When is such a statement necessary?

The pilot project of direct payments of social benefits from the Social Insurance Fund covered almost all regions of the Russian Federation. The Krasnodar Territory, the Perm Territory, the Moscow, Sverdlovsk, and Chelyabinsk regions, the Khanty-Mansiysk Autonomous Okrug, and the federal cities of Moscow and St. Petersburg are not yet participating in the project. They will join on January 1, 2022.

The essence of the project is that the benefits are paid not by the employer, but by the Social Insurance Fund itself. Its rules are set out in government decree No. 294 dated April 21, 2011.

To assign benefits you need:

- certificate of incapacity for work or other documents (for example, a birth certificate from the registry office);

- application for calculation of sick leave from the employee.

When making direct payments, the employer collects a package of documents from the employee and transmits the information to the Social Insurance Fund. And the fund itself makes calculations and payments to the recipient.

How to fill out this application

One copy of the application must be completed. The form consists of two pages; no calculation data is required. The document will only serve as an accompanying document for income certificates, on the basis of which the payment will be recalculated.

What you need to indicate in the form:

- Name of the employing company or full name of the individual entrepreneur-employer.

- Full name of the applicant employee.

- The payment that needs to be recalculated. Here you need to tick the type of benefit.

- Reasons for recalculation. For example, providing income certificates while the employee was working for another employer. In this case, the payment will be changed upward.

- Information about the insured person. Write your last name, first name, patronymic, date of birth, SNILS number. The employee signs and indicates the date of submission of the document to the employer.

After submitting the application to the accountant, the data is checked, the accountant signs, dates, and enters the organization’s phone number and email. Then the application is sent to the FSS.

For your information! The accountant himself may ask the employee to fill out such an application if he suddenly sees inaccuracies in previous calculations.

What benefits are they asking for?

In the pilot project, the Social Insurance Fund pays all social benefits that the employer previously compensated for through insurance contributions:

- due to illness;

- for pregnancy and childbirth;

- for child care;

- at birth;

- one-time when registering in the early stages of pregnancy;

- payments for temporary disability due to an accident at work or occupational disease;

- additional admission for treatment and travel to and from the place of treatment.

The employer continues to pay social benefits independently:

- for burial;

- to pay for additional days of rest to care for a disabled child.

These accruals paid to employees will be reimbursed in full by the Social Insurance Fund of the Russian Federation to the organization upon request.

In addition, the employer pays for the first three days of the employee’s illness at his own expense. The organization is obliged to pay these amounts to the employee itself.

The FSS has approved register forms that employers submit to the Fund for direct benefit payments

As you know, from 2022 all regions switched to direct payments of benefits from the Social Insurance Fund.

The algorithm for interaction between employees, the employer and the fund is set out in the Regulations approved by Decree of the Government of the Russian Federation dated December 30, 2020 No. 2375. It states that, having received supporting documents from the employee, the accounting department must transfer to the FSS the information (in particular, sick leave registers) necessary for the appointment and benefit payments.

In this regard, the FSS approved the forms of documents used for payment of benefits. In total, the commented order contains 17 forms. Among them:

- application for recalculation of previously assigned benefits (Appendix No. 1);

- information about the insured person (Appendix No. 2);

REFERENCE

This form, in particular, contains information about the employee and identity document, information about the place of registration and residence, as well as bank details for transferring benefits. According to Resolution No. 2375, the employee must provide information about himself necessary for the assignment and payment of benefits at his place of work. This can be done during employment or during the period of employment.

- inventory of submitted documents (information) (Appendix No. 3);

- notification of termination of the insured person's right to receive a monthly child care benefit (Appendix No. 4);

- application for reimbursement of expenses for payment of benefits for temporary disability (Appendix No. 5);

- notice of submission of missing documents (information) (Appendix No. 6);

- notice of amendments to the certificate of incapacity for work (Appendix No. 7);

- decision to refuse to assign and pay temporary disability benefits (Appendix No. 8);

- application for reimbursement of expenses for payment of social benefits for funeral (Appendix No. 9);

- application for reimbursement of expenses for additional paid days off for one of the parents (guardian, trustee) to care for disabled children (Appendix No. 10);

- application for reimbursement of the cost of funeral services (Appendix No. 11);

- decision to refuse to consider documents (information) (Appendix No. 12);

- certificate of calculation of the amount of vacation pay (Appendix No. 13).

- application for reimbursement of expenses incurred for preventive measures to reduce occupational injuries and occupational diseases of workers and sanatorium-resort treatment of workers engaged in work with harmful and (or) dangerous production factors (Appendix No. 14).

The same order approved the forms and procedure for filling out three types of registers for the following payments:

- temporary disability benefits, maternity benefits, as well as benefits for women with early pregnancy registration;

- lump sum benefit for the birth of a child;

- monthly allowance for child care up to 1.5 years.

IMPORTANT

The method of transferring information (sick leave registers) depends on the average number of individuals to whom payments were transferred in the previous billing period.

