Inventory of fuels and lubricants at the enterprise

On the date of the inspection, the inventory commission (usually an accounting employee included in its composition) displays the balance of fuel and lubricants according to accounting data, and receipts are collected from the responsible persons for the delivery to the accounting department of all documents that recorded the receipt of fuel and its consumption.

Only after this do they begin directly measuring fuel and lubricants in containers and tanks. The nature of this work requires the use of special tools and measuring equipment - weighted tapes, measuring rods, etc. Inventory of fuels and lubricants is the most troublesome procedure of all types of control activities.

It is especially difficult to carry out measurements in large tanks with a capacity of 2 or 5 thousand tons. When recording natural indicators in such containers, auditors need to take into account the presence of condensation that accumulates in them due to significant temperature changes. Also, a mandatory procedure is to calculate the surface tension error of each type of inventory fuel depending on the air temperature on the day of inspection.

The actual quantity of fuels and lubricants stored in sealed containers that cannot be opened according to storage specifications is calculated using certain formulas.

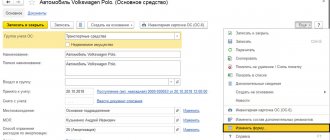

How to take into account the fuel received with the car

As a rule, when buying a car, the new owner receives not only the car itself, but also a certain amount of gasoline in the tank. If this is specified in the purchase and sale agreement, the accountant will be able to capitalize the fuel and lubricants without any problems.

But more often than not, fuel is not mentioned in the contract. What to do in this case? In practice, various approaches are used.

If there is not a lot of gasoline, then it is simply not taken into account, and the countdown of receipt and write-off of fuel and lubricants begins with the first refueling.

If the tank is almost full, fuel is taken into account. First, the volume is determined using the same methods as for inventory. Then they arrange either a free receipt or identification of surplus.

In the case of gratuitous receipt, the cost of fuel is recorded as the debit of account 10 and the credit of account 98 “Deferred income”. Subsequently, when writing off, entries are made to the debit of the “cost” account (20, 26 or 44) and the credit of account 10 “Materials,” as well as the debit of account 98 and the credit of account 91 “Other income and expenses.”

In tax accounting, fuels and lubricants received free of charge are taxable income (subclause 8 of Article 250 of the Tax Code of the Russian Federation).

If an organization shows surpluses identified during inventory, then in accounting they should be included in income and posted as the debit of account 10 and the credit of account 91. In tax accounting, it is also necessary to generate income on the basis of subparagraph 20 of Article 250 of the Tax Code of the Russian Federation.

Inventory of fuels and lubricants in car tanks

The remaining fuel in the tanks of the company's vehicles is not inventoried in the generally accepted sense. However, the company’s accounting department keeps monthly records of the receipt of gasoline and fuels and lubricants, and also controls the consumption of waybills and work orders. The head of the company has the right to initiate the removal of fuel residues in tanks and compare them with registration data by issuing an appropriate order. The results of such verification are also documented in a form acceptable to the enterprise.

Analytical accounting of fuels and lubricants is carried out by type of petroleum products and by each driver or tractor driver. They ensure rational consumption of fuels and lubricants, developed on the basis of a guideline document periodically issued by the Ministry of Transport, fuel and lubricant consumption standards. They are compiled taking into account the characteristics of the existing vehicle fleet and are updated annually. The document is approved by the head of the company.

Often, based on fuel consumption standards, enterprises develop Regulations on bonuses for saving fuel and lubricants and apply it in practice, ensuring control of fuel and lubricant consumption by vehicle units.

Why do you need an act for writing off fuel and lubricants?

The act relates to primary documentation and is of great importance for the accounting and tax accounting of the organization. It allows you to calculate the expenses incurred by the company on fuels and lubricants in order to subsequently deduct them from profit, thus reducing the tax base.

It should be noted that in addition to the write-off act, to carry out this procedure, you must have one more document: the driver’s waybill, which reflects in detail information about the fuel and lubricants spent, kilometers traveled, time spent on the road and other data.

Waybills must be issued at the beginning of the working day, after which drivers are required to submit them to the accounting department (with an advance report that records the expenditure of cash issued for fuel, as well as checks and receipts).

Commission approval

In order to legally write off fuels and lubricants, as well as to correctly draw up the act, the organization must create a special commission consisting of at least two people. For her appointment, the head of the enterprise issues a separate order. The commission should include employees from various departments, as well as a financially responsible person. In this case, it is advisable to allocate a chairman and ordinary members to the commission.

The commission’s tasks include reconciling actual fuel costs with the standards established by the company (it should be noted that they are different for each type of transport and must be approved separately), conducting test trips with drivers to check the amount of daily fuel, oil consumption, etc. , as well as collection of waybills for the reporting period.

NOTE! The creation of a commission is required only in large organizations; small businesses can do without it: here, to write off fuel and lubricants, a simple written decision of the head of the company is sufficient.

