What is the difference between standardized and non-standardized advertising expenses?

Advertising expenses, which are taken into account for tax purposes, are divided into two groups:

- non-standardized expenses, that is, those that can be taken into account completely;

- standardized expenses, that is, those for which there is a recognition procedure.

Tax Code of the Russian Federation in paragraph 4 of Art. 264 contains a more detailed classification.

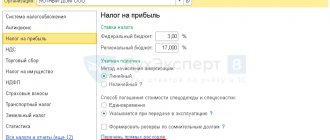

The procedure for accounting for advertising expenses for organizations on the OSN and the simplified tax system

The procedure for accounting for advertising expenses for organizations on the OSN and the simplified tax system is almost identical. Individual entrepreneurs using the simplified tax system do not pay income tax, but pay a single tax with the object of taxation “income” or “income minus expenses”. Expenses on the simplified tax system can be taken into account for tax purposes only after actual payment for advertising services. At the same time, to prove payment, the taxpayer must have an agreement for the provision of services for the creation and placement of online advertising, a certificate of completion of work, certified screenshots of pages with advertising.

- Non-standardized expenses for the simplified tax system are taken into account in full, but only when calculating the single tax with the object of taxation “income minus expenses”.

- Normalized expenses are taken into account within 1% of revenue received and advances in the reporting period.

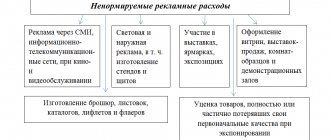

Non-standard advertising expenses

It is allowed to include the following types of advertising expenses in the full amount of actual expenses:

- advertising that is placed through the media (television, radio, print, Internet);

- outdoor advertising (illuminated, billboards, stands, etc.);

Expenses on outdoor advertising are taken into account according to special rules. Which one? ConsultantPlus experts spoke about them:

Get free access to K+ and find out all the details on outdoor advertising.

- advertising carried out through participation in exhibitions, fairs, as well as through the design of shop windows, expositions, showrooms and sample rooms;

- production of advertising catalogs and brochures containing information about products, goods, services or work offered by the company, or about itself;

- deliberate reduction in price (markdown) of goods that have lost their quality during exhibition.

Is it possible for income tax purposes to include as advertising expenses for adhesive tape with the organization’s logo used to package goods? The answer to this question was given by 3rd Class Advisor to the State Civil Service of the Russian Federation Razgulin S.V. Get free trial access to the ConsultantPlus system and get acquainted with the official’s point of view.

There are some clarifications in the non-standardized part. The Ministry of Finance of Russia, using the provisions of paragraph. 4 p. 4 art. 264 of the Tax Code of the Russian Federation, included leaflets, booklets, leaflets and flyers among brochures and catalogues. The ministry’s specialists reflected their position in letters from the Ministry of Finance of Russia dated August 12, 2016 No. 03-03-06/1/42279, dated October 12, 2012 No. 03-03-06/1/544, dated November 2, 2011 No. 03-03-06/ 3/11 and dated 10.20.2011 No. 03-03-06/2/157. That is, the costs of producing such materials can be taken into account as part of non-standardized expenses.

Reflection in accounting of services for advertising placement in directories of third-party organizations

Regulatory regulation

Advertising is information disseminated in any way and in any form, addressed to an indefinite circle of people and aimed at attracting the attention of a potential buyer to a particular product, creating or maintaining interest in it and promoting it on the market (Article 3 of the Federal Law of March 13, 2006 N 38 -FZ).

Does not apply to advertising (clause 2 of article 2 of the Federal Law of March 13, 2006 N 38-FZ):

- information in both material (booklets, signs, indexes, etc.) and intangible (placement in the media) forms that do not contain an advertising nature and do not have the main goal of promoting a product on the market;

- information of an advertising nature, but addressed to certain persons (for example, indicating their full name).

