All economic entities engaged in commercial activities in the field of sale of goods, services, and property rights are required to prepare the appropriate primary accounting papers. That is, organizations and individual entrepreneurs use in their work accounting documentation confirming the conduct of economic life. Therefore, everyone who is directly connected with the business environment needs to know the rules for filling out the UTD (universal transfer document).

By whom and when is it used?

The UPD form was developed by the Federal Tax Service of the Russian Federation on the basis of an invoice at the end of 2011. When creating the new form, the obligatory consignment note, TORG-12 and other papers that confirm the transfer of inventory items were taken into account.

Thus, the UPD document is an invoice expanded by introducing additional details. Including information from other primary accounting documentation:

- TN;

- TTN;

- document confirming shipment;

- act of acceptance and transfer of goods and services.

When understanding how to fill out the UPD according to all the rules, you should remember that any trade organizations and private entrepreneurs can use it. The tax system applied to them does not matter. Thus, companies and individual entrepreneurs operating under special tax regimes also have the right to use the UTD form in their work. In addition, taxpayers who work without charging VAT can also adopt this type of paper. For them, the form is a sample of primary documentation.

INN/KPP

The rules for filling out invoices, approved by Government Resolution No. 1137 of December 26, 2011, do not determine which checkpoint should be indicated in the invoice issued to a separate unit: the parent organization or a separate unit.

In this case, in line 6b “TIN/KPP” the Ministry of Finance of the Russian Federation recommends indicating the KPP of a separate unit (see letters of the Ministry of Finance of Russia dated 05/04/2016 No. 03-07-09/25719, dated 02/26/2016 No. 03-07-09/11029, dated 09/05/2014 No. 03-07-09/44671).

From 07/01/2021 a new invoice form is in effect, incl. adjustment, as amended by the Decree of the Government of the Russian Federation dated 04/02/2021 No. 534. The update of the form was caused by the introduction of a goods traceability system. All taxpayers are required to use the new form, even if the goods are not included in the traceability system. We provide more information about changes to the invoice here.

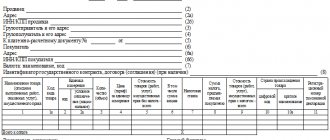

You can download the new invoice form by clicking on the image below:

ConsultantPlus experts have prepared step-by-step instructions for preparing each line of the updated invoice. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

What is it for?

The scope of this document is very broad. So, it is used:

- when supplying goods, carrying out contract work, providing services;

- during the conclusion of property agreements;

- in order to confirm the implementation of transactions involving intermediaries, etc.

When collecting information about the UPD details and figuring out how to fill out the form according to all the rules, it is important to know that this form is not mandatory. Managers of commercial companies and individual entrepreneurs decide for themselves whether to use it in registering business activities. If an organization decides to use a document in its work, this is reflected in its accounting policies.

At the same time, you can use the UTD form only for certain types of transactions and operations. All others can be issued using standard invoices. So, for example, a company has the right to make the transition to working with a universal transfer document under contract agreements, but for other types of contracts continue to use s/f and ordinary primary accounting papers. In addition, according to data from the Federal Tax Service, it is possible to combine various documentation within one transaction. The first batch of goods is registered using a UPD document, the second using a consignment note, and then alternately.

From the Seller's side

In line 13 “Responsible for the correct registration of the fact of economic life” of the UPD on the part of the seller, the following is indicated:

- the position of the person responsible for the correct execution of the transaction, as well as his signature indicating his surname and initials.

The person responsible for completing the transaction may be:

- the person who directly made the shipment (storekeeper, seller, etc.), this employee fills out line 10 of the UPD

or

- a person authorized to act on a transaction on behalf of the company (by proxy or manager).

If the person responsible for processing the transaction is the person who made the shipment (line 10), then in line 13 only information about the position and last name with initials can be filled in without repeating the signature.

If, according to the company’s rules, several persons are simultaneously responsible for the correct execution of the transaction, then an additional line is entered into the UPD to reflect the position, full name. and signatures of the second responsible person (Letter of the Federal Tax Service of the Russian Federation dated October 21, 2013 N ММВ-20-3/ [email protected] ).

