Any hired labor, being the main activity of a person, must be paid. In other words, the end result of any work is receiving a reward for it. When finding employment, an employee expects a certain payment, agreed upon in advance and reflected in the relevant documentation.

In turn, the employer, when forming a staff, must calculate in advance the funds intended for wages and take this indicator into account throughout the entire functioning of the organization. The costs of hired personnel constitute the most important expense item for an entrepreneur.

How to draw up and approve regulations on wages and bonuses in an organization?

Let's consider how the wage fund (payroll) differs from the wage fund (wage fund), how the payroll is formed, how to plan it correctly and using what formula to calculate it.

Payroll or payroll?

Remuneration involves not only the regular receipt of wages by employees. In enterprises that care about their staff, employees usually receive not only the amounts intended to be paid according to the salary or tariff schedule, but also additional funds provided for by the internal policy and/or industry characteristics of the organization.

Thus, the wage fund includes all types of payments that the entrepreneur makes in favor of employees, that is, all expenses provided for the organization’s personnel in the planned, current or past period, regardless of the reasons for the accrual. If we compare this totality with the wage fund (WF), then the latter will be part of the payroll.

The main difference between the FW is that this fund includes only those payments that are directly related to the labor operations performed by employees and their results.

NOTE! These funds will match if the organization's employees do not receive any payments other than salaries. But in practice this happens quite rarely.

FW and payroll are calculated using identical algorithms.

How to analyze the efficiency of using the wage fund ?

Changing the approach

It’s good if an organization can organize remote work for everyone, but what if this is not possible? Or, as a result of staff sitting outside the office, the company loses clients, income falls, but expenses do not decrease much. You still have to pay for office rent. During the time employees are at home (after all, it is not their fault), they need to accrue wages and pay contributions to the budget.

Isn't it time to reconsider your approach to organizing work? Maybe you can find some specialists online, remotely, and they will be ready to provide you with the same services, but without investment on your part (except for the fee, of course):

- There are many freelancers; if one cannot complete the assigned tasks, you can attract another ;

- depending on the format of the work, you will save on contributions from 2.9% (accident contributions) to 30% of payments made to the freelancer;

- you will not have to include vacation pay, bonuses and other accruals in future calculations, as is the case with payroll. The mercenary is not entitled to vacation or sick leave, because... he will work with you within the framework of civil law, not labor law.

- When you hire an employee, you know about him exactly what is written on his resume and what his former boss says about him (if there is even an opportunity to communicate with him). Freelance exchanges set ratings. It is in their interests that the client leaves the platform satisfied and returns, so they monitor the work of the performers. You can see objective ratings and reviews .

No matter how difficult it is, in a crisis you have to cut staff and take tough measures to save your business. Therefore, reviewing the system of working with employees and performers is normal practice.

Why is the payroll indicator needed?

The importance of payroll as an economic category, in addition to directly accounting for necessary expenses, helps in solving many management problems, such as:

- analysis of personnel costs of different structural divisions;

- adjusting the company's general expenses;

- a certain role in increasing profitability and reducing expenses;

- adjustment of product costs and, as a consequence, the company’s pricing policy;

- calculation of mandatory social payments - insurance contributions, pension contributions, etc.;

- budgeting expenses.

Composition of the wage fund

The wage fund is the totality of the wage fund and all other types of personnel costs. Includes the following categories:

- premium;

- “thirteenth” salary;

- sick leave;

- vacation pay of all types;

- business trips;

- bonuses for length of service;

- amounts for time that was not actually worked, but is legally subject to payment (for example, downtime);

- additional payments for part-time work, for odd or overtime work, for dangerous or harmful working conditions, etc.;

- employee compensation;

- expenses for providing the employee with discounted or free uniforms;

- preferential working hours for employed minors;

- medical examination costs;

- social payments;

- compensation (for example, for food, travel to work, etc.)

The wage fund does not include:

- annual bonuses;

- targeted payments in favor of employees;

- bonuses paid from special funds;

- separate pension benefits;

- reimbursement of vouchers, travel, etc.;

- gifts from the company;

- dividends;

- all types of financial assistance.