Folk tricks

A stationary device that could measure the amount of fuel in the tank with an accuracy of up to a liter is not included in any of the most complete configurations of modern cars. But among car enthusiasts and specialists, on automotive forums, you can find a lot of advice on determining these residues: from rocking the car to evaluate the sound (the less gasoline, the louder the splashes) to weighing it and comparing it with the weight in the owner’s manual. One of these original algorithms for measuring fuel residues is to drain it from the tank into a measuring container, and then pour it back into the tank.

Of course, there are more reasonable methods that are suitable in road conditions.

By instruments

If the fuel indicator is working, the first solution is to navigate it. For example: the volume of the tank is 50 liters, 10 divisions are conventionally marked on the scale, which means that each “beats” 5 liters. When estimating the remaining fuel in this way, remember that the result will be approximate, and pay attention to the location of the car: the car must be strictly horizontal, otherwise the indicator will not correspond to reality.

More accurate readings can be obtained using a special probe. The gas tanks of some old cars were supplied with it from the factory, but by analogy you can do it yourself, having studied the topic well. The distance between the cutoffs depends on the size and shape of the tank; the length of the ruler must be at least one and a half meters, and the material from which it is made must not contain metal and not create sparks.

Using diagnostic mode

If your car has a dashboard from the Renault family, which selectively includes LADA, Nissan and some others, you can find out how much gasoline is in the tank, accurate to the nearest liter, in the panel diagnostic mode.

To run diagnostics on the device, you need to:

– before turning on the ignition, hold down the daily mileage reset button for 5 seconds, then turn on the ignition and release the button when the instrument needles begin to move;

– use the same button to switch the diagnostic mode of the instrument panel, finding the gas pump icon in the upper right corner.

Below this icon a number is displayed that exactly corresponds to the volume of fuel remaining in the gas tank.

You can check whether the diagnostic mode of the instrument panel will work on a specific car experimentally.

Problems of lack of control

If there is a negligent attitude towards reporting and calculating fuel costs and a complete lack of control, the company may face a number of problems associated, first of all, with the dishonesty of drivers. Examples include:

- Drain off the remains. After a work shift or during downtime of a company vehicle, the driver can drain unused gasoline or diesel fuel and use it for further resale or refueling his own car.

- Working with “left” checks. This method is used in cases where fuel is purchased at the expense of the drivers themselves, and the costs are reimbursed by the company’s accounting department against the provided check. By purchasing “left” checks, the driver gets the opportunity to “cash out” the difference between them and the actual cost of refueling.

- Personal trips. If the vehicle's route is not tracked by the company, the driver may use fuel for his own needs and trips.

- Inflating readings. When the vehicle is idle, drivers can also increase the odometer, compensating for the difference between its readings and the true values in their favor.

This is not a complete list of ways to deceive a company, so organizations that are responsible about spending and saving resort to various methods of tracking the gasoline consumption of company vehicles. Most often, specialized fuel consumption monitoring systems are used for this.

Practical advice on accounting and write-off of fuel and lubricants

Organizations using their own or rented cars keep records of the receipt and consumption of fuel and lubricants. There are standards that must be followed when disposing of fuel.

As practice shows, accountants do not always clearly understand how to correctly apply these standards. In particular, people are confused about how to write off gasoline: according to the number of liters actually consumed or according to the standard.

We will begin the answer to this question with a remark: it should be noted that the purposes of the standards in accounting and tax accounting do not coincide.

Maintain accounting and tax records for free in the web service

Accounting

In accounting, fuel and lubricants must be written off as actual. But the difficulty is that the car does not have a device that would record the amount of gasoline in the tank. Accordingly, it is very difficult to determine “by eye” how much fuel was spent on a particular trip. Therefore, most often actual fuel consumption is calculated as the number of kilometers on the speedometer multiplied by a certain standard.

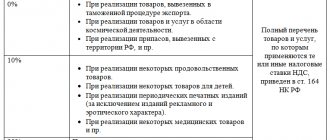

Tax accounting

The application of the standard in tax accounting is a controversial issue.

A few years ago, officials argued that when writing off fuel and lubricants as expenses, organizations must adhere to the limits approved by the Methodological Recommendations put into effect by Order of the Ministry of Transport of Russia dated March 14, 2008 No. AM-23-r. Specialists from the Russian Ministry of Finance have repeatedly reminded us of this (see.

, for example, letter from the Ministry of Finance of Russia and dated November 17, 2011 No. 03-11-11/288). Also, representatives of this department insisted: if an organization uses a machine for which the standard is not approved, it is necessary to develop its own limit and use it to write off fuel and lubricants as expenses (letter dated June 10, 2011 No. 03-03-06/4/67).

However, there is no such right in the Tax Code. Therefore, many companies did not adhere to any standards and reduced the tax base by the full cost of gasoline consumed. This approach was supported by the judges (decision of the Supreme Arbitration Court of the Russian Federation dated August 14, 2008 No. 9586/08, resolution of the Federal Antimonopoly Service of the West Siberian District dated January 27, 2009 No. F04-7730/2008 (17508-A03-46)).