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

The consignee and his address on the invoice for the delivery of goods

Consignee - an organization or individual authorized to receive cargo, luggage, cargo luggage (paragraph 6, article 2 of the Federal Law of January 10, 2003 No. 18-FZ “Charter of Railway Transport of the Russian Federation”).

Data about the consignee is reflected in line 4 of the invoice. They are only needed when filling out information when shipping goods. In this case, the name of the consignee must comply with the terms of the contract for the supply of goods.

In line 4 “Consignee and his address”, the invoices reflect the full or abbreviated name of the consignee in accordance with the constituent documents, as well as his address.

When selling goods to a separate division of the organization, in line 4 “Consignee and his address” of the invoice, you must indicate the name and address of this division (letter of the Ministry of Finance dated May 4, 2016 No. 03-07-09/25719).

Information about the consignee can be taken from the consignment note using form No. TORG-12. The Ministry of Finance drew attention to this in a letter dated October 27, 2022 No. 03-07-09/86934.

If the consignor and the buyer are the same person, you cannot indicate “aka” in line 4 “Consignee and his address”. The rules for filling out an invoice, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137, do not provide such an opportunity. You can indicate “aka” only if the seller and the shipper are the same person.

Therefore, officials of the Ministry of Finance drew attention to the fact that if in line 4 “Consignee and his address” of the invoice the words “he” are indicated, then the organization will be denied VAT deduction on such a document (letter of the Ministry of Finance dated July 21, 2008 No. 03-07-09 /21).

Also on topic:

How to fill in the information about the consignee in the invoice

Transportation costs: it is better not to neglect the delivery note!

How to justify VAT deduction for transportation?

The invoice is issued by the “isolator”

In what situations is it used?

When studying the question: how to correctly fill out the UPD, according to line numbers, you should understand the capabilities of this document. Companies and individual entrepreneurs can engage as:

- invoices;

- overhead transfers;

- combined documentation.

The use of the form is advisable when:

- documenting the work done or services provided to the client;

- shipment of commodity items;

- property transactions.

Can a special regime officer issue a UPD for services?

Special regimes do not pay VAT, so they do not issue invoices. If a VAT defaulter nevertheless provides his counterparty with an invoice with allocated VAT, he will have to pay VAT to the budget and report to the state with a declaration.

Is it possible for a special regime person to use UTD and not be subject to VAT? Yes, you can.

UPD has the functions of not only a combination of a primary document (act) and an invoice, but also simply a primary document (act). To differentiate these functions, the UPD form provides a “Status” field.

A VAT non-payer must pay special attention to filling out this field, as well as the columns relating to VAT. We will consider a sample of filling out the UPD for services below. Now let’s explain how to fill out the “Status” field:

Invoice or UPD form

Many organizations and individual entrepreneurs still cannot decide what exactly to use in their activities: a s/f or a new universal form. But here it should be noted in advance that the UTD document is not required for registration, unlike an invoice. At the same time, it allows commercial organizations and private entrepreneurs to:

- use it as accounting documentation;

- accept VAT for deduction, since it largely copies the details corresponding to the contents of the invoice;

- used as confirmation of costs incurred when forming a tax basis.

When getting acquainted with the procedure and rules for registering a UPD for services, and considering the required fields to fill out, it is important to understand that it cannot be used exclusively as a s/f. The form can be used in two situations:

- when it replaces the invoice and primary document;

- only a transfer document.

According to information provided by the Federal Tax Service of the Russian Federation, the UTD form of the first status can be used to generate a deduction. However, its use as a single account is prohibited, since there is no separate status position for this.

Instead of what documents - UPD

The UPD was not initially an independent document. It was introduced in 2013 to reduce paperwork.

The universal transfer document combines the functions of a primary document and an invoice.

Here are the operations for which UTD can be used (letter of the Federal Tax Service of Russia dated October 21, 2013 No. ММВ-20-3/96):

As can be seen from the diagram, the answer to the question of whether it is possible to issue UTD for services is positive.

