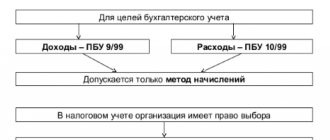

We recognize income and expenses based on accrual

In Art.

271 and 272 of the Tax Code define the rules regarding the accrual method. They all boil down to the fact that income and expenses when calculating income tax are taken into account in the period in which they occurred, i.e., the moment of their recognition does not depend on the date of receipt or expenditure of funds. When income and expenses relate to several tax periods, they will need to be distributed either according to the agreement or in accordance with approved local regulations.

When accounting for expenses, the group to which they belong is of great importance. Expenses are subdivided by the Tax Code:

- on straight lines;

- indirect.

Costs from the first group, related to balances of work in progress or unsold goods, are not taken into account in the expenses of the reporting period.

Any income and expense transactions must be documented using contracts, acts, invoices, etc.

Income recognition procedure

Note 1

Funds received as a result of any operation must be reflected in the accounting records of the enterprise. The recognition procedure depends directly on whether the appearance of these funds is related to the main activity of the company or not.

All organizations, except insurance and credit, which are legal entities, are required to consolidate information on income received in accordance with the rules outlined in PBU 9/99 “Income of the organization.”

PBU9/99 is also applied by non-profit organizations, but exclusively in relation to income received from business activities.

The income of an enterprise, according to the definition set out in paragraph 2 of PBU9/99, is considered to be an increase in the economic benefits of the enterprise from the receipt of assets or the repayment of liabilities, leading to an increase in the capital of this company.

Are you an expert in this subject area? We invite you to become the author of the Directory Working Conditions

However, not all funds and property received by the organization are income. In accordance with clause 3 of PBU9/99, the following receipts are not recognized as income of the enterprise:

- amounts of VAT, excise taxes, export duties and other similar mandatory payments;

- under commission, agency and similar agreements in favor of the principal, principal and the like;

- advance payment for goods, products, works or services;

- advances in payment for products, goods, works, services;

- deposit amount;

- funds as collateral;

- funds to repay a loan.

What is the cash method when calculating income tax?

The cash method is discussed in Art. 273 Tax Code of the Russian Federation. According to it, income is recognized in the period in which it is received, and expenses are recognized when it is incurred.

The moment of receipt of income is either the day of repayment of debt to the company by its customers and other debtors, or the day of receipt of an advance payment on account of upcoming shipments.

For expenses, the moment of their recognition is defined as the day of repayment of obligations to creditors by paying funds from the cash register or writing them off from the current account or by disposing of other property.

However, you need to know some features. For example, in order to take into account the costs of purchasing materiel in a specific tax period, three conditions must be simultaneously met:

- materials have been paid for;

- written off for production;

- used in production at the end of the month, i.e. there are no WIP balances.

And in order to take into account the costs of purchased goods, you need to not only pay the supplier for them, but also sell them to the buyer.

For this accounting method, in addition to the primary documentation received from the supplier and issued to the buyer, the basis for including a particular operation in the calculation of income tax are primary documents reflecting the flow of funds: cash receipts and consumables, payment orders, bank statements.

How to properly set up payment of other income

In 1C ZUP you can set up such payments using two methods:

- With the transfer of information about such income to the company’s accounting system. In this case, all accruals occur in the ZUP. The data is then transferred to the accounting program.

- Without transferring data to the program where company accounting is maintained. Income accrual will occur in the accounting system. At the same time, the ZUP will contain only the data necessary for calculating insurance premiums and personal income tax.

Let's start by considering the first option. To do this, go to the settings and activate the “Payroll calculation” option there.

Having done this, you can see that two new magazines have appeared in the “Salaries” section. These are “Planned accruals of other income” and “Accruals of other income”. The second journal was previously called “Registration of other income”.

Open the document “Accruals of other income”, click on the “Create” button. Here you must indicate the period of conduct, type of income and organization. There is a directory that already has a selection of types of income:

- issuance of prizes;

- transport rental;

- remuneration paid to the heirs or legal successors of the authors;

- income from licensing agreements;

- issuing prizes for advertising purposes;

- income received from the alienation of copyright or related rights.

This document can be opened directly from the “Payments” section. There is only a limited list of income options. Therefore, it can be expanded by adding your own clause. This could be, for example, renting premises or renting vehicles.

To practice, add the item “Apartments for rent” to the list. To do this, open the directory “Types of other income of individuals” and click the “Create” button. In the field, enter the name “Apartments for rent.” This type of accrual is not subject to insurance premiums. The personal income tax code will be 1400 (income from rental or other use of property (except for income from leasing computer networks, vehicles, communications equipment)).

Let's move on to the created type of income. We see that the code and type of income have been entered. This data cannot be changed here. To do this, you need to go back to the “Types of other income of individuals” directory. And here you should enter the date of payment of income, which will go into personal income tax reporting, as well as the details of the document.

