Serious engineering communications, such as buildings and structures, as a rule, serve as fixed assets for a long time: years and decades. They slowly lose properties useful for use. But the concept of “long” is very vague. In each specific case, the useful life (USI) can vary greatly. How exactly to set this deadline and document it correctly, what points to pay attention to when regulating, read in this article.

Why determine SPI

Useful lives are established for adequate accounting purposes. But in accounting and tax accounting, the features of their establishment are different, since the goals are different:

- SPI for accounting. It is necessary in order to correctly determine the decrease in the value of a fixed asset and correctly calculate depreciation on it. PBU 6/01 in paragraph 20 says that the organization can set this period at its discretion, taking into account the following key parameters:

- how long it is planned to actively use the building or structure;

- what factors influence physical wear and tear in this particular case;

- what degree of wear is acceptable;

- Are there any special restrictions for a specific property (for example, staying in a rental, leasing, etc.).

- SPI for tax accounting . It is established to classify fixed assets according to the time of their useful operation (clause 1 of Article 258 of the Tax Code of the Russian Federation). For this purpose, all fixed assets are divided into groups, the composition of which is fixed in the classification table. This document was approved by the Government of Russia in Resolution No. 1 of January 1, 2002. The table shows codes according to the OKOF classifier adopted for fixed assets and the distribution of fixed assets by groups. For each group, a time range is established within which the SPI can be assigned for each asset (including “long-term” ones, such as buildings and structures).

NOTE! When maintaining accounting records, it is convenient to use the Tax Classification to determine the SPI of real estate: in this case, the calculations will be the same, that is, depreciation deductions will be calculated at a minimum. But it is also possible to set a smaller SPI in accounting.

The method for determining SPI must be recorded in the accounting policies of the organization.

How to calculate?

There are several methods for calculating depreciation in tax accounting. They have their own characteristics and differences, but at the first stage it is necessary to calculate the initial cost of the object.

Initial cost of the object

The initial cost of a building is calculated from several parameters. First of all, the amount for the purchase or construction of this object. To this is added the amount spent on bringing the non-residential premises to normal condition, suitable for the necessary use.

This figure does not include VAT and excise taxes, except for certain exceptions that are prescribed in the Tax Code of the Russian Federation. If the object was received free of charge, then its value must be determined using an independent examination.

There are some cases where the initial cost may change. These include:

- completion and radical modernization of the premises;

- partial demolition;

- reconstruction.

Accrual methods

There are several ways to calculate and charge depreciation in tax reports. The first method is reducing balance. For this calculation you need to know the following data:

- The residual value of a specific object as of the first day of the month.

- Depreciation rate.

- Acceleration coefficient.

The residual value in this case is divided by the number of months remaining until the end of the joint venture.

The calculation formula is as follows:

A = (P0 – P1)*N , where:

- P0 is the cost of the premises.

- P1 - depreciation for the previous year.

- A is depreciation for the current year.

- N is the depreciation rate (this is 100% divided by the number of years of SPI).

Example: SPI is 25 years. This means the depreciation rate per year is 4%. The cost of a non-residential property is 28 million rubles. The first year of depreciation is equal to 28 million:25 = 1 million 120 thousand rubles. Next year the depreciation amount will be as follows:

(28 million-1 million 120 thousand) x 0.04= 1 million 115 thousand 520 rubles. Such accruals will be made annually until the cost of the building is completely written off.

With the straight-line method of calculation, the cost of depreciation for the previous year is not taken into account. The formula in this case looks like this: A = P0 *N.

As a result, the same figure is calculated every year. In our case, this is 28 million x 0.04 = 1 million 120 thousand.

Useful life

When determining the SPI of buildings and premises, it is necessary to take into account:

- how much the facility is expected to be used due to its performance;

- expected wear depending on the mode of use of the structure;

- regulatory and other restrictions imposed on the facility.

This is all regulated by clause 20 of PBU 6/01. It is also allowed to use the Fixed Asset Classifier. The SPI is established by the enterprise independently based on the data when the building was put into operation. As confirmation, you need to use documents that indicate this date.

Depreciation groups of buildings and structures

According to the Classification, various types of real estate in the form of buildings and structures can be classified into several groups for calculating depreciation - from 4 to 10. Each group includes buildings of certain, strictly defined types, for which different time intervals are provided for. Table 1 shows various immovable objects with the SPI periods established for them.

Table. Depreciation groups for buildings and structures

| № | Depreciation group | Features of the property | Sample SPI |

| 1 | 4 | Film non-residential structures, mobile structures, kiosks made of various materials (metal, glass, plastic, pressed plates) | 5 – 7 |

| 2 | 5 | Prefabricated and mobile structures not intended for housing | 7 – 10 |

| 3 | 6 | Residential buildings of lightweight construction (frame, reed, etc.) | 10 – 15 |

| 4 | 7 | Various non-residential buildings (frame and panel) made of wood, wood and metal, panels, adobe, etc. | 15 – 20 |

| 5 | 8 | Frameless buildings with lightweight walls made of stone, timber, logs with floors, columns, pillars made of various materials (not intended for housing) | 20 – 25 |

| 6 | 9 | Stone warehouses for vegetables/fruits (reinforced concrete or brick columns are allowed) | 25 – 30 |

| 7 | 10 | Other non-residential buildings and structures (brick objects, etc.). Residential buildings and premises | Over 30 |

How to determine SPI: algorithm

When a company acquires a fixed asset - any kind - it needs to be depreciated, for which it is necessary to know the period of its planned useful use. In the table it is given in approximate time frames, but for each object it must be indicated precisely. The algorithm is as follows:

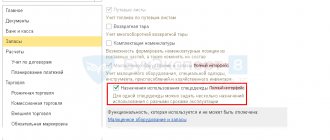

- Determine the OKOF code of your property using the OK 013-2014 classifier, approved by Rosstandart order No. 2018-st.

