Control over the calculation and payment of insurance premiums from 2022 is largely carried out by the Federal Tax Service. The Social Insurance Fund also has the right to administer part of the payments calculated from employee salaries. In what cases can contributions be additionally accrued and how to reflect the amounts based on the inspection report in accounting?

Question: What actions should the tax authority take to re-qualify the GPC agreement into an employment contract for the purposes of additional assessment of insurance premiums? View answer

Who checks?

So, the legislator gives the tax service and the Social Insurance Fund the right to carry out inspections. Inspections can be both desk-based and on-site.

Refusal to accept payment amounts for credit is not a reason for additional assessment of insurance premiums

Insurance premiums are verified:

- for compulsory pension insurance - Federal Tax Service;

- for compulsory health insurance - Federal Tax Service;

- in case of temporary disability and in connection with maternity (“sick leave”) - the Federal Tax Service;

- insurance against accidents at work and occupational diseases (contributions for injuries) - Social Insurance Fund.

On a note! The recipient and administrator of the contributions may not be the same. For example, the recipient of contributions under compulsory pension insurance is the Pension Fund, in case of temporary disability - the Social Insurance Fund. The Federal Tax Service monitors the completeness and urgency of payment of contributions.

IMPORTANT! A complaint to a higher authority against the tax authority’s decision to charge additional insurance premiums from ConsultantPlus is available at the link

Most often, scheduled inspections are carried out according to a schedule that complies with federal legislation. However, if a company undergoes reorganization, is liquidated, or a supervisory authority receives a complaint from an employee, an unscheduled inspection is carried out.

For periods up to 2022, inspections are carried out by the FSS and the Pension Fund.

Reasons for recalculations in 1C: ZUP

- The order to change the accrual last month was not entered. Entering it “retrospectively” will require recalculation in the current period.

- Changes have been made to the document of the previous period, errors have been corrected. This can be either an accrual document or a personnel order. Error in data when hiring, personnel transfer, etc.

- Changing the vacation date due to an employee returning to work early, providing him with sick leave while on vacation, or a calculation error in indicating the vacation dates.

- The employee went on sick leave, the salary for the month has already been accrued, but absenteeism is not reflected. When providing sick leave, the program will offer to recalculate wages.

1C:ZUP implements a recalculation mechanism based on data entry control. Even with a simple re-posting of the document, the program will offer to recalculate, and the user will decide whether there is really a need for recalculation or not

You can view the options offered by the program in the “Service-Recalculations” section.

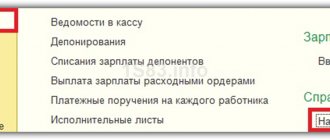

Fig.1 Software service

Let's take a closer look at how such an operation is registered, its settings, and what to do if additional salary calculations are required in 1C 8.3 ZUP during recalculation.

Reasons for additional contributions

Additional assessment of contributions, as a rule, is a consequence of underestimating the base in calculations.

In practice, errors most often occur for the following reasons:

- Incorrect application of settlement rates. Thus, the current rate for compulsory health insurance is 22%, for compulsory medical insurance – 5.1%, for compulsory social insurance – 2.9%, and contributions “for injuries” depend on the type of activity of the company. Their value can range from 0.2 to 8.5%.

- Incorrect use of base limits for calculating insurance premiums for the current year. A similar situation may arise if the company is large, the wages of employees are quite high and at some point may exceed the limits established by government regulation in relation to one employee. In such cases, for pension contributions the basic tariff is set at 10%, and for contributions to the Social Insurance Fund, accrual occurs only within the limit (Article 425 of the Tax Code of the Russian Federation). Errors affect the OPS and OSS databases.

- Errors in including payments in the contribution base. In a general sense, this is the employee's income subject to contributions. The list of income is given in Art. 420 of the Tax Code of the Russian Federation, and in Art. 422 contains a similar list of amounts not included in the base. For example, financial assistance only in the amount of up to 4,000 rubles is not subject to contributions; compensation for unused vacation upon dismissal may be mistakenly not included in the base, etc.

