During this difficult period of the spread of coronavirus infection for everyone, some employers had to fire some of their staff. At the same time, there will probably be those who did this in violation of labor laws. Therefore, it is possible that cases of employees being reinstated at work by court decision will soon become more frequent. We tell you how to formalize reinstatement, what payments are due to the reinstated employee and how to reflect them for tax purposes.

Reinstatement means returning the employee to the legal position that existed before dismissal. He is restored in all his rights: to work (labor function - work according to the position in accordance with the staffing table), stipulated by his employment contract and its components, to the corresponding wages, etc. Thus, all conditions previously provided to him in accordance with the employment contract continue to apply to the employee. Such clarifications were given by the Ministry of Labor of the Russian Federation in letter dated 06/03/2019 No. 14-2/OOG-3951.

In this case, the court decision to reinstate the employee at work must be executed by the employer immediately (Article 396 of the Labor Code of the Russian Federation). True, what exactly is meant by immediate execution is not explained by the provisions of the current legislation. In practice, an approach has been formed that “immediately” means the day after the court’s decision.

However, if the employer did not know about the decision made by the court due to the absence of his representative at the court hearing, then after receiving a copy of the court decision or other reliable information about the decision in favor of the employee, he is obliged to immediately reinstate the employee at work.

If the employer did not comply with the court decision voluntarily, then the demands for reinstatement at work must be fulfilled no later than the first working day after the date of receipt of the writ of execution by the bailiff department (Clause 4 of Article 36 of the Federal Law of October 2, 2007 No. 229-FZ).

The concept of forced absenteeism according to the Labor Code of the Russian Federation

The Labor Code does not define the term “forced absenteeism.” Traditionally, it is believed that this is the absence of working days by an employee due to the direct fault of the employer. For example, a boss wants to fire a worker, but the latter does not seek to draw up a resignation letter of his own free will. The employer literally forces the employee to leave by not allowing him to enter the workplace. The worker cannot continue to work, which can be considered forced absenteeism (AF). As a rule, this concept is associated specifically with illegal dismissal.

The concept of forced absenteeism is set out in the following articles of the Labor Code of the Russian Federation:

- Article 373 . Establishes the employer’s obligation, in the event of illegal dismissal, to restore the employee to his previous rights, as well as to pay for all days of forced absence.

- Article 391 . A person, if he cannot get a job due to an illegal entry in the work book or due to failure to issue a work book, can recover through the court from the employer compensation for days of temporary work leave.

- Article 234 . Establishes the need for the employer to pay compensation to the employee in the amount of average earnings for days of temporary work.

The Labor Code of the Russian Federation protects the rights of workers. If an employer infringes on the interests of an employee, the latter may appeal to the labor inspectorate or court.

In what cases does forced absenteeism occur?

Absenteeism may be considered forced in the following circumstances:

- The employer is trying to force an employee to leave the organization by not allowing him to enter the workplace. This fact needs to be confirmed. Witness statements, photos and videos are used as evidence.

- Transferring an employee to a position with less pay without sufficient grounds.

- Refusal to hire a person without any reason.

- An employer illegally dismisses an employee “under an article” (for example, the dismissal occurs due to the worker’s absenteeism, but the fact of failure to appear at the workplace is not confirmed or documented in any way). Due to this, a person cannot get a job.

- The employer does not issue the employee with a work book upon his dismissal. This again makes it difficult to get a job. A person is forced to sit at home rather than continue his work activity.

In all these cases, the employer commits an offense. He is obligated not only to make all necessary payments for the period of VP, but also to eliminate the violation of the law. For example, reinstate an employee or remove a negative entry from his work record.

Concept

Forced absenteeism is a period of time during which an employed citizen was absent from the workplace for reasons beyond his control.

This kind of need arises at the initiative of the employer.

Most often this is due to the following circumstances:

- unjustified dismissal (from a legal point of view);

- untimely issuance of an employee’s work book by the organization;

- retroactive execution of an employment agreement;

- presence of errors in the work book;

- illegal transfer to a lesser position.

The current legislation does not provide for this type of leave at the initiative of the employee.

It should also be noted that it does not clearly define the concept of time off.

At the same time, thinking logically, we can come to the conclusion that in this case the employee’s forced absence from the workplace through his own fault may be due to the need to visit a medical facility.

