Step-by-step instruction

In the Organization, according to the local act, wages are paid twice a month: on the 25th and 10th. Gordeev N.V. wrote an application for payment of wages in cash.

On August 10, 2022, he was paid his salary for the second half of July through the cash register.

Tab. No. Last name I.O. employee To payoff Payment method 9 Gordeev Nikolay Vasilievich 16 632 through the cash register On the same day, personal income tax for July 2022 was paid.

Step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Payment of salary in cash | |||||||

| 10th of August | — | — | 16 632 | Formation of payment statement | Statement to the cash register | ||

| 70 | 50.01 | 16 632 | 16 632 | Salary payment | Cash withdrawal - Payment of wages to an employee | ||

| Payment of personal income tax to the budget | |||||||

| 10th of August | 68.01 | 51 | 4 368 | Payment of personal income tax to the budget | Debiting from a current account – Tax payment | ||

Is it possible to receive a salary through a cash register: rules for issuing

The rules for paying wages to employees of the organization, which determine the procedure, forms, terms, places of issue, are prescribed in local regulations (Articles 131 and 136 of the Labor Code of the Russian Federation).

Such documents may be considered a collective agreement or internal labor regulations. Additionally, the rules for issuing wages are fixed in the employment contract. Is it possible to receive salary in cash? In accordance with current legislation, employee remuneration can be made in cash or in kind. Cash issuance for these purposes is carried out at the place where the employee performs his official duties. On the day when the employer must pay wages in cash, it is necessary that the organization’s cash desk has the required amount of money.

By law, there are two sources of cash that a business can use to pay salaries:

- Bank account of the organization. Payroll withdrawals are made by the authorized person in whose name the check for this action is written (for example, a cashier). This document must state the purpose - payment of wages.

- Cash received at the cash desk, with the exception of funds accepted by payment agents from citizens as payments in favor of other persons (clause 1 of the Central Bank Directive No. 5348-U dated December 9, 2019).

Payment of salary in cash

Regulatory accounting

You can use the following to pay wages:

- funds specially withdrawn from the current account for this purpose;

- proceeds received at the cash desk, loans received or returned in cash, unspent accountable funds (clause 1 of the Directive of the Bank of the Russian Federation dated December 9, 2019 N 5348).

The period for paying wages from the cash register is no more than 5 days, including the day the funds are received at the cash register. The specific period is established by local regulations of the enterprise. An Expense Cash Order is generated for the paid wages, and the unpaid wages are deposited (clause 6.5 of the Bank of the Russian Federation Directive No. 3210-U dated March 11, 2014).

An employer does not have the right to refuse to give an employee a salary in cash, even if other employees receive it on cards. If the employee has not received a written application for payment to the card, then the payment of wages is possible only in cash (Article 136 of the Labor Code of the Russian Federation). An exception is if the company does not use a cash register (Appeal ruling of the Judicial Collegium for Civil Cases of the Kirov Regional Court dated April 25, 2017 in case No. 33-1671/2017).

Formation of payroll statements

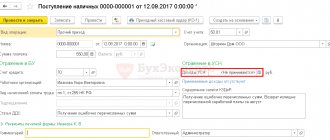

Formation of a statement for the payment of wages through the cash register is drawn up with the document Statement to the Cashier in the section Salaries and Personnel - Salary - Statement to the Cashier.

Please pay attention to filling out the fields:

- Type of payment - Salary , since it is the salary that is transferred at the end of the month.

- Month —the month the salary is calculated and paid to the employee.

By clicking the Fill , a tabular section is formed with the data for payment based on the results of the specified month:

- For payment - the balance of the accrued amount for which a statement has not previously been generated.

The document does not generate a posting to the Accounting and Tax Accounting .

Documenting

Payment of wages can be carried out according to (clause 6 of the Directive of the Bank of the Russian Federation dated March 11, 2014 N 3210-U):

- Expense cash order;

- Payroll statement in form T-49;

- Payroll in form T-53.

