The consignment note is a mandatory primary document (Parts 1, 2, Article 8 of the Law of November 8, 2007 No. 259-FZ). It confirms the fact of concluding a transportation contract, is one of the documents confirming the reality of the transaction, and justifies expenses in tax accounting (clause 2 of article 785 of the Civil Code, part 1, 2 of article 8 of the Law of November 8, 2007 No. 259-FZ, clause 7 Rules for the transportation of goods by road, approved by Government Decree No. 2200 dated December 21, 2020, Federal Tax Service letter dated July 2, 2019 No. SD-4-3/ [email protected] ) Based on this, the customer recognizes transportation costs, the carrier recognizes revenue (Federal Tax Service Letter dated April 19, 2021 No. SD-4-2/5238).

According to the Decree of the Government of the Russian Federation No. 2200 dated December 21, 2020, the new TN is valid from January 1, 2022. The rules for the transportation of goods by road, approved by this resolution, are valid until January 1, 2027 (clause 3 of the Rules).

What's new in the bill of lading in 2022

The updated invoice will be used from the beginning of 2022. It was approved by Government Decree No. 2200 dated December 21, 2020, the form is in Appendix No. 4. New columns have appeared in it.

- Section 1 "Consignor" . A checkbox has appeared that the sender of the cargo is a forwarder: check this box if the forwarder pays for the delivery of the cargo in accordance with the contract and therefore has the status of a sender. Section 1a has also been added for information about the delivery customer - they are entered if necessary.

- Section 3 "Cargo" . Indicate the cost of the cargo and the input data of waybills, invoices, contracts that relate to the cargo.

- Section 6 “Reception of cargo” . Enter information about the person who transfers the cargo to the carrier.

- Section 11 "Vehicle" . This includes data about the car and a code that characterizes the type of car ownership: “1” – owned car, “2” – rented car; “3” - in leasing.

During 2022, the invoice will be drawn up in paper form, and from the beginning of 2022 an electronic document format will appear, its approval is expected from the Federal Tax Service, the Ministry of Transport and the Ministry of Digital Development.

Who does the design

Everything is quite simple here. According to the current rules, the consignment note in 2022 can be filled out by the owners or sellers of goods. This is possible in cases where transportation is directly carried out by the cargo owner or seller himself. Then his prerogative becomes the mandatory execution of Form 1T. There are situations when the cargo owner or seller uses the services of an intermediary. To do this, a special agreement is drawn up with the cargo carrier, which undertakes obligations to deliver the cargo to its destination. The agreement with carriers is filled out on behalf of the recipient or sender. Then both parties can fill out the invoice. In simple terms, the responsibility for issuing a bill of lading rests with the company or party that hires the freight carrier. You should also strictly adhere to the rules according to which the consignment note for the carriage of goods is filled out.

If the transported goods do not have a TTN in the package of accompanying documents, such cargo transportation may encounter serious difficulties.

When to fill out the waybill

With the help of a bill of lading, transportation of goods by motor transport across the Russian Federation is formalized. This is the primary document that confirms the costs of delivering the goods, and it also stipulates the terms of delivery.

If the driver is carrying cargo in his car, he is required to have a bill of lading with him and present it to State Traffic Inspectorate employees upon request. If the driver does not have a consignment note for the cargo, he risks receiving a fine of 500 rubles (Part 2 of Article 12.3 of the Code of Administrative Offenses of the Russian Federation).

An invoice is needed in two cases:

- if the seller delivers the goods using his own transport (except for those cases when the cost of delivery is included in the price of the goods and this is reflected in the contract);

- if the goods are delivered from the seller to the buyer by a third-party company.

An invoice is not issued in the following situations:

- if the goods are delivered by the supplier, but delivery is included in the price of the goods;

- if the buyer picks up the cargo in his own car, then he confirms the transportation costs with a salary slip, waybill or other document.

