Installment plan and deferment of tax payments

If there are sufficient grounds, a legal entity, individual entrepreneur and individual can pay taxes, fees and insurance premiums later than the deadline established by law, using installments or deferment.

- Installment plans involve paying off debt by developing a payment schedule with specific amounts, deadlines for paying taxes and interest on them.

- Deferment involves changing the tax payment deadline to a later date. When it occurs, you must fully repay the amount of deferred payments and accrued interest.

The period for granting an installment plan or deferment depends on the type of tax, as well as on the budget to which it is paid.

- Installment plans and deferments for taxes and fees to regional and local budgets are provided for up to a year .

- Installment plans and deferments for federal taxes and contributions are provided for a period not exceeding 3 years .

Security

If a deferment of up to 6 months is granted, security for the fulfillment of the obligation is not required. If from 6 months, then you need:

- real estate pledge, the cadastral value of which exceeds the amount of taxes or insurance premiums included in the debt repayment schedule;

- guarantee or bank guarantee (Article 74, 74.1 and clause 2.1 of Article 176.1 of the Tax Code of the Russian Federation).

Who is eligible for installment and deferment?

Installment or deferment of payment of taxes, fees and insurance premiums is provided to interested parties whose financial situation does not allow payment on time. This takes into account the possibility of making payment within the newly established period.

According to paragraph 2 of Art. 64 of the Tax Code of the Russian Federation, a legal entity and individual entrepreneur can receive an installment plan or deferment if:

- The business has suffered damage as a result of natural disasters, technological disasters or other force majeure circumstances.

- The state or municipal order has been completed, but payment has not been received.

- Funding from the budget has not been provided or is delayed.

- There is a threat of bankruptcy with a lump sum payment of taxes.

- The activity is seasonal in nature (see the List of industries and activities that are seasonal in nature, approved by Decree of the Government of the Russian Federation dated 04/06/1999 No. 382)

- The importer wishes to receive an installment plan or deferment of taxes in accordance with customs legislation ( Article 59 of the EAEU Labor Code )

- During a tax audit, additional taxes, fees, insurance premiums, penalties and fines are assessed if it is not possible to pay them off in a lump sum payment.

According to clause 2.1 of Art. 64 of the Tax Code of the Russian Federation, installment payments for taxes are provided only for an amount not exceeding the value of the organization’s net assets.

According to paragraph 12 of Art. 64 of the Tax Code of the Russian Federation, constituent entities of the Russian Federation and municipalities have the right to establish additional grounds and other conditions for providing installment plans or tax deferments.

Please note : the basis for installment or deferment requires documentary evidence . For example, to confirm the threat of bankruptcy with a lump sum payment of taxes, you need to conduct a financial analysis. For this purpose, the methodology approved by Order of the Ministry of Economic Development dated June 26, 2019 No. 382 is used. In this case, the taxpayer should independently conduct a financial analysis, and then apply for an installment plan or deferred payment.

According to clause 5.1 of Art. 64 of the Tax Code of the Russian Federation , in order to receive installments on payments accrued as a result of a tax audit, legal entities and individual entrepreneurs must meet additional criteria:

- carry out activities for at least one year from the date of registration

- no bankruptcy proceedings initiated

- are not in the process of reorganization or liquidation

- can repay the additional accrued amount during the period for which the installment plan is provided

- do not appeal the decision of the tax audit on additional accrued payments.

Additional restrictions on the period for which installment plans are provided, subject to additional assessment of taxes upon verification upon request, depend on the size of additional assessed payments:

- for a period of up to one year , if the amount of additional accrual was less than 30% of the amount of revenue received for the year preceding the entry into force of the tax authorities’ decision

- for a period of up to three years , if the amount of additional accrual is 30% or more of the amount of revenue received for the year preceding the entry into force of the decision on additional accrual

How tax control measures will be carried out in connection with coronavirus

A number of measures relate to tax audits and tax control measures.

Until May 31 of this year the following will be suspended:

- making decisions on conducting on-site, including repeated, tax audits and audits of transactions between related parties;

- Conducting assigned on-site inspections and inspections on transactions between related parties;

- the timing of all types of inspections;

- within the time limits provided for in Art. 100, 101, 101.4 Tax Code of the Russian Federation;

- initiation and conduct by tax authorities of inspections of compliance with the currency legislation of the Russian Federation with rare exceptions;

- making decisions by tax authorities to suspend transactions on current accounts and electronic money transfers.

