When is sick leave issued for pregnancy?

Maternity leave (Maternity Sick Leave) is issued to every pregnant woman at 30 weeks for a singleton pregnancy, and at 28 weeks for a multiple pregnancy. A woman has the right to refuse to receive it and continue to work. In this case, a certificate of incapacity for work is issued after the pregnant woman applies for it at a medical institution.

Sick leave under BiR is also issued to a woman who has adopted a child under 3 months of age.

Sick leave for pregnancy and childbirth in 2022 is needed to:

- issue the woman with maternity leave (B&P) for the period specified by the gynecologist on the certificate of incapacity for work;

- accrue and pay B&R benefits in the amount of 100% of average earnings based on the duration of maternity leave.

Sick leave for pregnancy and childbirth in 2022 is issued on a standard form, approved. By Order of the Ministry of Health and Social Development of the Russian Federation dated April 26, 2011 No. 347n.

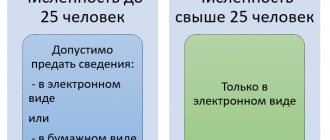

In 2022, electronic sick notes operate on a par with traditional paper ballots. All clinics that have an electronic signature can issue them.

To work with electronic forms, the employer will need a personal account on the FSS website. Read here whether an employer has the right to refuse to accept electronic sick leave.

In general, sick leave according to BiR is issued for 140 calendar days: 70 days before the expected date of birth and 70 days after. In case of complicated childbirth, it is issued for 156 days, in case of pregnancy with two or more children - for 194 days. You can find out more about the duration of leave under the BiR in this article.

How many days is maternity leave?

In a normal pregnancy, maternity leave is granted at 30 weeks. It is given for 140 calendar days.

Of these, 70 are calculated before the expected date of birth of the child, 70 - after. It does not matter whether the woman gave birth on the due date, before it or later.

Sick leave after childbirth can be extended if the pregnancy is multiple or has problems. In this case, the woman is issued a ballot for 194 days.

It is issued 84 days before the expected date of birth of the baby. 110 days should fall in the period after the birth of the child (Law No. 255-FZ, Art. 10).

The question often arises of how long sick leave after childbirth will last if the woman or newborn had problems during the process itself.

The doctor observing the woman in labor may issue an additional certificate of incapacity for work for a period of 16 days.

If a woman gives birth before 30 weeks, then maternity hospital employees issue sick leave for 156 days.

When is additional sick leave due to pregnancy issued?

Sick leave for pregnancy and childbirth in 2022 is issued for the estimated period of incapacity for work, depending on the course of pregnancy and the complexity of childbirth.

But a situation is possible when a medical institution issues a woman additional sick leave under the BiR. If a woman initially received a certificate of incapacity for work for 140 days, and then complications emerged, the gynecologist (or maternity hospital) increases the period of incapacity for work and issues additional sick leave for pregnancy and childbirth.

So, if a multiple pregnancy is detected during childbirth, sick leave is extended by 54 days: 70 days before childbirth and 124 after. If childbirth began at 28-30 weeks, sick leave is issued after childbirth for 156 days.

Upon adoption, a certificate of incapacity for work is issued:

- for 70 days from the date of birth of the child - if he was under 3 months old at the time of adoption;

- 110 days from the date of birth - if two or more babies under the age of 3 months are adopted.

When extending maternity leave (including during complicated births, multiple pregnancies, and births occurring between 22 and 30 weeks of pregnancy), the signature of an obstetrician-gynecologist (general practitioner) is sufficient on the certificate of incapacity for work, and in the absence of a doctor - signature of a paramedic. In this case, the signature of the chairman of the medical commission is not required (Letter of the Social Insurance Fund dated December 23, 2011 No. 14-03-11/15-16055).

How to calculate sick leave benefits

There are a number of nuances when processing sick leave payments for women in labor:

- working for one or more employers at the same time, full-time or part-time;

- temporarily unemployed people employed by the employment service;

- unemployed (housewives);

- dismissed due to liquidation/bankruptcy of the organization or laid off;

- individual entrepreneurs, notaries or lawyers with private practice;

- full-time students (students);

- military personnel.

We will discuss below how sick leave is calculated for pregnancy and childbirth.

Sick leave payments for unemployed (housewives) and temporarily unemployed

Non-working people (housewives) do not receive any payments under the certificate of incapacity for work, namely maternity benefits.

Having unemployed status, expectant mothers receive benefits for up to 30 weeks. Next, they need to provide the received sick leave to the employment service.

