How to calculate

1. Determine the number of shares you own. Information is available in your broker's personal account.

2. Find out DPS (dividends per stock). This is the amount that holders receive per share. You can calculate it yourself, but it’s more convenient to look at dividend calendars. For example, here or here.

3. Multiply DPS by the number of shares you own. The resulting indicator is profit in the form of dividends.

To evaluate a company, study its dividend policy. It can be different:

- Sberbank has established that it will consistently increase the amount of dividend payments to 50% of net profit over three years.

- Lukoil believes that it is necessary to regularly allocate at least 25% of consolidated net profit to pay out.

- NLMK says that if the Net Debt/EBITDA ratio is less than or equal to 1.0: the level of dividend payments is within the range of 50% of net profit and 50% of free cash flow. If the Net Debt/EBITDA ratio is above 1.0: the level of dividend payments is within the range of 30% of net profit and 30% of free cash flow.

Example of use on "Secret"

“Oil companies in Russia are traditionally dividend aristocrats and pay their shareholders generously. And the authorities obliged all state-owned companies from July 1, 2022 to allocate at least half of their adjusted net profit, determined in accordance with international financial reporting standards (IFRS), dividends For the state this is a way to replenish the budget, and for the investor it is “dividend” harvest.”

(Expert in personal finance and investment management, investment adviser to the EUS Group of Companies Igor Fainman - about investments in the Russian oil sector.)

How to get

For the sake of dividends, you do not need to do any additional actions. It is enough to be a shareholder and follow the company's news.

It all starts with the publication of a profit report for the year. Most often it comes out in the spring. Dividends are paid from profits, so it is important to know its size. Next, read the dividend policy; if it is not there, then wait for statements from the company’s first person.

After this the official part begins. The board of directors proposes to allocate a share of profits to dividends and indicates the date on which you need to be a shareholder of the company. There are a few important dates:

- Declaration date. On this day, the board of directors publicly informs shareholders how much dividends will be paid.

- Register closing date (dividend record date). This is the day on which the list of persons receiving the payment is determined. To expect to receive a profit, you must become a shareholder before this date.

- Ex-dividend date. From this day on, the company's shares are sold without the right to dividends.

- Payment date. On this day, security holders receive money.

The delivery mode is also important for the investor. For example, the Moscow Exchange has a T+2 mode. This means that you are not included in the register at the time of purchase, but two business days after that. For example, we bought shares on March 3rd, but became the owner on the 5th.

Therefore, shares must be taken no later than two days before the closing date of the register and take into account weekends.

Examples:

- The register of shareholders closes on Friday - shares must be purchased before Wednesday.

- The register closes on Monday - you must purchase before Thursday.

- The register closes on Friday, but Thursday and Wednesday – public holidays – must be purchased before Monday.

When will the money arrive in the account?

In Russia, after closing the register, the company transfers money to the shareholder within 25 working days. By default, they go to the brokerage account. But now brokers agree to pay clients dividends directly to their bank cards. Prices and conditions for such services must be clarified with the company.

On the US stock market, the delivery mode is T+3 - the investor is recognized as a shareholder three days after purchasing the security. And the payment date is clearly defined in advance.

Payment terms

There are no strict requirements for how often a company must pay dividends. It can do this at any time under two conditions: the presence of net profit and the decision of shareholders.

Stable and large companies establish clear dividend payment algorithms. They know they will be able to make regular payments to shareholders.

Small companies are not confident that they can make payments consistently. Therefore, they put aside profits in a “box” and then decide where to allocate the funds. Either for development or for dividends.

The Russian stock market is developing, and most companies are growing. Therefore, dividends are often paid once a year. But there are a few big figures that are calculated quarterly. For example, Severstal, NLMK, QIWI.

Payment of interim dividends: new position of the Ministry of Finance

Letter of the Ministry of Finance of Russia dated October 15, 2020 No. 03-03-10/90152

In connection with the letter on the issue of the procedure for taxation of interim dividends paid to shareholders (participants) of business companies, the Tax Policy Department reports the following.According to paragraph 1 of Article 43 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), a dividend is any income received by a shareholder (participant) from an organization when distributing profits remaining after taxation (including in the form of interest on preferred shares) among those owned by the shareholder (participant) ) shares (shares) in proportion to the shares of shareholders (participants) in the authorized (share) capital of this organization.

Dividends also include any income received from sources outside the Russian Federation that are classified as dividends in accordance with the laws of foreign countries.

In the Russian Federation, legal relations regarding the distribution of profits of business companies are regulated by the provisions of the Civil Code of the Russian Federation, Federal Law dated December 26, 1995 No. 208-FZ “On Joint Stock Companies” (hereinafter referred to as Federal Law No. 208-FZ) and Federal Law dated February 8, 1998 No. 14 -FZ “On Limited Liability Companies” (hereinafter referred to as Federal Law No. 14-FZ).

