The terms “retro bonus” or “retro discount” appeared in the business lexicon relatively recently. Who and when first used them and what did they want to express with them? This will not be easy to remember, but something else is important - in a short period of time they managed to occupy an important place not only in trade, but also in accounting.

The terms we have named have many analogies: “retrospective discount”, “retrospective bonus”, “rebate” (more typical for world practice), “extra premium”, etc. essentially mean a kind of “encouragement” that comes from the seller within the framework of the concluded transaction. Those who are unkind prefer to call retro bonuses “legalized kickbacks.”

Agree, it sounds criminal. And yet we encounter such “crime” everywhere. We all know very well about the promotions of the stores we visit, the suppliers from whom we purchase goods, like “1+1=3” or “buy a car and get a set of winter tires as a gift.” For us, this has become so commonplace that we consider any purchase without this to be somehow incomplete. In fact, we have long been accustomed to retro bonuses.

Despite the fact that the terms already exist and are widely used in practice, the Tax Law does not classify them in any way. From the point of view of the Tax Code of the Russian Federation, all of the above can only be explained by the “premium” that the seller pays to the buyer as an incentive to work with him or the very fact of compliance with certain clauses of the contract.

For example, buying two rather than one pizza - there is a certain condition under which the buyer will receive a gift from the seller in the form of a third pizza, which is a kind of “premium”. It sounds absurd at first glance, and yet the tax authorities operate precisely with this logic when assessing the economic activities of a company. As a matter of fact, accounting for retrospective bonuses and discounts is based precisely on this understanding of things.

To move on, let's separate the concepts of “bonus” and “discount”. This will allow us to use the most optimal wiring in the future:

- Retrospective discount is a condition of the supply contract that affects price changes;

- A retrospective bonus is an additional product or service that the client will receive upon concluding an agreement, paying an invoice, or fulfilling certain conditions under the agreement.

Discounts, bonuses, BU bonuses

The following are excluded from the actual cost of inventories:

- discounts,

- concessions,

- deductions,

- awards,

- privileges,

regardless

of the form in

which the supplier provides preferences (subclause b, clause 12 of FSBU 5/2019).

The initial assessment of inventories is carried out on the date of acceptance

for accounting

based on the amounts paid to the supplier. When a discount is provided, the amount of payment to the supplier is reduced.

In the reporting, inventories must be reflected in a reliable estimate - taking into account discounts confirmed by the seller,

as well as

discounts likely to be received

:

- Balance page “Inventory” minus discounts,

- OFR page “Cost of sales” minus discounts.

The procedure for reflecting discounts in reporting is given in the Recommendation of the BMC “Retrospective discounts” dated January 25, 2013 N R-35/2013-KpR.

Retrospective discounts are determined after inventory is taken into account - at the end of the reporting period or contract. The discount amount must be excluded from the cost of inventories in the amount of the estimated

value

if:

- the probability of receiving it is high;

- it is controlled by the buyer;

- the assessment is made on the basis of practical experience.

The amount of the probable discount before the actual provision is determined based on practice and the agreement (Recommendations of the BMC “Preferences from suppliers” dated 03/01/2017 N R-79/2017-OK TORG).

Discounts, bonuses, bonuses NU OSN

Discount reduces the unit price of goods

The value of remaining goods is adjusted and the tax base for the period in which the goods were sold is reduced. It is necessary to pay the arrears, penalties and submit an income tax update (Letter of the Ministry of Finance of the Russian Federation dated May 22, 2015 N 03-03-06/1/29540, clause 1 of Article 54 of the Tax Code of the Russian Federation).

The discount does not reduce the unit price of goods

Premiums not related to changes in the price of goods are taken into account in non-operating income as property received free of charge (Letter of the Ministry of Finance of the Russian Federation dated September 27, 2012 N 03-03-06/1/506, clause 19.1 clause 1 of Article 265 of the Tax Code of the Russian Federation). In NU, discounts are recognized on the date of settlements or on the date of the basis document for settlements (credit notes) (clause 3, clause 7, article 272 of the Tax Code of the Russian Federation).

Award in the form of a bonus product

January 27, 2022 organization "Buyer"

, as a bonus for fulfilling the terms of the contract for the supply of goods, received an additional 100 units of goods from the organization

“Supplier”

. The usual price for purchasing such a product from a supplier is 2,000 rubles plus 18% VAT (360 rubles), which corresponds to the market price.

In order to stimulate the buyer to increase the volume of goods supplied to him, the supply agreement may provide for the provision of a bonus in the form of a certain quantity of goods for fulfilling the terms of the agreement. From the point of view of civil law, such a transfer of goods is not a donation, since in accordance with paragraph 4 of Art. 423 of the Civil Code of the Russian Federation, such a supply contract is considered as a paid contract.

Goods received as a bonus and intended for resale, in accordance with clause 5 of PBU 5/01 “Accounting for inventories”

, are accepted for accounting as inventories (MPI) at actual cost. But the above-mentioned PBU does not contain a special procedure for determining the actual cost of inventories received under paid contracts and not subject to payment (transferred at zero cost). Therefore, the organization has the right to take into account a bonus product at the current market value (which corresponds to clause 9 of PBU 5/01), or at the regular price of its purchase from a given supplier (which corresponds to clause 9 of PBU 5/01).