Sick leave payments for employees

If a woman in labor officially works for several employers, then she has the opportunity to receive maternity benefits from each of them. In this case, the doctor fills out several sick leaves or one electronic sick leave for her.

The total amount depends on the amount of income of the employee at each enterprise in the previous year of the occurrence of the insured event (2 years) and the duration of sick leave according to the BiR, but the maximum benefit amount in 2022 cannot exceed:

- RUB 321,750.80 - on sick leave issued for 140 calendar days;

- RUB 445,854.68 - at the birth of two or more children (the ballot is issued for 194 days);

- RUB 358,522.32 - in case of complicated (premature) birth (sick leave for 156 days).

The minimum benefit amount is calculated based on the minimum wage. From January 2022, the minimum wage is 12,130 rubles. This means the minimum benefit amount will be:

Find out how sick leave is paid for pregnancy and childbirth here.

Sick leave payments for those laid off and laid off

Dismissing a pregnant woman is illegal. If a situation occurs, she can file a complaint with the labor inspectorate or the prosecutor's office.

But if the dismissal or layoff occurred during the liquidation/bankruptcy of an enterprise, termination of the activities of an individual entrepreneur, or termination of the license of a private notary, lawyer, etc., then the woman in labor can count on maternity sick leave payments by contacting the social security authorities.

Sick leave payments for persons engaged in private business activities

If a woman in labor carries out individual entrepreneurial activity, then the sick leave benefit is paid from the insurance contributions she has made.

IMPORTANT! An individual entrepreneur has the right to receive maternity benefits only subject to voluntary registration with the Social Insurance Fund of the Russian Federation and payment of insurance contributions for himself (Part 3, Article 2 of Law No. 255-FZ).

The amount of the benefit is calculated from the minimum wage, i.e. it will be equal to the minimum amount that we described above. Sick leave for pregnancy and childbirth, as well as an application for granting benefits, must be submitted to the Social Insurance Fund at the place of registration. The FSS, within 10 days after submitting the documents, assigns and pays maternity benefits from the funds of the fund.

To receive the benefits due, the student must apply to her place of study/service with an application and maternity leave (to the accounting department). Payments are made from budgetary funds, and not from the Fund, as in all other cases.

The benefit is the average monthly salary for the last 2 years (amount of scholarship, insurance premiums, etc.). Paid for the entire period of sick leave (140, 156 or 194 days), 10 days after submitting the application and sick leave.

Filling out sick leave by an employer in 2020

If the sick leave for pregnancy and childbirth contains code “052” in the “Cause of disability” line, fill out the “To be completed by the employer” section according to the same rules as the sick leave for temporary disability.

When filling out a sick leave certificate for pregnancy and childbirth B&R:

- do not fill in the line “TIN of the disabled person (if any)”;

- fill out the line “Insurance experience” even in cases where the length of service does not affect the amount of maternity benefits;

- in the boxes “at the expense of the Social Insurance Fund of the Russian Federation” indicate the entire amount of the calculated maternity benefit;

- Do not fill out the “at the expense of the employer” cells.

Terms of payment of maternity benefits

The procedure for paying maternity benefits depends on whether the region in which the employer is registered is included in the FSS “Direct Payments” pilot project or not. You can learn more about the essence of the pilot project and the list of regions included in it from the article “FSS Pilot Project 2022: List of Regions.”

- Payment of sick leave through the Social Insurance Fund in a region where the pilot project has not been introduced.

The employee brings her sick leave to the employer and writes a free-form application for the appointment and payment of benefits for her under the BiR. More details on the form of this document can be found in the article “Sample application for maternity leave during pregnancy.”

The employer is obliged to calculate the benefit within 10 days (from the date of receipt of the documents) and pay it on the next day of payment.

- Payment of sick leave through the Social Insurance Fund: pilot project.

The employer, having received documents from the employee, is obliged to transfer the documents to the Social Insurance Fund within 5 days. Social insurance will make a decision on payment of benefits within 10 days and will independently transfer it to the maternity leaver’s account.

Procedure for paying maternity benefits if the employee continues to work

The employee has the right to either take maternity leave and receive benefits at the expense of the Social Insurance Fund of the Russian Federation, or continue to work and receive wages. If a woman continues to work after receiving sick leave for pregnancy and childbirth, then there are no grounds for paying benefits for this period (Information letter of the Federal Social Insurance Fund of the Russian Federation dated October 8, 2004 No. 02-10/11-6671). Pay the employee benefits only for the period of maternity leave specified in the application, within the period of release from work according to the sick leave.