- Compare with the left column of the Classification table - determine which depreciation group your building and structure belongs to.

- Set any period from the given interval. For example, if the SPI is set at 10-15 years, you can prescribe 10 years 5 months, 12 years, 14.5 years, etc.

- Specify the established deadline in the text of the Order signed by the head of the organization.

- For accounting, set the SPI yourself or also use the Classification (this is much more convenient).

SPI for parts and the whole

What if the room for which the SPI needs to be determined is part of the building? There are accepted rules regulating quite common situations in determining the SPI of buildings and structures:

- each individual residential premises in a common residential building (for example, an apartment building) receives the same SPI as the entire building as a whole - as a rule, for at least 30 years;

- if there is a non-residential premises (hall, office, etc.) in a residential building, then it acquires the same SPI as the entire house (also, as a rule, from 30 years).

General rules for accounting

There are general rules that an accountant must follow when calculating depreciation of non-residential premises and non-residential buildings. These include:

- accruals occur monthly in the amount of 1/12 of the amount calculated for the current year;

- during the SPI, depreciation accrual is not suspended;

- accrual stops from the first day of the following month after the amount of the cost of the fixed asset has been fully repaid or it has been removed from the company’s books.

Everything is described in detail in instructions No. 157 N.

SPI upon change of owner

A piece of real estate may change its owner and end up in the hands of a new owner not new. How to determine the useful life in this case?

It is necessary to correctly establish depreciation, and from here calculate the depreciation period. This must be done separately for tax and accounting purposes.

SPI of used objects for tax accounting

The tax legislation of the Russian Federation provides for the possibility of reducing the SPI of a non-new property for the period during which it was used by the former owner (clause 7 of Article 258 of the Tax Code of the Russian Federation). This time can be easily determined from the accompanying documentation (transfer and acceptance certificate OS-1a) when purchasing a fixed asset.

IMPORTANT! If it is not possible to establish this period from the documents, then it is legally impossible to reduce the SPI. Even if such confirmation exists, a reduction in SPI is not necessary.

If there is no documentary evidence of the operation of the building, it will be considered new from the point of view of tax accounting. To determine its SPI, the above algorithm should be used.

If you purchase a building or structure that has been in use for more than 30 years, it may end up being completely depreciated. In this case, the new owner evaluates the condition of the object according to safety regulations and sets a reasonable SPI for it at his own discretion.

SPI of non-new objects for accounting

There are no legislative regulations here, other than those prescribed in the accounting policies of the organization itself. By establishing SPI for accounting, the owner can:

- follow the requirements of the Classification (duplicate tax accounting);

- Having thoroughly assessed the object, set another appropriate period.

Useful life of the building

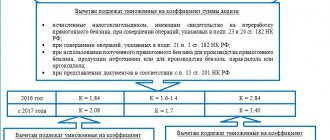

In accordance with these standards, for two-story buildings of all purposes, except for wooden buildings of all types, an annual depreciation rate of 1.2% of the book value is established. Determine the useful life using the formula given in recommendation No. 4 (100%: 1.2% = 83 years).

An error discovered in the calculation of depreciation must be recalculated.

To do this, calculate the amount of depreciation for the period the object is in operation.

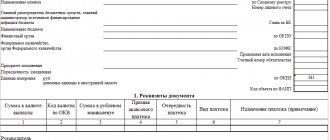

0504833). Please indicate in the certificate:

- justification for making corrections;

- the name of the accounting register being corrected (transaction journal), its number (if any), the period for which it was compiled.

Based on the certificate (f.

0504833) make entries in the journal for other transactions (f.

Features of SPI for certain real estate objects

Each building and structure has a set of unique characteristics that affect the period of its possible use as a fixed asset. But there are some features that allow you to group objects to establish an adequate SPI. Let's consider the most common types of buildings and structures from the point of view of classifying them into one or another depreciation group.

Brick buildings

Brick is a very strong and durable material that is little subject to wear. Buildings constructed from it serve regularly for many decades without losing any significant characteristics. Whether they are residential buildings or other structures, their SPI will be the longest of those provided for in the Classification table. The rubricator provides for group 10 for them, according to which you can set any period over 30 years. Which one, the organization has the right to determine itself.

If the building has only brick columns, pillars or floors, its useful life is reduced and will be only 20-25 years, according to the requirements of depreciation group 8.

Garages

They are built from various materials, depending on this, the shock-absorbing group is installed. Most often this is 4 (metal non-residential structures), the SPI for this group will be 5–7 years. If the garage is made of brick, it can be classified as group 8 (not group 10, since the walls will be of lightweight masonry), and the SPI will be selected from the interval of 20-25 years.

Depreciation objects

Depreciation of a building and the useful life of the same property are related concepts.

The first is the transfer of the value of an object to the products created during its use. This also includes the work and services provided. Deductions taking into account depreciation help create a source for simple reproduction. Thus, it is actually possible to increase the cost of the final product by 5-7 percent, which will later be used to repair or replace equipment, if necessary. In other words, depreciation of a building allows you to transfer the money spent on the acquisition of capital assets to services and goods, including them in the final cost. Depreciation is charged on the following objects:

- Fixed assets whose consumer properties do not change over time. This property includes plots of land, museum objects, environmental management facilities, etc. The useful life of fixed assets (buildings and structures) is determined in accordance with the depreciation group.

- Housing stock. But only in cases where it is not used with the intention of generating income.

- Road maintenance and external improvement.

- Perennial plantings that have not reached operational age.

- Cattle

- Used for the purpose of mobilization and mobilization preparation. These include facilities that are mothballed and closed for production and management needs, as well as those put out for temporary paid use.