What are the rates in 2022

The general income tax rate for 2022 is 20% of profits. Of these, in 2016, 2% received the federal budget, 18% received the regional budget. [email protected] came into force , which introduced a new declaration form and changed the procedure for distributing interest between budgets. In 2022, 3% will go to the federal treasury, 17% to the regional treasury.

At the local level, authorities have the right to lower the tax rate, but only in that part that goes to the local budget: 3% is added on top. Local regulations indicate what indicator is used to calculate income tax in the region - not lower than 13.5%. Together with payments going to the federal budget, the lower threshold is now 16.5% (13.5 + 3) - it has increased compared to 2016.

In Moscow, a rate of 13.5% is paid by certain categories of taxpayers who:

- use the labor of disabled people;

- produce cars;

- work in a special economic zone;

- are residents of technopolises and industrial parks.

In St. Petersburg, 13.5% of profits is paid only by residents of the special economic zone who operate on its territory.

In most regions, the rate has been reduced for at least some types of activities.

In addition to the main one, there are special rates. Profit tax at such rates is fully directed to the federal budget.

They are used if you have a certain status or for special types of income:

- 20% is paid by foreign companies without Russian representation, hydrocarbon producers and controlled foreign companies;

- 10% - foreign companies without a representative office in the Russian Federation from income from leasing vehicles and international transportation;

- 13% - local organizations from dividends of foreign and Russian companies and from dividends from shares on depositary receipts;

- 15% - foreign organizations from dividends of Russian companies; all owners of income from state and municipal securities (CB);

- 9% - from interest on municipal securities and other income from paragraphs. 2 clause 4 art. 284 Tax Code of the Russian Federation;

- 0% - rate for medical and educational institutions, residents of special economic zones (EZ), participants in regional investment projects, free EZ in Crimea and Sevastopol, residents of the territory of rapid socio-economic development.

Instructions for calculating income tax

Current step-by-step instructions on how to calculate income tax in 2022:

Example: your organization operates on OSN and received an income of 4,500,000 rubles for the calendar year. Expenses amounted to 2,700,000 rubles. Your profit: 4,500,000 – 2,700,000 = 1,800,000 rubles.

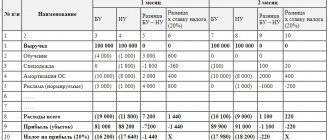

Let's look at the calculation of corporate income tax using a formula with tables based on this data:

| Income | 4,500,000 rubles |

| Expenses | 2,700,000 rubles |

| Profit | 1,800,000 rubles |

The contribution is paid on the amount of 1,800,000. See below for an example of how to find income tax.

If the regional rate in your area is basic and equal to 18%, then at the end of the year you will pay the following amounts.

To the local budget:

To the federal budget:

If a reduced rate of 13.5% is applied in the region, then the calculation is as follows.

To the local budget:

To federal:

The example shows that the amount of receipts to the federal budget does not change - 3% of income goes there.

Advance payments

Income tax is paid in advance payments every month or quarter, and then at the end of the year. Transferring advances quarterly in 2022 is allowed to those companies whose sales revenues do not exceed 15 million rubles per quarter over the previous 4 quarters. Other legal entities pay advances monthly. We described how to calculate advances for income tax in a separate article. Quarterly advances are calculated from actual income, and monthly advances are calculated from estimated income (based on data for the previous quarter).

Expenses and income

What is included in income?

Income is your revenue from your main activity (sales, provision of services or performance of work) and from additional sources (bank interest, rental of property). When the tax base for income tax is calculated, income is taken into account without VAT and excise taxes, confirmed by invoices, payment orders, entries in the book of income and expenses, and accounting documents.

What are expenses?

Expenses are confirmed and justified expenses of the company. They may be related to production activities, for example:

- employee salaries;

- cost of raw materials and equipment;

- depreciation.

But there are also those not related to production:

- legal costs;

- difference in exchange rates;

- interest on loans.

What expenses are deducted from income?

Accountants pay close attention to papers that confirm income tax expenses, since reducing income by expenses is allowed only if the following conditions are met:

- it is necessary to justify expenses - to prove economic feasibility;

- prepare primary documents (book of income and expenses, tax documentation).

