In this article we will look at interview questions and answers for accountants. Let's find out what is special about conducting an interview with an applicant for the position of an accountant. Let's figure out what types of interviews exist.

Selecting a candidate for the position of accountant is a rather difficult and very responsible task. It is important not to miss a truly valuable employee and not to make a mistake in choosing an employee with whom it will be impossible to work with in the future. This article will help both the applicant for the position of accountant and the employer find common ground.

What types of interviews are there?

Both the applicant and the employer need to know and be prepared for different types of interviews. Often, all types of interviews can be applied to one person, but at different stages of consideration of a candidacy:

| Type of interview | Explanation |

| Phone conversation | This type of interview is used if there are quite a lot of applicants simultaneously applying for a vacant position. The HR manager conducts a preliminary assessment, often accompanying communication with a potential employee with arithmetic ratings. It is useful for the applicant to ask questions that interest him during the dialogue in order to determine the advisability of passing further tests. |

| First interview with HR manager | An HR manager can successfully assess the qualities of an applicant that will enable them to successfully join the company’s team. It is necessary to understand that any company differs from a similar one in its atmosphere, traditions, and ambitions. The task of the HR manager in this case is to choose congenial company person. The applicant needs to be himself during an interview with the HR manager, because... In the future, it is very important to psychologically integrate into the structure of the organization, which will allow:

|

| Interview with the chief accountant | This type of interview is perhaps the most important and, most likely, the most difficult for an applicant for the position of accountant, because... It is in this case that the professional component of the future accountant is assessed. The chief accountant will certainly evaluate:

|

How to understand that something went wrong in accounting

You can easily identify accounting problems if you know the special rules.

When starting the test, forget about embarrassment: ask a lot of questions, don’t be afraid to seem incompetent. You are not required to know the nuances of accounting, but you have the right to completely control the company.

Tax debt and late submission of reports

Reports must be submitted on time, and taxes must be paid in full. A reconciliation with the tax office will help you make sure whether this is true or not.

Certificate on the status of settlements for taxes and fees

Through electronic reporting services (for example, VLSI, Astral, Kontur and others), the taxpayer’s personal account, or directly from the tax office, request a certificate about the status of settlements for taxes and fees.

Certificate on the status of settlements for taxes, fees, etc.

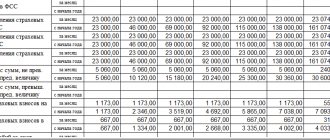

In the certificate of settlement status, examine columns 4 - taxes, 6 - penalties, and 8 - fines. A competent and responsible accountant will have the number “0” in them. This means that everything is in order with the calculations. An amount with a “+” sign indicates an overpayment of tax to the budget. An amount with a “—” sign indicates that the taxpayer has debts.

Overpayment or debts on taxes should alert the manager. Ask your accountant to explain the discrepancies. In some cases, for example, when making advance payments under the simplified tax system, the certificate sometimes shows an overpayment. A competent accountant will clearly explain what’s going on.

The deadline for submission in paper form is 5 working days from the date of receipt of the application from the taxpayer. If you submit an application electronically - on the next business day after registering an electronic request from the organization (order of the Federal Tax Service of the Russian Federation dated December 28, 2016 No. ММВ-7-17 / [email protected] ).

Bank statement for the last 2 - 3 years

Another way to find out whether reports are submitted on time is to look at your bank statements for the last 2 to 3 years.

Filter all payments to the budget and see their purpose. The manager should be wary of two points:

- if among the expense documents there are collection orders - documents that confirm that the Federal Tax Service has written off tax debt from your current account;

- if the payment instructions contain the phrases “payment of penalties”, “payment of fines”, etc.

Even if the amounts are small, ask the accountant to explain why he failed to submit reports on time, which resulted in the company having to pay penalties and fines.

Extracting transactions for settlements with the budget

From the tax office you will receive an extract of transactions involving settlements with the budget. In paper form, it is issued within 5 working days, or 1 day in advance if the request was sent electronically.

The extract will help you quickly analyze the reasons for debts and overpayments of taxes, if any. It indicates charges and payments for each type of tax.