In accounting, advertising costs are expenses for ordinary activities and are recognized in the reporting period in which they occur. In accounting, advertising costs are not standardized and are included in expenses in full (clause 5, clause 7, clause 18 of PBU 10/99).

Advertising costs associated with the sale of products and goods include:

- in trading organizations - as part of commercial expenses in the debit of account 44.01 “Distribution costs in organizations engaged in trading activities” (chart of accounts 1C);

- in non-trading accounts - to the account “General business expenses” (chart of accounts 1C).

In NU, advertising costs are divided into standardized and non-standardized.

Non-standardized costs include advertising costs according to a “closed” list (clause 4 of Article 264 of the Tax Code of the Russian Federation):

- costs of advertising events in the media (including advertisements in print, radio and television broadcasts), information and telecommunication networks, film and video services;

- costs for illuminated and other outdoor advertising, including the production of advertising stands and billboards;

- costs for participation in exhibitions, fairs, expositions, for the design of shop windows, sales exhibitions, sample rooms and showrooms;

- production of advertising brochures and catalogs containing information about the goods sold (works, services), trademarks and service marks and (or) about the organization itself;

- for the discounting of goods that have completely or partially lost their original qualities during exhibition.

They can be included at a time as part of indirect (other) expenses in the period in which they occurred.

Learn more Accounting for non-standardized advertising costs

All other advertising costs are normalized, which are allowed to be taken into account in indirect (other) expenses in an amount not exceeding 1% of sales revenue (Article 249 of the Tax Code of the Russian Federation, clause 4 of Article 264 of the Tax Code of the Russian Federation).

Placing advertising information in catalogs of third-party organizations is a regulated type of advertising expenses (Letter of the Ministry of Finance of the Russian Federation dated December 23, 2016 N 03-03-06/1/77417).

Advertising expenses must be documented. Supporting documents may be (Letter of the Ministry of Finance of the Russian Federation dated 09/06/2012 N 03-03-06/1/467, dated 06/22/2012 N 03-03-06/2/71):

- acts of completed work;

- photo reports;

- broadcast certificates or other similar documents issued directly by a television or radio company, including schedules of confirmed advertising releases;

- files of articles and other similar documents.

Accounting in 1C

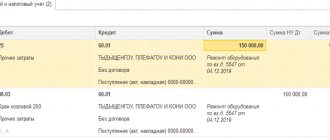

Accounting for advertising costs is reflected in the document Receipt (act, invoice) transaction type Services (act) in the section Purchases – Purchases – Receipt (acts, invoices).

In the document please indicate:

- Act No. from - date and number of the primary document;

- from - date of signing the act;

- Agreement - a document according to which settlements are carried out with the counterparty, Type of agreement - With the supplier .

- Follow the link Accounting accounts : Cost account - 44.01 “Distribution costs in organizations engaged in trading activities.”

- Cost items - cost item for regulated advertising. Selected from the directory Cost Items, Type of Expense - Advertising Expenses (standardized) .

To reflect standardized advertising costs in the Cost Items in the Type of expense select the value Advertising costs (standardized) . Then advertising costs will be recognized as expenses automatically at the end of the month in the amount of 1% of revenue when performing the operation Closing account 44 “Costs of distribution” in the Closing the month .

If advertising costs are not standardized, then the cost item should have the Type of expense Other expenses : costs will be taken into account as part of the expenses of the reporting period according to NU at a time and in full.

- VAT account - 19.04 “VAT on purchased services.”

Postings according to the document

The document generates transactions:

- Dt 44.01 Kt 60.01 - accounting for advertising costs;

- Dt 19.04 Kt 60.01 - acceptance of VAT accounting.

Standardized advertising expenses

In an amount not exceeding 1% of the amount of sales proceeds (calculated in accordance with Article 249 of the Tax Code of the Russian Federation), the following types of expenses should be included in expenses:

- expenses for the production or purchase of prizes that are awarded during drawings during mass advertising campaigns;

- other advertising expenses.

