Where to begin

To fill out a 2-NDFL report in the “Legal Taxpayer”, to enter a certificate of income of an individual, you must select the appropriate sub-item of the menu item Documents→Personal Income Tax Documents→Income Certificates (2-NDFL) .

This mode provides for entering a certificate of income of individuals for submission to the tax authorities or at the request of other authorities (individuals). That is, you can create a “Taxpayer Legal Entity” and 2-NDFL for an employee.

To add a new message, you must use the button (the [Insert] ), after which a selection window will appear.

Help entry is provided in 2 options:

- by employees;

- by counterparties.

Entering by employees initially involves entering all the necessary details for automated completion of a certificate (for example, full name, address, etc.) for the employee in the menu item Taxpayer→Employees . Similarly for counterparties in the menu item Taxpayer→Counterparties .

After selecting the input option, a list of employees (counterparties) opens. Using the <Select> , you need to identify an individual.

Also see “What does the Legal Entity Taxpayer program give an accountant.”

Available programs for filling out 2-NDFL

Thanks to modern technologies, today there are a lot of different software that you can install in your enterprises to facilitate accounting and control. Through such programs they usually receive various documents, including a 2-NDFL certificate. Such programs include:

- Pension Fund (CheckXML);

- Bukhsoft;

- 2-NDFL;

- VLSI;

It is worthwhile to dwell in more detail on each version of the proposed programs.

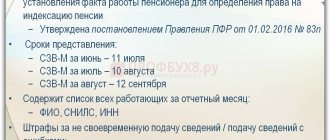

Pension Fund (ChekXML)

The PRF program (ChekXML) can be presented in both free and paid versions. It is quite actively used in their activities by small entrepreneurs and large enterprises, since it brings many advantages to the work of those managers who use the labor of hired employees in their activities.

- Any reporting entered into the program undergoes the most careful monitoring and testing.

- Version updates are constantly taking place, taking into account changes that are allowed by the legislation of the Russian Federation.

The following functions will be available in the paid version of this program:

- It opens up the possibility of accounting for several enterprises or organizations at once;

- At the same time, you can generate reports to any non-budgetary organizations;

- If necessary, it is possible to print any reporting forms;

- If the report has already been submitted, and you need to make any corrections or additions to it, then here you can do it painlessly. You can later import the corrected version.

For entrepreneurs and various types of enterprises where there are employees, this version of the program will cost around one thousand rubles per year of its use.

The advantage of the program can be considered its versatility and functionality, as well as its accessibility even to a non-professional. Considering that the program is subject to constant updates and technical support from developers, it can be considered quite competitive compared to other programs.

You can download the program from the official website of the Pension Fund.

Bukhsoft

The new version of the Bukhsoft program offers expanded functions for its use.

- For example, here it is possible to receive information from the 1C program.

- An option has also been added here that allows automatic transmission of data on warehouse balances (accounts 40 and 41).

- Settlements with counterparties that are entered into account 60 can also be transferred to the Bukhsoft program.

- In this version, it is easier to take into account information on personnel that was previously located in the 1C program.

- All tariffs for taxes and insurance fees relating to residents of Crimea, in connection with its annexation, have also been added here.

To date, all updates regarding the 2022 changes have been made to the program:

- Data relating to the minimum wage;

- Information on the tariffs used for calculating sick leave and maternity benefits;

- Information about contributions to various types of funds;

- Contributions at rates of 9 and 6 percent have been added;

- New sample reporting forms have been added to the program.

Now merchants and small businesses have the opportunity to use transactions reflecting the transfer of taxes to the budget. You can download the program from the official website.

2-NDFL

A very convenient 2-NDFL program, suitable for any entrepreneur who seeks to introduce modern accounting tools into his business.

- This program is free and available to any user, as it does not require specialized education.

- It also includes all the updates that will allow you to keep full records of transactions.

But there is also an extended updated version of this product, which makes it possible to use it in the economic activities of the enterprise. By purchasing a paid version, an entrepreneur can be sure of constant technical support from the designers of this program. You can download the program for free here.

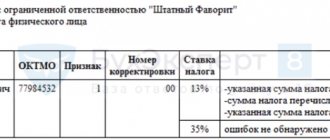

Rates and OKTMO

After selection, the “Tax Rates” Directory will be provided for selection with the help attribute:

- “1” – information about income in accordance with clause 2 of Art. 230 Tax Code of the Russian Federation;

- or “2” – a message about the impossibility of withholding tax in accordance with clause 5 of Art. 226 of the Tax Code of the Russian Federation).

