UTII no longer applies!

This article describes the broken tax system.

We wrote in an article with up-to-date information which tax regimes are suitable for individual entrepreneurs. Go to new article Prepare documents according to the new rules

UTII makes it possible to save on taxes and work without an accountant. But this system is not used for all types of activities. In the article we will analyze in detail the requirements for individual entrepreneurs, the conditions and procedure for switching to imputed income.

In this article:

- Conditions for the transition of individual entrepreneurs to UTII in 2022

- Application for transition to UTII

- Step-by-step instructions for switching to imputed tax

- Formula for calculating UTII

When to submit an application for UTII

If a company or individual entrepreneur wants to use UTII in future activities and they meet the requirements of tax legislation, they should submit an application for imputation to the tax authority.

Registration for the transition to UTII is required. For information about who can use imputation, read the material “Who can apply UTII (procedure, conditions, nuances)?” .

ATTENTION! A number of constituent entities of the Russian Federation have already abandoned UTII. And from January 2021, the special regime will be abolished throughout Russia. Read more in the material “Cancellation of UTII in 2022: latest news, changes from January 1, 2022.”

For such an operation there are certain deadlines established by clause 6 of Art. 6.1, para. 1 clause 3 art. 346.28 Tax Code of the Russian Federation. In accordance with the norms of these articles, an application must be submitted within 5 days from the moment the taxpayer begins working for UTII.

The moment of transition may not coincide with the actual start of activity on UTII. There is nothing wrong with this, since the taxpayer himself indicates in the application the start date of application of this special regime. It will also be the date of registration as a UTII payer (paragraph 2, paragraph 3, article 346.28 of the Tax Code of the Russian Federation).

Example

Sigma LLC began providing car washing services on February 11, 2020. Until this date, the organization used the simplified tax system with the object “income minus expenses” in its activities. However, car washing in the region where this organization is registered as a taxpayer is subject to UTII. It was decided to switch to this special regime from March 14 - this is the date that appeared in the statement.

In order for the organization to be registered from the specified date, an application for the transition to UTII must be submitted to the tax authority within 5 working days. This period is counted from the next day after the date defining its beginning. Such rules are established in paragraph 2 of Art. 6.1. Tax Code of the Russian Federation.

In these circumstances, the period allotted for registration begins on March 15 and ends on March 22.

In other words, in order to be considered registered as a UTII payer on March 14, Sigma LLC must submit an application before March 21 inclusive.

ConsultantPlus experts have prepared answers to the most frequently asked questions from taxpayers:

If you do not have access to the K+ system, get a trial online access for free.

Rules for filling out UTII-2

There are certain requirements for completing the application that individual entrepreneurs must take into account when entering indicators in the UTII-2 fields.

Design requirements:

- When filling in manually, black or blue ink is used (various shades are possible) - the letters are written in capitals, printed;

- Data is entered into the fields, starting from the leftmost field;

- Cells without indicators are filled with dashes;

- It is possible to fill out the application on a computer - font 16-18 Courier New;

- When printing UTII-2, filled out on a computer, there may be no cell boundaries, and dashes are not necessary;

- It is prohibited to use corrective tools to edit and correct errors in filling out;

- You cannot print an application on both sides of one sheet, you cannot damage the sheets of UTII-2 in the process of fastening them.

UTII-2 can be used by an entrepreneur not only to submit information about the transfer of an activity to UTII, but also to make changes to previously submitted information.

If the transition to “imputation” is made from the middle of the year, then the single tax is calculated in proportion to the number of days of actual work on UTII.

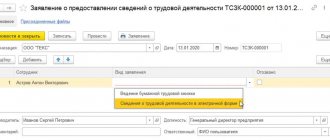

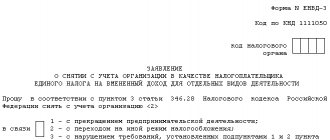

Application for imputation - 2022: sample form

The application for the transition to UTII is strictly regulated. Its form was approved by a separate circular - order of the Federal Tax Service of Russia dated December 11, 2012 No. ММВ-7-6/ [email protected] (hereinafter referred to as Order No. ММВ-7-6/ [email protected] ).