The reason for additional accrual may also be calculation errors, incorrect transfer of data from previous periods, or even deliberate evasion of payment of contributions.

Based on the act, the company is obliged to calculate an additional amount to the funds, reflect it in accounting and make payment or resolve the issue in court.

Method 2. Using special documents for contributions

To update register data on income for contributions, you can use one of the special documents for accounting for contributions:

- Recalculation of insurance premiums (Taxes and contributions – Recalculation of insurance premiums);

- Contribution accounting transaction (Taxes and contributions – Contribution accounting transactions).

The difference in using documents is that in the Recalculation of Insurance Premiums you can not only enter information on income, but also recalculate contributions automatically. In the Contribution Accounting Transaction, the contribution amounts will have to be entered manually.

Let's use the document Recalculation of insurance premiums and on the Income Information we will “transfer” the amounts of income from the completed Working Conditions Class to the unfilled one. At the same time, in the column Subject to contributions for those employed in jobs with early retirement, the values will be the same.

In our example, income amounts are “rolled forward” in December 2020 to February 2022.

Based on the Month of Registration (in the example this is December 2020), the month will be determined in which the following will fall:

- entries for recalculated contributions,

- the amount of contributions in the report Analysis of contributions to funds .

The month the income was received affects the period in which the data is reflected in the DAM (in our case, in February 2022)

On the Calculated contributions the Calculate command in the document, contributions for February 2022 are automatically recalculated.

However, you do not have to recalculate contributions in the document Recalculation of insurance premiums . In this case, the recalculation will automatically occur in the document Calculation of salaries and contributions during the next payroll calculation. The same will happen when using the document Transaction of Contributions Accounting , if you “transfer” only income into it and do not enter information on contributions on the Contributions to the Pension Fund of the Russian Federation at home tariff tab .

How to reflect additional accrual in reporting?

Additional charges must be reflected:

- in the calculation of insurance premiums, which is submitted to the Federal Tax Service;

- in form 4-FSS, which is submitted to the Social Insurance Fund.

In both cases, adjustment reports are submitted, where the adjustment number is indicated in the appropriate field.

When paying additionally accrued contributions (respectively, “for injuries” - to the Social Insurance Fund, the rest - to the Federal Tax Service) and possible penalties for them, it is important to pay attention to the current payment details. As a rule, they are indicated in the inspection report. If an error occurs, the payment may be classified as unclear and the obligation to pay additional contributions will not be fulfilled. It is necessary to submit an application for clarification of payment.

Adjustment of calculation of insurance premiums in 1C: Salaries and personnel management ed. 3.1

Published 01/27/2021 08:10 Author: Administrator Calculation of insurance premiums in itself is considered one of the complex reports in payroll accounting. And its correction – even more so. Even with all the care in the process of filling out a report, it is very easy to make a mistake. In this article we will not only talk about the most popular errors in the DAM, which entail the need to submit adjustments, but also show how to do this using the example of the 1C program: ZUP ed. 3.1

So, the procedure for filling out the report form “Calculation of insurance premiums” is regulated by Order of the Federal Tax Service of Russia dated September 18, 2019 N ММВ-7-11 / [email protected] “On approval of the form for calculation of insurance premiums, the procedure for filling it out, as well as the format for submitting calculations for insurance premiums in electronic form and on the invalidation of the order of the Federal Tax Service dated 10.10.2016 N ММВ-7-11/ [email protected] "; (Registered with the Ministry of Justice of Russia on October 8, 2019 N 56174)

In the practice of an accountant, situations often arise when it is necessary to make clarification on the calculation of insurance premiums (DAM).

Conventionally, types of corrections can be divided into three types:

1. If the base and calculated insurance premiums have decreased;

2. Errors in the employee’s personal data;

3. Other data errors.

Situations may be different:

• correction of inaccuracy or error in calculation;

• change in data as a result of reversal of calculations for the period for which information was transferred.