You will also be given a choice of rate size, OKTMO (OKATO until 2012 incl.). Selecting what you need from the list will ensure the generation of a certificate with the selected attribute, rate and OKTMO for further entering information about income, deductions, etc.

In accordance with the procedure for filling out the 2-NDFL certificate, the OKTMO Code provides the code of the territory of the municipality in whose territory the organization or its separate division is located, where the stationary workplace of the employee for whom the certificate is being filled out is located.

If during a calendar year an individual, whose income a certificate is being filled out, received income from work in several separate units located on the territory of different municipalities, then several certificates are filled out about his income (according to the number of OKTMO codes on the territory of which the separate units are located and in which the individual received income).

You can fill out 2-NDFL in “Taxpayer Legal Entity” for one individual at one rate and several OKTMOs as follows: to enter the certificate, you need to add to the directory the required amount of the same rate for different OKTMOs.

This directory is available for viewing and editing in Taxpayers → Lists and Documents → Personal Income Tax Documents → Income certificates (form 2-NDFL) when editing the certificate.

To add a new bet, you must fill in the following details:

- description(comment; for self);

- meaning;

- OKATO (selecting the current taxpayer from the OKATO list; if the required value is missing, it is possible to edit this list);

- OKTMO (selection from the OKTMO list of the current taxpayer);

- sign of the certificate: “1: information about income” (in accordance with clause 2 of Article 230 of the Tax Code of the Russian Federation) or “2: message about the impossibility of withholding tax” (clause 5 of Article 226 of the Tax Code of the Russian Federation), as well as “3: information about income are submitted by the legal successor of the tax agent" and "4: the message about the impossibility of withholding tax is presented by the legal successor of the tax agent" - for the case of the submission of a certificate by the legal successor of the tax agent.

All details (except for OKATO - this detail was mandatory in the 2-NDFL certificate formats until 2012 incl.) are required to be filled out .

...more instructions

Creation of personal income tax report 2 for submission to the tax office

04/22/2015

ATTENTION: Since 2013, the code OKTMO (8 or 11 characters) has been used instead of OKATO. In the program, it is entered in the Service / Own organization menu. "Codes" tab. The OKTMO code can be found at the tax office at the place of registration of the enterprise or at the following link.

Brief contents of the instructions: 1. Creating a report 2 personal income tax. 2. Appendix 1 (conditions for preparing the report). 3. Appendix 2 (entering the transferred tax).

Before creating the 2-NDFL report, you must specify the listed tax in the program. How to do this, see Appendix 2. To obtain a file with information on personal income tax and documents attached to it, in accordance with the requirements of the Federal Tax Service, perform the following operations:

- Select the main menu item Reports / 2-NDFL in electronic form

- Fill in the standard fields for the report preparation conditions. Entering standard conditions for report preparation is discussed in Appendix 1

- Click the "Ok"

. The program will begin processing the data of those individuals who were selected for the report

- First, the program will display the message “Check cards before generating a report”

, click

“Yes” - If the program produces an error log, correct them and regenerate the report

- If there are no personal cards with errors, the program will display the message “Verification was successful”

- After a successful check, the program will display the “Register of information on the income of individuals”

for the reporting year. The structure of the register meets the requirements of the tax authorities. Print the register

.

The program will offer to write the generated file. By default, the file is written to a floppy disk (drive a:\). If writing to a floppy disk does not suit you, click the “Change recording path”

and select the disk on which you want to write the file

. The program will inform you that the file was successfully written

Appendix 1 Conditions for preparing a report

To generate a report, you must select the conditions for its preparation.