Paragraph 1 of Article 42 of Federal Law No. 208-FZ establishes that joint-stock companies have the right, based on the results of the first quarter, half-year, nine months of the reporting year and (or) based on the results of the reporting year, to make decisions (announce) on the payment of dividends on placed shares, unless otherwise established by Federal Law No. 208-FZ.

According to paragraph 2 of Article 42 of Federal Law No. 208-FZ, the source of payment of dividends is the company’s profit after taxation (net profit of the company). The company's net profit is determined according to the accounting (financial) statements of the joint-stock company. Dividends on preferred shares of certain types can also be paid from special funds of the joint-stock company previously formed for these purposes.

A limited liability company has the right to make a decision quarterly, once every six months or once a year on the distribution of its net profit among the participants of the limited liability company (clause 1 of Article 28 of Federal Law No. 14-FZ).

The general requirements for the accounting (financial) reporting of organizations, contained in Article 13 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” (hereinafter referred to as Federal Law No. 402-FZ), provide for the preparation of annual and interim accounting (financial) statements .

Part 3 of Article 13 of Federal Law No. 402-FZ stipulates that annual accounting (financial) statements are prepared for the reporting year.

Interim accounting (financial) statements are prepared by an economic entity for a reporting period less than the reporting year in cases where the legislation of the Russian Federation, regulatory legal acts of state accounting regulatory bodies, contracts, constituent documents of an economic entity, decisions of the owner of an economic entity establish the obligation to submit it (part 4 and 5 Article 13 of Federal Law No. 402-FZ).

Thus, for business companies, a procedure is provided for determining profit after tax (net profit) as a source of payment of dividends in cases where the decision on the distribution of profit is made based on the results of the first quarter, half a year, nine months and (or) the reporting year. At the same time, the current legislation of the Russian Federation does not contain provisions that change the economic qualification of paid dividends (distributed profits) in cases where the amount of net profit of a business company, determined according to the annual accounting (financial) statements, is less than the amount of dividends (distributed profits) paid by such a business entity on the basis of relevant decisions made on the basis of interim accounting (financial) reporting data.

In this regard, we believe that income in the form of dividends paid to shareholders (participants) of business companies based on the results of the work of these business companies for the quarter, six months and nine months of the reporting year are not subject to further re-qualification for tax purposes.

Director of the Department D. V. VOLKOV

Taxation

13% - for residents of the Russian Federation 15% - for non-residents

- If the company pays in rubles, they go to a brokerage account, bank account or IIS (individual investment account) with taxes already removed. There is no way to avoid losses - tax deductions do not apply to dividends.

- If a company pays in dollars, taxes are not deducted - they must be calculated independently, taking into account the exchange rate.

When investing in US securities, it is better to sign Form W8-BEN. It tells you that you are not a US tax resident. With it the rate is 13%. 10% is withheld automatically, and the investor pays 3% himself.

Dividend loss

Some investors think that when working with dividends, you can cheat: buy shares for one day, receive a payment and sell. But such a scheme will not bring profit, because the share price falls on the day the register is closed by the amount of payment (dividend gap) and recovers for several months. You will first receive dividend income, and then lose about the same amount on changes in the stock price. You won't be able to make money.

Don't make a fuss. Evaluate the company fundamentally and buy for the long term. So, you will earn both on dividends and on changes in the market value of the stock.

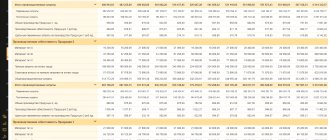

What is dividend yield and why know it?

When buying shares, an investor can make a profit in two ways: through the payment of dividends and through an increase in the price of the security. And if the second strongly depends on the market situation, then the first allows you to predict future income.

Dividend yield is a measure that reflects what percentage of the market value of shares the holder will receive in one year.

In fact, the amount of dividends a company pays during the year is compared to the market price of its shares.

Where to look for payment dates

Information about the payment amount and register dates can be viewed on the Moscow Exchange website (in the company’s information card) or on the websites of the companies themselves (if there is a section “For Investors”). Also use dividend calendars - it’s more convenient.

- Dividend calendar Dokhod.ru – publishes data on Russian companies.

- Calendar from BCS is a convenient calendar from the largest Russian broker. The table can be filtered by instruments, economic sectors and individual parameters.

- NASDAQ Calendar - here is information about American companies.

Try the Right robot, a service that helps you choose stocks and bonds. Invest like a pro – without experience or special knowledge