If this figure exceeds 25 people, the information must be sent electronically. If there are 25 people or less, the information can be submitted on paper (on how to calculate the average number of employees, see “Crib sheet for calculating the average number of employees”). Let us recall that FSS branches assign and pay the following types of benefits to working citizens:

- for temporary disability (including due to an accident at work and (or) occupational disease);

- for pregnancy and childbirth;

- a one-time benefit for women who registered in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly child care allowance.

Calculate your salary and benefits taking into account the increase in the minimum wage in 2022 Calculate for free

Also, under the direct payment system, additional leave (in addition to the annual paid) is paid to an employee injured at work.

The new forms will come into effect on May 2, 2022. From the same date, FSS orders No. 578 and 579 dated November 24, 2017 will no longer be in force. These orders approved the document forms that were used within the pilot project.

Form and filling rules

For the pilot project, a unified application form to the Social Insurance Fund for sick leave in 2022 was developed, which was approved by Order No. 578 of the Social Insurance Fund dated November 24, 2017.

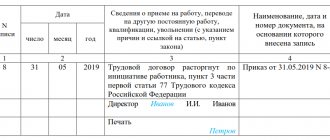

The employer fills out the sick leave according to the usual rules, with the exception of two lines (they are left blank): “Amount of benefit at the expense of the Social Insurance Fund” and “Total accrued.”

Instructions on how to fill out an application for sick leave:

- We indicate the exact name of the territorial body of the Social Insurance Fund at the location of the employer.

- We write down the full name. applicant (employee).

- We put a mark in the line corresponding to the requested social benefit. The form is used both when assigning and recalculating payments. It is necessary to put the appropriate mark.

- We indicate the payment method and recipient details.

- We fill in the passport details, date of birth and place of registration of the applicant.

- We write down the details of the document on the basis of which the benefit is assigned (certificate of incapacity for work, certificates, birth certificate, etc.).

- Information on the assignment of benefits is filled out by the employer. It indicates the SNILS and INN of the employee, data on earnings excluded from the billing period.

- The completed form is signed by the applicant (employee) and an official of the organization.

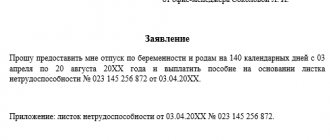

Sample application to the Social Insurance Fund for payment of sick leave from an employee:

Participation in the FSS pilot project in the 1C: Salaries and Personnel Management program (ed. 3)

In the accounting policy of the organization, it is necessary to indicate the date of entry into the project (it is enough to set the flag - the date is determined automatically by the checkpoint).

Additionally, the date of transition to direct payments from 01/01/2021 is written in the program code, so even if the transition date is not set in the accounting policy, the direct payment mechanism will work automatically from 01/01/2021.

Employers need to familiarize employees with the new procedure for paying benefits.

The general procedure in the program for processing benefits paid directly from the Social Insurance Fund:

- Register the appropriate benefit (documents Sick leave, Parental leave

).

- Complete an application for payment of benefits and print it for the employee to sign.

- If an organization electronically submits registers of information necessary for calculating benefits, create a register (except for benefits for work-related injuries and occupational diseases, for these benefits a list of applications is submitted in paper form).

- If an organization does not electronically submit registers of information (you may not have to create electronic registers if the number of employees is less than 25 people) necessary for calculating benefits, create an inventory of applications and documents and print it out (for benefits for work-related injuries and occupational diseases it is mandatory).

Let's look at the procedure in the program using the example of applying for temporary disability benefits.

Temporary disability benefits are registered with the document Sick Leave

.

The document calculates only the part of the benefit paid at the expense of the employer. That part of the benefit that is accrued at the expense of the Social Insurance Fund is reflected in the document with a zero result.

FSS Pilot Project appears in the document.

, on which data is entered for subsequent filling out the application form for payment of benefits, as well as a register of information transmitted electronically.

The employer must submit an application (Appendix No. 1 to the order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578) of the employee for payment of temporary disability benefits to the fund.

It can be generated using the link Enter an employee’s application for payment of benefits

on the

FSS Pilot Project tab,

the Benefits at the expense of the FSS

workplace or from the journal

Transferring information about benefits to the FSS (

section

Reporting, certificates).

There is no requirement to apply for sick leave paid entirely by the employer.

When filling out an application using the link from the Sick Leave

Most information is filled in automatically. The header of the document indicates the type of benefit and the basis document. Information about the recipient is filled in automatically based on the employee's data.

The payment method is filled in automatically, but if necessary, it can be changed (for example, if the benefit should be paid to the MIR card).

On the Attached Documents

fill in the number and date of the certificate of incapacity for work.

Basic data on the Benefit Calculation

are filled in automatically from the

Sick Leave document.

Periods of downtime, average earnings for the period of downtime, as well as periods for which benefits are not assigned (Part 1, Article 9 of Federal Law No. 255-FZ of December 29, 2006), if necessary, are filled in manually.

If an electronic register of information for the assignment and payment of benefits will be sent to the fund, then you must fill out the Information for the register

.

The validity period of the employment contract is completed only if a fixed-term employment contract is concluded with the employee for a period of up to six months. In the field Number of paid days of incapacity for work

the number of paid days of incapacity used by a disabled employee in the current year is indicated manually (clause 3 of article 6 of the Federal Law of December 29, 2006 No. 255-FZ).