Standard conditions for preparing a report (Fig. 1):

- Panel Selecting faces

is intended to limit the list of persons on whom the report will be compiled:- First position only those marked

from the list of persons marked in bold

We remind you that you can mark individuals in the list using the Insert

- First position only those marked

- The position of selecting one employee

from the list by clicking on the arrow in the window opens the entire list of individuals. Marking the Personal Card required for the report with the cursor inserts the last name into the selection window, the report will be generated only for the employee with the selected last name - The Department No.

position will allow you to select only one department from the list of employees - The position All

will collect in the report all persons included in the list, regardless of any marks - Compilation date

panel is automatically filled with the current date read from the computer's system clock. If you are not happy with the current date, change it by entering it from the keyboard or using the attached calendar - Panel Numbering of certificates in the register

:- Again, starting from: determines from which number the list of individuals included in the report will begin in the register

- According to the directory of certificate numbers 2-NDFL: numbers employees in the register according to the certificate number (used mainly when creating corrective information) in the directory, which is pre-filled through the main menu item Service/Directories/Directory of certificate numbers 2-NDFL)

- Panel File identification number

Regulated reports are numbered from the beginning of the year. The number is indicated from the keyboard or using the counter arrows to the right of the input window - Sign of personal income tax withholding

- “The tax has been fully withheld (signature 1) – clause 2 of Art. 230 NK". Means that employees’ calculated tax has been fully withheld

- “Inability to withhold tax (sign 2) – clause 5 of Art. 266 NK". Means that employees have no tax withheld

The condition selected in the panel is marked with a dot in one of four possible positions. To reassign a condition, left-click on another condition. The point should move to a new position.

Rice. 1. Screen form for selecting report preparation conditions

Appendix 2 Entering the listed tax

To indicate the listed tax in the Archa program, you need to select one of the settings in the menu item Service / Settings

on the “for personal income tax” tab. The “Reflection of transferred personal income tax” setting allows you to select the following options for entering the transferred tax:

- "From Tax Payment Documents (Recommended)". By selecting this item, fill out your tax payments. The payment must be entered into the program of the year for which it was made. For example:

- if the payment was made in 2014 for 2013, then the payment must be entered into the 2013 program;

if the payment was made in 2015 for 2014, then the payment must be entered into the 2014 program;

- if the payment was made in 2014 for 2013 and 2014, then you need to enter part of the payment in 2013, and the other part in 2014

- “Indicate one total amount for everyone at once for the year.” When selecting this item, the transferred tax is indicated to each employee for the year. For this:

- Select an employee from the list

- Go to the menu item Amounts - Entering amounts personally

- Go to the "Summary" tab. The “Listed” column is editable. In it, indicate the amount of tax transferred for this employee for the entire year.

- When you select the item “The transferred tax always matches the withheld tax,” the program will automatically set the transferred tax equal to the withheld tax.

Advantages: - all payments will be reflected in the tax register.

Instructions for entering the transferred personal income tax through tax payments.

Advantages: - the annual amount of the transferred tax can be specified for each employee as you wish. Disadvantages: - the transferred tax will not be reflected in the tax register; — the tax is paid to each employee for the year.

Advantages: — the listed tax does not need to be entered manually. Disadvantages: - the transferred tax will not be reflected in the tax register; — used when the withheld and transferred for the year coincide.

The amounts of calculated, withheld and transferred tax in the Archa program can be viewed in the menu item Reports / Auxiliary personal income tax report

.

Instructions for creating a personal income tax report 2 for enterprises that have divisions.

Actions with help

To edit the help, you must use the button ( [Enter] ).

To delete help, you must use the button ( [Delete] ). Please note that in order to delete, you must confirm this intention.

To upload a document, you must use the button.

At the same time, a register of 2-NDFL certificates is formed in the “Taxpayer Legal Entity”: after uploading, information about the uploaded file is stored in the register of uploaded files.

The registry can be viewed in the Service mode → Register of uploaded files .

There is also a function for copying help using a template. It allows you to create 2-NDFL certificates based on the entered certificate.

In addition, there is a function for renumbering certificates. The need for it may arise when submitting certificates to the Federal Tax Service. To do this you need:

1. Select the required certificates (check the box).

2. Use the More-Renumber . In the window that appears, you must specify the number of the first certificate.

Certificate 2-NDFL for 2022 - 2022

With the inclusion of the 2-NDFL certificate in the 6-NDFL calculation, its form has changed. The current form of the certificate (and the calculation of 6-NDFL in general) was approved by Order of the Federal Tax Service dated October 15, 2020 No. ED-7-11 / [email protected] A separate form used for issuance to employees is contained in it. You can download both forms for free by clicking on the desired image below:

A sample from ConsultantPlus will help you fill it out. You can watch it for free by signing up for trial access to the system.

A sample of filling out this certificate can also be viewed in ConsultantPlus, free of charge, by signing up for trial access.