Subordinate to the account “Settlements with suppliers and contractors” (60).

Account type: Passive.

Account type:

- Foreign exchange

- Tax

Analytics on the account “60.21”:

| Subconto | RPM only | Total accounting | Accounting in currency |

| Counterparties | No | Yes | Yes |

| Treaties | No | Yes | Yes |

| Documents of settlements with the counterparty | No | Yes | Yes |

Postings to account “60.21”

By debit

| Debit | Credit | Content | Document |

| 60.21 | 52 | Transfer of funds from an organization’s foreign currency account to pay off debt to a foreign supplier under an agreement in foreign currency | Debiting from current account |

| 60.21 | 55.21 | Transfer of funds from a special account of the organization (letter of credit) to repay debt to a foreign supplier under an agreement in foreign currency | Debiting from current account |

| 60.21 | 55.24 | Transfer of funds from special bank accounts (except for letters of credit, check books, deposit accounts) to repay debt to a foreign supplier under an agreement in foreign currency | Debiting from current account |

| 60.21 | 60.21 | Transferring the amount of debt to the supplier from one contract in foreign currency to another contract in foreign currency | Debt adjustment |

| 60.21 | 62.21 | Offsetting the amount of debt of the supplier and buyer under contracts in foreign currency | Debt adjustment |

| 60.21 | 91.01 | Write-off of the amount of debt to the supplier due to the expiration of the limitation period under the contract in foreign currency. Recognition of other income | Debt adjustment |

By loan

| Debit | Credit | Content | Document |

| 000 | 60.21 | Entering initial balances: settlements with suppliers and contractors in foreign currency | Entering balances |

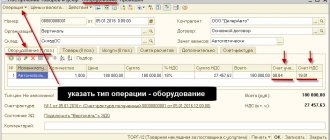

| 07 | 60.21 | Acceptance for accounting of equipment requiring installation received from the supplier under a contract in foreign currency | Receipts (acts, invoices) |

| 08.01 | 60.21 | Reflection of debt to the supplier for the purchased land plot under the contract in foreign currency | Receipts (acts, invoices) |

| 08.01 | 60.21 | Inclusion in the price of a land plot of additional expenses (services of third-party organizations) under an agreement in foreign currency | Receipts (acts, invoices) |

| 08.03 | 60.21 | Reflection of debt to the supplier for the purchased construction project under the contract in foreign currency | Receipts (acts, invoices) |

| 08.03 | 60.21 | Inclusion in the cost of the construction project of additional expenses (services of third parties) under the contract in foreign currency | Receipts (acts, invoices) |

| 08.04 | 60.21 | Reflection of debt to the supplier for the purchased non-current asset (equipment) under the contract in foreign currency | Receipts (acts, invoices) |

| 08.04 | 60.21 | Inclusion in the cost of a non-current asset (equipment) of additional expenses (services of third parties) under a contract in foreign currency | Receipt of additional expenses |

| 08.05 | 60.21 | Reflection of debt to the supplier for the purchased intangible asset under the contract in foreign currency | Receipt of intangible assets |

| 08.08 | 60.21 | Reflection of debt to the supplier for completed research, development and technological work under the contract in foreign currency | Receipt of intangible assets |

| 10.01 | 60.21 | Receipt of raw materials and supplies from the supplier. Reflection of debt to the supplier under the contract in currency | Receipts (acts, invoices) |

| 10.01 | 60.21 | Receipt of raw materials and supplies from processing at planned cost. Reflection of debt to the supplier under the contract in currency | Receipt from processing |

| 10.01 | 60.21 | Inclusion in the cost of raw materials and materials of additional expenses (services of third-party organizations for transportation, storage, etc.) under the contract in c.u. | Receipt of additional expenses |

| 10.02 | 60.21 | Inclusion in the price of purchased semi-finished products, components, structures and parts of additional costs (services of third-party organizations for transportation, storage, etc.) under the contract in cu. | Receipt of additional expenses |

| 10.02 | 60.21 | Receipt of purchased semi-finished products, components, structures and parts from processing at the planned cost. Reflection of debt to the supplier under the contract in currency | Receipt from processing |

| 10.02 | 60.21 | Receipt of purchased semi-finished products, components, structures and parts from the supplier. Reflection of debt to the supplier under the contract in currency | Receipts (acts, invoices) |