What does a UPD document consist of?

The details that must be reflected when drawing up the paper transfer of goods, services, and property rights include:

- name of the form and date of registration;

- information about the organization or private entrepreneur;

- name and information about the transaction being carried out, the validity of which is confirmed by the transfer documentation;

- information about the person responsible for the transaction;

- signature of a representative of the management team or responsible employee with a full transcript.

When forming a document according to the procedure for filling out the UPD in accordance with the line-by-line recommendation, you must remember that the “Status” position, located on the top right of the form, is of particular importance. It directly determines how the universal UTD form is to be used.

When is it necessary to write details?

The specifics of filling out an invoice depend on the specific agreements under which it is used. The fact is that we can talk about the consignor and the consignee only in the case when the actual transfer of goods (cargo) takes place under the contract. If we are talking only about the provision of services, the corresponding terms are simply not used.

In this case , the columns relating to the seller and buyer are always filled in in the invoice . This is due to the requirements established by Art. 169 of the Tax Code of the Russian Federation, and the terminology used in the Code. According to it, any person who provides services or transfers goods is considered a seller, regardless of who he is from the point of view of the Civil Code - actually a seller, a performer, etc. The same applies to the buyer.

Status Definition Meaning

This detail can be reflected under the number “1” or “2”. By indicating the unit in the required field, you confirm that the paper is used simultaneously as an invoice and a form of primary accounting (primary).

According to the information presented in the annex to letter 20-3/96 from the Federal Tax Service of the Russian Federation, the status acts only as an information category. In fact, it depends on the absence or presence of data required for accounting documentation and accounts. Thus, in a situation where the seller makes a mistake when filling out the form and puts a two instead of a one, the buyer still has the right to take advantage of the deduction.

Buyer's location

In line 6a of the invoice you need to write: “The address indicated in the Unified State Register of Legal Entities, within the location of the legal entity” (subparagraph “k” of paragraph 1 of the Rules for filling out invoices as amended by the resolution of the Government of the Russian Federation dated 19.08. 2017 No. 981).

Until 10/01/2017, officials recommended that when preparing invoices, indicate in line 6a “Address” the address of the buyer - a legal entity represented by the parent organization (see letters of the Ministry of Finance of Russia dated 02/26/2016 No. 03-07-09/11029, Ministry of Finance of Russia dated 26.02 .2016 No. 03-07-09/11029).

There are currently no official clarifications on the procedure for indicating the address when issuing an invoice to a separate division using the new form. But analyzing in totality clause 3 of Art. 55 of the Civil Code of the Russian Federation and the Rules for filling out invoices, it can be assumed that in the situation under consideration, in line 6a “Address” of the invoice, the address should be given:

- a separate division that is not a representative office or branch must indicate the address of the parent organization entered in the Unified State Register of Legal Entities;

- branch or representative office specified in the Unified State Register of Legal Entities.

Read about the consequences of an error in specifying address data in the material “ Address on the invoice: what is not an error.”

Correct filling of the UPD: instructions for registration

The easiest way to figure out how to fill out the form line by line is in the table below:

| Line numbers/graph | Requisites | Recommended data |

| Status | 1-2 | A one or a two is indicated depending on the purpose of the paper being compiled. |

| Page No. 1-7 Gr. No. 1-11 | — | The first status value implies filling in all fields. When registering the second one, it is allowed to enter information only in some lines and columns. |

| A-graph | Order number | Intended for affixing the record number. |

| B-graph | Coding of goods, services provided, work performed | For product items, an article number is prescribed. In other cases, OKUN or OKVED is indicated. |

| 8 | Basis of reception and transfer | Data characterizing the relationship between the parties entering into a transaction. |

| 9 | Information about the transportation process and the cargo being transported | Accompanying documentation (waybill, TTN), additional documents. |

| 10 | Delivery confirmation | It is recorded with the signature of an official with a full transcript or an authorized employee. |