For profit tax purposes in accordance with paragraphs. 3 p. 1 art. 268 Tax Code of the Russian Federation

, when selling purchased goods, the taxpayer has the right to reduce income by the cost of purchased goods. Since the bonus product was received at a zero price, when it is sold, the taxpayer does not have the right to reduce the tax base for income tax. Therefore, the cost of the bonus product in tax accounting should be equal to zero. This point of view is reflected in numerous letters from the Russian Ministry of Finance.

Receipt of property without obligations to pay for it, in accordance with clause 2 of PBU 9/99 “Income of organizations”

, represents an increase in economic benefits that is recognized as income to the organization.

The buyer must reflect the cost of the bonus product as part of other income ( clause 7 of PBU 9/99

).

The instructions for using the Chart of Accounts state that income associated with the gratuitous receipt of property is accounted for in account 98 “Deferred income”

subaccount

“Gratuitous receipts”

.

Since 2011, according to the majority of consultants, deferred income can be reflected in accounting only in cases directly provided for by regulatory legal acts on accounting (instructions for using the Chart of Accounts do not apply to regulatory acts). But there is a fairly widespread opinion that an organization can prescribe the use of account 98 “Deferred Income”

to account for income upon receipt of bonus (free) goods in its accounting policy.

Therefore, in our example we will consider two options: without using account 98

and using account

98

.

For profit tax purposes, goods received from a supplier as a premium (bonus) are considered for the purchasing organization as property received free of charge ( clause 2 of Article 248 of the Tax Code of the Russian Federation

).

The gratuitous receipt of property leads to the recognition of non-operating income in the amount of the market price of the received property (clause 8 of Article 250 of the Tax Code of the Russian Federation). The specified income is recognized on the date of receipt of the bonus product ( clause 1, clause 4, article 271 of the Tax Code of the Russian Federation

).

Receiving a bonus product does not change the prices of previously purchased products. Consequently, the buyer does not adjust the VAT amounts previously accepted for deduction on purchased goods.

If the supplier recognized the provision of bonus goods as a gratuitous transfer and calculated VAT on it, the buyer does not have the right to deduct the accrued amount of VAT ( clause 19 of the Rules for maintaining a purchase book, Resolution of the Government of the Russian Federation No. 1137 of December 26, 2011.

).

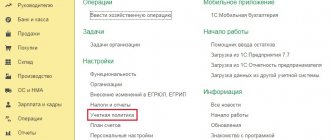

To reflect the receipt of bonus goods in the program, we need two documents: the Receipt document (acts, invoices)

with the type of transaction

Goods

and the document

Operation

.

In the header of the document Receipt

We will indicate the counterparty-seller and the agreement with him.

In the tabular part of the document, we will select (create) the corresponding product nomenclature and indicate its quantity without indicating the price. Accounting accounts in the configured program are installed automatically.

When posted, the document credits the goods to account 41.01 “Goods in warehouse”

only in quantitative accounting.

Example of filling out an Admission

and the result of its implementation are shown in Fig. 1:

To form the accounting value of a bonus product and to accrue income in accounting and for profit tax purposes, we will use the document Operation

.

First, let's consider the option without using an account 98

.

Let's add wiring. We will indicate the account by debit 41.01

and fill out its analytics, we will not indicate the quantity.

For the loan, we will indicate account 91.01 “Other income”

and, as an analytics, we will select (create) the item of other income and expenses with the type of item

Free receipt of property, work, services, property rights

.

We will indicate the accounting value of the bonus product received. In tax accounting ( Amount Dt

), we will indicate the zero cost of the goods and reflect the corresponding constant difference.

The amount of non-operating income in tax accounting ( Amount Kt

) corresponds to the amount of income in accounting.

Completed document Operation

shown in Fig. 2:

Upon subsequent sale of the bonus product, an expense will be recognized in accounting - the cost of the product. For profit tax purposes, there will be no expenses, since the cost of the bonus product in tax accounting is zero.

To sell a bonus product, we will use the Sales

with the transaction type

Goods

. The document is filled out in the usual manner.

When carried out, the document will accrue revenue in accounting and tax accounting (Dt 62.01 – Kt 90.01.1).

In accounting, VAT will be charged on the proceeds (Dt 90.03 - Kt 68.02) and the document will be recorded in the Sales VAT

(sales book).

Expenses in the form of the cost of goods (Dt 90.02.1 - Kt 41.01) will be recognized only in accounting, there are no expenses in tax accounting, as a debit of the account 90

the corresponding constant difference will be taken into account.

Document Implementation

and the result of its implementation are presented in Fig. 3:

When closing the month, when closing the account 90 Sales

, the permanent difference will be written off as a debit to account

99 “Profits and losses”

, and, therefore, a permanent tax liability will be accrued. The amount of permanent tax liability is calculated as the product of the permanent difference and the income tax rate (200,000 rubles * 20% = 40,000 rubles).

