Step-by-step instruction

Attention! The VAT rate has been changed from 01/01/2019 from 18% to 20% and from 18/118 to 20/120.

Let's look at the actions in 1C using the following example.

The organization produces women's shoes.

On January 29, the product “Megan” women’s sandals (500 pairs) was produced, for which the following was used:

- eco-leather “Lazur” - 250 linear meters;

- insoles - 500 pairs;

- shoe decorations with rhinestones - 1,000 pcs.

In addition, the Organization entered into an agreement with Zolushka LLC for the supply of women's shoes.

On January 30, the first batch of women's shoes worth RUB 177,000 was shipped. (incl. VAT 18%):

- Women's sandals “Megan” – 150 pcs. at a price of RUB 1,180.

Accounting for costs of production and release of finished products in 1C 8.3

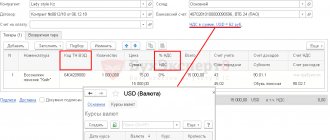

Document production output with the document Production Report for a Shift in the section Production – Product Output – Production Reports for a Shift – Create button.

Reflect material costs for production on the Materials or in the document Requirement invoice .

Postings according to the document

The document generates transactions:

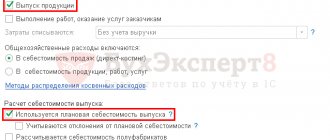

- Dt Kt 20.01 - release of finished products only in quantitative terms, because Planned cost is not used.

- Dt 20.01 Dt 10.01 - release of materials into production.

Sales of finished products produced during the month of production

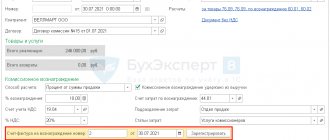

Document the sale of finished products with the document Sales (act, invoice) transaction type Goods (invoice) in the section Sales – Sales – Sales (acts, invoices).

In the tabular section, indicate the products sold from the Nomenclature directory:

- Accounts are filled in the document automatically, depending on the settings in the Item Accounts .

For the item type Products, default Accounting Account “Finished Products”, but it can be changed manually in the document.

Specify the nomenclature group related to the sale of products of your own production in the Nomenclature groups for the sale of products and services, section Main - Settings - Taxes and reports - Income Tax tab - link Nomenclature groups for the sale of products and services. The correct completion of the income tax return depends on this setting.

Read more Setting up accounting policies

Postings according to the document

If the product is sold in the month of its production, i.e. before the formation of the actual cost, then the amount for posting Dt 90.02.1 Kt will be equal to:

- The planned cost of finished products, if the planned cost of production is used when calculating output.

- Zero if the planned cost of production is not used when calculating output.

The document generates transactions:

- Dt 90.02.1 Kt - write-off of the cost of finished products without an amount, because production was carried out without using planned prices.

- Dt 62.01 Kt 90.01.1 - revenue from the sale of finished products: in accounting accounting, including VAT;

- in NU excluding VAT;

If there is a balance of finished products in accounting at the beginning of the month, then in the Sales document (act, invoice) the cost of goods sold will be formed taking into account this balance and the Method of estimating inventories (FIFO, average) established in the Accounting Policy. But the final cost will be formed after completing the Month Closing procedure.

Finished product accounting

After the products have gone through all stages of production, they are shipped to the warehouse for subsequent sale to customers. In this case, the accounting department of the enterprise needs to determine the cost of finished products.

Let's consider accounting and tax accounting of finished products.

Accounting

In accounting, the cost of finished products in the warehouse is reflected in account 43 “Finished products” at actual cost. This is stated in clause 5 of the Accounting Regulations “Accounting for Inventories” (PBU 5/01), approved by Order of the Ministry of Finance of the Russian Federation dated 06/09/01 No. 44n.

However, in analytical accounting, an enterprise can use accounting prices. The following can be used as a discount price:

- actual cost of finished products;

- standard cost of finished products;

Let's look at these options in more detail.

Accounting at actual cost

In this case, finished products in the warehouse are reflected based on the cost of raw materials, materials, semi-finished products, energy used in their production, accrued depreciation of equipment, workers' wages, etc. When selling products, an enterprise can write them off the books:

- at the cost of each unit;

- at average cost;

- at the cost of the first units of product received at the warehouse (FIFO method);

- at the cost of the most recent units of product received at the warehouse (LIFO method). By Order of the Ministry of Finance of the Russian Federation dated March 26, 2007 No. 26n “On Amendments to Regulatory Legal Acts on Accounting”, the LIFO method was excluded from January 1, 2008.

All these methods are provided for in clause 16 of PBU 5/01 “Accounting for inventories”.

