All enterprises whose activities are related to the provision of logistics services, and which have vehicles on their balance sheet, need a fuel and lubricants (fuels and lubricants) accounting sheet. This document fully displays when, to whom and in what volume the use of fuel or other fuels and lubricants was paid. For an accountant at a logistics company, this paper is one of the most frequently filled out.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

A statement is needed only when the acquisition of resources is carried out through an accountable person.

If a company issues (purchases) fuel cards to employees, then all expenses are recorded on them and then, at the end of the month, written off. But the purchase of these cards will also have to be carried out and documented.

On what basis is fuel provided?

The issuance of fuel and lubricants is carried out strictly if the driver has waybills. No receipts, certificates or statements can be the basis for the formation of a document. In order to verify the fact of presentation, the accountant (or any other person appointed financially responsible for fuel and lubricants) signs on the waybill, and the driver – on the statement.

Inspection authorities are usually interested in whether the taxpayer’s expenses are justified. In addition, it is necessary to prove that the consumption of fuels and lubricants is directly or indirectly related to the generation of income by a specific organization.

According to paragraph 1 of Art. 264 of the Tax Code of the Russian Federation, expenses associated with the purchase of gasoline, gas and other types of fuel and lubricants can be taken into account both in accounting and tax accounting.

Fuel and lubricants issue accounting form

Documenting the movement of fuels and lubricants Document flow in a motor transport enterprise largely depends on the availability of a fuels and lubricants warehouse, a gas station (gas station), the presence of special containers for storing fuels and lubricants in the garage, refueling vehicles (mobile gas stations) and other conditions.

Regardless of the conditions, only a clearly constructed document flow system and completed primary documentation can provide reliable accounting and control over the use of fuels and lubricants.

Accounting for fuels and lubricants is regulated by the standards for fuel and lubricant consumption in road transport, approved by the Order of the Ministry of Transport of Ukraine and the State Department of Road Transport of Ukraine dated February 10, 1998.

These include: “Passenger car waybill” (f.

N 4-с), “Truck waybill” (f. N 4-p), “Bus waybill” (f.

N 6), etc. To record the operation of agricultural machines and mechanisms, industry-specific forms are used, approved by the organization in the prescribed manner within the framework of their accounting policy.

Fuels and lubricants for other production needs (for maintenance and repair of vehicles, machinery and equipment) are issued from the oil warehouse on the basis of requirements, according to limit and intake cards (standard interdepartmental forms N M-10, M-8) or according to invoices ( for on-farm purposes) if they bear the signatures of persons who, by order of the head of the organization, are given the right to authorize the release of these materials.

Blanker.ru

Legal grounds The form has existed since the State Committee for Oil Products of the USSR approved it on August 15, 1985 (No. 06/21-8-446). Despite many editions, the essence of the paper remains the same, it shows its relevance, is republished and remains significant for many organizations.

Important

On the basis of which fuel is issued. Fuel and lubricants are issued strictly if the driver has waybills.

No receipts, certificates or statements can be the basis for the formation of a document.

In order to verify the fact of presentation, the accountant (or any other person appointed financially responsible for fuel and lubricants) signs on the waybill, and the driver – on the statement.

Inspection authorities are usually interested in whether the taxpayer’s expenses are justified.

In addition, it is necessary to prove that the consumption of fuels and lubricants is directly or indirectly related to the generation of income by a specific organization.

According to clause

Record sheet for the issuance of fuels and lubricants

Attention

Accounting for the movement of inventories in a motor transport enterprise is carried out on the basis of primary documents that document operations for the receipt of material assets into the warehouse, release from the warehouse for the implementation of activities and their use in the process of activity in the manner generally established for inventory accounting. In motor transport enterprises (and in any other enterprises that have their own vehicles), a special place is occupied by the accounting of fuels and lubricants (fuels and lubricants), spare parts and car tires.

- Legal Resources

- Collections of materials

- Fuel and lubricants issue record sheet

A selection of the most important documents on request Fuel and lubricants issuance record sheet (regulatory acts, forms, articles, expert consultations and much more).

Regulatory acts: Record sheet for the issuance of fuels and lubricants “Instructions on the procedure for maintaining records, reporting and consumption of fuels and lubricants in civil aviation” (approved by the USSR MGA 28.06.

