02.12.2018

Is it necessary to create reserves for vacation pay in an autonomous institution? How to correctly form and reflect such reserves in accounting and tax accounting? How to conduct an inventory of reserves? What should be included in the accounting policy? You will find answers to these questions below.

According to labor legislation, employers are required to provide employees with annual paid leave while maintaining their place of work (position) and average earnings (Articles 114, 115 of the Labor Code of the Russian Federation).

By virtue of this norm, a state (municipal) autonomous institution has an obligation to provide employees with annual paid leave. But at the same time, there is no certainty regarding the time of execution of the upcoming vacation payment for the time actually worked, since it is possible to postpone the planned vacation dates and, in addition, the amount of such an obligation cannot be accurately determined. In addition, the bulk of vacations fall in the spring-summer period, which entails an increase in labor costs at this time.

In order to evenly attribute the expenses under consideration to the financial result of the institution for obligations that are not determined by the amount and (or) time of execution, reserves for future expenses are created in accounting.

At the same time, the institution’s obligations, the value of which is determined at the time of their acceptance conditionally (calculated) and (or) for which the time (period) for their fulfillment is not determined, provided that a reserve for future expenses is created in the institution’s accounting for these obligations, are reflected in the expense authorization accounts as deferred obligations.

Based on the above, it is advisable to create reserves for vacation pay for actually worked hours in order to reflect complete and reliable information about the institution’s deferred obligations, as well as to evenly attribute expenses to the institution’s financial result. The need to form such reserves is also stated in letters of the Ministry of Finance of the Russian Federation dated 03/07/2018 No. 02-07-10/14688, dated 06/05/2017 No. 02-06-10/34914, dated 11/09/2016 No. 02-06-10/65506.

Vacation reserve as an estimated liability

According to PBU 8/2010 “Estimated Liabilities”, organizations must create certain amount-weighted liabilities in their accounting accounts.

That is, financial statements must contain not only data on the company’s documented obligations to contractors and third parties, but also information on planned expenses that are inevitable. For example:

- future employee holidays;

- planned tax assessments;

- costs for suppliers in terms of expenses that we know for sure that they will be (for example, if a work completion certificate already exists, but has not yet been signed, so it cannot yet be recorded, although it is known for sure that the director will sign the document will be held next month).

With the advent of this information, the balance sheet becomes the most reliable, since it reflects the most realistic picture of the financial position of the enterprise. Let's take a closer look at what a reserve for vacation pay is.

Each employee, in accordance with labor legislation, is entitled to at least 28 calendar vacation days, and in a number of legally established cases this figure may be higher. Thus, for each reporting date we have vacation days that have not yet been used by employees (it is difficult to imagine an organization in which all employees took 28 vacation days at once). Accordingly, for each reporting date, there are estimated obligations of the company to employees to pay for these days and, as a result, certain obligations to funds to pay insurance premiums.

Who is responsible for reporting this information? In accordance with paragraph 3 of PBU 8/2010, all companies are required to reflect these accruals, with the exception of small enterprises (issuers of securities are not included in such exceptions), which can use a simplified method of accounting. The characteristics of such companies are specified in the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

Thus, if a company does not fit the definition of a small business entity, the accrual of valuation reserves becomes mandatory, and the absence of this information on the accounting accounts may be regarded as a violation of the rules for accounting for income and expenses. Responsibility for this comes on two grounds:

- for gross violation of accounting for income and expenses under Art. 120 of the Tax Code of the Russian Federation in the amount of 10,000−30,000 rubles;

- administrative liability applied to officials under Art. 15.11 Code of Administrative Offences.

IMPORTANT! If a company creates a reserve for vacation pay, it is necessary to stipulate this in the accounting policy, as well as the procedure for calculating this reserve.

The period and meaning of conducting an inventory of estimated liabilities and reserves

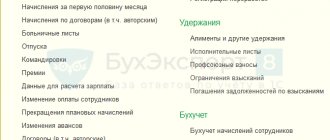

Inventory of estimated liabilities and vacation reserves is carried out automatically in the Vacation Reserves (Salary - Vacation Reserves) when it is created in December :

ZUP version , the Vacation Reserves document was called Accrual of estimated vacation liabilities .

For more details, see Where can I find a document on the accrual of estimated obligations for vacations, starting with ZUP 3.1.10?

Regardless of the methodology used (Standard Method or IFRS), estimated liabilities (AL) and reserves (RU) are calculated in the same way - based on accumulated vacation days. We can say that calculations are made using the IFRS method. Thus, it turns out that the calculated amounts in BU and NU are the same. This information can be seen in the Vacation reserves on the Calculation of vacation liabilities and reserves in the column calculated based on the amounts of liabilities and reserves:

The point of carrying out such an inventory is to obtain a balance on loan account 96 at the end of the year in an amount that coincides with the amount that the organization would pay to all employees if they quit at the end of December.