Managerial employees of the association who overspend the wage fund are deprived of bonuses for the period of its compensation, but not more than 50%.

[p.106] In case of overexpenditure of the wage fund for an association (enterprise), workshop, site or other structural unit, bonuses for the corresponding management employees. [p.175]

From the table 4.6 shows that the absolute overexpenditure of the wage fund (the difference between the planned and actual size of the fund) amounted to 3.8 thousand rubles. (4348.5—4344.7), or 0.1%. [p.252]

In order not to be faced with the fact of an overexpenditure that has already occurred, the chief accountant, relying on the rights granted to him, must not allow salaries to be inflated compared to the approved staffing table and the hiring of new employees in the absence of corresponding vacant positions and free labor limits, and not make additional payments for work, included in the responsibilities of full-time employees, etc. In addition, with regard to the wage fund of piece workers, it is necessary to carefully and systematically check the amount of work performed and the correct application of prices and production standards. The responsibility of the chief accountant is to check the compliance of production data on work orders, shift reports and other primary documents with the general indicator of fulfillment of the production plan for the reporting period. Particularly careful control should be organized over unproductive additional payments for overtime hours of work and for deviations from normal working conditions, over payment for defects and downtime, etc. These payments are a direct overexpenditure of the wage fund. It is necessary that all such payments be issued in separate additional payment slips and approved by the head of the enterprise. [p.160]

An absolute overexpenditure of the wage fund can be the result of either an increase in the actual number of employees or an increase in average earnings. [p.402]

When comparing the growth rates of labor productivity and wages, the actual ratio (lead coefficient) is compared with the planned one. Failure to meet the planned ratio between the growth rates of labor productivity and wages inevitably leads to overspending of the wage fund and an increase in production costs. The latter is determined by the formula [p.403]

Savings or overexpenditure of the wage fund are determined each quarter on an accrual basis from the beginning of the year. [p.134]

The considered bonuses to workers under the piecework-bonus and time-bonus wage systems are paid from the wage fund, regardless of the state of its expenditure. Even if there is an overexpenditure of the wage fund, there is no reason to deprive workers of bonuses in whole or in part for achieved performance indicators. [p.189]

Bonuses at the expense of the foreman’s fund exist only in contracting organizations and do not apply to repair and construction organizations. This fund is formed in the amount of up to 3% of the wage fund of workers of the facility managed by the foreman due to actual salary savings. If there is no overexpenditure of the wage fund in the foreman’s area, but there are no savings, then bonuses are not given to workers, since there are no funds for the formation of the foreman’s bonus fund. The foreman has the right, at the expense of the bonus fund allocated at his disposal, to bonus workers in the amount of up to half a month's tariff rate. [p.189]

If there is an overexpenditure of the wage fund for employees of the management staff of a construction and installation organization, the bonus is reduced by the amount of the allowed overexpenditure, but not more than 50% of the accrued premium for the period until the overexpenditure is reimbursed. If within six months of the current calendar year the overexpenditure is compensated, then the employees of the management apparatus are paid the underpaid 50% of the bonus, provided that these payments do not lead to the growth rate of average wages exceeding the growth rate of labor productivity. Line engineers, senior work producers and foremen, as well as production managers are awarded bonuses regardless of the state of expenditure of the wage fund for the construction and installation organization as a whole. If there was an overexpenditure of the wage fund, resulting from the fault of the site manager, then the construction and installation manager [p.192]

If the wage fund is overspent, funds from the material incentive fund are allocated to cover it (within the limits of wage fund savings transferred to this fund in the previous year). [p.237]

In cases where the enterprise has overexpended the wage fund in the reporting month (quarter), but there have been sufficient savings for the period that has elapsed since the beginning of the calendar year, accrued bonuses to management staff are paid in full. Bonuses are paid in the same manner to management employees of production, workshops and services of the enterprise in case of overexpenditure of the wage fund. In this case, overexpenditure of the wage fund is taken into account only for the corresponding production, workshop and service. [p.333]

