KND 1120101: what kind of certificate

In order to confirm the absence or presence of debt to the budget or to verify balances, there are several documents (Article 32 of the Tax Code of the Russian Federation):

- information on the status of settlements (KND 116080 and 116081);

- information on the fulfillment of the taxpayer’s obligation (form KND 1120101);

- reconciliation report on taxes and fees (KND 116070).

All these documents can currently be obtained in both paper and electronic forms.

Today we will dwell in more detail on what constitutes a certificate of tax arrears in the KND form 1120101. The document form was approved by Order of the Federal Tax Service dated January 20, 2017 No. ММВ-7-8/ [email protected]

KND 1120101 (form)

Is there a difference in ordering a certificate by an individual and a legal entity?

Yes, I have. The answer to the question of how to obtain a certificate of absence of debt on taxes and duties differs somewhat depending on the status of the taxpayer - a legal entity, an individual or an individual entrepreneur.

Firstly, the tax service issues certificates with different codes for legal entities and individuals. We talked about this in the paragraph above.

Secondly, the information in the application from an individual and a legal entity is different. An individual just needs to indicate his TIN, full name, passport details and place of work. A legal entity or individual entrepreneur must in addition indicate:

- Enterprise checkpoints and bank details;

- Legal address, OKPO and OGRN of the company;

- Full name of the general director.

You can see a sample certificate below.

Certificate of presence (absence) of tax debt: where and how to get it

To obtain information about the fulfillment of taxpayer obligations, you must contact the Federal Tax Service. The document can be obtained from the tax office:

- in paper form with the seal and signature of the head of the Federal Tax Service;

- in electronic form with the digital signature of the head of the Federal Tax Service.

The form does not contain specific debt figures. If there is no debt, then a certificate of no debt will be received from the Federal Tax Service. If there is a debt, then a corresponding entry will be made in the form, and the Appendix will indicate the codes of the inspections with which the taxpayer has a debt.

If you receive information about the existence of a debt to the budget, you do not agree with this, you should check with the Federal Tax Service to detect and correct the error.

How to get a certificate of no debt?

A person can become an EOS client for many different reasons. Difficult life circumstances, family delays, and financial difficulties lead to the bank assigning the borrower’s debt to a collection agency under an assignment agreement. In this case, the agency becomes the lender. You can reduce the amount of obligations: if cooperation is successful, EOS is ready to write off part of the debt, provide the client with discounts and bonus repayment terms. We do everything to ensure that you successfully get rid of your obligations. And when you repay the loan, EOS provides you with written evidence - a certificate - and will make adjustments to your credit history.

When is a certificate of no debt issued?

A paper confirming that the borrower has no debt remaining is issued when the loan is fully repaid and paid, and the client does not have any financial obligations to us. Otherwise, it will be temporary, and a permanent certificate will be issued only after full payment. The document may be needed when taking out new loans or when traveling abroad or during legal proceedings. Its presence protects the client from possible difficulties associated with the human factor: it happens that official structures make mistakes when processing information, and closed debt is still listed as outstanding. In such circumstances, a certificate will avoid unnecessary proceedings.

Certificate of debt balance

If the obligations have not been fully repaid, but you are interested in information about how many payments and in what mode you still have to make, you have the right to know it. EOS are ready to provide you with complete information in accordance with Article 408 of the Civil Code of the Russian Federation. According to the code, the lender is obliged to issue its client a certificate of the balance of the debt upon request, usually after an application from the borrower.

What should the certificate include?

A legally binding document must be easily identifiable and contain:

- Client's full name;

- contract number and date of its conclusion;

- full details and name of the financial institution-creditor;

- confirmation that the borrower has no debt;

- date of signing;

- the official seal of the creditor and the signature of an authorized person.

Is the certificate issued for a fee?

Financial institutions have the right to withhold a commission for issuing paper, but only for repeated applications or for urgent processing. According to 353-FZ, once a month the client has the right to receive a document as usual free of charge.

How to get a certificate

If you have fully repaid your debt as an EOS client and you need a document confirming this, contact us by phone hotline, email or chat in your Personal Account. We will help you prove that you have no obligations to financial organizations. To do this, we will need the following information about you:

- FULL NAME;

- ID or loan agreement number;

- email address (e-mail);

- phone number.

In addition to a certificate of absence of debt, you also have the right to receive information about the payment schedule and data on the assignment agreement.

Features of receiving in paper form

A certificate of taxes and fees on paper is issued upon written request. It is better to fill it out using the form recommended by the Federal Tax Service (you can download the application form at the end of the article).

The request can be submitted by visiting the inspection in person, or it can be sent by mail in a valuable letter with a list of the contents. If the company is registered in the taxpayer’s personal account, then the request can be sent through it. During a personal visit, the request must be submitted by the head of the company or an authorized person.