Later, officials agreed that although it is desirable to apply the established standards, it is not necessary (see, for example, letter of the Ministry of Finance of Russia dated January 27, 2014 No. 03-03-06/1/2875; “Taxpayers are not required to standardize the cost of gasoline for official vehicles” ).

Thus, today companies can easily account for fuel not according to standards, but based on actual consumption. The only thing you should not do is ignore the limits developed by the organization itself.

The judges believe that since the company has approved the standard, it must be guided by it, otherwise it will face a fine (Resolution of the Administrative Court of the North Caucasus District dated September 25, 2015 No. A53-24671/2014).

Let us add that taxpayers who nevertheless decide to apply a standard (approved by the Ministry of Transport or independently developed) for tax accounting purposes are allowed to apply the same standard in accounting. In other words, use the same limit value when calculating the gasoline consumed and when reducing the tax base.

How to calculate your own standard

If there is no limit approved by the Ministry of Transport for a machine, or the organization decides to use a different value, it has the right to calculate its own limit. Typically, in such a situation, companies act in one of two ways.

The first way is to borrow information about fuel consumption from the technical documentation for the car. This approach corresponds to the position of the Russian Ministry of Transport (see “The rules for determining fuel consumption standards for passenger cars have changed”).

The second way is to create a commission and take measurements. To do this, you need to pour a certain amount of gasoline into the empty tank of the car, for example, 100 liters. Then the car should be driven until the tank is completely empty.

Based on the speedometer readings, you need to determine how many kilometers it took to completely empty the tank. Finally, the number of liters must be divided by the number of kilometers. The result will be a figure showing how much gasoline the car consumes when driving one kilometer.

This indicator should be recorded in the act and signed by all members of the commission.

Since fuel consumption depends on travel conditions, it is better to make control measurements “for all occasions”: separately - for a loaded and empty car, separately - for summer and winter trips, separately - for idle time with the engine on, etc. All obtained results should be reflected in the act drawn up and signed by the commission.

There is a simpler option: to approve one basic standard (for example, for the summer period) and increasing coefficients: for winter trips, for trips on congested roads, etc.

How to conduct a fuel and lubricants inventory

Since write-off according to the standard implies errors, the organization must periodically reconcile the data reflected in the accounting records and the actual balances. This reconciliation can be done once a week, a month or a quarter. Some companies do it daily.

To determine the actual balance, different methods are used. The simplest is to pour gasoline from the tank into a measuring container and find out the volume. However, organizations rarely resort to this method.

Another method is more common. Its essence is as follows. First you need to completely fill the tank. Then you need to look in the technical documentation to determine the volume of the tank.

And also look at the gas station receipt to see how much fuel was poured into the tank. If we subtract the volume of gasoline poured from the volume of the tank, we get the remainder that was in the tank before refueling.

This figure must be checked with the one that appeared according to accounting data for the same date.

There are other ways - for example, using a special probe with a printed scale. However, none of the methods, except for emptying the tank, eliminates errors.

Get a free demo version of the “Waybills and fuels and lubricants” service

Satellite navigation systems

Nowadays, so-called satellite tracking systems (another name is satellite navigation systems) are becoming increasingly popular.

They allow you to determine exactly when and how many kilometers the car has traveled and how much gasoline it has consumed.

In this regard, the company that purchased such a system can write off actually consumed fuel and lubricants without using standards. The need for inventory also disappears.

To reflect in accounting the transition to the use of a satellite system for accounting for fuel and lubricants, it is necessary to issue an order that cancels the previously used fuel consumption standards. In the same document, a new method of fuel accounting is established - based on system data. It is important that the date of the order coincides with the date when the system was put into operation.

Next, you will need a printout from the system, which shows the gasoline consumption for each flight. The accountant will attach these printouts to the waybills, and based on these documents, write off the fuel and lubricants. By the way, the Russian Ministry of Finance does not object to this method (letter dated June 16, 2011 No. 03-03-06/1/354).

How to take into account the fuel received with the car

As a rule, when buying a car, the new owner receives not only the car itself, but also a certain amount of gasoline in the tank. If this is specified in the purchase and sale agreement, the accountant will be able to capitalize the fuel and lubricants without any problems.

But more often than not, fuel is not mentioned in the contract. What to do in this case? In practice, various approaches are used.

If there is not a lot of gasoline, then it is simply not taken into account, and the countdown of receipt and write-off of fuel and lubricants begins with the first refueling.

If the tank is almost full, fuel is taken into account. First, the volume is determined using the same methods as for inventory. Then they arrange either a free receipt or identification of surplus.

In the case of gratuitous receipt, the cost of fuel is recorded as the debit of account 10 and the credit of account 98 “Deferred income”. Subsequently, when writing off, entries are made to the debit of the “cost” account (20, 26 or 44) and the credit of account 10 “Materials,” as well as the debit of account 98 and the credit of account 91 “Other income and expenses.”

