How to capitalize a 1C program in 1C 8.3

Let's look at how to reflect the purchase of a 1C program in 1C 8.3 using the following example.

On July 24, the Organization, in accordance with the license agreement, received, under an acceptance certificate from FIRST BIT LLC, non-exclusive rights to use the 1C:ERP Enterprise Management 2 program worth 360,000 rubles. The period of use of the program specified in the contract is 2 years.

Accounting for the costs of acquiring the 1C program (non-exclusive right) is reflected in the document Receipt (act, invoice) transaction type Services (act) in the section Purchases - Purchases - Receipts (acts, invoices).

The document states:

- Nomenclature is a software product from the Nomenclature directory, Type of nomenclature - Services .

Follow the Accounts :

- Cost account - 97.21 “Other deferred expenses”;

- Deferred expenses (FPR) - parameters for automatic uniform recognition of costs for the purchase of the 1C program (software).

According to the recommendations of the Ministry of Finance for auditors (Appendix to the Letter of the Ministry of Finance of the Russian Federation dated January 29, 2014 N 07-04-18/01), the RBP is reflected:

- in the balance sheet in Section I “Non-current assets” on line 1190 “Other non-current assets” - if the period for writing off the RBP is more than 12 months;

- in Section II “Current assets” on line 1210 “Inventories” - if the write-off period is less than 12 months.

Study the regulatory regulation of cost accounting for the acquisition of software (non-exclusive right)

Postings according to the document

The document generates transactions:

- Dt 97.21 Kt 60.01 - reflection of the costs of the non-exclusive right in the expenses of the future period.

Find out more about how to reflect deferred expenses in 1C 8.3 Accounting

Purchasing software

The fact of purchasing the software is reflected in the 1C program with the document “Receipt of goods and services”, and a note is made that the purchase belongs to the category of services. The corresponding item must be entered in the nomenclature directory, in this case “Purchase of the 1C program: Accounting version PROF”. The nomenclature should be based on service category.

In the “Accounts” column, you need to enter data on account 97.21 “Other deferred expenses”.

In the process of filling out the details “Deferred expenses”, you need to create a new expense item, specifying not only the acquisition cost, but also the period during which the write-off will be carried out (indicate the start and end dates, analytics parameters, and so on).

After this, the specified cost is immediately included in deferred expenses for the specified amount. After posting the “Receipt of goods and services” document, the system will generate the following transaction:

Debit 97.21 Credit 60.01

Taking into account the fact that the company in question is a VAT payer, the amount of tax on the purchase is entered as a separate entry Debit 19.04 Credit 60.01

Accounting for non-exclusive rights

Intangible assets received for use must be accounted for in an off-balance sheet account (clause 39 of PBU 14/2007):

- Dt 012 “Non-exclusive rights to software” - for the cost of the non-exclusive right received for use.

In 1C there is no special off-balance sheet account for accounting for non-exclusive rights, so you need to create it yourself, for example, 012 “Non-exclusive rights to software”.

Acceptance of a non-exclusive right for off-balance sheet accounting is documented in the document Transaction entered manually, type of operation Transaction in the section Transactions – Accounting – Transactions entered manually.

Reflection of 1C ERP purchase

Go to the “Purchases” section and select “Receipts (acts, invoices)”.

In the window that appears, click on the “Create” button and select the “Services (act)” view.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

The counterparty in our case will be. Add a line to the services table and select the item “1C:ERP Program”. We will also indicate here that the purchase amount will be 360 thousand rubles. and additional 18% VAT.

In the last column “Account”, it is very important to correctly indicate all the data. Click on the corresponding hyperlink, and a window for editing this value will open in front of you.

We will indicate 97.21 expense account, including tax accounting.

To fill in the “Future expenses” fields, you need to add a new position to the directory of the same name, if this has not been done previously. In his card we indicated the price of the software, the period of its write-off, as well as the account to which it will be paid. We will write off expenses every month.

Now that all the data in the receipt document is indicated, you can post it and register the invoice. As a result, the wiring shown in the image below will be formed.

Reflection in accounting of costs for the purchase of 1C software

To automatically account for the monthly costs of purchasing a 1C program, you need to run the procedure Closing the month, a routine operation Write-off of deferred expenses in the section Operations - Closing the period - Closing the month.