To prove a good reason why this act was committed, the citizen must provide the employer with a sick leave or outpatient card with the corresponding entry. An equally significant reason for absenteeism is participation in a court hearing.

How is the duration of forced absence determined?

It is extremely important to determine the duration of the VP, since in order to calculate compensation you need to know the time frame for which accruals occur. The period of absenteeism is the time between the date of dismissal (the first forced absence from work) and the date of the decision of the legal structure (court).

Example 1

On May 15, 2016, the person was illegally fired under the article “absenteeism.” He immediately filed a claim in court to restore his rights. On June 15, a court ruling came into force, according to which the employer is obliged to remove the illegal in this case wording of dismissal from the work book, and also reinstate the employee in his position. The period of forced absence in this case is a month. The employer must pay compensation for all these days.

The procedure for recovery from the employer

In a situation in which a citizen has been suspended from performing his official duties due to the fault of the company’s management, he can appeal to higher authorities to protect his rights.

In this case, going to court is considered the most effective. Payment of appropriate compensation is carried out on the basis of a decision made by a government agency.

To contact the specified authority, an employee whose rights have been violated must prepare a special statement of claim.

An important point is the correctness of its design.

Subsequently, a court hearing is scheduled, following which a document is issued that serves as the basis for collecting average earnings from the employer - an order.

This is how an employee can hold the employer financially liable for violating worker rights.

How to file a claim with the courts?

A citizen can go to court both to receive compensation for removal from work for unjustified reasons, and to recover compensation for moral damage.

To do this, he must draw up a special statement of claim.

The document must reflect the following information:

- full name of the judicial authority;

- Full name of the plaintiff, actual address of his residence;

- information about the employer - address of the company, full name of the manager, indication of the form of labor activity;

- document's name;

- text outlining the essence of the problem:

— date of hiring;

— the position for which the employee was assigned;

— indication of the moment of absence of violation during the performance of official duties;

- the reason for forced absence with a description of the details. For example, if a citizen was unreasonably dismissed, the date of this event and the rationale for his opinion should be indicated - why he believes that the dismissal was unlawful;

- reference to Article 234 of the Labor Code of the Russian Federation - in accordance with it, the employer’s obligation to pay compensation for illegal dismissal is determined;

- assessment of moral damage;

- the plaintiff’s requests for the recovery of average earnings, for the issuance of the necessary documentation;

- list of attachments - employment contract, various certificates and orders that act as confirmation of the information presented;

- applicant's signature, transcript;

- document submission date.

statement of claim to the court for reinstatement in case of illegal dismissal and recovery of average earnings from the employer - word.

Sample certificate of average salary for the court

The calculation of average earnings is usually carried out by the court itself based on the data provided on a person’s income for the last 12 months.

A citizen must obtain this certificate at his place of work.

To confirm the level of income on the basis of which the amount of compensation for absenteeism is determined, a certificate of the employee’s average earnings is submitted to the court.

It should contain the following information:

- company name, TIN, OGRN, KPP;

- Title of the document;

- initials and position of the citizen, information about which is included in the certificate;

- the amount of average earnings for a certain period of time;

- the basis on which the employer was guided when making calculations - Article 139 of the Labor Code of the Russian Federation;

- signatures of the compilers - chief accountant and director of the organization;

- date of writing;

- phone number and full name of the performer.

certificate of salary for 12 months for the court - word.

How is forced absence paid?

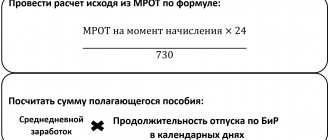

For each day of absenteeism through no fault of the employee, compensation equal to the average salary of the employee per shift is accrued. First, the accountant must determine the average salary of the employee.

ATTENTION! The rules for calculating average income are set out in Article 139 of the Labor Code of the Russian Federation. They are also recorded in Decree of the Government of the Russian Federation dated December 24, 2007 No. 922.

Calculation of payments to an employee during VP

How will the average employee income be calculated in this case? When calculating, the following sources of the worker’s earnings are taken into account:

- Salary.

- Premium.

- Various surcharges.

- Allowances.

ATTENTION! The calculations do not take into account benefit payments and contributions to the pension fund. That is, before determining official earnings, they must be subtracted from the employee’s income.