In tax accounting, fuels and lubricants received free of charge are taxable income (subclause 8 of Article 250 of the Tax Code of the Russian Federation).

If an organization shows surpluses identified during inventory, then in accounting they should be included in income and posted as the debit of account 10 and the credit of account 91. In tax accounting, it is also necessary to generate income on the basis of subparagraph 20 of Article 250 of the Tax Code of the Russian Federation.

How to take into account the fuel in the tank of a sold car

The opposite situation is also possible, when an organization sells a car, and with it the fuel in the tank. Here it is best to include a separate clause in the purchase and sale agreement, where the volume and price of gasoline should be indicated. This will make it possible to show the implementation of fuels and lubricants separately from the implementation of the machine. From a legal point of view, everything will be correct, because no license is required to sell fuel.

In the absence of a special clause in the agreement, the disposal of gasoline must be carried out as a debit to account 91 and a credit to account 10. Such expenses cannot be reflected in tax accounting, since the value of gratuitously transferred property does not reduce taxable income (sub. 16, Article 270 of the Tax Code of the Russian Federation).

Fuel and lubricants in the tank of a rented car

When renting out a car, the fuel tank is also fully or partially filled. Here, as in the situation with the purchase and sale, you have to figure out how to take such gasoline into account.

Sometimes organizations simply agree that the lessor transfers a certain amount of fuel, and the lessee, at the end of the lease period, undertakes to return the same amount along with the car. In this case, ownership of fuel and lubricants remains with the lessor, and the transfer of fuel is not reflected in the accounting records.

But this option is not entirely correct for the tenant, because in fact he uses the gasoline received and, as a result, must make certain entries in the accounting registers. For this reason, most companies still show the transfer of fuel and lubricants from the lessor to the lessee.

How to reflect such a transfer? The most common option is implementation. First, the lessor sells fuel to the lessee, and after the end of the contract, the lessee sells the same amount to the lessor.

Another option is a commodity loan. Here the landlord acts as a lender and the tenant as a borrower. Both options are completely legal, and the accountant can only choose the one that is most convenient in a particular situation.

Types and capabilities of accounting systems

Such a system is a software and hardware complex that allows you to monitor various parameters of the use of cars and other units running on gasoline or diesel fuel. The general principle of operation is to equip equipment with sensors to collect certain data and then transfer it to a central program, where a dispatcher or other employee can analyze the information received, generate reports and transmit them for further solving identified problems.

Now an organization can choose from several types of systems that differ in functionality and, of course, cost.

Satellite tracking

One of the most accessible systems relies on a PC program or smartphone app and beacons installed on vehicles. By connecting them to GPS and GLONASS satellites, management can not only track the vehicle’s position in real time and all routes, but also keep fuel consumption statistics.

The main disadvantage of the system is the calculation method itself, since it is based on the distance traveled and is completely mathematical, that is, it does not take into account many features, such as gasoline consumption for warming up the engine and idle time in traffic jams, as well as increased consumption associated with natural wear and tear. In addition, it makes sense to use beacons only on moving cars.

Fuel sensors

The above equipment can be supplemented with fuel level sensors and devices that transmit their readings to the central program. Such a system is more expensive, but also provides more reliable data, since all calculations are based directly on the fuel level in the tank, and not on data on movement and theoretical consumption.

Such a system can be considered an ideal option for most enterprises whose vehicle fleet consists of passenger cars and heavy-duty vehicles or even construction equipment.

High precision installation

And the last of the possible options for monitoring fuel consumption is a large system that includes not only GPS and GLONASS beacons, but also many other sensors, including flow meters, pressure and temperature sensors, and others. It is the most expensive, but allows you to obtain maximum information about the operation of each machine of the enterprise, including special equipment.

Such a high-precision installation is most relevant for the largest enterprises that own not only automobiles, but also other vehicles, and consume huge amounts of fuel during their operation.

In conclusion, it is worth noting that any of the above remedies can effectively solve at least some of the above problems and stop (or at least detect) employee misconduct. At the same time, the first solution copes directly with control of consumption rather poorly, but is quite capable of eliminating deviations in the route and trips on personal business. And more advanced systems can truly effectively control each vehicle, even with a large fleet.

How to measure gasoline in a tank during inventory

In cases where the chairman of the commission is temporarily unable to perform his duties for valid reasons (illness, vacation, study, etc.), by order of the head of the airline, a temporary new chairman is appointed from among the members of the inventory commission.

- Members of inventory commissions for entering into the act of removal of residuals deliberately incorrect data on the actual balances of fuel and lubricants in order to conceal their shortages, waste or surpluses are subject to liability in the manner prescribed by law. 7.5. The inventory of fuels and lubricants is carried out on the first day of each month following the reporting month in the presence of the head of the fuels and lubricants warehouse or another financially responsible person. The inventory must be carried out with the full composition of the inventory commission.

