What is included in bank assets

In practice, this concept includes various property. We are not always talking about specific things owned by the company. And assets include:

- real and movable property owned by a financial company;

- bank's own capital, money in correspondent accounts;

- securities, currency, precious metals;

- loans issued to citizens, companies, and other banks.

Banks are required to regularly provide the Central Bank with reports on their work, assets and liabilities. This information is not a trade secret and is therefore freely available.

An analysis of the assets of all banks in the country allows us to determine the financial situation in the country and make forecasts, including for work on the securities market.

What are liabilities

In addition to assets, organizations also have liabilities. If the first is the bank’s personal property, then the second is its liabilities. It is clear that if liabilities outweigh assets, then things are bad. Therefore, bank managers closely monitor the ratio of indicators.

Liabilities include debt obligations to various structures, securities issued by the bank, and deductions from profits. Deposits are also classified as liabilities, since they are an obligation to depositors. But, meanwhile, this money is circulated, for example, a bank can lend it out or buy securities with it. As a result, with existing liabilities, assets are created.

What are active and passive accounting accounts?

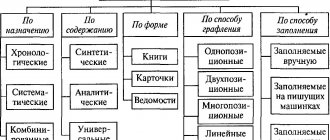

In the course of its activities, each organization must keep constant and continuous records of ongoing business transactions, changes in the volume of its own funds and property, and sources of funds. The most convenient and fairly simple way of maintaining such records is accounting accounts. All accounts, regardless of type, have their own specific number, name and the same structure, which is a two-sided table, the left side of which is called debit, and the right side is called credit. Each account has a balance at the beginning and end of the accounting period and turnover: debit and credit.

All accounts can be divided according to their economic meaning into active and passive accounting accounts. Differences in the purpose of debit, credit and balance are a distinctive characteristic of active and passive accounting accounts. Active accounting accounts are responsible for the state of the enterprise's property and its external debts. We can say that active accounting accounts keep records of the movement of the company's assets. Passive accounting accounts are designed to account for the sources of the formation of property and the organization’s obligations to third-party partners, employees, the state and even the owner of the company.

The main difference between active accounts and passive ones is the following:

- They always have a debit opening balance, showing the availability of funds at the beginning of the reporting period;

- The debit turnover of active accounting accounts is an increase in funds, and the credit turnover is a decrease;

- The ending balance of active accounting accounts must also always be debit; it shows funds at the end of the reporting period and is calculated by adding the opening balance with the debit turnover minus the credit turnover.

The second group of accounts are passive accounting accounts. In contrast to active ledger accounts, they:

- They always have a credit opening balance, which shows the amount of capital or liabilities of the organization at the beginning of the reporting period;

- The debit turnover of passive accounting accounts reflects a decrease in capital or liabilities, and the credit turnover reflects their increase;

- The ending balance must be a credit balance; it provides information about the amount of capital of the enterprise and its liabilities at the end of the reporting period and is defined as the sum of the opening balance and credit turnover, reduced by the amount of debit turnover.

In addition to active and passive accounting accounts, there are also those that take into account both property and the sources of its formation, and those that change the final balance, i.e. at different reporting periods they may have either a debit or a credit balance. These accounts are primarily used for simultaneous settlements with various creditors and debtors and are called active-passive accounting accounts. Debit turnover in active-passive accounting accounts reflects an increase in accounts receivable or a decrease in accounts payable, and credit turnover, in turn, shows an increase in accounts payable or a decrease in accounts receivable.

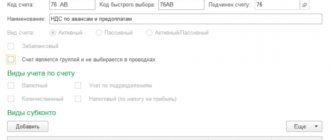

The list of active and passive accounts is regulated by the Ministry of Finance in the Chart of Accounts for accounting of financial and economic activities of organizations. The current Chart of Accounts has been used since 2001 according to Order of the Ministry of Finance No. 94n dated October 31, 2000. Based on this Chart of Accounts, the list of active accounts is located, as a rule, in sections IV, they have numbers from 01 to 59. Typical examples of active accounting accounts are, for example, 01 “Fixed assets”, 10 “Materials”, 50 “Cash of the organization” . Passive accounting accounts are numbered from 80 to 99 and are mostly found in sections VII and VIII. Section VI contains active-passive accounts with numbers from 60 to 79, which, based on the situation of who has obligations (debts) to whom, can be both active and passive.

What are active and passive accounting accounts?