To determine average income, you must first calculate the employee's total income since the beginning of the year. For example, on February 1 he received 31,700 thousand. From this amount, standard charges to the funds are deducted, amounting to 1,700 rubles. The resulting amount must be divided by the number of days from the beginning of the year. It turns out 1,000 rubles. This is the employee's daily income.

IMPORTANT! When calculating, only the official salary of the employee is taken into account. For example, if a worker officially received only 8,000 rubles, but his unofficial salary was 100,000 rubles, calculations will be made based on the official 8,000 rubles. That is why it is beneficial for an employee to have a “white” salary.

What's next?

The average daily wage of a person is multiplied by the number of days of temporary work. For example, absenteeism due to the fault of the employer was 30 days. The average daily salary is 1,000 rubles. The amount of payments in this case will be 30,000 rubles.

Are payments subject to personal income tax?

Payments for the WP period can be considered a regular salary. Therefore, they will be taxed at the standard rate of 13%.

Personal income tax cannot be withheld

Suppose the firm makes no other payments to the individual. In such a situation, she should inform the taxpayer and the tax service at her place of registration in writing about the impossibility of withholding personal income tax and its amount. This must be done no later than one month from the end of the tax period (calendar year) in which the relevant circumstances arose (clause 5 of Article 226 of the Tax Code of the Russian Federation).

Reference

A message about the impossibility of withholding personal income tax and the amount of tax in accordance with paragraph 5 of Article 226 of the Tax Code of the Russian Federation is submitted in form 2-NDFL. It was approved by order of the Federal Tax Service of Russia dated November 17, 2010 No. ММВ-7-3/611.

Then the individual himself will have to calculate, declare and pay personal income tax in accordance with subparagraph 4 of paragraph 1 of Article 228 of the Tax Code of the Russian Federation. Similar explanations are given in letters of the Ministry of Finance of Russia dated 04/07/2014 No. 03-04-06/15507, dated 09.20.2013 No. 03-04-06/39111, dated 08.28.13 No. 03-04-06/35386, as well as in the letter Federal Tax Service of Russia dated October 28, 2011 No. ED-4-3/17996.

Thus, the procedure for withholding personal income tax depends on whether the court, when making a decision, divided the amounts due to the individual and subject to withholding from him. And if not, does the company pay other income to the taxpayer?

Tax consultant O.L. Alekseeva

, for the magazine “Regulatory Acts for Accountants”

Fresh documents for accounting

Every day, on your computer, the latest documents that affect your work. Laws, regulations, letters and orders - all regulations on accounting and tax rules. Find out more >>

If you have a question, ask it here >>

Reflection of payments in accounting

Data in accounting, according to the Letter of the Ministry of Finance dated June 17, 2016, must be entered simultaneously with the elimination of the offense against the employee. For example, if an illegal dismissal occurs, the accountant enters information simultaneously with the employee’s reinstatement and the order for his dismissal is cancelled. Payments for the period of forced absence and accrued insurance premiums can be included in expenses in the general manner.

Example 2

The employee was illegally fired in February. He went to court to restore his rights. The court upheld his claim and ordered the employer to pay 110,000 rubles for the period of temporary detention. The employee was reinstated and received funds in full. As of the date of compensation:

- The employee does not have the right to a standard personal income tax deduction.

- The amount of compensation does not exceed the maximum amount accepted for calculating insurance premiums.

The accountant makes the following entries:

- DT20 (25, 26, 44) KT70. Explanation: calculation of average earnings. Amount: 110,000 rubles.

- DT20 (25, 26, 44) KT69. Explanation: calculation of insurance premiums. Amount: 33,220 rubles (110,000 * 30.2%).

- DT70 KT50. Explanation: payment of compensation to an employee. Amount: 110,000 rubles.

- DT70 KT68. Explanation: personal income tax withholding. Amount: 14,300 rubles (110,000 * 13%).

This is the standard procedure for recording information in accounting.

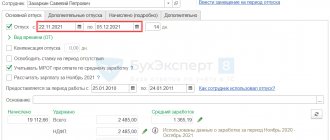

Calculation example

For understanding, we will give a specific example of calculating payments for forced absences

At the initiative of the employer Kazantsev T.A. dismissed on September 30, 2017. The employee started working on February 16, 2018 based on a court decision

Attention

Forced absence subject to payment is the time period from 10/01/2017 (the day following the day of dismissal) to 02/15/2018.

