Theoretically, the dates on which the primary documents were issued and the dates on which the corresponding business transactions are reflected in the accounting records should coincide. But in practice, there are often cases when goods, work or services are actually accepted in one period, and the documents for them (invoices or acts) are received in another. As a result, the organization is aware of the actual expenses incurred, but there are no grounds for reflecting them in accounting (both accounting and tax). The situation becomes especially confusing when we are talking about different tax periods. We believe that every taxpayer has encountered a similar problem at least once in their life, therefore, ways to solve it are of interest to a wide range of readers.

The situation under consideration is not directly regulated by the Tax Code. And this, in turn, indicates the presence of at least several ways to account for expenses, the supporting documents for which were received by the taxpayer late. We will consider each of them, as well as their pros and cons, in detail.

Adjustment of the tax base of the previous period

This option is completely legitimate and complies with the provisions of tax legislation, in particular paragraph 1 of Art. 54 and paragraph 1 of Art. 272 Tax Code of the Russian Federation .

Let us remind you: the procedure for recognizing costs using the accrual method is determined by clause 1 of Art. 272 , according to which expenses accepted for tax purposes taking into account the provisions of Chapter. 25 of the Tax Code of the Russian Federation , are recognized as such in the reporting (tax) period to which they relate, regardless of the time of actual payment of funds and (or) other form of payment and are determined taking into account Art. 318 – 320 Tax Code of the Russian Federation . In other words, expenses are recognized in the reporting (tax) period in which they arose based on the terms of the transaction. This is the so-called general principle of cost recognition for income tax purposes. As the Federal Antimonopoly Service emphasized in Resolution No. A72-5678/2011 , this principle does not give the taxpayer the right to arbitrarily choose a tax period to reflect expenses.

Based on the above principle, a taxpayer, having received documents late, must adjust the tax base for the income tax of the previous period by the amount of expenses incurred (and, accordingly, the amount of tax payable) and submit an updated declaration to the inspectorate.

The following arguments can be given in favor of this method of reflecting expenses previously not taken into account when taxing profits. Tax accounting is a system for summarizing information to determine the taxable base for income tax based on data from primary documents, grouped in accordance with the procedure provided for by tax legislation (Article 313 of the Tax Code of the Russian Federation ). If primary documents (regardless of their format - paper or electronic) are missing, then there is no possibility of accounting for costs incurred for tax purposes. As a result, the taxable base reflected in the tax return for the period when the expenses were actually incurred by the taxpayer turns out to be overestimated. As a result, the amount of tax calculated and declared for payment to the budget for this period is also overestimated.

Document “Adjustment of sales” in 1C 8.3 when purchasing goods

The document is either generated from the implementation or added to the list of adjustment documents manually. After creation, if this was done through the “Add from list of adjustment documents” tool, you need to check that it contains exactly the sales document from which the data needed to be adjusted.

If sales change, in addition to mutual settlements with the buyer, this also affects revenue, and therefore the financial result of the company.

If a downward adjustment to sales is required, it is carried out in the same way as an adjustment to receipts. Namely: an operation is selected (adjustment by agreement or corrections to the primary documents), the necessary changes are made regarding the quantity or cost of the goods.

You need to choose how the position will be displayed: in all relevant sections or exclusively in VAT accounting. If the first option is selected, then as a result of the adjustment, movements will be generated in accounting and tax accounting, as well as in VAT accounting registers.

If only VAT accounting is selected, then movements will be generated only for it. It is also possible to select only the printed form - in this case, movements will not be generated at all.

When purchase book entries are generated, adjustment invoices are entered into them according to the documents “Adjustment of receipts and sales.” they are also included in the VAT return - it is generated from the “Reports” section.

As can be seen from what has been discussed, 1C offers not only extensive functionality that allows you to avoid accounting errors, but also, if they are made, to correct them. If any nuances cause difficulties, you should contact our specialists - they will help solve any problems that arise.

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Controllers with both hands “for”

Local tax authorities (as evidenced by examples from arbitration practice) often insist on precisely this method of recognizing the expenses in question in accounting. They justify their demands by reference to the provisions of paragraph 1 of Art. 54 of the Tax Code of the Russian Federation (which corresponds to clause 1 of Article 272 of the Tax Code of the Russian Federation ), which determines the procedure for correcting the tax base in the event of detection of errors and inaccuracies relating to previous periods.