The Payroll slip form T-49 can be printed by clicking the Print button - Payroll slip (T-49) of the Cashier slip . PDF

In order to print the Payroll in form T-53, you must select Print - Payroll (T-53). PDF

Salary payment

The actual issuance of wages to the employee is documented in the document Issuance of cash type of operation Payment of wages to the employee using the Pay statement at the bottom of the document form Statement to the cash desk . PDF

In 1C, you can generate an expense cash order for the total amount of wages issued according to the statement; in this case, you must select Type of operation - Payment of wages according to statements . PDF

Please pay attention to filling out the fields:

- from - the date of payment of wages or the date of closing of the statement for payment of wages (paragraph 4, clause 6.5 of the Directive of the Bank of the Russian Federation dated March 11, 2014 N 3210-U).

- The recipient is the employee to whom the salary was paid, selected from the directory Individuals .

- Amount - the amount of wages issued from the cash register.

- Statement - a statement according to which wages were paid.

- Expense item - Labor remuneration , with the Type of movement Labor remuneration PDF, selected from the Cash Flow Items directory.

If an expense cash order is drawn up without a payroll slip (T-49) or a payroll slip (T-53), then in the fields Issued (full name) , According to the document , the full name and passport details of the employee who received wages through the cash register must be indicated.

If the Organization prepares a settlement and payment (T-49) or payroll (T-53) statement, then these fields are not required to be filled out. In this case, confirmation of the payment of wages from the cash register to the employee is a payroll or payroll statement (clause 6, 6.1 of the Bank of the Russian Federation Directive No. 3210-U dated March 11, 2014).

Postings according to the document

The document generates the posting:

- Dt Kt 50.01 - payment of wages.

Documenting

Regardless of whether the organization draws up a payroll or payroll statement, for the wages actually paid out it is necessary to issue a Cash Expense Order (KO-2), approved by Resolution of the State Statistics Committee of the Russian Federation dated 08.18.1998 N 88 (clause 6.5 of the Bank of the Russian Federation Directive dated 11.03 .2014 N 3210-U).

The Cash Outflow Order (KO-2) PDF form can be printed by clicking the Print button - Cash Outflow Order (KO-2) from the Cash Issue .

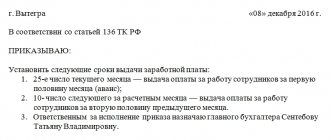

Dates and frequency of payments

The Labor Code establishes the procedure for paying salaries twice a month. The final payment to the employee for the reporting period must be made before the 15th of the next billing month.

Employees must be paid wages (Part 6 of Article 136 of the Labor Code of the Russian Federation):

- for the first half of the month (advance) – no later than the 30th (31st) day of the current month;

- for the second half of the month - no later than the 15th day of the next month.

Specific dates and method (cash or transfer to a card) are established by an employment or collective agreement or a local regulatory act of the organization (for example, internal labor regulations or regulations on remuneration) (Letters of the Ministry of Labor dated August 10, 2017 No. 14-1/B-725, Rostruda dated 03/06/2012 No. PG/1004-6-1).

The period for paying wages from the cash register is limited to three working days from the date of receipt of funds in the cash book. After this time, all unclaimed amounts are deposited.

Employers are not authorized to independently shift the deadlines for settlements with staff, withhold cash in the cash register with the subsequent exceeding of the limit, and refuse to deposit funds. Legislation requires that the exact dates of income payment be recorded in local acts. If the organization has a large number of staff, then different deadlines can be set for each category of employees.

Reflection in reporting 6-NDFL

Calculation of personal income tax amounts is carried out by tax agents on the date of actual receipt of income on an accrual basis from the beginning of the tax period (clause 3 of Article 226 of the Tax Code of the Russian Federation). The date of actual receipt of income in the form of wages is the last day of the month indicated in the Salary Payroll document PDF (Clause 2 of Article 223 of the Tax Code of the Russian Federation). It will be reflected on page 100 of Section 2 of form 6-NDFL.

