Every accountant needs to know in which account (sub-account) to record office supplies in order to keep records correctly and remove the finished materials from balances on time. Only at first glance it may seem that these are little things that you don’t have to bother with. But in fact, even experienced specialists make a lot of mistakes when they try to reflect all the movements of the office. Moreover, different professionals talk about different things, and each of them bases their decision on the laws and requirements of the tax office. Let's remember the general rules that should be used to avoid complaints and fines from inspection authorities and figure out how best to reflect such operations.

Receipt of stationery: what applies to them

In accordance with Instruction No. 157 and paragraph 118, the office may include:

- paper;

- pens;

- rods;

- pencils;

- folders;

- paper clips;

- stapler;

- printer ink.

These are the basic items that can always be classified as stationery, but in reality there are many more. Sometimes they are defined as products that are used for correspondence or paperwork, but this is not a complete formulation.

In accordance with it, the office includes:

- drawing and school supplies (ready sets, rulers, pencil cases);

- office equipment (typewriters, scanners, calculators).

In addition to all this, the work of the enterprise is almost always associated with printing and preparing materials for storage. Therefore, this also includes:

- cross-linking agents;

- stamped goods;

- special threads in some cases;

- glue.

Separately, it is worth noting a few more items of inventory, which are also classified as CT:

- accounting books;

- plastic stationery;

- photocopying and duplicating equipment;

- paper cutting devices;

- means that provide a protective coating on sheets of paper;

- equipment for destroying documents;

- storage cabinets;

- hole punchers.

Accounting for stationery in accounting

It is worth noting that if a non-financial asset is classified as an office, this does not mean that it should automatically be classified as inventory. The main criterion for whether to count it as fixed assets or as inventories is the period of use. It is important to understand whether the item will be used constantly, repeatedly or only once.

How to lead correctly

They are usually accepted in the format of inventories (inventories), credited at the actual cost of the purchase, in other words, according to the amount of money spent on the purchase:

- in accordance with the invoice issued by the supplier;

- According to the traveler’s reporting, a receipt is attached to it if the employee bought “stationery” on a business trip.

Reception is issued according to the PKO (cash receipt order), which has form No. M-4. The movement will be reflected in accounting cards according to f. No. M-17. Everything is divided by type, product groups and other characteristics. The storekeeper fills out these documents according to the receipt and expenditure documentation, which is provided to him on the day the business operation is carried out. At the end of the month, balances are calculated and signed by an accountant after reconciling the analytical data with the actual data.

Why draw up an act for writing off office supplies?

A common mistake many companies make is that the regular purchase of office supplies is considered an expense at the time of purchase. This is incorrect, because in the event of a sudden tax audit, the inspector of the supervisory service will not recognize expenses for office supplies issued in this way, which in turn will lead to additional income tax. The correct basis for writing off this category of inventory items would be the execution of a special act.

Thus, the act of writing off office supplies allows you to legally classify the funds spent on the purchase of “stationery” as expenses of the enterprise and justify the removal of material assets from the register. It also allows you to reduce the tax base of the organization by the entire amount of expenses incurred on office supplies.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Stages of the process of registering the purchase of office supplies

The procedure for registering expenses for office supplies consists of several stages.

- First, a purchase, in which a cash and sales receipt, as well as a receipt order, must be received.

- Next, the office supplies are sent to those departments that need them (here the requirement is an invoice, without indicating the purpose of the inventory items).

- The final stage is the act of writing off office supplies.

How is this enshrined in law?

There are guidelines that indicate how to take these values into account. This is all included in paragraph 49 of the instructions:

- if they were purchased for cash or non-cash, then a receipt order is drawn up using a special form. No. M-4;

- everything will move around the warehouse according to types, varieties, colors, shapes and other differences, written in cards according to f. No. M-17, they are set up for each type of material separately.

All documentation will have to be maintained by the MOL (financially responsible person) on the basis of receipts and expenses with the date stamped when exactly the business transaction occurred, so that the CT can be taken into account at this cost.

Receipts are made through debit 10, which is called “Materials”. Then, according to the Instructions, the organization can independently determine subaccounts for each type of inventory. Therefore, in one accounting account it appears 10.01, which is responsible for CT, and in the other it is 10.09, necessary for other goods.

