A number of organizations carry out operations for the acquisition and sale of goods without posting them to their own warehouse: the goods are delivered in transit from the supplier’s warehouse to the final buyer’s warehouse. Let's consider the features of documentation, accounting and taxation of this kind of transactions in the field of wholesale trade.

Transit trade represents two transactions independent of each other: a trading company enters into a contract for the purchase and sale of goods with a supplier (manufacturer, importer, etc.), on the basis of which it undertakes to pay for the purchased goods, and the supplier undertakes to ship the goods to that warehouse , which the trade organization will indicate, and a separate agreement with the buyer of the goods, within the framework of which he undertakes to supply the goods for a fee. In this case, the trading company will act as the buyer of the goods in the first contract, and as its seller in the second.

The peculiarity of transit trade agreements is as follows.

Under the first agreement, the trading organization transfers funds to its supplier for the goods. Their consignee under the contract is the final buyer. This method of trade is possible due to Art. 509 of the Civil Code of the Russian Federation, since the supply of goods can be carried out by the supplier, including through their shipment (transfer) to the person specified in the contract as the recipient.

In this case, the goods do not actually arrive at the warehouse of the trading organization (in practice, the transit supplier may not even have a warehouse, because for the deliveries in question its presence is not required). Despite this, the organization acquires ownership of the goods supplied.

Under the second agreement, the transit supplier receives money from the buyer for the goods transferred. The shipper is the supplier of the goods under the first contract, and not the wholesale trade organization.

In the case under consideration, when purchasing goods, the supplier’s obligation to transfer the goods to the buyer (in this case, the “transit” seller) is considered fulfilled at the moment the goods are handed over to the carrier for delivery to the final buyer (clause 2 of Article 458, clause 5 of Article 454, clause 1 Article 509 of the Civil Code of the Russian Federation).

When selling goods, the obligation of the organization - the “transit” seller to transfer the goods to the final buyer is considered fulfilled at the moment the goods are delivered to the buyer, since the purchase and sale agreement provides for the seller’s obligation to deliver the goods (clause 1 of Article 458 of the Civil Code of the Russian Federation).

Determining the moment of transfer of ownership of goods

When trading goods in transit, it is necessary, based on the terms of a specific supply agreement, to determine the moment of transfer of ownership of purchased goods from the supplier to the trading organization and from the transit supplier to the final buyer.

This will allow the parties to the transaction to distribute between themselves the risks of loss of property, and the trade organization will provide the opportunity to correctly determine the date of sale of goods in accounting and tax when applying the accrual method.

As a general rule, ownership of goods arises from the moment of their transfer (Clause 1, Article 223 of the Civil Code of the Russian Federation). The transfer of goods is their delivery. In the case under consideration, the organization cannot directly transfer (hand over) the goods to the buyer, because it does not physically receive them at its warehouse.

If the goods cannot be transferred personally (handed over) to the recipient, the moment of their transfer is the delivery of the goods to the first carrier for delivery to the recipient (Clause 1 of Article 224 of the Civil Code of the Russian Federation). During transit trade, the organization does not transfer the goods to the carrier. This is done by the supplier when sending goods from its warehouse. Then the moment of transfer of goods to the first carrier can be confirmed by a notification from the supplier about their transfer to the carrier with shipping documents attached to it.

Depending on the moment of transfer of ownership between the parties to the contracts, the date of receipt of income by the trading organization may be determined differently.

When ownership of goods is transferred to a trading organization at the time of their shipment from the supplier’s warehouse, and to the final buyer at the time the goods arrive at his warehouse, the organization’s income in accounting and tax accounting when applying the accrual method will appear on the date of transfer of goods upon their delivery to buyer's warehouse.

If ownership of goods passes to a trading organization at the time of their shipment from the supplier’s warehouse (for example, in the presence of a representative of the organization) and is immediately transferred to the final buyer (through the carrier or the final buyer’s representative at the supplier’s warehouse), then income will appear immediately after the transfer of the goods to the carrier.

If the contract stipulates that the delivered goods are received by the final buyer for safekeeping, and ownership rights are transferred to him only after full payment, then the income of the trading organization will be considered received after the final payment of the final buyer.

Seal imprint on documents

For all primary documents, details that must be specified are defined. This rule applies equally to documents that are drawn up when selling goods. All these details are specified in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ. The presence of a seal imprint is not mentioned in them. That is, regardless of whether there is a stamp on the primary document or not, it can be accepted for accounting.

