Definition and creation of deferred liabilities

The resulting discrepancy in the accrued tax amount is reflected in special reporting (according to the provisions of PBU 18/02 for accounting for profit tax calculations).

According to PBU, indicators are divided into two types: temporary and permanent. The first include those reflected at one time (period) as expenses/revenues and taken into account in another period for taxation. Indicators of the second type in the form of income or expenses are not taken into account according to the taxable base, but are taken into account according to accounting or vice versa. The result of the resulting discrepancy in the amount of profit before tax, which was greater in terms of income according to the accounting method than according to the tax method, was the emergence of a deferred tax liability (DTL).

IT represents a deferred portion of income tax, causing an increase in income tax in future temporary reporting periods. Recognition of these obligations is carried out in the cycle in which the corresponding temporary differences occurred.

IT = Temporary differences subject to tax * amount of deduction from profit (rate)

The reasons for the formation of temporary differences accepted for taxation may be:

- the difference in methods for calculating depreciation in two accounting options (tax, accounting method);

- difference in the types of accounting for expense transactions: according to the cash method in accounting and according to the tax method, accrual method;

- discrepancy in accounting and taxation methods for reflecting interest payments made by enterprises when using borrowed funds (loans, credits);

- rescheduling (deferment) or payment in installments (installments) of tax payments on profits.

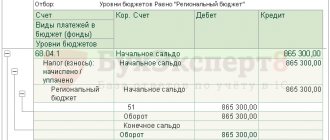

What accounting data will be needed when filling out line 1420

Enterprises, when preparing financial statements, have the legal right to reflect the balanced (i.e., rolled up) amount of deferred assets/liabilities in their balance sheet. In any case, the line contains the amount of deferred tax liabilities, which is relevant as of the reporting date, as of December 31, the previous and previous periods. To enter information in line 1420 you will need to look at:

- credit balance on account 77,

- debit balance for account 09.

So, depending on which method of reflecting the amount of deferred liabilities the organization’s management chooses, additional actions may be required. A couple of points to consider:

- In any case, the indicators on line 1420 are transferred from the balance sheet for the previous year to December 31—the previous and previous periods.

- If in the balance sheet for the reporting year, the indicators as of December 31—the previous and previous periods preceding the previous one—the amounts of deferred assets/liabilities were indicated in expanded form, and it is customary for the enterprise to reflect the amounts of deferred tax assets/liabilities as of the reporting date in a collapsed form, the indicators as of December 31. - those periods will have to be recalculated before reflecting them in the balance sheet for the reporting period - this will ensure the comparability of the reporting data. The same applies to the reverse situation, when the information was reflected in a collapsed manner, but in the reporting period it was decided to indicate the indicators in an expanded manner.

- It is necessary to compare the balance on account 09 with the balance on account 77 - depending on which value is larger, the indicator on line 1420 can be calculated differently (formulas will be given below in the article).

Reflection of deferred tax liabilities in accounting

To display deferred tax liabilities in accounting documentation, a credit of account 77 is used paired with a debit of account 68 (for calculations of taxes and fees). For statements of losses and profits, the display is taken into account on line 2430, for the balance sheet - on line 1420.

For your information! Deferred tax liabilities should not be mixed with permanent tax assets. The source for the appearance of the latter is in the constant discrepancies that arise in accounting methods, accounting and tax. In subsequent periods, permanent differences are not subject to disappearance (as taxable and subtractable). Permanent assets are associated with the reflection of certain costs in only one accounting method - the tax method. For example, the amount of depreciation bonus on capital investments does not find expression in the accounting bonus, because such a concept does not exist in accounting.

Calculation example 1. An enterprise purchased a production tool worth RUB 750,000 through leasing. with a service life of 7 years. According to accounting, depreciation of the acquisition amounted to 50,000 rubles, according to the tax method - 150,000 rubles, due to coefficient 3. Before calculation and taxation, the profit in the first case reached 600,000 rubles, in the second, the taxable base was 500,000 rubles. The tax rate on profit is 20%.

The difference between the two depreciation values amounted to 100,000 rubles. (150,000 rubles - 50,000 rubles), seems temporary, since after 7 years the amount will be fully accounted for as depreciated using both accounting methods.