Fuel and lubricants in the warehouses of VT enterprises are carried out in order to compare the actual availability of each brand of fuel and lubricants, measured in units of mass on the day of inventory in tanks, process pipelines, refueling means (TZ, MZ), small containers and other containers, with accounting data on movement and storage of fuels and lubricants for the reporting period. 7.2. Inventory is carried out without fail: - within the time limits established in accordance with the “Regulations on Accounting Reports and Balance Sheets” (for oil and petroleum products - at least once a month); - in case of a change of financially responsible persons - on the day of acceptance and transfer of cases; - when establishing facts of theft, robbery, theft or abuse, as well as damage to fuel and lubricants - immediately following the establishment of such facts; - after a fire or natural disaster (flood, earthquake, etc.) - immediately after the end of the fire or natural disaster. 7.3. During the inventory, working and “dead” (Appendix 1) fuel residues are determined at actual humidity and for “dry” weight (minus operating humidity).

- After the inventory, an act is drawn up in accordance with Appendix 2, in which the results of measurements and calculations are entered. The act is approved by the director of the power plant. 1.8. Fuel is taken as a “dead” residue: - in supply tanks - at a level exceeding by 20 cm the mark at which the pumps fail at the nominal hourly fuel consumption at the power plant, taking into account the flow rate in the recirculation line; - in reserve tanks - what remains after the failure of one pump-out pump at 30% supply; — in receiving tanks — at a level 10 cm higher than the mark at which one transfer pump fails at its nominal flow.

- Total balance: at actual moisture content 14385.421 tons; for dry weight 14037.042 tons.

Note. In columns 9 and 10, the mass of fuel is indicated as a fraction: in the numerator - at actual humidity, in the denominator - per dry mass. The measurement was carried out by the Chairman of the commission Signature Members of the commission Signature Measured parameters, operation Name of the device, GOST Characteristics of the device Additional instructions Fuel level in the tank Float level gauges with spring balancing according to GOST 13702-78 and TU 25-070374-79. Measuring metal tape 10 and 20 m long according to GOST 7502-80 Measurement error at local reading ±4 mm.

The division value is 1 mm. The use of other types of level gauges with the specified error is allowed. Sampling Samplers in accordance with GOST 13196-85 and GOST 2517-85.

Portable samplers in accordance with GOST 2517-85 Provides the collection of combined samples.

Borrow fuel

The transfer of goods on credit is formalized by a loan agreement (§ 1, Chapter 71 of the Civil Code). A loan agreement between legal entities must be concluded in writing (Part.

1 tbsp. 1047 Civil Code). This means that an oral agreement on the transfer of fuel “back and forth” between the parties to the lease agreement is not taken into account. And the fuel “exchange” operation can be interpreted by the tax authorities as a free transfer (receipt) of goods.

And this, in turn, will affect its taxation (see option 1 in the table). The provision for providing fuel on loan can simply be included in the car rental agreement. In this case, it is necessary to indicate how much fuel is transferred and must be returned. The transfer of fuel is formalized either in a separate acceptance certificate or reflected in the vehicle acceptance certificate.

The transfer of fuel is formalized either in a separate acceptance certificate or reflected in the vehicle acceptance certificate. It must be understood that in accounting such an operation takes on the characteristics of barter (see below). Plus: this method is the most convenient and is used by many businesses that rent out their cars.

There is no need for additional payment orders, as when compensating for the cost of fuel. Disadvantage: when returning a car from a rental, the cost of fuel may be higher than when receiving a rental car. In this case, the operation will be unprofitable for the tenant.

Fuel fraud

Before setting up a fuel control system, you should find out how it is stolen.

There are a lot of options, but the most common fuel theft fraud schemes are as follows:

Providing “left” fuel receipts to the accounting department. This scheme works in those enterprises where drivers purchase fuel and lubricants in cash and report receipts to the accounting department. Drivers, citing exceeding the established norms for fuel write-off, purchase refueling receipts from third parties and receive compensation for them from their company.

Draining fuel and lubricants from work vehicles. Often there is unused fuel left in the tank of cars. It is used by unscrupulous drivers to refuel their own vehicles or to sell at a low price.

Extra flights. Without proper control of waybills, drivers can make trips at their own discretion. For example, to transport building material to a dacha or to make a couple more trips by minibus and not have to account for them.

Adjusting the odometer. With the help of special devices, drivers can adjust the meter to the required readings after a work shift. For the difference between the actual and inflated values, drivers buy “left” receipts or drain gasoline from the tank.

There are still plenty of options to deceive a company. The organization itself suffers losses mainly not from stolen fuel, but from the forced downtime of the vehicle.

How to calculate your own standard

If there is no limit approved by the Ministry of Transport for a machine, or the organization decides to use a different value, it has the right to calculate its own limit. Typically, in such a situation, companies act in one of two ways.

The first way is to borrow information about fuel consumption from the technical documentation for the car. This approach corresponds to the position of the Russian Ministry of Transport (see “The rules for determining fuel consumption standards for passenger cars have changed”).