Table showing which subaccount is allowed to be used and how to properly capitalize various stationery items

| Dt | CT | What does it mean | Supporting documents |

| 60.01 | 51 | Paid to supplying company | Extract |

| 10.01 | 60.01 | Accepted | TN, filled in according to f. M-4 |

| 19.03 | 60.01 | Input VAT is taken into account | SF is added to the previous one |

| 68.02 | 19 | VAT accepted | Another invoice |

| 71 | 50 | Employees who go on business trips are given money | RKO |

| 10.01 | 71 | Acceptance of office from a traveler | A sales receipt is issued and supported by the case |

| 50 | 71 | Funds that accountable persons did not spend are returned | PKO |

Documenting

The biggest difficulty that arises in the process of purchasing office supplies through accountable persons is the availability of necessary supporting documents (clause 56 of the Methodological Guidelines for Accounting for Inventory Production). In addition to drawing up an advance report, the accountable person must provide documents confirming payment and documents that allow you to determine a specific list of purchased goods:

- cash receipts, receipts for a cash receipt order, sales receipts (confirm payment);

- sales receipts, invoices, store invoices (confirm the range of goods).

Particular attention should be paid to sales receipts, which must contain all the details of the primary accounting documents given in Law No. 402-FZ “On Accounting” and contain a breakdown of the purchased goods by name: pens, office paper, notepad, stapler, etc. The general name “stationery” on a sales receipt is unacceptable!

When stationery supplies are received by an organization, a receipt order No. M-4 is drawn up for them (approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a) or another primary document approved by your organization.

When releasing office supplies to users from the warehouse, a demand invoice (form No. M-11) is drawn up. You can save office supplies as expenses during their release in one of the following ways:

- at the cost of each unit;

- at average cost;

- at the cost of the first in time acquisition of inventories (FIFO method);

- at the cost of recent acquisitions (LIFO) - this method can only be used in tax accounting.

To which account should stationery be attributed and how to take it into account?

The main one is 10, called “Materials”. Their appearance should be recorded as a debit on subaccount 10.09, but there are other options.

Regardless of the type of payment, the transactions should be entered in the following form:

| Procedures | Dt | CT | According to what |

| Office costs are paid | 60 | 51 | Documentation from the bank is attached |

| Everything is moved to storage areas | 10.09 | 60 | PKO f. M-4 or invoice from the supplier signed by MOL |

| VAT on the purchase of office supplies | 19 | 60 | SF from the supplying organization |

| Accounting for incoming VAT | 68 | 19 | |

| Processed by JSC | 60 | 71 | Advance documentation |

| Credited to CT | 10 | 60 | F. M-4 |

| Input VAT | 19 | 60 | Papers that confirm arrival |

| VAT included | 68 | 19 | A receipt showing VAT separately |

To which subaccount should I assign stationery and how to capitalize them later?

Organizations operate in two different ways:

- each item indicating price and quantity;

- a homogeneous group is isolated; as an example, different folders or writing instruments can be cited.

It is worth remembering that method 1 is more reliable; tax authorities have no questions about it. It is easy to use if you purchase a lot of office supplies, but it is sent to employees gradually, in small portions. Another advantage of the method is that you can calculate the need to ensure a normal workflow.

The main entries will be associated with accounts Dt 10 and Kt 60 and 71. There is no big difference in which sub-account everything is credited to, the main thing is to reflect your desire to conduct business in a certain way in the UP.

We count the entire receipt as one piece

If this option was chosen, then everything is credited as 1 unit and will be written off the same way. To use this method, you need to issue an order, on its basis the office will be accepted and immediately left for needs.

In this case, the PKO is attached to a copy of the delivery note from the supplier, this will allow the receipt to be tracked if necessary.

To deregister, employees’ applications are attached to an invoice or other similar document.

Among the advantages is ease of use. But this method can provoke a lot of questions from the tax inspectorate.

Acceptance by quantity

This is another option that is not used as often. Here only the purchased volume will be counted, without names or forms. It will look like “Stationery, 15 pcs.” This is convenient, but can create issues due to the large difference in cost. For example, disposing of one chair will cost many times more than a ballpoint pen.

How to keep records without counting 10

In practice, sometimes accounting is carried out without “Materials”. Typically, this method is chosen when it is planned to immediately use CT for the needs of the company. And these expenses can be recorded as services as expenses. All this is recorded in accounting entries, where Dt is 25-26 and 44, and Kt is considered as 60 and 71.

If only small amounts are used in this algorithm, then the tax authorities will not have any questions. But if a lot of money is regularly spent on this and the article is often repeated, then such an error will provoke the interest of inspectors.