To draw up an application for UTII - 2022, a sample can be taken from Appendices 1 and 2 to the tax service order mentioned above. This possibility still exists today.

It should be borne in mind that the application form, in accordance with which registration takes place, is one for organizations - UTII-1, and another for individual entrepreneurs - UTII-2. Below are links to download these forms.

There is no need to attach additional documents to the application. The Federal Tax Service of Russia, in a letter dated September 21, 2009 No. MN-22-6/ [email protected], separately drew the attention of taxpayers to this. But this only applies to cases where the form is submitted by the taxpayer himself.

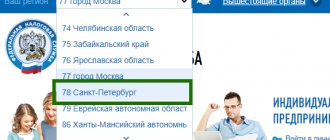

Where to submit UTII-2?

You need to notify the tax office of your desire by submitting a standard UTII-2 application form.

This form must be submitted:

- at the business address in respect of which special tax will be paid;

- at the entrepreneur's registered address.

If an individual entrepreneur transfers to UTII an activity that does not have a specific address for implementation, then a branch of the Federal Tax Service is selected according to registration. Examples of such types of activities include delivery or distribution trade, passenger or freight transportation, and advertising in transport.

An individual entrepreneur is not obliged to inform the tax office at his residence address about doing business on the “imputation” if he reported this information to the department at the place of its implementation.

Application for imputation - 2022: the form is submitted by a representative of the taxpayer

UTII-2020 - an application for the transition can be submitted by both the taxpayer himself and his representative. The possibility of attracting a representative is provided by clause 1 of Art. 26 of the Tax Code of the Russian Federation.

However, in order for the tax authority to accept the application, in this case it must be accompanied by a copy of a document confirming the authority of this person. This condition is contained in order No. ММВ-7-6/ [email protected] , in the notes to the UTII-1 and UTII-2 forms.

The tax inspectorate has 5 working days from the date of submission of the set of documents to register the taxpayer (clause 6 of Article 6.1, paragraph 1 of clause 2 of Article 84, paragraph 2 of clause 3 of Article 346.28 of the Tax Code of the Russian Federation).

Sample of filling out UTII-2

Each page of UTII-2 must contain the entrepreneur’s TIN, which is indicated at the top of the form. In addition, each page is numbered in order, starting with the first title page. The number of completed sheets depends on the number of activities transferred to “imputation”.

Their list is given in the appendix, on one sheet of which you can indicate information on three types of business. If an entrepreneur needs to transfer a larger number to the imputed regime, then additional application sheets are filled out.

On the title page (first page) of UTII-2 the total number of completed pages of the application to the application is indicated.

The order of filling out the fields of the first page

| Field name | Explanations for filling |

| TIN | Placed on each page in accordance with the certificate issued by the tax office upon registration of an individual as a taxpayer. |

| Tax code | Corresponds to the code of the department to which UTII-2 is submitted - at the place of business or at the place of registration. |

| Full name IP | Last name, first name and patronymic of the entrepreneur in full - as indicated in the passport, without abbreviations. If there is no patronymic name, it is not registered. The information is given line by line. |

| OGRNIP | It is taken from the certificate issued by the tax office when registering an individual as an individual entrepreneur. During this procedure, the individual entrepreneur is assigned a personal registration state number. |

| date | The date, month and year in digital form when the entrepreneur began working for UTII. |

| The application has been compiled... | The number of sheets in the annex to the application filled with information about the types of activities (if their number does not exceed three, then one sheet is drawn up). For example, if one sheet of the application is drawn up, then the indicator in question is written in the format “1 – -”. |

| Copies of documents for... | The number of documents attached to the application confirming the legality of the compiler of UTII-2 to put his signature on the form. The application can be filled out and signed not only by the individual entrepreneur himself, but also by his representative. In the second case, documents are required indicating that the representative has such powers, for example, a power of attorney. |

| Reliability and completeness of information... | Put “1” if UTII-2 is filled out by the individual entrepreneur himself, “2” if his representative. If “1”, then the entrepreneur’s signature, telephone number (taking into account the locality code) and the date of signing are placed below. If “2”, then the full name of the representative, his TIN, telephone number, as well as details of a power of attorney or other document confirming the right to represent the interests of the merchant are written below. Phone numbers are written without spaces or omissions. |

