Fuel cost accounting

All types of fuel (gasoline, diesel fuel, liquefied petroleum gas, compressed natural gas) are classified as fuels and lubricants (fuels and lubricants), which are part of inventories. In accordance with PBU 5/01 “Accounting for inventories” (approved by order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n), inventories are accepted for accounting at actual cost. To summarize information on the availability and movement of fuel in the Chart of Accounts for accounting the financial and economic activities of organizations (approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n), subaccount 10.03 “Fuel” is intended, subordinate to account 10 “Materials”.

A document that confirms fuel consumption, data on actual mileage and the production nature of the vehicle’s route is a waybill. The forms of waybills for various types of road transport are approved by Decree of the State Statistics Committee of Russia dated November 28, 1997 No. 78 “On approval of unified forms of primary accounting documentation for recording the work of construction machinery and mechanisms, work in road transport.” These forms of documents are mandatory only for motor transport organizations. Other organizations can develop their own form of waybill, which must contain the mandatory details provided for in Article 9 of the Federal Law dated December 6, 2011 No. 402-FZ “On Accounting” and Order of the Ministry of Transport of Russia dated September 18, 2008 No. 152 “On approval of the mandatory details and procedure filling out waybills":

- name and number of the waybill;

- information about the validity period of the waybill;

- information about the owner (holder) of the vehicle;

- information about the vehicle (type, state sign, odometer readings);

- driver information.

For profit tax purposes, expenses for fuel and lubricants are not standardized and are taken into account in full if they are economically justified, documented and incurred for the purpose of carrying out activities aimed at generating income (clause 1 of Article 252 of the Tax Code of the Russian Federation). For the purpose of internal control, an organization can independently establish fuel consumption standards, having them approved by order of the manager. In this case, you can be guided by the fuel consumption standards specified in the vehicle operating instructions, or the standards recommended by the order of the Ministry of Transport of Russia dated March 14, 2008 No. AM-23-r (see, for example, letter of the Ministry of Finance of Russia dated March 22, 2019 No. 03-03- 07/19283).

In accounting, actual fuel consumption based on waybills is written off as expenses for ordinary activities. For profit tax purposes, expenses for the maintenance of official vehicles are classified as other expenses associated with production and (or) sales (clause 11, paragraph 1, article 264 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated 08.08.2019 No. 03-03-06/1/ 59876). When applying the simplified taxation system (STS) with the object “income reduced by the amount of expenses”, the cost of fuel for a car used in activities aimed at generating income is also taken into account as expenses for the maintenance of official vehicles (clause 12, clause 1, p. 2 Article 346.16 of the Tax Code of the Russian Federation).

Accounting and tax accounting of fuels and lubricants

IMPORTANT! A sample fuel and lubricants write-off act from ConsultantPlus is available here

If you refer to the form of the waybill and the requirements contained in Order No. 152, the waybill reflects the following information necessary for accounting for fuel and lubricants:

- remaining fuel in the tank, delivery, balance at the time of closing the submarine;

- speedometer data at the beginning and end of the movement.

Fuel consumption can be calculated both directly from these data and from standards that determine how much fuel a particular vehicle uses per kilometer (Ministry of Transport standards, documents AM-23-R dated March 14, 2008, NA-51- r dated 6/04/18).

IMPORTANT! A sample fuel and lubricants write-off statement from ConsultantPlus is available here

The standards are advisory in nature, and if a company can justify other figures for fuel consumption or the vehicle it operates is not included in the regulatory documents, the legislation does not prohibit such things.

Expense justification can be based on:

- technical documentation of the vehicle;

- control measurements of fuel consumption in various weather and seasonal conditions, documented by commission acts.

It is permissible to approve one standard, and then apply coefficients to it, for example, of an increasing nature, in the winter. The use of fuel consumption standards requires regular inventories and reconciliation of actual consumption with calculated data. To account for costs, fuel is most often priced at the average cost.