Difficulties may also arise if it is necessary to deduct the amount of input VAT, because the purchase was not accepted for accounting according to the rules.

Another difficulty is trying to track what exactly was spent and in which workshop or department. When checking, it will be very difficult to understand which employees are ordering too much, and which departments are purchasing too much and is costly and unjustified.

How to save on office supplies?

Not all companies know how to take control of office supply costs, while nothing is simpler.

Many people mistakenly believe that it is enough to budget for office supplies for each department, department, business area or branch, focusing, for example, on an expert assessment, or on the actual average for previous months. And they think that by controlling this amount when paying bills during the month, they thus keep the costs of office supplies under control.

However, it is not. This type of budgeting approach will never allow you to truly keep your office supply costs “under control.” It will be common for you to have a situation where, having planned one amount in the budget, you will in fact receive an invoice for a larger amount. And they will always explain to you why the amount is exceeded. And they will do it with reason. They will cite the move, the arrival of new employees, the increase in paperwork, and who knows what else. Although there can be only 2 objective reasons for the fact to exceed the plan when it comes to stationery, and more on them below.

Therefore, we forget about all the ways to plan expenses for stationery, except one.

Limit on stationery.

There is only one simplest and surest way to really properly plan and keep office supply costs under control - setting a limit on office supplies .

You only need 2 limits:

- for 1 already working employee - this is an employee who has worked in the company for more than a month,

- per 1 new employee, i.e. just hired, because the first purchase of stationery is usually the main one and, therefore, the most expensive. It is clear that the amount of this limit will be higher than the first.

IMPORTANT: set a limit on office supplies per 1 employee. Once again: PER ONE EMPLOYEE. Why not to the department? Yes, because today you have 5 people working in your department, and tomorrow there are 15, and the day after tomorrow there is a crisis, layoffs, and there are 7 people left. And what? Will you review the department limit each time? This is not practical.

IMPORTANT: there must be only 2 of the above-mentioned limits. There is no need to create limits for different positions, for different departments, mistakenly thinking that some official or department will not meet the established limits. Believe me: they will manage to do it. And there will still be more. And the General Director, I assure you, actually needs less office supplies than an ordinary employee. And if the General Director wants an expensive writing instrument, then this is a production necessity. This is a one-time situation. Therefore, for God’s sake, buy expensive writing instruments for your managers, but the amount of the limit on stationery has nothing to do with it.

IMPORTANT: understand that the indicated 2 limits on office supplies do not include the cost of purchasing printing paper. Paper, as a rule, is purchased in boxes, and the cost of such a box itself is high and you will not meet any limit if you include printing paper in your purchase. Expenses for printing paper should be planned separately from the limit on stationery. And it’s better also according to a separate limit based on the number of packs per department, for example. Or an employee. Decide for yourself here. There are departments in which 1 employee will use 1 pack of paper for several months, and there are those in which a pack can fly away in a day. You can get very confused with this issue and install office equipment that will count the number of sheets actually used, and even by department, but be prepared that its cost and the cost of consumables for it will never pay off your desire to save on paper. Or you can not bother with the limit on paper at all and buy it based on considerations of rationality, relying on your employees. It’s difficult to drag a stack of paper out of the office. And who needs it, anyway? You will calm yourself with this))

How to set a limit amount for office supplies?

The limit amount for office supplies must be adequate. It should not be overestimated, but it should not be underestimated either. If you increase the limit under pressure from your employees, you will not only spend more money each time, but will also provoke a situation where there will be an excess of office supplies and they will simply start “dragging” them from the office. If you set an unreasonably low limit on office supplies, you will not save on costs, but will be forced to:

- listen to an explanation every time why the limit has been exceeded,

- cause negativity on the part of employees who, when ordering stationery, will worry that they won’t have enough.

It is also a mistake to set a limit on office supplies as a single amount for the entire company, for example, 15,000 rubles. per month. Then, if the limit is exceeded due to an increase in the number of employees due to business expansion or for some other reasons, this limit will have to be reviewed each time and the excess will be justified.

I will give an example of limit amounts for stationery , based on practice.

The adequate amount of the limit on stationery for a company in Moscow before the 2008 crisis (without expenses for printing paper) was:

- 600 rub. per month per 1 working employee

- 1,200 rub. per month for 1 new employee.

During the crisis, the limit on stationery was revised and amounted to:

- 450 rub. per month per 1 working employee

- 900 rub. per month for 1 new employee.