The above list has one interesting feature. The fact is that the list of non-standardized expenses is closed and does not allow additions, while standard advertising expenses are not limited, and this list is always open.

For this reason, any expenses that bear signs of advertising expenses can be taken into account in expenses, even if they are not listed in the Tax Code. They will simply fall into the category of “standardized advertising costs.” Confirmation of this thesis can be found in the resolutions of the Federal Antimonopoly Service of the Moscow District dated March 21, 2012 No. A40-54372/11-91-234 and dated March 14, 2012 No. A40-63461/11-99-280.

An example is this type of advertising, such as promotional and informational materials delivered in the form of bulk and unaddressed mail. The costs of paying for courier or postal services can be attributed to advertising costs, and, in accordance with the provisions of paragraph. 5 paragraph 4 art. 264 of the Tax Code of the Russian Federation and letter of the Ministry of Finance of Russia dated January 12, 2007 No. 03-03-04/1/1, these will be standardized advertising expenses.

Peculiarities of recognition of advertising expenses under the simplified tax system

The amount of VAT on excess advertising expenses also cannot be taken into account as part of the simplified tax system costs. Expenses include input VAT only on those costs that fall within the standard. Activities for the distribution of outdoor advertising are transferred to UTII (clause 10, clause 2, article 346.26 of the Tax Code of the Russian Federation). However, if a “simplified person” distributes advertising information about his goods (works, services) or about his company, such activity does not fall under UTII.

Costs for the production of banners, as well as for their placement on other sites, fees for entering information about the store into search engines and online catalogs are advertising. If an organization's website is not an intangible asset, but was opened only for advertising purposes, then the costs of its creation can be accounted for as advertising expenses.

“Simplers” use the cash method of accounting for income and expenses, therefore the date of receipt of income is the day the money is received in bank accounts or the cash register (clauses 1, 2 of Article 346.17 of the Tax Code of the Russian Federation). Consequently, payers of the simplified tax system take into account advances received in the reporting (tax) period in which they were received. And when returning advances received, the income of the period in which the return was made is reduced by the amount being returned.

Based on this, we can conclude that “simplified” people, when calculating the standard for advertising expenses, should take into account advances received from customers as part of their income. If advances were received in the previous year, but partially returned to customers in the current year, then the “advertising” standard, equal to 1% of the revenue received, is recalculated in the current year taking into account the reduction by the amount of returned advances. There is no need to recalculate the standard for the previous year (letter of the Ministry of Finance of Russia dated February 11, 2015 No. 03-11-06/2/5832).

When to apply the provisions of international agreements

In business practice, there are circumstances in which an international agreement on the avoidance of double taxation determines the accounting of advertising expenses on other principles that differ from those provided for by the Tax Code of the Russian Federation. In such cases, according to Art. 7 of the Tax Code of the Russian Federation, contractual provisions should be adhered to.

In particular, the agreement between the Russian Federation and Germany provides that advertising expenses incurred by a Russian organization with the participation of a company from Germany are allowed to be taken into account when calculating income tax in full. There is only one condition: the amount of such a deduction cannot exceed the amount of expenses of independent companies under similar operating conditions.

Confirmation of this statement can be found in letters from the Ministry of Finance of Russia dated 03/05/2014 No. 03-08-RZ/9491, dated 03/01/2013 No. 03-08-05/6124 and dated 01/11/2013 No. 03-08-05. The authors of the letters explain that if the above conditions are met, even normalized advertising costs can be taken into account in full. This principle must be observed regardless of the size of the German company’s share.

What is advertising and who should it be addressed to?

In practice, accounting for advertising costs can be difficult. Some aspects of this topic were explained by the Deputy Director of the Department of Tax and Customs Tariff Policy of the Ministry of Finance, Actual State Councilor of the Russian Federation, 3rd class, Sergei Razgulin.