1991) Appendix 14 “Methodological recommendations for accounting of fuels and lubricants in agricultural organizations” (approved.

Gsm

The issuance of fuel to drivers is carried out by measuring the amount of fuel issued - in volume units (liters), lubricants - in mass units (kilograms) upon presentation by the driver of a waybill or other documents authorizing receipt.

The accounting department monitors the correct distribution of fuel and oils.

The quantity of petroleum products issued is recorded in the Record Sheet for the issuance of fuels and lubricants, in which the driver signs for the specified materials received, and in the Waybills, the financially responsible person who issued the specified materials signs.

For waybills, standard interindustry forms are used, approved by Resolution of the State Statistics Committee of the Russian Federation of November 28, 1997 N 78 “On approval of unified forms of primary accounting documentation for recording the work of construction machines and mechanisms, work in road transport.”

Record sheet for the issuance of diesel fuel and gasoline

If an organization issues gasoline through transport cards, then the presence of this column is not necessary.

- The final part of the paper. It is on the back and consists of the phrase “In total, the number was issued according to the statement.” Also at the end, the person who issues the document and the person who checks the information specified in the power of attorney signs. At the very end the seal of the organization is affixed.

Analogues of waybills In addition to waybills, the following can be considered a suitable basis for filling out:

- for special equipment - specialized route sheets;

- for special equipment - work reports;

- mileage control system documents, etc.

On November 28, 1997, the State Statistics Committee of Russia adopted Resolution No. 78.

It lists all forms of primary accounting documentation that may require the preparation of a fuel and lubricants accounting sheet.

These include: To account for the operation of agricultural machines and mechanisms, industry forms are used, approved by the organization in the prescribed manner within the framework of their accounting policy.

Fuels and lubricants for other production needs (for maintenance and repair of vehicles, machinery and equipment) are issued from the oil warehouse on the basis of requirements, according to limit and intake cards (standard interdepartmental forms N M-10, M-8) or according to invoices ( for on-farm purposes) if they bear the signatures of persons who, by order of the head of the organization, are given the right to authorize the release of these materials. The issuance of fuel and lubricants based on any other documents (receipts, certificates, notes, etc.) is prohibited.

Source: //vipkonsalt.ru/blank-vedomost-ucheta-vydachi-gsm/

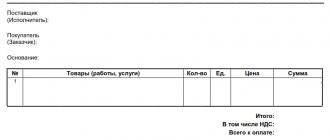

What does the document look like and fill out?

The paper has three parts:

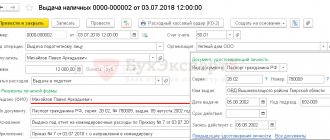

- Introduction, top. It indicates the serial number of the statement, the name of the organization itself, the brand, the name of the petroleum product issued, the date, and the full name of the person responsible for the issue.

- Middle part of the statement. It is presented as a table with columns to fill out. It must indicate: the model and number of the car, the number of waybills, the driver’s full name, his personnel number, how much fuel and lubricants was issued in liters in numbers and words.

Important point! The driver’s signature must appear directly in the table, in the last column, opposite the number of each waybill (if there are several of them).

Also mentioned in the tabular section are receipt coupons. If an organization issues gasoline through transport cards, then the presence of this column is not necessary.

- The final part of the paper. It is on the back and consists of the phrase “In total, according to statement number______ issued______.” Also at the end, the person who issues the document and the person who checks the information specified in the power of attorney signs. At the very end the seal of the organization is affixed.

Purchase of fuels and lubricants

Typically, the scheme for purchasing fuel and lubricants using coupons looks like this.

- The organization enters into a purchase and sale agreement with a fuel and lubricants supplier.

- The fuel and lubricants supplier issues an invoice to the organization for payment of coupons.

- The organization pays the bill and issues a power of attorney to its representative to receive coupons.

- A representative of the organization receives coupons and hands them over to the employee responsible for recording coupons and issuing them to drivers. Typically, on the day the coupons are issued, the supplier issues a consignment note (transfer and acceptance certificate) and an invoice for fuel and lubricants.