| 10.03 | 60.21 | Inclusion in the price of fuel of additional expenses (services of third-party organizations for transportation, storage, etc.) under the contract in c.u. | Receipt of additional expenses |

| 10.03 | 60.21 | Receipt of fuel from refining at planned cost. Reflection of debt to the supplier under the contract in currency | Receipt from processing |

| 10.03 | 60.21 | Receipt of fuel from the supplier. Reflection of debt to the supplier under the contract in currency | Receipts (acts, invoices) |

| 10.04 | 60.21 | Receipt of reusable collateral packaging and packaging materials from the supplier in organizations engaged in production activities or provision of services. Reflection of debt to the supplier under the contract in currency | Receipts (acts, invoices) |

| 10.04 | 60.21 | Inclusion in the price of reusable collateral containers and packaging materials of additional expenses (services of third-party organizations for transportation, storage, etc.) under the contract in c.u. in organizations engaged in production activities or provision of services | Receipt of additional expenses |

| 10.04 | 60.21 | Receipt of reusable collateral packaging and packaging materials from processing in organizations engaged in production activities or provision of services. Reflection of debt to the supplier under the contract in currency | Receipt from processing |

| 10.05 | 60.21 | Receipt of spare parts from processing at planned cost. Reflection of debt to the supplier under the contract in currency | Receipt from processing |

| 10.05 | 60.21 | Receipt of spare parts from the supplier. Reflection of debt to the supplier under the contract in currency | Receipts (acts, invoices) |

| 10.05 | 60.21 | Inclusion in the cost of spare parts of additional expenses (third-party services for transportation, storage, etc.) under the contract in c.u. | Receipt of additional expenses |

| 10.06 | 60.21 | Receipt of other materials from processing at planned cost. Reflection of debt to the supplier under the contract in currency | Receipt from processing |

| 10.06 | 60.21 | Receipt of other materials from the supplier. Reflection of debt to the supplier under the contract in currency | Receipts (acts, invoices) |

| 10.06 | 60.21 | Inclusion in the cost of other materials of additional expenses (third-party services for transportation, storage, etc.) under the contract in c.u. | Receipt of additional expenses |

| 10.08 | 60.21 | Inclusion in the cost of building materials of additional expenses (services of third-party organizations for transportation, storage, etc.) under the contract in c.u. | Receipt of additional expenses |

| 10.08 | 60.21 | Receipt of construction materials from processing at planned cost. Reflection of debt to the supplier under the contract in currency | Receipt from processing |

| 10.08 | 60.21 | Receipt of construction materials from the supplier. Reflection of debt to the supplier under the contract in currency | Receipts (acts, invoices) |

| 10.09 | 60.21 | Receipt of construction materials from processing at planned cost. Reflection of debt to the supplier under the contract in currency | Receipt from processing |

| 10.09 | 60.21 | Receipt of construction materials from the supplier. Reflection of debt to the supplier under the contract in currency | Receipts (acts, invoices) |

| 10.09 | 60.21 | Inclusion in the cost of inventory and household supplies of additional expenses (services of third-party organizations for transportation, storage, etc.) under the contract in c.u. | Receipt of additional expenses |

| 10.10 | 60.21 | Inclusion in the price of special equipment and special clothing of additional expenses (services of third-party organizations for transportation, storage, etc.) under the contract in c.u. | Receipt of additional expenses |

| 10.10 | 60.21 | Receipt of special equipment and special clothing from the supplier. Reflection of debt to the supplier under the contract in currency | Receipts (acts, invoices) |

| 10.10 | 60.21 | Receipt of special equipment and special clothing from processing at the planned cost. Reflection of debt to the supplier under the contract in currency | Receipt from processing |

| 19.01 | 60.21 | Reflection of the amount of VAT on purchased fixed assets under the contract in currency | Receipts (acts, invoices) |

| 19.02 | 60.21 | Reflection of the amount of VAT on acquired intangible assets under the contract in foreign currency | Receipt of intangible assets |

| 19.03 | 60.21 | Reflection of the amount of VAT on purchased inventories (except containers), goods under the contract in foreign currency | Receipts (acts, invoices) |

| 19.04 | 60.21 | Reflection of the amount of VAT on work performed, services provided under a contract in foreign currency | Receipts (acts, invoices) |

| 19.08 | 60.21 | Reflection of the amount of VAT on purchased construction projects under a contract in foreign currency | Receipts (acts, invoices) |