Postings according to the document

Accounting for software costs for July

The document generates the posting:

- Dt Kt 97.21 - accounting for software costs as part of general business expenses for July.

Accounting for software costs for August

The document generates the posting:

- Dt Kt 97.21 - accounting for software costs as part of general business expenses for August.

Similarly, the cost of purchasing the 1C program is recorded for the following months before the expiration of the non-exclusive right.

To access the section, log in to the site.

Write-off of deferred expenses

This operation is a regulatory one. That is, it will be carried out automatically by the system based on the initially specified calculation parameters in the “Month Closing” document. In this case, 1C takes care of all the calculations of the amount of funds written off and the write-off itself.

After the document is posted, a posting is generated with expenses assigned to account 26, as was originally established. The write-off amount was calculated by the system based on the established start and end dates of the period of use.

By going to the document movement through the “Calculation of write-off of deferred expenses” tab, you can always see the main write-off parameters for the category being carried out.

The program will automatically write off monthly expenses until the expiration date for the write-off is set in the program. The user can view automatically created operations in the journal of routine operations, where they are stored. To do this, you need to go through the section “Operations” - “Closing the period” - “Routine operations”.

It is worth noting that in 1C this operation is open for creation in manual mode, and the use of the “Month Closing” document is not required.

Program "1C 7.7" for simplified tax system

For fans of the software “1C: Accounting 7.7” there is also a special configuration “USN”. Version 7.7 is regularly updated, like version 8, but is significantly inferior to it in the number of useful functions and capabilities.

Thus, only in “1C: Accounting 8” will a taxpayer be able to organize in one information base the accounting of several enterprises using different taxation systems. In addition, the new version of the program supports all types of complex accounting, the work of assistant utilities is organized, it is possible to create special sub-accounts for organizing analytical accounting and manually changing transactions, as well as a lot of other advantages.

If you are already using Seven, then it will be useful for you to know that the development company offers its clients a low-cost and simplified transition from one version of the program to another. For those who are just planning to purchase software, it is better to immediately opt for the 8th version of 1C: Accounting. Moreover, the basic version of the 1C program for maintaining records according to the simplified tax system has long been discontinued from sale. Buy "1C: Accounting 7.7". Today it is possible only in the PROF version, which is much more expensive than the basic version of 1C: Accounting 8. You also need to take into account that the seven is updated only if there is a concluded agreement for information technology support, and the basic version of “1C: Accounting 8” can be updated independently without additional costs.

How to take into account the costs of purchasing programs in 1C:Accounting 8?

In accounting, a fixed one-time payment for the granted right to use the results of intellectual activity in accordance with paragraph. 2 clause 39 of PBU 14/2007 is reflected as deferred expenses and is subject to write-off within the period established by the license agreement.

In tax accounting for income tax, expenses associated with the acquisition of the right to use computer programs under license and sublicense agreements are included in other expenses associated with production and sales (clause 26, clause 1, article 264 of the Tax Code of the Russian Federation).

If the terms of the license agreement establish a period for using computer programs, expenses are taken into account evenly over this period (clause 1 of Article 272 of the Tax Code of the Russian Federation). If the license period is not established, then the organization can independently set the period for writing off expenses for the program (letters of the Ministry of Finance of the Russian Federation dated 08/31/2012 No. 03-03-06/2/95, dated 03/18/2014 No. 03-03-06/1/11743) or take it equal to 5 years (letter of the Ministry of Finance of the Russian Federation dated April 23, 2013 No. 03-03-06/1/14039).

The transfer of rights to use computer programs on the basis of license agreements is not subject to VAT (clause 26, clause 2, article 149 of the Tax Code of the Russian Federation).

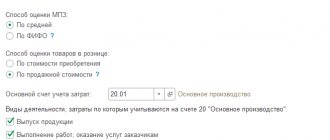

- Reflection of expenses for the purchase of the program in account 97.21 Other deferred expenses (Fig. 1):

- Section: Purchases

–

Receipts (acts, invoices)

. - Click the Receipt button to select the transaction type of the Services document and create a new document.