However, keep the following in mind. If the manager has approved unified forms for use, then in each document where a seal is provided, it must be affixed. After all, for each unified form, it is usually specified in the instructions for filling it out that the presence of all the details in it is mandatory. Including the impression of a seal or stamp. For example, such an indication is in paragraph 2 of paragraph 2 of the instructions approved by Decree of the State Statistics Committee of Russia dated November 28, 1997 No. 78, for the consignment note in form No. 1-T. The same applies to independently developed forms: if they provide space for a seal imprint, then a stamp must be placed.

And in general, by the way, printing is never superfluous. If it is on the document, then this additionally certifies the powers of the representatives of the parties to the transaction.

Attention: when a seal is provided in an independently developed form of a document, but a seal is not affixed, then there will be insufficient evidence that the obligations have been fulfilled. If, in addition, there are no signatures of authorized employees, then such a document cannot be recognized as primary at all.

For example, the seal and signature of the buyer’s representative in the delivery note in form No. TORG-12 serve as confirmation that the goods have been received. If they are missing or falsified, the goods are considered not received by the buyer.

Often the contract states that ownership passes from the moment the goods are received. It turns out that if there is no signature on the invoice, the goods will formally still be the property of the seller. It will not be possible to request full or partial postpayment for this product.

This conclusion, in particular, was made in the decisions of the Federal Antimonopoly Service of the West Siberian District dated April 20, 2006 No. Ф04-2185/2006(21507-А70-9) and dated May 16, 2007 No. Ф04-2820/2007(34070-А03 -38).

Preparation of primary documents

- Packing list

The primary accounting document used to register the sale of goods may be a consignment note (form No. TORG-12), which is generally drawn up in two copies.

The first remains with the organization handing over the goods and is the basis for its write-off, and the second is transferred to the buyer and is the basis for the receipt of the goods. In the situation under consideration, the organization—the “transit” seller—has concluded two contracts: with the supplier for the purchase of goods and with the buyer for the sale of goods. Consequently, as a result of these transactions, the organization must have two invoices, while the original supplier and the final buyer will have copies of different invoices. In this case, the “transit” seller does not receive the goods at his warehouse and does not release them to the buyer, therefore, he is neither a consignee nor a consignor.

Since the invoice confirms the transfer of ownership, in the invoice issued to the buyer, the trade organization must reflect the dispatch of goods to the buyer in transit. This goal is achieved by correctly filling out the details of each of the invoices.

The invoice issued by the transit supplier must indicate:

- in the lines “Supplier” and “Consignor” - the supplier organization;

- in the line “Payer” - the organization - the “transit” seller;

- in the line “Consignee” - the final buyer;

- in the line “Base” the details of the supply agreement concluded between the supplier and the “transit” trade organization are indicated;

- in the line “Cargo released” the signature of the responsible person of the supplier is placed;

- The lines “Cargo accepted” and “Cargo received by consignee” are not filled in.

Such registration of the invoice confirms that the supplier has fulfilled its delivery obligations under the contract to the final buyer specified by the trade organization.

The supplier draws up the specified invoice in two copies on the date of shipment of the goods to the address of the consignee (final buyer).

Before the goods are shipped, the organization - the “transit” seller hands over to the supplier its invoice for the buyer, which indicates the sale price of the goods (and not the price at which the goods were purchased from the supplier).

This invoice is also drawn up in two copies and is handed over by the supplier to the carrier as accompanying documents.

This invoice can be issued in the following order:

- in the line “Consignor” the details of the original supplier are indicated;

- in the line “Supplier” - “transit” seller;

- in the lines “Consignee” and “Payer” - the name of the final buyer;

- in the line “Base” - details of the supply agreement concluded between the trade organization and the buyer of the goods;

- the line “Cargo released” is not filled in;

- the line “Cargo accepted” is filled in by the carrier’s representative (note that in practice it is also possible not to fill in this detail if the carrier refuses to fill it out);

- in the line “The cargo was received by the consignee” the signature of the buyer’s responsible person is placed.

After shipping the goods to the buyer, the supplier will have to transfer to the organization - the “transit” seller the original copy of the invoice issued to him.

In turn, the final buyer must give the “transit” seller a signed copy of the invoice drawn up in his name by this organization. As a result, the “transit” seller will have both versions of documents, and the initial supplier and the final buyer will have copies of different invoices: the original supplier will have an invoice under the agreement between him and the “transit” seller (as a buyer), the final buyer will have one between him and a “transit” seller (in the role of a seller). During transit trade, when the trade organization and the supplier do not meet during the fulfillment of contractual obligations and the goods do not arrive at its warehouse, primary documents (contracts, delivery notes, invoices, etc.) are sent by mail or sent by courier. The same should be done if the transit supplier does not have the opportunity to transfer shipping documents to the buyer through the carrier. They should also be sent to the buyer by mail or sent by courier.