Take payment orders for taxes and check whether all amounts are included in the statement. If there is no payment, check that the details and required fields of the payment order, which is not in the Federal Tax Service Inspectorate statement, are filled in correctly. Often, due to inattention when specifying BCC, OKATO or periods, payments are posted to the general account “until clarification” and are not reflected in the taxpayer’s personal account.

If it turns out that some payments are really missing or there are errors in filling out payment orders, prepare statements clarifying the erroneous payments. You can do this yourself or entrust it to your accountant. An application for clarification of payment is written to the territorial department of the Federal Tax Service in any form, and copies of tax payment slips certified by the bank are attached to it.

When studying the statement of account transactions, be sure to pay attention to the type of document (column 5). RnalP is the primary tax return or calculation. RNalU - updated report.

An example of recording transactions for settlements with the budget. Column 5 should not contain RNalU

Some accountants practice submitting false primary reports in order to meet deadlines. Later they submit the correct report. Having discovered RnalU in several periods, check with the accountant what prevented him from submitting correct reports on time. Know that regularly submitting “clarifications” or zero reports sooner or later leads to unscheduled inspections of the organization.

It happens that a company has arrears of penalties, but there are no unpaid taxes. This is a consequence of late transfer of payments to the budget. Check when the taxes were paid in the period in which the penalties appeared. Be sure to check with your accountant about why taxes were not paid on time.

Having discovered an overpayment of taxes, do not rush to rejoice: your organization once paid more to the budget than it should have. Overpayment is also a sign of accountant incompetence. Prepare an application to the tax office for a refund or offset of the overpayment. Money overpaid more than 3 years ago cannot be returned from the budget.

The accountant of the limited liability company regularly submitted “clarifications” on profits, which led to confusion with the payment of taxes. Due to changes in accounting data, overpayments and debts regularly appeared on the taxpayer's personal account. Both overpayments and debts passed from period to period and accumulated. The accountant knew about this, but did nothing.

After a year and a half of this practice, tax authorities paid attention to the organization and conducted an unscheduled on-site income tax audit. As a result, the company was charged an additional amount of about 350,000 rubles due to the formation of periodic debts. This could have been avoided if the accountant had filed returns and paid taxes on time.

Frauds with current account

An organization's current account requires close attention. An unscrupulous accountant who has access to a current account can create serious problems for an organization:

- theft of money from a current account through shell companies;

- cash withdrawal for third parties;

- illegal secret lending to individuals or legal entities.

How to Detect Irregularities Using Bank Statements

To detect irregularities in your current account, check your bank statements. Here are the cases in which you should be wary:

- An unknown counterparty transfers significant amounts of money, which are cashed out immediately or in parts: this may turn out to be “laundering” of someone else’s money.

Art. 172 and art. 174 of the Criminal Code of the Russian Federation provides for various punishment options for such a violation. Depending on the amount and the sender of the money that is indicated in the current account, this may be a fine of up to 200,000 rubles or imprisonment for up to 2 years. An unsuspecting manager will be held accountable, but for an accountant this is just a way of earning additional, albeit illegal, income. - Payment orders addressed to unknown organizations or to the accounts of individuals.

Even if they indicate small amounts, study the reasons for the transfer. This is often used to disguise the theft of money. There are known cases where unscrupulous accountants monthly transferred funds under fictitious contracts to a shell company for subscriber services. The firm paid the accountant in cash and deducted interest for his “service.” - Erroneous transfers of money to a third party, which after some time are returned to your company’s bank account.

In this case, the accountant can explain that he made a mistake in the transfer, and then discovered the inaccuracy and asked for a refund. The third-party organization returned the funds, and everything seemed to be fine.However, if this happens regularly, it may be hidden lending. For a fee, your accountant lends working capital to other companies, for which it is more profitable and faster than taking out a bank loan.

Control of transactions on the current account

If you want to control your cashless transactions, start your day by reviewing your bank statement for the previous day.

First, check your checking account balances for the morning with your balances for the evening. There should be no discrepancies in the numbers. Check all incoming and outgoing payments. If you have questions about amounts or contractors, ask your accountant.