Posting a routine transaction Calculating income tax

shown in Fig. 4:

Let's consider the second option for filling out the document Operation

- using account

98 “Deferred income”

.

First, let's add an accounting entry. We will indicate the account by debit 41.01

, we will fill out its analytics, we do not indicate the quantity.

For the loan, we will indicate account 98.02 “Gratuitous receipts”

.

We will indicate the accounting value of the bonus product. In tax accounting ( Amount Dt

), we will indicate a zero cost and reflect the corresponding permanent difference.

The amount of income for future periods in tax accounting ( Amount Kt

) is also equal to zero, since in tax accounting non-operating income is recognized in the current period, therefore we will indicate the corresponding temporary difference for the loan.

Let's add a posting for tax accounting (you can copy the previous one). The debit account does not matter in this case, we can leave the account 41.01

.

For the loan, we will indicate account 91.01 “Other income”

, as an analytics we will select the item of other income and expenses with the item type

Free receipt of property, work, services, property rights

.

In accounting ( Amount

) we indicate zero.

In tax accounting, we will indicate the amount of non-operating income for the loan ( Amount Kt

) and reflect the corresponding temporary difference with a minus sign.

Completed document Operation

shown in Fig. 5:

With this option for registering a transaction, in the month the bonus product was received, a deferred tax asset will be accrued at the end of the month. The amount of the deferred tax asset is calculated as the product of the temporary difference and the income tax rate (200,000 rubles * 20% = 40,000 rubles).

Posting a routine transaction Calculating income tax

shown in Fig. 6:

If we use the account 98

, then simultaneously with the sale (disposal) of the bonus product, we need to write off deferred income and recognize other income.

To do this, we again need the Operation

.

Let's add wiring. By debit we will indicate account 98.02 “Gratuitous receipts”

.

For the loan, we will indicate account 91.01 “Other income”

with the article

Gratuitous receipts

. In accounting we will indicate the cost of the sold (retired) bonus product. In tax accounting, we will indicate only the corresponding temporary differences as debits and credits.

Completed document Operation

shown in Fig. 7:

When closing the month of sale of a bonus product, in addition to the accrual of a permanent tax liability, the repayment of a deferred tax asset will also be accrued.

Regular transaction entries Calculation of income tax

shown in Fig. 8:

Premiums not related to a specific product

Is it necessary to take into account bonuses in the cost of goods for fulfilling the sales plan in BU and NU? Does the supplier pay a premium for the total volume of goods purchased without reducing the unit price?

BOO

The procedure for accounting for preferences does not depend on the form of their provision (subclause b, clause 12 of FSBU 5/2019). Premiums, as well as discounts, are taken into account in the cost of goods. Moreover, if the premium is not related to the purchase of a specific unit of goods, then it is not taken into account in the cost of

goods

(Letter of the Ministry of Finance of the Russian Federation dated March 18, 2021 N 07-01-09/19540).

WELL

In NU, the cost of goods does not need to be adjusted. Premiums that do not reduce the cost of a unit of goods are taken into account as part of non-operating income (Ct 91.01 NU) on the date of sending the primary document by the supplier (credit note, etc.) (Clause 1 of Article 271 of the Tax Code of the Russian Federation, Article 313 of the Tax Code of the Russian Federation).

NU USN

Premiums are taken into account as part of non-operating income (clause 1 of article 271 of the Tax Code of the Russian Federation, clause 1 of article 346.15 of the Tax Code of the Russian Federation).

Income is determined using the cash method:

- on the date of receipt of money - at the time of transfer of the premium;

- on the date of repayment of the debt - an advance appears. Income will be recognized on the date of receipt of the goods (Letter of the Ministry of Finance of the Russian Federation dated May 12, 2012 N 03-11-11/156).

Discounts and bonuses (premiums) for customers. VAT taxation procedure and accounting nuances

Discounts and bonuses (premiums) for customers. VAT taxation procedure and accounting nuances.

Any organization that sells its goods, work or services is interested in increasing sales volumes. The most effective method of attracting and stimulating customers currently is to provide them with discounts and bonuses.

Incentive payments not only attract new customers, but also encourage existing customers to increase purchase volumes.

The current legislation does not contain a definition of the concepts of discounts and bonuses (premiums). According to economic terminology:

1. Discount is the amount by which is reduced . Essentially, this is a reduction in the base price of a product or service, taking into account market conditions, contract terms, etc. The most common price discounts can be:

- bonus,

- temporary,

- dealerships,

- closed,

- quantitative,

- special,

- "skonto"*,

- etc.

*discounts that are provided for payment in cash or for decent payment compared to the terms of the contract.

“Skonto” discounts can be up to 5% of the transaction value. Providing a discount leads to a reduction in the contract price. In accordance with clause 2 of Article 424 of the Civil Code of the Russian Federation, price changes after the conclusion of an agreement are permitted in cases and on the conditions provided for by the agreement, the law, or in the manner prescribed by law.

2. Bonus (premium) – premium*, additional remuneration, additional discount provided by the seller to the client in accordance with the terms of the contract or a separate agreement.

*A prize is a monetary or material incentive for achievement or merit in any field of activity.

