Accounts receivable is one of the most significant indicators of financial statements. The write-off of accounts receivable is preceded by a lot of analytical and organizational work: identifying problematic accounts and debtors, and the possibility of debt collection. If it is impossible to collect the debt, it should be written off. At the same time, an accountant needs to know not only accounting and tax legislation, but the Civil Code and arbitration court practice.

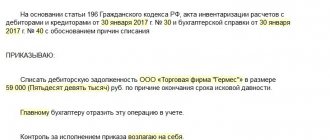

Question: How to reflect in the accounting records of an organization that applies the simplified tax system (taxable object “income reduced by the amount of expenses”), the write-off of accounts receivable for goods sold due to the expiration of the statute of limitations? A provision for doubtful debts regarding this debt was not formed. As a result of an inventory of settlements with counterparties (based on the manager’s order), unsecured, overdue receivables were identified, for which the statute of limitations had expired. The amount of debt for the goods sold is 50,000 rubles. View answer

In what cases should a debtor be written off?

There are legitimate reasons to write off debt. They are confirmed by documents from third-party organizations. These papers are the basis for entries in BU and NU.

How to recognize receivables as uncollectible and take them into account for income tax purposes?

Causes:

- The statute of limitations has expired. This means that the company cannot file a lawsuit for debt collection, since 3 years have passed since the organization learned of a violation of contractual obligations by the counterparty: for example, it received a refusal to pay for goods, work, or services after delivery under the contract. The period is interrupted if the organization files a lawsuit or the debtor confirms in writing the existence of obligations to the organization (Civil Code of the Russian Federation, Art. 196-1, Art. 200, Art. 203).

- The government agency signed an act on the impossibility of collection. This refers to the act of the bailiff as the basis for writing off the debt. Despite individual attempts by local Federal Tax Service officials to challenge this basis for write-off, the Tax Code of the Russian Federation and judicial practice indicate its legality (Article 266-2 of the Tax Code of the Russian Federation, Op. VAS No. 2727/08 on case No. A60-3260/2007-C6 from 02/07/08).

- The debtor organization ceased to exist as a legal entity. The basis for write-off will be an entry in the Unified State Register of Legal Entities in relation to the debtor (Article 63–9 of the Civil Code of the Russian Federation).

How to write off unrecoverable (bad) receivables in accounting?

On a note! On similar grounds, debts to creditors can be written off.

Accounts receivable can also be written off due to the impossibility of collecting them, as assessed by specialists from the company itself. This option is applicable if the economic analysis revealed that going to court is inappropriate. Usually in such cases we are talking about small volumes of receivables, compared to significant legal costs in the future (see letters of the Ministry of Finance No. 03-03-06/1/3 dated 13-01-09, No. 03-03-06 /1/124 dated 02/21/08, determined by the Supreme Arbitration Court of the Russian Federation No. 9473/08 dated 07/30/08, FAS MO No. KA-A40/13269-08-P-2 dated 02/02/09 g. and a number of similar ones).

Write-off sources

- Due to the reserve for doubtful debts. One of the sources through which accounts receivable can be written off is the creation of a reserve for doubtful debts. However, only companies that determine shipment revenue can create it. The general reservation procedure is determined by Art. 266-4 Tax Code of the Russian Federation. The reserve includes the full amount of the debt, the term of which exceeded 3 months, half the amount - if the period is from 45-90 days. Receivable amounts with a shorter term are not taken into account. At the same time, the amount of VAT expected to be transferred from the debtor is also reserved. The amount of reserved funds is limited, above 10% of revenue for the tax and settlement period.

- If there is no reserve in the organization. The receivables must be written off at the expense of other expenses, i.e. it will affect the value of the final indicators in one way or another.

- Source: net profit. The decision to write off receivables is made exclusively by the general meeting of founders, since such actions directly affect the financial result.