The second way is to create a commission and take measurements. To do this, you need to pour a certain amount of gasoline into the empty tank of the car, for example, 100 liters. Then the car should be driven until the tank is completely empty. Based on the speedometer readings, you need to determine how many kilometers it took to completely empty the tank. Finally, the number of liters must be divided by the number of kilometers. The result will be a figure showing how much gasoline the car consumes when driving one kilometer. This indicator should be recorded in the act and signed by all members of the commission.

Since fuel consumption depends on travel conditions, it is better to make control measurements “for all occasions”: separately - for a loaded and empty car, separately - for summer and winter trips, separately - for idle time with the engine on, etc. All obtained results should be reflected in the act drawn up and signed by the commission.

There is a simpler option: to approve one basic standard (for example, for the summer period) and increasing coefficients: for winter trips, for trips on congested roads, etc.

Fuel monitoring systems

Due to losses incurred by organizations due to theft and negligence in official duties, many enterprises began to implement monitoring and control systems for their fleet.

All of them have the same purpose - recording the actual use of fuel and lubricants. Depending on the type of equipment installed in cars, the quality of accounting and other indicators of system performance are determined.

You should choose a monitoring system based on the scale of the enterprise and the amount of fuel consumed.

There are 3 main options for fuel control systems:

Telecommunications equipment that works with satellites – Glonass or GPS.

The simplest and most affordable option for small businesses with limited finances.

Type of operation: the device is mounted in a vehicle, and using an electronic map you can track its movement, speed, stops, etc. The calculation of gasoline consumed is carried out by special programs.

This system greatly simplifies the determination of fuel consumption, but has a number of significant disadvantages:

- calculation of fuel consumption is carried out according to a mathematical formula specified in the program, without taking into account traffic jams, the need to warm up the car, wear and tear, etc., which can lead to errors in calculations;

- not suitable for all types of vehicles (not suitable for stationary vehicles, such as drilling rigs).

The obligation to calculate compensation for delayed wages is enshrined in the Labor Code of the Russian Federation. The organization has the right to establish its own amount of compensation to the workforce in such cases, the figure is indicated in the contract.

When calculating wages based on salary, the accountant uses the following documents: employment contract, staffing table, orders for bonuses and incentives, time sheets, pay slips, etc. Read about salary calculation.

A set of equipment, including a transmitting device, gasoline level sensors in the tank and standard sensors.

This is a fairly reliable and economical option that allows you to accurately determine the amount of gasoline poured into the car’s tank and its consumption. The cost of this equipment is quite affordable for a mid-level enterprise.

To monitor the vehicle fleet remotely and analyze the information received from the system, a dispatcher position is required. The optimal combination of price and quality.

Specialized installation with a lot of additional equipment.

Its composition may differ slightly, but the presence of satellite monitoring is mandatory for all configurations. Also, as additional equipment there can be temperature sensors, fuel flow meters, pressure sensors, etc. These systems are used at the largest enterprises that use large amounts of fuel and lubricants - ships, diesel locomotives, universal ground equipment, etc.

Built-in modules automatically process calculations and present users in a visual form with ready-made reports and graphs on all vehicle performance indicators of interest.

Such installations cost a lot, but their implementation leads to significant financial savings for the enterprise. This explains the fairly quick payback of the equipment - on average in just 3 months of operation.

Is it possible to write off fuel and lubricants without a waybill?

Is it possible to write off fuel and lubricants without waybills?

The Ministry of Finance admits (letter dated June 16, 2011 No. 03-03-06/1/354) that the amount of work performed can be confirmed in another way. For example, data from the GLONASS system or other similar systems that allow you to reliably determine the path taken by the car. In addition, it will not be necessary to have a waybill if the route is strictly defined and does not allow deviations.

In addition, it will not be necessary to have a waybill if the route is strictly defined and does not allow deviations. For example, this may be applicable to estimating the fuel consumption of a business delivery service that transports workers to and from work on the same route day after day. The number of such trips is always under control.

Accordingly, taking into account their unambiguous length and the link to each of them with a volume of fuel in a fixed amount, calculated according to the standards, the total volume of write-off will also be justified. Thus, there are still certain options that allow you not to use a waybill to justify the amount of fuel to be written off, but there are not many of them. And you will definitely have to explain them to the inspectors.

But in a situation where a waybill has been issued, unnecessary questions during checks can be avoided. Read about whether the volume of consumed fuel and lubricants affects the amount of compensation for the use of personal vehicles by an employee. *** Fuel and lubricants are a type of inventory, to which the usual rules for accounting for inventory and materials apply: they must first be capitalized and then written off, justifying the amount of write-off.

What complicates fuel accounting is that, as a rule, it is purchased outside the location of the vehicle owner (legal entity or individual entrepreneur), immediately entering the tank of a working car, and must be taken into account in relation to each unit of the car.