- The driver who has received the coupons presents them at the gas station and refuels the car. The volume of fuel supplied must correspond to the nominal value of the coupon. The driver is given a tear-off coupon for a redeemed ticket with a gas station stamp.

Situation: is it possible to capitalize fuels and lubricants purchased with coupons on the basis of tear-off coupons attached to the coupons?

Answer: yes, it is possible, provided that the amount of fuel received corresponds to the value of the coupon.

If less fuel is dispensed according to the coupon, its actual amount can only be confirmed by a cash receipt issued by the gas station.

Purchased fuel and lubricants can be capitalized on the basis of primary documents that contain the mandatory details specified in paragraph 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ. If the tear-off coupon for the coupon meets these requirements, then it can be accepted for accounting as a primary document. However, this should only be done if the driver has filled the tank with the same amount of fuel as indicated on the ticket. If less fuel is dispensed according to the coupon, its actual quantity can only be confirmed by a cash receipt issued by the gas station (letter from the Ministry of Finance of Russia dated April 3, 2007 No. 03-03-06/1/209 and the Federal Tax Service of Russia for Moscow dated June 26, 2006 No. 20-12/56636). Moreover, when dispensing fuel and lubricants using coupons, gas stations have the right to issue cash receipts, which record only the volume of fuel without indicating the price and total cost (see, for example, letters from the Federal Tax Service of Russia for the Moscow Region dated August 4, 2005 No. 22-19/0156, UMNS Russia in Moscow dated April 30, 2004 No. 29-12/29514).

Advice: if the coupons are about to expire and the car’s gas tanks are fully filled, drain the gasoline into empty fireproof containers. For example, in metal cans. By choosing fully paid for fuel, the organization will avoid financial losses.

In practice, it is better to avoid situations in which the organization receives fuel in quantities less than the nominal value of the coupon. The fact is that, regardless of the actual volume of fuel supplied, the gas station coupon presented will pay off in full. In this case, the unselected amount of gasoline cannot be reflected either in accounting or tax accounting.

Analogs of waybill

In addition to waybills, the following can be considered a suitable basis for filling out:

- for special equipment - specialized route sheets;

- for special equipment - work reports;

- mileage control system documents, etc.

On November 28, 1997, the State Statistics Committee of Russia adopted Resolution No. 78. It lists all forms of primary accounting documentation that may require the preparation of a fuel and lubricants accounting sheet. If the institution is not a motor transport enterprise, then it is not obliged to strictly comply with all the requirements of the unified forms in this regard. But during inspections by regulatory authorities, it will be more convenient to use these forms.

Important! These papers must be stored for at least 5 years. If the employee performed his duties in harmful, dangerous or difficult conditions, then, according to Order of the Ministry of Culture No. 558 of August 25, 2010, waybills are retained for 75 years.

If fuels and lubricants are needed for other purposes

There are situations when liquids are needed that allow not only travel, but also repairs, maintenance, etc. In order to do without waybills in this case, they use invoices for on-farm purposes (signed by the MOL) or limit collection cards (forms M- 8 and M-10).

If the statement is printed, then it does not have a title part. The document has two sides. On the first - the name, on the second - the signatures of the responsible persons and the seal.

When is refilling acceptable?

If the driver has not provided a report on the use of the previous “portion” of fuel and lubricants, then the financially responsible person does not have the right to release him the next one.

Sometimes, for additional control over fuel consumption, large enterprises introduce special coupons with the enterprise’s seal. Information about their availability and numbers can also be entered into a general paper. Unused coupons are safely returned, on the basis of which a coupon return sheet can be compiled.

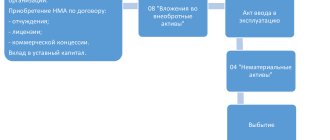

Fuel write-off

The cost of fuel, which is written off as expenses, depends on the method of assessing fuel oil (FIFO, at average cost) (clause 16 of PBU 5/01).

When writing off fuel and lubricants in accounting, make the following entry:

Debit 20 (23, 26, 44...) Credit 10-3 (10 subaccount “Coupons in gas tanks of cars”)

– the cost of consumed fuel is written off (based on the waybill).