Reflection of the vacation reserve in accounting

The calculation and reflection of the vacation reserve in accounting must be carried out at each reporting date. According to current legal requirements, the balance sheet is compiled once a year - that is, December 31 will be the reporting date.

For information about when to submit financial statements, read our material “When to submit a balance sheet - deadlines, nuances.”

However, it is more accurate and correct (primarily for management accounting) to form vacation reserves on a monthly basis, since this type of reserve depends on the number of employees and vacations taken - and these values can change very often. It should be understood that monthly reserve calculation is labor-intensive. The organization needs to independently determine the desired frequency of settlements and record it in its accounting policies.

In accounting, account 96 is intended to reflect such information. All planned costs of the company are accumulated on it, including vacation pay. In this case, a separate sub-account is opened for each type of expense.

Let's consider typical transactions for the accrual and write-off of reserves in correspondence with the account. 96:

| Account Dt | Account name | Kt account | Contents of operation |

| 08 | Fixed assets | ||

| 20 | Primary production | 96.01 “Reserve for payment of employee vacations” | A reserve for employee leave has been accrued (accounts are selected depending on the department in which the employee works) |

| 23 | Auxiliary production | ||

| 26 | General expenses | ||

| 44 | Selling expenses | ||

| Other expense accounts of the company, which account for salary expenses | |||

| 96.01 | Reserve for employee vacation pay | 70 “Labor expenses” | Vacation pay accrued at the expense of the created reserve |

| 69 “Settlements with extra-budgetary funds” | Insurance premiums accrued from the reserve | ||

As you can see, the reserve is always accrued to the same accounts as employee salaries. Insurance premiums are calculated according to the same principle, but in correspondence with the reserve account, and not with accounts for settlements with extra-budgetary funds.

The balance of account 96 when generating periodic reporting is reflected in the liability side of the balance sheet. Line 1540 “Estimated Liabilities” is intended for this purpose.

Please note: if reserves in an organization are created only in accounting, then the base for calculating income tax is not reduced, and temporary tax differences arise, in accordance with PBU 18/02. If the accounting policy for tax accounting states that this reserve is taken into account when calculating income tax, the right appears to create it in the manner specified in Art. 324.1 Tax Code of the Russian Federation.

IMPORTANT! Creating a reserve for tax purposes is a voluntary matter, depending only on the decision of the business entity.

Recommendations from ConsultantPlus experts will help you create and use a vacation reserve in tax accounting. If you don't have access to the legal system, a full access trial is available for free.

You can read more about the information required to be reflected in the accounting policies in our article “Accounting Regulations and Accounting Policies of the Organization.”

You can read about the provisions of tax policy in the material “How to draw up an organization’s tax policy?”

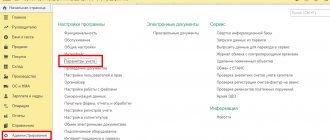

Inventory postings in Accounting 3.0

After synchronization, the Vacation Reserves appears in Accounting 3.0. To generate transactions, check the box Reflected in accounting by user :

Postings are generated separately for estimated liabilities, insurance premiums and Social Insurance Fund:

- for positive amounts (additional accruals): Dr. Cost account – Kt account 96.

Subaccount 96.01.1 reflects the amounts for liabilities and reserves, and for 96.01.2 - for insurance premiums and contributions for “injuries”:

- for negative amounts (write-offs): Dt 96 accounts (for subaccounts 96.01.1 and 96.01.2) – Kt 91.01.

If you haven't subscribed yet:

Activate demo access for free →

or

Subscribe to Rubricator →

After subscribing, you will have access to all materials on 1C:ZUP, recordings of supporting broadcasts, and you will be able to ask any questions about 1C.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Inventory of estimated liabilities and reserves for vacations in December (from the recording of the broadcast on December 03, 2022) You do not have access to view To gain access: Complete a commercial...

- Inventory of estimated liabilities and reserves for vacations for 2019 (from the recording of the broadcast on December 3, 2022) You do not have access to view To gain access: Complete a commercial...

- Calculation of estimated liabilities and reserves for vacations...

- Calculation of estimated leave obligations for persons on parental leave...

Methodology for calculating the amount of reserve for vacation pay

Since the formula used to calculate the amount of the reserve is not defined by law, each company determines it independently. In this case, the developed method should be fixed in the accounting policy.

IMPORTANT! Any estimated liability should be as close as possible to a reliable monetary estimate of future expenses. The reserve should be determined on the basis of existing facts of the organization's economic activity, and the calculation should be based on accumulated work experience and, possibly, some expert opinions. That is, calculations must be supported by documents and be extremely justified.