The amount of write-off is justified when the amount of fuel consumed is determined in relation to the nature of the auto work performed according to the fuel consumption standards corresponding to this work. Consumption rates are developed by the owner independently or taken from those recommended by the Ministry of Transport. And the Russian Ministry of Finance considers the waybill to be the only document capable of confirming the amount of work done on the car.

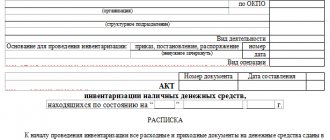

Inventory order form

The main document of the inventory process is the order. Therefore, we will consider it in more detail and learn how to compose this document correctly. A unified sample order for inventory for 2022 can be found in Resolution No. 88 of the State Statistics Committee of Russia dated August 18, 1998. Form No. INV-22 is a universal form that can be used by organizations of all forms of ownership. The form can be used both when conducting scheduled and unscheduled inspections of material assets.

Accounting for fuel consumption in an organization

The introduction of a fuel consumption monitoring system does not exclude the need to organize fuel and lubricants accounting, starting with primary documents.

Accounting for fuel consumption at the enterprise is carried out on the basis of the Regulations “On Accounting and Reporting”.

Gasoline is accepted for accounting at its actual cost - the purchase price excluding VAT to account 10 “Materials” subaccount 3 “Fuel”.

There are no restrictions in the legislation regarding the write-off of the cost of fuel and lubricants to the cost of production. The main condition that allows this to be done is the availability of documents confirming the use of fuel in business activities.

This is evidenced by waybills and waybills additionally attached to them. These documents contain all the information about mileage, refueling and the weight of the transported cargo necessary to calculate the normal gasoline consumption for a particular car.

Fuel consumption standards are set depending on the car brand, year of manufacture, modification, design, trailer, etc. All this information is contained in the Consumption Standards for motor vehicles approved by the Ministry of Transport of the Russian Federation on March 14, 2008 No. 23.

For the purpose of calculating taxable profit, fuel costs can be taken into account in two ways: as part of material costs and other expenses related to the main activities of the enterprise.

Business representatives turning to outsourcing companies for HR services is becoming increasingly popular. This is explained by the desire to receive professional help and create a system of effective personnel management, providing oneself with good personnel.

The work of a personnel officer can be very intense, especially if the enterprise is large and there are many employees. Some programs come to the rescue, greatly simplifying personnel accounting in the company. Read about HR management software.

The choice of method depends on the purpose of the car: for production purposes these costs are included in material costs, for management needs - in other costs. Expenses for fuel and lubricants are written off at actual costs. They must be documented and justified from an economic point of view (Article 252 of the Tax Code of the Russian Federation).

The process of accounting for fuel and lubricants is simplified by purchasing it using fuel cards. This is an effective and fairly simple method that allows you to keep accurate fuel records and eliminate unauthorized gasoline refills. To reflect these expenses in the company's accounting, the documents provided by the processing center are sufficient.

Economical fuel consumption and its strict accounting are the most important tasks, the solution of which is a prerequisite for the effective operation of a business entity.

How to calculate the remaining fuel in the tank formula

The waybill contains the following parameters:

- refilled during the trip - 60 liters

- remaining fuel before departure – 15 liters

- vehicle mileage at the start of work – 20,000 km

- remaining fuel at the end of the working day – 30 liters

- mileage figure at the end of the working day – 20,170 km

The mileage during working hours is 20,170 km - 20,000 km = 170 km. Now let's move on to calculating the fuel consumption rate:

- (21 l * 170 km) / 100 * 1.1 = 39.27 liters

Actual fuel consumption:

- (15 + 60) – 30 = 45 liters

The difference between the two values is:

- 45 liters - 39.27 liters = 5.73 liters

In fact, more fuel was consumed, which resulted in overconsumption.

content and procedure for inventory of fuels and lubricants

In this case, the following error values are taken in the calculations (according to GOST 26976-86): 0.8% - for containers containing up to 100 tons, 0.5% - for containers containing 100 tons and above, as well as to determine the error when spending through the counter. The inventory commission calculates the loss of fuel and lubricants according to the norms of natural loss (Appendix 32) and the error in measuring fuel and lubricants by meters, based on the amount of fuel and lubricants pumped through them. 7.15. The Residue Removal Report (Appendix 28) includes data from the book of balances, the actual quantity of fuels and lubricants according to the measurement sheet (Appendix 29), discrepancies in the quantities of fuels and lubricants, natural loss, the total error of measuring instruments and capacities for each brand of fuels and lubricants, and surpluses and shortages are calculated. 7.16. The amount of fuel and lubricants that should be included in the accounts of financially responsible persons is determined as follows: 7.16.1.