Debt write-off procedure

Creating an inventory report

Before writing off debt, it is necessary to reconcile the balances of mutual settlements with counterparties, identify doubtful debts, and find differences in accounting and tax accounting.

For these purposes, the program uses the document “Settlements Inventory Act”. The document can be opened in the “Purchases” and “Sales” menus:

Let's look at how to work with a document.

1. First, the inventory date and organization are indicated.

2. On the “Settlement Accounts” tab, check boxes indicate the accounts for which the document will be filled out:

3. When you click the “Fill” button, the “Accounts Receivable” and “Accounts Payable” tabs are automatically filled in with information about debts by counterparties:

The “Confirmed” column displays amounts for which there are supporting documents. If there are no such documents, the column should be cleared and the amount transferred to the “Not confirmed” column.

In the column “Incl. the statute of limitations has expired”, the amounts of the overdue debt are manually indicated.

4. On the “Inventory taking” tab, the inventory period, document and reason are indicated:

5. On the “Inventory Commission” tab, the members of the inventory commission are indicated:

The document does not make postings. When you click on the “Print” button, you can display printed forms:

- Inventory report of settlements (INV-17).

- Order to conduct an inventory (INV-22).

Debt adjustment

After the inventory is completed, a “Debt Adjustment” document is created. The document can be opened in the “Purchases” and “Sales” menus:

In the document:

1. The organization and date are indicated, and the type of operation “Debt write-off” is selected.

2. Next, you need to select one of the options to write off:

- Buyer's debt.

- Buyer's advances.

- Debt to the supplier.

- Advances to the supplier.

3. After selecting the write-off option, the counterparty for whom the operation needs to be performed is indicated.

4. The document is filled out automatically by clicking the “Fill” button.

5. On the “Write-off account” tab, indicate the account to which you want to write off the debt and the necessary analytics.

By clicking the “Post” button, the document is saved and transactions are generated.

Let's look at examples of debt write-off for various situations.

Accounting for writing off accounts receivable

To begin with, let us recall that if for the same counterparty there is, in addition to accounts receivable, accounts payable, you must first offset the amounts, and then, if accounts receivable are eventually identified, write them off.

The following documents confirm the debt:

- acts, invoices as confirmation of the provision of services, supply of goods, performance of work;

- acts of reconciliation with partners;

- letters demanding repayment of debt, official responses to them;

- payment documents that reflect the amounts paid by the organization, etc.

Their presence is necessary, among other things, in order to record and confirm the statute of limitations.

Important! Documents are stored for at least 5 years after the amounts are written off.

BU postings are generated depending on the sources of write-off. The coverage of written-off receivables by the created reserve for doubtful debts is reflected by posting Dt 63 Kt 60, 62, 76. Debts not covered by the reserve are included in other expenses: Dt 91/2 Kt 60, 62, 76. Similarly, i.e. according to debit 91/2 in correspondence with the corresponding settlement accounts, receivables are taken into account if there is no reserve in the organization.

If the general meeting decides to reduce net profit by the amount of written off accounts receivable, entry Dt 84 Kt 60, 62, 76 , etc. is made.

The written-off debt must be taken into account on the balance sheet on Dt 007 for 5 years and only then the final write-off must be carried out.

Blog

Photo source: https://www.pexels.com/

Although Mr. Chibis constantly chirps that the population regularly pays for housing and communal services, there is a group of owners from whom it is almost impossible to collect the debt. Most often, these are marginal individuals who can only be submitted to the Cabinet of Curiosities, and even then they will not take them, since there are too many applicants for one place. The period of debt of such comrades is calculated in years, which means that there is a need to write off such debt in accounting with all the ensuing consequences. We'll talk about the consequences...

The Herods don’t pay... We are starting to write off the debt...

Accounting.

The debt of the owner of the premises to the management organization must be recognized as uncollectible and written off from the balance sheet in full, including VAT.