Thus, to justify the amount of the accrued reserve for vacation pay, the organization must have:

- A method for calculating a reserve established in the accounting policy that would provide a reliable estimate of expenses for this item.

- Developed primary document to reflect the calculated reserve (certificate, for example). It is worth attaching a primary document, the information on which was used in the calculation (time sheet, pay slip, etc.).

There are several ways to calculate the reserve for vacation pay. First, let's look at one of them, which is fairly accurate - it is based on the actual number of unused vacation days and the average daily earnings of employees:

- First, you should break down all employees by department to determine which cost accounts are used (20–26, 44, etc.).

- It is necessary to have information on the number of vacation days entitled to each employee. If you have automated accounting, collecting this information is not difficult. These days should be summed up for each employee group.

- We calculate the average daily earnings (ADE) of workers for each group. To do this, you must first divide all employee salaries for the past selected period (month, quarter) by the number of calendar days in this period, and then by the number of employees in the group. Visually, this formula looks like this:

Employee SDZ = Salary / DN / K,

Where

ZP - salary for the period,

DN - calendar days of the period,

K is the number of employees in the group (or the company as a whole).

IMPORTANT! Calendar and working days should not be confused, since the number of vacation days is always counted in calendar days - therefore, earnings for calculating vacation pay should also be counted in calendar days.

- The final point is to calculate the amount of the reserve itself (do not forget to calculate insurance premiums from this reserve). The final reserve amount will be calculated using the following formula:

Reserve = (employee SDZ × K × DNO) + (employee SDZ × K × DNO) × St,

Where

DNO - days of unused vacation,

Cst - the total rate of insurance premiums in%.

Read more about the rates of insurance premiums and objects of taxation in our section “Insurance premiums”.

IMPORTANT! The most accurate way to calculate the reserve is to calculate it individually for each employee. In this case, the amount of the reserve will consist of the amount of obligations to each employee. However, if the number of employees in the company is large, this process will be quite labor-intensive.

Write-off of vacation reserves in 1C ZUP

Accrued reserves are “closed” when vacation pay is accrued. For example, two employees received leave in November 2019. One of them will continue to rest in December.

Wages are calculated and reflected in regulated accounting. After opening the document “Reflection of wages in regulated accounting”, a new tab “Payment of vacations due to estimated obligations” should appear. The columns in this subsection will reflect information on vacations received.

The vacation of one of the employees is divided into two parts, relating to different months.

An example of calculating and reflecting the vacation reserve in the accounting accounts

This is an example of the above method of calculating the reserve - based on average earnings. Below you will see examples for other reservation options.

Example

reflected in the accounting policy that the reserve for vacation pay is formed quarterly. To calculate wages and insurance premiums, account 44 “Distribution costs” is used; in total, the company employs 20 people. The company has no grounds for applying reduced or increased insurance premiums (the total rate of insurance premiums is 30.2%). As of March 31, the data for the quarter is as follows:

- number of days of unused vacation - 134;

- for the 1st quarter, the amount of accrued wages amounted to 678,000 rubles;

- there are 91 days in the quarter.

- Let's calculate the reserve as of 03/31/20XX:

SDZ = 678,000 / 91 / 20 = 372.53 rubles.

The reserve amount is 372.53 × 134 × 20 + 372.53 × 134 × 20 × 30.2% = 998,380.40 + 301,510.88 = RUB 1,299,891.28.

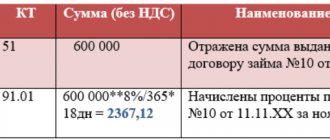

Postings:

Dt 44 “Sales expenses” Kt 96.01 “Vacation reserve” - RUB 998,380.40.

Dt 44 “Sales expenses” Kt 96.01 “Vacation reserve” - RUB 301,510.88.

- Let’s add a few more data to this example to understand how the vacation reserve is adjusted:

- as of 03/31/20XX, a reserve for vacation and insurance premiums was accrued in the amount of RUB 1,299,891.28;

- in the 2nd quarter, the amount of accrued vacation pay and insurance contributions from them amounted to 140,900 rubles;

- the number of unused vacation days at the end of the 2nd quarter is 120 days;

- wages for the 2nd quarter and the number of employees remained the same as in the previous period.

Thus, as of 06/30/20XX, the amount of the unused reserve amount is equal to 1,299,891.28 – 140,900 = 1,158,991.28 rubles.

Reserve amount as of 06/30/20XX:

SDZ = 678,000 /91 / 20 = 372.53 rubles.

The reserve amount is 372.53 × 120 × 20 + 372.53 × 120 × 20 × 30.2% = 894,072 +270,009.74 = 1,164,081.74 rubles.

Amount for contributions to the reserve as of the end of the 2nd quarter:

1,164,081.74 (calculated reserve) – 1,158,991.28 (reserve balance, balance on account 96) = 5,090.46 rubles.