The cost balance of fuels and lubricants is added to the cost of newly capitalized fuels and lubricants. The resulting value is divided by the sum of the remaining and received fuel and lubricants in kind. Fuel is accounted for in active account 10/3 and debited to “cost” accounts 20, 25, 44, etc.

The Tax Code of the Russian Federation does not contain strict instructions regarding the use of actual or calculated, based on standards, data for including fuel and lubricants in costs. For the purposes of NU, the legislation does not prohibit the use of both the “in fact” method and cost rationing. Document AM-23-R contains an indication that the standards can also be used for NU purposes, using mileage data from the waybill (General Provisions, paragraph 3).

It can definitely be said that if an organization has approved fuel consumption standards, but does not comply with them and includes inflated amounts of consumption in fuel consumption costs, regulatory authorities will pay attention to this as a violation and recalculate the tax towards additional charges.

Carriers include amounts spent on fuel and lubricants in material costs, firms not engaged in transportation - in other costs (Tax Code of the Russian Federation, Articles 254-1, 264-1).

On a note! In addition to waybills, data from tachographs, GLONASS, and GPS systems are used to write off fuel and lubricants. They can be used both instead of waybills and in combination with them.

Options for accounting for fuel and lubricants in 1C: Accounting 8

Fuel can be purchased in cash or non-cash. If the organization has chosen a non-cash form, then a supply agreement is concluded with the fuel supplier, according to which the organization transfers funds to the supplier’s bank account, and in return receives coupons or fuel cards, with which drivers refuel cars at gas stations (gas stations).

Accounting for fuel and lubricants using coupons

To account for transactions using fuel coupons, it matters what type of coupons are used and at what point the ownership of fuel and lubricants is transferred to the organization. Depending on the terms of the agreement for the supply of petroleum products, ownership of the gasoline received may pass to the organization either at the time of receipt of coupons or at the time of refueling the car at a gas station.

If, under an agreement with the supplier, ownership of fuels and lubricants is transferred to the organization at the time of refueling the car at a gas station, then coupons for fuels and lubricants can be taken into account as part of monetary documents in account 50.03 “Cash documents”.

In the program "1C: Accounting 8" (rev. 3.0), the following documents are used for accounting for fuel as part of monetary documents:

- Receipt of monetary documents and Issuance of monetary documents (section Bank and cash desk) - to register the receipt of coupons from the supplier and transfer them to the driver;

- Advance report (section Bank and cash desk) - to reflect the purchase of fuel and lubricants;

- Request invoice (Warehouse section) - for writing off purchased fuel and lubricants as expenses.

If, under an agreement with the supplier, ownership of fuel and lubricants passes to the organization at the time of transfer of fuel coupons, then the supplier, simultaneously with the coupons, transfers to the organization a set of documents for fuel (waybill, invoice). In this case, it is necessary to stipulate in the contract that the fuel is in responsible storage with the supplier until the fuel coupon is presented and fuel is poured into the car tank. The receipt and issuance of coupons for fuel and lubricants should be registered in a special journal - the coupon book.

In the program “1C: Accounting 8” (rev. 3.0), the following documents are used to account for fuel and lubricants with the transfer of ownership at the time of receipt of coupons:

- Receipts (acts, invoices) (Purchases section) - to register the purchase of fuel;

- Movement of goods (Warehouse section) - to reflect the actual filling of fuel from the gas station into the tank of the car;

- Request invoice (Warehouse section) - for writing off fuel as an expense.

| 1C:ITS For more information about accounting for fuel and lubricants in cash and using coupons, see the section “Instructions for accounting in 1C programs”: “Purchase of fuel and lubricants using an advance report (sales receipt without an invoice)”, “Accounting for fuel and lubricants using coupons with transfer of ownership at the moment receipt of coupons”, “Accounting for fuel and lubricants using coupons with transfer of ownership at the time of receipt of coupons”. |

Accounting for fuel and lubricants using a fuel card

A fuel card is a microprocessor-based non-bank plastic card with a PIN code and a chip that carries information:

- on established limits, quantity and range of petroleum products and related services;

- and/or the amount of money within which petroleum products and related services can be obtained at a gas station.

