Actual cost of inventories in accounting records

The actual cost of inventories received from the disposal (disassembly) of fixed assets is the smallest of the values (clause 16 of FSBU 5/2019):

- the cost of similar inventories in the organization,

- cost of retiring fixed assets, dismantling costs.

IC remaining from the disposal of fixed assets that are planned to be sold are classified not as inventories, but as long-term assets available for sale (LAS).

. Their assessment is carried out according to the rules specified in clause 10.2 of PBU 16/02 “Information on discontinued activities”.

Liquidation commission

To make a decision on partial liquidation of a fixed asset, create a commission that should:

- determine the possibility and feasibility of restoring part of the fixed asset that is subject to liquidation;

- determine the possibility of using individual components, parts, materials of the retiring part of the fixed asset.

The commission should include the chief accountant, employees responsible for the safety of fixed assets, and other employees appointed by order of the head of the organization. The decision on partial liquidation of a fixed asset made by the commission is approved by order of the head of the organization. After the liquidation of part of the fixed asset, an act is drawn up. The commission can draw up an act on partial liquidation of a fixed asset using form No. OS-4 or No. OS-4a.

This procedure follows from paragraph 77 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

DAP cost

DAP

– MC remaining from the disposal of fixed assets, recovered in the process of routine maintenance, repair, modernization, reconstruction, with the exception of the case when such values are classified as reserves (clause 10.1 of PBU 16/02).

DAP is assessed in accounting:

- at the residual value of the disposed fixed assets;

- at zero cost for repairs and modernization.

Subsequent assessment of DAP - in the manner prescribed for inventories (clause 10.2 of PBU 16/02), is reflected in the reporting in Section II “Current assets”.

Until 2022, assets were valued at the market price on the date of their recording (clause 9 of PBU 5/2001):

- Dt 10 Kt 91.01

But!

From an economic point of view, this is not true. At the time of extraction of assets from the liquidation of the OS, no new assets are received, and the organization does not receive economic benefits, because OS was already recognized as an asset of the organization. Income must be recognized at the time of sale of these assets (clause 12 of PBU 9/99), but not at the time of their extraction (BMC Recommendation dated April 24, 2015 N R-63/2015).

Postings upon liquidation of OS

Postings when liquidating an operating system:

- Dt 10 Kt 01.select – acceptance for accounting of inventories from the liquidation of fixed assets;

- Dt 10 Kt 60 – costs for dismantling and disassembling the OS;

- Dt 41.DAP Kt 01.select – acceptance for accounting of DAP from liquidation of fixed assets;

- Dt 02 Kt 01.vyb – depreciation write-off;

- Dt 01.select Kt 01.01 – write-off of the initial cost of fixed assets.

Postings when selling DAP:

- Dt 62.01 Kt 91.01 – income from the sale of DAP;

- Dt 91.02 Kt 41.DAP – the cost of DAP is written off as expenses.

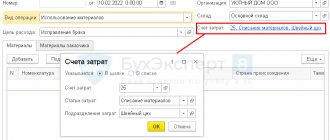

How to take into account costs when dismantling

Partial liquidation involves various expenses. They also need to be taken into account. This can be done in several ways:

- If the disposed object will be used in the future, disposal costs are included in the cost at which the item is taken to the warehouse.

- If the retired part will not be used in the future, it must be liquidated. Disposal expenses are included in other non-operating expenses.

When accounting, certain accounting entries are used. Each of them reflects a specific operation. That is, from the wiring we can conclude what action was carried out.

Accounting for dismantling

After disassembly, you need to draw up a certificate of acceptance and delivery of the OS. It is drawn up according to the OS-3 form. Liquidation of funds does not involve drawing up a primary statement in a given form. The procedure can be documented by an act of write-off of fixed assets in the OS-4 form. Correcting the initial cost of an object involves changing the information recorded in the inventory card. Finally, you need to reduce the initial cost of the OS by the cost of the seized object. Let's look at the wiring that is used during disassembly:

- DT01.09 CT01.01. Write-off of a commission share of the initial cost of fixed assets based on partial liquidation. Primary documentation: commission act, dismantling order, OS tool inventory card.

- DT02 KT01.09. Write-off of part of the depreciation that was accrued before dismantling work. Primary documentation: similar to the previous posting.