Senior foremen (heads of sections) and foremen are awarded bonuses regardless of the state of expenditure of the wage fund for the section, service, workshop, production and the enterprise as a whole. In this case, the manager, if there is an unreimbursed overexpenditure of the wage fund for a site or workshop, caused by the fault of the senior foreman (head of the site) and the foreman, can reduce the bonuses for these employees, but not more than 50%, as in the month in which the overexpenditure occurred , and the next month until it is reimbursed with the subsequent payment of the bonus. [p.333]

If there are savings in the wage fund for the enterprise as a whole, the head of the enterprise has the right to pay bonuses in full to the management employees of the enterprise, services and workshops who have improved their work, but have not yet compensated for the overexpenditure of the wage fund committed during the previous period. [p.333]

At the same time, the increase in the amount of the carry-over balance (compared to the plan - by 50 thousand rubles) is alarming, since the reasons for its growth are most often violations in the implementation of the plan for the product range and overspending of the wage fund. In both cases, bonuses are not paid during the period of violations or are reduced until they normalize. [p.194]

The regulations developed at the plant provide for financial liability for overspending of the wage fund. In the event of a relative overexpenditure of this fund, bonuses to management employees and engineering personnel are reduced by the amount of the allowed overexpenditure, but not more than 50% of the accrued bonus amounts for the period until the overexpenditure is reimbursed. If the workshop compensates for the overexpenditure of the wage fund within six months, then the specified employees are paid half of the withheld bonus amounts. The director of the enterprise may authorize the payment of the entire bonus when the plant as a whole has achieved savings in the wage fund. It should be noted that in addition to financial responsibility, management employees and engineers bear administrative responsibility for overspending of the salary fund. [p.159]

As can be seen from table. 41, the enterprise has an absolute overexpenditure of the wage fund (the difference between the planned and actual value of the fund) in the amount of 3.8 thousand rubles. (4348.5—4344.7), or 0.1%. However, the plant exceeded the program, and a certain overspending of the wage fund is natural. The extent to which it corresponds to the level of implementation of the plan in terms of production volume shows the relative overexpenditure (or savings) of the fund. The difference is determined by subtracting the actually spent fund from the planned value of the salary fund, recalculated to the actual volume, i.e. [p.308]

Bonuses accrued to executive employees of an association (enterprise), in the event of an overexpenditure of the wage fund, are generally reduced by the amount of the resulting overexpenditure, but not more than 50% of the accrued bonuses. [p.164]

Bonuses accrued to management employees in case of overexpenditure of the wage fund for the district administration [p.169]

The resolution on improving the economic mechanism expanded the possibilities of material incentives for workers and employees. Enterprises were given the opportunity to manage their payroll. If previously they could not use the saved part of their wages, since it was not taken into account in the next year’s plan, now these funds can be transferred to the material incentive fund, subject to the fulfillment of the production plan and the growth of labor productivity. If the wage fund is overspent, funds from the material fund are allocated to cover it [p.204]

The economic mechanism formed in this way will economically encourage enterprises that are legal entities to take more effective measures aimed at reducing the construction time of facilities and increasing the efficiency of social production. Indeed, when the construction period is extended (if the necessary block devices and structures are delivered to the site), mobile trusts will incur large economic losses, since the volume of work performed by the association is removed from their scope of construction and installation work performed on their own (or from the volume of GSP - when the block facility is fully equipped products) with all the ensuing consequences: a decrease in output per worker, overspending of the wage fund, and a deterioration in key indicators. In these conditions, the mobile (assembly) trust should strive to begin the installation of block boxes immediately after their delivery to the construction site, which means that the living and material labor invested in factories and other divisions of the industrial construction association will give a return faster, since work in progress is transformed into enterprises for the production of products or provision of services. On the other hand, an industrial-construction association, using all the advantages of large, highly mechanized machine production, works not just for a plan and profitable products in conditions of frequently changing needs for products, but for specific objects and specified deadlines, as required by the contract, [p. 45]

As can be seen from table. 49, the production unit has an absolute overexpenditure of the wage fund (the difference [p.351]

Since the absolute deviation is determined without taking into account the degree of fulfillment of the production plan, it cannot be used to judge savings or overexpenditure of the wage fund. [p.135]