You can also highlight situations when errors are detected in the personal data of employees (section 3):

• mistaken full name, erroneous or incorrect SNILS, etc.;

• change of employee's passport data and other similar situations.

Each clarification option has its own characteristics.

When making changes and clarifying information on insurance premiums, you should be guided by the Letter of the Federal Tax Service dated April 2, 2022 No. BS-4-11 / [email protected] On the submission of updated calculations on insurance premiums.

Let's look at the situations using examples.

Let's consider the initial calculation of insurance premiums for 9 months.

Section 3.2.1 reflects the amount of income of an individual. Sheets were generated separately for each employee.

Errors in accruals and personal data will be caused by V.M. Kiselev’s employees. and Sviridova M.V.

Section 1 of the report shows the amounts broken down by insurance premiums and detailed by month of accrual.

Situation No. 1: adjustment of the DAM as a result of a reversal of accrual

Let's consider an example when the calculation base changes and, accordingly, the amount of insurance premiums for the period for which they have already reported.

One example would be a situation where a recalculation (reversal) occurs, for example, in the 4th quarter, and the amounts of the 3rd quarter are affected.

If the report for the 3rd quarter is submitted, then clarification of the information is submitted, i.e. adjustment report.

But not in all cases a reversal results in filing an adjustment.

If the amount of income being reversed is less than the accrued amount in the current period, then no adjustment is required. If the reversed amount of the previous period exceeds the current accrual for the employee, then clarification is necessary.

Let's look at specific examples.

Let's analyze two situations in parallel.

In October, employees of Sviridov M.V. and Kiselev V.M. provided sick leave certificates. The salary for the month of September has already been accrued and the DAM for 9 months has already been paid. In both situations, the date of onset of the disease affects September: from September 24, 2020 to October 29, 2020.

Both employees had their wages recalculated for the previous period – for September. And this “minus” was reflected in October.

But employee Sviridov M.V. for October the accrued payment was more (RUB 4,806.82) than the amount being reversed (RUB 1,534.09). And Kiselev V.M. less was accrued in October (RUB 2,045.45) than the reversal for September (RUB 10,227.27).

As a result, employee V.M. Kiselev the program recalculated insurance premiums for September, because The salary reversal for September is greater than the current accrual and in this case the base for calculating insurance premiums for September has changed. If the reversed amount does not exceed the current accrual (as with employee M.V. Sviridov), no recalculation occurs and there is no need to clarify the DAM.

In Kiselev V.M. The repayment for September is greater than the accrued salary in October, so there has been a change in the base for calculating insurance premiums, requiring an adjustment to the DAM.

Let’s create an adjustment report “Calculation of insurance premiums”.

Step 1. Go to the “Reporting, certificates” section - “1C – Reporting”.

Step 2. Create a new DAM report and indicate the adjustment number “1” on the title page.

Step 3. After taking sick leave and calculating wages for October, generate an adjustment report using the “Fill” button.

Section 1 reflects the amount of contributions, taking into account the change - the total amount and the month that affected the recalculation. In our example, this is the 3rd month of the period – September.

Section 3 shows only those employees for whom the amount of income and contributions has changed. The rest of the employees are not repeated.

Table 3.1 shows personal data that remained unchanged - provided that there was no error or correction in it.

In our example, a sheet appeared for employee V.M. Kiselev, on which the amount of clarification for September is reflected in section 3.2.1. Those. instead of 45,000 rub. we see the base taking into account the amount being reversed - 34,722.73 rubles.

According to employee Sviridov M.V. the amounts remained unchanged, because The September reversal did not exceed the accrued salary in October and no clarification is required.

Let's conclude:

• Adjustment is NOT REQUIRED if the reversal income for the 3rd quarter overlaps with the income for the 4th quarter, i.e. the amount of reversal income is less than the income of the current month.