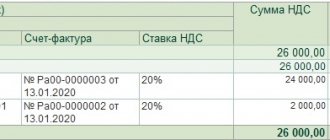

An example of how fuel and lubricants purchased using coupons are reflected in accounting. Ownership of fuel and lubricants passes to the organization upon receipt of coupons

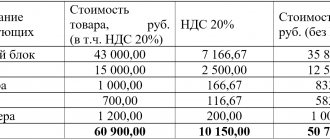

On June 1, Alpha LLC purchased a cash voucher for gasoline worth 510 rubles. (including VAT - 78 rubles). The supplier issued an invoice and issued an invoice to Alpha.

On June 4, a ticket was issued to the driver of the company car, Yu.I. Kolesov. A corresponding note about this is made in the book for registering the movement of coupons. On the same day, the driver purchased 30 liters of AI-92 gasoline using a coupon at a price of 17 rubles. per liter (including VAT - 2.59 rubles). To evaluate materials in accounting, the organization's accounting policy provides for the average cost method.

According to the organization's accounting policy, waybills are prepared monthly. On June 30, Kolesov submitted his waybill to the accounting department. According to the waybill, all the gasoline received with the coupon (30 liters) was consumed within a month. Actual consumption corresponds to the standards approved by the head of the organization.

The following entries were made in the organization's records.

June 1st:

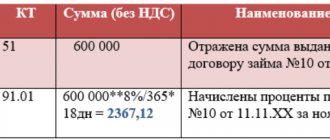

Debit 60 Credit 51 – 510 rub. – paid for a gas ticket;

Debit 10 subaccount “Coupons received for fuel and lubricants” Credit 60 – 432 rub. (510 rubles – 78 rubles) – a petrol coupon has been capitalized;

Debit 19 Credit 60 – 78 rub. – VAT is reflected on the purchased coupon.

June 4:

Debit 10 sub-account “Coupons for fuel and lubricants issued” Credit 10 sub-account “Coupons for fuel and lubricants received” – 432 rubles. – a ticket was issued to the driver (based on the ticket book);

Debit 10 subaccount “Fuels and lubricants in gas tanks of cars” Credit 10 subaccount “Coupons for fuels and lubricants issued” – 432 rubles. – gasoline filled into the tank of the car is credited (based on the gas station receipt and the tear-off coupon attached to the coupon);

Debit 68 “Calculations for VAT” Credit 19 – 78 rub. – submitted for VAT deduction.

On June 30, Alpha's accountant calculated the average cost of 1 liter of fuel. Based on the calculation, the average cost of 1 liter of gasoline turned out to be equal to its purchase price.

Based on the waybill, the cost of fuel and lubricants was written off as expenses in accounting:

Debit 26 Credit 10 subaccount “Fuels and lubricants in gas tanks of cars” – 432 rubles. – actually consumed gasoline is written off.

Tax accounting

If gasoline, diesel fuel or another type of fuel and lubricants is used by a transport organization (its main activity is related to the transportation of goods and people), then the consumption goes as material costs. If the company is not a logistics company in its core activity, then they should be taken into account as other expenses.

Moreover, in tax accounting, you can take both the amount of this resource actually used and the amount of this resource calculated using the formula, depending on the convenience of calculations and recording.

If special equipment or a vehicle does not have an odometer, then a report on the write-off of fuel and lubricants is drawn up and further accounting is carried out on its basis.

Accounting for fuel and lubricants

Like all inventories, fuel and lubricants are accounted for in the accounting department at actual cost. Expenses that are included in the actual cost are indicated in section II of PBU 5/01.

Acceptance of fuel and lubricants for accounting can be carried out on the basis of gas station receipts attached to the advance report (if the driver purchased the fuel in cash) or on the basis of coupon stubs (if gasoline was purchased using coupons). If the driver purchases gasoline using a fuel card, then accounting for fuel and lubricants on fuel cards is carried out on the basis of a report from the company issuing the card. Write-off of fuel and lubricants can be carried out using the following methods (section III):

- at average cost;

- at the cost of the 1st time of acquisition of inventory (FIFO).

PBU 5/01 has another write-off method - at the cost of each unit. But in practice, it is not applicable for writing off fuel and lubricants.

The most common way to write off fuel and lubricants is at average cost, when the cost of the remaining material is added to the cost of its receipt and divided by the total amount of the remainder and receipt in kind.