We believe that to a large extent, such categoricalness of the controllers was influenced by the explanations given in the Letter of the Federal Tax Service of Russia dated August 17, 2011 No. AS-4-3/13421 . Let us recall that in it, tax department specialists came to the conclusion that a taxpayer may not submit an amended return only when the period of occurrence of the error is not clear. With regard to documents received late, there can be no such ambiguity, since the period when the costs were incurred is determined.

It should be noted: there are judicial acts in which the arbitrators agree with this position of the controllers. For example, the judges of the Federal Antimonopoly Service of North Kazakhstan, in Resolution No. A15-1905/2012 , 2013, came to the conclusion that the reflection in the tax base of expenses incurred, the confirmation documents for which were not received before the reporting deadline, is carried out by submitting an updated declaration. A company can attribute expenses to the period of their identification (receipt of documents from counterparties) only if the period of occurrence of the expenses incurred is not known.

It is also appropriate to add here that tax inspectors often appeal to the conclusions made in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 09.09.2008 No. 4894/08 (hereinafter referred to as Resolution No. 4894/08 ), according to which expenses related to past periods are subject to reflection in the tax accounting in compliance with the requirements of Art. 54 and 272 of the Tax Code of the Russian Federation . Meanwhile, the dispute in the said judicial act arose over episodes related to the additional assessment of income tax on non-operating expenses for the period from 2001 to 2003. In other words, the conclusions of the senior arbitrators were made in relation to legal relations regulated by the previous wording of paragraph 1 of Art. 54 of the Tax Code of the Russian Federation (before amendments were made to it by Federal Law No. 224-FZ ), which was applied until January 1, 2010. Therefore, reference to the mentioned judicial act when considering controversial situations that arose after this date is, to put it mildly, incorrect.

A similar conclusion was made in the Resolution of the Ninth Arbitration Court of Appeal dated October 23, 2013 No. 09AP-33336/2013 .

So, by choosing this method of recording expenses based on late supporting documents, the taxpayer will most likely avoid claims from regulatory authorities.

"A spoon of tar"

At the same time, it should be noted that the above option for reflecting expenses has one significant drawback. The fact is that filing an updated declaration with a smaller amount of tax payable to the budget, in addition to a desk audit (conducted in the manner established by Article 88 of the Tax Code of the Russian Federation ), can provoke an on-site audit.

The validity of this statement is confirmed by the recommendations of Federal Tax Service specialists on conducting on-site inspections ( clause 1.3.2 of Letter No. AS-4-2/13622 ). It follows from this document that the tax authority, as part of an on-site audit, has the right to check the period for which the updated declaration was submitted (even if this period exceeds three calendar years preceding the year in which such a declaration was submitted). An exception is the case when the corresponding period was previously covered by an on-site inspection (see also Letter of the Federal Tax Service of Russia dated May 29, 2012 No. AS-4-2/8792 ).

Thus, by submitting an amended return in which the amount of income tax payable to the budget is reduced, the taxpayer risks that an unscheduled on-site tax audit may be assigned to him. Let us add that this risk increases in the case of repeated clarification of information for the same period.

At the same time (as mentioned above), adjusting the tax base of the previous period is far from the only way to reflect previously unrecognized expenses in accounting.

Non-operating expenses

If we are talking about “late” documents for non-operating or other expenses (as a rule, these are costs associated with paying third-party organizations for work or non-production services), then a special rule established in paragraphs. 3 paragraph 7 art. 272 Tax Code of the Russian Federation . Let us remind you that this provision provides for the taxpayer’s right to choose a specific method of accounting for expenses (including those confirmed by “late” documents). This may be (unless otherwise established by Articles 261 , 262 , 266 , 267 of the Tax Code of the Russian Federation ):

- settlement date in accordance with the terms of concluded agreements;

- the date of presentation to the taxpayer of documents serving as the basis for making calculations;

- the last day of the reporting (tax) period - for expenses in the form of commission fees, costs of paying third parties for work performed (services provided), rental (leasing) payments for rented (leased) property, as well as other similar expenses.