• An adjustment is REQUIRED if the recalculation was performed after the report was submitted and the reversed income of the 3rd quarter is greater than the amount of income of the current month.

All created types of reports with notes are saved in the journal, for example K/1 - adjustment 1.

Situation No. 2: Adjustment of the DAM due to changes in personal data

Situations often arise when an error is made in personal data - an error in the full name or SNILS.

We decided to consider this example. The program initially entered the employee's last name with an error and, accordingly, the initial DAM report was generated and submitted with incorrect personal data.

According to the explanations of the Federal Tax Service, clarification is made as follows:

When receiving an updated calculation of insurance premiums for the corresponding billing (reporting) period, the personalized information reflected by the payer in the initial calculation is compared using the set of details “SNILS”, “Last Name, First Name, Patronymic”.

If it is necessary to adjust the indicators specified in subsection 3.2 for individual insured persons. “Information on the amount of payments and other remuneration accrued in favor of an individual, as well as information on calculated insurance contributions for compulsory pension insurance” calculation (hereinafter referred to as subsection 3.2), whose personal data (“SNILS” has changed on the date of submission of the updated calculation) “Last Name, First Name, Patronymic”) the calculation is filled out in the manner corresponding to the explanations set out in the letter of the Federal Tax Service of Russia dated June 28, 2017 N BS-4-11/ [email protected]

In particular, for each insured individual for whom, at the time of submission of the updated calculation, the personal data (“SNILS”, “Last name, First name, Patronymic”) has changed in the corresponding lines of subsection 3.1 “Data about the individual in whose favor payments and other payments have been accrued” remuneration" calculation (hereinafter referred to as subsection 3.1), the personal data reflected in the initial calculation is indicated; in the lines of subsection 3.2 of the calculation, the total indicators are filled in with the value “0”.

At the same time, for the specified insured individual, subsection 3.1 of the calculation is filled out, indicating the personal data current on the date of submission of the updated calculation and the line of subsection 3.2 of the calculation in accordance with the established procedure.

Let's move on to a specific example.

So, employee Kiselev V.M. the surname is misspelled - KisIlev V.M. and this was discovered after the report was generated and submitted. Personalized information about the insured persons is reflected in section 3 of the report.

Let's consider the formation of the corrective DAM step by step.

Step. 1. Create a report in the “Reporting, references” - “1C – reporting” section.

Step 2. In the “Tax reporting” section, select the “Calculations for insurance premiums” report.

Step 3. Set the adjustment number on the title page of the report. If adjustments have already been made, then the next number is set (2, 3, etc.). Let in our case be adjustment No. 2.

Step 4. After correcting the error in the last name (or SNILS), generate a report - the “Fill” button.

When changing personal data in section 3, two sheets are generated for each employee:

• the first sheet - with the established sign of cancellation of information - the number “1”, which reflects the “old” information”, canceling erroneous data. Section 3.2 – not completed;

• second sheet – updated, new data.

And the next sheet reflects the corrected data indicating the income data for the “faithful” employee, we corrected the name V.M. Kiselev.

When saving a corrective report, the program will ask you to create a new report or save the current one. We answer “Yes, create a new one” and then all adjustments will be saved separately in the journal.

In this simple way, an adjustment is created to change erroneous data about individuals.

Situation No. 3: Adjustment of the DAM in case of other personal data errors

Let's look at another common mistake when filling out the RSV form - incorrectly filled out or blank passport data.

In this case, the correction occurs in a slightly different form - the correction number is indicated on the title page, and in Section 3 the general data is repeated for the entire list of employees and a correction is made for the employee with the error. Let's look at an example.

In section 3 of the DAM report on employee M.V. Kiselev. When submitting the report, they did not indicate passport information.

Go to the “Personnel” section of the “Employees” directory and on the “Personal Data” tab, add information about V.M. Kisilev.