As of May 2013, everyone continues to comfortably fit into these amounts.

The limit on stationery is set for a year. An office supply limit set at the correct amount may not change for several years. Just remember to confirm it every year.

How to budget for office supplies?

Once you set a limit on office supplies, you will never again wonder: “How to budget for office supplies?” So you will do it like this:

Stationery expenses =

= limit amount per 1 already working employee multiplied by the number of already working employees +

+ the amount of the limit per 1 new employee multiplied by the number of employees who are planned to be hired in the planning period

What to do if you actually receive an overspend on office supplies?

If your company has established limits on office supplies and in fact there is an overrun, then there can only be 2 reasons for this:

- hiring of new employees to the staff of the central center, whose exit was not foreseen when planning the budget,

- supplier price increase.

Everything is transparent. Controlled. Reason to ask a question to the supplier.

Do I need to create a reserve for office supplies?

Here we mean the reserve not in monetary terms, but in kind. Each company decides this issue in its own way, but in 99 cases out of 100, of course, a certain amount of office supplies should be in reserve in case of unexpected departure of a new employee, in case some office supplies are suddenly used up (and staples in a stapler always run out suddenly ), and the purchase will be a little later, etc. Responsible for the reserve of stationery, as a rule, is the administrative and economic department.

This is awesome for stationery! :-) If I missed something or you have a different experience, please write to me via the feedback form on the “Contacts” page.

Return to list of articles

How to document the purchase and use of office supplies

There are two options to purchase and arrive:

- piece by piece;

- homogeneous groups.

A predetermined method should be noted in the company's accounting policy and always adhered to.

When CT scans are transferred to the person responsible for the materials, a certain action has to be taken:

- draw up a special receipt order using the unified form No. M-4;

- On the invoice that arrived from the supplier, put a stamp where the name of the company, the date of receipt of the MC and the cash register number will be entered.

In the second case, the responsible employee must sign this document. The cost of goods used will be expenses according to PBU 10/99, that is, it is considered that these are ordinary activities of the organization.

When they are issued to employees, they are written off in accordance with the drawn up invoice requirement according to f. M-11.

To simplify work and increase efficiency, it is worth having appropriate programs that will facilitate the preparation of documentation. To make it easier to choose among the variety of software, we recommend contacting Cleverence. Our specialists will help you find the right software for your business that automates work processes by combining the work of accounting systems and equipment, for example, data collection terminals. So, for those who use 1C: Accounting there is a software product called “OS Inventory”.

Write-off of stationery

All that remains is to figure out which accounting account to assign the spent office supplies to. Here it is worth remembering that this group of material assets is directly involved in the main activity. Therefore, you can write it off to your account. 26, which is responsible for general business expenses, and 44, which reflects sales costs.

When they are given to employees, they are taken from the warehouse. To do this, you need a demand invoice, which is filled out according to f. M-11. Another option is to use a standard form that the company developed specifically for this task, but in this case the document must be included in the accounting policy and always be used. It is imperative to indicate the cost of the CT scan as of the date on which the issuance took place.

In which accounting account should stationery items subject to write-off be reflected?

The accounting entry will look like this:

- Dt 26 or 44 - the amount is indicated for everything that was transferred for use.

The simplified version has a slightly different algorithm. They can legally write off all costs to standard and core activities immediately after acquisition. For this reason, they do not issue transfers to employees. All amounts will be recognized upon payment.

What the postings for writing off the office will look like - sample acts

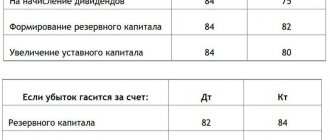

If “stationery” was accounted for as production inventories, then the company has the right to completely remove them from the balance sheet when they are issued to the employee. There is no further control. This is formalized as Dt 91-94 and Kt 209.

As we have already said, if an item is issued from a warehouse, then form M-11 is filled out, which will become the basis for drawing up a write-off act. It can be written in any form, the main thing is that it is signed by MOL. It is also important to indicate all the names and costs of accessories.

The order in which CT will be written off

After we have figured out what account to include office supplies in, it is worth finding out how they are deregistered. When writing materials are transferred from the warehouse to responsible employees, it is necessary to complete the following paperwork:

- limit-fence card according to f. M-8;

- invoice-request M-11;

- invoice, which is drawn up in the interindustry form M-15.