The fairness of this approach is confirmed by the conclusions of the arbitrators made in the resolutions of the FAS North-West District dated 06/05/2012 No. A44-3816/2011 , FAS North-West Region dated 02/22/2012 No. A53-11894/2011 . And FAS MO in Resolution No. A40-54227/12-90-293 clarified: in tax legislation there is no obligation for the taxpayer to record his choice of the date of non-operating and other expenses in the form of costs for paying third parties for the services they provide in the accounting policy for tax purposes. If the taxpayer recognizes the costs of paying for such work not at the time of signing the act, but during the period of payment for the service provided, these actions fully comply with the requirements of paragraphs. 3 paragraph 7 art. 272 Tax Code of the Russian Federation .

Significant point: In subclause 3 of clause 7 of Art. 272 refers to the presentation of documents. The concept of “present” in explanatory dictionaries of the Russian language means “show in confirmation.” In other words, the use of the concept of “presentation” in relation to documents indicates that these documents can be seen with one’s own eyes. That is, we are talking about the date when the documents were actually received by the taxpayer. This is exactly how the mentioned concept is interpreted in law enforcement practice (see, for example, resolutions of the Federal Antimonopoly Service of the Moscow Region dated August 14, 2013 No. A40-110013/12-20-566 , Federal Antimonopoly Service of the North-West Zone dated January 31, 2011 No. A56-10165/2010 ).

Officials of the Ministry of Finance, in turn, often replace the concepts in this norm. For example, in Letter No. 03-03-06/1/774 , financiers indicated that the date of presentation to the taxpayer of documents serving as the basis for making calculations should be understood as the date of preparation of these documents. Agree, there is a difference between drafting and submitting documents, and a considerable one.

What to do if you forgot to submit a document for sale?

Often, in the process of documenting transactions, some inconsistencies may occur, documents may not be drawn up or drawn up incorrectly, in such situations it is necessary to take additional actions in order to resolve this situation. Otherwise, tax deductions will not be received, since the main basis for this is a correctly drawn up document.

The transaction must be carried out in accordance with legal regulations . What to do if you forgot to post a document from the supplier in a timely manner?

If a discrepancy or absence of an invoice is identified, it is necessary to immediately draw up this document in accordance with the rules and provide it to the buyer within 5 days from the date of its preparation.

The invoice must indicate the exact date of the transaction; in addition, a certificate of completion of work is drawn up, which, together with the invoice, is sent to the customer’s address. This act is also drawn up on the date of the actual transaction. Read more about whether an invoice and a work completion certificate are interchangeable here, and find out more about the rules for issuing a power of attorney for signing invoices and work completion certificates in this material.

Production costs

When considering the issue of a special procedure for recognizing expenses for profit tax purposes, one cannot fail to mention clause 2 of Art. 272 of the Tax Code of the Russian Federation , which determines the procedure for recognizing expenses for payment for work and services of a production nature .

Let us remind you that such expenses are recognized in tax accounting on the date the customer signs the acceptance certificates for work and services. In this case, the taxpayer is not given the right to choose a specific method of accounting for material costs. At the same time, to include the cost of work (services) in tax expenses, a primary document is required, on the basis of which these works will be accepted for accounting. Therefore, obtaining information about costs that was not available to the taxpayer at the time of drawing up the declaration does not give rise to the taxpayer’s obligation to adjust the tax base of the previous period by filing an updated declaration.

As stated in the previously mentioned Resolution of the Ninth Arbitration Court of Appeal No. 09AP-33336/2013 , in a situation where we are talking about “late” documents, a special rule is subject to application - clause 2 of Art. 272 of the Tax Code of the Russian Federation , and the tax inspectorate’s reference to the general procedure ( clause 1 of Article 272 of the Tax Code of the Russian Federation ) and to the provisions of Art. 54 of the Tax Code of the Russian Federation , which talks about detected errors and distortions (that is, about reflecting expenses in the absence of primary documents), is unlawful.

Step-by-step instruction

On May 20, 2022 (Q2), the Organization’s postal address received primary documents for the provision of supplier services, as well as an invoice dated December 25, 2022 in the amount of RUB 72,000. (incl. VAT 20%)

The accountant was not aware of the fact of economic life that had occurred at the time of reporting; reconciliation with this counterparty was not carried out. Accounting statements have been submitted and approved. The income tax return for the year was filed with a profit

How to register an unrecorded document for admission?