| 20.01 | 60.21 | Inclusion of third party services into the costs of main production. Reflection of debt to the supplier for production services provided under the contract in foreign currency | Receipts (acts, invoices) |

| 20.01 | 60.21 | Reflection of debt to the supplier for rendered production services for processing under the contract in foreign currency | Receipt from processing |

| 23 | 60.21 | Inclusion of third-party services into auxiliary production costs. Reflection of debt to the supplier for production services provided under the contract in foreign currency | Receipts (acts, invoices) |

| 25 | 60.21 | Inclusion of third-party services into general production costs. Reflection of debt to the supplier for services rendered under the contract in foreign currency | Receipts (acts, invoices) |

| 26 | 60.21 | Inclusion of services from third parties in general business expenses. Reflection of debt to the supplier for services rendered under the contract in foreign currency | Receipts (acts, invoices) |

| 29 | 60.21 | Including the services of third-party organizations in the expenses of servicing industries and farms. Reflection of debt to the supplier for services rendered under the contract in foreign currency | Receipts (acts, invoices) |

| 41.01 | 60.21 | Inclusion in the price of goods of additional expenses (services of third-party organizations for transportation, storage, etc.) under the contract in c.u. | Receipt of additional expenses |

| 41.01 | 60.21 | Receipt of goods. Reflection of debt to the supplier under the contract in currency | Receipts (acts, invoices) |

| 41.02 | 60.21 | Inclusion in the price of goods of additional expenses (services of third-party organizations for transportation, storage, etc.) under the contract in c.u. (retail, accounting at acquisition cost) | Receipt of additional expenses |

| 41.02 | 60.21 | Receipt of goods at the retail outlet. Reflection of debt to the supplier under the contract in foreign currency (retail, accounting at acquisition cost) | Receipts (acts, invoices) |

| 41.04 | 60.21 | Inclusion in the price of purchased products of additional expenses (third-party services for transportation, storage, etc.) under the contract in c.u. | Receipt of additional expenses |

| 41.04 | 60.21 | Receipt of purchased products. Reflection of debt to the supplier under the contract in foreign currency | Receipts (acts, invoices) |

| 41.11 | 60.21 | Receipt of goods at the retail outlet. Reflection of debt to the supplier under the contract in foreign currency (retail, accounting at sales cost) | Receipts (acts, invoices) |

| 41.12 | 60.21 | Receipt of goods at a manual point of sale. Reflection of debt to the supplier under the contract in foreign currency (retail, accounting at sales cost) | Receipts (acts, invoices) |

| 44.01 | 60.21 | Inclusion of third-party services into distribution costs. Reflection of debt to the supplier for services rendered under the contract in foreign currency in organizations engaged in trading activities | Receipts (acts, invoices) |

| 44.02 | 60.21 | Attribution of third-party services to business expenses. Reflection of debt to the supplier for services rendered under the contract in foreign currency in organizations engaged in industrial and other production activities | Receipts (acts, invoices) |

| 50.23 | 60.21 | Receipt of monetary documents to the organization's cash desk from the supplier under an agreement in foreign currency | Receipt of cash documents |

| 60.21 | 60.21 | Transferring the amount of debt to the supplier from one contract in foreign currency to another contract in foreign currency | Debt adjustment |

| 76.22 | 60.21 | Reflection of the amount of the claim presented to the foreign supplier under the contract in foreign currency | Debt adjustment |

| 97.21 | 60.21 | Inclusion of the cost of services (values) into future expenses. Reflection of debt to the supplier under the contract in currency | Receipts (acts, invoices) |

Is it possible to set the contract price in foreign currency?

The provisions of the current legislation on the contract system, that is, 44 Federal Laws, do not establish specific regulations for conducting procurement procedures in foreign currency.

According to paragraph 2, 3, part 1, art. 50, paragraph 6, 7 art. 64 44-FZ, the customer organization can organize a purchase, the NMTsK of which will be determined in foreign currency, however, it is necessary to initially regulate and consolidate the procedure for recalculating the price into rubles for the further possibility of making payment under the concluded contract (letter of the Ministry of Economic Development No. D28i-717 dated March 17, 2015 ). The norms of the Civil Code of the Russian Federation also approve for the customer the possibility of concluding a contract in foreign currency. When concluding, it is necessary to note the rate at which the contract price will be recalculated into rubles to fulfill the conditions for mutual settlements (clause 2 of Article 317 of the Civil Code of the Russian Federation).