The official pointed out that not all information disseminated about goods and services is advertising. Its definition is given in the Federal Law “On Advertising” dated March 13, 2006 No. 38-FZ. According to the law, advertising is information disseminated in any way, in any form and using any means and aimed at attracting attention to the object of advertising, generating and maintaining interest in it and promoting it on the market. In this case, an important condition must be met: the advertisement is addressed to an indefinite circle of people, it does not indicate specific recipients. If this requirement is not met, the information cannot be considered advertising.

Advertising encouraging people to pay taxes on time

The law allows targeted advertising when distributed via telephone, fax, mobile radiotelephone communications (for example, SMS messages). Distribution by regular mail to a database of potential clients intended for specific individuals cannot be considered advertising, and related expenses are not recognized as advertising. This was stated in the letter of the Ministry of Finance dated July 5, 2011 No. 03-03-06/1/392. Another letter from the Ministry of Finance (dated July 15, 2013, No. 03-03-06/1/27564) clarifies: in the case of sending advertising brochures by mail to specific addresses, but without specifying the recipient, the costs of producing brochures are recognized as advertising costs. If advertising is sent to specific addresses indicating the full names of specific recipients, the costs should be taken into account “as other expenses associated with production and (or) sales” (clause 49, clause 1, article 264 of the Tax Code).

Advertising costs are included in other expenses

In accordance with sub. 28 clause 1 art. 264 of the Tax Code of the Russian Federation, advertising expenses should be included in other expenses that are associated with production and sales. Moreover, according to paragraph 1 of Art. 318 of the Tax Code of the Russian Federation are indirect. Depending on the accrual method, the moment at which such expenses are recognized will differ:

- If a legal entity uses the accrual method of accounting, then advertising expenses should be classified as other expenses in the reporting or tax period in which they were incurred. The moment of actual payment (in any form) does not matter here (clause 1 of Article 272 of the Tax Code of the Russian Federation).

- If the cash method is used, then advertising expenses should be recognized after the actual payment is made (clause 3 of Article 273 of the Tax Code of the Russian Federation).

Separately, it is worth pointing out that if advertising costs are due to payment for the services of third-party companies, then they can be taken into account in 2 different ways:

- at the time of presentation of documents on the basis of which calculations should be made (invoice and certificate of completion of work);

- on the last day of the reporting or tax period.

Both options are legal in accordance with clause 7.3 of Art. 272 of the Tax Code of the Russian Federation, which is confirmed in the letter of the Ministry of Finance of Russia dated March 29, 2010 No. 03-03-06/1/201.

Expenses and income tax: a brief educational program

For companies that pay income tax, the law establishes certain rules for accounting for such expenses.

Payers of income tax are all Russian legal entities, except for those who apply special tax regimes (simplified system, UTII, Unified Agricultural Tax), as well as payers of tax on gambling business and participants in the Skolkovo project. From 2022, participants in projects of innovative science and technology centers will also be exempt from income tax.

Article 264 of the Tax Code, which regulates the taxation of profits, classifies advertising costs as other expenses associated with production and sales (clause 28, clause 1, article 264). In the same article, paragraph 4 lists the types of expenses that are recognized as advertising. At the same time, the code divides costs according to the method of adoption.

Some expenses are accepted in full (that is, the tax base is reduced by the entire amount of the expense). They are called non-standardized. This, according to the Tax Code:

- expenses for advertising events through the media,

- expenses for lighting and other outdoor advertising,

- expenses for participation in exhibitions, for window dressing, production of advertising brochures and catalogs containing information about goods, as well as for the markdown of goods that have lost their quality during exposure.

PSA: “Feeding the hungry is easier than you think”

Other types of expenses may be taken into account only in an amount not exceeding 1% of sales revenue for the reporting (tax) period. These are standard expenses. These include:

- expenses for the purchase or production of prizes awarded to the winners of drawings during mass advertising campaigns,

- expenses for other types of advertising not specified in Article 264 of the Tax Code.