Example 1

< The organization produces televisions. As of 01/01/07, there were 2 televisions in the enterprise’s warehouse, the actual cost of each of which was 350,000 rubles. The cost of manufacturing televisions in January 2007 amounted to 1,800,000 rubles. During this month, 6 TVs were released. Thus, the actual cost of one TV was 300,000 rubles. (RUB 1,800,000: 6 pcs.).

In January, 7 televisions were sold. To determine the cost of televisions sold, the company uses the FIFO method. This means that the actual cost of sold TVs was 2,200,000 rubles. (350,000 rub. x 2 pcs. + 300,000 rub. x 5 pcs.).

In January, the company’s accountant will make the following entries: Dt43 - Kt20 - 1,800,000 rubles. — reflects the actual cost of televisions manufactured in January 2007; Dt90 subaccount “Cost of sales” - Kt43 - 2,200,000 rubles. — the actual cost of TVs sold is written off.

At the end of January 2007, there will be one TV left in the warehouse, the cost of which is 300,000 rubles. (this is account balance 43). >

Accounting at standard cost

With this method, a cost lower than the actual cost is usually used as a standard cost. The difference between actual and standard costs is called variance. It can be reflected either on account 43 or on account 40 “Output of products (works, services)”.

To account for finished products at standard cost using account 43, the company needs to open two separate sub-accounts for account 43. One of them reflects the standard cost of finished products, and the other shows the deviation of the actual cost of finished products from the standard.

By writing off finished products from account 43, the company needs to calculate the amount of deviations that accounts for the balance of finished products in the warehouse. This can be done using the following formula:

Os = (He + Op): (Nn + Nn) x But,

where Oc is the amount of deviations attributable to the balance of finished products in the warehouse;

It is the amount of deviations attributable to the balance of finished products in the warehouse at the beginning of the reporting month;

Op - the amount of deviations attributable to products received at the warehouse in the reporting month; Нн - standard cost of the balance of finished products in the warehouse at the beginning of the reporting month;

Нп - standard cost of finished products received at the warehouse in the reporting month; But - the standard cost of the balance of finished products in the warehouse. Then the amount of deviations attributable to the shipped products is calculated using the formula:

Oo = He + Op - Os,

where Оо is the amount of deviations attributable to the shipped products.

Example 2

<At the beginning of February 2007, the company had 10 finished products (bicycles) in stock. The standard cost of one bicycle is 2000 rubles. Consequently, the standard cost of finished products in the warehouse at the beginning of the month was 20,000 rubles. (2000 rub. x 10 pcs.). The amount of deviations is 4000 rubles.

In February 2007, the company produced 100 bicycles, the production costs of which amounted to 250,000 rubles. In the same month, 105 units of finished products were sold. In accounting, the accountant makes the following entries:

Dt43 subaccount “Finished products at standard cost” - Kt20 - 200,000 rubles. (2000 rub. x 100 pcs.) - reflects the standard cost of finished products released in February;

Dt43 subaccount “Deviations of the actual cost of finished products from the standard” - Kt20 - 50,000 rubles. (250,000 - 200,000) - reflects the deviation of the actual cost of finished products produced in February from the standard;

Dt90 subaccount “Cost of sales” - Kt43 subaccount “Finished products at standard cost” - 210,000 rubles. (RUB 2,000 x 105 pcs.) - the standard cost of bicycles sold is written off for sales.

The standard cost of the balance of finished products in the warehouse at the end of February 2007 will be 10,000 rubles. (20,000 + 200,000 – 210,000).

Let's calculate the amount of deviations that accounts for the balance of finished products in the warehouse at the end of February: (4,000 rubles + 50,000 rubles): (20,000 rubles + 200,000 rubles) x 10,000 rubles. = 2454.55 rub. Thus, the balance on account 43 at the end of February 2007 will be 12,454.55 rubles. (10,000 + 2454.55).

Let's calculate the amount of deviations that account for the shipped products: 4,000 rubles. + 50,000 rub. — 2454.55 rub. = 51,545.45 rub.

In accounting, the accountant must make the following entry for this amount:

Dt90 subaccount “Cost of sales” - Kt43 subaccount “Deviation of the actual cost of finished products from the standard” - 51,545.45 rubles. — the deviation of the actual cost of finished products from the standard cost is written off as sales. >

If the enterprise takes into account the deviation of the actual cost of finished products from the standard one in a separate account 40 “Product output (work, Cost of sales” - Kt40), the excess of the actual cost of finished products over the standard one is written off.

If it is revealed that the standard cost exceeds the actual cost, then the following posting is made:

Dt90 subaccount “Cost of sales” - Kt40 - the excess of the standard cost of finished products over the actual one was reversed.