Typically, the concept of “bonus” is used if the incentive payment is provided in the form of a cash bonus. Free bonuses are called:

- works and services,

- consignments of goods,

- present,

provided to clients upon fulfillment of certain conditions.

Providing a bonus or premium does not change the original price of the product (work, service).

Thus, the main difference between discounts and bonuses (premiums) is as follows: discounts change the initial price of a product (work, service), while bonuses (premiums) do not change the original price of a product (work, service).

This difference leads to the fact that discounts and bonuses are reflected differently in the accounting and tax registers.

This article will discuss the features of VAT taxation, discounts and bonuses provided to customers.

PROCEDURE FOR REGISTRATION OF INCENTIVE PAYMENTS

When drawing up an agreement providing for the client to receive discounts and bonuses, it is very important to pay attention to the wording:

- conditions under which incentive payments are provided,

- the order of their provision.

When establishing the types and amounts of discounts and bonuses, companies selling food products must be guided by the provisions of the law of December 28, 2009.

No. 381-FZ “On the fundamentals of state regulation of trade activities in the Russian Federation.” Thus, in accordance with paragraph 4 of Article 9 of Law No. 381-FZ, an agreement between the parties to a contract for the supply of food products may provide for the inclusion in its price of remuneration paid in connection with the purchase of a certain quantity of goods. The amount of the specified remuneration is subject to agreement by the parties to this agreement, inclusion in its price and is not taken into account when determining the price of food products. The amount of remuneration cannot exceed 10% of the price of purchased food products.

At the same time, in accordance with clause 6 of Article 9 of Law No. 381-FZ, the inclusion of other types of remuneration is not allowed .

The conditions under which discounts and bonuses are provided may be, for example, the following:

- For the purchase by the buyer of a certain volume of products (works, services), within a certain (or indefinite) period (month, quarter, year).

- For the purchase by the buyer of the entire range of products (works, services).

- For timely or advance payment for purchased goods (works, services).

Compliance with the conditions established by the contract is necessary to receive incentive payments.

The fulfillment of these conditions must be documented by relevant primary documents. The list and form of these documents should also be provided in the terms of the concluded agreement. Documents confirming the fulfillment of contractual terms may be:

- Reconciliation statements signed by the seller and the buyer,

- Notifications from suppliers about discounts and bonuses,

- Calculation tables confirming purchase volumes,

- etc.

PROCEDURE FOR TAXATION OF VAT DISCOUNTS

Taxation of VAT discounts and bonuses depends on the moment of their provision:

1. Before shipment (or at the time of shipment) of goods to the buyer.

In this case, the amount of debt the buyer owes to the seller for the goods (work, services) received is immediately reduced by the amount of discounts.

2. After shipment of goods to the buyer (provision of services, performance of work).

The supplier of goods (works, services) returns to the buyer the amount specified in the contract or reduces the buyer's debt (recognizes the advance) under the mutual settlement act.

1. PROVIDING A DISCOUNT BEFORE SHIPMENT (AT THE TIME OF SHIPMENT) OF THE GOODS

Discounts provided before (or at the time of shipment) goods are often associated with seasonal discounts and sales. In addition, such discounts may be provided:

- regular customers,

- a new customer when making their first purchase.

When such a discount is provided, the price of the goods in the documents is immediately indicated taking it into account and the documents are issued for the amount of the goods (work, services) with a discount.

When a discount is provided before shipment (or at the time of shipment), goods (work, services) are immediately charged at the purchase price (including the discount). The sales price of goods (work, services) by the supplier is reflected in accounting, taking into account the discounts provided.

This type of discount does not cause difficulties when reflected in accounting and tax accounting.

The supplier's tax base is determined in accordance with clause 1 of Article 154 of the Tax Code of the Russian Federation as the cost of goods sold. The cost of goods will be taken into account in accordance with primary documents (invoices, acts, invoices) drawn up taking into account the discounts provided.

The buyer's VAT base is reduced by the deductions established by Article 171 of the Tax Code of the Russian Federation. In accordance with paragraph 2 of Article 171 of the Tax Code, VAT amounts presented to the buyer are subject to deductions. Since the buyer has been issued documents (waybills, acts, invoices) taking into account the discounts provided, the VAT reduced accordingly, taking into account the discounts and indicated in the documents, is accepted for deduction.

2. PROVIDING DISCOUNTS AFTER SHIPMENT OF THE GOODS

Discounts provided after shipment of goods (provision of services, performance of work) raise much more questions regarding their accounting and taxation. Since a discount is a reduction in the price of a product (work, service), the price of a product that has already been shipped by the supplier and received by the buyer is revised downward.

A discount can be provided both before the buyer pays for the goods and after such payment. In the first case, the amount of the buyer's debt is reduced by the amount of the discount. In the second case, the money is either returned to the buyer, or the discount amount is recognized as an overpayment and is taken into account as an advance to the supplier against upcoming shipments (then the supplier is obliged to charge VAT on this amount on the advance received in accordance with clause 1 of Article 154 of the Tax Code of the Russian Federation).