- DT10.09 CT01.09. Capitalization of a retired instrument at the residual price. Primary documentation: certificate-calculation.

- DT08.03 KT60.01, 70. Recording expenses for dismantling. Primary documentation: act of work performed, salary slip, act of write-off of materials, certificate of calculation.

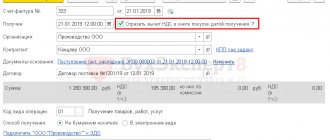

- DT19.04 KT60.01. Fixation of the VAT amount presented by the contractor. Primary documentation: invoice.

- DT68.02 KT19.04. Acceptance of VAT for deduction. Primary documentation: certificate of work performed, invoice.

- DT60.01 KT51. Transfer of funds to the contractor. The extract is confirmed by an extract from the banking institution.

- DT01.01 CT08.03. Reconstruction costs were included in the initial cost. Primary documentation: Primary documentation: certificate of acceptance and delivery of OS tools, certificate of calculation of the recalculated cost.

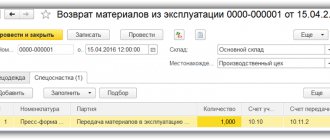

- DT10.09 CT10.09. The disposed instrument is sent to another department or storage facility. PD: invoice, receipt order.

- DT20 KT02. Calculation of depreciation for fixed assets. The posting is confirmed by a calculation certificate.

The list of primary documents may be different. It all depends on the specifics of the specific company’s activities. However, the primary is required. It confirms that the transaction has taken place. Unconfirmed transactions should not be taken into account.

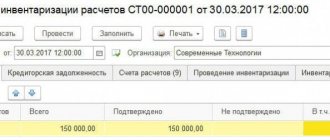

Assessment at NU

NU does not have a DAP category. The value of assets received upon liquidation of the OS is taken into account in non-operating income at market value (clause 8, 13 of Article 250 of the Tax Code of the Russian Federation, Article 105.3 of the Tax Code of the Russian Federation).

DAP cost

The forklift was liquidated:

- From the first — 1,200 thousand rubles;

- SPI - 60 months;

- Depreciation — 1,180 thousand rubles;

- With residual - 20 thousand rubles.

As a result of liquidation, scrap metal was capitalized and subject to sale.

Spare parts received as a result of liquidation

How to capitalize spare parts received as a result of the liquidation of an operating system if the operating system is completely depreciated:

- OS Status = 0.

Residual value of fixed assets = 0 rubles, which means there is no way to evaluate spare parts in used equipment (clause 16 of FSBU 5/2019). Receive spare parts to NU at market value.

How to account for capitalized scrap metal from written-off tools or replaced spare parts for production equipment and does it belong to inventories? We sell scrap metal after a certain amount has been collected.

The scrap metal will be sold in the future and therefore needs to be classified as DAP. The assessment of DAP in accounting is carried out at the residual value of the fixed assets. If there is no disposal of fixed assets, then the valuation of scrap metal as a result of repairs in the accounting department = 0 rub. At the time of sale of the DAP, other income will be reflected under Kt 91.01; the cost of the DAP will not be written off, because = 0 rub. In NU, the asset is valued at market value and is reflected in non-operating income.

How to account for spare parts received during the liquidation of an operating system? It is not known in advance how they will be used - for sale or as spare parts for the OS.

Depends on the further fate of the assets received as a result of the liquidation of the OS. If they are:

- to be sold, then Dt 41. DAP - assessment according to C rest. OS;

- be taken into account as inventories, then Dt 10 is an assessment at a similar cost of inventories, but not more than Comp. OS.

We provide services for the transportation of goods in our own railway cars. In connection with the liquidation of cars at the end of their standard service life, spare parts are formed, which then:

- sell over time;

- installed on their cars;

- are sold as scrap metal if they are rejected at the carriage depot during installation.

Are wagons considered inventories and how can these operations be reflected in 1C?

MC for sale (clause 1 and clause 3) are within the meaning of DAP and they must be reflected:

- Dt 41 Kt 01.09 - at residual value in accounting;

- Dt 41 Kt 91.01 - at market value in NU.