Set a time when you will personally sign all payment orders. An accountant can generate payment slips using an electronic signature key, and retain the right of first signature. Set 2 time intervals when you will review and sign payments.

All these activities take no more than 30 minutes a day, but they are useful. As a rule, if the manager is personally involved in monitoring statements and settlements, there is no abuse or fraud with the current account.

A group of 3 micro-enterprises was engaged in retail and wholesale trade. The accounting was done by a friend of the founder at home. She had remote access to the online accounting service and current accounts of organizations.

One day the accountant went on sick leave, and then stopped communicating completely. The manager himself was responsible for the calculations at this time, and he became concerned only after the specialist’s 2-week absence during the reporting period.

As a result, the company was unable to submit its reports on time and got into major trouble with the tax authorities. Additionally, it turned out that over the course of 2 years, large sums of money were regularly written off from the current accounts of organizations to unknown companies. The total amount of write-offs is 4 million rubles. After this incident, the manager entrusted accounting to a professional company and independently conducts payments through a current account.

Errors in cash management

The cash register is always about cash. Therefore, the tax office often checks cash discipline. For inexperienced or negligent accountants, the cash register contains many pitfalls that can result in fines for the organization.

If you decide to analyze the state of the cash register, check the cash book: how much money was at the beginning of the day and how much was left at the end. The rule “there should be no minus at the box office” must be strictly observed.

The presence of more money in the cash register than indicated in the cash book means that receipts are not made on time. When surpluses are discovered, tax officials seize them into state revenue.

So, find out to whom, when and for what purposes cash was issued. Be sure to study supporting source documents and expense reports. Check that all transactions are recorded in the cash book. Documents must be completed correctly, expenses must be related to the activities of the company.

If your organization pays in cash, check your payroll records. They may include former employees or inconsistent bonuses for those still working.

Check the completeness of the receipt of money to the cash desk. Compare the amounts issued according to bank statements with the amounts that were deposited into the cash register - they should match. The discrepancy in the amounts of money issued from the current account and deposited into the cash register means that the unreceipt of the money was stolen.

How to detect irregularities at the cash register

To effectively control cash discipline, the manager should know the signs of the most common violations.

- Entries in the cash book are completely or partially missing.

This is often the result of carelessness or laziness on the part of the accountant. Don’t believe stories about being busy and having no free time. A good accountant will never allow such situations to happen because he understands the importance of accurate cash accounting. - The accountant does not use cash register equipment or commits violations when working with it.

New rules for working with cash registers (hereinafter referred to as cash registers), introduced by 54-FZ, allow tax authorities to track any cash register transactions online and quickly detect violations. For example, if the fact of non-use of cash registers for a large amount is repeatedly revealed, inspectors have the right to suspend the organization’s activities for up to 3 months (Clause 3 of Article 14.5 of the Code of Administrative Offenses of the Russian Federation).The main reason for neglecting the use of cash registers is the desire to hide profits and reduce taxes. However, with proper accounting, this can be done in other legal ways: through outsourcing of personnel, choosing the optimal taxation system, saving on social contributions through employee compensation, and others;

- Cash limit exceeded.

The amount of money that can remain at the enterprise’s cash desk at the end of the day is calculated using a special formula of the Central Bank of the Russian Federation and depends on the revenue and type of activity of the company or individual entrepreneur (Appendix to the Directive of the Bank of Russia dated March 11, 2014 N 3210-U “On the procedure for maintaining cash registers”). transactions by legal entities and a simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses).If at the end of the day the amount in the cash register exceeds the maximum cash limit, cash discipline has been violated (Article 15.1 of the Code of Administrative Offenses of the Russian Federation). In this case, some accountants issue excess money for reporting. And when the cash balance decreases, the advance is returned as unused. This helps the accountant avoid punishment and not hand over money to the bank;

- An entrepreneur deposits personal money into the company's cash desk without formalizing a loan agreement.