- We determine the average salary for the 12 calendar months preceding the month of dismissal. A calendar month is considered to be 30 (31) days long, February – 28 (29) days.

- We calculate the amount of payment.

Initial data:

Kazantseva’s monthly salary, taking into account bonuses and long service bonuses, is 40 tr.

In August 2022, the employee received a bonus for completing a particularly important task in the amount of 10 thousand rubles.

The total amount of accrued wages for the period from 10/01/2016 to 09/30/2017 amounted to 490 rubles, including:

| Month year | Number of working days | Earnings amount |

| October 2016 | 23 | 40 t.r. |

| November2016 | 18 | 40 t.r. |

| December 2016 | 23 | 40 t.r. |

| January 2017 | 15 | 40 t.r. |

| February 2017 | 19 | 40 t.r. |

| March 2017 | 21 | 40 t.r. |

| April 2017 | 22 | 40 t.r. |

| May 2017 | 17 | 40 t.r. |

| June 2017 | 20 | 40 t.r. |

| July 2017 | 23 | 40 t.r. |

| August 2017 | 21 | 50 t.r. |

| September 2017 | 22 | 40 t.r. |

| TOTAL: | 244 | 490 tr. |

SMZ = 490/244 = 2008.2 rubles

The period of forced absence by T.A. Kazantseva is 90 days .

We multiply 90 (days) by 2008.2 rubles (average daily earnings), we get 180,738 rubles .

Additional compensation

The employee can also count on additional compensation for moral damage caused. The decision on the obligation to pay it is made by the court. The amount of compensation depends on the employee’s requirements, as well as the judge’s decision. For example, a worker may request a million rubles, but the judge will assess the moral damage caused as a lesser amount and oblige the employer to pay 10,000 rubles.

IMPORTANT! When such cases are initiated, compensation does not automatically accrue. To receive them, you must indicate the corresponding requirement in your claim.

How to withhold personal income tax

How can a company withhold personal income tax on amounts of money that it must pay by court decision if they are not exempt from taxation in accordance with Article 217 of the Tax Code of the Russian Federation? After all, the company, as the guilty party, cannot pay the injured party an amount of money less than that indicated in the court document containing the result of the dispute resolution. The fact is that the court recognizes this as a failure to comply with its decision.

Let us note that judicial acts of the arbitration court and courts of general jurisdiction that have entered into legal force are binding on everyone. Including organizations, officials, citizens throughout the Russian Federation. Their failure to comply, as well as failure to comply with the requirements of arbitration courts, entails liability established by law (clauses 1 and 2 of Article 16, Article 119, Article 332 of the Arbitration Procedure Code of the Russian Federation, clauses 2 and 3 of Article 13 of the Code of Civil Procedure of the Russian Federation ).

In this case, the debtor company, in accordance with civil procedural legislation, may, at the stage of consideration of the case, draw the court’s attention to the need to determine the debt subject to collection, taking into account the requirements of the legislation on taxes and fees.

The court may listen and reflect in the decision two amounts: that which is due to the individual, and the personal income tax subject to withholding. Then the total amount of debt under the court document must be reduced by the company by personal income tax directly upon actual repayment of the debt in accordance with paragraph 4 of Article 226 of the Tax Code of the Russian Federation.

Calculation of downtime and absenteeism at the expense of the employer 2020-2021

Labor Code of the Russian Federation (as amended on July 27, 2010)

Article 157. Payment for downtime

Downtime (Article 72_2 of this Code) due to the fault of the employer is paid in the amount of at least two-thirds of the employee’s average salary (as amended by Federal Law No. 90-FZ of June 30, 2006 - see. previous edition).

Downtime for reasons beyond the control of the employer and employee is paid in the amount of at least two-thirds of the tariff rate, salary (official salary), calculated in proportion to the downtime (as amended, entered into force on October 6, 2006 by the Federal Law of June 30 2006 N 90-FZ, see previous edition).

Downtime caused by the employee is not paid.

About the beginning of downtime caused by equipment breakdown and other reasons that make it impossible for the employee to continue to perform his job functions, the employee is obliged to inform his immediate supervisor or another representative of the employer (part additionally included on October 6, 2006 by Federal Law of June 30, 2006 N 90- Federal Law).