Sometimes accounting includes refilling cartridges here, but this is the wrong approach. This is what pp. says. 2 from clause 1 in Article 254 of the Tax Code of the Russian Federation. These costs should be translated into material costs.

It remains to understand which accounting account to include the office that has served its purpose. First, a corresponding act is drawn up. It must include:

- consumption standard, if available;

- name and amount of costs;

- where everything was spent;

- price per piece and all items;

- additional information if required.

In accounting it will look like this:

| Dt | CT | Description | Base |

| 26 | 10.01 | Pens written off | Request-invoice |

What the documents will look like and who will sign them is established by internal regulations - instructions, orders, regulations.

How to work with VAT

We already know which accounting account to put office supplies into, but it is important to remember about taxation. Each company has the right to deduct all VAT charged to them by sellers. All this is done on the basis of pp. 1 and 2 tbsp. 171 of the Tax Code of the Russian Federation.

Everything must be written down on a separate line in all settlement documents in accordance with Art. 168 Tax Code of the Russian Federation. The deduction occurs in accordance with paragraph 1 of Art. 172.

Tax applied to corporate profits

The cost of CT should be included in other expenses, this occurs on the day when they are transferred to employees for use, this is indicated in Article 264. Tax Code of the Russian Federation.

What do they pay under the simplified tax system?

Each company that operates according to this principle reduces its income by all incurred expenses specified in Art. 346. The office also belongs here if it complies with Article 264 of the Tax Code of the Russian Federation. VAT amounts are also included in costs, but they must be entered on a special line. Their cost is recognized as part of the amount spent after payment.

Rules for drawing up an act for write-off of stationery

The act can be drawn up on the organization’s letterhead or on an ordinary A4 sheet - it doesn’t matter, nor does it matter whether it is handwritten or printed on a computer.

The only condition: it must contain “live signatures” of the persons responsible for the write-off.

It is not necessary to affix a seal, since since 2016 legal entities have been exempted from the need to use them in their activities.

After drawing up the act and recognizing the expenses for office supplies in the company’s accounting and tax records, the document is transferred for storage to the archive of the enterprise, where it must be kept for at least three years.

Can I return it to the supplier?

It depends on the conditions under which they were purchased. It is important to determine in advance who bought and what is not suitable for CT. If the purchase was made privately by an individual for use, then the law “On the Protection of Consumer Rights” applies, which confirms the possibility of returning low-quality items or items that do not meet expectations.

But when registering such an operation by an enterprise, problems arise, since the Civil Code does not provide for the possibility of returning or changing quality goods. And the law that protects individuals has no effect on companies. We have to hope that the seller will meet you halfway.

We looked at what account office supplies go to, where to include their receipt, how to spend and write them off. This is a simple operation, but it raises questions and disputes among many specialists. We advise you to adhere to accounting by quantity in order to attract the interest of the tax authorities. This method will help you get rid of the difficulties with counting balances, controlling them and spending them.

In the video you can see how inventory is carried out in a warehouse using TSD and Warehouse 15 software from Cleverence.

Number of impressions: 47228

Posting - materials were purchased by an accountable person by proxy

If material assets were purchased by an employee by proxy from a seller who does not pay VAT, then the entries are as follows:

- Dt 71 Kt 50 (51) - money was given to the accountant;

- Dt 10 (15, 41) Kt 60 (account for accounting of settlements with suppliers) - reflects the receipt of material assets from a specific supplier;

- Dt 60 Kt 71 (account for accounting of settlements with accountable persons) - the accountable person paid these values to the supplier;

- Dt 50 Kt 71 - unspent accountable amounts were returned to the cash desk.

When an employee purchases materials by proxy from a VAT payer seller and has an invoice in the name of the purchasing organization, the accounting entries are as follows:

- Dt 71 Kt 50, 51 - money was issued on account;

- Dt 10 (15, 41) Kt 60 “Settlements with suppliers and contractors” - purchased goods and materials from a specific supplier (the cost of material assets is reflected without VAT);

- Dt 19 “VAT” Kt 60 “Settlements with suppliers and contractors” - VAT on acquired assets is reflected;

- Dt 68.2 “Calculations with the budget for VAT” Kt 19 “VAT” - VAT on acquired assets is accepted for deduction;

- Dt 60 (account for settlements with suppliers) Kt 71 “Settlements with accountable persons” - the accountable person paid these assets to the supplier;

- Dt 50 Kt 71 (mutual settlements with accountables) - unspent accountable amounts were returned to the cash desk.