- Waybill

The consignment note contains a special line “Billing note”, which indicates the details of the corresponding waybill.

Depending on the type of transport used for delivery, these will be:

- waybills - for delivery by road;

- railway transport invoices - for delivery by rail;

- port bill of lading - for sea transportation;

- sender's waybill and cargo waybill - for delivery by air.

Transport documents must contain marks from the shipper (supplier) about the shipment of the goods and the consignee (the final buyer) about receipt of the goods, which serves as confirmation that the goods have actually been received by them.

This is also necessary for the timely reflection of transactions for the registration of transit goods, depending on the conditions for the transfer of ownership rights enshrined in the contracts of the trade organization with the supplier and the buyer.

To account for the movement of inventories and payments for their transportation by road, currently you can use a consignment note (approved by Decree of the Government of the Russian Federation of April 15, 2011 No. 272) or a consignment note f. No. 1-T (approved by Resolution of the State Statistics Committee of Russia dated November 28, 1997 No. 78). Both of them confirm the conclusion of a contract for the carriage of goods (Clause 1, Article 8 of the Federal Law of 08.11.07 No. 259-FZ “Charter of Road Transport and Urban Ground Electric Transport”).

Typically, the invoice is issued in four copies, the first remains with the shipper (in the case of transit trade, he is the supplier of the goods) and is intended for writing off the goods.

The second, third and fourth copies, certified by the signatures and seals (stamps) of the shipper and the signature of the driver, are handed to the driver. The second copy is handed over by the driver to the consignee (the final buyer), it is intended for the receipt of goods.

The third and fourth copies, certified by the signatures and seals (stamps) of the consignee, are handed over to the organization that owns the vehicle.

The organization that owns the vehicle attaches the third copy, which serves as the basis for calculations, to the invoice for transportation and sends it to the customer of the vehicle.

If, under the terms of supply contracts, the delivery of goods is carried out at the expense of a trade organization, it is also the customer and payer under the contract for the carriage of goods. In this case, when filling out the invoice, in the “Payer” line, indicate the full name of the organization carrying out transit transactions, its address, and bank details.

The fourth copy of the invoice is attached to the waybill and serves as the basis for accounting for transport work and calculating the driver’s wages in a motor transport enterprise.

As you can see, each of the four participants in the transaction will have one original invoice on hand.

If the delivery of goods in accordance with concluded supply agreements is carried out not by a wholesale seller, but, for example, by a supplier of goods or by the final buyer, then the name of the customer organization will be indicated in the “Payer” line.

In this case, the trade organization must have a copy of one of these invoices.

It is its presence that confirms the fact that the supplier has shipped goods to the final buyer.

New TN form

By Decree of the Government of Russia dated December 21, 2020 No. 2200, the Rules for the transportation of goods by road were approved from January 1, 2022. And along with them - a new form of consignment note in Appendix No. 4.

REFERENCE

The conclusion of the contract for the carriage of goods is confirmed by the waybill (clause 2 of article 785 of the Civil Code of the Russian Federation, part 1 of article 8 of the Charter of Automobile Transport (UAT)).

Accounting

A trading organization is obliged to take into account goods, the ownership of which has been transferred to it, regardless of their receipt at its warehouse.

Instructions for using the Chart of Accounts provide for the posting of goods on account 41 “Goods” when they arrive at the warehouse. Since in this case the goods do not arrive at the warehouse, their recording in account 41 may be considered incorrect.

Alternative accounting of transit goods is possible on account 45 “Goods shipped”. Instructions for using the Chart of Accounts recommend using this account to summarize information on the availability and movement of shipped products (goods), the proceeds from the sale of which cannot be recognized in accounting for a certain time.

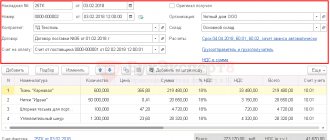

Reflection of transactions for the acquisition and sale of transit goods when using one or another account is accompanied by the following entries: D-t account. 41

“Goods” (45 “Goods shipped”),

Set of accounts.

60 “Settlements with suppliers and contractors” goods shipped by the supplier to the buyer are accepted for accounting;

Dt sch. 19

“Value added tax on acquired assets”,

Kt.

60 “Settlements with suppliers and contractors” the amount of VAT presented by the supplier of goods is highlighted;

Dt sch. 68

“Calculations for taxes and fees”, subaccount.

“Calculations for VAT”, Set of accounts.

19 “Value added tax on acquired assets” the presented amount of VAT is accepted for deduction;

Dt sch. 62

“Settlements with buyers and customers”,

Set of accounts.