If creative workers of the media, cinematography organizations, television and video crews, theaters, theatrical and concert organizations, circuses and other persons involved in the creation and (or) performance (exhibition) of works, in accordance with the lists of works, professions, positions these workers, approved by the Government of the Russian Federation taking into account the opinion of the Russian Tripartite Commission for the Regulation of Social and Labor Relations, for any period of time do not participate in the creation and (or) performance (exhibition) of works or do not perform, then the specified time is not downtime and may be paid in the amount and manner established by a collective agreement, a local regulatory act, an employment contract (part additionally included on October 6, 2006 by Federal Law of June 30, 2006 N 90-FZ; as amended, entered into force on March 30, 2008 Federal Law of February 28, 2008 N 13-FZ, see previous edition).

Article 220. Guarantees of the right of workers to work in conditions that meet labor protection requirements

The state guarantees workers the protection of their right to work in conditions that meet labor protection requirements.

The working conditions provided for in the employment contract must comply with labor protection requirements.

During the suspension of work in connection with the suspension of activities or a temporary ban on activities due to violation of state regulatory requirements for labor protection through no fault of the employee, his place of work (position) and average earnings are retained. During this time, the employee, with his consent, may be transferred by the employer to another job with remuneration for the work performed, but not lower than the average earnings for the previous job (as amended as amended on August 12, 2005 by Federal Law of May 9, 2005 N 45-FZ; supplemented on October 6, 2006 by Federal Law of June 30, 2006 N 90-FZ - see previous edition).

If an employee refuses to perform work in the event of a danger to his life and health (except for cases provided for by this Code and other federal laws), the employer is obliged to provide the employee with another job while such danger is eliminated (part supplemented from August 12, 2005 by the Federal Law of May 9, 2005 N 45-FZ; as amended, put into effect on October 6, 2006 by Federal Law of June 30, 2006 N 90-FZ - see previous edition).

If providing another job for objective reasons is impossible for an employee, the employee’s downtime until the danger to his life and health is eliminated is paid by the employer in accordance with this Code and other federal laws.

If the employee is not provided with personal and collective protective equipment in accordance with established standards, the employer does not have the right to require the employee to perform work duties and is obliged to pay for downtime arising for this reason in accordance with this Code.

An employee’s refusal to perform work in the event of a danger to his life and health due to violation of labor protection requirements or from performing heavy work and work with harmful and (or) dangerous working conditions not provided for in the employment contract does not entail bringing him to disciplinary liability .

In the event of harm to the life and health of an employee during the performance of his job duties, compensation for said harm is carried out in accordance with federal law.

In order to prevent and eliminate violations of state regulatory requirements for labor protection, the state ensures the organization and implementation of state supervision and control over their compliance and establishes the responsibility of the employer and officials for violation of these requirements (as amended, entered into force on October 6, 2006 by the Federal Law of June 30, 2006 N 90-FZ, see previous edition).

Article 139. Calculation of average wages

For all cases of determining the amount of average wages (average earnings) provided for by this Code, a uniform procedure for its calculation is established (part supplemented from October 6, 2006 by Federal Law of June 30, 2006 N 90-FZ - see the previous edition).

To calculate the average salary, all types of payments provided for by the remuneration system are taken into account, applied by the relevant employer, regardless of the sources of these payments (as amended by Federal Law of June 30, 2006 N 90-FZ - see .previous edition).

In any mode of operation, the average salary of an employee is calculated based on the salary actually accrued to him and the time he actually worked for the 12 calendar months preceding the period during which the employee retains his average salary. In this case, a calendar month is considered to be the period from the 1st to the 30th (31st) day of the corresponding month inclusive (in February - to the 28th (29th) day inclusive) (as amended, entered into force on October 6 2006 Federal Law of June 30, 2006 N 90-FZ - see previous edition).

Average daily earnings for vacation pay and compensation for unused vacations are calculated for the last 12 calendar months by dividing the amount of accrued wages by 12 and by 29.4 (average monthly number of calendar days) (as amended as amended on October 6, 2006 Federal Law of June 30, 2006 N 90-FZ, see previous edition).

The average daily earnings for payment of vacations granted in working days, in cases provided for by this Code, as well as for payment of compensation for unused vacations, are determined by dividing the amount of accrued wages by the number of working days according to the calendar of a six-day working week.