To purchase fuel using cards, the company enters into an agreement with the fuel supplier (this can be a processing center that acts as the issuer of the fuel card and operates under commission agreements with fuel owners). Depending on the terms of the contract, the fuel card can be transferred to the organization and serviced free of charge or for a fee.

An organization may have several fuel cards at its disposal. Fuel cards in an organization are assigned either to the driver or to the vehicle. Neither money nor liters are credited to each individual card. The supplier stores information as a whole for the entire purchasing organization, and the fuel card is a technical means for individual drivers to obtain fuel and services at a gas station.

When receiving fuel at a gas station, the driver receives a receipt confirming the refueling completed, which should be attached to the waybill. At the time specified in the contract (at the end of the month or more often), the fuel supplier provides the organization with a set of documents for the specified period:

- report on the brand and quantity of fuel provided (register of transactions carried out using fuel cards);

- financial documents (delivery note and invoice).

In the program “1C: Accounting 8” (rev. 3.0), Receipt documents (acts, invoices) are used to reflect the receipt of fuel cards and fuels and lubricants. The transfer of the card is formalized by the document Transfer of materials into operation (Warehouse section), and the accounting of fuels and lubricants in expenses is documented by the document Requirement-invoice.

| 1C:ITS For more information about accounting for fuels and lubricants using fuel cards, see the section “Instructions for accounting in 1C programs”: “Accounting for fuels and lubricants using fuel cards.” |

As you can see, “traditional” fuel accounting methods are quite labor-intensive. At the same time, in previous versions of the program there was no printed form of the waybill.

Simplification of accounting for fuel costs in 1C: Accounting 8

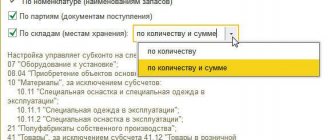

Starting from version 3.0.74 in “1C: Accounting 8” you can keep track of fuel using waybills. In order for the new feature to become available to the user, you will need to enable the corresponding functionality (section Main - Settings - Functionality). On the Inventory tab, you must set the Waybills flag (see Fig. 1). After enabling this setting, a new document appears in the program - Waybill.

Rice. 1. Setting up the program functionality

A waybill is issued for each vehicle. This document is used to substantiate fuel expenses for income tax purposes. The Waybill also indicates the amount of fuel that was purchased and consumed during the flight. In the full interface, the document is available in the Purchases section. In a simple interface - in the Documents section. Let's take a closer look at the new document.

Features of the new document “Waybill”

Using the Waybill document (Fig. 2) of the program, the user can:

- take into account information about the route of a passenger car that is used for business purposes. Moreover, this can be either the organization’s own car or a rented one, as well as personal transport belonging to an employee of the organization;

- reflect the purchase of fuel in cash or using a fuel card;

- take into account fuel consumption in the vehicle tank;

- take into account fuel costs in accounting and tax accounting (for profit tax purposes, when applying the simplified tax system with the object “income reduced by the amount of expenses”, as well as for the professional deduction of an individual entrepreneur when paying personal income tax).

- print the waybill according to the standard intersectoral form No. 3 (approved by Resolution No. 78) or in a simplified form;

- print an advance report in form AO-1 (approved by Resolution of the State Statistics Committee of the Russian Federation dated August 1, 2001 No. 55) - when purchasing fuel for cash.