Let's look at step-by-step instructions for creating an example. PDF

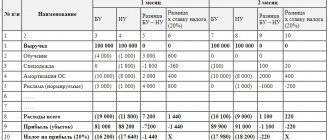

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Registration of an unaccounted receipt document for the services of a third party organization | |||||||

| May 20, 2020 | 91.02 | 60.01 | 60 000 | 60 000 | 60 000 | Accounting for service costs | Receipt (act, invoice) - Services (act) |

| 19.04 | 60.01 | 12 000 | 12 000 | Acceptance for VAT accounting | |||

| Registration of an unrecorded SF supplier | |||||||

| May 20, 2020 | — | — | 72 000 | Registration of SF supplier | Invoice received for receipt | ||

| 68.02 | 19.04 | 12 000 | Acceptance of VAT for deduction | ||||

| — | — | 12 000 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

| VAT return for the second quarter of 2020 | |||||||

| June 30, 2020 | — | — | 12 000 | Reflection of VAT accepted for deduction | Regulated report VAT return Section 3 p.120 | ||

| Income tax return for the first half of 2020 | |||||||

| June 30, 2020 | — | — | 60 000 | Reflection of identified losses in the declaration for the current period | Regulated report Income tax return Sheet 02 Appendix. 2 page 400, page 401 | ||

What if you recognize it as a loss?

Expenses not previously taken into account (due to the lack of supporting documents) can be qualified as losses from previous periods that were identified in the current tax period.

True, this method does not exclude disputes with regulatory authorities (remember, they insist on the need to adjust the tax base of the previous period). In addition, from the Letter of the Ministry of Finance of Russia dated December 28, 2010 No. 03-03-06/1/814 , it follows that the taxpayer must record previously unrecognized expenses under the same item and group of expenses (material expenses, wages or non-operating expenses) , according to which they are taken into account in case of timely receipt of documents.

What are the organization’s chances of defending its interests in this case (including in court)? It is quite difficult to predict the outcome of such a dispute in advance, since judicial practice in this regard is very contradictory.

For example, in Resolution No. A65-6652/2010 , the FAS PO arbitrators considered the actions of the taxpayer correct, who, guided by paragraphs. 1 item 2 art. 265 of the Tax Code of the Russian Federation , previously unaccounted expenses were reflected in non-operating expenses as losses of previous tax periods identified in the current tax period. Despite the fact that the dispute considered in the case concerns the recognition of expenses in 2008, the arbitrators applied clause 1 of Art. 54 of the Tax Code of the Russian Federation as amended, effective from January 1, 2010. Motivating their actions, the judges referred to paragraph 3 of Art. 5 of the Tax Code of the Russian Federation , according to which acts of legislation on taxes and fees that establish additional guarantees for the protection of taxpayers’ rights have retroactive effect without special instructions.

True, later the Federal Antimonopoly Service ( Resolution No. A65-30248/2012 ) came to the conclusion that the provisions of paragraphs. 1 item 2 art. 265 of the Tax Code of the Russian Federation are subject to application in the current tax period only if the period of occurrence of expenses incurred by the taxpayer is unknown. In all other cases, expenses related to previous tax periods are subject to reflection in tax accounting in compliance with the requirements of Art. 54 and 272 of the Tax Code of the Russian Federation . (The reason for the change in the position of the arbitrators of this district is also indicated here - Resolution No. 4894/08 .)

Of interest is also the Resolution of the Federal Antimonopoly Service of the Moscow Region dated July 5, 2013 No. A40-122173/12-20-621 , which considered a similar episode (documents on previously incurred expenses were received in 2008 and 2009). Making a decision in favor of the tax authority (with reference to Article 54 (as amended before 01/01/2010), 272 of the Tax Code of the Russian Federation and, of course, Resolution No. 4894/08 ) and canceling the decisions of lower authorities (which decided in favor of the taxpayer), the arbitrators decided: the taxpayer does not have the right to take into account as losses from previous years expenses identified in the current year associated with ordinary business activities.

In making such conclusions, the judges nevertheless noted that the case materials do not contain documents confirming the later receipt of primary documents.

Perhaps, if the taxpayer had bothered about this evidence in time, the outcome of the dispute would have been different. However, this cannot be said for certain. But! The mentioned clause from the Resolution of the Federal Antimonopoly Service No. A40-122173/12-20-621 once again convinces us that such evidence is very useful in disputes about the period for reflecting previously unaccounted expenses. Consequently, taxpayers need to worry about preparing this kind of documents (for example, logs of incoming correspondence) in advance.