| 11 | Date of shipment/transfer | The day of the transaction is entered. |

| 12 | Additional data | Additional information. For example, information about passports, certificates, quantities and types of accompanying documentation. |

| 13 | Responsible for registration | The official responsible for completing the transaction, concluding an agreement, carrying out work, etc. is indicated. |

| 14 | The name of the entity composing the paper. Including agent | The name of the organization or information about the individual entrepreneur who generated the UTD document on the part of the seller is indicated. It is allowed not to fill out this position if the form is endorsed with the seal of an individual entrepreneur or company. |

| 15 | Confirmation of receipt of goods/services, property rights, work performed | The position of the employee who received the cargo, recorded the service or transferred ownership of the property on behalf of the buyer is noted. |

| 16 | Receipt date | The day of delivery and acceptance of the results of work activities is recorded. |

| 17 | Other data | Marks are made indicating the absence of claims, as well as additional papers generated by the purchasing party at the time of receipt, which are attached to the UTD form. |

| 18 | Responsible for the correct execution of the transaction/operation | An official is designated who is responsible for the formalities under the agreement. His signature must be affixed with a full transcript. |

| 19 | Name of the economic entity generating the documentation | The name and details of the organization involved in drawing up the UTD document on behalf of the buyer are indicated here. If there is a seal, you can skip the line. |

| M.P. | Place for stamps, tax identification number, checkpoint. |

The recipient of the goods is the consignee instead of the buyer

Question:

We are seller and shipper. An additional agreement was concluded with the buyer on the transfer of goods directly to the consignee. We deliver the goods ourselves, we issue only UPD. Whose seal and signature on the part of the recipient should be on the UTD?

At the moment we have received documents signed by the consignee, but with the seal of the buyer. Which is correct?

Answer:

The Federal Tax Service of Russia in Letter dated October 21, 2013 N ММВ-20-3/ [email protected] proposed the use of a form of universal transfer document (UDD), which combined information from previously mandatory forms for the transfer of material assets (TORG-12, M-15 , OS-1, commodity section of the TTN) with duplicate details for most positions with information on invoices issued for the purpose of complying with legislation on taxes and duties.

The same Letter approved recommendations for filling out certain details of the UPD form.

| Line name | Filling procedure |

| Goods (cargo) received/services, results of work, rights accepted | The position of the person who received the cargo and (or) authorized to accept services, results of work, rights under the transaction of transfer of results of work (services, property rights) on behalf of the buyer may be indicated; his signature indicating his last name and initials. The person authorized to act in a transaction on behalf of an economic entity is determined by the norms of the relevant chapters of the Civil Code of the Russian Federation. |

| Date of receipt (acceptance) | The date of receipt of goods (cargo), acceptance of the results of work performed, receipt of property rights by the buyer or another person authorized by the buyer. |

| Other information about receipt, acceptance | Information about the presence/absence of claims; data on documents drawn up by the buyer (customer) upon receipt of goods (work, services, property rights), which are integral annexes to the UPD. |

| Can be filled out by the buyer (customer) to confirm acceptance without complaint. If there are claims, information about additional documents drawn up upon receipt/acceptance of goods (work, services, property rights) may be indicated. | |

| Responsible for the correct execution of the transaction, operation | The position of the person responsible for the correct execution of the transaction, operations on the part of the buyer, his signature indicating the surname and initials. |

| An indicator that allows you to determine the person responsible for processing the transaction. If the person responsible for processing the transaction is a person authorized to act on the transaction on behalf of the economic entity, then only information about the position and full name can be filled in this line. without repeating the signature. | |

| Name of the economic entity that compiled the document | The name and other details identifying the economic entity that drew up the document on the part of the buyer (participant in the transaction, operation) may be indicated. |

| An indicator that allows you to include in a document information about an economic entity participating in the preparation of a bilateral document on the part of the buyer. This line may indicate information about the person maintaining the accounting records of the economic entity on the basis of the agreement. It may not be filled in if there is a seal containing the full name of the economic entity taking part in the preparation of a specific bilateral document. | |

| M.P. | Seals of economic entities - the drafters of the document. |

Thus, if the recipient of the goods is not the buyer, but a consignee authorized to act on behalf of the buyer, then the UPD lines regarding receipt of the goods should be filled out as follows.