Please note that from 01/01/2011. A new version of clause 3 of Article 168 has come into force, regulating the procedure for calculating VAT in the case of granting discounts after the shipment of goods.

In accordance with clause 3 of Article 168, if the cost of shipped goods (work, services), transferred property rights changes, including in the case of a change in price or clarification of the quantity of goods shipped, the seller issues an adjustment invoice to no later than 5 calendar days counting from the date of drawing up the documents specified in clause 10 of Article 172 of the Tax Code. (this paragraph was introduced by law dated July 19, 2011 No. 245-FZ)

Please note: The form of the adjustment invoice and the Rules for filling it out were approved by the Decree of the Government of the Russian Federation dated December 26, 2011. No. 1137.

A discount provided after shipment of goods (works, services) changes the price of the shipped goods. In this case, the seller must issue an adjustment invoice to the buyer no later than 5 days from the date the supplier notifies the buyer of the change in the price of the goods. The date of notification by the supplier to the buyer will be the date:

- Agreement (on providing a discount) agreement (on providing a discount)

- Written notification from the supplier

- Any similar document confirming that the buyer has been notified and agrees with the discount provided.

Please note: Starting from 10/01/2011.

There is no longer a need to adjust VAT for the period in which the goods (works, services) were sold when a discount was provided. The seller will have to re-issue the primary documents confirming the sale of the goods, taking into account the discount provided. In addition, both the buyer and the seller will have to make adjustments to the accounting registers.

The supplier's tax base is determined in accordance with clause 13 of Article 171. When the cost of shipped goods (work, services) changes downward, including in the case of a price decrease, the from the seller of these goods (work, services). .

The corrective invoice is entered by the supplier into the purchase ledger.

The buyer’s tax base in accordance with clause 10 of Article 172 of the Tax Code of the Russian Federation increases by the amount of the difference specified in clause 13 of Article 171 of the Tax Code of the Russian Federation, based on adjustment invoices issued by sellers of goods (works, services), if any :

- agreements,

- agreements,

- other primary document,

confirming the consent (fact of notification) of the buyer to a change in the cost of shipped goods (work, services), transferred property rights, including due to a change in the price of goods (work, services), but no later than three years from the date of drawing up the adjustment invoice.

The adjustment invoice is entered by the buyer into the sales ledger.

PROCEDURE FOR TAXATION OF VAT PREMIUMS

Providing a cash bonus, unlike providing discounts, does not affect the contract price of goods, including those previously shipped.

This means that the cost of goods in the accounting and tax registers does not change in any way. There is also no need to redo the primary documents that confirm the sale of goods (works, services).

Accordingly, there is no reason:

- For the supplier to issue adjustment invoices.

- To reduce the amount of VAT accrued by the supplier.

- To increase the amount of VAT accrued by the buyer.

A cash bonus is a form of incentive to the buyer for fulfilling the conditions stipulated by the contract (purchase by the buyer of a certain volume of products, work, services, purchase of a full range, early payment for goods, etc.).

Cash bonuses are not only easy to account for and register, they are also not subject to VAT, if the contractual relationship does not provide for the reciprocal provision of services (from the buyer to the supplier).

If buyers, simultaneously with receiving a premium from suppliers, provide services to the supplier:

- delivery,

- product advertising,

- “displays” of goods,

- and the like,

by agreement of the parties, these services (works) are subject to VAT in the generally established manner.

The tax base will be the size of the premium. It is for this amount that the buyer issues an invoice to the supplier, who, on the basis of this invoice, can deduct the VAT indicated in it, subject to compliance with the requirements of the Tax Code. This position is set out in Letters from the Ministry of Finance of Russia dated October 25, 2007. No. 03-07-11/524, dated July 26, 2007. No. 03-07-15/112, as well as in Letters of the Federal Tax Service of Russia dated March 21, 2007. No.MM-8-03/ [email protected] , Federal Tax Service of Russia for Moscow dated 04/06/2010. No. 16-15/035737, dated 04/05/2010. No. 16-15/035207, dated May 28, 2008. No. 19-11/051071, dated 08/06/2008 No. 19-11/73653. If the buyer does not provide any services to the seller, then the premiums may not be subject to VAT.

In accordance with paragraph 1 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation, the object of VAT taxation is the sale of goods (work, services, property rights) on the territory of the Russian Federation.

In accordance with paragraph 2 of paragraph 1 of Article 162 of the Tax Code of the Russian Federation, the tax base is increased by the amounts received for goods sold (work, services) in the form of:

- financial assistance,

- to replenish special purpose funds,

- to increase income,

- otherwise related to payment for goods (work, services) sold.

At the same time, the payment of a cash bonus is not related to the sale of goods and payment for goods (work, services) sold, respectively:

- For the supplier, these amounts are not included in the VAT calculation base.

- The buyer's premium amounts are also not subject to VAT.

The tax authorities adhere to the same position (letter of the Federal Tax Service of Russia dated 04/01/2010 No. 3-0-06/63, Federal Tax Service of Russia for Moscow dated 04/06/2010 No. 16-15/035737, dated 08/06/2008 No. 19- 11/73653) and the Ministry of Finance of the Russian Federation.