Rice. 2. Document “Waybill”. Purchasing fuel using a cash receipt

Please note that the Waybill document has limitations: it can only be used by enterprises that are not transport companies and for which transportation is not their main activity. In addition, the Waybill does not support fuel accounting using coupons for fuel and lubricants. If the organization’s activities do not use passenger cars, refueling “in a can” is practiced, coupons for fuels and lubricants are used, and the fuel is stored in different warehouses, then accounting for fuels and lubricants should be carried out according to the previous (“traditional”) scenario. The methodology for accounting for fuel using waybills required changes to the program.

Changes in 1C:Accounting 8 to automate cost accounting for waybills

As part of the automation of accounting for fuel costs using waybills in 1C: Accounting 8, starting from version 3.0.74, the following changes have occurred:

- Third order subaccounts have been added to account 10.03 “Fuel”:

- 10.03.1 “Fuel in warehouse”;

- 10.03.2 “Fuel in the tank.”

Subaccount 10.03.1 takes into account the availability and movement of petroleum products and lubricants intended for the operation of vehicles, technological needs of production, energy generation and heating, solid and gaseous fuels. Analytical accounting is maintained by item, storage location and batch (receipt document). Each name is an element of the Nomenclature directory. Each storage location is an element of the Warehouses directory. To maintain analytical accounting for warehouses and batches, you must make the appropriate settings for accounting parameters (section Main - Chart of Accounts - Setting up a chart of accounts - Inventory accounting). Subaccount 10.03.1 is the “successor” of account 10.03, used in previous versions of the program, and is used in “traditional” scenarios for working with fuels and lubricants. Subaccount 10.03.2 takes into account the presence and movement of petroleum products in the vehicle tank. Analytical accounting is carried out by fuel types and vehicles. Each name is an element of the Nomenclature directory. Each car is an element of the Vehicles directory.

- A new subaccount 76.15 “Purchases using fuel cards” has been added to account 76 “Settlements with various debtors and creditors”. This sub-account is intended for quantitative accounting of payments for fuel purchased by an organization using fuel cards in the currency of the Russian Federation. Analytical accounting is carried out for individual types of fuel (subconto Nomenclature) and cars (subconto Vehicles).

- A new program object has appeared - Vehicle (an element of the Vehicles directory), which can be accessed from the Directories - OS and Intangible Materials section. If a car is accounted for in an organization as a fixed asset (FPE), then the Vehicle (Fig. 3) is created automatically when the vehicle is registered with the Federal Tax Service (fixed asset card - link Register), since the Register entry of a vehicle contains all necessary information. Rented cars and personal vehicles of employees used for business purposes should be entered manually in the Vehicles directory;

- For the document Receipt (act, invoice), a new type of operation Fuel has appeared.

Rice. 3. Vehicle card

Calculation example

Let us use a conditional example to explain the procedure for writing off fuel according to waybills. Almaz LLC has a certain brand of gasoline in stock, 70 liters, at a price of 42 rubles. This month, 100 liters of fuel of the same brand were purchased at a price of 40 rubles, and 40 liters were dispensed. Fuel and lubricants are written off at average cost.

The average write-off value will be:

- 70 * 42 = 2940 rubles;

- 100 * 40 = 4000 rub.;

- 2940 + 4000 = 6940 rubles;

- 70 + 100 = 170 l;

- 6940 / 170 = 40.82 rubles.

Based on actual fuel consumption, costs are calculated as follows:

- The waybill shows the remaining fuel in the tank is 5 liters, 40 liters were filled, the remainder after the flight is 10 liters.

- Actual consumption: 5 + 40 – 10 = 35 l.

- Having assessed this expense according to the calculated cost, we obtain the cost of fuel and lubricants: 35 * 40.82 = 1428.70 rubles.

- Let the car be used for official purposes by the deputy director, then the costs will be written off Dt 26 Kt 10/3 for maintenance.

When calculating according to standards, the calculation formula is taken from document AM-23-R. The car, the waybills of which we took for the calculation, is a passenger car, the formula (p. 2, p. 7) will be as follows: Qн = 0.01 * Hs * S * (1 + 0.01 x D), where:

- D – correction factor in percentage established in the organization;

- S—mileage;

- Hs – consumption rate per 100 km.