Procedure for filling out the fields of the Appendix

| Field name | Explanations for filling |

| Activity code | Taken from the appendix to the Procedure for filling out the UTII declaration. This field is required. |

| Address | The address for conducting the specified type of activity or the address of the place of residence, if it is impossible to accurately determine the address for carrying out certain types of activity. |

| Signature | Signature of the compiler of UTII-2, confirming the accuracy of the reflected data. |

If an individual entrepreneur is engaged in several different areas of business, or they are located at different addresses, then in the appendix to UTII-2 it is necessary to explain at what address to register the merchant as a UTII payer.

In this case, the tax specialist focuses on the address indicated first in the list. Therefore, the entrepreneur must be the first to enter the type of activity that has the address at which registration will be carried out.

On the first page there is a place to record the fact of registration of the applicant as a UTII payer. When a tax specialist, on the basis of the received application, performs the necessary actions in connection with the registration of an individual entrepreneur as an “imputed person,” a record will be made in this subsection about the executor, as well as the date of registration.

Who can switch to imputation

Imputed income tax is not available everywhere and not for everyone. Article 346.26 of the Tax Code of the Russian Federation contains a list of types of activities in respect of which UTII may be applied. But on the territory of a specific municipality (city, town), it must be introduced by law of local authorities. They decide which specific activities from those mentioned in the Tax Code will be subject to UTII in the territory under their jurisdiction.

The transition to UTII in 2022 is carried out on a voluntary basis upon application to the Federal Tax Service. Previously, payment of this tax was mandatory for certain activities, but this provision was abolished in 2013.

Organizations and individual entrepreneurs can switch to imputation. The main condition is that the number of employees on average for the previous year should be no more than 100 people. An additional restriction is established for organizations: participants must include no more than 25% of legal entities.

UTII cannot be used in the following cases:

- when leasing gas and gas filling stations;

- during activities in the field of public catering carried out by healthcare, educational or social welfare institutions;

- in activities carried out within the framework of a simple partnership agreement or trust management of property;

- if the organization belongs to the category of the largest taxpayers.

Specific activities are transferred to UTII, and not the entire business. That is, imputation can be combined with other tax regimes.

Free tax consultation

Mid-year transition

Each individual entrepreneur has the right to make the transition to UTII in the middle of the tax period (calendar year), subject to the initial choice of this tax or the start of a new business allowed on the “imputation”, for example, when opening a veterinary clinic or store. You must inform the Federal Tax Service about this and register as a UTII payer. The transition algorithm and the procedure for filling out the form do not differ from those provided for new entrepreneurs. But if an individual entrepreneur opened a new object of taxation (for example, a store), and did not start conducting a new type of activity (for example, trade) in the middle of the year, then he does not have the right to switch to UTII with the simplified tax system in the middle of the year; the application must be submitted in January. The application must be submitted before January 15; violation of this requirement will result in the impossibility of switching to UTII; the next time you can apply to the tax office only after a year. Thus, the transition is only allowed once a year. In case of combination with the general taxation system, this right is retained.

Main types of activities for which UTII may be applied

We list the main types of activities in which individual entrepreneurs and LLCs can apply UTII. This:

- provision of household services;

- veterinary services;

- repairing vehicles, washing cars;

- parking;

- provision of services for passenger and cargo transportation;

- retail trade;

- running a catering business;

- placement of outdoor advertising, its distribution;

- provision of retail space for rent.

Please note that the full list of activities that fall under the application of UTII is indicated in Chapter 26.3 of the Tax Code.

The most important nuance: if an individual entrepreneur or LLC operates in several areas, then a single tax on imputed income is paid for each of them.

At the same time, the areas of entrepreneurial activity are indicated when registering a business in the relevant documents (or are added during the course of activity).

This rule can be supplemented with one more. If some types of activities fall under UTII, while others do not, then taxation for each is separate.