| Line name | Filling procedure |

| Goods (cargo) received/services, results of work, rights accepted | The position of the person who received the cargo on behalf of the consignee is indicated; his signature indicating his last name and initials |

| Date of receipt (acceptance) | The date of receipt of the goods (cargo) by the consignee is indicated. |

| Other information about receipt, acceptance | Indicate information about the documents that are the basis authorizing the consignee to act on behalf of the buyer (power of attorney, agreement, etc.). |

| Responsible for the correct execution of the transaction, operation | The position and full name are indicated. the person receiving the goods on behalf of the consignee |

| Name of the economic entity that compiled the document | The name and other details of the buyer are indicated |

| M.P. | Buyer's stamp. |

Types of universal transfer documents

This documentation can be used in two versions:

- simultaneously as an account-f and a primary account (one is entered in the status);

- solely as confirmation of the transfer of goods and materials (a two is registered).

Depending on how exactly the application is recorded, you will have to fill out the forms differently.

Rules for filling out UPD 1

In this case, all details are required (for s/f and transfer papers). This is the only way to use the completed form to receive VAT deductions and account for income tax expenses.

UPD document with status 2

In the second option, there is no need to enter information for the invoice. This UPD form is used exclusively as transfer documentation to confirm the conduct of business transactions. And the account-f, if necessary, is generated additionally.

We provide services: what is the procedure for using UPD

Business entities providing services issue their counterparties with certificates of services rendered, as well as invoices, provided that the business entity is a VAT payer.

UPD allows you to reduce the list of exposed documents. Instead of a deed and an invoice, this single universal transfer document for services is issued.

Here are the functions it performs:

The use of UPD is not mandatory. You can continue to use acts and invoices. Moreover, it is permissible to provide different sets of documents for different counterparties. Exactly what documents the customer receives is indicated in the contract.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Document of the first status in the purchase/sales books, accounting journal

Knowing where the contract number is indicated in the UPD, what to write in the basis of the transfer, you should consider the rules for registering universal forms with the status value “1”.

On the selling side

When the transfer paper is drawn up during the delivery of commodity items, provision of services, re-registration of property rights, the moment of approval of the tax basis is considered the day of the business transaction.

Accounts are registered in the established chronological order in the first part of the ledger, according to the government decree of 2011. When generating the UTD document, the exact date is determined when the goods are to be received and transferred.

If the days of preparation and shipment coincide

In such a situation, when preparing the transfer documentation, the value of the first line is actual for sending and registering the invoice. They ship commodity items, provide services, or re-register rights to property at the same time. At the same time, the issuance of the s/f to the purchasing party is dated. The document is registered in the accounting book upon simultaneous delivery and the generation of documentary evidence in the form of an invoice.

When actions are performed at different times

In this case, the transfer paper is formed in a similar way. Line No. 1 indicates the day the UPD form was issued. In this case, the actual date of shipment is noted in the 11th. It is also the factual one, according to which the tax period is registered. The immediate moment of issuing a paper confirmation remains simply an indicator that simplifies identification.

Rules for filling out the UPD by the consignee (buying party)

Buyers also record invoices according to chronology. Only records are kept in the second part of the accounting journal. Registration is considered the day of signing an agreement for the supply of commodity items, provision of services, transfer of rights to property. The information is reflected in line No. 16.

In the purchase book, the consignee carries out registration actions in relation to accounts-f.

What address should I put on the invoice?

The purchasing organization's actual address does not coincide with its legal address. In line 4 “Consignee and his address” of the invoice, the supplier indicates the actual address of the organization.

Is this true?

According to paragraph 1 of Art. 172 of the Tax Code of the Russian Federation, tax deductions provided for in Art. 171 of the Tax Code of the Russian Federation, are made on the basis of invoices issued by sellers when the taxpayer purchases goods (works, services), property rights, documents confirming the actual payment of tax amounts when importing goods into the customs territory of the Russian Federation, documents confirming payment of tax amounts withheld tax agents, or on the basis of other documents in cases provided for in paragraphs. 3, 6-8 tbsp. 171 Tax Code of the Russian Federation.