In many organizations, business owners cover cash gaps with their own funds. In such cases, accountants sometimes neglect to draw up loan agreements: when checking cash discipline, this is classified as a violation of the procedure for working with cash and cash (clause 15.1 of the Code of Administrative Offenses of the Russian Federation). The fine for each violation for legal entities is from 40,000 to 50,000 rubles.If you practice contributing personal money to the needs of an enterprise, draw up a loan agreement according to the rules of paragraph 1 of Chapter 42 of the Civil Code of the Russian Federation.

The accountant of an individual entrepreneur went on maternity leave and before hiring a new employee, the manager was forced to manage the cash register and all payments independently. When looking at the cash register documents, he noticed the regular issuance of money from the cash register for gasoline. Attached to the expense statements were receipts from gas stations he never filled up at. The individual entrepreneur had no other transport. It turned out that the accountant unauthorizedly refueled her car at the expense of the entrepreneur’s money. Having checked all the cash documents for the period of work of this accountant, the individual entrepreneur discovered a whole bunch of unauthorized expenses. In addition to gasoline, the girl regularly gave herself money from the cash register to study French and travel on vacation. She explained her actions: gasoline costs are associated with traveling to work, and she is learning the language to improve her professional level and expand her competence.

Errors in recording primary documentation

Primary documents are necessary for proper tax accounting of an organization (Article 313 of the Tax Code of the Russian Federation). A competent accountant will never allow violations in working with documents, because this can lead to additional taxes, penalties and fines during an audit.

Primary documents will confirm the business transactions of the company only if they are correctly executed. A primary document whose registration has been violated cannot be taken into account.

There are problems in the organization’s document flow if:

- there are no signatures or seals on the primary documents, not all fields are filled in, there are signs of corrections;

- originals are missing or replaced by copies received by email;

- documents for past periods are stored in folders or “in bulk” in boxes; document registers have not been compiled.

How to check the accuracy of document accounting

Ask the accountant to show the primary report, for example, for the 3rd quarter of the previous year. He must bring volumes of documents bound in chronological order. Each volume is accompanied by a register - it has the accountant’s signature and the organization’s seal. All other methods of storing documents indicate violations of document flow.

The second verification method is more complex. Take the statement from the previous tax period and select 5 or 6 different transactions on it. For example, take payments to your regular and one-time suppliers, as well as the receipt of money from counterparties. Invite the accountant to bring all the primary documents for these transactions.

The accountant must present contracts, invoices, delivery notes or acts of work performed, powers of attorney for receipt and other documents. Pay attention to how these documents are stored. Copies, incorrect filling of document details, lack of seals or signatures - all these are indicators of employee negligence.

If you find problems with the accounting of primary documentation, immediately fix them and think about changing your accountant

An individual entrepreneur baked bread and ran a small pizzeria. The staff consisted of 16 employees. In addition to accounting, the accountant was involved in tax reporting, hiring and firing staff. The accountant convinced the entrepreneur that UTII has no obligation to keep records. And she didn’t.

Taking over the cases after her dismissal, the new accountant discovered that there was no document flow as such. Cash was not accounted for, cash books were not kept, and settlements with staff and suppliers were not recorded anywhere. The documents were just piling up in the box.

The new accountant restored the accounting for the last calendar year. It turned out that about 1 million rubles were missing. There were no supporting primary documents for exactly this amount. By that time, the former accountant had changed her phone number and place of residence.

Preparing for an interview for an accountant position

Before entering the interview stage, the applicant is recommended to familiarize himself with the available information about the company:

- explore the site;

- view accounts and groups on social networks;

- read reviews.

In order to make a positive impression on the employer, the applicant needs to think through a short message about himself as a worthy specialist. It is likely that the interview will focus on professional successes and failures, and planned prospects for professional growth and development.

In addition to introducing yourself, it is advisable for the applicant to think through in advance the questions that will be addressed to the employer. It is necessary to understand that an interview is an assessment of both the applicant and the employer. This is an opportunity to reach a common agreement that allows both the company and the applicant to get a new round of development.