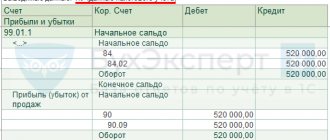

Standardized advertising expenses: calculation of the maximum amount

As already noted, recognition of standardized advertising expenses in the reporting period is possible only in an amount that does not exceed 1% of sales revenue, determined, in turn, in accordance with Art. 249 of the Tax Code of the Russian Federation.

In paragraph 1 of this article there is a rule that requires the inclusion of proceeds from sales as income. However, in accordance with paragraph. 2 clause 1.2 art. 248 of the Tax Code of the Russian Federation, when determining the final amount of income, it is necessary to subtract from the received proceeds all amounts of taxes that are presented to the buyer. This refers to VAT and excise taxes.

That is, the maximum amount of standardized advertising expenses is calculated from the amount of sales revenue minus the amount of VAT and excise taxes. Confirmation of this thesis can be found in the letter of the Ministry of Finance of Russia dated 06/07/2005 No. 03-03-01-04/1/310.

Example

The organization received revenue from the sale of services in the amount of 530,000 rubles in the reporting period. (including VAT). First, let's determine the amount of VAT that is included in the revenue:

530,000 rub. × 20/120 = 88,333 rub.

Then let's find the difference:

530,000 rub. – 88,333 rub. = 441,667 rub.

Now, finally, let’s determine the amount of the maximum amount of advertising expenses:

RUB 441,667 × 1% = 4417 rub.

Within the limits of this amount, it is permissible to include advertising costs in expenses.

If you have access to K+, check whether you have determined the standard correctly. If you don’t have access, get free trial access to the system and go to the Ready Solution.

To learn how this limit is calculated under the simplified tax system, read the material “How to take into account advertising costs under the simplified tax system.”

Advertising costs through the Indoor TV system are not standardized

Today there are many different types of advertising that did not exist 10 - 20 years ago at the dawn of the advertising market.

Accordingly, taxpayers looking for new approaches to the hearts, or rather wallets, of consumers use non-standard types of advertising (for example, such as the Indoor TV system). This system provides the customer with the right to broadcast videos on a media rental network in the sales areas of retail store chains, which the performer owns on the contract territory. When using such advertising, the question also arises as to whether the entire amount paid for advertising services can be taken into account in expenses based on paragraphs. 28 clause 1 and clause 4 art. 264 Tax Code of the Russian Federation. The judges gave the answer.

The subject of the proceedings in the Resolution of the Supreme Court of Ukraine dated September 18, 2019 in case No. A76-1202/2019 was the cost of advertising services on the Indoor TV system. And although in this case the plaintiff is an individual entrepreneur paying personal income tax, the conclusions made by the court are also relevant for corporate income tax payers, since entrepreneurs take into account expenses in a manner similar to the procedure for determining expenses for tax purposes established by Chapter. 25 of the Tax Code of the Russian Federation (Article 221 of the Tax Code of the Russian Federation).

How are advertising expenses reflected in accounting and reporting?

In accounting, advertising expenses are expenses for ordinary activities that are reflected as part of business expenses. Sub-paragraph is aimed at such reflection. 5 and 7 of the accounting regulations “Expenses of the organization” PBU 10/99 (approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n).

As for the chart of accounts, it is recommended to reflect such expenses in the debit of account 44 “Sale expenses” (instructions for using the Chart of Accounts for accounting financial and economic activities of organizations, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n). For accounting purposes they do not have a standardized nature.

The amount of advertising expenses in the income tax return is always reflected in one place, regardless of the method used to determine income and expenses. This amount forms the data indicated in line 040 of Appendix 2 to sheet 02 of the declaration (approved by order of the Federal Tax Service of Russia on October 19, 2016 No. ММВ-7-3 / [email protected] ).

Why do we need a standard for advertising expenses?

