3-NDFL is a universal document approved at all government levels, which annually collects all information about the income and expenses of individuals, by calculating the difference between which the tax base is determined, from which tax is collected into the country’s budget.

The personal income tax records basic information about the following operations:

- Income from labor activities received by citizens during the reporting period.

- All periodic income from the ownership of publicly traded securities, as well as interest and dividends on bank deposits and from participation in various investment government and commercial funds.

- One-time income from the sale of property that is subject to mandatory registration (real estate - apartments, houses, plots, garages, etc., movable - cars, motorcycles, ATVs, boats, jet skis, airplanes). This also includes inheritance, winnings and accidental profits from participation in various gambling activities.

- Costs of medical care beyond the scope of VHI, purchase of medications, education of the child, as well as additional programs as part of their studies.

- Purchase of large residential real estate, registration of mortgage loans.

For each of the operations in the declaration, special sheets are provided that must be filled out.

The completed declaration is submitted to the tax office along with a set of papers confirming the income and expenses of the population, which is carefully analyzed by employees, and as a result, the citizen is presented with the amount of tax collection or deduction for repayment.

Federal Tax Service hotline

How to enter the type of property in line 020

After the applicant for the deduction has noted the name of the property in the 3-NDFL form, the tax inspector must make it clear what type of property is registered for this property. The indication of the type is required in paragraph 1.2 near the designation 020. The numbering of these types is four-digit. We propose to understand the meaning of each of the signs:

- One. This code is written in situations in which the taxpayer has registered a private type of property for housing and is the sole owner of the property.

- Two. This code must be used if the property is jointly owned by two or more individuals, one of whom is an applicant for a reduction in the tax base. Moreover, the housing is not only jointly owned, but shares are also distributed.

- Three. Three is indicated if more than one individual invested in the purchase of real estate. That is, when the owner of a given object is more than one person.

- Four. Russian legislation allows for property transactions related to the registration of housing or land in the name of individuals who are currently under eighteen years of age. Thus, if the property is owned by a child, then the number four is written on the 3-NDFL form.

In addition to the name code and type of ownership of the property, you must write the coordinates of its location on sheet D1. You will also need to enter data regarding the date of receipt of documents on the basis of which the taxpayer became the legal owner of housing or land. And only after this can you proceed to settlement transactions related to the calculation of property tax discounts.

After the sheet is completely completed, be sure to check whether it contains the page number, surname, initials and identification code of the applicant for the deduction, as well as his personal signature and today’s date.

How to fill out Appendix 7 of the 3-NDFL declaration: instructions

At the end of last year - 3 days before its end - the Federal Tax Service of Russia announced a new version of the program for filling out the 3-NDFL form for 2018, and by order of October 3 No. ММВ-7-11 / [email protected] approved the new form of the declaration itself.

You can download the new form from here .

Other changes to the form include changing the sheet names. Thus, sheet D1, required by citizens receiving a property deduction, has been renamed “Appendix 7”. This sheet has previously caused difficulties in filling out, especially in the second and subsequent years, when balances are transferred, and now, after the changes, citizens need to learn how to fill it out again.

The procedure for filling out Appendix 7 in 3-NDFL depends on whether this is the first year you are submitting a form for a deduction or whether you continue to receive it from previous years. If in 2022 you are submitting documents for a refund for the first time, then filling out the form is simple - using the existing documents for the apartment.

If you received a refund for at least 1 year, then for further filling out you will need a declaration from last year. And if you hand over for a return on interest, then filling it out requires even more attention.

Important! If you have lost the form for the previous period, then you can find out the balance of the deduction from the Federal Tax Service, but the inspector will only tell you the amount, and you will not be able to get a duplicate of the old declaration.

If you have questions or need help, please call Free Federal Legal Advice.

Results

- The object name code is used when applying for a deduction for the purchase or construction of housing.

- Numbers from 1 to 7 indicate what type of real estate the deduction is issued for (room, apartment, house, etc.).

Sources

- https://zen.yandex.ru/media/geograf/chto-delat-esli-v-dokumentah-napisan-uslovnyi-nomer-a-nujen-kadastrovyi-5ae9ac2a58166913139d9507

- https://blogkadrovika.ru/kody-naimenovaniya-obekta-v-3-ndfl-tablica/

- https://zen.yandex.ru/media/id/5ad617f86104934709d6f71b/deklaraciia-3ndfl-i-imuscestvennyi-vychet-5b2b5b69c8dfbc00a8551497

- https://rosreester.net/poisk-po-uslovnomu-nomeru

- https://pravovoy-standart.ru/gilishnoe-pr/nedvigimost/gkn/kd-nomer-nedvig/uslovnyj.html

- https://EGRNka.ru/info/uslovnyj-nomer/

- https://bankiros.ru/wiki/term/kod-naimenovania-obekta-v-3-ndfl

- https://prpr.su/stati/kod-naimenovaniia-obekta-v-3-ndfl-ili-kak-zapolnit-stroky-010/

- https://grazhdaninu.com/nalogi/ndfl/vyichetyi/3-ndfl/kod-naimenovaniya-obekta-010.html