This difference leads to the formation of IT, equal to 20,000 rubles in the example under consideration. (RUB 100,000 * 20%).

The correctness of the calculation must be confirmed by the same tax amounts according to the PBU method and in the declaration.

Current tax (PBU) = 100,000 rubles. = tax expense on profit (conditional) – IT = 120,000 rub. (profit of 600,000 rubles * 20%) – 20,000 rubles.

Profit tax indicated in the declaration = 100,000 rubles. = taxable base of 500,000 rubles. * 20%.

04.03.2022Transport tax on expensive cars

Companies whose managers prefer to have an expensive luxury car as a business vehicle pay transport tax taking into account increasing factors.

04.03.2022Creation of the Social Fund. What will change for business?

The Ministry of Labor proposed merging the Pension Fund and the Social Insurance Fund. The reform is planned to be completed within this year. The new structure, which received the short name “Social Fund,” could begin work as early as 2023. The details of the reform were studied by the editors of the magazine “Calculation”.

04.03.2022How to distinguish between repair and reconstruction costs and why this is important

In practice, disagreements with tax authorities arise due to the fact that inspectors try to subsume certain repair work under reconstruction. And the accountant’s task is to prove the opposite. The fact is that the costs of any repairs - current, medium or major - can be immediately and completely included in expenses. And reconstruction costs are written off only through depreciation.

04.03.2022Fourth capital amnesty

The government has submitted to the State Duma a bill on holding a capital amnesty from March 14, 2022 to February 28, 2023. This will be the fourth amnesty under which Russian businessmen will be able to legalize their savings, real estate, foreign accounts, etc.

04.03.2022A simplified taxation system company must pay VAT if it purchases services from a foreign company

Firms using the simplified tax system are exempt from paying value added tax. But, if a Russian company uses the simplified tax system to purchase services from a foreign entity, it has the responsibilities of a tax agent for VAT.

04.03.2022New form 4-FSS from the report for the 1st quarter of 2022. Project overview

The Federal Social Insurance Fund of Russia has developed and published a draft of a new form of calculation for accrued and paid insurance premiums for compulsory social insurance against industrial accidents and occupational diseases.

04.03.2022What documents need to be used to justify transport costs?

To write off expenses for official transport in the tax base for profits, you can use any document that complies with the law, contains all the required details and justifies the costs. The name and form of the document do not matter.

04.03.2022Workers want their salary in cash, not on a card: how to prepare the documents?

Many banks came under sanctions. There are queues at ATMs after working hours. Employees who have cards from such banks want to receive their salaries in cash, which is what they asked their employer to do. Can he accommodate his employees if the money has always been transferred through the bank to the card?

04.03.2022I was sick. Have worked. How will they be punished? And who?

The general director, a creative, spontaneous and not very predictable person, issued an order in which the responsibility for monitoring execution was assigned to the person who was on sick leave. Could this cause problems? From the point of view of regulating labor relations, it is important for an employer in such a situation to pay attention to 2 aspects. The first is how exactly the employee controlled the execution of the order, for example, whether he gave written instructions during illness, or whether he drew up any other papers with his signature. The second is how the work time sheet for the same period is filled out (whether a period of temporary disability is noted there or not).

03.03.2022How long does a desk audit of a VAT return have?

If for most taxes a desk audit lasts 3 months, then for VAT there can be as many as three such periods. Official - 2 months. It can be extended up to 3 months. There is also a shortened period - 1 month. It is associated with the acceleration of tax refunds and requires the fulfillment of a number of conditions.

03.03.2022Central Bank of the Russian Federation on restrictions on foreign exchange transactions: clarifications, March 2022

The Central Bank clarified a number of issues regarding the ban on the sale of currency and the restrictions imposed on foreign exchange transactions for Russian companies.

03.03.2022VAT on advertising expenses is included in the profit base

The company has the right to take into account VAT on advertising expenses in the tax base for profits. The Ministry of Finance was reminded of this.

03.03.2022Measures to support the IT industry have come into force

The President signed a Decree on support measures for companies in the IT industry. Only accredited IT industries can take advantage of the benefits.