A collective agreement or local regulatory act may provide for other periods for calculating average wages, if this does not worsen the situation of workers (part supplemented from October 6, 2006 by Federal Law of June 30, 2006 N 90-FZ - see previous edition) .

The specifics of the procedure for calculating average wages established by this article are determined by the Government of the Russian Federation, taking into account the opinion of the Russian Tripartite Commission for the Regulation of Social and Labor Relations.

Article 394. Making decisions on labor disputes regarding dismissal and transfer to another job

If dismissal or transfer to another job is recognized as illegal, the employee must be reinstated in his previous job by the body considering the individual labor dispute.

The body considering an individual labor dispute makes a decision to pay the employee the average salary for the entire period of forced absence or the difference in earnings for the entire period of performing lower-paid work.

At the request of the employee, the body considering an individual labor dispute may limit itself to making a decision to recover in favor of the employee the compensation specified in part two of this article.

If the dismissal is declared illegal, the body considering the individual labor dispute may, at the request of the employee, decide to change the wording of the grounds for dismissal to dismissal of one’s own free will.

If the wording of the grounds and (or) reasons for dismissal is recognized as incorrect or not in accordance with the law, the court considering an individual labor dispute is obliged to change it and indicate in the decision the grounds and reasons for dismissal in strict accordance with the wording of this Code or other federal law with reference to the relevant article , part of an article, paragraph of an article of this Code or another federal law.

If the dismissal is declared illegal and the term of the employment contract has expired at the time the dispute is being considered by the court, then the court considering the individual labor dispute is obliged to change the wording of the grounds for dismissal to dismissal upon expiration of the employment contract.

If, in the cases provided for by this article, after declaring the dismissal illegal, the court makes a decision not to reinstate the employee, but to change the wording of the grounds for dismissal, then the date of dismissal must be changed to the date of the court’s decision. If, by the time the said decision is made, the employee, after a contested dismissal, has entered into an employment relationship with another employer, the date of dismissal must be changed to the date preceding the day of commencement of work for this employer.

If the incorrect formulation of the grounds and (or) reasons for dismissal in the work book prevented the employee from taking another job, then the court decides to pay the employee average earnings for the entire period of forced absence.

In cases of dismissal without legal grounds or in violation of the established procedure for dismissal or illegal transfer to another job, the court may, at the request of the employee, make a decision to recover in favor of the employee monetary compensation for moral damage caused to him by these actions. The amount of this compensation is determined by the court.

Decree of the Government of the Russian Federation dated December 24, 2007 No. 922

In accordance with Article 139 of the Labor Code of the Russian Federation, the Government of the Russian Federation decides:

1. Approve the attached Regulations on the specifics of the procedure for calculating average wages.

2. The Ministry of Health and Social Development of the Russian Federation shall provide clarifications on issues related to the application of the Regulations approved by this Resolution.

3. Decree of the Government of the Russian Federation of April 11, 2003 No. 213 “On the specifics of the procedure for calculating average wages” (Collected Legislation of the Russian Federation, 2003, No. 16, Art. 1529) shall be declared invalid.

Chairman of the Government of the Russian Federation V. ZUBKOV

Approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922

Regulations on the specifics of the procedure for calculating average wages

1. This Regulation establishes the specifics of the procedure for calculating average wages (average earnings) for all cases of determining its size provided for by the Labor Code of the Russian Federation (hereinafter referred to as average earnings).

2. To calculate average earnings, all types of payments provided for by the remuneration system and applied by the relevant employer are taken into account, regardless of the sources of these payments. Such payments include:

a) wages accrued to the employee at tariff rates, salaries (official salaries) for the time worked;

b) wages accrued to the employee for work performed at piece rates;

c) wages accrued to the employee for work performed as a percentage of revenue from sales of products (performance of work, provision of services), or commission;

d) wages paid in non-monetary form;

e) monetary remuneration (salary) accrued for hours worked to persons holding government positions in the Russian Federation, government positions in constituent entities of the Russian Federation, deputies, members of elected local government bodies, elected officials of local government, members of election commissions operating on a permanent basis;

f) salary accrued to municipal employees for time worked;

g) fees accrued in editorial offices of mass media and art organizations for employees on the payroll of these editorial offices and organizations, and (or) payment for their labor, carried out at the rates (rates) of author's (production) remuneration;

h) wages accrued to teachers of primary and secondary vocational education institutions for hours of teaching work in excess of the established and (or) reduced annual teaching load for the current academic year, regardless of the time of accrual;