There is a list of costs that cannot be taken into account when reducing the base.

Subtracted from income:

- commercial, transport, production costs (raw materials, wages, depreciation, rent, services of third-party lawyers, representation expenses);

- interest on debts;

- expenses on advertising (with a limitation - only 1% of sales revenue is written off);

- insurance costs;

- spending on research (to improve products);

- expenses for education and training of personnel;

- expenses for the purchase of databases and computer programs.

What expenses cannot be deducted?

The list of costs that do not reduce income is given in Article 270 of the Tax Code of the Russian Federation:

- remuneration of members of the board of directors;

- contributions to the authorized capital;

- contributions to the securities reserve;

- payments for exceeding the level of emissions into the environment;

- losses associated with economic activities in the communal, housing and socio-cultural spheres;

- penalties and fines;

- money and property transferred to pay for loans and borrowings;

- fees for notary services above the tariff;

- prepayment for a product or service;

- repayment of loans for employee housing;

- voluntary membership contributions to public funds;

- the amount of revaluation of the Central Bank with a negative difference;

- the cost of property that was given free of charge, transfer costs;

- payment for employee travel to work and home, if it is not provided for by production features and contract;

- pension benefits;

- vouchers for treatment and rest of employees;

- payment for vacations that are not provided for by law, but are specified in the contract with the employee;

- payment for sports and cultural events;

- payments for personal consumption goods purchased for employees;

- the cost of subscriptions to newspapers, magazines and other literature not related to production;

- payment for food for employees, unless this is provided for by law or collective agreement.

Taxable profit

The tax base from which the income tax is calculated consists of the income of a legal entity from the business activities carried out by it minus the expenses incurred in connection with the activities carried out.

Thus, the following are considered as income:

- sales income (profit received from the sale of goods, provision of services, performance of work, provision of this or that property for rent);

- non-operating income, that is, essentially, passive income in the form, for example, of interest on lending agreements.

Documented expenses of the enterprise are subtracted from the total profit, which include:

- expenses for paying wages to employees;

- production costs;

- transferred insurance premiums;

- depreciation, etc.

Money transferred to repay the loan is not included in expenses. Accordingly, money received in the form of a loan also cannot be considered profit of the enterprise.

Thus, the tax base is actually the amount obtained by subtracting the total amount of expenses from the total amount of income.

Some nuances when calculating the tax base exist for foreign enterprises that receive profit on the territory of the Russian Federation or from sources in one way or another connected with the Russian Federation. In accordance with Art. 309 of the Tax Code of the Russian Federation, these companies pay income tax on the following types of income:

- received in the form of dividends;

- received as a result of profit distribution;

- received in the form of interest on shares and other securities and in the form of interest on any types of debt obligations;

- received from the use of exclusive rights;

- received from the sale of shares (with the exceptions provided for in Article 280 of the Tax Code of the Russian Federation);

- received from the sale of real estate located on the territory of the Russian Federation;

- received for leasing property located on the territory of the Russian Federation (including income from leasing operations, charters, etc.);

- other income, in accordance with Art. 309 of the Tax Code of the Russian Federation.

All types of income specified in Art. 309 of the Tax Code of the Russian Federation are taken into account when calculating the tax base.

Moment of recognition of income and expenses

The moment of recognition is the period in which income or expenses are reflected in income tax accounting. There are two such points, they depend on the method of recognizing income and expenses:

- cash method;

- accrual method.

The company chooses one of the methods and, before December 31 (without waiting for the start of the next tax period), informs the territorial body of the Federal Tax Service about its choice.

When applying methods, firms take into account amounts at different times. Let's look into the nuances.

The cash method assumes that:

- income is taken into account at the time of receipt at the cash desk or in the company's current account, not earlier;

- expenses are taken into account at the time of debiting from the account or paying from the cash register, not earlier;

- When paying tax, amounts are taken into account according to the dates of receipt or write-off.

Accrual method:

- income is taken into account at the time of occurrence (under contracts or payment orders), and not upon direct payment;

- expenses are taken into account at the time of occurrence, and not when funds are written off from accounts;

- When paying tax, amounts are taken into account based on documented dates, even if payment actually occurred later.