So, in his Letter dated July 16, 2010. No. 03-01-10/2-62, the Ministry of Finance recommends that you be guided by its own Letter dated July 26, 2007. No. 03-07-15/112, which reads:

“It should also be noted that in the relationship between sellers of goods and their buyers, various bonuses and rewards paid by sellers of goods to their buyers, not related to the provision of advertising and promotion services, may be used, for example:

- for the fact of concluding a supply agreement with the seller;

- for the supply of goods to newly opened stores of the retail chain;

- for the inclusion of product items in the assortment of stores,

- and so on.

The indicated amounts, in our opinion, should not be recognized as payments related to settlements for the goods supplied.

Payment by sellers of goods to their buyers for these actions is not related to the buyers’ obligations to transfer property (property rights) to sellers of goods, perform work or provide services under the supply agreement. The operations listed above, for which bonuses and rewards are paid, are carried out within the framework of the activities of the buyer of goods (store) in the field of retail trade and are not related to the activities of the seller of goods.

In this regard, the amounts of bonuses and rewards received by the buyer of goods from the seller and not related to payment for goods are not subject to the requirements of paragraph 2 of paragraph 1 of Article 162 of the Tax Code (that is, these amounts are not subject to value added tax as amounts related to payment for goods).

At the same time, in his Letter dated November 13, 2010. No. 03-07-11/436, the Ministry of Finance expressed the opinion that when providing premiums, the contract price may also change. In this case, premiums should be considered a form of discounts, which means that the seller and buyer need to adjust the amounts of VAT payable and deductible. Most court decisions agree with this position.

For example, in accordance with the Resolution of May 21, 2009. No. KA-A40/4338-09, FAS Moscow District states that bonuses received for completing procurement volumes are not revenue from the sale of services, and therefore do not increase the VAT tax base.

In accordance with the Resolutions of 06/04/2010. No. A26-8794/2009, dated July 24, 2009. No. A13-10612/2008, FAS North-Western District, such premiums are not subject to VAT, since they are not related to the taxpayer’s obligation to perform work or provide services.

Other courts share the same opinion (Resolutions of the FAS Volga District dated 08/02/2011 No. A55-22303/2010, FAS Central District dated 07/26/2011 No. A68-8136/2010, FAS East Siberian District dated 09/02/2010 No. A33-20390/2009).

At the same time, there is a Resolution dated May 26, 2011 N KA-A40/4206-11-2 of the Federal Antimonopoly Service of the Moscow District, in which the court concluded that premiums (bonuses) received for fulfilling obligations under the distribution agreement are subject to VAT.

PROCEDURE FOR TAXATION OF VAT BONUSES

It should be noted that the procedure for accounting and taxation of bonuses differs from the procedure for accounting and taxation of cash bonuses.

Providing bonuses means receiving gifts (an additional batch of goods, services, works) by the buyer from the supplier, subject to the fulfillment of the conditions stipulated by the contract.

At the same time, from the point of view of tax legislation, the provision of gifts is a gratuitous transfer, which entails certain tax consequences.

This is exactly how the tax authorities interpret the provision of bonuses by suppliers.

The supplier has an obligation to charge VAT in accordance with paragraph 1, paragraph 1, Article 146 of the Tax Code. VAT is calculated based on the market value of goods (work, services) transferred free of charge in accordance with clause 2 of Article 154 of the Tax Code of the Russian Federation.

An invoice for free transfer is issued in a single copy and is registered in the supplier's sales book.

The buyer does not deduct VAT on goods received free of charge in accordance with clause 1 of Article 171 of the Tax Code of the Russian Federation.

Thus, the provision of bonuses is one of the most unprofitable types of incentive payments from a tax point of view.

To avoid such tax consequences, you can register the transfer of bonus goods together with those sold, as the sale of goods at a discount in the amount of the price of “gift” goods.

In this case, the amount of revenue from the sold product will be reduced by the bonus amount. For example, a batch of 110 units of an item may be sold at a price of 100 units of an item. In this case, there is no gratuitous transfer and no additional VAT will be required.

In this case, primary documents (invoices, acts, invoices) are drawn up for a reduced amount (in the amount of the bonus price).

Related links:

Income of individuals within the framework of bank customer incentive programs is not subject to personal income tax - Klerk.Ru, 05.21.12

Premiums to the buyer for fulfilling the terms of the contract reduce the seller’s income tax - Klerk.Ru, 04/19/12

Not every premium to the buyer reduces the seller’s income tax - Klerk.Ru, 03.11.11

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

Comparison. Discounts in BU and NU

Simplified accounting

An organization with simplified accounting has the right not to reduce the cost of inventory for discounts.

The procedure for accounting for discounts should be fixed in the UP according to accounting

:

- reduction in cost of sales (Dt 90.02 reversal);

- other income (Kt 91.01).

Accounting for discounts likely to be received is not automated in 1C.

Advice

- provide for accounting of discounts in the UE for accounting without adjusting the cost of inventories - * only for simplified accounting;

- premiums and discounts likely to be received should be reflected manually on the reporting date in accounting;

- for goods sold – Dt 90.02 Kt 60 reversal;

- for inventory balances – Dt 10, 41 Kt 60 reversal.