Save the employee’s data and generate another report “Calculations for insurance premiums”. On the title page, set the correction number (next sequential) and click “Fill”.

In section 3, all employees will be displayed again, and for the employee being corrected, two sheets will be displayed - the first sheet with the cancellation sign set to “1”. Section 3.2. it is not filled in.

And the second sheet - with the corrected data of the employee and with transferred information about his income in section 3.2.

Thus, correct elimination of errors in primary documents leads to the normal completion of the adjustment calculation for insurance premiums.

Author of the article: Olga Kruglova

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Anna Kulikova 08/19/2021 14:01 Quoting Victoria:

Hello. I am sending a DAM adjustment with a missing employee (not included in the main one). When generating the report, the amounts were added; only this employee was included in section 3. But in the uploaded report (EDO), only the employee’s data is sent without amounts. What could be the reason?

Good afternoon, Victoria.

It’s not entirely clear why you are uploading the DAM report on EDI. EDI is an electronic document flow for settlements with counterparties, and not with regulatory authorities. Or perhaps I misunderstood you? Clarify please. Quote 0 Anna Kulikova 08/19/2021 13:58 Quoting Natalya:

Good afternoon. Please tell me how to send an adjustment to the RSV in 1C ZUP without section 3 (there are no changes in section 3, but if you send it with it, the data on employees may be doubled.) Thank you.

Good afternoon.

You simply create an adjustment report, then the 3rd section does not fit there. If the 3rd section appears, it means that changes have been made to employees and the program tells you that adjustments need to be sent for them. Quote 0 Victoria 08/17/2021 13:35 Hello. I am sending a DAM adjustment with a missing employee (not included in the main one). When generating the report, the amounts were added; only this employee was included in section 3. But in the uploaded report (EDO), only the employee’s data is sent without amounts. What could be the reason?

Quote

+1 Natalya 07.27.2021 13:49 Good afternoon. Please tell me how to send an adjustment to the RSV in 1C ZUP without section 3 (there are no changes in section 3, but if you send it with it, the data on employees may be doubled.) Thank you.

Quote

0 Irina Plotnikova 02.24.2021 18:41 I quote Denis:

Good afternoon Do you have a question regarding Situation No. 3. Must the adjustment DAM include all employees or is only the corrected employee sufficient?

Good evening.

When generating an adjustment report, the program itself pulls up data only for those employees for whom changes have been made. So yes, you submit adjustments only for the employees being adjusted. Quote 0 Denis 02.24.2021 18:27 Good afternoon! Do you have a question regarding Situation No. 3. Must the adjustment DAM include all employees or is only the corrected employee sufficient?

Quote

Update list of comments

JComments

What wiring needs to be done?

In accounting, the correction of errors is regulated by PBU 22/2010. The current year's error is corrected in the month in which it was detected (clause 5). If the error is related to the reporting period, it is corrected by posting Dt 20, 25, 44, etc. Kt 69 (according to the corresponding contribution subaccounts).

If we are talking about the previous reporting year, the reporting for which has already been signed, then Dt 91 Kt 69 - in case of a minor error (clause 14 of the PBU). If the error is significant, and the reporting for the year has already been signed, use posting Dt 84 Kt 69 (clause 9 of PBU).

At the same time, the right to determine the significance of an error remains with the organization (clause 3 of the PBU), and therefore many, especially small firms, use the entry Dt 91 Kt 69 (in terms of subaccounts reflecting the types of contributions) for additional accrual.

The issue of reflecting fines under the act has not been fully regulated. Many experts attribute the fine to the account. 91 as other expenses, and a penalty for 99. At the same time, instructions for using the chart of accounts (Order No. 94n 10/31/2000), as well as letters from the Ministry of Finance (see No. 03-03-06/1/42 dated 29/ 01/2007) allow us to say that account 99 reflects the amounts of tax penalties due throughout the year. In this regard, it seems possible to take into account penalties and fines by posting Dt 99 Kt 69.