Then you need to indicate to whom and in what amount these amounts were accrued. To do this, you need to open a directory with a list of individuals, which opens when you click on the “Selection” button. There will only be those persons who have previously received income. To add a new individual to the list, who is present in the database but has not yet received income, you must enable the “Select from a complete list of individuals” option.

If the required individual does not exist at all, you should click on the “Create” button, then create it in the database. The same actions are available if you go to the “Personnel” - “Individuals” section.

Next, you should indicate the amount of income and post a new document. This will ensure the generation of reporting on personal income tax, as well as on insurance premiums.

In “Reflection of salaries in accounting,” this type of operation will be called “Income of counterparties.”

After this is done, the accounting program will reflect entries for accrual of income, contributions and personal income tax.

Who has the right to choose accounting methods and who does not?

The accrual method can be used by absolutely all companies paying income tax. There are restrictions on the cash method - only:

- organizations whose average revenue from sales of products (works, services) excluding VAT over the previous 4 quarters did not exceed 1 million rubles. for the quarter;

- participants of the Skolkovo project, who determine income and expenses according to a simplified scheme, regardless of the amount of average quarterly revenue.

The cash method is not available to participants in property trust management agreements or simple partnership agreements.

If the average quarterly revenue is too close to the established limit or the company plans to organize joint activities, it is better not to resort to the cash method. After all, having gone beyond the established limits, the company will have to recalculate all income and expenses accrued from the beginning of the year.

Income accrual method

If an organization uses the accrual method of accounting, then income is considered received in the period when the company has them shipped, i.e. there is title (but not yet paid) on the basis that there will be retaliation upon receipt. The timing of payment for goods sold does not matter.

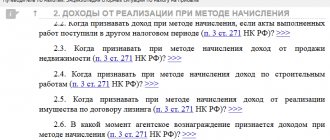

Points of revenue recognition

| Type of implementation | Revenue recognition |

| goods (works, services) | day of receipt of title (shipment) from the seller to the buyer |

| goods (works, services) under a commission agreement by the taxpayer-committee | date of sale of property (property rights), which the commission agent indicates in the notice of sale |

| real estate | date of transfer of such property according to the acceptance certificate or other transfer document |

| valuable papers | date of termination of the obligation to transfer them by offsetting counterclaims |

The date of receipt of income from non-primary is determined at the time of accrual.

If income relates to several periods, the organization distributes it evenly (for work performed over a long period of time - more than a year or started in one year and completed in another, i.e. in two tax (reporting) periods).

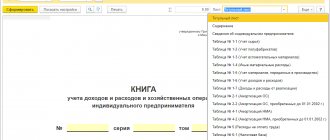

Tax accounting provides for the following methods of accounting for revenue:

- evenly (income is divided by the number of months of the contract)

- in proportion to the share of expenses in a particular period according to the estimate for the contract.

Where is the chosen method written?

The choice between the accrual method and the cash method is made in accounting policies for tax purposes. However, even those entities that do not have the right to choose usually indicate in it how tax accounting will be maintained. Those who have the right to choose should remember that with the accrual method, the moments of recognition of income and expenses often coincide with accounting, which greatly simplifies the work of accountants. However, even here it is possible that temporary differences may arise due to differences in the moments of recognition of income and expenses, such as, for example, when a company receives dividends from participation in the capital of another organization or with some compensation payments to employees.