Further, cases of non-volume (not included in the estimate) work, downtime, interruptions in the production of work as a result of poor organization, the presence of overtime work, insufficient coverage of workers with piecework and piecework orders and other factors affecting the overexpenditure of the wage fund are identified. [p.360]

Absolute savings (or overexpenditure) of the wage fund is the difference between the amount of actually accrued wages and the amount of the planned wage fund. [p.390]

Relative savings (or overexpenditure) of the wage fund is the difference between the amount of actually accrued wages and the amount of the planned wage fund, recalculated by the percentage of construction and installation work completed. [p.390]

Relative savings (or overexpenditure) of the wage fund are calculated as follows [p.305]

To a certain extent, this also applies to another cost element, which also occupies a large share in the cost price - wages. With the help of operational analysis, the causes and culprits of the overspending of the wage fund are revealed in order to quickly eliminate and prevent it. For example, the following violations are more often detected at machine-building enterprises. [p.228]

Bonuses for executive employees of the base in case of overexpenditure of the wage fund are reduced, but not by more than 50% of the accrued bonuses. If, within a period of up to 6 months, the overexpenditure of the wage fund is compensated, the specified employees are paid 50% of the bonus, which is not [p.136]

If there is an overexpenditure of the wage fund in the reporting quarter, but there have been sufficient savings in the wage fund since the beginning of the calendar year, bonuses accrued to executive employees are paid in full. [p.137]

Elements of national wage regulation are regulation of the relationship between labor productivity and wages, taxation of wage increases, deductions from profits as a percentage of wages, regulation of the wage fund and average wage, linking material incentives for managers with overspending of the wage fund, organization of labor exchanges, organization of associations of company managers regulation of the conditions of compensation payments and income indexation. State laws regulate minimum wage rates; determine the rules for hiring and dismissal; establish options for organizing work and rest; determine wage rules; regulate the working conditions of women and youth. Job salaries set by the government determine the guaranteed minimum level of pay and at the same time establish the importance of positions. Justice does not lie in receiving equally, but in receiving unequally fairly. (A.I. Gelman). [p.328]

To more fully characterize the use of the wage fund, it is necessary to determine the relative savings (overspend), taking into account the growth of production output. To determine the relative savings (overspending) of the wage fund, the actual fund is compared with the planned one, adjusted by the percentage of plan fulfillment in terms of production volume, taking into account the correction factor established by the enterprise. [p.62]

The sum of the results of the influence of each factor gives the previously obtained result of absolute savings (overspending) of the wage fund. [p.62]

The amount of relative savings (overspend) of the wage fund is determined by the formula [p.62]

In the reporting year, absolute savings in the amount of 44.3 thousand rubles were achieved in the workers' wage fund. It was formed as a result of a decrease in the level of average wages of workers against the plan. The savings due to this amounted to 48.4 thousand rubles. At the same time, the increase in the number of workers led to an overexpenditure of the wage fund in the amount of 4.1 thousand rubles. [p.64]

In case of some negative performance indicators (production of low-quality products, defects exceeding the permissible level, overexpenditure of the wage fund, etc.), the bonuses are reduced or not paid to the teams of the relevant levels and individuals. [p.202]

If a construction organization fulfills the construction and installation work plan with a smaller workforce, then an additional increase in labor productivity will be obtained in construction production and, vice versa, if the workforce increases beyond 755 people. The construction company will not only fail to complete the task, but will also overspend the wage fund. [p.153]

An enterprise can use the wage fund savings received in previous quarters and months, recalculated in accordance with the percentage of plan fulfillment, to pay wages and bonuses in subsequent quarters and months of the same year. Overexpenditure of the wage fund is subject to compensation in subsequent months, and management employees of the enterprise who have committed overexpenditure of the wage fund are deprived of their bonus for the period until it is reimbursed. The unrecovered part of the amount of overexpenditure of the wage fund can be registered with the enterprise no longer than until July 1 of the following reporting year. If the enterprise fully compensates for the overexpenditure of the wage fund on time (six months) or ahead of schedule, then the management employees who committed the overexpenditure are paid 50% of the bonus due to them that was not paid in the previous period due to the overexpenditure of the wage fund. In the same order, bonuses are paid in case of overexpenditure of the wage fund in workshops, departments and services of the enterprise. In this case, overexpenditure of the wage fund is taken into account only for the corresponding structural division of the enterprise. If there is no overexpenditure of the wage fund for the enterprise as a whole, then the enterprise can write off the unreimbursed overexpenditure of the wage fund for the past period that exists in individual workshops, sections and other parts of the enterprise. [p.109]

