Registration - how is it extended if it includes the January holidays?

Holidays at the beginning of the year are included in vacation at the legislative level and for this the employee does not need to write any additional applications or forms other than the main application for vacation. A correctly formulated application for leave is your guarantee of the full use of well-deserved rest and due payments.

How to write an application correctly?

The application is written by the employee in any format convenient for him: manually or on a computer. A typical application must contain the following elements:

- A cap . In the upper right corner you write the name and position of the person to whom you are sending the application - your manager (most often the general director or deputy for personnel matters). Below you write who it is from - your full name, department and position.

- Title "statement" . It is written with a lowercase letter, under the heading and located in the center of the page.

- Text . It is written in any form, unless otherwise specified by the company’s internal requirements. Required items: type of vacation, start date and duration in days.

- Date , signature and transcript of the employee’s signature.

- The signature of the immediate supervisor is not accepted without approval.

An unspoken rule: when compiling, indicate not the dates, but the duration. In this case, all non-working holidays will be taken into account.

Consider, as an example, two seemingly identical statements:

- “I ask you to provide another paid leave from December 29, 2017 to January 12, 2018.” In 2022, the New Year holidays approved by the Ministry of Labor fell from 12/30/2017 to 01/08/2018. Thus, the employee will be paid on the days from December 29, and from January 9 to 12. The employee must return to work on January 13.

- “I ask you to provide another paid leave from December 29, 2019 for 14 calendar days.” In this case, all 10 holidays (from 12/30/2017 to 01/08/2018) will be counted as non-working holidays, and the vacation will be extended by 10 days. In this case, the employee must return to work on January 23.

Do you feel the difference? In both cases, you had a standard vacation of 14 working days, but with the careful inclusion of January holidays, in the second case it was extended.

Conclusion: you should always indicate the number of days of your vacation, not the dates . Non-working days, sick leave - all these days are not included in your vacation and are automatically extended.

During January holidays, vacation is extended by the number of non-working holidays approved by the Ministry of Labor. This figure ranges from 9 to 12 business days. For example, in 2022 this figure was 10 days.

Vacation Holidays: What You Should Know

In accordance with legislative acts, the following days are considered non-working days in Russia:

| date | Holiday |

| January 1, 2, 3,4, 5, 6, 8 | New Year holidays |

| Jan. 7 | Nativity |

| February 23 | Defender of the Fatherland Day |

| March 8 | International Women's Day |

| 12 June | Russia Day |

| 1st of May | Labour Day |

| 9th May | Victory Day |

| November 4 | National Unity Day |

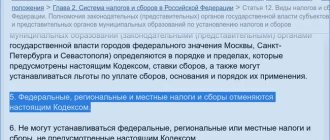

Regional authorities provide additional holiday dates due to religious holidays or other reasons. This is stipulated in Law No. 125-FZ of September 26, 1997.

In the event that annual leave falls on one or more days declared as holidays, they are not included in the rest period. This case is regulated by Art. 120 Labor Code of the Russian Federation. In addition, they are not paid in the amount of average earnings. In this case, the vacation is extended by the number of days that are declared non-working at the federal level. This rule applies to both main and additional leave. If the holiday falls on the dates when the employee took a vacation “at his own expense,” that is, without saving his earnings, then it will not be extended.

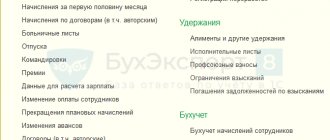

How to calculate vacation pay?

Now let’s talk about how the amount payable is calculated if an employee’s vacation falls on the New Year holidays.

In any case, vacation pay is paid for the calendar days specified in the application and order approved on the basis of this application. Holidays falling during the vacation period are not included in the payment and are paid separately - according to the schedule established by the company.

How to calculate the amount of vacation pay?

