Form 182n

Order of the Ministry of Labor No. 182n dated April 30, 2013 approved the certificate form 182n for calculating sick leave. From February 20, 2022, a new form is used as amended by Order of the Ministry of Labor dated January 10, 2022 No. 1n. Technical changes: the signature of the chief accountant has been removed. It is expected that the innovation will speed up the processing of the document.

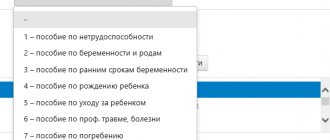

Earning information is required so that the new employer receives information about your income. It is used to calculate average earnings when assigning benefits:

- due to illness;

- maternity leave;

- for child care.

This is what a certificate in form 182n looks like in 2022:

Help and calculation for the Social Insurance Fund in 2022 in 1C Enterprise 8.3.

Calculation certificate for the Social Insurance Fund in 2021 , as well as its formation in the 1C configuration: Salaries and personnel management Edition 3.1 and Enterprise Accounting 8.3 Edition 3.0 .

From January 1, 2022, the assignment and payment of benefits throughout the Russian Federation is carried out directly by the territorial bodies of the Social Insurance Fund using the “ direct payments ” mechanism.

What does the “ direct payment ” mechanism mean? This mechanism involves changes in the procedure for paying benefits under Compulsory Social Insurance ( CHI ) in case of temporary disability and in connection with maternity. At the same time, employers will be required to transfer insurance premiums for two types of insurance in full without reducing the amount of benefits paid, and the assignment and payment of benefits for mandatory social insurance. insurance will be provided directly from the Social Insurance Fund .

The calculation certificate is submitted accordingly when applying for the allocation of funds for reimbursement of benefits from the Social Insurance Fund. Payers of contributions for compulsory insurance in case of temporary disability and in connection with maternity compensate part of the costs of benefits from the funds of the Social Insurance .

There are two options for how this can be done: 1. Reduce the debt on insurance premiums (clauses 1, 2, article 4.6 of the Federal Law of December 29, 2006 No. 255-FZ, clause 2 of article 431 of the Tax Code of the Russian Federation); 2. Reimbursement of expenses (clause 3 of article 4.6 of the Federal Law of December 29, 2006 No. 255-FZ, clause 9 of article 431 of the Tax Code of the Russian Federation).

If the second option is preferable for the employer, then a calculation certificate must be submitted the Social Insurance Fund the Social Insurance Fund ).

The list of documents provided to the Social Insurance Fund for reimbursement of expenses incurred depends on the benefit. The Social Insurance Fund compensates the employer's expenses for benefits: 1. Temporary disability; 2. Related to the birth of a child, including registration in the early stages of pregnancy; 3. For burial.

The FSS the costs of some benefits in full. For example, maternity benefits, child care benefits up to 1.5 years old, funeral benefits from the Social Insurance Fund . Sick leave is compensated only starting from the fourth day of the employee’s incapacity for work. The first 3 days are at the expense of the employer.

In accordance with the Order of the Ministry of Health and Social Development dated December 4, 2009 No. 951n, the payer of insurance premiums must submit the following set of documents for reimbursement of benefits expenses: 1. Application (approved by the Letter of the Federal Social Insurance Fund of Russia dated December 7, 2016 No. 02-09-11/04-03-27029) ; 2. Certificate-calculation-decoding of expenses (Appendix No. 2 to the letter from the Social Insurance Fund ); 3. Copies of documents confirming expenses; 4. Application and 2 appendices to it.

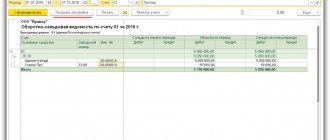

How to fill out this calculation certificate for 2021 in 1C Enterprise 8.3 ?

This certificate for the 1C ZUP 3.1 is located in the menu section Taxes and contributions – Reports on taxes and contributions – Application and certificate-calculation for the Social Insurance Fund . Similarly, the same report in the 1C BP 3.0 is located in the section Salaries and personnel - Salary - Salary reports - Application and certificate-calculation for the Social Insurance Fund .

This report will simultaneously form the Statement ,

as well as Help-calculation and Application-decoding No. 2 .

The rules for filling out the certificate are as follows:

The policyholder indicates in the document on an accrual basis: 1. Initial and final debt to the Social Insurance Fund ; 2. Contributions payable, including for the last three months; 3. Additional accrued contributions, if any; 4. Expenses not accepted for offset; 5. Contributions refunded or credited; 6. Funds spent for the purposes of Compulsory social insurance, including for the last three months; 7. Contributions paid to the Social Insurance Fund , including for the last three months; 8. Debt written off to the policyholder by the Social .

The certificate is Appendix No. 1 to the application for the allocation of funds for insurance coverage.

This calculation certificate is a complete copy of Table 1 of the previous 4-FSS . The data in the calculation certificate is filled in automatically based on the data from the information entered by the documents, except for lines 9 and 20. Data can also be entered manually, however, when entering a value in one cell, automatic recalculation does not occur in other cells, thus filling out all cells is done by an accountant manually.

Appendix No. 2 is also attached to the calculation certificate .

It indicates a breakdown of expenses for the Social Insurance Fund (Appendix 2 to the Social Insurance Fund dated December 7, 2016 No. 02-09-11/04-03-2702).

Filling rules

Let's see what certificate 182n is and how to fill out the document for 2 years for sick leave. When drawing up reference document 182n, you must provide the following information:

- about the employer (section 1): name, TIN, data of the territorial body of the Social Insurance Fund to which the organization belongs, its registration number, contact details of the company;

- employee (section 2): full name, passport details, information about the period of his work in the organization;

- employee income (section 3);

- periods of incapacity for work during work, periods of absence, if the employee during this time accrued income that was not subject to insurance contributions.