Spare parts for installation on your own cars (item 2):

- if for major repairs carried out at intervals > 12 months. or for modernization: Dt 08 Kt 01.09 - at the residual value of the fixed assets in the used book,

- Dt 10 Kt 91.01 - at the market price of spare parts in NU,

- Dt 10.21.1 Kt 10.21.2 – immaterial assets in accounting,

Dt 10.21.1 Kt 91.01 - at the market value of spare parts in NU,

or

Discuss the procedure for accounting for “pseudo inventories” with your auditors.

See also:

- [05/28/2021 entry] Practice of application of FSB 5/2019 Inventories in 1C - Part 2

- Long-term assets for sale

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Income tax: how to take into account expenses when liquidating unfinished construction The Federal Tax Service of Russia in Letter dated August 27, 2018 N SD-4-3/ [email protected] explained that...

- Net assets, reduction of authorized capital You do not have access to view To gain access: Complete a commercial...

- Long-term assets for sale in 1C Starting with the reporting for 2020, it is necessary to apply changes in...

- Long-term assets for sale. Concept You do not have access to view To gain access: Complete a commercial…

Accounting: depreciation during partial liquidation

Do not suspend depreciation on fixed assets that are in the stage of partial liquidation. There is an exception to this rule - if the liquidation of part of the fixed asset is carried out as part of reconstruction for more than 12 months (clause 23 of PBU 6/01, clause 63 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n). For more information about this, see How to reflect the reconstruction of fixed assets in accounting.

Upon receipt of the act of partial liquidation, adjust the value of the fixed asset (paragraph 2, clause 14 of PBU 6/01). Calculate the monthly amount of depreciation after partial liquidation based on the adjusted initial (residual) value of the fixed asset and the previous depreciation rate.

Do not revise the useful life of a fixed asset. An exception to this rule is the partial liquidation of a fixed asset carried out as part of reconstruction. Reconstruction work can lead to an increase in the useful life of the fixed asset. In this case, for accounting purposes, the remaining useful life of the reconstructed fixed asset must be revised. For more information about this, see How to reflect the reconstruction of fixed assets in accounting.

This procedure follows from paragraph 20 of PBU 6/01 and paragraph 60 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Situation: how to determine at the end of the partial liquidation of a fixed asset the amount by which its initial cost should be reduced and the amount of accrued depreciation?

The procedure for reducing the value of a fixed asset after its partial liquidation is not established by law. Therefore, the organization must develop it independently.

The best way is to determine the initial cost of the liquidated part of the fixed asset using accounting data. For example, if in the primary documents submitted by the supplier when purchasing a fixed asset, the cost of the liquidated part is highlighted as a separate line, in this case the amount of depreciation charges attributable to the liquidated part can be calculated using the formula:

| Depreciation charges attributable to the liquidated part of the fixed asset | = | Initial cost of the liquidated part of the fixed asset | : | Initial cost of the entire fixed asset | × | Accrued depreciation at the end of liquidation |

If it is impossible to determine the initial cost of the liquidated part of the fixed asset based on accounting data, it can be calculated:

- a commission created from employees of the organization;

- independent appraiser.

In this case, the share of liquidated property must be determined as a percentage of any physical indicator characterizing the fixed asset. Taking into account this share, the cost and amount of depreciation attributable to the liquidated property are calculated.

For example, for buildings (structures), the initial cost and depreciation charges attributable to the liquidated part can be determined by calculation:

| Initial cost attributable to the liquidated part of the building (structure) | = | Area of the liquidated part of the building (structure) | : | Total area of the building (structure) before liquidation | × | Initial cost of the building (structure) |

| Depreciation charges attributable to the liquidated part of the building (structure) | = | Area of the liquidated part of the building (structure) | : | Total area of the building (structure) before liquidation | × | Accrued depreciation at the end of liquidation |

The applied option for adjusting the initial cost and the amount of accrued depreciation after partial liquidation of a fixed asset should be fixed in the accounting policy for accounting and tax purposes.

After partial liquidation, depreciation on the fixed asset continues to be calculated based on its value adjusted to the cost of the liquidated part.

This procedure is confirmed by letter of the Ministry of Finance of Russia dated August 27, 2008 No. 03-03-06/1/479. Although this letter contains references to the old version of the Tax Code of the Russian Federation, the conclusions drawn in it can still be applied now, as amended by the current rules of law.