The general calculation formula is as follows:

Amount of vacation pay = Amount of average daily earnings * Number of calendar days of vacation

The amount of average daily earnings is calculated by the ratio of the average accrued wages for the billing period to the average monthly number of days (usually this figure is 29.3). January has the smallest number of working days of the year, and accordingly, the salary for 1 working day is the highest. Payment for 1 shift with a shift work schedule is calculated according to the same principle.

How is the duration of vacation calculated?

Every working citizen has the opportunity to receive 28 calendar days of “idleness” for each year of work.

This is the minimum; some citizens have more days off paid by their employer. But regardless of the duration of rest, personnel officers do not use holidays in the first month of the year to calculate rest days. In January (including a shift work schedule), there are 8 non-working holidays at once, which means that employees will be able to sit at home and relax longer. How to count rest days during the New Year holidays:

- Determine the duration of rest.

- We are adding upcoming holidays.

- We determine the start and return date for work.

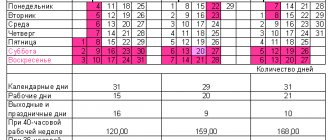

To figure out which days of the New Year holidays are not included in the vacation in 2022, taking into account holidays, first look at the production calendar.

In Art. 120 of the Labor Code of the Russian Federation answers whether January holidays are included in the vacation calculation - no, so they should be excluded from the calculations. The official holidays themselves are listed in Art. 112 of the Labor Code of the Russian Federation is the period from the 1st to the 8th inclusive (indicated in red in the image).

Let us show with a specific example which days in January will not be included in vacation if the employee plans to leave from 01/01/2022 for 28 calendar days.

Since official holidays that are not included in the calculation are from the 1st to the 8th inclusive, 28 calendar days of rest must be counted from the 9th. Regular weekends (Saturdays and Sundays) are counted along with weekdays. Thus, if a person leaves on 01/01/2022, he will return to duty only on February 6, since the January weekends are days of annual leave, but are not cumulative with it. If we are talking about an employee on a five-day shift, go to work on Monday, February 7. During a six-day workday, the employee also leaves on Monday 02/07/2022.

Let's look at another example of how many days to increase vacation time on January holidays if the employee goes on vacation from 01/09/2022.

Since the 8th is an official New Year's day off, it is not taken into account, and in fact the holiday begins on 01/09/2022. Let's add the same 28 days and get vacation during the New Year holidays - until February 6, Sunday, to work on February 7. If you calculate by how many days the January 2022 vacation is shifted in this case, it turns out that it does not shift if you go on vacation from the 9th. For both five-day and six-day work, the date of going to work, depending on the workweek schedule, is the same - 02/07/2022.

Please note: 12/31/2021 is a non-working day.

If an employee decides to take a vacation before the New Year holidays, when to go off in January with a six-day week, if the vacation is scheduled from December 6: January 11. Since the 28 days will end on 01/02/2022, the New Year holidays until 01/08/2022 are added to them (not included).

ConsultantPlus experts examined whether it is necessary to pay vacation pay for holidays. Use these instructions for free.

Payment term

According to Article 136 of the Labor Code of the Russian Federation, the employer must pay vacation pay to the employee no later than three calendar days before the start of the vacation . The fact that your vacation begins on a non-working day is not a reason for late payment. For example, in 2022 such days are set from 12/30/2018 to 01/08/2018.

If an employee goes on vacation from 01/09/2018, the last working day in this case will be 12/29/2018. Vacation pay must be paid no later than this day.

Are weekends included in vacation?

The duration of vacation is calculated in calendar days, so weekends are also included. At the same time, you are always paid in the amount of average earnings.

Expert commentary

Kamensky Yuri

Lawyer

In accordance with Art. 112 of the Labor Code of the Russian Federation, if a holiday falls on Saturday or Sunday, the next day is declared a non-working day. This also applies to holidays established at the regional level. However, this rule does not apply to the New Year holidays and is not mandatory in all cases. The Russian government may postpone weekends that coincide with holidays to any date during the year. A resolution on this is issued annually, agreed upon with the Ministry of Labor.