For example, if, according to the inspection report for the previous period, additional contributions in the amount of 300 rubles were accrued (an insignificant error), a posting is made Dt 91/2 Kt 69 - 300 rubles. Fine the organization in the amount of 200 rubles. and a penalty of 150 rubles. will be taken into account Dt 99 Kt 69 - 350 rubles. Dt 69 Kt 51 – 650 rub. an additional payment was made according to the inspection report and the sanctions were paid off.

Interesting nuance! According to tax authorities, errors in calculations when calculating insurance premiums for compulsory medical insurance cannot serve as a refusal to accept the report. In doing so, they refer to Art. 431 of the Tax Code of the Russian Federation, paragraph 7 (Letter of the Federal Tax Service dated 02/19/18 No. GD-4-11/ [email protected] ). At the same time, when checking, on the basis of Art. 88 of the Tax Code of the Russian Federation, the tax authority will report the error, and it can be corrected with an updated calculation, which is submitted within 5 days. This rule does not apply to community pension contributions.

Briefly

- The administration of wage contributions is handled by the Federal Tax Service, with the exception of contributions for injuries, which are administered by the Social Insurance Fund. The reasons for additional assessment of contributions may be: incorrect interpretation of legislative norms, arithmetic errors, malicious negligence.

- Additional assessment of contributions based on the inspection report entails the need to:

- reflect new data in accounting;

- submit updated calculations to the Federal Tax Service and Social Insurance Fund;

- pay contributions using the correct details, along with penalties and fines.

- In accounting, additional amounts of contributions for previous years are most often reflected in Dt 91. If the error is significant, Dt 84 is taken into account. The accounts correspond with the account. 69 in terms of subaccounts reflecting contributions.

- Sanctions reflect either Dt 91 or Dt 99 accounts. This issue needs to be regulated in the accounting policies.

Common mistakes when calculating additional insurance premiums

Any shortcomings can be detected both independently and during an inspection (reconciliation). Typical errors: incorrect application of insurance rates, false accrual of taxable profits, inaccurate indication of disability data, etc.

Correction of errors is described in detail in PBU 22/2010. Minor miscalculations made in past periods and identified after the submission of financial statements are corrected in the month in which they were discovered. For this purpose, proper accounting entries are made, and the resulting income (damage) is shown as part of other profits (expenses) of the reporting period (from account 91).

For example, an employer awarded benefits to an employee based on a false medical certificate. The erroneous accrual on the fake sick leave was not discovered immediately, but after some time. The payment was made in violation, therefore, the FSS will not accept it for credit. Additional insurance charges will be made on the amount itself.

A number of errors may be associated with unreasonable additional assessment of contributions. The law stipulates that compensation, financial assistance, and social benefits are not subject to insurance fees (Tax Code of the Russian Federation, Article 422). Contributions are calculated only from payments provided for under labor and civil law agreements; in other cases, calculations (additional accruals) will be considered unfounded.

| Examples of payments in favor of an employee that are not included in the base for accrual (additional accrual) of insurance premiums | Reasons why contributions are not calculated (additionally accrued) from payments |

| Compensation by the employer for a trip to an employee for sanatorium-resort treatment on the basis of a collective agreement | The social nature of the payment provided for by the collective agreement; the compensation paid is not remuneration for work in accordance with the employment contract |

| Payment of fines for traffic violations by the head | The driver is an official in execution, and payment of a fine by the employer does not constitute a material benefit and is not income |

| Amounts spent on corporate events for employees provided for by the collective agreement | These expenses are not considered income under employment agreements. |

Thus, additional accrual (calculation) will be legal when it is supported by the relevant norms of the collective agreement and has a replenishing, compensating nature. In the listed situations, additional assessment of insurance premiums from amounts paid by the employer will be contrary to the law and considered erroneous.

The clarification must be submitted within the deadlines.