The discount is provided simultaneously with delivery

On April 21, materials were purchased from the supplier for a total amount of 78 thousand rubles. (including VAT 20%):

- Luxury fabric - 100 linear m. in the amount of 48 thousand rubles;

- Linen fabric - 50 linear m. for the amount of 30 thousand rubles.

In TORG-12, a separate line indicates a total discount for all items in the amount of 7,800 rubles. The invoice amount including the discount is RUB 70,200. (including VAT 20%)

See also:

- How to reflect the receipt of materials with a general discount for a document?

Discount confirmed by supplier after delivery

The organization entered into an agreement with a supplier for the supply of goods. According to the terms of the agreement, when purchasing goods worth more than 1 million rubles. The supplier will provide a retro discount of 10%.

On February 10, the curtains arrived at the warehouse and were accepted for accounting in the amount of 198 thousand rubles. (including VAT 20%):

- Bent curtains - 100 pcs. at a price of 1,200 rubles;

- Curtains Hilja - 50 pcs. at a price of RUB 1,560.

On July 13, the conditions were met, the supplier confirmed the provision of a 10% discount on the goods supplied and issued the CSF.

Under the terms of the agreement, the supplier provides the buyer with a 5% discount for the volume of goods purchased during the quarter in an amount exceeding 1 million rubles. We can have more than 1,000 invoices per quarter. Do you need to manually change the price of the product in each invoice taking into account the discount?

Accounting in 1C depends on the discount category:

- discounts confirmed by the supplier on the basis of each Receipt document (act, invoice, UPD) Receipt Adjustment is entered - type of operation Adjustment by agreement of the parties .

The functionality of applying retro discounts in 1C remains unchanged!

- if the discount has not yet been confirmed by the supplier, but it is very likely that it will be received in 1C, the adjustment to the cost of each product must be reflected through the document Transaction entered manually .

The main thing is that in the reporting as of December 31, inventories are reflected taking into account the discount.

Discounts and their consequences

There are two types of discounts: current and retrospective (retro discounts).

With the current discount, everything is simple: the client immediately buys a product (work or service) at a reduced price. He has no problems with taxes.

With a retro discount, the situation is more complicated, since it is provided retroactively.

Example: according to the terms of the contract, if a client purchases goods worth 10 million rubles during the year, he will receive a 5% discount on the entire volume of goods purchased.

In March, the client purchased a batch of goods worth 6 million rubles. (including VAT - 1 million rubles). In May, the client bought a second batch of goods at a discount in the amount of 8.55 million rubles. (including VAT - 1.425 million rubles). For fulfilling the terms of the contract, the client received a retro discount for purchasing goods in March. The supplier issued him an adjustment invoice.

This will be reflected in the buyer's account as follows:

March:

- D 41 K 60 - 6 million rubles. (the first batch of goods has been received);

- D 19 K 60 - 1 million rubles. (VAT included);

- D 68 K 19 - 1 million rubles. (VAT is accepted for deduction).

May:

- D 41 K 60 - 8.55 million rubles. (the second batch of goods has been capitalized);

- D 19 K 60 - 1.425 million rubles. (VAT included);

- D 41 K 60 reversal - 300 thousand rubles. (the cost of the first batch of goods purchased in March has been reduced);

- D 19 K 60 reversal - 50 thousand rubles. (input VAT was reduced in March);

- D 60 K 19 reversal - 50 thousand rubles. (the amount of VAT deductible has been reduced).

The buyer in the example has a problem: he purchased the first batch of goods in one reporting period, and received a discount in another.

After he corrects the accounting data based on the adjustment documents, he will have a debt to the budget for income tax and VAT. Since the amount of expenses already taken into account in the tax base and the amount of input VAT will decrease.

As a result, the buyer will have to pay additional tax, pay penalties and submit updated returns.

To avoid this problem, it is better to replace the retrospective discount with a retro bonus.

NASB specialists will help prevent tax risks. Get advice from a tax lawyer. Write to us on Telegram: @nasb_su, WhatsApp, email: [email protected]

Discount likely to be received

According to the terms of the agreement with the supplier ARMADA LLC, when purchasing 1,000 pcs. curtains for children's Velo for the period from 02/01/2021 to 01/31/2022 a retro discount of 10% of the product price will be provided.

As of 12/31/2021:

- purchased 950 pcs. curtains for children's rooms and there is a high probability that the conditions for providing a discount will be met by 01/31/2022;

- sold 500 pcs. curtains for children's, 450 pcs. on the balance.

Simplified accounting methods are not used.

The contract does not stipulate the provision of a discount; it is issued through an additional service. agreements. Is it possible not to recalculate the price?

Discounts affect reporting regardless of the type of document with which they are provided (agreement, credit note, additional agreement, etc.). The discount is not stated in the documents, but is provided at the discretion of the supplier, and is not included in the cost of inventory, because the situation is not controlled by the buyer (Recommendation NRBU BMC R-35/2013-KpR “Retrospective discounts”, Recommendation NRBU BMC R-79/2017-OK TORG “Preferences from suppliers”).