After completing the document, you can print out the completed application for signature by the employee.

To transfer the register for payment of benefits electronically, you must enter data for the register using the appropriate link on the Pilot Project

.

At the same time, if the data of the electronic certificate of incapacity for work is loaded into the program, the information for the registry will be filled in automatically.

Next, you need to create a register for transfer to the FSS. This can be done from your workplace Benefits at the expense of the Social Insurance Fund

or from the journal

Transfer of information about benefits

in the section

Reporting, certificates.

Formation of a register for transfer to the Social Insurance Fund

In the document, select the type of register, and on the Information tab required to assign benefits

data from prepared documents is filled in.

Both manual and automatic filling are available using the Fill

.

On the Policyholder Information

General information about the organization is filled in based on the data specified in its card.

The Register compiled

field is filled in manually.

The register is compiled and sent to the FSS. If the 1C-Reporting service is connected, then you can directly send the register of information to the FSS of the Russian Federation from the program using the Send

.

If the register is not generated electronically, then it is necessary to create an Inventory of employee applications for payment of benefits

in the journal

Transfer of information about benefits

in the section

Reporting, certificates.

For other types of benefits, the procedure is similar - you need to enter an employee’s application and then create a register or inventory.

For child care benefits up to 1.5 years old, the application can be entered using the link from the Child Care Leave

.

In the application on the Attached documents

manually enter data on the documents provided, for example, a certificate from the other parent about non-receipt of benefits.

For other types of benefits paid directly from the Social Insurance Fund (one-time benefit when registering early or at the birth of a child), applications are entered from the workplace Benefits at the expense of the Social Insurance Fund

or from the journal

Transfer of information about benefits

in the section

Reporting, certificates.

How to transfer to the FSS

Having explained to the employee how to write an application for paid sick leave, and having received a complete package of documents from him, submit them to the Social Insurance Fund in paper form. The employer has five calendar days to do this. The package of documents must be accompanied by an inventory.

If there are more than 25 people, organizations submit to the Fund an electronic register of information necessary to assign benefits. Companies with fewer than 25 employees are entitled, but not required, to use an electronic registry. When using an electronic registry, the sick leave certificate, the employee’s application for sick pay and other original documents remain in the custody of the employing organization.

What to tell employees about direct payments: sample documents, payment rules

We present step-by-step instructions for direct payments, which it is highly advisable for staff to familiarize themselves with:

Deadline

You can apply for benefits no later than 6 months from the end of the insured event (recovery, disability, birth of a child, etc.).

Package of documents

The employee must collect supporting documents and write a statement in the form corresponding to the insured event. Application forms are given in Appendix No. 1 to Order No. 578 of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017.

When choosing a payment method in the application, you need to take into account that sick leave for Chernobyl victims and maternity benefits will be transferred only to the MIR card (RF Government Decree No. 419 of 04/11/2019).

Sample application for payment of sick leave

An authorized employee of the company accepts documents. To avoid any disagreements, it is better to hand them over against signature and record the date.

Payment terms

Within 5 days, the employer sends documents to Social Security. You can do this:

- in paper form with an inventory, if the staff does not exceed 25 people;

- in electronic form, if the staff is more than 25 people.

The FSS has 10 days to check and pay. The employer will be notified of errors or missing documents in writing.

An application for monthly child care benefits must be submitted once. Leave will be paid monthly until the 15th.

Control of accruals

Employees will be able to check Social Insurance calculations and receive a 2-NDFL certificate on the Social Insurance Fund website or at a fund branch (in person or by submitting an application by mail).

Control of personal data

Employees must immediately report changes to their passport data, registration address, and bank details to an authorized company employee. This will allow you to avoid errors in calculations and transfer benefits on time.

Sample notification to employees about the transition to direct payments

Timeframe for making a decision

The Social Insurance Fund makes a decision on the assignment and payment of benefits within 10 calendar days after receiving the necessary documents from the employer. Payment is made to the recipient's details specified in the application.

If errors are detected in the documents provided, no later than five days from the date of receipt, the Social Insurance Fund notifies the employer of the need to make corrections. The corrected certificate of incapacity for work is processed in an expedited manner, which takes no more than 3 working days.

Sample how to draw up an application for payment of a lump sum benefit upon the birth of a child

If you need to write an application for payment of a lump sum benefit for the birth of a child, and you do not know how to do it correctly, read the information below and pay attention to the sample document.

Today, an application for the payment of a one-time benefit can be written in free form or, if the employer or public service offers a document template, in its form.

The application can be drawn up on a regular sheet of any convenient format (but it is better to choose A4 - this is the standard format for business documentation), by hand (with a ballpoint pen with dark ink) or typed on a computer. There is only one important condition here: the form must be certified by the “living” signature of the applicant.

It is best to write the application in two copies , one of which should be given to the employer or a specialist of a government agency, and the second, after the representative of the receiving party has marked receipt on it, should be kept. In the future, such forethought will avoid possible disagreements about the deadline for filing an application.