If the amount of the reserve on the account. 96 exceeded the calculated amount at the end of the quarter, the reserve should have been reduced. In our case, it is necessary to make an additional accrual posting.

Postings:

Dt 44 Kt 96.01 - 5,090.46 rub.

Tax accounting

Unlike accounting, in tax accounting the creation of RO is the right of the employer.

Also, a distinctive feature of the formation of RO in tax accounting is the method of creation. It is spelled out in Art. 324.1 Tax Code of the Russian Federation. This method provides:

- determination of the percentage of contributions to the RO;

- calculation of the RO amount monthly on the last date of the month;

- Conducting an inventory of RO at the end of the year.

If a company wants to avoid differences in tax accounting according to RO, it can accrue the reserve in both accounting and tax accounting in the same way :

At the end of the year, an inventory of accrued RO is carried out. To adjust the RO, it is necessary to calculate the actual amount of vacation days not taken off as of December 31. The resulting amount is compared with the calculated amount and, if necessary, adjustments are made.

Other ways to calculate reserves

As already noted, the algorithm for calculating the amount of the reserve is prescribed in the accounting policy, this is due to the fact that PBU 8/2010 does not contain formulas and methods that allow obtaining the value of the reserve.

In addition to the above method, in practice, you can also use one of the following amounts to calculate the reserve:

- wage fund (hereinafter referred to as OT);

- vacation pay paid for the calendar year preceding the year for which the reserve is created (standard method).

The procedure for calculating the reserve amount is carried out in the following steps:

- determination of the average daily wage fund or vacation pay;

- formation of a reserve.

Let's look at examples of using each of these methods.

Example 1

Molniya LLC's accounting policy reflects the creation of a reserve for vacation pay for the year 20XX based on labor costs. The organization uses the following formula to calculate the reserve:

(OT + insurance premiums) / 28 × 2.33,

where 28 is the number of vacation days per year for each employee;

2.33 - number of vacation days for 1 month worked.

The reserve is formed at the end of each month. The reserve does not include payments to employees who have not worked for a full month. The amount of the reserve at the end of 2022 is 0 rubles. The OT values for 2022 are presented in column 2 of Table 1. Insurance premiums - 30.2% (including contributions for injuries).

Table 1. Reserve calculation

| Month | FROM | Insurance premiums (OT × 30.2%) | Reserve (OT + insurance premiums) / 28 × 2.33 |

| 1 | 2 | 3 | 4 |

| January 20XX | 100 000 | 30 200 | 10 835 |

| February 20XX | 110 000 | 33 220 | 11 918 |

| March 20XX | 120 000 | 36 240 | 13 001 |

| April 20XX | 100 000 | 30 200 | 10 835 |

| May 20XX | 130 000 | 39 260 | 14 085 |

| June 20XX | 90 000 | 27 180 | 9 751 |

| July 20XX | 108 000 | 32 616 | 11 701 |

| August 20XX | 111 000 | 33 522 | 12 026 |

| September 20XX | 120 000 | 36 240 | 13 001 |

| October 20XX | 100 000 | 30 200 | 10 835 |

| November 20XX | 101 000 | 30 502 | 10 943 |

| December 20XX | 100 000 | 30 200 | 10 835 |

| Total | 1 290 000 | 389 580 | 139 765 |

At the end of each month, Molniya LLC will reflect in the accounting the accrual of the reserve for the year 20XX: Dt 26 (44.20) Kt 96 in the amount from column 4, i.e. as of 01/31/20XX - 10,835, as of 02/28/20XX - 11,918 , as of 03/31/20XX - 13,001, etc.

IMPORTANT! The reserve amounts are reflected in the balance sheet as part of the indicators in line 1540 “Reserves for future expenses.” Read about changes to the balance sheet from 2022 here.

Example 2

LLC "Molniya" in its accounting policy recorded the creation of a reserve once a year, based on the payment of vacations of the previous year. According to accounting data, these expenses are 960,000 rubles.

Reserve calculation:

Insurance premiums = 960,000 × 30.2% = 289,920 rubles.

Reserve = 960,000 + 289,920 = 1,249,920 rubles.

For what, with what frequency and how is inventory of reserves in accounting carried out, find out from the Ready-made solution from ConsultantPlus. You can get a trial full access to K+ for free.

Nuances of reserve inventory for employees on maternity leave

When filling out the December Vacation Reserves , situations are possible when the employee’s average earnings have not been determined. As a rule, these are workers on maternity leave who have had no earnings this year.

In order for the average earnings for maternity leave to be filled out, you need to open the average decoding form and change the billing period.

The nuances of calculating obligations for employees on maternity leave were discussed in the article Calculation of estimated vacation obligations for persons on parental leave.