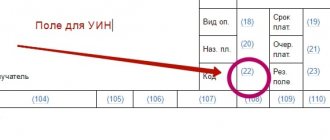

Field value 108 for tax payments

The value of field 108 depends on the basis of payment specified in field 106. If these are current payments (field 106 = TP), 0 is entered in field 108.

To repay debts for previous periods, new rules for filling out both of these fields apply from 10/01/2021.

So, in field 106 the following codes are no longer used:

- TR - repayment of debt at the request of the tax authority to pay taxes (fees, insurance contributions);

- PR - repayment of debt suspended for collection;

- AP - debt repayment according to the inspection report;

- AR - repayment of debt under a writ of execution.

Instead, you need to enter a single PO code. It means repaying debts for expired tax, settlement (reporting) periods, regardless of whether the taxpayer does this voluntarily or as a result of additional assessments or collections.

At the same time, field 108 is where you can distinguish voluntary repayment from forced repayment. The fact is that the codes TR, PR, AP and AR, previously used in field 106, now need to be indicated in field 108 before the number of the base document:

- “TR0000000000000” - number of the Federal Tax Service’s request for payment of taxes, fees, and insurance contributions;

- “PR0000000000000” - number of the decision to suspend collection;

- “AP0000000000000” - number of the decision to prosecute for a tax offense or to refuse to prosecute;

- “AR0000000000000” - number of the executive document or enforcement proceedings.

When voluntarily repaying old debts, field 108, as before, is entered with 0.

In other cases, in field 108, in the usual manner, the number of the document is indicated - the basis for the payment, for which one of the following codes is entered in field 106:

- RS. Paying off debt in installments. In accordance with paragraph 3 of Art. 61 of the Tax Code of the Russian Federation, taxpayers who are unable to repay their debt to the budget on time can receive an installment plan. The tax authority may issue a permit allowing you to make the required payment evenly throughout the year. But for this it is necessary to provide compelling reasons (damage resulting from a natural disaster, seasonal nature of the work) with supporting documents. In addition, you will have to pay interest on the amount of debt not repaid on time (Clause 2 of Article 61 of the Tax Code of the Russian Federation).

Read about the nuances of obtaining installment plans here .

- FROM. Number of the decision to defer the current payment made by the tax authority. In some circumstances, entities are unable to pay the assessed tax in full on time. In this case, you can contact the inspectorate with an application for a deferred payment. Tax authorities are required to make an appropriate decision no later than 30 days.

- RT. The number of the decision made by the tax authorities on restructuring is indicated. If an organization is unable to repay debts on taxes and penalties, it can take advantage of preferential conditions in accordance with the adopted debt repayment schedule.

- PB. Case number regarding the decision made by the arbitration court. Sometimes disputes arise between taxpayers and regulatory authorities regarding the correctness of calculation and completeness of payment of budget obligations. If the arbitration court agrees with the demands of the tax authorities, the payer will have to transfer the missing amounts for taxes based on the decision made by the arbitration court.

- IN. The decision number on granting an investment tax credit is another way to change the deadline for paying taxes. In addition to deferment of payment, it carries some features of budget lending with subsequent payment of accrued interest and principal. The period of use of the funds can be up to 10 years. Often used when calculating income tax.

- TL. The number of the arbitration court ruling that satisfies the application for repayment of claims against the debtor is indicated.

Check whether you have filled out the tax payment order correctly. To do this, use advice from ConsultantPlus experts. Get trial access to the legal system and upgrade to the Ready Solution for free.

What to indicate

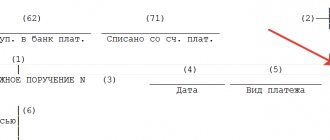

On November 12, 2013, the Russian Ministry of Finance issued order number 107n on the introduction into practice of rules for writing data when processing money transfers from the payer to budgets.

Clause 9 of Appendix No. 2 to Order No. 107n of the Ministry of Finance determines that field 108 of the payment form should reflect the number of the corresponding document.

Below are the abbreviations for field 108, which are specified in the law. Based on their transcripts, it can be seen that the field indicator 108 depends on the name of the document on the basis of which money is transferred to the treasury.

| TR | Number of the Federal Tax Service's request for payment of taxes/fees/contributions |

| RS | Installment decision number |

| FROM | Postponement decision number |

| RT | Restructuring decision number |

| PB | Number of the case or material considered by the arbitration court |

| ETC | Number of the decision to suspend collection |

| AP | Number of the decision to impose tax liability or to refuse it |

| AR | Number of the writ of execution and the proceedings initiated on it |

| IN | Number of the decision on granting an investment tax credit |

| TL | Number of the ruling of the AS on satisfaction of the statement of intention to repay the claims against the debtor |

EXAMPLE

The table shows that when transferring transport tax, field 108 should reflect the index “TR”. If current amounts of this tax are paid voluntarily, then “0” is entered.

It is important to note that in field 108 only the symbolic-numeric part of the number is entered, and the number sign “No” itself is excluded.

Remember that specifying other codes not designated by the Russian Ministry of Finance is not permitted!

In addition, it is necessary to understand that column 108 of the payment form is filled out only when making payments on the basis of documents issued by the Federal Tax Service/court/bailiffs mentioned in Order No. 107n of the Ministry of Finance.

If an enterprise voluntarily makes a payment to the state budget, enter the number zero “0” in field 108. When paying to the state budget of Russia, an individual also writes zero in column 108.

Also see “Deciphering the abbreviations of payment basis codes in a payment order.”