The requirements for invoices are established by Art. 169 of the Tax Code of the Russian Federation.

In accordance with paragraph 1 of Art. 169 of the Tax Code of the Russian Federation, an invoice is a document that serves as the basis for accepting the presented amounts of tax for deduction or reimbursement in the manner prescribed by Chapter 21 of the Tax Code of the Russian Federation.

Invoices compiled and issued in violation of the procedure established by paragraphs. 5 and 6 tbsp. 169 of the Tax Code of the Russian Federation cannot be the basis for accepting tax amounts presented to the buyer by the seller for deduction or reimbursement. Based on clause 2 of Art. 169 of the Tax Code of the Russian Federation, failure to comply with the requirements for an invoice not provided for in paragraphs. 5 and 6 tbsp. 169 of the Tax Code of the Russian Federation cannot be a basis for refusing to accept for deduction the tax amounts presented by the seller.

Subclause 3 of clause 5 of Art. 169 of the Tax Code of the Russian Federation does not specify which address of the consignee - the actual location of the organization or its legal address - should be indicated in the invoice (Resolution of the Federal Antimonopoly Service of the North-Western District of June 1, 2012 N F07-2120/12 in case N A21-5420/2011 ).

The form of the invoice and the procedure for filling it out, the forms and procedure for maintaining a log of received and issued invoices, purchase books and sales books are established by the Government of the Russian Federation (Clause 8 of Article 169 of the Tax Code of the Russian Federation).

In pursuance of this norm of the Tax Code of the Russian Federation, Resolution of the Government of the Russian Federation dated December 26, 2011 N 1137 “On the forms and rules for filling out (maintaining) documents used in calculations of value added tax” (hereinafter referred to as Resolution N 1137) was adopted. Appendix No. 1 to Resolution No. 1137 approves the form of the invoice used in VAT calculations, as well as the rules for filling it out (hereinafter referred to as the Rules).

It should be noted that previously there was a Decree of the Government of the Russian Federation dated December 2, 2000 N 914 “On approval of the Rules for maintaining logs of received and issued invoices, purchase books and sales books for value added tax calculations.” The procedure for filling out the line “Consignor and his address” established by this document has not changed.

In accordance with the Rules, line 4 “Consignee and his address” indicates the full or abbreviated name of the consignee in accordance with the constituent documents and his postal address (clause “g”, clause 1 of the Rules). It does not specify what is meant by postal address.

Based on paragraph 1 of Art. 11 of the Tax Code of the Russian Federation, institutions, concepts and terms of civil, family and other branches of legislation of the Russian Federation, used in the Tax Code of the Russian Federation, are applied in the meaning in which they are used in these branches of legislation, unless otherwise provided by the Tax Code of the Russian Federation.

According to clause 2 of the Rules for the provision of postal services, approved by Decree of the Government of the Russian Federation of April 15, 2005 N 221, the postal address is the location of the user indicating the postal code of the corresponding postal facility. That is, the actual address of the organization will be the postal address.

At the same time, the Ministry of Finance of Russia, as well as the tax authorities, previously (during the period of validity of Decree of the Government of the Russian Federation of December 2, 2000 N 914) expressed the opinion that the invoice should indicate the addresses of the seller and buyer in accordance with their constituent documents, and not actual (postal) addresses (letters from the Ministry of Finance of Russia dated October 16, 2009 N 03-07-14/98, dated March 31, 2008 N 03-07-11/129, dated August 7, 2006 N 03-04-09/15, Federal Tax Service of Russia for Moscow dated December 13, 2006 N 19-11/109634, UMNS for Moscow dated July 1, 2004 N 24-11/43467, dated April 19, 2004 N 24-11/26608).

At the same time, the indication of the actual address in the invoice when the actual and legal addresses do not match has been the subject of numerous disputes with the tax authorities, and on this basis the latter often refuse to apply a VAT tax deduction to organizations.

