Conditions of recognition

The key conditions for recognizing expenses in accounting are as follows:

- the expense takes place in accordance with a specific agreement/legislative and regulatory requirements/business customs;

- the amount of expenditure can be determined;

- there is certainty that a particular transaction will result in a reduction in the entity's economic benefits (i.e. the entity has transferred the asset or there is no uncertainty about its transfer).

Also see “Main types of costs in production”.

The basic principles for recognizing expenses in accounting are as follows: if at least one of the listed conditions is not met in relation to any expenses incurred by an organization, then in accounting it recognizes receivables.

Also see “Accounting for accounts receivable in accounting: to which account should it be attributed?”

Depreciation is recognized as an expense based on the amount of depreciation charges - based on:

- the value of depreciable assets;

- their useful life;

- methods adopted by the organization for calculating depreciation.

Recognition of expenses in accounting

Note 1

The rules for generating data in accounting about an organization’s expenses are established by PBU $10/99$ “Organization’s Expenses.” This does not apply to credit and insurance organizations.

Non-profit organizations with the exception of government agencies that carry out business activities, in accordance with paragraph $2$ of article $24$ of Law No. $7$-FZ, must also apply the provisions of PBU$10/99.$

Definition 1

Enterprise expenses , according to this document, recognize a decrease in economic benefits due to the disposal of assets and the occurrence of various obligations leading to a decrease in the capital of the enterprise. At the same time, a decrease in deposits by decision of participants and property owners is not recognized as expenses of the enterprise.

Are you an expert in this subject area? We invite you to become the author of the Directory Working Conditions

Expenses for the purposes of taxing the profit of an organization on the basis of Article $252$ of the Tax Code of the Russian Federation are justified and documented expenses. Also, based on Article $265 of the Tax Code of the Russian Federation, expenses include losses incurred by the taxpayer. Expenses may be incurred on the territory of a foreign state, in which case, documents from that state should be drawn up in accordance with business transactions. Primary documents drawn up in accordance with the requirements of a foreign state for operations carried out on its territory must contain data reflecting the essence of the business transaction. These documents must be translated into Russian.

In order to recognize expenses, a number of conditions must be met.

The conditions for recognizing expenses in accounting are established by paragraph $16$ of PBU$10/99$; according to it, an expense is recognized in cases where:

- is carried out under a specific contract, in compliance with the requirements of laws, regulations and business practices;

- the amount of expenses can be accurately determined;

- there is an understanding that as a result of a certain operation there will be a decrease in the economic benefits of the enterprise.

Finished works on a similar topic

Coursework Recognition of expenses in accounting 470 ₽ Abstract Recognition of expenses in accounting 220 ₽ Test work Recognition of expenses in accounting 200 ₽

Receive completed work or specialist advice on your educational project Find out the cost

Note 2

If at least one of the indicated conditions is not met, then the enterprise’s accounting records recognize receivables , not expenses.

According to paragraph $16$ of Accounting Regulations No. 10/99, depreciation is recognized as an expense and is calculated from the amount of depreciation charges determined based on the cost of depreciable assets, useful life and the method of calculating depreciation that the organization uses.

Expenses can be recognized in accounting regardless of the purpose of receiving revenue and the form in which the expense was incurred. This confirms point $17$ PBU$10/99$.

Expenses must be recognized in the period in which they are incurred. Recognition of expenses does not depend on the date of actual payment of funds.

Small businesses and socially-oriented non-profit organizations may accept the recognition of revenue from the sale of goods, works or services after receipt of funds and other forms of payment. This method is called the cash method. When using this method, expenses are recognized after the actual repayment of debt.

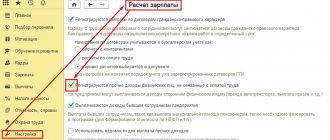

Picture 1.

In tax accounting, expenses are considered to be any expenses incurred to carry out business activities aimed at generating income.