What needs to be done to exchange electronic waybills

- Purchase a CEP for employees responsible for shipping and receiving cargo. This could be a storekeeper or logistics manager. You can obtain such a signature from the Federal Tax Service for free. But in addition to it, you need protected media and software.

- Connect to the EDF operator. It will process and transmit electronic transportation documents to the EPD GIS. The Ministry of Transport will determine a list of such operators and enter it into a special register. You will also need to choose an operator solution for exchanging documents: a cloud service or integration of the service with the enterprise’s internal accounting systems. If you are already using some EDI solutions or accounting system, please inform the operator about this. He will assess whether integration with his platform is possible, the timing and cost of implementing ETRN. If integration is possible, you will be able to work with electronic waybills in the interface of your accounting system. If not, the operator will provide you with their solution.

- Connect to GIS EPD. It will ensure the exchange of electronic transportation documents and the information contained in them between cargo transportation participants and store data.

- Conclude an agreement on the exchange of electronic documents. Two agreements will be required: the first is between the transport company and the driver, the second is between the shipper, the transport company and the consignee. Describe the current document exchange process and possible exchange scenarios: which employee signs, transfers and checks documents in what order; How is the process of interaction with the forwarder and carrier structured? Also, be sure to indicate which employee has the right to sign, who will sign the documents and how, what responsibilities the manager, storekeeper, driver, accountant perform in the exchange.

- Take care of technical equipment. It is necessary to purchase smartphones or tablets for drivers, set up mobile EDI clients and teach them how to use them. Since the cargo is sent from the warehouse and warehouse workers need to record the shipment, they also need to purchase tablets or laptops with access to the EDI operator platform.

How many copies are needed?

Three parties are involved in filling out the paperwork: the sender of the cargo, the carrier and the recipient. Each of them contributes their information at their own stage of work. Therefore, paper TNs are drawn up in triplicate so that each party has its own original. Each of them must be signed by all parties. Initially, when sending cargo, the invoice is not completely filled out; information in some sections is added during the delivery process and when transferring the cargo at the end of delivery.

One more nuance: if the shipment did not fit into one vehicle, but was distributed among 2 or more vehicles, a separate document must be drawn up for each vehicle in triplicate. The driver of each car will fill out some of the information on their forms. But if one car carries several orders, you can draw up a single document for them.

How to fill out a waybill

There are requirements for the invoice that make it valid (based on the Rules for the transportation of goods by road, Letter of the Ministry of Transport of the Russian Federation dated March 26, 2021 No. D3/6976-IS).

To confirm expenses, indicate the date, information about all parties, and the cost of transportation. Sections 6, 7, 15, 16 indicate the positions of responsible persons, names and signatures. It is not necessary to put a stamp on the invoice, but if you do, it will not affect anything. If a line is not filled in due to lack of information, a dash is placed in it. Sections marked “if necessary” may not be completed.

You can start filling out the invoice with a pen with blue or black ink, or you can also use a computer and print out a copy for the shipper with the fields already filled in. You can then continue filling out the document with a pen.

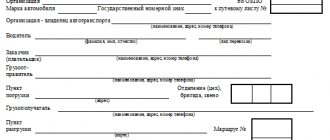

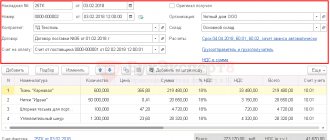

Accounting in 1C

In the 1C:Accounting 8 rev.3.0 program, a printed form of the new waybill has been implemented (as of release 3.0.88). The document can be printed in the same way as before by clicking the Print from a sales document with a date starting from 2022 (Sales - Sales - Sales (acts, invoices, UPD)).

Consignment note 2022 - example of filling

In the program, part of the TN data is filled in automatically ( Delivery at the bottom of the Implementation document (act, invoice, UPD) ), new details, if necessary, are specified manually in printed form.

- If the Contractor himself acts as a Carrier: The Shipper (p. 1) indicates the Client under the contract, and p. 1a is not filled out.