So, taking into account the above, we can conclude: the procedure for recognizing in tax accounting expenses confirmed by “late” primary documents cannot be universal. The choice of the period for reflecting previously unaccounted expenses (and, as a consequence, the need to adjust the taxable base for income tax) directly depends on the specific type of expense. At the same time, the taxpayer must weigh the negative consequences of each of the possible options, as well as assess the likelihood of a legal dispute with controllers. And here it is important to clearly understand what is an error for tax purposes and what is not.

Correcting errors of previous years in “1C: Accounting 8”

- home

- About the franchisee

- News

- Correcting errors of previous years in “1C: Accounting 8”

August 25, 2019

1C experts tell how users can correct their own mistakes of past years made in accounting and tax accounting for income taxes.

To simplify income tax accounting, the 1C:Accounting 8 version 3.0 program implements the following mechanism for correcting errors of previous years related to the reflection of the receipt of goods (work, services). If errors (distortions):

- led to an underestimation of the amount of tax payable, then changes to the tax accounting data are made for the previous tax period;

- did not lead to an underestimation of the amount of tax payable, then changes to the tax accounting data are made in the current tax period.

If the taxpayer still wants to exercise his right and submit to the tax authority an updated income tax return for the previous period (in the case where errors (distortions) did not lead to an understatement of the tax amount), then the user will have to adjust the tax accounting data manually.

Example 1

| A technical error made in the accounting of New Interior LLC and described in Example 1 was discovered after submitting the income tax return for 2015 and after signing the financial statements for 2015. The organization makes the necessary changes to the accounting and tax records and submits updated tax returns to the tax authority: for VAT - for the third quarter of 2015; for income tax - for 9 months of 2015 and for 2015. |

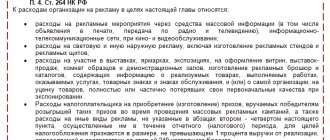

To correct errors in overestimating costs of the previous tax period, the document Adjustment of receipts with the operation type Correction in primary documents is also used. The difference is that the date of the basis document and the date of the adjustment document refer to different years: in the field from the Receipt Adjustment document we indicate the date: 02/29/2016. After this, the document form Adjustment of receipts on the Main tab is modified: in the details area Reflection of income and expenses, the Item of other income and expenses field appears instead of the switches:. In this field you need to indicate the desired item - Profit (loss of previous years), selecting it from the directory Other income and expenses.

The procedure for filling out the tabular part of the Service and registering the corrected version of the Invoice document received does not differ from the procedure described in Example 1 in the article “Correcting a reporting year error in 1C: Accounting 8.”

Please note that if the accounting system for the organization New Interior LLC has set a prohibition date for changing the data of the “closed” period (i.e., the period for which reporting is submitted to the regulatory authorities - for example, 12/31/2015), when trying to post a document on The screen will display a message stating that it is impossible to change data during the prohibited period. This happens because the document Adjustment of receipts in the described situation makes changes to tax accounting data (for income tax) for the previous tax period (for September 2015). In order to post the Receipt Adjustment document, the date of prohibition of data changes will have to be temporarily removed.

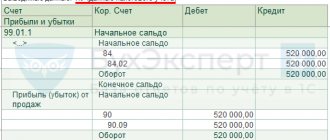

After posting the Receipt Adjustment document, accounting entries and records will be generated in special resources for tax accounting purposes for income tax (Fig. 1).

Rice. 1. Result of conducting the “Receipt Adjustment” document

In addition to entries in the accounting register, corrective entries are made in the accumulation registers of VAT presented and VAT purchases. All entries related to the VAT adjustment for the third quarter do not differ from the entries in Example 1 in the article “Correction of a reporting year error in 1C: Accounting 8”, since in terms of VAT in this example the procedure for correction is no different. Let's take a closer look at how errors of previous years are corrected in accounting and tax accounting for income taxes.

According to paragraph 14 of PBU 22/2010, the profit resulting from a decrease in the inflated cost of rent in the amount of 30,000 rubles is reflected in accounting as part of other income of the current period (corrected by an entry in the credit of account 91.01 “Other income” in February 2016).