The difference in the methodology for recognizing expenses in tax and accounting is as follows: expenses in accounting must be recognized regardless of the purpose of obtaining revenue or other income; expenses in tax accounting are any expenses incurred only for activities aimed at generating income.

Based on point $4$ of PBU$10/99$, all expenses incurred by the enterprise are divided into:

- expenses for ordinary activities;

- other expenses.

Expenses for ordinary activities include expenses that are associated with the production and sale of products, the purchase and sale of goods, as well as those expenses that are associated with the performance of work and the provision of services.

If an organization is engaged in providing for a certain fee the temporary possession and use of its assets under lease agreements, providing for a certain fee rights to objects of its intellectual property, and also participates in the authorized capital of other companies, current expenses for ordinary activities include expenses associated with the listed types of economic activities.

The classification of expenses is implemented and depends on the nature, conditions and type of activity of the company. Expenses not included in expenses for ordinary activities are classified as other expenses of the organization.

For tax accounting in accordance with paragraph $2$ of Article $252$ of the Tax Code of the Russian Federation, taxpayers' expenses are divided into:

- costs associated with production and sales;

- non-operating expenses.

The criteria for dividing expenses are similar to those defined in accounting and depend on the nature, conditions of sale and activities of the taxpayer.

Note 3

It should be noted that some costs can be attributed simultaneously to several groups of expenses; in this case, the taxpayer can determine which group he includes the costs in.

According to accounting rules, when generating expenses for ordinary activities, it is necessary to ensure that expenses are grouped according to the following elements:

- material costs;

- labor costs;

- contributions for social needs;

- depreciation;

- other costs.

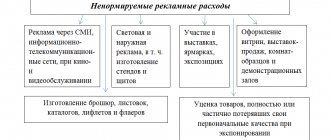

Figure 2.

For management accounting, unlike accounting, the list of cost items is established by the enterprise independently.

The differences in recognition of expenses between accounting and tax accounting were discussed above. As a result of such differences, permanent tax liabilities or permanent tax assets, or temporary differences are formed (Fig. 2).

Get paid for your student work

Coursework, abstracts or other works

Simplified accounting

Some organizations have the right to use simplified accounting methods, including simplified accounting (financial) reporting. They can establish for themselves the following procedure for recognizing sales revenue: not as the rights of ownership, use and disposal for the delivered products/goods sold/work performed/services rendered are transferred, but after the receipt of money and other forms of payment.

In this case, expenses are recognized after the debt is repaid.

Also see “Accounting on the simplified tax system”.

Clause 3 of Article 272 of the Tax Code of the Russian Federation

Depreciation is recognized as an expense on a monthly basis based on the amount of accrued depreciation, calculated in accordance with the procedure established by Articles 259, 259.1, 259.2 and 322 of this Code. (As amended by Federal Laws No. 57-FZ dated May 29, 2002; No. 158-FZ dated July 22, 2008)

Expenses in the form of capital investments provided for in paragraph 9 of Article 258 of this Code are recognized as indirect expenses of the reporting (tax) period on which, in accordance with this chapter, the start date of depreciation (date of change in the original cost) of fixed assets in respect of which capital investments have been made. (Paragraph introduced - Federal Law dated 06.06.2005 No. 58-FZ; as amended by Federal Law dated 22.07.2008 No. 158-FZ)

Recognition rules in financial statements. results

Expenses are recognized in the income statement based on the following rules:

- taking into account the relationship between expenses incurred and revenues (correspondence between income and expenses);

- by their reasonable distribution between reporting periods - when expenses determine the receipt of income over several reporting periods and when the relationship between income and expenses cannot be clearly defined or is determined indirectly;

- for expenses recognized in the reporting period when the non-receipt of economic benefits (income) or receipt of assets becomes determined;

- regardless of how they are accepted for the purposes of calculating the tax base;

- when obligations arise that are not caused by the recognition of the corresponding assets.

