The order assigning the duties of the chief accountant to the director relates to the internal administrative documentation of the company and is drawn up under certain conditions. In most cases, such a document is published at enterprises in the small sector of the economy, since in large organizations with large turnover, shifting the function of an accountant to a director is simply impractical.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

When and for what purpose is an order created?

Organizing the work of the accounting department is the responsibility of the head of the enterprise. It can go one of three ways:

- appoint a specialist according to the staffing schedule;

- conclude an agreement on accounting services on an outsourcing basis with a third-party organization;

- assign this function to yourself.

The latter is possible when a company cannot, for some reason, maintain a separate specialist in the position of chief accountant and uses the simplified tax system (USN), a simplified taxation system (the main tax system, due to some of its features and rather high complexity, requires special education and knowledge).

It is necessary to make a choice immediately after the creation of a Limited Liability Company at the very beginning of the enterprise’s activities through the issuance of an appropriate order.

Sometimes this document is also called “Order No. 2” (the first order is on the appointment of a director), because According to the staff of any LLC, two main positions are a priori defined: director and chief accountant.

It should be noted that sometimes the transfer of responsibilities occurs during the period of active activity of the organization: this is not prohibited by law and this procedure does not require any special explanation.

After the order is issued, full responsibility for the financial part of the enterprise’s work, including submission of reports, calculations, payment of taxes, etc. falls on the director. The right to sign payment documents is automatically transferred to him.

How to assign accounting responsibilities to the responsible person?

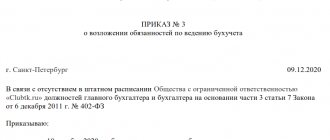

The responsibility for keeping records of the responsible person arises on the basis of the order on accounting dated December 6, 2011 402-FZ. The form of the document is not regulated by the legislator - the enterprise has the right to develop it independently. The order is drawn up in writing - all responsible persons must read it and sign it.

The document must indicate:

- name of company;

- name and number of the document;

- date and place of compilation;

- the text of the order, according to which the responsibilities for keeping records are assigned to a certain person;

- Full name of the manager and his signature.

What to pay attention to when drawing up an order

Today there is no single, unified sample order on assigning the duties of a chief accountant to a director, so representatives of enterprises and organizations can write it in any form, based on their vision of this document.

Some companies have their own order template that is mandatory for use. In any case, when drawing up a document, it is important to adhere to the norms of office work, business documentation and, no matter how trivial it may sound, the rules of the Russian language.

The document must include a number of certain information, without which it will not acquire legal force:

- number, date and place of creation;

- name of the enterprise;

- the reason for creating the order, as well as the essence: assigning the duties of the chief accountant to the director. The whole idea can be expressed in one or two sentences.

If there are any additional documents, they should also be attached to the document, noting them in the main part as a separate paragraph.

How to assign the duties of a chief accountant to a director - sample order

According to Art. 6, 7 of the Law “On Accounting” No. 402-FZ dated December 6, 2011, the head of the enterprise is personally responsible for maintaining accounting records. Taking into account the type and nature of the enterprise’s activities, its size and form of ownership, as well as the organizational and legal form and ownership of capital, it can choose any convenient method of accounting:

- Organize a structural unit for accounting.

- Approve the position of accountant in the staffing table.

- Conclude an agreement with a specialized organization for accounting.

- Perform the duties of an accountant independently.

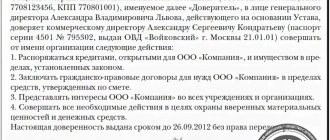

The chief accountant of an enterprise is appointed to the position by order of the director and reports only to him. The order must be issued on company letterhead and contain all constituent details (name of organization, TIN, KPP, PSRN, legal address).

If the director has the right and considers it possible to take over the accounting, he must also issue the appropriate order for the organization:

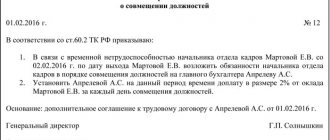

If the company has an accountant, then during his absence it is necessary to assign accounting responsibilities to another employee. This can be formalized by an order to perform duties or combine positions.

If the enterprise does not have an employee who could cope with such a position, and there is no one other than the director to delegate the duties of the chief accountant, an order is issued for the director to combine these positions. In addition, an additional agreement to the employment contract is drawn up, which specifies the duration of the combination, the amount of additional payment for it and the reason for the accountant’s absence.