Thus, the state will give a small respite to companies and entrepreneurs in terms of tax control.

See all the details of such relaxations in the ConsultantPlus system. Get trial access to the K+ system for free and proceed to expert explanations.

Who is not eligible for installment plans and deferments?

Art. 62 of the Tax Code of the Russian Federation establishes that installment plans and deferments are not provided if:

- A criminal case has been initiated against the taxpayer for committing a tax crime.

- Proceedings have been initiated against the taxpayer for an administrative or tax violation.

- There are suspicions that the taxpayer made illegal payments in order to cash out funds, hide property, etc.

- The taxpayer has violated the conditions under which an installment plan, deferment or investment loan was previously provided (if three years have not passed from the moment of their violation until the submission of a new application).

- The deadline for paying income tax by a company that is part of a consolidated group of taxpayers is postponed.

- According to paragraph 9 of Art. 61 of the Tax Code of the Russian Federation, the interested person is a tax agent.

Terms of service

An interested person has the right to a deferment or installment plan if he has one of the following indicators:

- decrease in income by more than 10%;

- a decrease in income from the sale of goods (works, services) by more than 10%;

- a decrease in income from the sale of goods (works, services) for transactions subject to VAT at a rate of 0% - by more than 10%;

- receipt of a loss according to income tax returns for the reporting periods of 2022, if there was no loss for 2022.

Those who suffered a loss . But provided that there was a profit in 2022.

If, as a result of filing an updated declaration (updated calculation) or as a result of tax control, a discrepancy with the conditions is established:

- The decision to grant a deferment (installment plan) will be cancelled.

- Penalties will be charged from the date established for payment of taxes and contributions.

The amount for which installments and deferments are provided

Installment plans and deferments can be provided for both the entire tax amount and part of it. In this case, the amount of the transferred payment cannot exceed the value of the company’s net assets. However, this limitation does not apply to the following cases:

- when the taxpayer did not receive funding from the budget

- when the state or municipality has not paid for the completed order

- for other situations related to restrictions due to coronavirus

The rules by which the company’s net assets are assessed were approved by Order of the Ministry of Finance of the Russian Federation dated August 28, 2014 No. 84n. Their value is determined as the difference between assets and liabilities. At the same time, receivables of the founders are subtracted from assets, and future income is deducted from liabilities.

Interest charged on installments and deferments

When providing an installment plan or tax deferment, interest is almost always accrued. There are different interest rates for different reasons.

| Base | Interest rate |

| no interest accrued |

| ½ key rate of the Central Bank of the Russian Federation for the remaining debt |

| additional charges based on the results of a tax audit | full key rate of the Central Bank of the Russian Federation for the remaining debt |

Please note : interest is included in non-operating expenses at the end of each month throughout the entire period of installment or deferment.

Step-by-step instructions on how to get an installment plan or deferment

To postpone the payment of taxes and other payments, you need to collect the necessary documents, secure security for obligations and obtain approval from the competent authorities.

Preparation of documents

First of all, you need to draw up an application and indicate the reasons why it is impossible to pay taxes on time. The application form is approved by Appendix No. 1 to the Order of the Federal Tax Service of the Russian Federation dated December 16, 2016 No. ММВ-7-8/ [email protected]

(screen)

According to clauses 5 and 5.1 of Art. 64 of the Tax Code of the Russian Federation the following must be attached to the application:

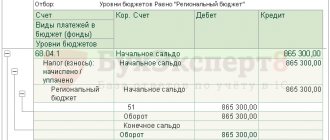

- bank statements on monthly account turnover 6 months before submitting the application

- bank certificates confirming the presence or absence of payment documents placed in the appropriate file cabinet

- bank statements about the balances of cash and precious metals in the company’s accounts

- list of debtors indicating the terms of agreements and amounts of money (with the provision of copies of these agreements and other documents confirming receivables)

- an obligation that provides for compliance with the conditions for providing an installment plan or deferment

- tax debt repayment schedule

- documents provided for in clause 5.1 of Art. 64 of the Tax Code of the Russian Federation , confirming the existence of grounds for changing the deadline for paying taxes.

The recommended forms of the listed documents are presented in the appendices to the Procedure approved by Order of the Federal Tax Service of the Russian Federation dated December 16, 2016 No. ММВ-7-8/ [email protected] , including the form of the application itself and the form of the obligation providing for compliance with the conditions for obtaining an installment plan or deferment.