An organization can spend significant amounts on advertising; management decides which ones, taking into account the effectiveness of management decisions made in this regard and the financial capabilities of the organization. Since advertising is not only information, but also a business activity, it is reflected in appropriate accounting and is subject to taxation.

advertising expenses recognized in tax accounting ?

For this purpose, spending on advertising is usually divided into two types:

- normalized – those that are recognized as such only in accordance with certain criteria;

- non-standardized - unconditionally taken into account as advertising expenses, without limitation for tax purposes.

This division determines what amount of costs a company can take into account when determining the base for income tax: within limited limits or in full.

REFERENCE! Expenses intended for advertising are usually taken into account as part of “Other expenses” among expenses for the production or sale of goods.

How to correctly take into account advertising expenses when increasing profits in the tax period

The tax base for profit during the tax period is determined on an accrual basis (clause 7 of Article 274 of the Tax Code of the Russian Federation). Naturally, due to the gradual increase in the amount of revenue, the maximum amount of standardized advertising expenses will also increase, which can be taken into account when calculating the tax.

The letter of the Ministry of Finance of Russia dated November 6, 2009 No. 03-07-11/285 states that excess advertising expenses that could not be taken into account in the past reporting period can be taken into account during the calendar year in subsequent reporting periods (clause 44 of Art. 270 of the Tax Code of the Russian Federation).

In accounting, in such circumstances, a deductible temporary difference is formed, which is a deferred tax asset equal to the amount of excess advertising expenses (clauses 8–11, 14, 17 of the accounting regulations “Accounting for income tax calculations” PBU 18/02, approved. by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n).

Example

Circumstances:

, engaged in trade, spent 21,000 rubles on the production of prizes, which were then raffled off during the advertising campaign. (including VAT 3,500 rubles) The company is exempt from having to pay VAT in accordance with Art. 145 Tax Code of the Russian Federation.

Sigma's revenue by quarter was:

- for the 1st quarter - RUB 1,590,000;

- for half a year - 2,380,000 rubles.

Reflection in accounting:

According to paragraph 2 of Art. 285 of the Tax Code of the Russian Federation for income tax, reporting periods are considered to be 1 quarter, 6 months and 9 months.

If there were no other advertising expenses in the specified periods, the calculation of the maximum amount of normalized advertising expenses will look as follows.

- In the 1st quarter, since the amount of revenue is RUB 1,590,000:

- maximum amount of advertising expenses: RUB 1,590,000. × 1% = 15,900 rub.;

- the amount of advertising expenses that can be recognized in this reporting period is also equal to 15,900 (since it is less than the entire amount of expenses of RUB 21,000).

- maximum amount of advertising expenses: RUB 2,380,000. × 1% = 23,800 rub.;

- It will still be possible to admit: 21,000 rubles. – 15,900 rub. = 5,100 rub.

But it would be possible to write off a larger amount of advertising costs as expenses if their cost were higher. For the half year, this value was: 23,800 – 21,000 = 2,800 rubles.

In accounting, the above transactions will be reflected as follows:

Dt 10/6 Kt 60 – prizes in the amount of 21,000 rubles were capitalized. (VAT is included in their price, since the company operates without VAT);

Dt 44 Kt 10/6 – the cost of prizes (21,000 rubles) was written off as expenses.

In addition, at the end of the first quarter on March 31, you need to make the following posting:

Dt 09 Kt 68 - a recognized and deferred tax asset of 1020 rubles is reflected. ([21,000 – 15,900] × 20%).

And based on the results of the six months of June 30 of the current year, the following entries are drawn up:

Dt 68 Kt 09 - the deferred tax asset is written off in the amount of 1020 rubles.