The transfer of PMKtkr to internal subcontracting helps to speed up the installation time of objects. When construction time is extended, installation departments incur significant economic losses, since the volume of work performed by PMKtkr is excluded from the total volume of construction and installation works with all the ensuing consequences of reduced output, overexpenditure of the wage fund, deterioration of key indicators [p.63]

Rhythmic work is the main condition for the timely release and sale of products. Irregularity worsens all economic indicators, the quality of products decreases, the volume of work in progress and excess balances of finished products in warehouses increase and, as a result, capital turnover slows down, deliveries under contracts are not fulfilled and the company pays fines for late shipment of products, revenues are not received on time, the wage fund is overspent due to the fact that at the beginning of the month workers are paid for downtime, and at the end for overtime work. All this leads to an increase in production costs, a decrease in the amount of profit, and a deterioration in the financial condition of the enterprise. [p.458]

Construction and installation organizations can use the savings received in previous months and quarters from the Salary Fund to pay wages in subsequent months and quarters of the same year. If the construction and installation organization has allowed an overexpenditure on the workers' wage fund, based on the level of plan implementation, then Stroybank can issue the missing amount within no more than 2% of the Quarterly wage fund, subject to full compensation for the overexpenditure from the beginning of the year. In all other cases, the issuance of funds to cover overexpenditure of the wage fund is carried out by Stroybank of the USSR only with the permission of the heads of ministries and main departments, who are obliged to consider the reasons for the overexpenditure and establish control over its compensation. [p.387]

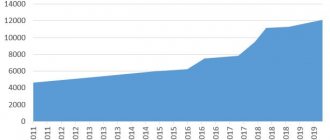

Terms of formation of the wage fund

Depending on the needs of the organization, the payroll can be calculated for any period of interest, even for one day. In practice, other reporting units are more often used:

- Payroll for the year is calculated for the last calendar year period, this indicator is used to determine the entire amount of the wage fund;

- Monthly payroll is more often used for various types of reports;

- Payroll per day is used as a theoretical indicator for analyzing a company’s expenses;

- Payroll per hour will be needed for those enterprises where employees work on an hourly payment system.

An example of calculating the wage fund for a month .

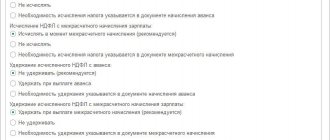

General calculation formula

The legislation does not have a universal formula for how to calculate the wage fund - it all depends on its composition, defined in the organization. Usually it’s not difficult to calculate the total amount - just add everything up. In planning, it is often necessary to determine the cost of financing workers for the production of a certain batch of goods. In this case, the cost of manufacturing one unit is determined and multiplied by the required quantity, adding bonuses and other allowances. The formula looks like this:

Payroll = Cost of one product × number of products % premium.

Accounting uses a more accurate formula for calculating the wage fund, but it is suitable for determining the actual payroll based on the results of a certain period, and not the planned payroll.

It is equal to the amount of the credit to account 70 “Settlements with personnel for wages” with the debit of the accounts for other expenses (provided that expenses for payments to employees are included):

- 20 “Main production”;

- 25 “General production expenses”;

- 26 “General business expenses”;

- 08 “Investments in non-current assets”;

- 91 “Other income and expenses.”

Since credit is a negative value and debit is positive, the real costs of the organization are obtained. But how to calculate the wage fund if you need to analyze the work of an organization - use average and reference indicators. Take into account:

- average monthly salary of one employee;

- volume of production per ruble of wages;

- the relationship between the growth rate of average wages and labor productivity.