Payroll for July 2022: PDF

- Accrued - 35,000 rubles.

- Deduction for children - 1,400 rubles.

- Personal income tax - 4,368 rubles.

In Form 6-NDFL, payment of wages is reflected in:

Section 1 “Generalized indicators”:

- page 070 - 4,368 , amount of tax withheld.

Section 2 “Dates and amounts of income actually received and withheld personal income tax”: PDF

- page 100 - 07/31/2018 , date of actual receipt of income;

- page 110 - 08/10/2018 , tax withholding date;

- page 120 - 08/13/2018 , tax payment deadline;

- pp. 130 - 35,000 , the amount of income actually received;

- pp. 140 - 4,368 , amount of tax withheld.

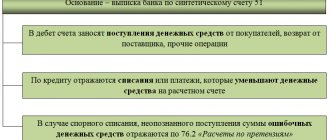

Payment of personal income tax to the budget

Payment of personal income tax to the budget is carried out no later than the day following the day of payment of wages to the employee (clause 6 of Article 226 of the Tax Code of the Russian Federation).

Payment of personal income tax to the budget is reflected in the document Write-off from the current account transaction type Tax payment in the Bank and cash desk section - Bank - Bank statements - Write-off button.

Please pay attention to filling out the fields:

- Transaction type - Tax payment .

- Tax - personal income tax when performing the duties of a tax agent .

- Type of liability - Tax .

- for - July 2018 , the month of accrual of income (salaries).

Learn more about reflecting personal income tax payments to the budget

Postings according to the document

The document generates the posting:

- Dt 68.01 Kt 51 - payment of personal income tax to the budget for May.

Postings for issuing wages

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| Payment of wages in cash | ||||

| 50-1 | 51 | 110 000 | Funds for payment of wages are credited from the current account to the company's cash desk | Receipt cash order, check book |

| 70 | 50-1 | 110 000 | Salary posting issued from cash register | RKO, Payroll statement |

| Payment of wages in non-cash form | ||||

| 70 | 51 | 128 900 | Employees' salaries are transferred to their current accounts, plastic cards | Payroll slip, payment order |

| 91-2 | 51 | 128,90 | A bank commission has been charged on the amount of salary payments | Bank salary project |

| Payment of deposited wages from the company's proceeds | ||||

| 50 | 62 | 75 000 | Proceeds from sales are credited to the enterprise's cash desk to pay wages. | Receipt cash order |

| 70 | 76 | 20 500 | Wages not received by the employee are deposited | Payroll statement |

| 76 | 50 | 20 500 | Payment of deposited wages through the company's cash desk | RKO, payroll statement |

| Salary money received from the bank | ||||

| 50 | 51 | 100 500 | Cash received from the company's bank to pay salaries | Receipt cash order, check book |

| 70 | 76 | 43 500 | Wages not received by the employee are deposited | Payroll statement |

| 51 | 50 | 43 500 | The deposited salary was handed over to the enterprise bank | RKO |

| 50 | 51 | 43 500 | The cash desk received money to pay deposited wages | Receipt cash order, check book |

| 76 | 50 | 43 500 | Deposited wages paid | RKO, payroll statement |

| Payment of wages in kind | ||||

| 70 | 90-1 | 55 000 | The employee’s salary is paid in finished products, goods, semi-finished products | Buh. reference |

| 90-2 | 43 (41) | 35 000 | Write-off of the cost of finished products | Write-off act |

| 70 | 91-1 | 89 000 | Other property transferred to pay wages | Buh. reference |

| 91-2 | 08, 10, 21 | 55 000 | Write-off of the cost of other property | Write-off act |

| 02 (05) | 01 (04) | 18 000 | Depreciation of retired assets written off | Buh. reference |