, if one of the following events occurred (clause 77 of the Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n “On approval of the Regulations on accounting and financial reporting in the Russian Federation” (hereinafter referred to as Regulation No. 34n):

- the statute of limitations has expired (in the case of debt for housing and communal services, it is three years);

- the debtor organization has been liquidated;

- the debtor organization is excluded from the Unified State Register of Legal Entities as an inactive legal entity;

- The bailiff issued a decision to terminate the enforcement proceedings and return the writ of execution to the recoverer due to the impossibility of collection.

Write-off of bad debts is documented with the following documents:

- settlement inventory act (INV-17). Please note that since 2013, this form is not mandatory for use

, so an organization can develop its own form of the act. - order from the head of the organization.

In the accounting records of the management organization, debt write-off is reflected in the following entries:

Dt 63 - Kt 62 (76)

Bad debt, against which a reserve for doubtful debts was created,

Dt 91 - Kt 62 (76)

Bad debt not covered by the reserve was written off

Dt 007

Bad debt is reflected in the off-balance sheet accounting of the management organization

The amount of debt written off for housing and communal services must be reflected in off-balance sheet account 007 within 5 years from the date of debt write-off

with the hope that the debtor will suddenly become a dollar millionaire and pay off the previously written off debt.

If a miracle does happen and the debtor pays the debt previously written off to an off-balance sheet account, the following entries are made in the accounting records of the management organization:

Dt 51 (50) - Kt 62 (76)

The receipt of money from the debtor is reflected

Dt 62 (76) - Kt 91

The repaid debt is taken into account in income (previously we put it as expenses)

Kt 007

A bad debt repaid by the debtor is written off

Tax accounting.

If everything is clear with the accounting of writing off bad debt amounts, then there are some peculiarities regarding the taxation of these amounts.

Income tax.

The criteria by which a debt is considered bad for income tax purposes are absolutely similar to the above criteria for writing off debt in accounting, so we will not dwell on them.

Please note that the debt of the owner of the premises cannot be considered a bad debt if this debt can be offset against the repayment of the management organization's counter-payables to the owner.

Amount of debt written off, including VAT:

- if the management organization has not previously created a reserve for doubtful debts for the purposes of calculating income tax, it is included in non-operating expenses on the basis of paragraph 2 of paragraph 2 of Article 265 of the Tax Code of the Russian Federation;

- if the management organization previously created a reserve for doubtful debts in tax accounting, the amount of debt written off is written off against the previously created reserve. If the amount of the formed reserve for doubtful debts is less than the amount of the bad debt being written off

, the amount of excess debt over the amount of the reserve is included in non-operating expenses on the basis of paragraph 2 of paragraph 2 of Article 265 of the Tax Code of the Russian Federation.

Simplified taxation system.

Start to be sad, but writing off bad debts is not reflected in any way when calculating the single tax under the simplified taxation system

(I would like it that way).

The reason is that, according to clause 1 of Article 364.17 of the Tax Code, the date of receipt of income for the purposes of calculating the simplified tax system is the day of receipt of funds in bank accounts and (or) at the cash desk (cash method). And since the money has not been received, it is quite logical that the list of expenses taken into account when calculating the simplified tax system and named in Article 346.16 of the Tax Code of the Russian Federation does not include expenses for writing off bad debts

.

This position, in particular, was expressed in the Letter of the Ministry of Finance of the Russian Federation dated February 20, 2016 N 03-11-06/2/9909.

Personal income tax.

Personal income tax and bad debts are made for each other. If you don't believe it, you'll get it...

Since January 1, 2016, a new version of clause 1 of Article 223 of the Tax Code of the Russian Federation has been in force. Clause 5 has been added to this article, according to which the date of actual receipt of income

by an individual is defined, in particular,

as the day when a bad debt is written off in the prescribed manner from the organization’s balance sheet

. This position was expressed in particular in the Letter of the Ministry of Finance of Russia dated October 6, 2017 N 03-04-06/65512.