Recognition of income and expenses under IFRS

In most cases, income and expenses are accounted for according to IFRS 15 “Revenue from contracts with customers”. The standard has been used since 2022. Its effect does not apply to income accounting for some types of contracts presented in the table.

Income not covered by IFRS 15

| Source of income | Applicable IFRS | Note |

| Rent | IFRS 16 | |

| Insurance | IFRS 4 | |

| Financial instruments | IFRS 9 | |

| Contractual rights and obligations | IFRS 10, IFRS 11, IAS 27, IAS 28 | |

| Non-monetary exchange between companies working in the same direction | To increase sales and help potential buyers | |

| Interest or dividends | IFRS 15 governs contracts with customers, and these types of income arise on other legal grounds |

Important!

When one portion of a contract's obligations is governed by a revenue standard and another portion is governed by any other standard, the latter's requirements are considered first. Next, the funds already accounted for are subtracted from the contract value, and the remaining amount is assessed according to IFRS 15.

Also, according to IFRS 15, they keep records of additional expenses incurred in connection with the conclusion of contracts or to fulfill contracts with customers.

During the previous revenue standard, IAS 18, revenue recognition was determined by the point at which the risks and rewards of the product were transferred to the customer.

The current standard does not have specific requirements regarding the recognition and measurement of income - it contains principles by which an accountant makes decisions about recognizing income on a case-by-case basis. This requires developing your accounting judgment and, where possible, coordinating your decisions with your auditors.

The current system of revenue recognition principles is called the “five-step (five-step) analysis model.”

Each step of the model is discussed in detail in the article devoted to the analysis of IFRS 15. Here we will focus on the last, fifth step, which directly relates to income accounting.

The selling company may recognize revenue:

- at the time or during the process of transferring control of the product to the customer by the seller;

- in the amount that it plans to receive by transferring control of the product to the client.

That is, income can be recognized at once or in stages.

Products and services, when control of them is transferred, are considered assets. And it is the duration of the transfer of control that determines whether revenue should be recognized immediately or in stages. Let us clarify what control means in this context - this is the company’s ability to control the use of assets and receive benefits from it.

Income is recognized in stages in several cases.

- 1. The client acquires and consumes benefits as the seller performs his duties. The most illustrative example: paying for a long-term subscription to the press or service maintenance. Although the seller receives the entire amount at once, he recognizes income as he fulfills his obligations, that is, every month in equal parts of the entire amount: if a subscription is paid for six months, then ⅙ part every month.

- 2. The client acquires control over the asset being created or improved in the process of working on it. Example: a development company is constructing a residential complex on a site owned by a client - during specified interim periods, the construction company will recognize such a portion of the income as it has completed construction.

- 3. The seller creates a product or performs a service that he cannot resell to another client, and at the same time he has the legal right to partial payment for the amount of obligations actually provided. Example: an engineering office creates a project for a specific building, and the contract states that the client will reimburse the costs incurred by the seller in the event of early termination of the transaction.

Clause 6, Article 272 of the Tax Code of the Russian Federation

Expenses for compulsory and voluntary insurance (non-state pension provision) are recognized as an expense in the reporting (tax) period in which, in accordance with the terms of the agreement, the taxpayer transferred (issued from the cash register) funds to pay insurance (pension) contributions. If the terms of an insurance contract (non-state pension provision) provide for the payment of an insurance (pension) contribution in a one-time payment, then under contracts concluded for more than one reporting period, expenses are recognized evenly over the term of the contract in proportion to the number of calendar days of the contract in the reporting period. If the terms of the insurance contract (non-state pension provision) provide for payment of the insurance premium (pension contribution) in installments, then under contracts concluded for more than one reporting period, expenses for each payment are recognized evenly over the period corresponding to the period for payment of contributions (year, half-year, quarter, month), in proportion to the number of calendar days of the agreement in the reporting period. (As amended by Federal Laws No. 57-FZ dated May 29, 2002; No. 58-FZ dated June 6, 2005; No. 216-FZ dated July 24, 2007)