Seasonal coefficient D (winter, increasing, reflecting increased gasoline consumption) is not applied. The consumption rate for this model is 8.8 l. The recorded speedometer readings when leaving were 2510, when returning - 2565.

Calculation:

- Mileage: 2565 - 2510 = 55 km.

- Flow: Qn = 0.01 * 8.8 * 55 * (1 + 0.01) = 0.01 * 8.8 * 55 * 1.01 = 0.01 * 484 * 1.01 = 4.84 * 1.01 = 4.89 l.

- 4.89 * 40.82 = 199.61 rub.

- Wiring: Dt 26 Kt 10/3 199.61 rub.

Examples of using the document “Waybill”

Let's look at the new possibilities for fuel accounting using specific examples. The first example is the recording of fuel purchased using a cash receipt.

Note

The prices in the examples are conditional.

Example 1

| The organization Sewing Factory LLC (OSNO, VAT payer) has its own Volkswagen Passat B7 on its balance sheet. The car is used for administrative purposes. On 08/01/2019, on the basis of an employee’s application, funds were issued from the organization’s cash desk in the amount of RUB 5,000.00 for reporting purposes. to buy gasoline in cash. On August 13, 2019, after completing an official assignment, the employee submitted an advance report, waybill and cash receipt to the organization’s accounting department. The cash receipt indicates: the name of the brand of gasoline is AI-95, the quantity is 70 liters, the cost of one liter is 45 rubles. and the total amount is 3,150 rubles. The VAT amount is not shown as a separate line. Based on the waybill, 60 liters of gasoline were consumed according to the route Moscow - Ivanovo - Moscow (600 km). On August 14, 2019, the balance of the unused accountable amount was handed over to the organization’s cash desk. In accordance with the accounting policy of the organization, expenses for fuel and lubricants are not standardized in tax accounting (they are taken into account in full). |

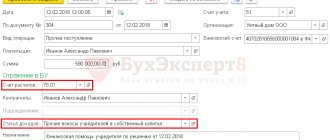

The issuance of cash to an employee for reporting is reflected in the document Cash Withdrawal with the type of transaction Issue to an Accountable Person. When posting the Cash Issue document, an accounting register entry is generated:

Debit 71.01 Credit 50.01 - for the amount of funds issued for the report (5,000 rubles).

Please note that for those accounts where tax accounting is supported, the corresponding amounts are entered into special resources of the accounting register for tax accounting purposes. In the examples discussed in this article, there are no differences between accounting and tax accounting.

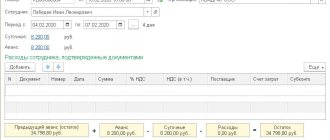

Let's reflect the purchase of gasoline using a cash receipt and its consumption using the document Waybill (see Fig. 2). The header of the document states:

- date of the waybill (the number is assigned automatically);

- vehicle;

- an employee who uses a car for business purposes;

- fuel consumption rate for the specified vehicle. By default, the norm is substituted from the vehicle card, but can be changed manually in the Waybill. In this case, the program will offer to save the changed norm for subsequent automatic filling of the Waybill;

- account and cost analytics in the Cost account form, which can be accessed through the appropriate link. By default, the Waybill document has a new predefined article Maintenance of official vehicles with the expense type Other expenses.

If fuel is purchased in cash, its quantity and price are determined at the time of refueling and are indicated on the cash receipt. When filling out the tabular part on the Fuel tab, in the Document field, select the Cash Receipt value, indicate the details of the cash receipt, quantity, price and amount of purchased fuel.

In the tabular section on the Route tab, you should fill in the points of departure and destination, the date, time and odometer readings at the time of departure and arrival, the distance between points and fuel consumption on each section of the route. The total amount of fuel in the tank, taking into account the balance at the beginning of the route, receipt and consumption according to the waybill, is calculated automatically and displayed in a visual form at the bottom of the document. The remaining fuel in the tank is automatically transferred to the next Waybill in chronological order.