Example 3

<Let’s change the conditions of example 2. Let’s assume that the accounting policy states that finished products in the warehouse are accounted for at standard cost, using account 40 “Product output (work, Cost of sales” - Kt43 - 210,000 rubles (2000 rubles). x 105 pcs.) - the standard cost of bicycles sold is written off; Dt90 subaccount "Cost of sales" - Kt40 - 50,000 rubles (250,000 - 200,000) - the deviation of the actual cost of bicycles from their standard cost is written off (for products shipped in February) .

The balance on account 43 at the end of February 2007 will be 10,000 rubles. (2000 rub. x 5 pcs.). >

Tax accounting

To calculate the cost of finished products in a warehouse in tax accounting, you need to know two quantities: the quantity of finished products and the amount of direct costs attributable to these products.

This is established in paragraph 2 of Art. 319 of the Tax Code of the Russian Federation. Indirect expenses in tax accounting are completely written off as expenses of the current period (clause 2 of Article 318 of the Tax Code of the Russian Federation).

Algorithm for calculating the cost of finished products in a warehouse in tax accounting

1. First, let's calculate the quantity of finished products that remained in the warehouse at the end of the month (K4):

K4 = K1 + K2 - K3,

where K1 is the balance of finished products at the beginning of the month; K2 - the quantity of finished products received at the warehouse in the reporting month; K3 - the quantity of finished products that were shipped to customers in the reporting month.

2. Next, we determine the amount of direct costs related to finished products manufactured in the current month (P4):

P4 = P1 + P2 - P3,

where P1 is direct costs related to work in progress at the beginning of the month; P2 - direct expenses incurred in the current month; P3 - direct expenses related to work in progress at the end of the month.

3. Then the amount of direct expenses related to the balance of finished products in the warehouse at the end of the month (P5) will be determined as follows:

P5 = P4 x (K4 : K3).

4. And finally, let’s calculate the amount of direct costs that relate to shipped products (P6):

P6 = P7 + P4 - P5,

where P7 is the amount of direct expenses related to the balance of finished products at the beginning of the month. Let us illustrate the above with a numerical example.

Example 4

<The organization produces microwave ovens. At the beginning of February 2007, there were 100 microwave ovens in the warehouse. Their cost in tax accounting is 9,000 rubles. Within a month, 1,950 microwave ovens were manufactured, and 2,000 microwave ovens were shipped to customers. Consequently, at the end of February 2007, there were 50 microwave ovens left in the warehouse (100 + 1950 - 2000).

The amount of direct expenses related to work in progress at the beginning of the month amounted to 16,000 rubles, and at the end of the month - 14,000 rubles. For the month, the amount of direct expenses amounted to 175,000 rubles.

Consequently, the amount of direct costs attributable to microwave ovens manufactured in February 2007 is RUB 177,000. (16,0000).

The amount of direct expenses that falls on the balance of microwave ovens in the warehouse at the end of the month will be 4,538.46 rubles. (RUB 177,000 x (50 pcs: 1950 pcs)). This is the tax value of finished products in the warehouse.

The amount of direct costs related to shipped products will be RUB 181,461.54. (9000 + 177,000 – 4538.46) >

Financial statements

Information on the balances of finished products at the end of the reporting year is reflected in the balance sheet in the group of items “Inventories” of Section II “Current Assets”. The indicator for the article “Finished products and goods for resale” is determined by summing the balance at the end of the reporting year in accounts 43 “Finished products” and 41 “Goods”. Finished products as part of inventories at the end of the reporting year are reflected in the balance sheet at a cost determined on the basis of the methods used to evaluate them.

Thus, when using account 40, the assessment of finished products is formed on the basis of a planned calculation of a unit of finished products approved in the current period. The amount of deviations in the actual cost of finished products transferred from the workshop to the warehouse in the current period from the amount of its estimate based on planned calculation is written off to the cost of goods sold.

Consequently, the amount of deviations does not participate in the assessment of finished product balances reflected in line 214 of the balance sheet asset. This accounting procedure is established by the Chart of Accounts for accounting the financial and economic activities of organizations, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n. Thus, finished products are reflected in the balance sheet at the planned cost, and the deviation of the actual cost from the planned one is reflected in the cost of goods sold.

Finished products that are obsolete, have completely or partially lost their original quality, or the current market value of which has decreased, are reflected in the annual balance sheet minus the reserve for a decrease in the value of material assets (clause 25 of PBU 5/01 “Accounting for inventories” , approved by Order of the Ministry of Finance of the Russian Federation dated 06/09/01 No. 44n).

If the finished product is intended for further use in the production process, its cost must be taken into account in account 10 “Materials” and reflected in the balance sheet in the line “Raw materials, materials and other similar values” of the group of items “Inventories” of Section II “Current assets”.