The main active accounts include:

01 – “Fixed assets”, used to account for the presence and movement of fixed assets of an enterprise that are in operation, in reserve, on conservation, in lease, in trust management;

04 – “Intangible assets”, intended to account for the presence and changes in the organization’s intangible assets, as well as its expenses for the organization for research, development and technological work;

10 – “Materials”, used to account for the availability and changes in volumes of materials, raw materials, fuel, spare parts, inventory and auxiliary tools and accessories, containers, etc.;

20 – “Main production”, which serves to account for production costs, products (works, services) that are necessary for the creation and functioning of the organization;

41 – “Goods”, used to account for inventory items acquired as goods for sale (for trade and public catering organizations);

43 – “Finished products”, used to account for volumes and movements of finished products (for enterprises engaged in industrial, agricultural and other production activities);

50 – “Cash desk of the organization”, intended for recording amounts and movement of funds in the cash registers of the organization;

51 – “Current accounts”, which serves to record the availability and movement of funds (in rubles) on the organization’s current accounts opened with credit institutions.

Main passive accounting accounts

The main passive accounts include:

66 - “Calculations for short-term loans and borrowings”, used to account for the status of short-term (for a period of no more than 12 months) loans and borrowings received by the organization;

67 - “Calculations for long-term loans and borrowings”, intended to account for the status of long-term (more than 12 months) loans and borrowings received by the organization;

70 - “Settlements with personnel for wages”, used to record information on wages to employees, as well as on the payment of income on shares and other securities of a given enterprise;

80 – “Authorized capital”, which serves to record information about the amount and movement of the authorized capital (share capital, authorized fund) of the organization;

86 – “Reserve capital”, intended to account for the state and movement of reserve capital;

87 – “Additional capital”, used to record information about the organization’s additional capital.

Among the active-passive accounts are:

60 — “Settlements with suppliers and contractors”;

68 — “Calculations for taxes and fees”; Designed to summarize information on settlements with budgets for taxes and fees paid by the organization, and taxes with the organization's employees.

69 — “Calculations for social insurance and security”;

75 — “Settlements with founders”;

76 - “Settlements with various debtors and creditors.”

These accounts may contain both a debit and a credit balance at the same time, but on account 99 - “Profits and losses”, which gives a conclusion about the final financial result of the enterprise’s activities in the reporting year, there is always only a one-sided balance. It allows you to make an unambiguous conclusion whether the company ended the year with a profit (credit balance) or suffered losses (debit balance).

As we see, in the process of any economic activity, all the company’s funds are in constant motion, which must be strictly monitored, recorded and documented. Accounting accounts are a way of such a visual and clear reflection of the impact of any business transaction on changes in accounting objects. Their management is a complex mechanism that requires care and extreme precision, because the most insignificant mistake can lead to disruption of the entire system. Therefore, such “jewelry” processes must be performed by professionals, guaranteeing accuracy, quality and deadlines!

Bank liquidity

Also an integral term in analyzing the work of a banking organization. Management's task is to maintain an adequate level of liquidity. If it decreases, this indicates financial problems. Due to a significant decrease in liquidity, the bank may lose its license.

The level of liquidity is determined by the ratio of the organization's assets and liabilities. That is, the bank must have the financial ability to fulfill all its obligations.

The Central Bank has introduced three liquidity standards, which are carefully monitored: instantaneous, current and long-term.

Violation of regulations is punishable by fines, a ban on certain banking operations, and the last resort is revocation of the license. It is clear that if the bank has more liabilities than its own assets, then there is a risk of serious financial problems.

Deposits play an important role in determining the liquidity indicator. These are key assets for the bank; all organizations are interested in attracting such capital. But if suddenly the bank begins to experience problems, then first of all it is faced with an outflow of funds - depositors take their money. As a result, the level of liquidity quickly decreases, and there is a risk of complete collapse.

Why is count 51 needed?

Account 51 is used to record the receipt and expenditure of the company's non-cash money in bank accounts. On 51 accounts, records are kept only in rubles. To account for money in foreign currency, there is account 52 “Currency accounts”.

Account 51 is active. Debit records the receipt of money, and credit records payments and write-offs. The account balance can only be in debit; it is reflected in the balance sheet in the “Cash” line.

Due to restrictions on cash payments, legal entities cannot operate without a current account. Therefore, 51 accounts are used by all companies.

Rating of banks by assets

Typically, the largest assets are found in banks that occupy top indicators in many areas of activity. Not only ratings of assets within the country are maintained, but also international ones, but we will consider only domestic organizations.

Please note that asset tracking is done frequently, every month. As a result, it is possible to track the dynamics by month, the growth and outflow of assets for each specific bank.

As of February 2022, the top ten largest Russian banks by assets look like this (indicator in billions of rubles):

- Sberbank, 28596. Increase compared to the previous month - 0.21%.

- VTB, 14124. Compared to January, the figure is 1.45% less.