Important

TTC and made an inventory of fuel balances in warehouses as of 24:00. 19 Date, month Name of tank Level, cm Volume, m3 Volume of “dead” residue, m3 Working volume of fuel, m3 Density, t/m3 Humidity, % Mass of fuel, t Additional information “dead” residue working residue “dead” residue working residue 1 2 3 4 5 6 7 8 9 10 11 Calculation example for a power plant with fuel consumption less than 100 t/h Consumption No. 1 930 3078.334 264.652 2813.682 0.912 3.2 2.0 241.363 233.639 2566.078 25 14, 756 Expenditure No. 2 898 3071.460 94.317 2977.143 0.921 3.0 2.1 86.866 84.260 2741.950 684.368 Reserve No. 1 1325 4538.651 92.940 4445.711 0, 945 5.0 3.1 87.828 83.369 4201.197 4070, 960 Reserve No. 2 1301 - - - - - - 90.938 86.391 4311.525 4225.294 According to the latest inventory Receiving capacity No. 1 41 59.041 59.041 - 0.943 3.0 - 55.676 54.005 - Total ...

How to detect theft

How to detect theft and how to formalize it? After all, any such accusations against an employee must be documented. In relation to the driver, it is necessary to pay attention to a thorough analysis of his waybills. It is necessary to check all its routes for reality and compliance with production goals. It often happens that the routes are scheduled in a completely “production” way, but the employee’s immediate superiors did not send him there on those days. Or, in general, the employee indicated “bogus” organizations with which the company did not cooperate.

It is important to check the times and dates of car refueling. For example, a working day until 18:00, and refills were systematically carried out after 20:00 or on weekends. Routes must be checked for correct mileage and rationality. Thus, there were cases when the distance between points A and B was indicated on the waybills as conditionally 120 km, while in fact the distance was 105 km. Or the mileage was indicated correctly, but for some reason the route was indicated as the least logical, longer, with a detour.

Gas station receipts must be checked on another basis. Nowadays, counterfeits are unlikely, but in the past there were cases of presentation of checks, which, for some reasons, aroused suspicion. That is, the employee handed over a check from a certain gas station No. 5 to Triumph LLC. However, after a thorough check, it turned out that such gas stations simply physically did not exist along the driver’s route. It is necessary to pay attention to this even now, even if the check is not in doubt. The fact is that a document from a gas station can be quite real, but judging by the date and time, it is presented from a gas station located completely in the opposite direction from the employee’s route. When sorting out the situation, it turned out that the driver asked for a check for a significant amount from his friend, who refueled for personal needs.

note

It is important to check the times and dates of car refueling. For example, a working day until 18:00, and refills were systematically carried out after 20:00 or on weekends. Routes must be checked for correct mileage and rationality.

All strange and suspicious factors may indicate the employee’s dishonesty.

Next, it is worth demanding an explanation about the reasons for the constant high consumption of fuel and lubricants. Based on this explanatory note, a commission can be appointed to control fuel consumption. If suspicions have already arisen, it may be worthwhile for the commission members to take the time to drive along the employee’s actual standard route, recording mileage and fuel tank indicators. In this case, it is better to do such a check unexpectedly.

In order to carry out thorough control in the future and eliminate the presence of loopholes for theft, it is worth considering the implementation of an automated transport control system, for example, GLONASS. This is not so cheap, especially in terms of the number of vehicles, but it gives very good results in terms of monitoring transport routes, stops, fuel consumption and drainage, etc.

By the way, such systems are already used in quite a lot of enterprises, but, paradoxically, no one systematically monitors or analyzes the results of control. Therefore, if such a system is available, in a situation where fears of theft arise, it is simply enough to raise the statistics of the work of a suspicious driver.

In general, as is not difficult to understand, a conscientious and systematic approach to monitoring waybills, fuel consumption and fuel residues, checking documents on the merits (routes, availability of management permits, refueling times, etc.), analysis of data from automated transport control systems initially gives the ability to eliminate opportunities for theft.

To identify shortages in an organization's warehouse, it is necessary to conduct an inventory. Clause 27 of the Regulations on accounting and reporting in the Russian Federation dated July 29, 1998 No. 34n (hereinafter referred to as the Regulations on accounting and reporting) requires an inventory to be taken when facts of theft, abuse or damage to property are detected.

The amount of damage can only be recovered with the consent of the employee. In the absence of his consent, these amounts can only be recovered through the court, proving that the employee is at fault for this overspending.

The head of the enterprise makes an appropriate decision regarding the results of detected thefts. Often, due to great difficulties in bringing the perpetrators to justice, statements are not submitted to the police. By agreement of the parties or for other plausible reasons, the negligent employee is dismissed.

Inventory of rented vehicles

Goals of inventory of fuels and lubricants at the enterprise.

All fuels and lubricants (diesel fuel, gasoline, motor oil, etc.) accounted for in subaccount 203 “Fuel” of account 20 “Industrial inventories” are subject to inventory. Inventory of fuels and lubricants pursues the following goals:

- assessment of the current actual availability of fuels and lubricants (tons, liters, cubic meters) by type, brand, storage location and responsible persons;

- correlation of the actual availability of fuel and lubricants by type and brand with accounting data;

- monitoring compliance with storage conditions and procedures.