90 “Sales”, subaccount 1 “Revenue” reflects the buyer’s debt for goods in transit;

Dt sch. 90

“Sales”, subaccount.

2 “Cost of sales”, Set of accounts.

41 “Goods” (45 “Goods shipped”) the purchase price of transit goods is written off;

Dt sch. 90

“Sales”, subaccount.

3 “VAT”, Set of accounts.

68 “Calculations for taxes and fees”, subaccount. “Calculations for VAT” the amount of VAT is calculated on the proceeds from the sale of goods in transit.

Taxation

- Value added tax

In general, for the purpose of calculating VAT for a trading organization, the moment of determining the tax base for shipped goods is considered to be the date indicated in the shipping documents, i.e., the day it draws up an invoice addressed to the buyer.

When delivering goods in transit, the trade organization does not transfer the goods to the buyer and does not hand them over to the carrier. This is done by the shipper. In this case, the date of shipment should be considered the date of the first drawing up of the primary document, issued either to the carrier for delivery of goods to the buyer, or to the buyer (letters of the Ministry of Finance of Russia dated 06.22.10 No. 03-07-09/37, 04.18.07 No. 03- 07-11/110).

For the transit supplier, the date of shipment will be the date indicated on the invoice, which he will issue in the name of the buyer.

The right to deduct the amount of VAT presented by the supplier of goods arises when the following conditions are met: the goods are purchased for resale, there is an invoice from the supplier, the goods are accepted for accounting and the relevant primary documents are available.

The term “acquisition” in civil legislation in relation to property means the acquisition of ownership of the latter (Articles 212, 218 of the Civil Code of the Russian Federation). Thus, when purchasing (purchasing) goods, the VAT presented by the supplier can be deducted by a trade organization when the goods become its property, are accepted for registration, and the relevant primary documents and an invoice issued by the supplier are available.

Acceptance of goods for registration means that goods purchased from a supplier and intended for resale are reflected in the accounting of a trading organization as a debit to account 41 or 45.

The trading organization should check how the supplier of goods filled out the invoice issued in its name.

On lines 2-2b

The “Seller” invoice as the seller of goods must indicate the details of the supplier, his address, taxpayer identification number (TIN) and reason for registration code (RPC).

On line 3

“Consignor and his address” also displays the supplier’s details.

On line 4

“Consignee and his address”, the supplier must indicate the details of the final buyer of the goods.

On lines 6-6b

The trade organization, its address, Taxpayer Identification Number (TIN) and checkpoint are listed as the buyer.

When issuing an invoice in the name of the final buyer, the trade organization must also reflect the features associated with the transit sale of goods.

On the lines of the invoice relating to the seller of goods, she must enter her own details, on the line “Consignor and his address” - indicate the details of her supplier, and fill out the lines relating to the buyer and consignee in the name of the final buyer of the goods.

The trade organization issues this invoice no later than five calendar days from the date of shipment of the goods, and registers it in the sales book on the day of such shipment.

- Income tax

The date of receipt of income from the sale of goods is the date of their sale, determined in accordance with clause 1 of Art.

39 of the Tax Code of the Russian Federation, regardless of the actual receipt of funds (other property (work, services) and (or) property rights) in payment for them. Therefore, income is considered received at the moment of transfer of ownership from the trading organization to the buyer. If an organization accounts for income and expenses using the cash method, then the moment of occurrence of income is the day of receipt of funds to the current account or to the organization's cash desk, the date of transfer of property as payment for goods and other methods of repaying debt (clause 2 of Article 273 of the Tax Code of the Russian Federation). In this case, income recognizes not only payment for previously delivered goods, but also advances received from the buyer for future deliveries.

When selling goods, expenses associated with their acquisition and sale are determined taking into account Art. 320 of the Tax Code of the Russian Federation, which determines the procedure for allocating expenses for trading operations for taxpayers using the accrual method. The current month's expenses in a trade organization are divided into direct and indirect. Direct expenses include: the cost of purchasing goods sold in a given reporting (tax) period; transportation costs for delivery of purchased goods to the warehouse of the taxpayer-buyer, if they are not included in the purchase price of these goods. The cost of purchasing goods shipped but not sold at the end of the month is not included by the taxpayer in expenses associated with production and sales until the moment of their sale. The amount of direct expenses in terms of transportation costs related to the balance of unsold goods is determined by the average percentage for the current month, taking into account the carryover balance at the beginning of the month. All other expenses incurred in the current month are considered indirect in the trading organization.

In other words, there is no need to distribute them, since they completely reduce the income from sales of the current month.