Calculation of annual payroll

In order to calculate the annual wage fund, you need to have the following data for calculations:

- the amount of wages paid to employees according to statements;

- number of hours worked (calculated using time sheets);

- indicators of additional costs enshrined in the company’s local regulations;

- the number of employees on the list and their salaries (fixed in the staffing table);

- forms of payment accepted at the company (salary, piecework, hourly).

Universal scheme

The universal calculation scheme involves the addition of all amounts intended for personnel. In order to calculate it as simply as possible, although somewhat approximately, use the following formula:

FOTyear = ZPs-m x Chsr-sp. x 12

Where:

- FOTyear – annual indicator of the wage fund;

- ZPs-m – average monthly salary (all amounts of payments for the year, divided by 12);

- Chsr-sp. – average number of employees (the summed number of employees for each day of the month, divided by the number of days in the month, repeated 12 times according to the number of months in the year).

FOR EXAMPLE. From January to March 2016, Traditsiya LLC employed 12 people; in April, 2 more workers were hired; the staff did not change until October, when 1 person was fired, and in December, three more were hired. The average monthly salary of personnel, including bonuses, additional payments and bonuses, pre-calculated from the statements, amounted to 456 thousand rubles. First, we determine the average number of employees: (12 x 3 months) + (12 + 2 (April)) + (14 x 6 (until October)) + (14-1 (October)) + 13 (November) + (13 + 3 (December)) / 12 = 13. Let's calculate the payroll for Tradition LLC for 2016: 456,000 x 13 x 12 = 71,136,000 rubles.

When paid hourly

Payroll calculation for hourly wages is carried out according to the following scheme:

FOThour = ∑st. x RF

Where:

- FOThour – wage fund for hourly workers;

- ∑st. – the sum of the rates of hourly workers;

- RF – number of working hours.

With piecework payment

Payroll calculation for piecework wages is carried out as follows:

FOTsd. = (Vpl. x Tsed.) + K + N + Pr. + Social

Where:

- FOTsd. – wage fund for workers with piecework wages;

- Vpl. – volume of production according to plan;

- Tsed. – price per unit of production;

- K – various compensations;

- N – allowances;

- Etc. – bonuses;

- Vsots. – social payments.

FOR YOUR INFORMATION! If you need to calculate not the annual, but the monthly payroll or use another reporting unit, you need to take the corresponding indicators for the formulas, that is, do not multiply the average monthly salary by 12, but determine the average number of employees for 1 reporting month.

Calculation examples

An organization has decided to open a branch and needs to draw up a plan for financing it. Let's look at an example of how the wage fund is calculated in such conditions. The branch must work:

- manager - salary 50,000 rubles;

- 2 specialists - salary 40,000 rubles;

- driver - salary 30,000 rubles;

- cleaning lady - salary 20,000 rubles.

At the end of the month, a bonus is provided in the amount of 30% of the salary for the administration and 20% for ordinary employees.

How to calculate monthly indicator

Let's figure out how to calculate the monthly payroll for this branch of the organization. To do this, we summarize all salaries:

50,000 + 40,000 + 40,000 + 30,000 + 20,000 = 180,000 rub.

But this is not the final version of the calculation. Next, we calculate the premiums:

50,000 × 30% = 15,000 rubles; 130,000 × 20% = 26,000 rubles; only 41,000 rub.

And insurance contributions for wages and bonuses:

(180,000 + 41,000) × 30% = 66,300 rub.

We sum up the indicators and get 287,300 rubles. per month. This is a planned indicator that differs from the real one, since during the work process employees take sick leave, go on vacation, or do not meet targets for receiving a bonus.

Don't save on payroll

Any entrepreneur strives to reduce his expenses, including through salary funds and wages. Of course, you can cut salaries, cancel compensation payments, remove bonuses, etc.

However, one should not get carried away with such a reduction. An employee has the right to expect fair remuneration. Financial motivation is one of the strongest factors influencing staff turnover, their qualifications, and the efficiency of performing work duties. A meager wage fund can provoke workers to commit crimes in order to somehow make up for the lost funds in an illegal manner.

To put it simply, the vast majority of employees work exactly as their employer pays them.