Therefore, vacations can fall not only on holidays, but also on weekends rescheduled from another date. If this happens, then they are included in the total rest time and paid according to the general principle.

How to get a job during the New Year holidays

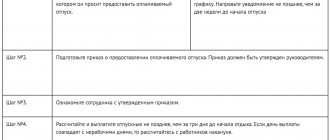

An employee can be invited to work on New Year's holidays only with his consent. To do this you will need two documents:

1. Written consent of the employee.

2. An order to attract an employee with his signature.

Some employees can be involved in work with written consent only if they are not prohibited from doing so for health reasons and there is a special medical report (Article 259 of the Labor Code of the Russian Federation). This includes women who have children under three years of age, workers with disabled children, workers who care for sick relatives based on a doctor’s opinion, and others. The employer must familiarize them with the right to refuse to work on a day off or a non-working holiday.

Pregnant women and minors cannot be hired to work on holidays, even with their written consent.

There is no need to issue an order and obtain written consent from employees who are employed in continuously operating organizations, when performing public service work, as well as in emergency, repair and loading and unloading work. Their working days are specified in the production schedule.

Let's sum it up

- Work on non-working New Year's holidays is paid at an increased rate (Part 1 of Article 153 of the Labor Code of the Russian Federation).

- When paying for non-working holidays, you need to take into account the employee’s remuneration system and his choice of receiving compensation for working on a holiday (increased pay or time off).

- Employees sent on a business trip to perform work during the New Year holidays must receive double pay for the days worked. If, while on a long business trip, an employee did not work during the New Year holidays, he does not need to be accrued special additional payments or compensation.

- If the employer pays less than double the amount for work on New Year's holidays, provided that the employee refused time off, punishment may follow under Parts 6 and 7 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Vacation pay is less than salary

Vacation pay is the money an employee receives for each day of vacation. Vacation pay is calculated as average daily earnings using the formula:

(sum of all salaries, bonuses and allowances for the year / 12) / 29.3.

For example, let’s calculate the average daily earnings for an employee with a salary of 50,000 rubles:

(600,000 / 12) / 29.3 = 1,706 rubles.

1,706 rubles is his vacation pay. If such an employee takes vacation for the entire month, for example, from February 1 to 28, instead of 50,000 rubles in salary, he will receive 47,781 rubles in vacation pay.

Work on New Year's Eve

An employee who works on a holiday night is entitled to two additional payments:

- for work on holidays (Article 153 of the Labor Code of the Russian Federation);

- for work at night (Articles 149, 154 of the Labor Code of the Russian Federation).

Night time is considered to be the time from 22:00 to 6:00. The amount of additional payment for work during this period is prescribed in the collective and labor agreements (Article 149 of the Labor Code of the Russian Federation). It cannot be lower than 20% of the salary (Resolution No. 554 of July 22, 2008).

New Year's Eve payment example

. A turner with a shift schedule will celebrate the New Year 2022 at work. His shift is scheduled to begin on December 31 at 20:00 and end on January 1 at 8:00. The hourly tariff rate is 250 rubles.

Payment for time worked will be as follows:

| Payment period | Explanation | Calculations |

| December 31 from 20.00 to 24.00 | December 31, 2022 is a day off (Resolution of the Government of the Russian Federation of October 10, 2022 No. 1648), but not a holiday. In a shift schedule he is paid as standard | 4 hours × 250 = 1000 rubles |

| From December 31, 22.00 to January 1, 6.00 | Night work - 8 hours. Additional payment of 20% of the tariff rate | 8 hours × 250 rubles × 20% = 400 rubles |

| January 1 from 00.00 to 08.00 | Work on a holiday was 8 hours | 8 hours × 250 rubles × 2 = 4,000 rubles |

| Total for the shift from December 31 to January 1, payment will be 1000 rubles + 400 rubles + 4000 rubles = 5400 rubles | ||