The form must indicate:

- name, TIN, address of the taxpayer;

- details of the inspection to which the request is submitted;

- the date for which the information needs to be generated;

- method of receiving the document (in person or by post);

- signature and full name manager or authorized person.

The document must be generated by the inspectorate and transferred to the taxpayer within 10 working days from the date of filing the application. If the application indicated that the certificate will be collected by the head or representative of the company, then after this period you must contact the operating room of the Federal Tax Service. The document will be issued against signature, and the fact of issue will be recorded in the appropriate log book.

Information about the status of settlements

Help for calculations of taxes and fees contains a breakdown of both tax debts and overpayments, including penalties and fines. Columns 4, 6 and 8 are intended for this. If they contain negative values, then you are a debtor. If positive, then the inspection owes you.

This certificate is issued in the form KND 1160080, which is approved by Appendix 1 to the order of the Federal Tax Service dated December 28, 2016 No. ММВ-7-17/ [email protected] The issuance period is five working days from the date of receipt of the request.

Features of receiving in electronic form

Increasingly, electronic document management is being used in practice and electronic forms of documents are being used. A certificate of tax arrears was no exception. Inspections are very actively introducing electronic document management via telecommunication channels through authorized operators.

To receive a document in electronic form, you must also send a request in electronic form via TKS. The Federal Tax Service has developed an appropriate form for this purpose. It was approved by Order of the Ministry of Finance dated July 2, 2012 No. 99n (see form at the end of the article).

In the application we fill in the following details:

- name, TIN, address of the taxpayer;

- details of the inspection to which the request is submitted;

- request code (in our case it is 2);

- the date for which the information needs to be generated.

In response, the Federal Tax Service will issue a form similar to a paper one, signed with an electronic digital signature.

The response time for TKS is also 10 days. But, as a rule, tax inspectorates generate a response much faster, and a response can be received within 2-3 days.

Results

A certificate of arrears of wages (or, conversely, of the absence of debt) is a document that can substantiate your claims or confirm insolvency. The legislation does not impose any specific requirements for this document. However, such a certificate must be drawn up taking into account the circumstances in connection with which it was needed, and include information that will help solve the problems of its bearer.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Is the received certificate filled out correctly?

Let's look at an example of what a completed certificate KND 1120101 should look like: a sample is presented below.

1. A serial number must be assigned.

2. The name, INN and KPP, and address of the taxpayer are indicated. When generating information for a company that has separate divisions, the checkpoint may not be specified.

3. The date must correspond to the date specified in the request

4. The most important record is the record of the presence or absence of debt

5. The name of the inspection that issued the form must be given

6. At the bottom of the paper document there must be the signature and seal of the head of the Federal Tax Service, and on the electronic document - the digital signature details.

Below is a completed document, which is assigned a code according to KND 1120101: certificate (sample).

KND 1120101 (form)

Application (request form)

Where and how can I order it?

The most important question of the article is how to order a certificate from the tax office about the absence of debt. But in the process of considering this task, it is necessary to take into account that the taxpayer has several options to request a document - online or in person at the Federal Tax Service Inspectorate attached to the person. The algorithm of actions directly depends on the chosen method.

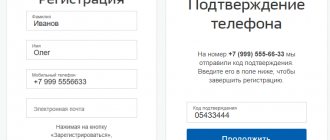

Online through State Services

- You will need a registered and verified account on the portal www.gosuslugi.ru . If the taxpayer does not yet have an account, you need to create one. Moreover, you will need an electronic digital signature, and for legal entities - an enhanced electronic digital signature;

- If the first step has been completed, write “Obtaining a certificate of no debt” in the search bar of the service. Among the available options, select the one that specifies that the document displays information specifically on tax fees;

- Click the “Get service” button;

- Choose how the finished document will be issued - in paper form or electronically. In the first case, the completed and signed form must be received at the MFC; in the second, look for help in email messages. From there, the document can be downloaded and printed, and it will have legal force.

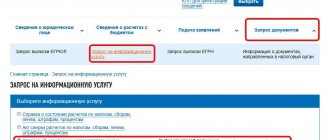

Personally at the Federal Tax Service

A certificate of absence of debt in the Federal Tax Service database is marked under code 1120101 (according to KND). For legal entities, code 1160080 is provided. Taking this into account, you must follow the instructions:

- Form a request to the Federal Tax Service. This can be done in person by submitting documents along with the application, or you can do it online through State Services;

- Please indicate that you would like to receive a certificate with KND code 1120101 (or 1160080 if you are an individual entrepreneur or legal entity);

- In the application, specify whether you want to receive a certificate on paper or electronic media;

- Wait for a response from the Federal Tax Service. If there are no debts to the state, there will be no problems - along with the approval of the application, you will immediately be given a completed certificate.