EXPLANATIONS from ConsultantPlus: The LLC (USN) staff has a single accountant who is not the chief accountant. Does the general director have the right to assign the responsibilities of the chief accountant to himself, while retaining the organization’s accountant on staff? Read the answer in the K+ legal reference system.

A sample order to assign the duties of chief accountant to a director when combined looks like this:

Key points when placing an order

There are no special requirements for both the information part of the document and its design: the document can be printed on a computer or written by hand (with a ballpoint pen of any dark color, but not with a pencil). Both the company's letterhead and a regular A4 sheet are suitable for the order.

Only one condition must be strictly observed: the document must bear the personal signature of the director of the organization or any employee authorized to act on his behalf in the matter of signing such papers (the use of facsimile signatures, i.e. printed in any way, is unacceptable).

It is not necessary to stamp the form using the official seal, since since 2016 legal entities have the right to use stamp products in their activities only if this norm is enshrined in the local documentation of the company.

The order is usually written in a single original copy and must be registered in the journal of internal documents.

After drawing up the order, you need to make several copies, which should be submitted to the banking institution serving the organization, as well as to the tax office and extra-budgetary funds.

Assigning the duties of the chief accountant to employees

Maintaining the company's accounting records can be delegated not only to the general director, but also to another knowledgeable employee - accountant, economist, financier, etc. This may also be necessary when:

- absence of the position of chief accountant in the staffing table;

- refusal of the manager to fulfill the duties of the chief accountant.

The main task in this case is to correctly prepare the documentation.

It is mandatory to issue an order assigning duties. A sample is shown below:

This document is provided to the person who assumes the duties of the chief accountant (on a permanent or temporary basis). If he agrees to accept the position on the proposed terms, the person puts his signature.

How to draw up an order assigning the duties of the chief accountant to the director?

When drawing up an order assigning duties Ch. accountant for director, it must be borne in mind that there is no approved standard template for such an administrative document. Therefore, it is allowed to be drawn up in any form, in compliance with the structure of such a document and generally accepted rules in personnel records management.

Some enterprises develop their own sample orders that are mandatory for use. In this case, the order must contain certain data, without which such a document will not receive legal status, including:

- Name of the enterprise.

- The name of the form, in this version “Order No. ___ on the assignment of ...”, assigning it a registration number recorded in the enterprise’s order register.

- Place and date of drawing up the administrative document.

- The basis or reason for its composition.

- After the phrase “I ORDER:”, the essence of the order is stated, which indicates the fulfillment of the duties of Ch. accountant director, with a description of the functions, according to the job description of this vacancy.

- You can also specify the effective date of the administrative document.

- If there are additional materials, they are attached to the administrative document, listing them in the appendix.

- The final stage of drawing up the order is the signature of the manager, with a transcript of his last name. At the same time, it should be noted that the order is signed personally by the director. It is strictly forbidden to use a facsimile signature. A stamp or seal is not required.

It must be borne in mind that such an order can be drawn up either manually or using office equipment. To compile it, a simple sheet of A4 paper or letterhead, if available, is suitable. At the same time, when drawing up the order, grammatical errors, corrections and strikethroughs must not be made. The content of the text must be presented in a business official style.

The order, as a rule, is drawn up in one copy with registration in the order book.

After it is signed by the director, several photocopies are required to be submitted to the bank, tax service and other departments.

Sample of filling out an order for the appointment of a chief accountant

Download

- Form, doc

- Sample, doc

Possible solutions

Who should be assigned accounting responsibilities?

There are several solutions to the issue related to accounting and related documents:

- Assignment of responsibilities to the chief accountant.

- Concluding an agreement with a third-party specialist or with an entire organization.

- When the director is in charge of accounting. This decision can be made by managers representing small and medium-sized businesses. The rule also applies to non-profit organizations entitled to apply a simplified taxation system.

These capabilities are confirmed by Federal Law No. 402, issued in December 2011.

After the document is issued, the director is assigned all responsibilities related to this area:

- financial part of the organization's work;

- preparation of reports and calculations;

- payment of taxes;

- and so on.

The director automatically receives the right to sign payment documents. Any employee with a sufficient level of knowledge and skills can generate a document. The form is then handed over to the director for the latter to sign.