i) wages, finally calculated at the end of the calendar year preceding the event, determined by the remuneration system, regardless of the time of accrual;

j) allowances and additional payments to tariff rates, salaries (official salaries) for professional excellence, class, length of service (work experience), academic degree, academic title, knowledge of a foreign language, work with information constituting state secrets, combination of professions (positions) , expanding service areas, increasing the volume of work performed, team management and others;

k) payments related to working conditions, including payments determined by regional regulation of wages (in the form of coefficients and percentage bonuses to wages), increased wages for hard work, work with harmful and (or) dangerous and other special conditions labor, for night work, payment for work on weekends and non-working holidays, payment for overtime work;

l) remuneration for performing the functions of a class teacher to teaching staff of state and municipal educational institutions;

m) bonuses and rewards provided for by the remuneration system;

o) other types of wage payments applicable to the relevant employer.

3. To calculate average earnings, social payments and other payments not related to wages (material assistance, payment for the cost of food, travel, training, utilities, recreation, etc.) are not taken into account.

4. The calculation of the average salary of an employee, regardless of his mode of work, is based on the salary actually accrued to him and the time actually worked by him for the 12 calendar months preceding the period during which the employee retains his average salary. In this case, a calendar month is considered to be the period from the 1st to the 30th (31st) day of the corresponding month inclusive (in February - to the 28th (29th) day inclusive).

Average daily earnings for vacation pay and compensation for unused vacations are calculated for the last 12 calendar months.

5. When calculating average earnings, time is excluded from the calculation period, as well as amounts accrued during this time, if:

a) the employee retained his average earnings in accordance with the legislation of the Russian Federation, with the exception of breaks for feeding the child provided for by the labor legislation of the Russian Federation;

b) the employee received temporary disability benefits or maternity benefits;

c) the employee did not work due to downtime due to the fault of the employer or for reasons beyond the control of the employer and employee;

d) the employee did not participate in the strike, but due to this strike he was not able to perform his work;

e) the employee was provided with additional paid days off to care for disabled children and people with disabilities since childhood;

f) the employee in other cases was released from work with full or partial retention of wages or without payment in accordance with the legislation of the Russian Federation.

6. If the employee did not have actually accrued wages or actually worked days for the billing period or for a period exceeding the billing period, or this period consisted of time excluded from the billing period in accordance with paragraph 5 of these Regulations, the average earnings are determined based on from the amount of wages actually accrued for the previous period, equal to the calculated one.

7. If the employee did not have actually accrued wages or actually worked days for the billing period and before the start of the billing period, the average earnings are determined based on the amount of wages actually accrued for the days actually worked by the employee in the month of occurrence of the event that is associated with the retention average earnings.

8. If the employee did not have actually accrued wages or actually worked days for the billing period, before the start of the billing period and before the occurrence of an event associated with maintaining the average earnings, the average earnings are determined based on the tariff rate established for him, salary (official salary ).

9. When determining average earnings, average daily earnings are used in the following cases:

to pay for vacations and pay compensation for unused vacations; for other cases provided for by the Labor Code of the Russian Federation, except for the case of determining the average earnings of workers for whom summarized recording of working time is established.

The average employee's earnings are determined by multiplying the average daily earnings by the number of days (calendar, working) in the period subject to payment.

Average daily earnings, except in cases of determining average earnings for vacation pay and payment of compensation for unused vacations, are calculated by dividing the amount of wages actually accrued for days worked in the billing period, including bonuses and remunerations taken into account in accordance with paragraph 15 of these Regulations, by the number of days actually worked during this period.

10. Average daily earnings for payment of vacations provided in calendar days and payment of compensation for unused vacations are calculated by dividing the amount of wages actually accrued for the billing period by 12 and by the average monthly number of calendar days (29.4). If one or more months of the billing period are not fully worked out or time is excluded from it in accordance with paragraph 5 of these Regulations, the average daily earnings are calculated by dividing the amount of actually accrued wages for the billing period by the sum of the average monthly number of calendar days (29.4) , multiplied by the number of complete calendar months, and the number of calendar days in incomplete calendar months.

The number of calendar days in an incomplete calendar month is calculated by dividing the average monthly number of calendar days (29.4) by the number of calendar days of this month and multiplying by the number of calendar days falling on the time worked in this month.

