How to start receiving your salary in cash

To begin with, the employee writes a free-form application addressed to the director of the enterprise with reference to Art. 136 Labor Code of the Russian Federation. An employee can ask for approval of his application, but not demand payment in cash - the law does not give such a right.

| General Director of LLC “First Workshop” I.I. Ivanov from mechanic Glushkov D.D. STATEMENT I ask that, from July 2022, you pay me wages at my place of work in cash in accordance with Article 136 of the Labor Code of the Russian Federation. 30.06.2020. (signature) Glushkov D.D. |

Can an employee claim payment of wages in cash?

The Constitutional Court of the Russian Federation, in its Determination No. 769-o dated April 26, 2016, explained that in Part 3 of Art. 136 of the Labor Code of the Russian Federation spells out guarantees for each employee, according to which the implementation of other articles of the Code is possible (Articles 2, 21, 22, 56). The employee can count with full confidence that all his work will be paid, regardless of the employer’s financial problems or other circumstances.

This article of the Labor Code of the Russian Federation is aimed at providing the opportunity for the employee and the employer to come to some agreement that will take into account the interests of both parties, based on the current labor legislation. That is, the employee must agree with the manager to change the form of payment for his work.

In turn, the employer must not prevent the employee from receiving wages (ILO Convention No. 95 of July 1, 1949 regarding the protection of wages).

Can an employer refuse to pay wages in cash?

The employer is obliged to regularly pay wages to its employees. At the same time, he himself decides in what form - cash or non-cash - to do this. An employee may ask to change the form of payment, but the employer is not required to agree to this.

Judicial practice shows that in most cases the courts do not satisfy the demands of employees to switch to cash payments. The main reason is that the employee initially signs an application for the transfer of salary to a bank account upon employment. Or this is immediately stipulated in the labor or collective agreement.

Moreover, if the employee did not sign an application to transfer his salary to the bank, and such a procedure is not enshrined in an employment or collective agreement, the employer cannot refuse to pay him a salary in cash. In fact, without these documents, the company did not even have the right to open a salary account.

The company may refuse to pay employees wages in cash if a decision has been made to liquidate the cash register. That is, the company uses only non-cash funds.

Keep records, pay salaries, taxes and contributions, report via the Internet to Kontur.Accounting. The web service itself will calculate the amounts, select transactions, and generate reports. Get free access for 14 days

Documentation of salary payment

When paying employees in cash, the payment of wages from the cash register in 2021 can be confirmed by the following forms:

- expense cash order, the template of which is recorded in sample KO-2;

- payroll statement according to the T-49 form recommended by the State Statistics Committee;

- pay slips T-53.

In payment forms, after the issuance of money, the handwritten signatures of the recipients of funds must be affixed. If an employee has entrusted a third party to receive his salary for him, the fact of delegation of authority must be confirmed by a notarized power of attorney. The original power of attorney at the time of payment is given to the cashier and filed with the payment documents (if this is a power of attorney for a one-time salary receipt).

The cashier's procedure when paying wages through the cash register:

- Acceptance of payment forms signed by responsible persons. The forms must be signed by the accountant and the head of the company.

- Verification of the identity of signatures in samples and documents accepted for execution.

- Checking the consistency of the totals and their correctness in words.

- Issuance of money to the recipient upon presentation of an identification document (passport).

- If the payment is made by power of attorney, the details of the power of attorney are indicated in the notes column in the statement.

In cases where there are deposited amounts, the total amount of unclaimed money is indicated in the statement when closing it. The processed payment documentation is signed by the cashier and submitted to the accountant for verification. The accountant checks all the results, the correctness of the cashier’s report, and confirms the results of the reconciliation with his signature.

Why is it more profitable for an employer to pay wages by bank transfer?

Typically, it is more profitable for companies to transfer wages to employee cards as part of a salary project. Firstly, making a non-cash transfer is easier than collecting employees and giving them cash. Secondly, the salary project provides a number of advantages to the company, for example, they do not charge a commission for transferring salaries or give a discount for servicing the current account. And when issuing cash, the employer will still have to spend money on a commission for withdrawing money.

Important! Unscrupulous entrepreneurs prohibit employees from even changing the bank where they receive their salary. It is illegal. Even if the company has a salary project in bank A, the employee can demand that the salary be transferred to his card in bank B.

The company's cash withdrawal costs should not in any way affect the employee's convenience in receiving their salary.

When should you write?

It is necessary to write an application in any case if an employee wants to switch from payment to a bank card to receiving cash at the cash desk.

.

There can be a variety of reasons for this: the employee may have lost his bank card, has no desire to enter into an agreement with the bank offered by the employer, it is simply more convenient for him to receive his salary in cash.

Let us immediately note that the employer does not have the right to refuse.

Some refer to the collective agreement, which is a local act of the organization and may specify that employees receive their salary on a bank card. But no one can force an employee to cooperate with the bank if the person is against it. Even the presence of a collective agreement in an organization is not a valid reason for refusal.

It’s another matter if the employee, when hired, signed an employment contract in which he agreed to pay wages to a specific bank card, and not in cash at the cash desk. In this case, it will be more difficult for the employee to prove that he is right, since in fact he is violating the terms of the employment contract.