Documentary evidence of advertising expenses for tax accounting

So, the income tax base is reduced by the amount spent on non-standardized expenses in full, and on standard expenses - in the amount of 1% of revenue for a given period. To recognize such expenses as advertising, they must be documented. Such confirmations may be:

- annual or quarterly plans for advertising campaigns;

- cost estimate for a particular advertising campaign;

- documents for the acquisition and/or write-off of tangible assets related to advertising activities;

- on-air certificates (when advertising on air).

Results

Advertising expenses can be taken into account in full when calculating profits if they are included in the list from clause 4 of Art. 264 Tax Code of the Russian Federation. If there are no advertising costs incurred, they are taken into account in an amount equal to 1% of revenue.

In accounting, advertising costs are written off in full. If the amount of standardized costs is more than 1% of revenue, temporary differences arise between tax and accounting accounting.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Judges' opinion

The opinions of the judges in this case differed: the first instance ruled in favor of the taxpayer, the appellate and cassation instances recognized the tax authority was right, and the Supreme Court of the Russian Federation, to which the company appealed, decided the case in favor of the taxpayer, upholding the decision of the first instance.

It is noteworthy that all interested parties were guided by the same standards - the Tax Code of the Russian Federation and the Law on Advertising, but different conclusions were drawn. Recognizing invalid the contested claim, the court of first instance, guided by paragraphs. 49 clause 1, clause 4 art. 264, art. 319 of the Tax Code of the Russian Federation, proceeded from the fact that the taxpayer, based on the results of the audited tax period, exceeded the limit provided for in paragraph 4 of Art. 264 of the Tax Code of the Russian Federation, in terms of expenses for advertising on transport, there were no expenses, and therefore the disputed expenses were also subject to accounting as expenses that reduce the income tax base, and additional assessment of corporate income tax and the issuance of a corresponding demand for payment of arrears are unlawful .

Canceling the decision of the court of first instance and refusing to satisfy the application to invalidate the disputed claim, the arbitration court of appeal came to the conclusion that the expenses incurred by the company for advertising on transport, carried out in accordance with Art. 20 of the Law on Advertising, relate to expenses accepted for profit tax purposes as part of other expenses in the amount provided for in paragraph. 5 paragraph 4 art. 264 Tax Code of the Russian Federation. Consequently, the inclusion of disputed expenses as part of advertising expenses subject to accounting in full (and not expenses according to the standard) led to an underestimation of the taxable base for income tax.

The Moscow District Arbitration Court supported the conclusions of the appellate court, noting that the tax inspectorate rightly classified the disputed expenses as expenses for advertising on vehicles. The Company paid contractors for the services of producing advertising materials for placement on vehicles and for applying advertising images to vehicles. The court has no doubt that these services relate to services for advertising on vehicles; they cannot be classified as services for outdoor advertising. The key point here is that outdoor advertising is placed on advertising structures of stable territorial placement. The vehicles (trolleybuses) on which the advertisement was placed cannot be classified as advertising structures with stable territorial placement.

Standard and excess expenses

In accordance with subparagraph 2 of paragraph 1 of Article 248 of the Tax Code of the Russian Federation, when determining income, the amounts of VAT and excise taxes presented by the taxpayer to the buyer in accordance with the Tax Code of the Russian Federation are excluded from them. The maximum amount of standardized advertising expenses is calculated based on the proceeds from the sale of goods, works, services and property rights, minus VAT and excise taxes.

Prizes to individuals during promotional events may be subject to personal income tax in accordance with paragraph 28 of Article 217 of the Tax Code of the Russian Federation. If advertising materials have their own consumer qualities, then they are recognized as goods. The transfer of goods costing more than 100 rubles per unit is subject to VAT. If the cost of purchasing or producing a unit of goods does not exceed 100 rubles, then its transfer for advertising purposes is not subject to VAT.

Excessive advertising expenses that were not taken into account when forming the tax base for income tax in one reporting period can be taken into account in subsequent reporting periods of the year. The balance cannot be carried over to the next year. It is recommended to keep separate records of expenses within advertising campaigns. This will allow you to take into account some costs other than advertising ones.