The actual cost of products sold is reflected in the income statement (form No. 2) in the line “Cost of goods, products, works, services sold.”

In practice, situations often occur when products have not been produced and the enterprise does not have work in progress. At the same time, the costs of the current period (wages, depreciation, etc.) cannot be attributed to finished products. And here the question arises: how should these current costs be reflected?

In this case, the costs of the period in which production is not expected are reflected in the same accounts that were used during the period of production activity. However, at the end of the month, the amount of costs for the downtime period should be attributed to future expenses: Dt97 subaccount “Activities in the absence of production” - Kt20 - costs for the downtime period are written off.

The procedure for writing off these expenses to the cost of finished products in subsequent months must be determined in the accounting policy. In tax accounting, such expenses are not distributed between reporting periods, but are recognized in the period of their occurrence.

The following documents were used in preparing the article:

- Tax Code of the Russian Federation (part two) dated 05.08.00 No. 117-FZ (adopted by the State Duma of the Federal Assembly of the Russian Federation on 19.07.00).

- Order of the Ministry of Finance of the Russian Federation dated 06/09/01 No. 44n “On approval of the Accounting Regulations “Accounting for Inventories” PBU 5/01″. In ed. dated 11/27/06.

- Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n “On approval of the Chart of Accounts for accounting of financial and economic activities of organizations and instructions for its application.” In ed. from 09.18.06.

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

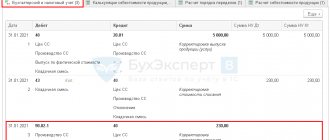

Adjustment of the output of products released during the month in 1C 8.3 when closing the month

When selling finished products produced during the month of production, expenses for accounting and technical documentation will be reflected incorrectly. This is due to the fact that the actual cost has not been formed.

In order for expenses from the sale of finished products to be reflected correctly in account 90.02.1 “Cost of sales for activities with the main tax system”, run the procedure Closing the month operation Adjustment of item cost in the section Operations – Closing the period – Closing the month.

Postings according to the document

The document generates the posting:

- Dt 90.02.1 Kt - adjustment of cost of goods sold.

Control

Let's check the calculation of cost of goods sold:

Study in more detail the formation of the cost of manufactured sandals “Megan”

To access the section, log in to the site.

Revenue recognition options

If revenue is recognized in accounting at the time of shipment, then the cost of goods is written off as:

Are you an expert in this subject area? We invite you to become the author of the Directory Working Conditions

- Dt $90$ – Ct $43$.

At the same time, an increase in customer debt for products is displayed:

- Dr $62$ – Kt $90$,

And the amounts of VAT and excise taxes are calculated:

- Dr $90$ – Kt $68$, $76$.

When recognizing sales revenue after payment by the buyer (a certain time after shipment), then at the time of actual shipment the following entry is made:

- Dt $45$ – Kt $43$ for the amount of actual production or standard cost.

Account $45$ - active, balance sheet, inventory. It is designed to collect information about the availability and movement of shipped products, the proceeds from the sale of which cannot be recognized in accounting for some time (export of products or commission agreement).

The account records products transferred to other organizations for sale on a commission basis. Accounting for goods in the account $45$ is carried out at a cost consisting of the actual production cost and the costs of shipping products (if they are partially written off). The $45$ account is debited in correspondence with the $43$ “Finished Products” or $41$ “Goods” accounts on the basis of executed documents (invoices, acceptance certificates and other documents) for the shipment of goods or their transfer for consignment sale.

Finished works on a similar topic

Course work Accounting and evaluation of shipped products 440 ₽ Abstract Accounting and evaluation of shipped products 230 ₽ Test work Accounting and evaluation of shipped products 250 ₽

Receive completed work or specialist advice on your educational project Find out the cost

Amounts accepted into the $45$ account are written off to the debit of the account simultaneously with the recognition of revenue from the sale of products or upon receipt of a notification from the commission agent about the sale of the products transferred to him. In practice, such notification is made by a document returned to the supplier from safekeeping. At the same time, a document for receiving the cargo is issued at the price indicated by the supplier of the product at the current moment (for goods priced in foreign currency, recalculation is made at the exchange rate on the day of shipment of the goods).

Analytical accounting of the $45$ invoice is carried out by location or by individual types of shipped products.

Synthetic accounting of shipments by assortment is carried out at accounting prices. At the end of the month, the actual cost of shipped products is determined, and the percentage and amount of deviations are calculated.

The amount of deviations is determined based on the percentage of deviations:

Figure 1. Formula for calculating cost variances

The percentage of deviations and the planned cost of shipped products calculate its actual cost and the balance in the warehouse at the end of the month.

On the account $45$, the goods are listed until the revenue is recognized in accounting, after which the goods are written off:

- Dt $43$ – Ct $45$.