See also:

- [05/28/2021 entry] Practice of application of FSB 5/2019 Inventories in 1C - Part 2

- Adjustment invoice for reduction in 1C 8.3

- How to reflect the receipt of materials with a general discount for a document?

- Retro discount accounting with the buyer

- Adjustment of income in 1C 8.3 downwards

- How to reflect the receipt of materials with a general discount for a document?

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Trade margin, discount, bonuses, premiums You do not have access to view To gain access: Complete a commercial...

- Online cash registers 2022: invisible risks and pleasant bonuses...

- Personal income tax 2021: pleasant bonuses and harsh reality Apply for participation in the online seminar → Traditionally, income tax…

- Accounting for fixed assets in a new way: FSBU 6/2020, FSBU 26/2020, FSBU 25/2018 Seminar program Analysis of the provisions of FSBU 6/2020 “Fixed Assets”, FSBU 26/2020...

How to correctly calculate VAT on discounts and bonuses

Current discounts

The simplest option from an accounting point of view. The seller indicates the reduced price in the contract, invoice and shipping documents. Both parties to the transaction calculate VAT in the standard manner.

Example:

Your Computer and Company LLC is a VAT payer and sells equipment. The standard cost of one laptop is 30,000 rubles. An order was received from Green City LLC, also a VAT payer, for 10 laptops, and we agreed on a discount. The total cost of each unit of goods is 28,000 rubles, the order is in the amount of 280,000, including VAT.

You generate an invoice and invoice for 280,000 rubles, including VAT - 46,666.67 rubles (280,000/120*20). VAT is payable on the proceeds received. Green City LLC pays you 280,000 rubles and deducts VAT in the amount of 46,666.67 rubles.

Retrospective discounts

The Civil Code of the Russian Federation allows for a reduction in the cost of goods or services after the fact by agreement of the parties. The use of such discounts is associated with a number of difficulties for the seller and the buyer.

Seller's actions

If you have agreed on a retrospective discount when a certain volume of orders is reached, you issue shipping documents to the buyer with the original price until he fulfills the condition. When this happens, you formalize the discount by signing an additional agreement. agreement to the contract, deed of reduction in cost, price approval protocol or other similar document. It should contain information about which goods are subject to the discount, what primary documents were used to supply them to the buyer, what the price was before and what it will be after the discount.

Within 5 days from the date of signing any of the above documents, you are required to send the customer an adjustment invoice confirming his consent to the price reduction ( ). This document will allow you to deduct VAT, which accounts for the difference between the original and final price of the sold batch of goods.

An example of an adjustment invoice that is filled out when providing a discount on an item that has already been paid for.

You can use the so-called universal adjustment document, which is transmitted only electronically through EDI operators. It combines the adjustment invoice and agreement with the change in value, must be in a format approved by or.

Example:

Your Computer and Company LLC is a VAT payer and sells equipment. The standard cost of one laptop is 30,000 rubles. You sold a batch of 100 laptops to Infoblock LLC for 3,000,000 rubles and agreed that if you pay for another 200 over the next 2 months, you will give a 5% discount on all 300 units of goods. The condition was met, the laptops were paid in full - 9,000,000 rubles. The batch price with a discount is 8,550,000 rubles. You return 450,000 rubles to the buyer.

After the discount is granted, you need to recalculate the VAT and, if it affects previous tax periods, submit an updated tax return. If the tax has already been paid, you can apply for a VAT deduction on the difference between the original and actual cost of the goods.

Buyer actions

If the goods are shipped in one tax period and the discount is received in another, a problem arises. Due to the reduction in the cost of the batch, expenses and “input” VAT, which was accepted for deduction, are reduced. Based on the adjustment documents from the seller, the tax return must be corrected, which results in an underpayment of income tax and VAT. The Federal Tax Service will demand repayment of the debt and charge penalties - you can try to defend your position, but it will not be easy.

Bonuses (prizes)

When using retrospective discounts, difficulties arise with the Federal Tax Service, so in practice bonuses are more often used - remuneration that is paid at the end of the period, but does not affect the cost of the product.

Example:

Your Computer and Company LLC is a VAT payer and sells equipment. Infoblock LLC is the buyer with whom you have agreed on a premium of 1% of the order value exceeding one million rubles. In June, the counterparty paid for a batch of laptops for 1,200,000 - you must pay him a bonus of 2,000 rubles.

For the seller, the premium is a non-operating expense (), and for the buyer - non-operating income. In both cases, the amount is not subject to VAT, since it is not a payment for goods or services.

Important! Specify in the contract that the bonus does not reduce the cost of goods or services. Otherwise, it will be considered a retrospective discount with all the attendant responsibilities.

The bonus can be expressed in kind - additional units of goods. But this method is rarely used, because when transferring the goods to the buyer, the seller must charge VAT on the actual cost of the goods and pay it from his own funds.

Entrust your accounting to us! We will help you correctly calculate VAT for discounts and bonuses, prepare and submit reports on time, and process the requirements of the Federal Tax Service. Error insurance - 1 million rubles.

Calculate the cost of service online