For the benefit, the calculation period is 2 years preceding the year of the start of leave according to the BiR, and not the year indicated in the column “From what date” of the table “Exemption from work” of the sick leave (Article 255 of the Labor Code of the Russian Federation, Part 1 of Article 14 of Law No. 255-FZ “On compulsory social insurance...”).

For example, the sick leave list indicates a period of release from work from December 15, 2020 for 140 calendar days. The employee wrote an application for leave under the BiR from 01/09/2020. In this case, the calculation period is 2018-2020, and the amount of maternity benefits must be calculated based on the actual duration of the vacation - 126 calendar days.

Key points

Before answering the question of how to calculate sick leave for pregnancy and childbirth, we will determine the important conditions that are provided by officials regarding the provision of maternity benefits:

- Maternity benefits from the state are paid exclusively to the woman who carried and gave birth to the baby. There is only one exception: it is paid to one of the parents when adopting an infant under three months of age.

- The simultaneous assignment of maternity benefits and payroll is not provided. Similar conditions apply for maternity leave of up to 1.5 years. The mother is entitled to only one type of payment.

- The benefit is assigned in the amount of 100% of average earnings for all calendar days of maternity leave. The amount of calculated state benefits for pregnant women is not subject to personal income tax.

The main provisions are enshrined in Chapter 3 of the Federal Law of December 29, 2006 No. 255 (as amended on March 7, 2018).

How to calculate additional maternity benefits

If an employee after giving birth brought a sick leave sheet in which the code “020” is indicated in the “additional code” cells, at her request the organization must provide additional maternity leave. For example, in connection with complicated childbirth, additional leave is provided for 16 calendar days (Article 255 of the Labor Code of the Russian Federation).

Leave for accounting and additional leave are associated with one insured event (clause 2, part 2, article 1.3 of Law No. 255-FZ). Therefore, to calculate the amount of benefits for additional days of vacation, you need to use the average earnings of the employee, on the basis of which the benefits for the period of the main maternity leave are calculated (Part 1, Article 14 of Law No. 255-FZ).

Example 2

Employee Artemenko Yu. V. was granted maternity leave from November 12, 2020 to March 29, 2020 for 140 calendar days. The BIR allowance is calculated based on the SDZ in the amount of 980 rubles, determined for the billing period 2017-2018.

After giving birth, Artemenko submitted a continuation of the certificate of incapacity for work and an application for 16 days of additional leave in connection with complicated childbirth.

Calculation of B&R benefits for the period of additional leave:

- SDZ - the same one that was used to calculate benefits for the period of the main leave under the BiR - 980 rubles;

- the amount of benefit for additional days is 15,680 rubles. (980 RUR x 16 days).

How is sick leave paid after childbirth?

Payment for sick leave depends on the employee’s average earnings. At the same time, the Social Insurance Fund has established a minimum and maximum payment amount.

In 2022, a woman will have to receive at least 58,878 rubles. and 340,795 rub. for a standard vacation of 140 days.

The minimum benefit amount is calculated based on the minimum wage. Maternity benefits depend on the employee’s earnings for the 2 years preceding the issuance of sick leave.

This excludes the days when the employee received:

- disability benefits;

- average earnings (travel allowances);

- leave to care for a minor.

To calculate benefits, the employee’s salary is taken to be no more than the established maximum. In 2022 it was 340 thousand rubles.

If a woman was on maternity or child care leave during this period, then she has the right to replace the year with any other one.

It is important that at this time the employer officially pays contributions to the Social Insurance Fund from her income.

Sick leave is paid in full. Current legislation does not provide for the division of benefits into before and after childbirth.

Application for maternity leave. [24.00 KB]

What payments are due on maternity leave in 2022?

If the newborn died.

In accordance with regulations (Law No. 514-FZ), if a woman gives birth to a stillborn fetus or the child does not survive the first 6 days, the woman is issued a bulletin for the entire period of incapacity.

However, it should not last less than 3 days. If the newborn died after 6 days, then the sick leave is extended for 16 days.

Thus, a woman has the right to receive benefits of 30 weeks in 140 calendar days. If the child does not survive after childbirth, then revocation of sick leave is not provided for by law.

If an employee decides to go to work ahead of schedule, she will lose the right to payment. Therefore, for this period, it is recommended to conclude a civil contract with the woman.