It is much easier to write a statement if neither the collective nor the employment contract stipulated where the salary will be transferred. Then the choice is entirely up to the employee and he just needs to write about his desire and provide the document to the accounting department.

How to issue a salary in cash: procedure and accounting entries

Salaries must also be paid in cash twice a month. The interval is no more than 15 calendar days between payments. To receive a salary, the employee must go to the organization's cash desk.

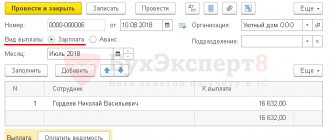

To process the payment of wages, use a payslip in form T-49 or a payslip in form T-51.

The algorithm for issuing money is simple:

- the manager or chief accountant signs the payroll slip and hands it to the cashier;

- the cashier carefully checks the presence of all signatures and prepares the required amount;

- cash is given to the employee: to establish identity, the cashier may ask for a passport;

- the cashier passes the payment document to the recipient for signature;

- the employee receives his salary and recalculates it without leaving the cash register.

When issuing wages, the accountant makes only one entry: Dt 70 Kt 50 .

Money for salary payments can remain in the cash register for up to 5 days, even if the cash register limit is exceeded. During this time, you need to manage to calculate all employees. The remaining salary must be deposited, that is, returned to the bank. Then the accountant makes the following entries:

Dt 70 Kt 76.4 - uncollected wages deposited;

Dt 51 Kt 50.1 - the deposited salary is transferred to the current account.

At the first request of the employee, the deposited amount must be returned. The accountant will make the following entries:

Dt 50.1 Kt 51 - money was received from the current account to the cash desk for payment of deposited salaries;

Dt 76.4 Kt 50.1 - the employee was given deposited wages.

Salary payment form

Employee benefits may be paid:

- in monetary form (cash or non-cash transfers);

- in kind.

In order to implement operations for issuing earnings in cash, the company initiates the withdrawal of the required amount from the current account to the cash desk. This procedure can only be carried out by an authorized official with whom a full liability agreement has been concluded. The check indicates the details of the person entrusted with receiving money from the bank.

In what cases is it prohibited to pay wages in cash?

Paying wages in cash is prohibited only when paying foreigners. The range of cash payments with foreigners is limited by Part 2 of Art. 14 Federal Law dated December 10, 2003 No. 173-FZ, and wages are not included in this list. The position that foreigners can only be paid wages in non-cash form was confirmed by the tax authorities in Letter No. 3N-4-17/15799 of the Federal Tax Service dated August 29, 2016.

Paying wages in cash to a foreign person is a violation of currency laws. Fine under Part 1 of Art. 15.25 of the Administrative Code of the Russian Federation will be 75-100% of the amount issued.

We recommend you the cloud service Kontur.Accounting. The program allows you to calculate, accrue and deposit employee salaries. In addition, the service will help you calculate and pay all taxes and contributions due from your salary and submit all reports on time.

Try for free

If an employee requests payment of wages in cash upon employment

An employee has the right to receive wages in cash by default if he has not previously received any applications for the transfer of earned funds. The employer does not have the right to refuse payment in cash (Part 1, Article 21 of the Labor Code of the Russian Federation, Part 3, Article 136 of the Labor Code of the Russian Federation). Since the Labor Code of the Russian Federation guarantees the employee timely payment of labor in a way convenient for him, the right to choose this method remains with him.

That is, if an employee initially aims to receive a salary in cash, he should not fill out an application for the transfer of funds under the salary project provided for in the organization. If there is no application from the employee, there is no permission to open a salary account for him.

An exception is if the employer liquidated the cash register as such.

Who is prohibited from paying wages in cash?

According to the legislation regulating foreign exchange transactions, these include all payments and transfers of funds and rights to alienate them between residents and non-residents of the Russian Federation. This includes payment of wages to foreign citizens or stateless persons, even when they are fully officially employed in the Russian Federation and in accordance with the requirements of Russian law. Accordingly, the legal regulation of such relationships is subject to additional restrictions of currency legislation, which oblige employers to conduct all payments with foreign employees exclusively in non-cash form.

Accordingly, in 2022, the issuance of wages in cash to foreigners is prohibited without the possibility of circumventing such a ban. Even if the employee himself desires to receive funds through the company’s cash desk, the employer cannot ignore the restrictions established by law.

But besides this category of employees, there are others who are subject to additional restrictive standards. Thus, changes from July 1, 2022 prohibit the payment of salaries in cash to employees of budgetary institutions and civil servants in general cases - it is allowed only if it is impossible to ensure non-cash payments to such employees.

Non-cash payments with all employees of budgetary institutions, as well as with persons in the municipal or public service, should be carried out exclusively through the use of the national payment system. A similar approach has been used since July 2022 to ensure the safety of workers’ personal data and state security. But if an employee from the above category does not have the opportunity to receive funds by non-cash means, he may demand payment of wages in cash. For example, if in his locality there are no places where a bank can issue funds without a commission, or if there are religious beliefs that prevent the use of payment cards and accounts. And he cannot be denied satisfaction of such a need.

Employees of budgetary institutions or civil servants can independently choose a credit organization to whose account their salaries will be transferred, provided that this organization works with the national payments system and can provide the opportunity to withdraw earned funds without commissions and restrictions.