- Gazprombank, 6651. Growth - 1.47%.

- Alfa-Bank, 3761. Reduction by 0.01%.

- National Clearing Center, 3714. The reduction is significant - 6.18%.

- Rosselkhozbank, 3409. Reduction by 3.73%.

- Opening, 2714. Reduction by 0.02%.

- Moscow Credit Bank, 2528. Increase by 0.41%.

- National Bank Trust, 1314. Reduction of 4.96%.

- UniCredit Bank, 1306. Increase by 4.98%.

As you can see, the confident leader of the rating is Sberbank, the gap from second place (VTB Bank) is twofold. Which is not surprising, because Sberbank can rightfully be called the main financial organization of the country. It has a huge circle of depositors, borrowers, and serves many business representatives. This is the most reliable bank in the country, with liquidity there will definitely not be any problems; the government will not allow this.

The rating of Russian banks practically repeats the rating in terms of reliability, which is important for depositors.

Financial indicators of the bank for the depositor

If a person plans to open a deposit and chooses a financial organization for this, it is extremely important to analyze the company’s financial performance. If it carries any risks, it is better to choose another structure.

Track bank ratings by assets, but look beyond the last month's performance. They are updated monthly, so check other periods as well. A one-time reduction in assets does not indicate a bad situation in the bank, but if it occurs from month to month, it is better to consider another company.

In addition to the rating by assets, you can also look at the rating by the volume of attracted deposits from individuals. The TOP includes banks that are most trusted by citizens. In addition, the rating allows you to assess the outflow of funds.

For February 2022, the TOP looks like this (billion rubles):

- Sberbank, 12934. Outflow compared to January - 2.84%.

- VTB, 4305. Outflow - 0.26%.

- Gazprombank, 1194. Growth - 2.94%.

- Alfa-Bank, 1179. Outflow - 1.74%.

- Rosselkhozbank, 1177. Growth - 0.93%.

- Opening, 895. Growth - 1.13%.

- Moscow Credit Bank, 478. Growth - 0.8%.

- Raiffeisenbank, 469. Outflow - 0.11%.

- Sovcombank, 435. Inflow - 0.2%.

- Post Bank, 379. Outflow - 1.15%.

Minor changes up or down should not alarm you. This is a normal process, the numbers cannot always be the same.

As well as in terms of assets, the leader in terms of deposits is Sberbank. The gap with second place VTB is almost three times. In general, the rating shows which banks citizens always trust the most and where their funds are most concentrated. But this does not mean that other companies, even those not included in the TOP 10, are unreliable.

When choosing a bank, analyze its assets relative to its liabilities. If there is information in the news about liquidity problems, it is better to refuse cooperation. Of course, all client funds are insured by the state, but you will have to run around to get them back.

5 / 5 ( 1 voice )

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Accounting accounts in "1C: Accounting 8"

An accounting entry or accounting formula is a correspondence of accounts indicating the amount of transactions

The accounting entry is compiled only on the basis of primary accounting documents. Primary accounting documents include orders, contracts, acceptance certificates, payment orders, cash receipts and expenditure orders, invoices, orders, receipts, sales receipts, etc.

Primary documents are supporting documents on the basis of which accounting records are maintained and which certify the facts of business transactions. The primary document is drawn up at the time of the relevant transaction or immediately after its completion.

In general, to draw up a posting you need to:

- determine the essence of changes occurring with accounting objects as a result of a completed business transaction;

- select, according to the Chart of Accounts, suitable accounts for recording the amount of a business transaction using the double entry method - debit and credit.

After determining the correspondence of accounts as a result of this operation, an accounting entry is drawn up. If a transaction corresponds to only two accounts (one for debit, the other for credit), then it is called simple

.

Accounting entries in which more than two accounts interact are complex entries

.

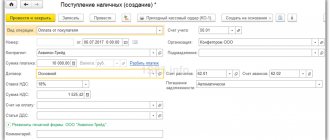

You can make accounting entries in 1C:Accounting 8 through standard configuration documents and through manually entered transactions.

The document “1C: Accounting 8” allows you to enter information about a certain business transaction into the accounting system, record the date and time of the transaction, the amount and content of the transaction. Examples of program documents: Receipt of goods and services, Expense cash order, Receipt to current account, Depreciation and depreciation of fixed assets

etc.

Based on the document, accounting entries are automatically generated and recorded in the accounting registers (each accounting entry corresponds to one entry in the accounting register), and entries are also entered into specialized information registers and accumulation registers. In the 1C:Enterprise system, accounting for a business transaction is always associated with the document that generated it: if the document needs to be edited, then when it is edited, the entries in the registers will be created anew, and when the document is deleted, the entries in the registers will also be deleted.