Rules of conduct during an interview

A self-respecting person usually prepares for an interview by paying attention to the following rules:

| Rule | Explanation |

| Punctuality | At the interview, it is recommended to arrive a little early or exactly at the appointed time. |

| Appearance | Employers often evaluate the compliance of the applicant's appearance with the corporate culture of the company. |

| Anamnesis | When presenting your professional experience, it is under no circumstances recommended to criticize previous employers. |

| Emotional condition | You shouldn’t be nervous or make unnecessary movements, but you shouldn’t be overly serious. It is recommended to be yourself. |

| Adoption | When communicating with an employer, it is advisable to give clear, balanced answers to the questions posed. You should not refuse to fill out all the proposed forms. |

| The final | Even if the outcome of the interview is unfavorable, it is recommended to part ways politely, intelligently, and with dignity. |

For example:

Alla V. Applying for the position of accountant in a large consulting company with a conservative corporate culture. Alla arrived for the interview 20 minutes late, sloppily dressed and wearing dirty shoes. During the interview process, she repeatedly criticized her former employers, interrupted the interlocutor and constantly clarified the amount of wages and benefits due. She reacted rudely to the HR manager’s remark regarding her behavior, and at the end of the interview, she slammed the door and left the company’s office. There is no need to even doubt that Alla will not get the desired position in this company.

How not to get confused during testing

Success comes to those who are persistent. The quality and speed of answers directly depend on the effort spent by the applicant on preparation and on how close the test material is to him.

Each institution that uses test items has its own approach to their development and assessment. But if, during the preparation process, the applicant takes the trouble to practice completing tasks of different types, then the final result will be noticeably better.

If you receive an invitation to take test assignments for accountants when applying for a job, there is no need to be shy. There is nothing wrong with asking the employer's representative what kind of tasks will be performed. If such a possibility exists, it is advisable to ask about the nature of the questions from those who have already been interviewed in this organization before, even for a different position.

It is worth taking advantage of online resources to:

- refresh your general knowledge of accounting;

- prepare for questions that reflect the industry specifics of a given enterprise (production, provision of services, catering);

- re-read tax regulations;

- practice passing professional, and if any, also intellectual or psychological tests.

During testing you should be calm, collected and extremely attentive. The applicant may not realize what qualities the tests for accountants are aimed at identifying when applying for a job. For example, if emergency situations or problems with the Federal Tax Service are not uncommon for an enterprise, an important quality of an accountant is nerves of iron. In this case, the number of tasks issued may obviously exceed what can be completed in the allotted period of time. The place will be given to an applicant who does not panic - does not give up and does not instruct the “birds” at random, but collects his thoughts and does everything possible in this situation.

There is no need to rush to complete the task - it is better to spend a few minutes to make sure that you understand it correctly. If necessary, you can always ask again the meaning of the question if its wording is vague or ambiguous. If a test or assignment is not given, you should skip it and come back to the solution later.

Interview questions and answers for an accountant

In addition to general questions, applicants for the position of accountant will be required to ask questions that determine the level of professionalism and competence:

| Questions | Answers |

| What do you know about accounting standards? | Here it is appropriate to clarify which standards and to what extent the applicant is proficient (RAS, IFRS, US GAAP, etc.). |

| What is your experience in managing or implementing....? | If you have experience, it is appropriate to talk about it; if there is no experience or it is very small, express a desire to develop in this direction. |

| How did you resolve issues with accounts receivable? | The answer to this question will be based on past experience, thanks to which the employer can get an idea of the applicant's work skills in this area. |

| What reports did you have to submit and with what results? | The answer to this question will help the employer obtain information about the applicant’s ability to analyze, process information, and make decisions. |

| Do you have audit experience? | The answer to this question will come from the inclusion of this aspect in job responsibilities. |

| How many mistakes do you make in your work? | This question helps to assess the desire and ability of the applicant to identify even minor errors, because With a certain amount of work experience, any employee develops a certain system of work. |

| How much work did you have to do? | Applicants with experience working in small companies have a different experience than those working in large companies. This question will allow you to assess the professional coverage of the future employee. |

| What atmosphere in the company would be most suitable for you? | The answer to this question will determine the applicant’s ability and desire to work in a team or, conversely, to work independently. It is necessary to understand that each company has a very individual approach to this issue. |

| How do you resolve conflict situations? | The answer to this question will determine the applicant’s ability to negotiate and find a way out of difficult situations. |

| Tell us about your shortcomings. | Any person must adequately assess both his strengths and weaknesses, which allows him to successfully adapt and work in a team. |