When posting a document, the following transactions will be generated:

Debit 10.03.2 Credit 71.01 - for the amount of purchased gasoline (RUB 3,150.00) in the amount of 70 liters;

Debit 26 Credit 10.03.2 - for the amount of gasoline written off (60 l). Since during the month similar fuel can be purchased in different ways and at different prices, the final cost of fuel taken into account in expenses for accounting purposes and for profit tax purposes will be formed at the end of the month when performing the regulatory operation Adjustment of item cost

included in

the month end

.

The return of unused accountable amounts to the organization's cash desk is documented in the document Receipt of cash with the transaction type Return from an accountable person. When posting a document, the following entry is entered into the accounting register:

Debit 50.01 Credit 71.01 - for the amount of returned funds (RUB 1,850.00).

On the last day of the month, August 31, 2019, when performing the routine operation Adjustment of item cost, the cost of written-off gasoline is taken into account in expenses:

Debit 26 Credit 10.03.2 - for the amount of expenses for the purchase of fuel (RUB 2,700.00). At the same time, the amount of gasoline in account 10.03.2 is no longer reflected in this posting.

When purchasing fuel using a cash receipt, the following printable forms are available in the Waybill document using the Print command:

- Waybill - simplified form (see Fig. 4);

- Waybill (No. 3);

- Advance report (AO-1).

Rice. 4. Simplified form of waybill

If, as a result of a business trip, in addition to fuel expenses, other reimbursable expenses of the employee arise (for example, expenses for the purchase of goods and materials or travel expenses), then such a trip is reflected in the accounting system with a combination of documents:

- Waybill - first the employee reports for fuel;

- Advance report or Advance travel report - then the employee reports on other reimbursable expenses.

Let's consider the following example, when fuel and lubricants were purchased using a gas station fuel card.

Accounting: purchase of fuels and lubricants

In accounting, reflect the issue of cash with the following posting:

Debit 71 Credit 50

– funds were issued on account for the purchase of fuel and lubricants.

Within three working days from the end of the period for which the accountable amounts were issued, the employee is required to report on expenses (clause 6.3 of Bank of Russia Directive No. 3210-U dated March 11, 2014). To do this, he must submit an advance report to the accounting department either according to the unified form AO-1, or according to the one that the organization has developed independently. Cash receipts indicating the quantity, brands and cost of fuels and lubricants, dates of purchases, etc. must be attached to the advance report.

In accounting, reflect purchased fuels and lubricants in subaccount 10-3 “Fuel”, opened to account 10 “Materials”. If the gas station issued an invoice to the employee, issued to the organization, then VAT can be deducted (clause 1 of Article 172 of the Tax Code of the Russian Federation). In this case, do not include the VAT amount in the cost of fuel and lubricants (clause 5 of PBU 5/01). Take it into account separately on account 19 “VAT on purchased valuables.” Do the same if the VAT amount is indicated in a separate line of the cash receipt confirming the purchase of fuel and lubricants.

If there is no invoice, capitalize the fuel and lubricants at the price indicated on the cash receipt, including VAT (clause 6 of PBU 5/01).

Reflect the receipt of fuels and lubricants purchased in cash by posting:

Debit 10-3 Credit 71

– fuels and lubricants are capitalized (based on the advance report).

Situation: at what rate should the cost of fuel and lubricants purchased by an accountable person for foreign currency be taken into account in accounting?

In accounting, purchased fuels and lubricants are taken into account at actual cost (clause 5 of PBU 5/01). If fuels and lubricants were purchased for foreign currency, their value must be converted into rubles on the date of acceptance for accounting (clauses 4, 5 of PBU 3/2006). This date is the day of approval of the accountant’s advance report (clause 6 of PBU 3/2006).