03.03.2022Wage delays: what threatens the employer in 2022?

If an employer delays wages, he may be fined from 10 to 50 thousand rubles. In addition to administrative liability, criminal and material liability is possible. The head of an organization, branch or separate unit may also be imprisoned for up to three years.

03.03.2022“My home is my... store.” Whose consent is needed to transfer premises from residential to non-residential?

The owner wants to turn his apartment on the ground floor of an apartment building into a store with a separate entrance. To do this, he must first enlist the support of other owners. But how many yes votes are needed? Will it be necessary to obtain the approval of all owners or is 2/3 of their total votes sufficient? The Supreme Court answered this question in one of its recent rulings.

02.03.2022The deadline for refunding the overpayment has passed. What to do?

The company missed the period for refunding overpaid taxes. Does this mean that she will no longer be able to receive funds? Not at all, but restoration of the period will have to be sought through the courts. The editors of the magazine "Raschet" studied the explanations of the Federal Tax Service.

02.03.2022What does the buyer risk if there is no delivery agreement?

If there is no delivery agreement and you received the goods according to the act, this does not mean that if you delay payment, the supplier will not impose sanctions on you, since there was nowhere to register them. Liability is provided for in Article 395 of the Civil Code of the Russian Federation, and it occurs faster than it could be written in the contract, and the amount of the fine may be higher.

02.03.2022When do you need to withhold personal income tax when making payments to individual entrepreneurs?

When paying an individual entrepreneur for services or work under OKVED that are not specified in his registration data, the company must withhold personal income tax.

02.03.2022Distribution of net profit at the end of the year

The net profit received by the organization can be paid to shareholders (founders) or participants.

02.03.2022Additional economic measures introduced from March 2

On February 28, 2022, the President signed a Decree on the introduction of special economic measures.

Yesterday, a new Decree No. 81 dated March 1, 2022 was adopted on additional measures to ensure the financial stability of Russia. 1 Next page >>

Write-off of deferred tax liabilities

When the volume of temporary differences decreases, deferred tax liabilities are reduced and written off. The operation is accompanied by posting to the accounts: Dt 77 (“ONO”) / Kt 68 (“Tax calculations”).

Calculation example 2. For the entire volume of temporary differences taken into account on the taxable base at the beginning of the period (500,000 rubles), a deferred liability equal to 100,000 rubles was calculated. (RUB 500,000 * 20%). Entry on the accounts of the transaction for the accrual of 100,000 rubles: Dt 68 / Kt 77.

By the end of the accounting period, temporary differences were partially written off, amounting to a total of RUB 200,000. In this connection, accrued deferred liabilities amount to RUB 40,000. (RUB 200,000 * 20%).

The previously accrued deferred amount is subject to write-off in the amount of RUB 60,000. (100,000 rub. – 40,000 rub.). Recording a transaction to write off RUB 60,000. according to accounts: Dt 77 / Kt 68.

In the event of disposal of an object in connection with which taxable differences were formed, the accrued liability must be written off in full. The operation performed in this case will be reflected using accounts 77 (Dt) and 99 (Kt) (“Profits, losses”).

Calculation example 3. The initial cost of a fixed asset recorded on the company’s balance sheet is 1,000,000 rubles. The calculation of depreciation at the end of the accounting period was carried out using different methods and amounted to 300,000 rubles. in accounting and 600,000 rubles. according to taxable accounting. The temporary taxable difference for the object in question amounted to RUB 300,000. (600,000 rub. – 300,000 rub.). The deferred tax amount is RUB 60,000. (RUB 300,000 * 20%).

The amount (60,000 rubles) was calculated by posting to the accounts: Dt 68 / Kt 77.

When selling—a fixed asset—the deferred liability must be written off. Operation to write off 60,000 rubles. according to the accounts it will look like: Dt 77 / Kt 99.

For your information! If the income tax rate decreases, deferred liabilities are also subject to write-off, and if the rate increases, additional tax is charged. The wiring affects Dt 84 ch. (“Retained profit”) / Kt 77 account. When decreasing, reverse wiring is performed.