Separate Revenue Recognition

As stated in Letter of the Ministry of Finance of Russia dated November 13, 2010 N 03-03-06/2/197, in relation to fines, penalties and (or) other sanctions for violation of contractual or debt obligations, the date of receipt of income by the credit institution will be recognized as the date of recognition by the debtor or the date entry into force of a court decision. In Letter dated 04.04.2011 N 03-03-06/4/27, the Ministry of Finance of Russia came to the conclusion that for profit tax purposes, the date of receipt of income in the form of subsidies is the date of their crediting to the taxpayer’s current account. Income in the form of accounts payable , for which the statute of limitations has expired, is taken into account as part of non-operating income on the last day of the reporting period in which the statute of limitations expires. This follows from Letter of the Ministry of Finance of Russia dated December 27, 2007 N 03-03-06/1/894. The provisions of the Tax Code of the Russian Federation do not establish the procedure for determining the date of sale of the leased asset . As follows from the explanations given in Letter of the Ministry of Finance of Russia dated June 10, 2004 N 03-02-05/2/35, the amount of the redemption value of the property is reflected in the lessor’s income as these payments are received. There is no uniform position on this issue in judicial practice. Some courts support such conclusions (see, for example, Resolution of the Federal Antimonopoly Service of the Volga District dated March 21, 2007 in case No. A55-10628/06). However, there is another position on this issue, according to which the lessor’s income, which constitutes compensation for the cost of the property that is leased, is included in the tax base for corporate income tax at the time of transfer of ownership of this property (see, for example, the Resolution of the FAS North -Western District dated November 23, 2006 in case No. A05-5133/2006-31). If the organization does not require buyers to pay penalties, and the debtors, in turn, do not take actions indicating recognition of the debt in the form of penalties, and there are no court decisions on the collection of penalties that have entered into legal force, the taxpayer has no grounds for recognition the amount of penalties as part of non-operating income that reduces taxable profit. The validity of such conclusions is confirmed by arbitration practice (see, for example, Resolutions of the FAS of the Ural District dated 09.12.2005 N F09-3932/05-S7, FAS of the Central District dated 04.15.2005 N A64-5748/04-11). In practice, the question may arise as to whether it is legal to include in non-operating income amounts of penalties or compensable losses only in connection with the presence of these conditions in the contract, regardless of the claims made by taxpayers to counterparties, and in the absence of objections from the debtor. Judicial practice proceeds from the fact that the moment of recognition of such income is the date of signing the document agreeing to penalties (see, for example, Decision of the Supreme Arbitration Court of the Russian Federation dated August 14, 2003 N 8551/03, Resolution of the Federal Antimonopoly Service of the North-Western District dated October 19, 2007 in the case N A56-56889/2005). As follows from the Letter of the Ministry of Finance of Russia dated October 7, 2009 N 03-03-06/1/651, deposited wages are taken into account in income after the expiration of the limitation period, which is equal to three months. At the same time, the Federal Tax Service of Russia, in Letter dated October 6, 2009 No. 3-2-06/109, explained that the period for an employee to submit a request for payment of deposited wages to the employer is not limited by law. If the employer refuses to satisfy this requirement and the employee goes to court in compliance with certain Art. 392 of the Labor Code of the Russian Federation, within a three-month period, the court can make a decision to satisfy the claim if the general one has not expired, i.e. three-year statute of limitations. Consequently, disputed accounts payable are included in income if the deposited wages have not been claimed by the employee within three years.

Features of the use of methods by individual business entities

In addition to the general regime, where organizations consider income tax, there are other taxation systems in which tax accounting is conducted differently. In addition, it should be conducted not only by organizations, but also by individual entrepreneurs. Let's try to figure out all the nuances further.

How do business entities account for income and expenses using the simplified tax system—cash method or accrual method?

Business entities using the simplified tax system, regardless of whether they are legal entities or individual entrepreneurs, count income and expenses for the purpose of calculating the single tax using the cash method. This is directly stated in clauses 1 and 2 of Art. 346.17 Tax Code of the Russian Federation.

If everything is more or less clear with income: money has been received - income is recognized, then for the recognition of certain expenses, separate requirements have been established. For example, as in the general regime, for goods intended for resale, in addition to payment for them, the supplier requires the fact of sale so that the cost of the goods is taken into account when calculating the single tax in the reporting period. While for material resources, shipment of manufactured products (works, services) is not required to take into account the cost of such resources in tax accounting. Also, unlike OSN, the release of these resources into production is not required.

Uniform distribution

At the same time, in the cases established by the Tax Code of the Russian Federation, income is distributed by the taxpayer independently, taking into account the principle of uniform recognition of income and expenses. Thus, the distribution of income taking into account the principle of uniform recognition of income and expenses is provided for in Art. 271 of the Tax Code of the Russian Federation in the following cases: - if income relates to several reporting (tax) periods; - if the relationship between income and expenses cannot be clearly defined or is determined indirectly; - if the production has a long (more than one tax period) technological cycle, in the case where the terms of the concluded contracts do not provide for the phased delivery of work (services). Each of these circumstances is an independent basis for the taxpayer’s distribution of income in tax accounting, taking into account the principle of uniform recognition of income and expenses. The issue of the procedure for recognizing income from the sale of products when applying the accrual method is discussed in Letter of the Ministry of Finance of Russia dated September 24, 2010 N 03-03-06/1/615. As the financial department explained, the Tax Code of the Russian Federation provides for an even distribution of income from the sale of work and services. At the same time, when producing products (goods) with a long production cycle, distribution of income from their sales is not carried out. Thus, the main principle of distribution of income from sales between reporting (tax) periods is the principle of formation of expenses. The tax authorities support the opinion of the Russian Ministry of Finance on this issue (see, for example, Letter of the Ministry of Taxes and Taxes of Russia dated September 15, 2004 N 02-5-10/54). The prevailing judicial practice overwhelmingly uses the same position (see, for example, Resolution of the Federal Antimonopoly Service of the Central District dated May 31, 2006 in case No. A36-4182/2005). Therefore, in a situation where, say, an organization has entered into an agreement to perform work in the period from 12/10/2010 to 02/24/2011 and payment is made on 02/24/2011, income under this agreement is distributed in proportion to the expenses incurred. The position of the tax authority, which believes that the taxpayer’s income should be distributed evenly between tax periods, is incorrect.