Postings for the return of erroneously paid wages

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 20 | 70 | 20 000 | Reversal of erroneously accrued wages | Buh. reference |

| 50 | 70 | 17 400 | Erroneously paid wages were returned to the company's cash desk | Receipt cash order |

| 73 | 70 | 17 400 | A claim regarding erroneously paid wages has been filed with the court. | Claim |

| 70 | 73 | 17 400 | Claim disclaimer displayed. The court ruled in favor of the employee. | Buh. reference |

| 20 | 70 | 20 000 | Reversal of erroneously accrued wages | Buh. reference |

| 91 | 70 | 20 000 | Wages paid by mistake were written off as other expenses | Buh. reference |

| 50 | 73 | 17 400 | Wages paid by mistake were returned by court decision | Buh. reference |

| 91 | 70 | 15 200 | Write-off of paid wages upon expiration of the statute of limitations | Buh. reference |

Checking mutual settlements

Checking mutual settlements with an employee

You can check mutual settlements with an employee using the report Balance sheet for the account “Settlements with personnel for wages” in the Reports section - Standard reports - Account balance sheet.

The absence of a final balance in the account “Settlements with personnel for wages” on the day of payment of wages means that the wage arrears to Gordeev N.V. absent.

Checking settlements with the budget

To check the calculations with the budget for personal income tax, you can create a report Analysis of account 68.01 “Personal income tax when performing the duties of a tax agent”, in the section Reports - Standard reports - Account analysis.

In our example, wages were paid on August 10, so the end date of the report should be August 13 (August 11 and 12 are Saturday and Sunday), i.e. the closest working day after the day of wage payment.

The absence of a final balance in account 68.01 “Personal income tax when performing the duties of a tax agent” means that there is no debt to pay personal income tax to the budget.

See also:

- General scheme for setting up salary and contribution accounting

- Salary settings in 1C

- Payroll

- Advance payment via cash register

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Payment of an advance through the cash register: in cash according to the statement Let's consider the features of reflecting in 1C the payment of an advance to an employee through the cash register....

- Transferring a work book to an employee - should it be done through the cash register and what to do with VAT? The Ministry of Finance reminded employers of the need to charge VAT when issuing...

- Payment of wages through a bank to bank cards There are several options for transferring wages to bank cards: in...

- Retail sales of goods through an automated point of sale: cash payment This article discusses the retail sale of goods through an automated point of sale…

Who is prohibited from paying wages in cash and how to pay foreigners?

In some cases, the state prohibits the payment of wages in cash. Violation of it may result in penalties being imposed on the employer.

It is established at the legislative level that all settlements with citizens of foreign countries relate to foreign exchange transactions. At the same time, payment of wages to foreigners is not included in the list of transactions that can be carried out in cash (Part 2 of Article 14 of the Law “On Currency Regulation...” dated December 10, 2003 No. 173-FZ). Therefore, payment for non-residents should be made only by non-cash method.

At the same time, the Supreme Arbitration Court of the Russian Federation, in its ruling No. VAS-19914/13 dated January 27, 2014, indicated that relations with a foreign employee fall within the scope of labor legislation. The Labor Code of the Russian Federation obliges the employer to pay the employee wages regardless of whether the employee has a bank account. Opening a bank account to receive a salary is a right, not an obligation, of a foreign worker. In this regard, imposing a fine for paying wages in cash to a non-resident is illegal. There are also court decisions canceling fines due to the insignificance of the violation.

Nevertheless, the Federal Tax Service continues to insist on violations of currency laws (letter of the Federal Tax Service dated August 29, 2016 No. ZN-4-17/15799) and impose fines for cash payments to foreigners. Therefore, if you do not want to sue, indicate in the employment contract with the foreigner that the payment of wages will be carried out by bank transfer to an account that the employee is required to open.

In 2022, payment of wages in cash to employees of state and municipal institutions is not prohibited. The Law “On Amendments to the Federal Law “On the National Payment System”” dated 05/01/2017 No. 88-FZ obliges banks from 07/01/2018 to credit wages of employees of the specified budget organizations only to the cards of the national payment system “Mir”. If an employee refuses to receive wages on the Mir card, it can be paid from the institution’s cash desk.