Sometimes taxpayers have a question about what documents need to be submitted to confirm the right to an installment plan or deferment.

, letters of guarantee from the managers of budget funds should be provided , which should indicate the delay in financing, as well as the amount of underfunding as of the date the taxpayer prepares an application for an installment plan or deferment.

When receiving an installment plan or deferment due to the seasonal nature of the activity, you must provide a document confirming that the amount of seasonal income is at least 50% of the total income. In addition, the taxpayer’s industry must be included in the List of industries and types of activities that are seasonal, approved. Decree of the Government of the Russian Federation dated 04/06/1999 No. 382).

Preparation of security for obligations

Postponement of tax payment deadlines is possible only if there are guarantees of the solvency of the interested party. You can secure the obligation:

- pledge of property

- guarantee of third parties

- bank guarantee

When submitting an application for installment payment of additional amounts accrued during the audit, obligations can only be secured with a bank guarantee. In other cases, provision is possible by any of the indicated methods.

| Methods of provision | Explanations | Consequences of breach of obligations |

| Pledge of property | Both your own property and the property of third parties are subject to collateral. The subject of collateral can be office buildings, property rights and securities. Only things that are not subject to collection (for example, your only home) cannot be mortgaged. The property of a state-owned institution cannot be the subject of a pledge ( clause 4 of Article 123.22 of the Civil Code of the Russian Federation ). | If obligations are violated, the tax service confiscates the property, sells it and compensates for losses incurred from the proceeds. |

| Third party guarantee | The guarantors, along with the taxpayer, bear subsidiary liability. | In case of incomplete fulfillment of obligations, the tax service will foreclose on the property of the taxpayer and the guarantors. Collection from the guarantors is carried out indisputably without a court decision. |

| Bank guarantee | If the taxpayer does not pay the tax on his own, the bank gives a guarantee to the tax service to repay the debt. Tax officials accept guarantees only from those banks that are included in the List posted on the website of the Central Bank of the Russian Federation. | If the payer does not fulfill his obligation to the tax service, the bank will pay off his debt on its own, after which the payer will have to settle with the bank on the terms stipulated by the agreement. |

Submission of documents to the competent authority

Within a month after the documents have been signed, they must be sent to the competent government agency. If any changes occur, 7 days are given to notify the tax service and provide new documents.

Which authority to file your application with depends on the tax.

| Tax name | Competent authority | Grounds provided for by the Tax Code of the Russian Federation |

| Federal Tax Service of Russia in agreement with the financial authorities of the regions of the Russian Federation and municipalities (through the Federal Tax Service for the subject of the Russian Federation) |

|

| Personal income tax payable by individuals regarding income from which tax is not withheld by tax agents | Federal Tax Service of Russia in agreement with the financial authorities of the regions of the Russian Federation and municipalities |

|

| state duty | bodies that are authorized to perform legally significant actions requiring the payment of state duties ( Chapter 25.3 of the Tax Code of the Russian Federation ) | subp. 4 paragraphs 1 art. 63 Tax Code of the Russian Federation |

| taxes paid when moving products across the customs border of the Customs Union | Federal Customs Service of Russia or customs authorities authorized by it | subp. 3 p. 1 art. 63 Tax Code of the Russian Federation |

| insurance premiums from 01/01/2017 | Federal Tax Service of Russia (through the Federal Tax Service for the constituent entity of the Russian Federation) |

|

| Federal Tax Service Administration for the constituent entity of the Russian Federation in agreement with the financial authorities of the regions of the Russian Federation and municipalities |

|

Clause 5 Art. 64 of the Tax Code of the Russian Federation establishes that a copy of the application submitted to the competent authority must be sent to the tax office at the place of registration within 5 days

The decision to grant an installment plan or deferment (refusal to provide them) is made within 30 working days from the date of registration of the application. In this case, the taxpayer has the right to request a suspension of tax payments while the application is being considered.

A positive decision comes into force from the date indicated in it. Penalties accrued during the period of delay in tax payment are included in the amount of the debt. If the deadline is postponed under the pledge of property, the decision comes into force after the signing of the pledge agreement.

If an installment plan or deferment is not granted, the tax authority is obliged to provide the reason why it made such a decision. According to paragraph 9 of Art. 64 of the Tax Code of the Russian Federation, a refusal can be appealed to a higher tax authority or court.