- The Client under the contract is indicated in section 1a Client (Customer of the transportation organization);

In section 3, manually enter the declared value of the cargo.

The person from whom the cargo is collected (p. 6) manually indicate the Client or the shipping warehouse (with details of the legal entity).

In section 10, the Carrier indicates (filled in automatically, if necessary, can be adjusted manually):

- the contractor under the contract (if the Contractor himself acts as a Carrier);

- owner of the vehicle (specified in clause 11) with whom the Forwarder has concluded a transportation agreement.

Section 11 states:

- data about the vehicle (filled in automatically - Delivery link in the sales document);

- vehicle ownership type - filled in manually.

If the Client issues a Bill of Lading on his own, it is necessary to obtain from the Contractor information about the type of ownership of the vehicle, as well as information about the direct carrier.

How does a shipper fill out a bill of lading?

The cargo can be sent by the supplier, buyer or forwarder. Sometimes the buyer becomes both the sender and the recipient of the goods.

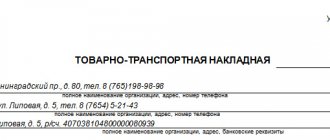

Header: enter the day of filling, TN and copy numbers, indicate the day of delivery and the number of the delivery request.

Section 1 . Customer name or organization name, contacts and other data. If the forwarder pays for delivery, he is considered the shipper, then he checks the appropriate box.

Section 2 . Filled out in the same way as Section 1, but with information about the consignee.

Section 3 . The section is extensive; it contains information about the cargo: name of the cargo, number of cargo pieces, weight, dimensions, hazardous substances, if any, cost. Data on the declared value is taken from the delivery note or UPD.

Section 4 . Here are the details of the shipping documents that are attached to the invoice in order to avoid tax doubts about the reality of the transaction.

Section 5 . Here they write delivery times, temperature conditions and other requirements for handling cargo. They also enter information about the vehicle that will carry the cargo.

Section 6 . This includes information about the person who transfers the cargo to the carrier, address, day and time of loading. Then they add actual data on the results of loading and describe it. The condition of the cargo, weight, and number of pieces of cargo are recorded. Those involved in loading put their signatures under the section.

Section 7 . This includes the address, date and time of delivery.

Section 15 and Section 16 . Here you need a position, name and signature.

Structural features

In order to correctly and competently draw up a consignment note on form 1T, you should first familiarize yourself with the features of the structure of this document. For clarity, it is better to use a sample that is made in compliance with the standards. Conventionally, the waybill is divided into 2 parts. Moreover, the 2022 sample form has not undergone any significant changes, and therefore the same registration rules apply this year as before. The first part of the form requires entering information about:

- cargo volumes;

- product names;

- parameters and characteristics of products;

- sender;

- consignee.

Due to this part, the consignment note used for cargo transportation provides grounds for writing off the shipped cargo from the shipper's warehouse, as well as confirming its arrival at the recipient. That is why this part of the document is called commodity. The second part is already transport. Here you enter information about:

- transportation;

- transport company;

- driver;

- the brand of the car used;

- delivery kilometers;

- transportation time;

- product, etc.

Also, the second part of the document is used to describe the cost of cargo transportation, according to which payments are made between the parties to the contract for the services provided. In reality, the consignment note has many nuances and features that should be strictly observed when filling it out.

How does a carrier fill out a waybill?

Section 6 and Section 7 . Signed by the carrier driver.

Section 8. Here the carrier enters a fee for storage in a warehouse, a fine for delay in export, etc.

Section 9. Here indicate the date of the order, the name, position of the person who accepted the order and his signature. Within three days after this date, the carrier must review the application.

Section 10. Indicate the names and contacts of the carrier and its driver.

Section 11. Vehicle details and type of ownership: owned, rented or leased.

Section 12. Comments Section.

Section 13. Number, date and period of validity of the transportation permit, information about the route - if we are transporting dangerous or large cargo, the driver’s operating mode.

Section 14. If the delivery address changes, the driver enters a new one here.