Section 3 provides data on the amount of accruals to the employee. A rule has been established for the period for which certificate 182n is issued upon dismissal: for the year of dismissal and for the two previous calendar years. Only the amounts of income from which the company calculated insurance premiums are indicated.

The question often arises: why does Form 182n contain an amount of earnings that is not equal to the amounts specified in 2-NDFL? This is due to the fact that the government of the Russian Federation annually sets a maximum amount of earnings from which insurance premiums are calculated. If an employee’s income from the beginning of the year exceeds the limit, then insurance contributions to the Social Insurance Fund are not calculated from the excess amount, and they are not taken into account when calculating benefits.

Limit base for calculating insurance premiums:

| Year | Limit base for calculating insurance contributions to the Social Insurance Fund, rub. |

| 2016 | 718 000 |

| 2017 | 755 000 |

| 2018 | 815 000 |

| 2019 | 865 000 |

| 2020 | 912 000 |

| 2021 | 966 000 |

| 2022 | 1 032 000 |

Thus, if an employee’s earnings exceed this amount, then the maximum base is indicated in form 182n. The certificate of income and personal income tax amounts indicates the full amount of income subject to personal income tax, including payments that are not subject to insurance contributions. This explains the discrepancy.

ConsultantPlus experts sorted out what documents and within what time frame should be given to an employee upon dismissal. Use these instructions for free.

When to prepare an accounting statement

First of all, let’s determine what kind of certificate it is. This is a primary accounting document that is used to reflect the specific business transactions of an institution. For example, Article 313 of the Tax Code of the Russian Federation regulates the list of situations in which an accounting certificate is used:

- When identifying inaccuracies and errors in accounting. In such a situation, a sample accounting certificate confirming the correction of the error is drawn up, which confirms that the corrections have been made to the accounting.

- If specific accounting details are required. For example, when maintaining separate accounting for VAT.

- If necessary, make explanatory notes on business transactions. For example, to reflect transactions to write off receivables or payables.

- To confirm calculations made during business transactions. An example of this situation could be the calculation of compensation for delayed wages, the calculation of vacation compensation upon dismissal, or the calculation of vacation or maternity pay.

Filling procedure

We fill out form 182n step by step.

Step 1. The issued document must be assigned a serial number and the date of creation.

Step 2. Fill in the organization data in section 1.

Step 3. Fill in the employee’s information in section 2.

Step 4. In section 2 we indicate the terms of work in the organization.

Step 5. In section 3 we provide information on earnings for 2020–2022. Please note that only income that was subject to insurance premiums is indicated.

Step 6. We indicate the name of the period in certificate 182n - periods of incapacity for work are reflected in section 4.

Step 7. And finally, the document is given to the responsible persons for signature; if available, the organization’s seal is affixed. Since February 20, the chief accountant of the organization does not sign a certificate of the amount of wages, other payments and remuneration for two calendar years. The new form contains a line only for the signature of the head of the organization.

Accounting certificate confirming the correction of errors

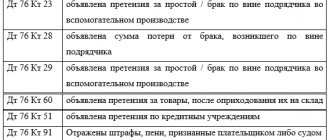

If an accountant discovers an accounting error, it needs to be corrected. In this case, an accounting certificate is also drawn up. It describes where and why the error occurred and how it was corrected.

An accountant can correct an accounting error through a reversal entry or additional posting.

Example:

Accounting certificate for transfer of information

Sometimes it is necessary to issue an accounting certificate for presentation to government authorities. In such situations, the certificate is for informational purposes only.

For example: an organization acts as a defendant in a labor dispute with an employee who was fired unlawfully. And now this employee is demanding through the court to pay him the average salary for the period of forced absence. Information on average earnings can be presented to the court in the form of an accounting certificate.

Example:

Exchange documents with government agencies without leaving your workplace. Online Sprinter is an online reporting service with 24/7 technical support. Work for 30 days for free and appreciate all the benefits of the service !

Why do you need a certificate-calculation 2022

Employers pay benefits both at their own expense (the first 3 days of the employee’s illness) and at the expense of the Social Insurance Fund. If a region participates in a pilot project, the entire benefit amount is often paid by the Social Insurance Fund.

At the same time, based on the amount of benefits paid, policyholders in 2022 will reduce their payments to the Social Insurance Fund (clauses 1, 2, Article 4.6 of the Federal Law of December 29, 2006 No. 255-FZ). If social insurance costs exceed accrued contributions, policyholders can apply to the Social Insurance Fund for reimbursement (clause 3, article 4.6 of the Federal Law of December 29, 2006 No. 255-FZ, clause 9, article 431 of the Tax Code of the Russian Federation).

In order for the FSS to make a decision on allocating funds to the policyholder for the payment of insurance coverage, it is necessary to submit a set of documents to the territorial body of the FSS based on the results of the quarter or any month of 2022. The kit in 2022 should include a certificate of calculation.

Samples of certificates and rules of registration

Sample forms are available at the regional offices of the Social Insurance Fund. You can review them when submitting your application. Samples are also posted on the company's official website. They are freely accessible without passwords, so anyone has the right to familiarize themselves with them.

The rules for completing the form are established by current legislation. The certificate states:

- information about the policyholder - name of the organization, details, etc.;

- information about the insured person - full name, place of work, SNILS, etc.;

- names of benefits;

- amount of payments;

- date of issue.

A certificate of benefits paid is one of the documents confirming the amount of profit received by a citizen. The form is issued by the FSS at the request of the applicant.