An analysis of arbitration practice shows that when considering disputes regarding the indication of a company’s address on invoices, the courts side with taxpayers, pointing out that Art. 169 of the Tax Code of the Russian Federation does not contain requirements regarding which address of the consignee (legal, actual, warehouse address) must be indicated in the invoice (resolution of the Fifteenth Arbitration Court of Appeal dated May 18, 2012 N 15AP-4814/12, Ninth Arbitration Court of Appeal dated 01.02 .2012 N 09AP-36132/11, FAS Far Eastern District dated January 25, 2012 N F03-6188/11 in case N A73-1596/2011, FAS Northwestern District dated January 14, 2010 N A56-48015/2007, FAS North Caucasian District dated December 28, 2009 N A53-22251/2008).

The reasoning for this is as follows.

In accordance with paragraph 2 of Art. 169 of the Tax Code of the Russian Federation, errors in invoices that do not prevent tax authorities from identifying the seller or buyer of goods (work, services) during a tax audit are not grounds for refusing to accept tax amounts for deduction. Accordingly, indicating the actual address of the taxpayer in invoices cannot serve as a basis for refusing a VAT refund, since this does not create obstacles to tax control.

Thus, the fact that the actual or legal address of the consignee (if they do not match) is indicated in the invoice cannot be a reason for refusing to apply for a VAT tax deduction if all other indicators in this document are filled out correctly. However, given the extensive arbitration practice, it is impossible to exclude the possibility of disagreements with the tax authorities, both in the first and second cases.

It should be noted that after Resolution No. 1137 came into force, the position of the Russian Ministry of Finance became more restrained. In their explanations on this issue, specialists from the financial department began to limit themselves to references to the provisions of the Rules, indicating that filling out line 4 of the invoice is possible, for example, on the basis of a similar indicator of the consignment note in form N TORG-12 (letter dated June 13, 2012 N 03- 07-09/61).

Another letter dated May 15, 2012 N 03-07-09/54 provides explanations for filling out individual columns of invoices for services provided. Thus, in columns 2, 2a, 3 and 4, respectively, the code, symbol (national) of the unit of measurement, quantity and price (tariff) per unit of measurement are indicated. If such indicators cannot be reflected, dashes are added.

For example, regarding filling out the list of details that must be indicated in invoices when selling goods, in a letter dated 04/03/2012 N 03-07-09/31, specialists from the Ministry of Finance of Russia reported only the following: “List of details that must be indicated in invoices issued for the sale of goods (work, services), transfer of property rights, is established by paragraphs 5 and 6 of Article 169 of the Code. At the same time, the provisions of Chapter 21 of the Code do not prohibit the reflection of additional details (information) in invoices.”

In the letter dated 05/02/2012 N 03-07-09/44, an answer was given (the situation was considered) regarding the preparation of invoices for the daily multiple shipment of goods to different retail outlets of the same buyer. As noted by specialists from the financial department, line 4 “Consignee and his address” of the invoice indicates the full or abbreviated name of the consignee in accordance with the constituent documents and his postal address (i.e., as we noted above, only to the provisions of the Rules). Moreover, if line 4 “Consignee and his address” of the invoice does not indicate the addresses of the buyer’s retail outlets to which the seller delivers the goods, then, in the opinion of the Ministry of Finance of Russia, such an invoice is not a basis for refusing to accept deduction of amounts VAT. However, the document should not prevent the tax authorities from identifying the above information when conducting a tax audit. Errors in invoices mentioned in the second paragraph of clause 2 of Art. 169 of the Tax Code of the Russian Federation are not grounds for refusing to accept VAT amounts for deduction. Among them are errors that do not prevent the tax authorities from identifying the buyer of goods (work, services, property rights) during a tax audit.

Thus, following the explanations of the specified letter, if the goods are intended for several retail outlets of the buyer at once, then in line 4 “Consignee and his address” you do not need to indicate the specific address of the retail outlet. Instead, it makes sense to include in it the name of the main consignee, that is, the buyer, in accordance with the constituent documents and his postal address.