When writing off a bad debt of an individual, the management organization, on the basis of clause 1 of Article 24 and Article 226 of the Tax Code of the Russian Federation, is recognized as a tax agent and must fulfill the duties provided for tax agents by Articles 226 and 230 of the Tax Code of the Russian Federation, including the obligation no later than one month from the date the end of the tax period in which the relevant circumstances arose, notify the taxpayer and the tax authority at the place of registration in writing about the impossibility of withholding tax and the amount of tax

.

A form of information on the income of an individual “Certificate of Income of an Individual” (Form 2-NDFL), approved by Order of the Federal Tax Service of Russia dated October 30, 2015 N ММВ-7-11/ [email protected]

The tax office will send the citizen a tax notice about tax payment

. It must be paid no later than December 1 of the year following the year in which the individual received the income.

If the management organization does not send Form 2-NDFL to the tax authority in relation to each individual for whom receivables have been written off, it will be held liable

:

- organization (IP) in the amount of 200 rubles for each unsubmitted certificate

(clause 1 of Article 126 of the Tax Code of the Russian Federation); - the head of an organization in the amount of 300 to 500 rubles (note to Article 2.4, Part 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

- You can discuss the article and ask questions here.

- The topic of debt forgiveness was discussed in detail at our webinar. More details at the link

Tax accounting for writing off accounts receivable

For NU purposes, accounting documents confirming the fact of the receivable and its limitation period are stored for 4 years. If a loss occurs, this period is counted from the period of reduction of the tax base by the amount of the loss indicator.

Depending on the availability of a reserve to cover doubtful debts, the NU takes into account the debt either according to the rules of Art. 266 of the Tax Code of the Russian Federation, or are classified as non-operating expenses. Entries for NU purposes are made upon the occurrence of the earliest of the following events:

- expiration of the statute of limitations;

- receipt of acts and other documents from bailiffs regarding the impossibility of collection;

- the appearance of an entry in the Unified State Register of Legal Entities with information that the debtor has ceased its activities.

An advance payment recognized as uncollectible leads to the need to restore the amount of VAT on it.

If the debtor recognized as hopeless is an individual, then when writing off the receivables, the organization acquires the responsibilities of a tax agent for personal income tax and is obliged to transfer tax for the individual, and if the debtor was an employee of the organization, then it is obliged to transfer contributions to the Funds for him (see letter of the Ministry of Finance No. 03-04-06/4-27 dated 08-02-12 and similar clarifications from the Federal Tax Service).

On a note! A company that uses the simplified taxation system “income minus expenses” does not have the right to include written off receivables in income and expenses for tax purposes, since it uses the cash method of accounting for income (Article 346.17-1 of the Tax Code of the Russian Federation). Such debt is taken into account only in accounting.

Results

- Write-off of accounts receivable is carried out on the basis of internal primary documentation and acts, decisions of government agencies.

- If an organization has both receivables and payables to the same counterparty, it is necessary to first offset the amounts and then proceed to write-off.

- Debt is written off from other expenses or from reserved amounts.

- To write off accounts receivable at the expense of net profit, a decision of the general meeting is required.

- In NU, written-off debt is covered by the reserve for doubtful debts or is classified as non-operating expenses.

How debt write-off affects the tax base under the simplified tax system

When a company's accounts payable are written off using the simplified tax system, non-operating income is generated (clause 1 of article 346.15 and clause 18 of article 250 of the Tax Code of the Russian Federation). However, the Tax Code of the Russian Federation does not define a specific day on which to recognize such income. The Ministry of Finance believes that written off accounts payable should be included in income under the simplified taxation system in the reporting (tax) period during which its statute of limitations expires (letter of the Ministry of Finance of Russia dated March 23, 2007 No. 03-11-04/2/66) . For example, if the deadline expired in the first quarter of 2015, in the same quarter you need to increase the tax base according to the “simplified” tax system.