In tax accounting, in accordance with paragraph 1 of Article 54 of the Tax Code of the Russian Federation, the inflated cost of rent should increase the tax base for the period in which the specified error (distortion) was made. Therefore, the amount is 30,000 rubles. reflected in sales income and forms the financial result with records dated September 2015.

To account for the result of adjusting settlements with counterparties (if such an adjustment is made after the end of the reporting period), the program uses account 76.K “Adjustment of settlements of the previous period.” Account 76.K reflects the debt for settlements with counterparties, starting from the date of the transaction that is subject to adjustment, to the date of the correcting transaction (in our example, from September 2015 to February 2016). Please note that the entry Amount NU DT 76.K Amount NU CT 90.01.1 is a conditional entry that serves only to adjust the tax base upward and correctly calculate income tax.

In our example, the tax base increased not due to an increase in sales revenue, but due to a decrease in indirect costs. Income and expenses in the updated declaration must be reflected correctly, so the user can choose one of the following options:

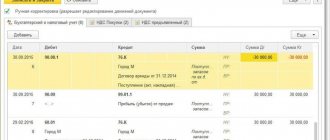

• manually adjust the indicators in Appendix No. 1 and Appendix No. 2 to Sheet 02 of the updated profit declaration for 9 months and for 2015 (reduce sales revenue and at the same time reduce indirect expenses by 30,000 rubles); • manually adjust the correspondence of accounts for tax accounting purposes as shown in Figure 2.

Rice. 2. Wiring adjustments

Since after the changes were made, the financial result for 2015 in tax accounting has changed, in December 2015 it is necessary to re-perform the regulatory operation Reformation of the balance sheet, which is part of the Month Closing processing.

Now, when automatically filling out reports, the corrected tax accounting data will appear both in the updated income tax return for 9 months of 2015 and in the updated corporate income tax return for 2015.

At the same time, the user inevitably has questions that are directly related to accounting:

- How to adjust the balance of settlements with the budget for income tax, which will change after additional payment of the tax amount?

- Why, after adjusting the last period, is the key relationship BU = NU + PR + BP not fulfilled?

| IS 1C:ITS For the key rule for the ratio of transaction amounts (BU = NU + PR + VR), see the article “Support for the requirements of PBU 18/02 “Accounting for income tax calculations”” in the “Technological support for application solutions” section. |

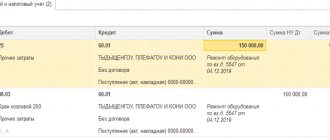

To additionally charge income tax from an increase in the tax base that occurred as a result of corrections made to tax accounting, in the period when the error was discovered (February 2016), you need to enter an accounting entry into the program using a manual Transaction:

Debit 99.02.1 Credit 68.04.2 - in the amount of 6,000 rubles.

At the same time, it is necessary to distribute the tax payable according to budget levels:

Debit 68.04.2 Credit 68.04.1 with the second subaccount Federal budget - in the amount of 600 rubles; Debit 68.04.2 Credit 68.04.1 with the second subaccount Regional budget - in the amount of 5,400 rubles.

As for the equality BU = NU + PR + BP, indeed, after adjusting the previous period, it does not hold. The report Analysis of the state of tax accounting for income tax (section Reports) for 2015 will also illustrate that the rule Valuation based on accounting data = Valuation based on tax accounting data + Permanent and temporary differences is not carried out for the Tax and Income sections. This situation arises due to discrepancies in the legislation on accounting and tax accounting and in this case is not an error.

According to paragraph 1 of Article 81 of the Tax Code of the Russian Federation, the correction of an error that led to an understatement of the tax base must be reflected in the period of reflection of the original transaction, and in accounting, the correction of an error from previous years is made in the current period. Permanent and temporary differences are concepts related to accounting (“Regulations on accounting “Accounting for calculations of corporate income tax” PBU 18/02”, approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n). There is no reason to recognize differences in the previous period before making a corrective accounting entry.

After the correction of the error is reflected in the accounting records during the discovery period, the financial result for 2016, calculated according to accounting and tax accounting data, will differ by the amount of correction of the error - the profit in accounting will be greater. Therefore, as a result of posting the Receipt Adjustment document, a constant difference is formed in the amount of the corrected error (see Fig. 3). After completing the regulatory operation Calculation of income tax in February 2016, a permanent tax asset (PTA) will be recognized.

To get a consultation

How to find out about useful materials on time?

Join our monthly newsletter and stay up to date.