Dependence of requirements on an accountant on the evaluator

A modern accountant needs the ability to write entries in the same way as an ordinary citizen needs the skill of dividing five-digit numbers into a column. However, if the chief accountant of the organization is a representative of the older generation, this and similar knowledge needs to be refreshed in memory before the interview. He will probably give you written assignments that will have to be completed by hand, without using reference materials.

If an applicant hopes to get a job in a large company, you can expect that tests for hiring an accountant will be prepared by top-class financiers and auditors, or, alternatively, by representatives of a recruiting agency.

In such cases, you need to prepare for the test of professional knowledge especially carefully. In addition, it is worth practicing completing intelligence tasks.

The applicant should be prepared for the fact that an individual entrepreneur or the head of a small enterprise may invite him to take tests on one of the publicly available Internet resources. Therefore, in order to prepare for an interview, it makes sense to practice online. If the result is not good enough, it will be possible to refer to the oldness of the tasks and their inconsistency with current legislation.

How can an employer draw conclusions about an applicant?

After the interview, the employer pays attention to:

- the ability of the applicant to express his thoughts consistently and logically;

- ability to keep the topic of conversation;

- sincerity of desire to occupy a vacant position;

- satisfaction with the proposed amount of earnings;

- level of professionalism;

- learning ability;

- the opportunity to provide benefits beyond your current position, etc.

It is very important to correctly make a first impression about the applicant for the position of accountant, because... There is a high probability of both hiring the wrong person and missing out on a truly valuable candidate.

What mistakes in an accountant's work will help you get rid of money.

To understand which mistakes in an accountant’s work pose risks for business, it is enough to know for which violations there are penalties. Here are some of them:

- The accountant forgot to submit the reports on time, in the prescribed manner (Article 219 of the Tax Code of the Russian Federation). A fine of 5% to 30% of the unpaid tax amount, but not less than 1 thousand rubles. In addition, for failure to submit reports on insurance premiums, personal income tax and VAT, tax authorities will instantly block the entire current account until this violation is completely eliminated. Quite an unpleasant situation, which completely depends on the action (inaction) of the accountant!

- The accountant grossly violated the rules for accounting for income and expenses, objects of taxation (Article 120 of the Tax Code of the Russian Federation). Fine from 10 thousand. R. up to 20% of unpaid tax caused by an accountant's error.

- The accountant forgot to pay taxes on time, or made a mistake and unlawfully reduced the tax (Article 122 of the Tax Code of the Russian Federation).

- Done intentionally - the fine will be 40% of the unpaid amount to the budget.

- Unintentional error (without malicious intent). Fine 20% of the unpaid tax amount.

- The accountant forgot to post agency tax withholdings. For example, personal income tax or agency VAT is not withheld when renting municipal property, or when working with foreign service providers. The fine will be 20% of the amount not withheld (Article 123 of the Tax Code of the Russian Federation).

- The accountant violated cash discipline - a fine of 40-50 rubles. for every violation.

As you can see, our legislation is quite harsh, but no one has abolished ownership control! Always check with your accountant and you will avoid unnecessary risks.

Why can an employer refuse to hire you?

The employer, of course, has the right both to hire and to refuse to hire an applicant.

There may be several reasons for refusal:

- discrepancy between the applicant’s appearance and the company’s corporate culture;

- discrepancy in the level of professionalism (and in this case the level of professionalism can be either too low or too high);

- discrepancy between the personal characteristics of the applicant and the general atmosphere of the company, etc.

At a certain moment, an employer needs a specialist of a certain personal structure and a certain level of professionalism, and therefore he is forced to make decisions, refusing employment to specialists of a sufficiently high level of development, both professional and personal.

How to write a job advertisement correctly?