Using the document "1C: Accounting 8" you can also obtain a printed form of the primary document, for example, a Payment order

,

Advance report

, etc.

In general, standard accounting system documents can generate accounting entries in various combinations, entries in special registers, and also offer or not offer printed forms of primary accounting documents, for example:

- in the document Invoice for payment to the buyer,

a printed form is available, but there are no entries in the accounting register and in special registers; - in the document Receipt to the current account

- there can be only one simple accounting entry, and there is no (as unnecessary) printed form of the document; - The document Sales of goods and services

contains a whole group of accounting entries, entries in registers, and also supports several options for printed forms.

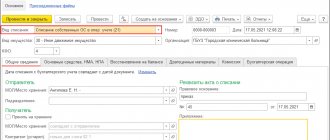

You can view transactions using the DtKt

both from the document form and from the list of documents form.

If the automatically created records for some reason do not satisfy the user, then in the form for viewing document movements, you must set the Manual adjustment flag (allows editing of document movements).

This flag allows you to add new and edit existing document movements; the automatic generation of movements is disabled.

After removing the Manual adjustment...

, the document will be re-posted, and the movements will be restored automatically by the posting algorithm (Fig. 12).

Rice. 12. Form for viewing document movements

In the accounting register form (section Operations

hyperlink

Transaction log

) information in the list can only be viewed (Fig. 13). To find the necessary information, it is advisable to use the list selection and sorting settings.

Rice. 13. Accounting register

If the user does not find the business transaction he needs among the standard documents of 1C:Accounting 8, then in this case a manual Operation

(Section

Operations

, hyperlink

Operations entered manually

).

You can check the correctness of manually entered account correspondence using the accounting express check mechanism.

Correspondence of Accounts directory is intended to assist in registering business transactions.

(section

Main

hyperlink

Enter a business transaction

), which is a configuration navigator that will help the accountant, based on the content of the business transaction or the correspondence of the accounting accounts for the debit and (or) credit of the account, to understand which document needs to be reflected in the configuration.

You can select the required account correspondence by debit or credit accounts, by the content of the transaction (Fig. 14) or by the configuration document.

Rice. 14. Directory of correspondence accounts

To facilitate the entry of recurring business transactions, standard transactions are provided. To store a list of standard operations, as well as to create new standard operations, a reference book of standard operations is provided (section Operations

hyperlink

Typical operations

).

A typical operation is a template (standard scenario) for entering data about a business transaction and generating entries for accounting and tax accounting, as well as entries in accumulation and information registers.

The entered operation will be reflected in the operation log, as well as in the list of manually entered operations.

In the header of the directory element Typical operation

in the

Contents

, a brief content of the transaction is indicated (Fig. 15).

The information from this field will be filled in the field of the same name when creating the Operation

.

Rice. 15. Creating a new standard operation

The form displays elements of a typical operation on the following tabs:

- Accounting and tax accounting;

- List of parameters.

On the Accounting and Tax Accounting

a set of templates for automatic generation of accounting and tax accounting entries is displayed. Records are entered into the tabular part, each of which will correspond to the automatically generated invoice correspondence. When you select a value for a field, a form appears with a choice of filling options. There are three options:

- Parameter

(used for values that are not known in advance and are set at the time of document creation); - Value

(set in the

Operation

automatically with the value specified in the template and is not requested when entering the

Operation

); - Do not change

(applies only to periodic information registers, and the value of this field will be obtained from the infobase at the time of creation of the

Operation

).

On the Parameter List

All parameters used in this typical operation are displayed.

On this tab you can add new or change existing parameters, as well as manage the order of parameters. Order is used to display parameters in an Operation

.

To set up a template for filling information and accumulation registers, you need to add the required registers using the Select registers

(

More

-

Select registers

).

After selection, the selected registers will be displayed on additional tabs between the Accounting and Tax Accounting

and

List of Parameters

.

You can analyze data on accounting and tax accounts using standard reports:

- Turnover balance sheet;

- Account balance sheet;

- Account analysis;

- Account turnover;

- Account card;

- General ledger and others.

Comments: 2

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Elena

02/01/2022 at 11:51 Good morning Irina! Do you provide up-to-date advice on investing funds? If yes, are they paid? My field of activity is far from financial, and therefore I lack financial literacy, but I would like to try investing money. Elena.

Reply ↓ Anna Popovich

02/02/2022 at 02:32Dear Elena, Brobank.ru service specialists do not provide investment advice, we provide only information services to provide site visitors with a transparent and simple selection of financial services from banks and credit companies.

Reply ↓