Reflection of a document of the first status in tax accounting

The selling and buying parties determine expenses and profits using UTD documents.

Seller's income tax

The date of recognition of official income is the period of sale of goods, services, and property rights of ownership. The amount of material benefit received is determined on the basis of accounting documentation and other papers subject to tax accounting.

Buyer's income tax

The situation is similar with the recipient. The day of expenditure transactions is considered to be the actual moment when goods items, works were accepted according to the UTD transfer papers, and the services provided were consumed.

What errors in the invoice are material for deduction?

Based on clarifications from the Ministry of Finance and the Federal Tax Service, we will highlight examples of errors that will lead to denial of the deduction:

- Violation of the deadlines for issuing an invoice, especially regarding its issuance before the execution of the shipping documents themselves and the implementation of the sale of goods, works, and services.

- Inconsistency of the address of the seller or buyer with the addresses from the unified state registers of organizations and entrepreneurs.

- Reflection of an erroneous TIN of the seller or buyer.

- Distortion of the product name.

- Indication of an incorrect quantity or incorrect price of a product, due to which the indicator in column 5 is not equal to the product of the indicators in columns 3 and 4.

- Reflection of an erroneous tax rate.

- Presence of a facsimile instead of a live signature of the director, chief accountant or other authorized persons.

There are other errors that may lead to disputes with the tax authorities and subsequent denial of the deduction. Therefore, if errors are discovered in a document, it is best to study the explanations of officials and judicial practice in order to understand what tax risks this or that error may lead to. And if the risks of refusal are high, then it is worth contacting the economic entity that issued the invoice with a request to reissue the documents.

Why do many organizations and entrepreneurs refuse to use the UTD document?

The block of signatures on the universal transfer form is quite voluminous. It is not always possible to place all the required information on one sheet of paper. Because of this, small fonts are often used when typing, making them difficult to read.

In addition, the new documentation does not enjoy much confidence among accountants (this is mainly due to the deduction of VAT). When switching to working with UTD papers, find out in advance whether this option is suitable for your counterparties. It would be a good idea to coordinate the implementation of the updated form with regular partners.

Separately, it should be said about the need to automate internal processes in any commercial organization, regardless of whether it works with UPD documents or not. You can make the work of enterprise employees easier and automate reception and transfer using special mobile accounting systems. The right decision in this case would be to purchase software for solving business problems in wholesale or retail trade in our company. The software presented in the catalog is compatible with most models of modern trading and accounting equipment. All the information you are interested in can be obtained on the official website cleverence.ru.

What are the requirements for issuing an invoice?

First of all, the invoice must be issued on a valid form. Currently, the form approved by Government Decree No. 1137 dated December 26, 2011 is used (as amended by Decree No. 981 dated August 19, 2017). Using any other form may result in the tax authorities refusing the deduction.

The invoice form has been updated by Decree of the Government of the Russian Federation dated 04/02/2021 No. 534 (comes into force on 07/01/2021). The changes are related to the introduction of a goods traceability system in the Russian Federation.

Amendments to the Tax Code of the Russian Federation provide that when selling traceable goods, invoices, including adjustment ones, must be issued in electronic form.

Also, the invoice must contain all mandatory details (date and document number, identification of the seller and buyer, name of the goods sold (works, services, etc.), its volume, cost, tax rate, tax amount, etc.) . If any of these details are missing, submitting an application for deduction is impossible.

The updated invoice form looks like this:

Another requirement for an invoice is the absence of errors critical for deduction. We will look at what these errors are in the next section.

Conclusion

For many who are just beginning to understand the nuances of designing a universal form, this task seems too difficult.

And since the document is not mandatory, not everyone uses it - and in vain. In fact, studying the intricacies of creating documentation, figuring out how to fill out column B in the UPD, finding out what the content of the operation is is much easier than it seems at first glance. But it is the UPD form that allows you to significantly reduce the volume of document flow and thereby facilitate the work of an organization or individual entrepreneur. Number of impressions: 15833