Make sure that the job description exactly matches the job description under which the person will subsequently work. You cannot write in an advertisement that you just need to count your salary, and then demand from your subordinate an in-depth analysis and optimization of the company’s financial flows. On the contrary, having hired an expert with a huge variety of experience, it is stupid to assign him to the simplest tasks.

What about remote and self-employed people? Most entrepreneurs are very reluctant to agree to such cooperation, as they are convinced that the level of responsibility of a full-time specialist is higher. But modern realities are such that many parts of business are switching to remote mode. Nevertheless, the desire to hire an accountant on staff is quite understandable: this way he is more firmly connected with management and production, and is constantly in the know. Decide according to your needs. If you need basic functions, then you can save money on a full-time accountant and use outsourcing.

Questions and answers

Question number 1 . Are employers required to inform the applicant about the decision made?

Answer: In general, employers are not required to notify the applicant about a negative decision, but notification is still considered good manners, because the person went through some stress, devoted time and attention to the company, for which he should be thanked.

Question number 2 . During the interview, I was offered to pay for the document preparation service. Is this action legal?

Answer: During interviews, the applicant needs to be very careful to avoid fraudulent activities on the part of false employers. The employer has no right to request any advance payment for paperwork.

Why is it important to control your accounting yourself?

With the strengthening of the role of regulatory authorities, the introduction of electronic document management and the availability of online access for tax authorities to current accounts and cash registers of organizations, incorrect accounting is fraught with audits, fines and other sanctions.

Sometimes, after the dismissal of an accountant, the manager suddenly finds out that the company’s accounting is in a deplorable state: the accounting documents are not sorted out or are missing, the figures in the statements are taken out of thin air, transactions are not posted to accounts. Restoring neglected accounting is a very labor-intensive process. In some cases, this is completely impossible to do. Errors and lack of documents during the first inspection will result in additional taxes, fines and penalties (Articles 120 and 122 of the Tax Code of the Russian Federation).

Counterparties will not deal with a company if it does not know how to draw up primary documents confirming the fact of carrying out income or expense business transactions (invoices, orders, instructions, etc.). An organization that cannot confirm VAT transactions when requested by the tax office will not inspire confidence in its partners.

Some accountants, in order to “earn money,” transfer transit amounts through the organization’s accounts or engage in cash transfers for strangers. For the use of fraudulent schemes, it is the head of the company who faces criminal prosecution (Articles 171, 174, 199, 199.2, 327 of the Criminal Code of the Russian Federation).

5 problems that will definitely arise if you don’t control your accounting:

- Difficulties with tax authorities: late submission of reports, non-payment of taxes, fines;

- Deterioration of relationships with partners: serious counterparties value their tax reputation and will not want to work with an organization in which accounting is carried out carelessly;

- Fraud with a current account and cash register: inappropriate expenses, theft, illegal cashing and transit of other people's funds;

- Continuing violations of primary documentation, which can remain in the shadows for a long time and “shoot” during a tax audit. This will lead to the most dire consequences for business: for example, a company may go bankrupt due to the inability to pay tax sanctions;

- Criminal prosecution of a leader by internal affairs bodies.

It should be remembered: if a company goes bankrupt and has tax debt due to the fault of its managers or participants, they may be subject to subsidiary liability (Article 3 of the Federal Law “On Limited Liability Companies” No. 14-FZ of 02/08/1998). Nowadays, increasingly, the tax debt of an LLC after bankruptcy is collected in court at the expense of the personal property of the director and founders.

The chief accountant of a small contracting company resigned due to health reasons immediately after receiving notification of a tax audit. The specialist taken in his place could not explain many aspects of accounting to the inspectors, since there was no order in the accounting department: some of the primary documents were missing, some were filled out with errors.

The result is that tax authorities did not accept a large number of transactions for accounting and assessed additional taxes, fines and penalties of more than 8 million rubles. For a company with an annual turnover of 5 million rubles, the amount was simply huge. Six months later, the tax inspectorate initiated bankruptcy of the organization. The owner lost his business and started everything from scratch.

The head of the company is responsible for errors in accounting: from fines and penalties to imprisonment