11. Average daily earnings for payment of vacations provided in working days, as well as for payment of compensation for unused vacations, are calculated by dividing the amount of actually accrued wages by the number of working days according to the calendar of a 6-day working week.

12. When working on a part-time basis (part-time, part-time), the average daily earnings to pay for vacations and pay compensation for unused vacations are calculated in accordance with paragraphs 10 and 11 of these Regulations.

13. When determining the average earnings of an employee for whom a summarized recording of working time has been established, except for the cases of determining the average earnings for paying for vacations and paying compensation for unused vacations, the average hourly earnings are used.

Average hourly earnings are calculated by dividing the amount of wages actually accrued for hours worked in the billing period, including bonuses and remunerations taken into account in accordance with paragraph 15 of these Regulations, by the number of hours actually worked during this period.

Average earnings are determined by multiplying average hourly earnings by the number of working hours according to the employee’s schedule in the period subject to payment.

14. When determining the average earnings for payment of additional educational leaves, all calendar days (including non-working holidays) falling during the period of such leaves provided in accordance with the educational institution’s certificate are subject to payment.

15. When determining average earnings, bonuses and remuneration are taken into account in the following order:

monthly bonuses and rewards - actually accrued in the billing period, but no more than one payment for each indicator for each month of the billing period;

bonuses and remunerations for a period of work exceeding one month - actually accrued in the billing period for each indicator, if the duration of the period for which they are accrued does not exceed the duration of the billing period, and in the amount of the monthly part for each month of the billing period, if the duration of the period for which they are accrued exceeds the duration of the billing period;

remuneration based on the results of work for the year, a one-time remuneration for length of service (work experience), other remunerations based on the results of work for the year, accrued for the calendar year preceding the event - regardless of the time the remuneration was accrued.

If the time falling within the billing period is not fully worked or time is excluded from it in accordance with paragraph 5 of these Regulations, bonuses and remunerations are taken into account when determining average earnings in proportion to the time worked in the billing period, with the exception of bonuses accrued for actual hours worked. time in the billing period (monthly, quarterly, etc.).

If an employee has worked an incomplete working period for which bonuses and rewards are accrued, and they were accrued in proportion to the time worked, they are taken into account when determining average earnings based on the amounts actually accrued in the manner established by this paragraph.

16. When tariff rates, salaries (official salaries), and monetary remuneration increase in an organization (branch, structural unit), the average earnings of employees increase in the following order:

if the increase occurred during the billing period, payments taken into account when determining average earnings and accrued in the billing period for the period of time preceding the increase are increased by coefficients that are calculated by dividing the tariff rate, salary (official salary), monetary remuneration established in the month of occurrence the case associated with maintaining average earnings, on tariff rates, salaries (official salaries), monetary remuneration established in each month of the billing period;

if the increase occurred after the billing period before the occurrence of an event that is associated with maintaining the average earnings, the average earnings calculated for the billing period increase;

if the increase occurred during the period of maintaining average earnings, part of the average earnings is increased from the date of increase in the tariff rate, salary (official salary), monetary remuneration until the end of the specified period.

When increasing average earnings, tariff rates, salaries (official salaries), monetary remuneration and payments established to tariff rates, salaries (official salaries), monetary remuneration in a fixed amount (interest, multiple), with the exception of payments established to tariff rates, are taken into account. salaries (official salaries), monetary remuneration in a range of values (percentage, multiple).

When average earnings increase, payments taken into account when determining average earnings, established in absolute amounts, do not increase. 17. The average earnings determined to pay for the time of forced absence are subject to increase by a coefficient calculated by dividing the tariff rate, salary (official salary), monetary remuneration established for the employee from the date of actual start of work after his restoration to his previous job, by the tariff rate, salary (official salary), monetary remuneration established in the billing period, if during the forced absence in the organization (branch, structural unit) tariff rates, salaries (official salaries), monetary remuneration were increased.

At the same time, in relation to payments established in a fixed amount and in an absolute amount, the procedure established by paragraph 16 of these Regulations applies.

18. In all cases, the average monthly earnings of an employee who has worked the full working hours during the billing period and fulfilled labor standards (job duties) cannot be less than the minimum wage established by federal law.

19. For persons working part-time, the average earnings are determined in the manner established by these Regulations.