What document numbers are indicated when making customs payments?

In the case of customs transfers, field 108 can take numeric values when the following payment grounds are indicated in field 106:

- DE or CT. The last 7 digits of the customs declaration are written down.

- BY. The existing customs receipt order number is indicated.

- ID. The number of the executive document serving as the basis for payment is indicated.

- THAT. Applies if customs duties are paid upon request.

- IN. The number of the collection document is indicated.

- DB. Number of the document created by the accounting department of the customs authorities.

- KP. The number of the current agreement between large taxpayers when paying centralized payments is indicated.

Filling field 108 with numbers indicating the numbers of documents on the basis of which the payment is made is possible only if there are certain statuses in field 101 of the payment.

Read about payer statuses in the payment order in this material .

NOTE! The number sign (No.) is not indicated in field 108.

Payment of fines and state fees to the traffic police

The next common payment is the repayment of debt on fines and state duties to the traffic police. In this case, payment by document number in Sberbank Online means entering the number of the resolution or protocol.

Here is the algorithm of actions that will be required to pay using your card via the Internet:

- Log in to your personal account.

- Select the section with payments and go to “Taxes/Traffic Police Fines”, then open the fines.

- Click on payment search and in the tab.

- Indicate where to write off funds from. Enter the required numbers from the decree or receipt,

- Confirm via SMS, the payment has been completed.

Payment through Sberbank Online is one of the most reliable and fastest methods, which makes it possible to deposit money regardless of the time of day or working days.

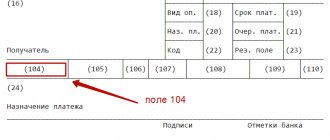

Filling out field 108 based on data about an individual

According to Appendix 4 to Order of the Ministry of Finance dated November 12, 2013 No. 107n by an individual (status 24), when paying insurance fees to the social insurance fund, in field 108 the digital 2-digit designation of the document - the individual’s identifier is indicated, and then its number is entered. Field 108 is also filled in if the payment is transferred to an individual:

- by the post office (status 03 in field 101) when drawing up an order to pay insurance premiums or other payments on behalf of an individual;

- by the employer (status 19 in field 101) when drawing up an order to pay the employee’s debt to the budget, withheld from his salary on the basis of an executive document;

- credit institutions (status 20) when transferring funds to pay insurance premiums or other payments accepted from individuals.

The following citizen identification cards are used:

- passport of a citizen of the Russian Federation (01);

- birth certificate issued by the registry office or other municipal authorities (02);

- seaman's passport (03);

- document confirming the identity of the military personnel (04);

- military service ticket (05);

- temporary certificate of citizenship of the Russian Federation (06);

- certificate of release (07);

- identity document of a foreign national (08);

- issued residence permit (09);

- document for temporary residence of stateless persons (10);

- refugee certificate (11);

- issued migration card (12);

- passport confirming USSR citizenship (13);

- SNILS card (14);

- driver's license (22);

- document confirming vehicle registration (24).

Numerical values in field 108 are entered using the separator character “;”. For example, RF passport 5800 No. 111222 in field 108 will be designated as follows: 01;5800111222.

Find out how to avoid mistakes when filling out a payment order for the payment of insurance premiums in ConsultantPlus. If you don't have access to the system, get a free trial online.

Repayment of debt under a writ of execution

More and more people are faced with the work of bailiffs. Some people have debts to banks or government agencies, others need to pay off debts for utility bills. In this case, the document number in Sberbank Online is the data from the writ of execution. They can be viewed on documents from the court or on the official website of the bailiffs (fssprus.ru).

In order to make a payment according to your writ of execution, do the following:

- Go to your personal account, select “Payments and transfers”.

- Select “Bailiff Services”.

- Specify the debit account and enter the document number. If you entered it correctly, then additional payment details will not be required.

Funds will arrive within one to three business days, and you can print a receipt if necessary.

Results

Field 108 of the payment order is filled in only if payments are transferred to the budget. In this detail it is necessary to display the document number - the basis of the fiscal (judicial) authority or the document number - the identifier of an individual in cases established by law.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Payment for kindergarten

The most common method of depositing funds in favor of a kindergarten through Sberbank Online requires the following actions:

- Log in to your personal account.

- Select “Transfers and Payments” from the top.

- Go to the transfer in favor of the organization and enter the garden data (account number, INN, BIC).

- Choose your card with which to make the payment.

- The next step is to fill out the KBK, OKTMO, the amount of payment and its purpose, and also enter your last name. At this stage, you may need to enter certain data, in this case it is your passport information.

Thus, the document number in Sberbank Online for kindergarten is your personal data that is required to identify payment for a specific child.

Error related to document number

For Sberbank Online users, the “Enter document number” error occurs when, when making a payment, a required field was not filled in or the data was entered incorrectly.

It can be easily resolved by simply entering the payment type data correctly.

Thus, individuals who are holders of Sberbank debit cards and users of the online service often have questions related to the document number. In each specific case, certain digital values associated with the purpose of payment are prescribed. Finding the data to enter is easy if you have receipts or a passport at hand.

When field 108 is filled in

A payment is a single document that all counterparties use for settlements with each other. Its form is strictly unified and fixed by the regulation of the Central Bank of the Russian Federation No. 383-P dated June 19, 2012. This standard contains all the required details, including the type of identifier in field 108 of the payment order, which reflects the number of the departmental executive document.

IMPORTANT!

Line 108 is filled out only when transferring money to the budget system. For settlements with suppliers and contractors, this detail is not required.