Section 15. Signature required.

Section 16. Cost of delivery services, freight charges and calculation method, transportation costs, VAT. The name, address and bank details of the parties are also entered here, along with the signatures of the responsible persons.

How the consignee fills out the waybill

Section 7. The recipient accepts the cargo, inspects it and then, in the presence of the carrier, enters the following data into the papers:

- the day and time of arrival of the vehicle to unload the goods, the day and time of departure of the empty vehicle;

- condition of the cargo, packaging, seals, etc.; if the cargo arrived in a sealed container with seals, the condition may not be checked, and if the seals are broken, you will have to open the container and describe the condition and number of goods;

- cargo weight - the weighing method must be the same as when sending;

- number of cargo places.

Section 17. If any of the parties has any complaints about the transportation or condition of the cargo, comments should be entered here. If the comments are extensive, then they draw up an act listing the claims, and in section 17 they enter only the number of the act and explain that the comments are given in it.

How to correct an error in a bill of lading

If you made a mistake when filling out a document, you do not need to rewrite everything. You can make a correction directly on the paper form:

- cross out the text with an error with one line, but so that it can be read;

- make the correct entry next to it;

- mark “Corrected” and indicate the date of correction;

- sign the edit, decipher the signature.

There is no need to paint over text with an error using whitewash or shade it completely - this may become the basis for a claim from regulatory authorities.

What does an invoice mean for accounting?

The Federal Tax Service warns that the invoice confirms delivery costs in accounting and tax accounting only if Section 16 on the cost of services and the calculation procedure is filled out correctly. If the section is empty or there are errors in it, then you will need another accounting document (letter from the Federal Tax Service dated 04/19/21 No. SD-4-2/ [email protected] and dated 02/20/21 No. SD-3-3/ [email protected] ).

The Ministry of Finance believes that a waybill is necessary to confirm the delivery agreement. But the courts believe that due to the absence of a consignment note, the contract of carriage cannot be declared invalid - other evidence is simply needed. The Federal Tax Service took into account the opinion of the Supreme Court and the provisions of Art. 252 of the Tax Code of the Russian Federation and decided that in the absence of a waybill or if it is filled out incorrectly, an organization or individual entrepreneur can submit other documents that indirectly confirm expenses. These can be contracts, invoices, bills of lading, and invoices.

To simplify accounting and work with primary documents, connect the Kontur.Accounting web service. The system makes it easy to maintain accounting and tax records, exchange documents, calculate taxes and salaries, automatically generate reports and send them via the Internet. All beginners can test the system for free for 14 days.

Number of copies of TTN

The consignment note consists of two sections:

- The first, commodity, refers to everything associated with a product;

- The transport section contains information related to the cargo carrier.

The waybill is always issued in 4 copies. The consignee fills out all 4 copies of the consignment note , and leaves the first copy of the consignment note It serves as the basis for deregistration of transported inventory items (TMV). In this case, the consignment note plays the role of a primary document in the formation of the expenditure side of the balance sheet.

The remaining three copies of the TTN are handed over to the forwarding driver. The main requirement is that these copies must be signed by those present (the driver and a representative of the shipper’s company) and certified by the seal of the shipper’s organization.

the second copy of the consignment note to the recipient of the cargo. This copy serves as the basis for registering received goods.

The third and fourth copies of the TTN are certified by the consignee with the signatures and seal of the organization and handed over to the driver. The driver submits these copies to the accounting department of the motor transport enterprise. One copy of the TTN serves as the basis for issuing an invoice to the client (the customer of the cargo transportation) and is sent to him along with the invoice for payment for services. The last, fourth copy of the TTN form is attached to the waybill and serves as the basis for calculating wages to the driver who delivered the cargo.

An important detail: since the TTN serves as the basis for the payment of wages, it must be issued separately for each flight, regardless of the homogeneity of the goods transported. The driver loaded up and received a TTN. I unloaded and submitted the TTN to the accounting department. 1 flight – 1 TTN.