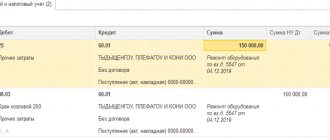

Example:

Kolibri LLC issued an invoice for office rent in March, but payment was made only in June. Under the cash method, the accountant of Kolibri LLC reflects the expenses for renting an office in June - upon the transfer of money. In tax accounting, this expense is written off in the second quarter. Under the accrual method, the accountant of Kolibri LLC takes into account rental expenses in March, when the company should have paid it. In tax accounting, this expense is reflected in the first quarter.

All enterprises have the right to use the accrual method, but the use of the cash method is limited:

- Banks are prohibited from using it;

- firms recognize income and expenses in fact only if revenue does not exceed 1 million rubles for each of the last four quarters;

- If, when applying the method, the limit is exceeded, then the company is obliged to switch to the accrual method from the beginning of the current year.

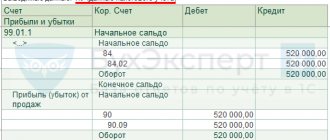

What is the tax base if the company suffers a loss?

According to tax accounting rules, the profit of an organization is not a negative value. Even if there is a loss at the end of the year, the tax base is recognized as zero. The tax in this case is also zero. Tax accounting documents must confirm the correctness of the tax base calculation. It is mandatory to submit a declaration, even if the amount is zero.

Using benefits when calculating tax amounts

Benefits established by federal, regional or local legislation reduce the amount of tax deductions. This may be a full or partial tax exemption. Other options may apply. For example, when paying personal income tax, the amounts specified in the Tax Code of the Russian Federation are deducted from the tax base before multiplying it by the rate.

Tax benefits allow you to save significantly. Therefore, before you start calculating the tax amount, you definitely need to find out whether you have these benefits.

Calculation

The basic formula for corporate income tax is:

NP = C * B,

Where

- NP - income tax;

- C - rate;

- B is the basis for calculation.

Kolibri LLC produces and sells soft toys. Let's find out the amount of tax that the company will pay for 2022 if:

- The LLC received a bank loan for 500,000 rubles;

- sold toys for 1,200,000 rubles including VAT;

- used raw materials for production worth 350,000 rubles;

- paid wages to workers in the amount of 250,000 rubles;

- insurance premiums amounted to 40,000 rubles;

- carried out depreciation in the amount of 30,000 rubles;

- paid interest on the loan in the amount of 25,000 rubles;

- wants to take into account last year’s loss of 120,000 rubles.

Expenses of Kolibri LLC in 2022:

Since income is calculated without VAT, it will be 1,000,000 rubles at a VAT rate of 20%. And 200,000 rubles is the amount of VAT that the LLC will transfer to the state. Loan amounts are not subject to contributions; they are simply not included in the tax base under paragraphs. 10 p. 1 art. 251 Tax Code of the Russian Federation. 500,000 rubles of loan are not considered income.

Then the profit of Kolibri LLC in 2022:

This is income minus expenses and minus last year's loss.

Calculation using the formula:

Of which go to the budget of the Russian Federation:

Goes to the regional budget:

We use the example of Kolibri LLC below to show calculations using an online calculator.

The convenient 1C:BusinessStart application allows you to automatically calculate tax amounts; you do not need to monitor changes in rates, the service is updated automatically, taking into account the latest changes in legislation. The program will warn you about the deadlines for submitting reports and paying taxes, and will tell you what and how to do.

Where to get basic data to calculate the tax amount

Art. 17 of the Tax Code of the Russian Federation requires, when introducing a tax, to establish taxation rules. It is necessary to determine:

- taxpayers;

- object of taxation;

- tax base;

- taxable period;

- tax rate;

- calculation order.

These characteristics are indicated in the second part of the Tax Code of the Russian Federation. There is a separate chapter for each tax.

Benefits may also be established by law. Those established at the federal level are indicated in the chapter of the Tax Code of the Russian Federation dedicated to each tax. Regional and local authorities can establish their own benefits. Information on the availability and nature of local and regional benefits can be obtained from the legislative acts of the relevant authorities. The Federal Tax Service (FTS) provides the opportunity to obtain information about the availability of benefits on its website.