Payments for insurance premiums must be submitted by the 30th day of the month following the end of the quarter. An update submitted earlier than this date will mean that the calculation was submitted on the date of update, that is, on time (clause 2 of Article 81 of the Tax Code of the Russian Federation). Corrections after the reporting date may result in interest and fines if the amount of contributions has increased. To avoid being fined, you must transfer the arrears and penalties before submitting the updated calculation. As in the case of taxes, this should be done before the inspectors themselves discover the error or before an on-site audit is scheduled for the given period.

If corrections are required in section 3 of the calculation, which affects personalized accounting, the prescribed deadlines must be observed. After all, such errors make the calculation unrepresented (as discussed above).

After receiving a calculation with errors, controllers will send a notification. You have 5 days to make changes. It must be counted from the date the notification was sent electronically. If it was on paper, then the period for clarification will be 10 days (clause 7 of Article 431 of the Tax Code of the Russian Federation). The days are, as usual, working days.

Compliance with these deadlines eliminates sanctions for late submission of calculations. The reporting date will be the day the original version was submitted. Otherwise, a fine of 1,000 rubles will follow. up to 30% of the amount of contributions according to the calculation data (clause 1 of Article 119 of the Tax Code of the Russian Federation) and blocking of the account became possible.

Read more about the deadlines for submitting mandatory clarifications and their consequences here.

NOTE! The fine for an overdue ERSV is paid in three installments .

Submission of documents as part of a desk audit

When conducting desk tax audits, an automated arithmetic control is initially carried out using control ratios (Letter of the Federal Tax Service of Russia dated July 16, 2013 N AS-4-2/12705). The control ratios of the calculation form for insurance premiums, approved by Order of the Federal Tax Service of Russia dated September 18, 2019 N ММВ-7-11/ [email protected] , are sent, in particular, by Letters of the Federal Tax Service of Russia dated April 14, 2021 N BS-4-11/ [email protected] ] , dated 02/19/2021 N BS-4-11/ [email protected]

When conducting a desk tax audit of the calculation of insurance premiums, the tax authority has the right to request, in the prescribed manner, from the payer of insurance premiums information and documents confirming the validity of reflecting amounts not subject to insurance premiums and the application of reduced tariffs for insurance premiums (clause 8.6 of Article 88 of the Tax Code of the Russian Federation ). The specified amounts not subject to insurance premiums are given in Art. 422 of the Tax Code of the Russian Federation, and in Art. 427 of the Tax Code of the Russian Federation lists preferential types of activities for which reduced rates of insurance premiums for payers can be applied, as well as the amount of such rates.

Thus, the list of information and documents required as part of a desk tax audit of the calculation of insurance premiums is limited to the indicators of the corresponding lines of calculation of insurance premiums, which reflect the above data. A specific list of information and documents of the Tax Code of the Russian Federation has not been defined; therefore, the tax authority will formulate a requirement depending on the specific situation.

At the same time, payers of insurance premiums have the right to independently submit supporting documents in electronic form for settlement; their type and content will depend on the grounds for using the benefit (clause 3 of Article 80 of the Tax Code of the Russian Federation).

Organization of accounting for account 69

An enterprise that makes payments to employees in accordance with concluded employment contracts is obliged to record the accrual of insurance premiums for their subsequent transfer to an extra-budgetary fund. The law provides for compulsory medical, social and pension insurance for employees. The employer must also ensure payment of insurance premiums in case of occupational diseases and accidents at work.

To reflect the amounts of accrued and paid contributions to extra-budgetary funds, account 69 is used. To analyze and control the amounts of contributions, the organization can open sub-accounts in accordance with the types of transfers made.

Regulatory documents provide that account 69 can be used to reflect the following transactions:

- calculation of the amount of contributions (including fines, penalties);

- payment of the amount of contributions (fines, penalties);

- reflection of expenses for contributions to extra-budgetary funds.

It should be noted that on account 69 not only the amounts of obligations to the funds are recorded, but also credits coming from the Social Insurance Fund are made.