- Complete the document. In the tabular part, in the Accounting account column, follow the link in the form that opens, indicate cost account 97.21 Other deferred expenses (Cost account field), add a new element to the directory Deferred expenses (field with the same name) and fill it out: Type for NU – Other;

- Type of asset in the balance sheet – Other current assets or Other non-current assets (depending on the period of use of the program);

- Recognition of expenses - By month or by calendar day (depending on the accounting policy).

Rice. 1

- Including part of the cost of the program in the expenses of the current month (Fig. 2):

From the month in which the cost of the program was reflected in account 97.21 Other deferred expenses, when performing a routine operation Write-off of deferred expenses as part of processing Closing the month, part of the cost of the program will be charged to the expense account specified in the directory Deferred expenses for this element of the directory . If the program was not purchased on the 1st day of the month, then part of the cost of the program attributable to this month will be written off as expenses for this month, in proportion to the period of its use in this month.

Rice. 2

The non-exclusive right to use a computer program may additionally be reflected in an off-balance sheet account (for example, 012 “Intangible assets received for use under a license agreement”).

For more details, see the article Purchasing a licensed computer program

Accounting and tax accounting computer programs

Almost every organization in the course of its activities is faced with the acquisition and use of computer programs. How are expenses for computer programs taken into account in accounting and tax accounting? What entries reflect accounting for computer programs?

A computer program, based on its characteristics, is similar to a specific category of property - intangible assets, but in reality it does not belong to them. Since in this case one of the main conditions for the compliance of an accounting object with the category of intangible assets is not met - the exclusive right to this object. The acquisition of a computer program by an organization is, in essence, the purchase of non-exclusive rights to use this program as a user.

Validity period of the right to a computer program

In order to accept a computer program for accounting, you need to know the period of its use - the period of validity of the license for the program. It is usually specified in the license copy or license agreement. In the absence of such, the period of use of the software is taken to be the validity period of the purchase agreement. If there is no mention of the period either in the contract or in the agreement, then following paragraph 4 of Art. 1235 of the Civil Code, it should be considered equal to 5 years.

Accounting for computer programs

PBU 14/2007 states that expenses for the purchase of a computer program should be recorded in accounting as deferred expenses.

When purchasing a non-exclusive right to use a computer program, account 97 reflects the amount of the initial cost of a specific object.

During the entire useful life of the computer program, the initial cost is written off to the debit side of the organization's cost accounts, in accordance with the specifics of the software used and its relationship to the production process. In simple terms, the object is, as it were, depreciated.

Accounting entries for accounting of computer programs:

- D 97 K 60 (76) – expenses were incurred when acquiring a non-exclusive right to software;

- D 19 K 60 – input VAT on purchased software is taken into account;

- D 68 K 19 – input VAT on the purchase of the program is deductible;

- D 60 (76) K 51 – payment was made from the current account for a computer program.

After the software is accepted for accounting, every month part of the cost is written off in the manner approved by the enterprise’s accounting policy.

Posting for writing off the cost of software - D 20 (25, 26, 44) K 97

In addition, the software object must be shown on the organization’s balance sheet. Since there is no such name in the chart of accounts, the accountant needs to create it himself.

Tax accounting accounting of computer programs

To correctly calculate income tax, costs associated with the purchase of any computer program should be taken into account as part of other expenses.

Clause 1 of Art. 272 of the Tax Code of the Russian Federation says that expenses accepted for tax purposes must be carried out in the reporting period in which they were made, regardless of their payment. According to paragraph 1 of Art. 26 of the Tax Code of the Russian Federation, expenses for software are taken into account when taxing profits. In this case, expenses in the amount of the initial cost of the object can be written off once, since the Tax Code does not prohibit this. In arbitration judicial practice, many cases have accumulated when judges supported precisely this position.

Organizations using the cash method can, without the slightest doubt, write off the costs of purchasing the necessary software at a time. Also, organizations that have chosen a simplified taxation system can do this without hesitation.

The difference between two accounting: tax and accounting

Since in accounting the costs of the program are taken into account as part of deferred expenses, and in tax accounting they are written off at a time in full at the time of the transaction, a taxable temporary difference arises. The effect of this difference is a deferred tax liability. It must be taken into account on account 77, specially created for such cases.

Rate the quality of the article. We want to be better for you:

online-buhuchet.ru